Printed Circuit Board Market Report

Published Date: 31 January 2026 | Report Code: printed-circuit-board

Printed Circuit Board Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Printed Circuit Board (PCB) market, providing insights into market size, growth trends, key players, and forecasts for the year 2023 to 2033. This analysis focuses on key market dynamics, segmentation, and regional highlights.

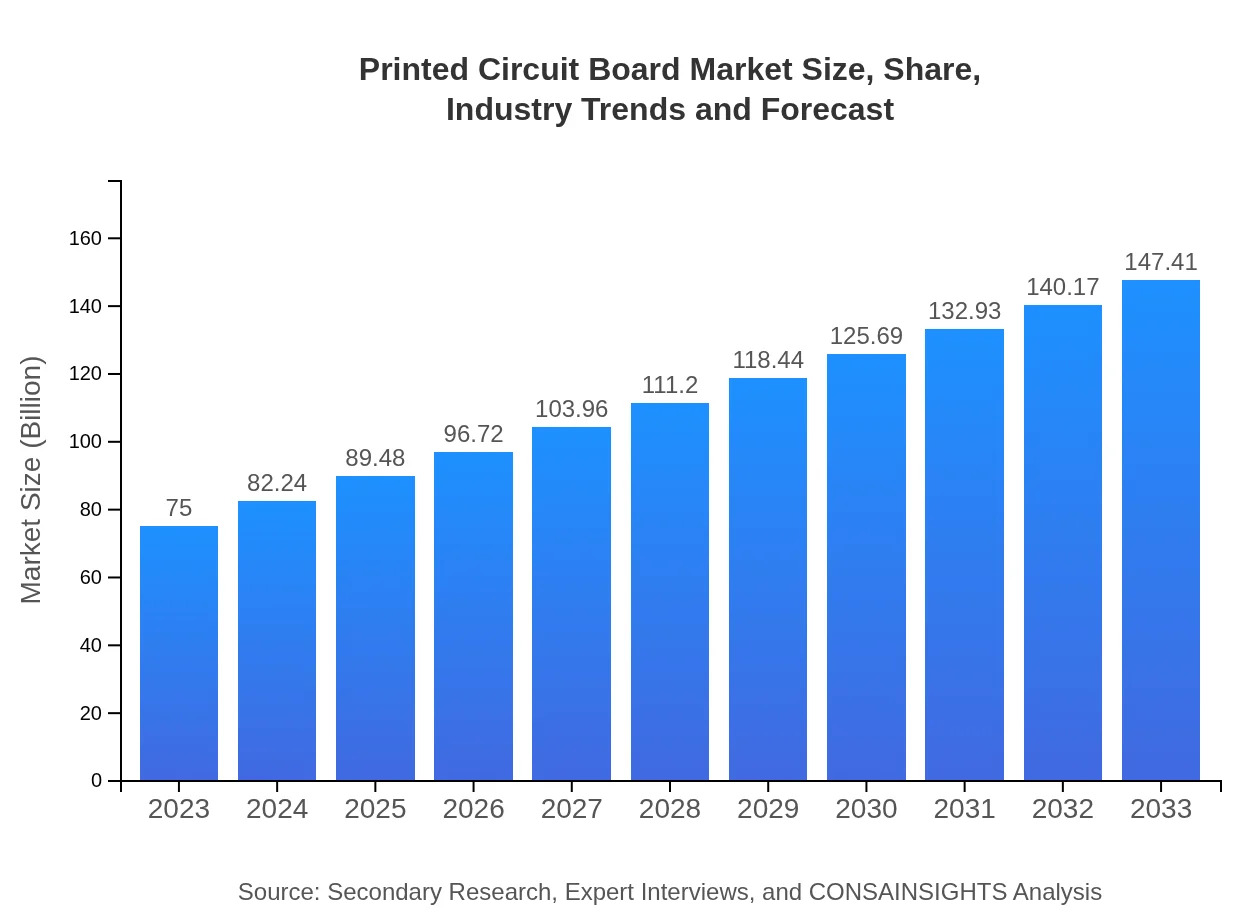

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $75.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $147.41 Billion |

| Top Companies | Taiyo Yuden Co., Ltd., Jabil Inc., Zhen Ding Technology Holding Limited, Aptiv PLC |

| Last Modified Date | 31 January 2026 |

Printed Circuit Board Market Overview

Customize Printed Circuit Board Market Report market research report

- ✔ Get in-depth analysis of Printed Circuit Board market size, growth, and forecasts.

- ✔ Understand Printed Circuit Board's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Printed Circuit Board

What is the Market Size & CAGR of Printed Circuit Board market in 2023?

