Pressure Sensors Market Report

Published Date: 31 January 2026 | Report Code: pressure-sensors

Pressure Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Pressure Sensors market for the forecast period from 2023 to 2033. It encompasses market size, growth trends, regional insights, technology advancements, segments, and leading players in the industry.

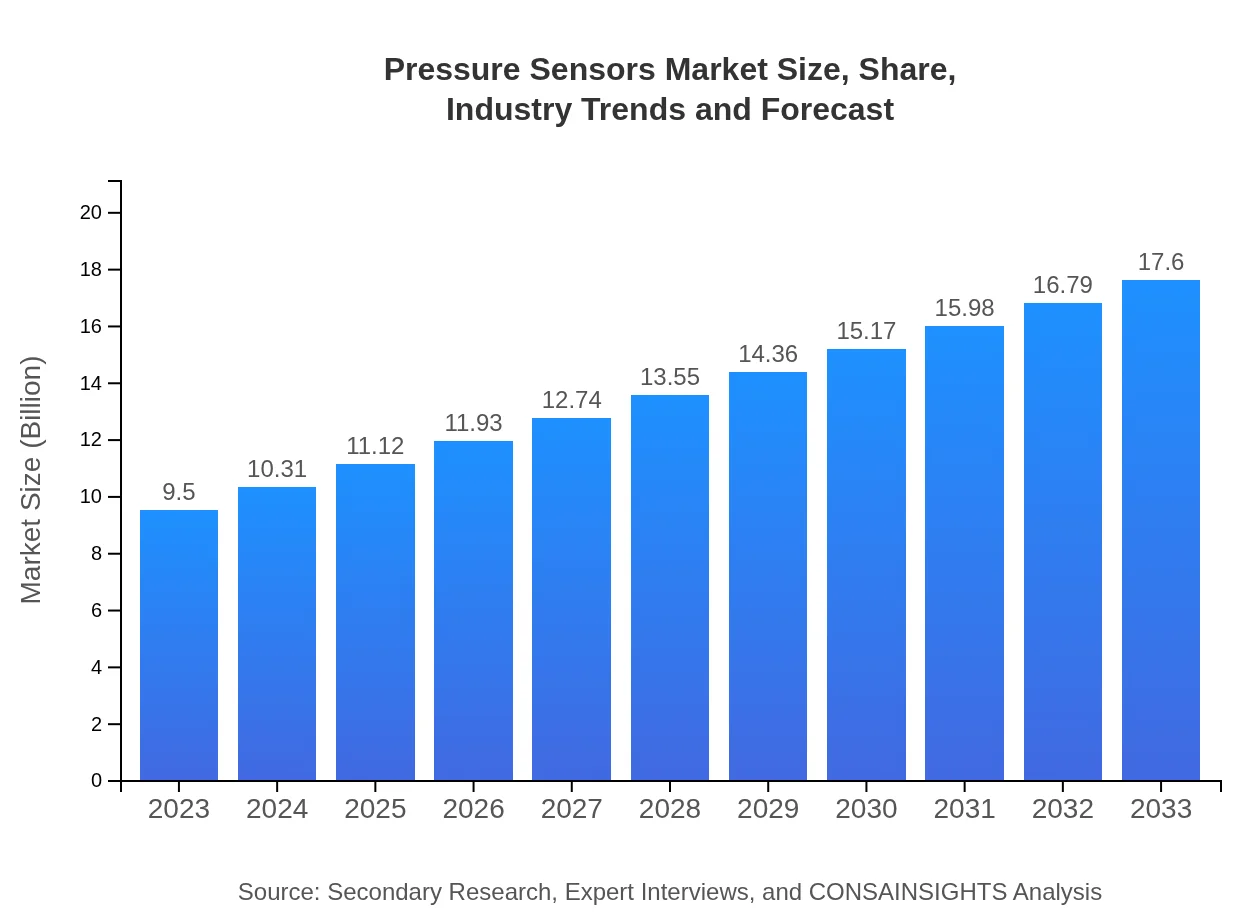

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $17.60 Billion |

| Top Companies | Honeywell International Inc., Texas Instruments Inc., Brookfield Engineering Labs, Vishay Precision Group, Siemens |

| Last Modified Date | 31 January 2026 |

Pressure Sensors Market Overview

Customize Pressure Sensors Market Report market research report

- ✔ Get in-depth analysis of Pressure Sensors market size, growth, and forecasts.

