Printed Circuit Board Inspection Equipment Market Report

Published Date: 31 January 2026 | Report Code: printed-circuit-board-inspection-equipment

Printed Circuit Board Inspection Equipment Market Size, Share, Industry Trends and Forecast to 2033

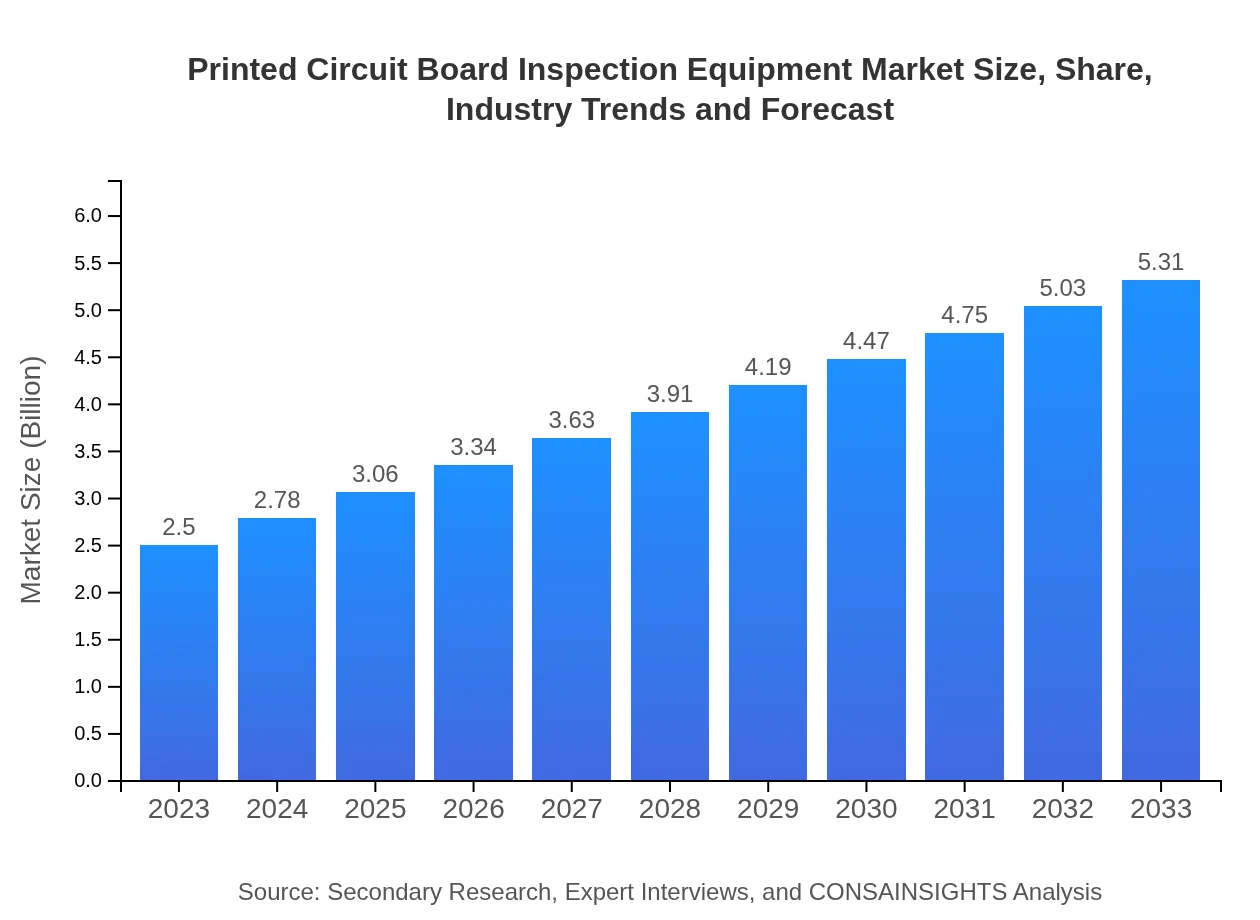

This report provides a comprehensive analysis of the Printed Circuit Board Inspection Equipment market, detailing market conditions, size, segmentation, technological advancements, and regional insights. Projections are made for the forecast period from 2023 to 2033, highlighting growth trends and challenges within the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.6% |

| 2033 Market Size | $5.31 Billion |

| Top Companies | Omron Corporation, Koh Young Technology, Viscom AG, Test Research, Inc., CyberOptics Corporation |

| Last Modified Date | 31 January 2026 |

Printed Circuit Board Inspection Equipment Market Overview

Customize Printed Circuit Board Inspection Equipment Market Report market research report

- ✔ Get in-depth analysis of Printed Circuit Board Inspection Equipment market size, growth, and forecasts.