Printed Circuit Board Industry Analysis

Printed Circuit Board Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Printed Circuit Board Market Analysis Report by Region

Europe Printed Circuit Board Market Report:

Europe is projected to grow from $22.99 billion in 2023 to $45.20 billion by 2033. The region's strong automotive sector and investments in green technologies are fostering PCB demand. Countries like Germany and France are at the forefront of PCB manufacturing innovations.Asia Pacific Printed Circuit Board Market Report:

The Asia Pacific region holds a significant share of the PCB market, with an estimated size of $16.07 billion in 2023, projected to reach $31.57 billion by 2033. The growth is driven by the presence of major electronics manufacturers in countries like China, Japan, and South Korea. Additionally, increasing investments in automotive and telecommunications are further bolstering market expansion.North America Printed Circuit Board Market Report:

North America captures a market size of $24.64 billion in 2023, expected to grow to $48.42 billion by 2033. The rise in IoT applications, automotive electrification, and aerospace innovations are driving demand. The presence of prominent PCB manufacturers enhances the region's market position.South America Printed Circuit Board Market Report:

In South America, the PCB market is anticipated to grow from $3.07 billion in 2023 to $6.03 billion by 2033. The rise in the consumer electronics sector and the growing automotive industry are key growth drivers in this region. Countries like Brazil and Argentina are leading the growth due to increasing local manufacturing capabilities.Middle East & Africa Printed Circuit Board Market Report:

In the Middle East and Africa, the PCB market is expected to expand from $8.24 billion in 2023 to $16.19 billion by 2033. The growth is attributed to increasing investments in electronics and telecommunications, along with the rising demand for consumer electronics in emerging economies.Tell us your focus area and get a customized research report.