- ✔ Understand Pressure Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pressure Sensors

What is the Market Size & CAGR of Pressure Sensors market in 2023?

Pressure Sensors Industry Analysis

Pressure Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pressure Sensors Market Analysis Report by Region

Europe Pressure Sensors Market Report:

Europe's market for pressure sensors will increase from $3.09 billion in 2023 to $5.73 billion in 2033. Driving factors include stringent regulations promoting safety and increased usage in automotive and aerospace applications.Asia Pacific Pressure Sensors Market Report:

In the Asia Pacific region, the pressure sensors market is expected to expand significantly, reaching approximately $3.03 billion by 2033, compared to $1.64 billion in 2023. The region's growth can be attributed to rapid industrialization, increasing investments in manufacturing, and a growing automotive sector.North America Pressure Sensors Market Report:

North America leads the pressure sensors market with an estimated market size of $3.42 billion in 2023, growing to $6.34 billion by 2033. The expansion is largely driven by advances in technology, especially in healthcare and industrial applications, coupled with significant investment in research and development.South America Pressure Sensors Market Report:

South America presents a growth opportunity, with the pressure sensors market projected to grow from $0.73 billion in 2023 to $1.35 billion by 2033. This growth is driven by the rise of the oil & gas sector and increasing safety regulations across industries.Middle East & Africa Pressure Sensors Market Report:

The Middle East and Africa market is smaller, starting at $0.62 billion in 2023 and projected to reach $1.16 billion by 2033. The growth here is fueled by infrastructural developments and a rising focus on automation in oil-rich countries.Tell us your focus area and get a customized research report.