- ✔ Understand Printed Circuit Board Inspection Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Printed Circuit Board Inspection Equipment

What is the Market Size & CAGR of Printed Circuit Board Inspection Equipment market in 2023?

Printed Circuit Board Inspection Equipment Industry Analysis

Printed Circuit Board Inspection Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Printed Circuit Board Inspection Equipment Market Analysis Report by Region

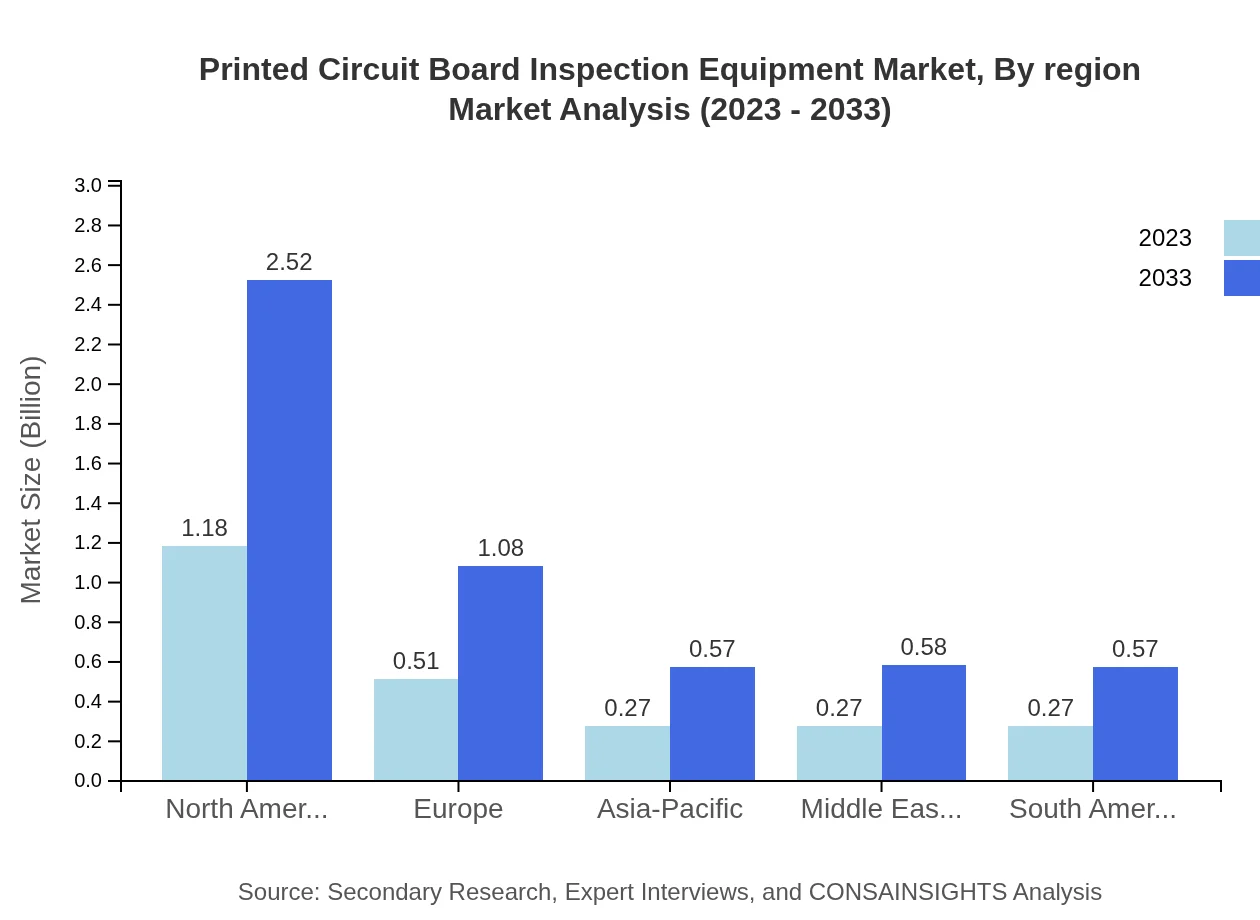

Europe Printed Circuit Board Inspection Equipment Market Report:

Europe's market is anticipated to witness growth from $0.86 billion in 2023 to $1.83 billion by 2033. The increasing focus on quality manufacturing and advanced inspection technologies, particularly in the automotive and aerospace sectors, propels market demand.Asia Pacific Printed Circuit Board Inspection Equipment Market Report:

The Asia-Pacific region is forecasted to grow from $0.43 billion in 2023 to $0.91 billion by 2033, driven by the increasing production of consumer electronics and automotive components. Countries like China, Japan, and South Korea are at the forefront of technological advancements in PCB manufacturing and inspection.North America Printed Circuit Board Inspection Equipment Market Report:

North America is projected to grow from $0.88 billion in 2023 to $1.87 billion by 2033. The presence of leading electronics manufacturers and high investment in R&D activities contribute significantly to the market growth in this region.South America Printed Circuit Board Inspection Equipment Market Report:

In South America, the market is expected to grow from $0.10 billion in 2023 to $0.20 billion by 2033. The growing demand for electronic devices and improvements in manufacturing processes are expected to boost the market in this region.Middle East & Africa Printed Circuit Board Inspection Equipment Market Report:

In the Middle East and Africa, the market is expected to increase from $0.24 billion in 2023 to $0.51 billion by 2033. The region sees a rise in electronics manufacturing hubs, leading to greater adoption of inspection equipment.Tell us your focus area and get a customized research report.

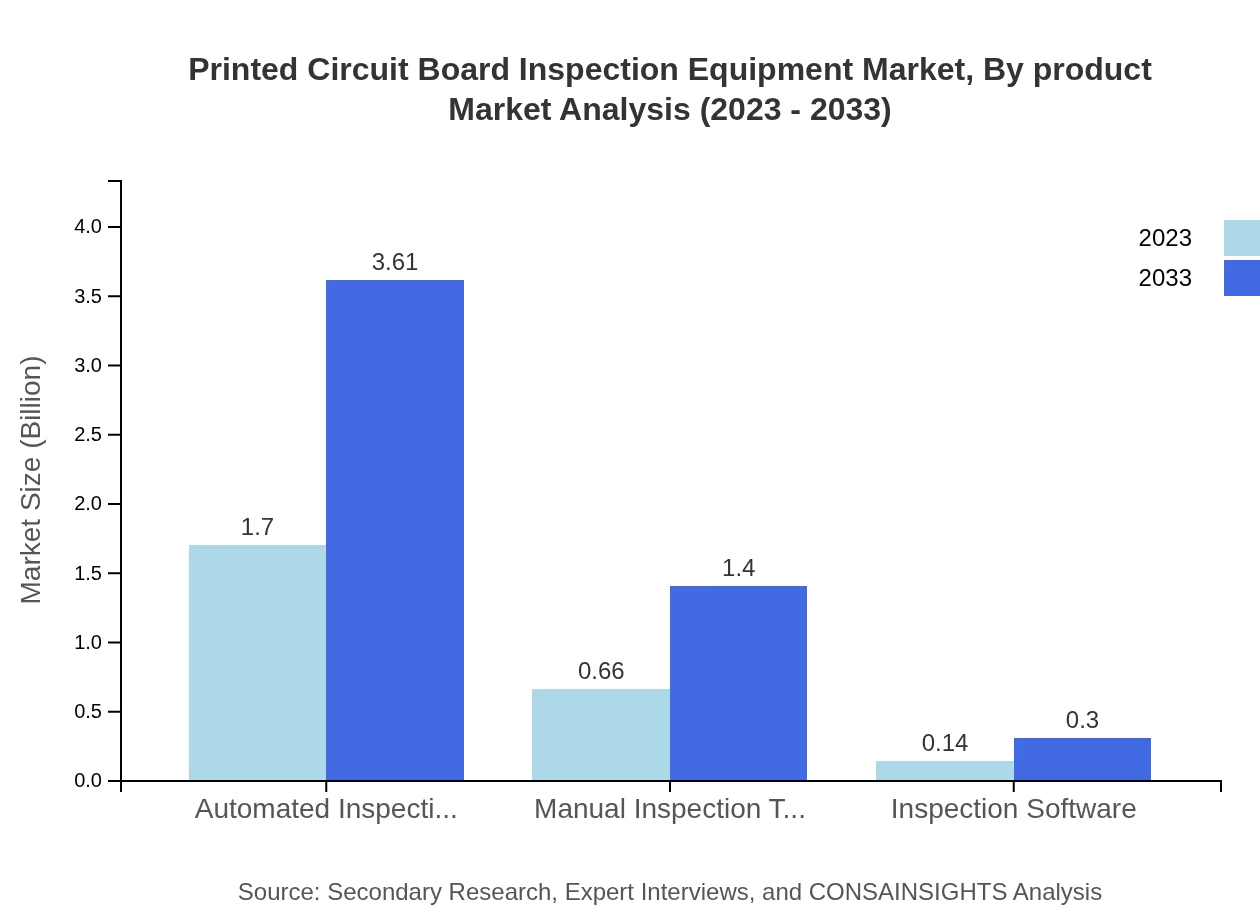

Printed Circuit Board Inspection Equipment Market Analysis By Product

The market for Printed Circuit Board Inspection Equipment by product comprises automated inspection systems, manual inspection tools, and inspection software. Automated inspection systems dominate the market, accounting for a significant share due to the demand for speed and efficiency in the inspection process. Manual inspection tools continue to play a role, especially in regions where costs need to be managed closely, while inspection software is increasingly integrated with hardware solutions for enhanced functionality.