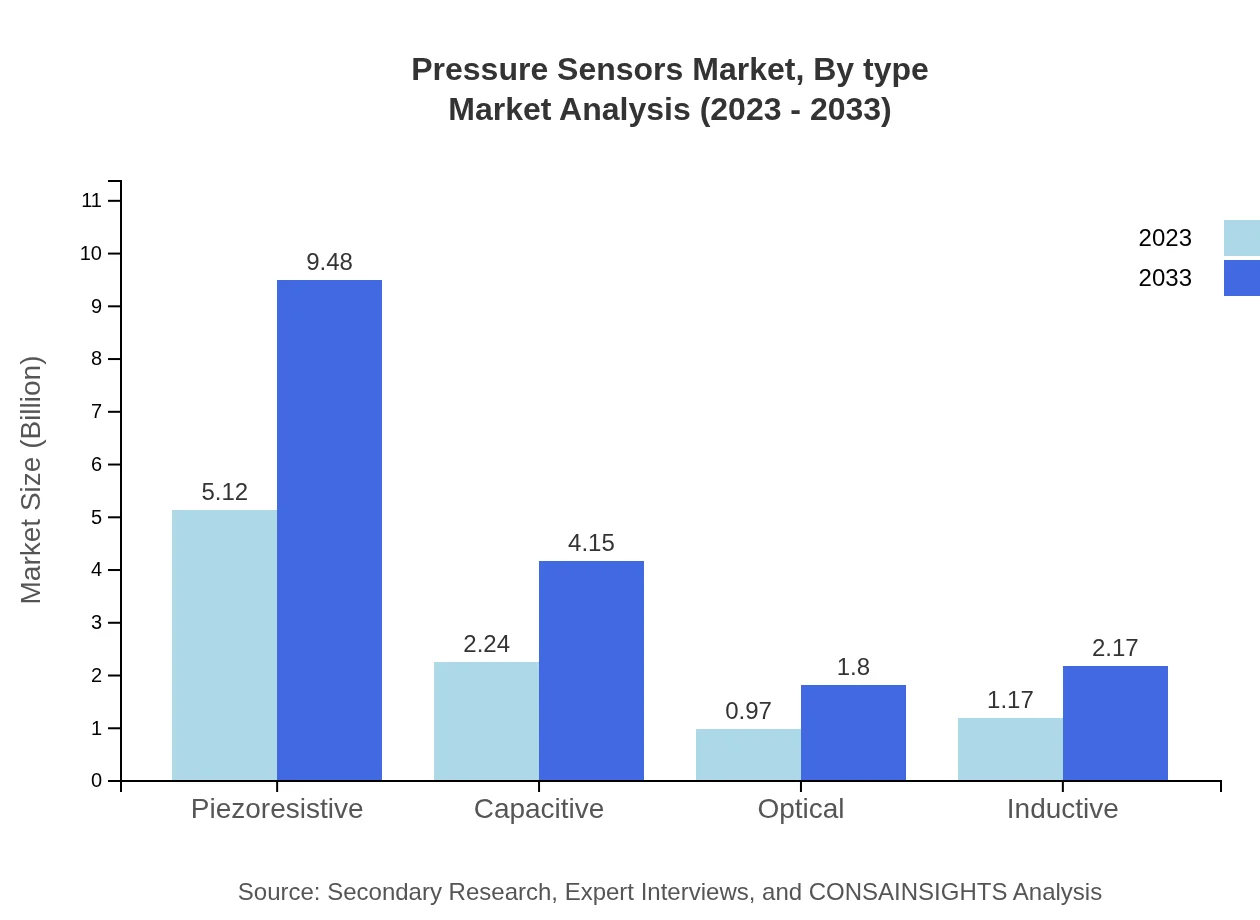

Pressure Sensors Market Analysis By Type

The Pressure Sensors Market is segmented by type into Piezoresistive, Capacitive, Optical, and Inductive sensors. By 2033, Piezoresistive sensors will dominate the market with a size of $9.48 billion, maintaining a market share of 53.85%. Capacitive sensors are expected to reach a size of $4.15 billion with a 23.56% share. Optical sensors are anticipated to grow to $1.80 billion with a 10.25% share, while Inductive sensors will see growth to $2.17 billion with a 12.34% share.