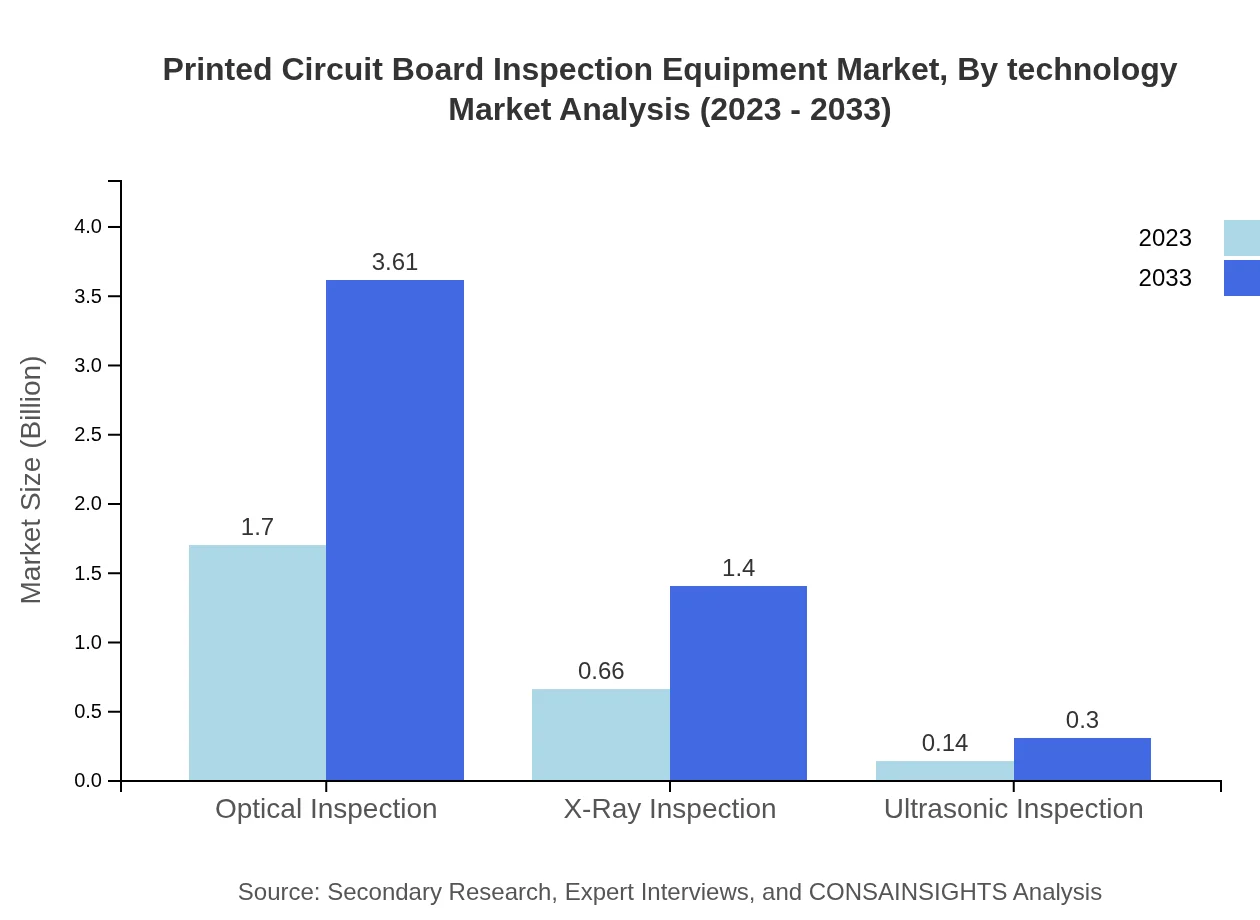

Printed Circuit Board Inspection Equipment Market Analysis By Technology

Technologies utilized in PCB inspection include optical inspection, X-ray inspection, and ultrasonic inspection. Optical inspection takes the largest market share due to its non-destructive testing capabilities and efficiency. X-ray inspection is crucial for assessing internal layers of complex PCBs, and ultrasonic inspection, while smaller in scope, holds potential for niche applications.