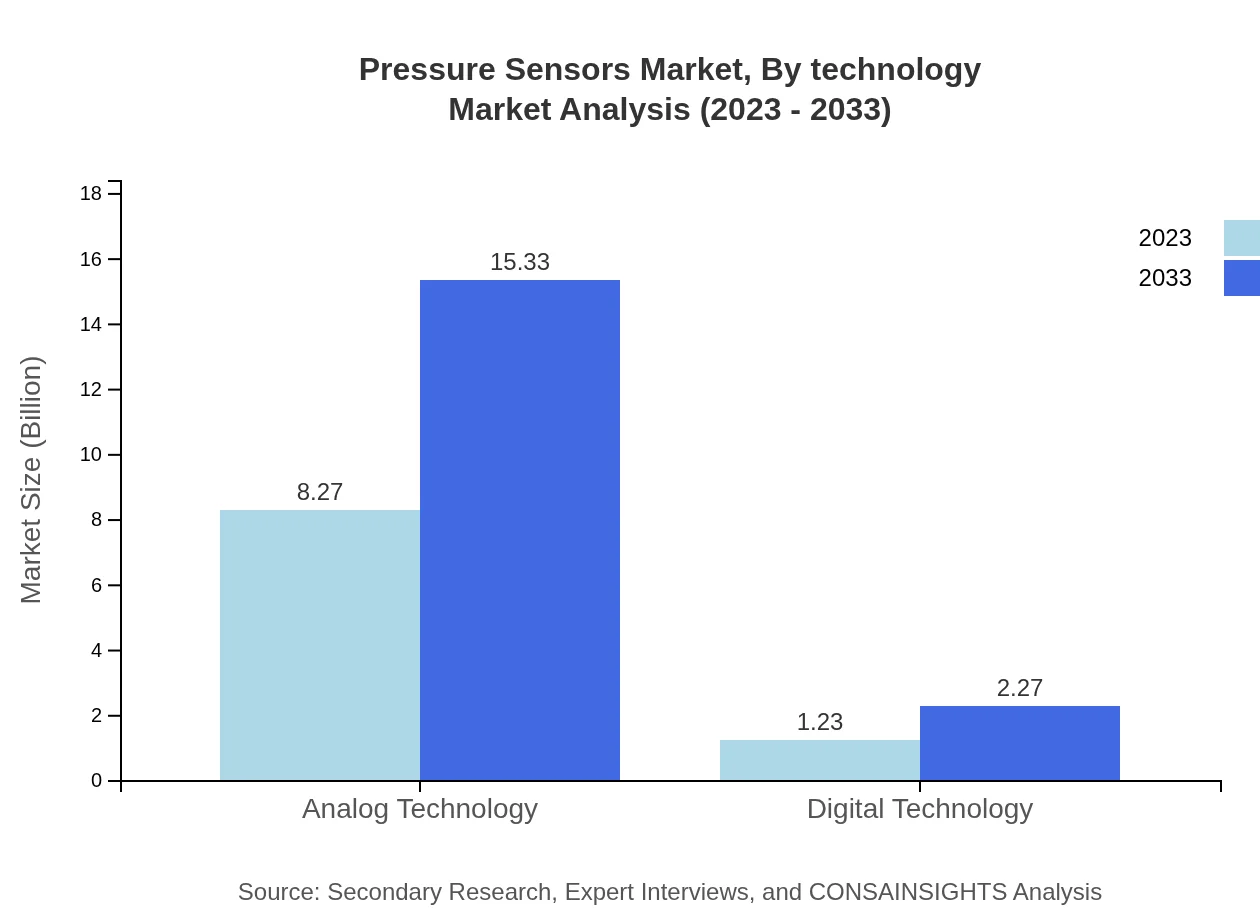

Pressure Sensors Market Analysis By Technology

The Pressure Sensors Market is segmented by technology into Analog and Digital. By 2033, the market for Analog technology will grow to $15.33 billion, maintaining a predominant share of 87.09%. Digital technology is expected to reach $2.27 billion, capturing 12.91% of the market as users increasingly adopt advanced sensing technologies.