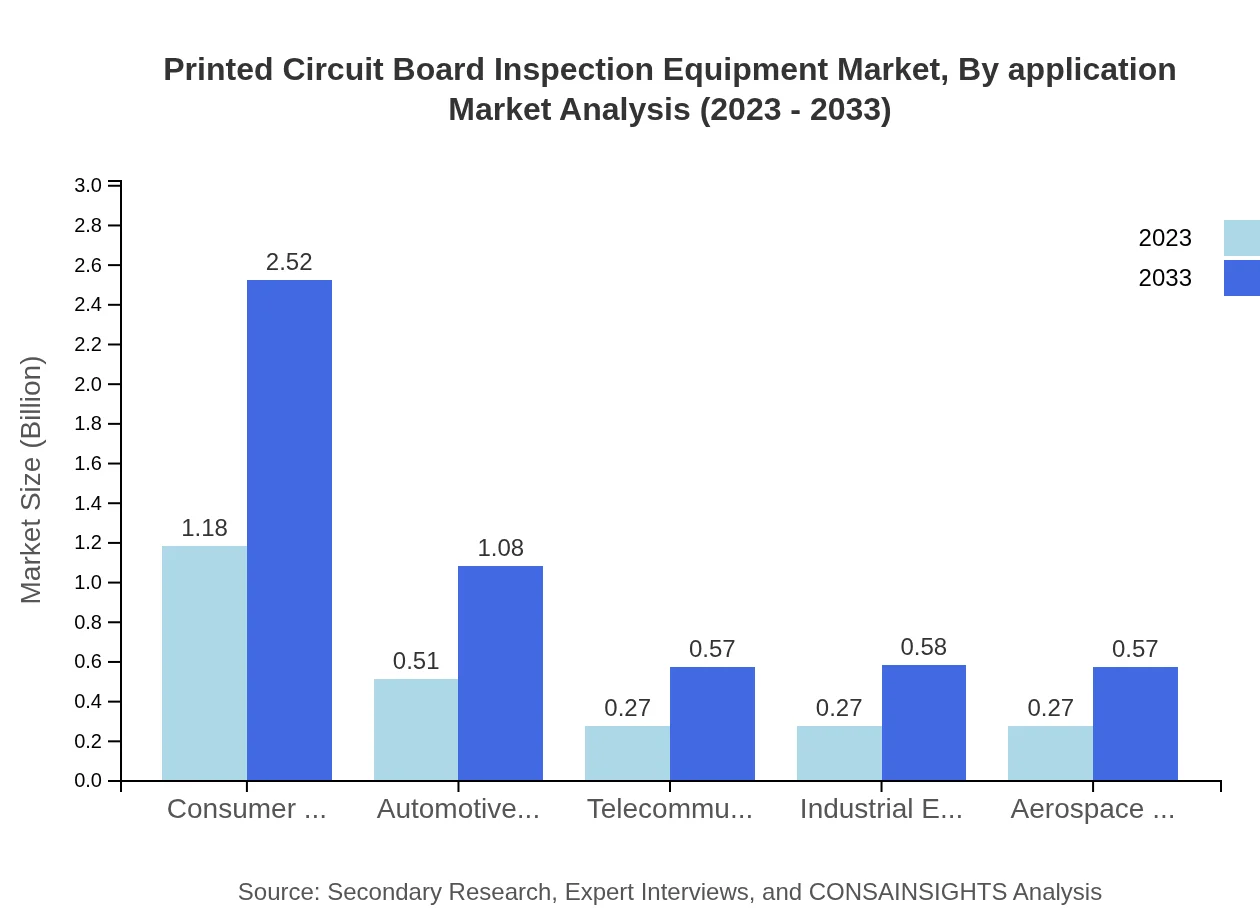

Printed Circuit Board Inspection Equipment Market Analysis By Application

Applications of PCB inspection equipment span across consumer electronics, automotive, telecommunications, and industrial equipment. The consumer electronics sector holds a significant share of the market, driven by the need for high-quality components in devices like smartphones. The automotive and telecommunications sectors are also substantial contributors as they integrate electronics into their systems.

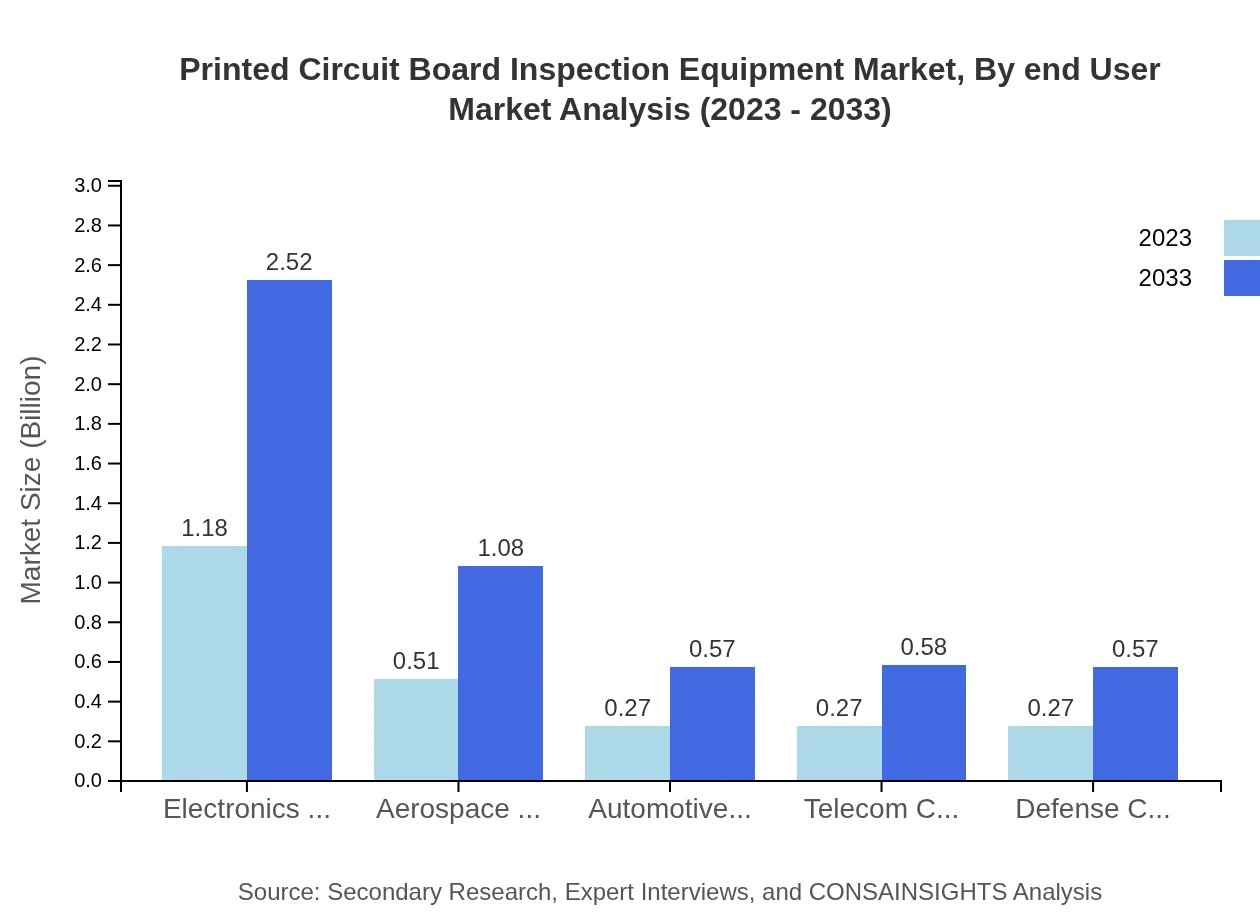

Printed Circuit Board Inspection Equipment Market Analysis By End User

Key end-users of PCB inspection equipment include electronics manufacturers, aerospace industries, automotive manufacturers, telecom companies, and defense contractors. Electronics manufacturers account for the largest market share, with companies actively investing in advanced quality control measures to maintain competitive advantage.

Printed Circuit Board Inspection Equipment Market Analysis By Region

Regionally, North America and Europe are the largest markets for PCB inspection equipment, characterized by high technological adoption rates and stringent quality standards. Asia-Pacific is emerging rapidly due to the increasing electronic manufacturing capabilities, while South America and the Middle East and Africa represent growth potential as industrialization in these areas continues to advance.

Printed Circuit Board Inspection Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Printed Circuit Board Inspection Equipment Industry

Omron Corporation:

A global leader in automation and sensing technologies, Omron specializes in robotic and electronic inspection solutions for PCB manufacturing.Koh Young Technology:

Known for their advanced 3D inspection systems, Koh Young Technology has made significant contributions to improving inspection accuracy and speed in PCB production.Viscom AG:

Viscom AG is a prominent player in the market, offering innovative optical inspection systems for PCB and component manufacturing.Test Research, Inc.:

This company provides end-to-end inspection solutions, leveraging proprietary software and hardware integrations for enhanced inspection performance.CyberOptics Corporation:

Specializes in advanced inspection solutions using machine vision technologies for quality assurance in PCB manufacturing.We're grateful to work with incredible clients.

FAQs

What is the market size of Printed-Circuit-Board-Inspection-Equipment?

The global market size for Printed Circuit Board Inspection Equipment is projected at $2.5 billion in 2023 and is expected to grow at a CAGR of 7.6% through 2033.

What are the key market players or companies in the Printed-Circuit-Board-Inspection-Equipment industry?

Key players in the Printed Circuit Board Inspection Equipment market include major manufacturers and technology providers who dominate sectors such as automated inspection systems, manual inspection tools, and software solutions.

What are the primary factors driving the growth in the Printed-Circuit-Board-Inspection-Equipment industry?

Growth in the Printed Circuit Board Inspection Equipment industry is driven by increasing demand for consumer electronics, advancements in automation, and stringent quality standards in electronics manufacturing.

Which region is the fastest Growing in the Printed-Circuit-Board-Inspection-Equipment?

The Asia-Pacific region is forecasted to show significant growth, increasing from $0.43 billion in 2023 to $0.91 billion by 2033, making it the fastest-growing market for Printed Circuit Board Inspection Equipment.

Does ConsaInsights provide customized market report data for the Printed-Circuit-Board-Inspection-Equipment industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and preferences for the Printed Circuit Board Inspection Equipment industry, ensuring relevant insights.

What deliverables can I expect from this Printed-Circuit-Board-Inspection-Equipment market research project?

The deliverables from the market research project include comprehensive reports, detailed analysis, regional insights, trends, and forecasts specific to Printed Circuit Board Inspection Equipment.

What are the market trends of Printed-Circuit-Board-Inspection-Equipment?

Trends in the Printed Circuit Board Inspection Equipment market include increased automation, emphasis on optical inspection technologies, and the rise in demand from automotive and consumer electronics sectors.