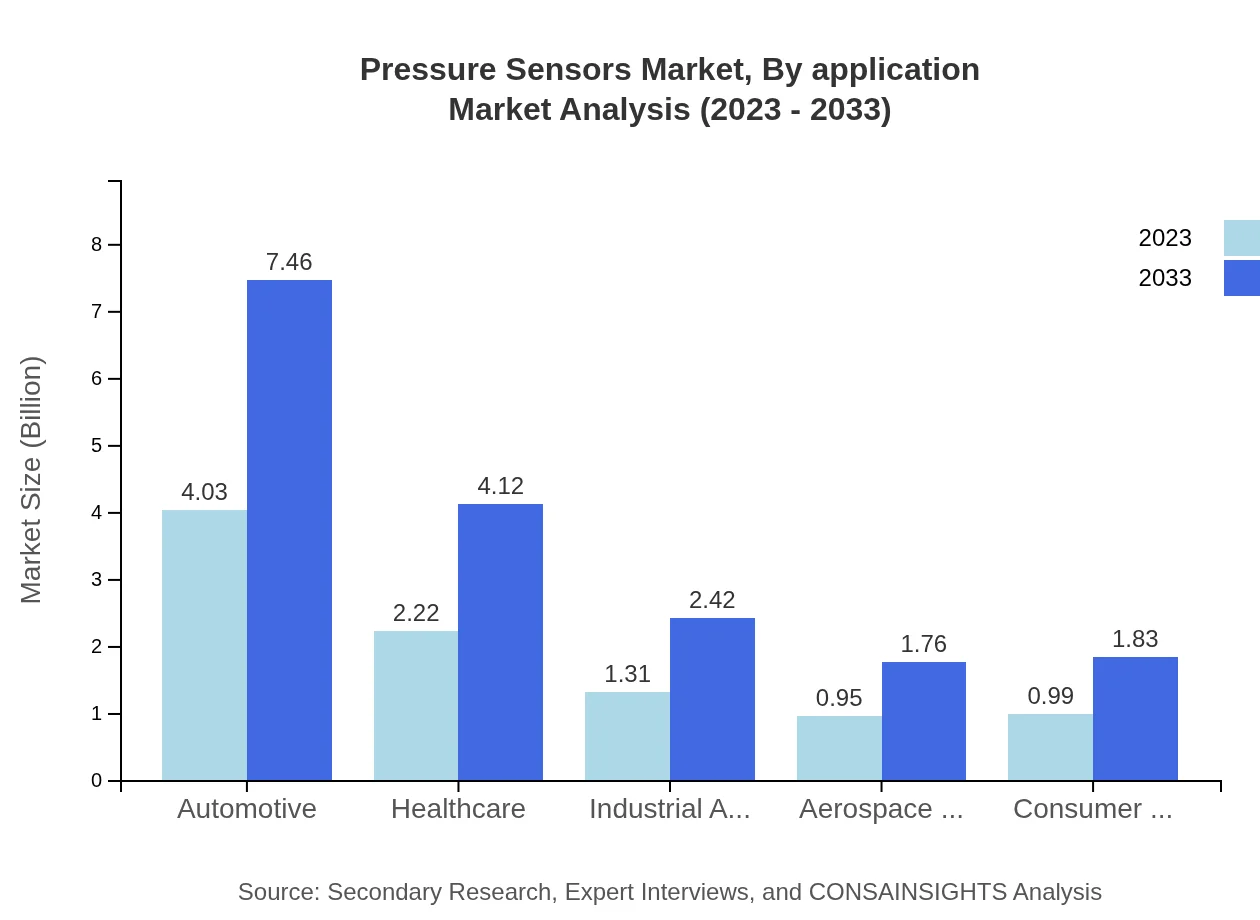

Pressure Sensors Market Analysis By Application

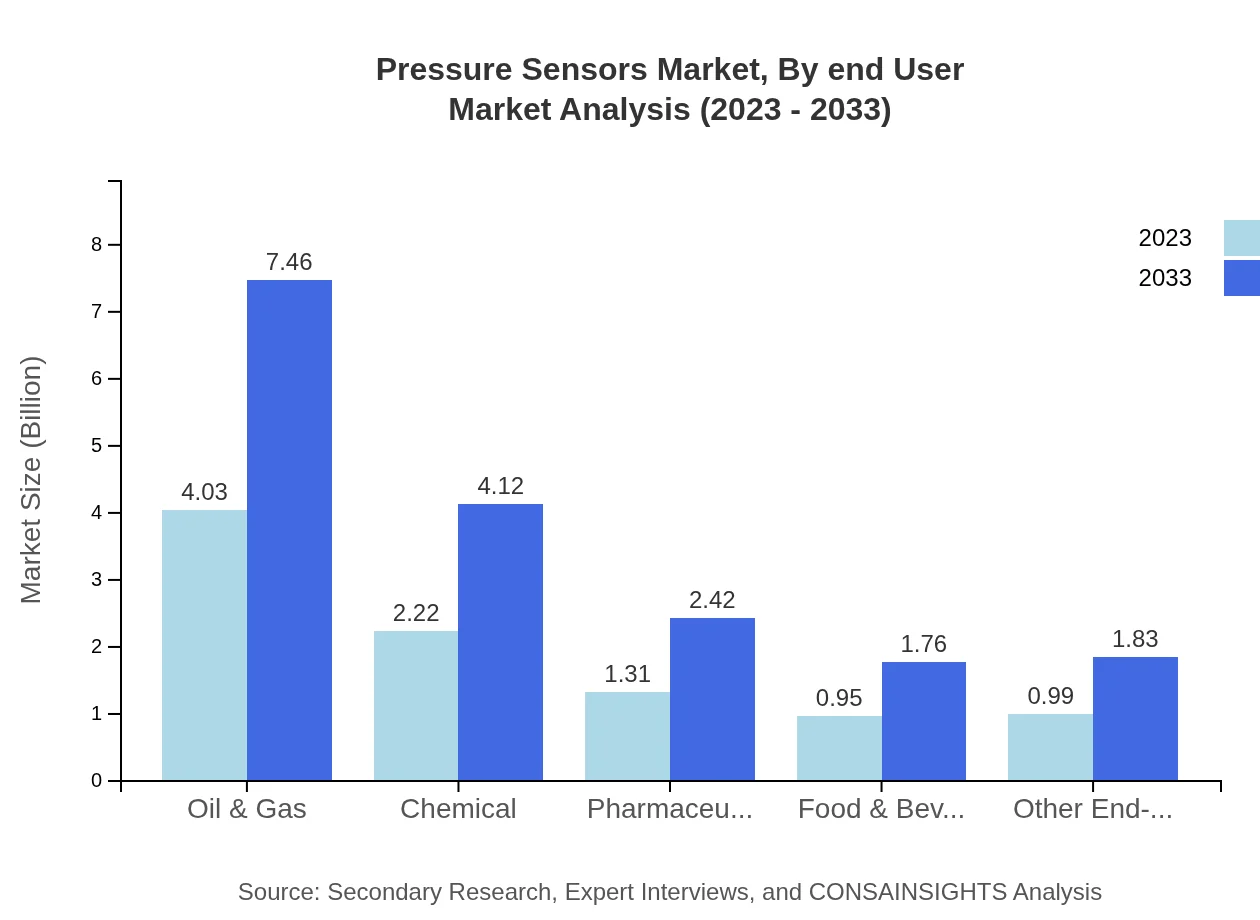

The applications for Pressure Sensors include Oil & Gas, Chemical, Pharmaceutical, Food & Beverage, and others. The Oil & Gas segment remains the largest, expanding from $4.03 billion in 2023 to $7.46 billion by 2033, capturing 42.41% of the market. The Chemical sector will have a market size of $4.12 billion with a 23.42% share. Each application reflects the industries' need for precise pressure measurements to ensure safety and efficiency.

Pressure Sensors Market Analysis By End User

Key end-user industries for pressure sensors include Automotive, Healthcare, Industrial Automation, Aerospace & Defense, and Consumer Electronics. The Automotive sector holds a strong position, with a market size increasing from $4.03 billion to $7.46 billion, while Healthcare's share will grow to $4.12 billion. Other segments, like Industrial Automation, are also expected to rise, emphasizing the diverse application of pressure sensors.

Pressure Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pressure Sensors Industry

Honeywell International Inc.:

One of the largest manufacturers of pressure sensors, Honeywell focuses on innovative sensing technologies that cater to automotive, aerospace, and industrial applications.Texas Instruments Inc.:

A leader in semiconductor technology, Texas Instruments produces high-performance pressure sensors used in various applications, enhancing accuracy and reliability.Brookfield Engineering Labs:

Specializes in pressure measurement products, Brookfield focuses on precise instruments used across industries, reinforcing its reputation in the sector.Vishay Precision Group:

Known for precise pressure measurement sensors, Vishay manufactures high-quality components that are used widely in automotive and industrial sectors.Siemens :

Siemens incorporates pressure sensors within its automation systems, contributing to enhancements in manufacturing efficiency and safety.We're grateful to work with incredible clients.

FAQs

What is the market size of pressure sensors?

The global pressure sensors market is anticipated to reach approximately $9.5 billion by 2033, growing from $8 billion in 2023. This indicates a strong CAGR of 6.2%, depicting the industry's robust expansion over the coming decade.

What are the key market players or companies in the pressure sensors industry?

Key market players include Honeywell, Bosch, Siemens, and Amphenol. These companies are pivotal in driving innovation and competitiveness within the pressure sensors industry, establishing significant market shares through advanced technology and strategic partnerships.

What are the primary factors driving the growth in the pressure sensors industry?

Growth factors include rising demand from automotive and industrial automation sectors, advancements in sensor technology, and increased deployment in healthcare applications. Additionally, heightened awareness of pressure monitoring benefits fuels market expansion.

Which region is the fastest Growing in the pressure sensors industry?

The North American region is the fastest-growing market for pressure sensors, projected to expand from $3.42 billion in 2023 to $6.34 billion by 2033, showcasing a significant opportunity for growth driven by technological advancements.

Does ConsaInsights provide customized market report data for the pressure sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the pressure sensors sector, allowing for detailed insights and strategic planning based on market conditions and trends.

What deliverables can I expect from the pressure sensors market research project?

Deliverables typically include comprehensive market analysis reports, regional forecasts, trend identification, competitive landscape overviews, and actionable insights tailored to your strategic requirements within the pressure sensors market.

What are the market trends of pressure sensors?

Current trends in the pressure sensors market include the rise of piezoresistive pressure sensors, increased adoption of digital technology, and a growing focus on wireless sensor solutions across various industries.