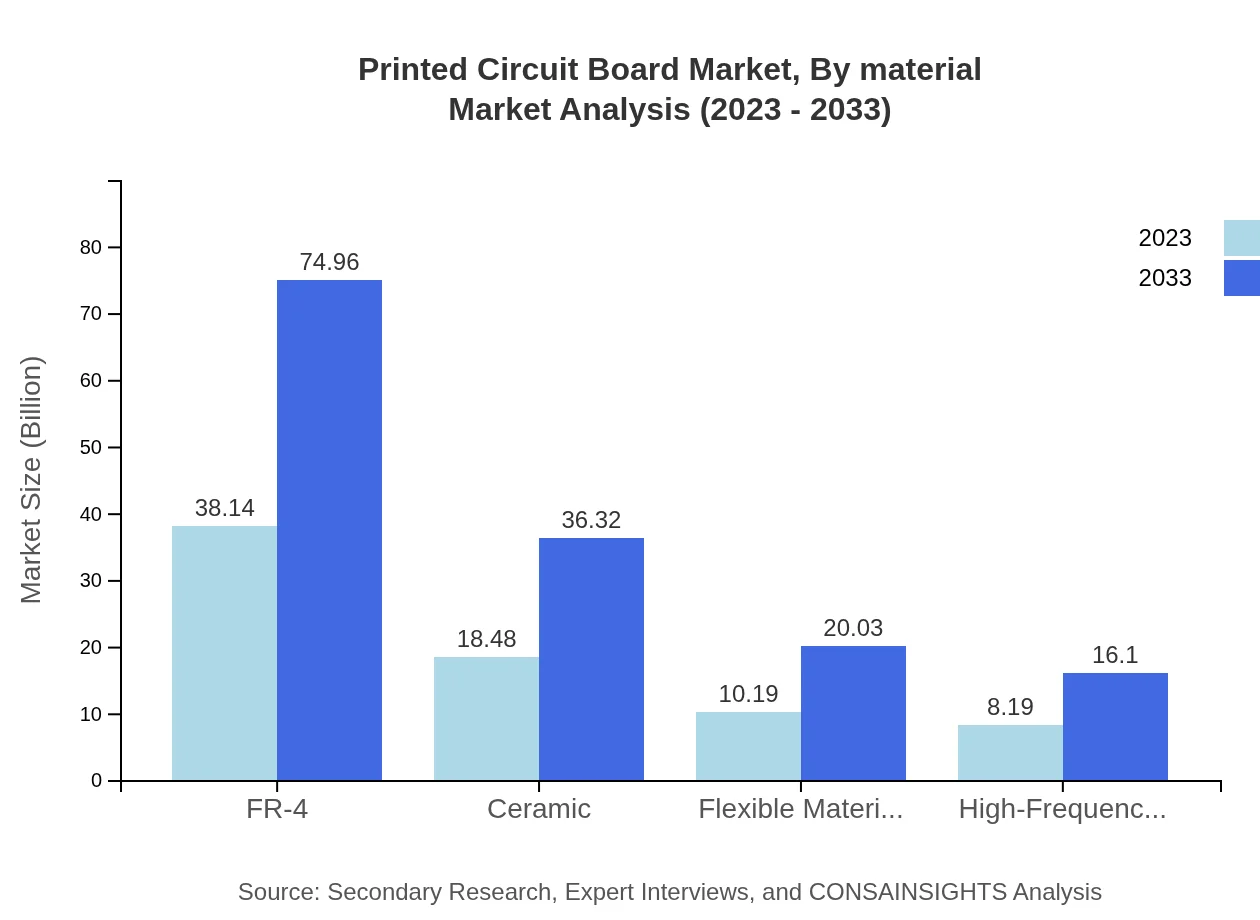

Printed Circuit Board Market Analysis By Material

The PCB market by material is predominantly driven by FR-4 type boards, which hold a significant market share of 50.85% in 2023, projected to remain stable until 2033. Other materials such as ceramic and flexible materials are also showing robust growth, driven by specific applications in high-frequency devices and flexible electronics.

Printed Circuit Board Market Analysis By Type

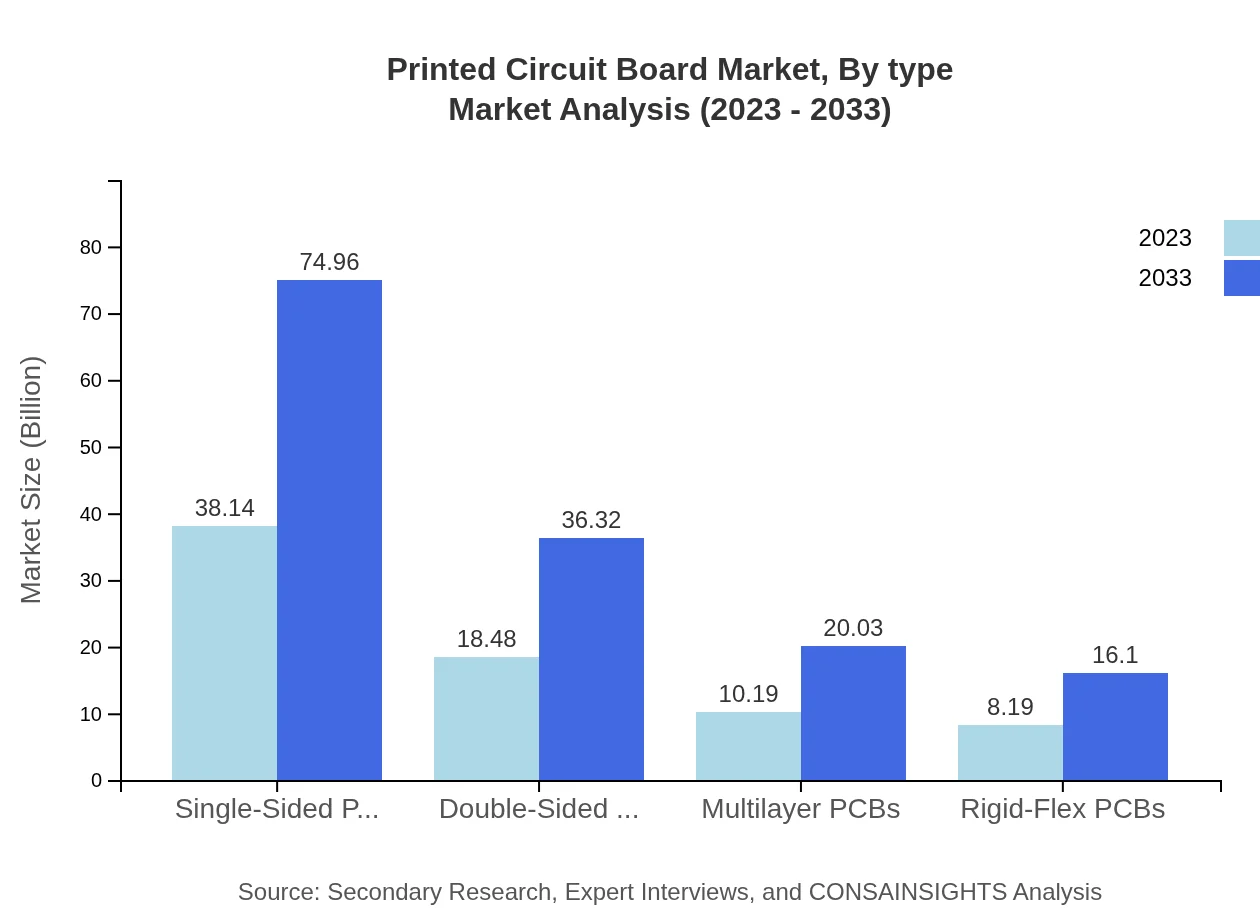

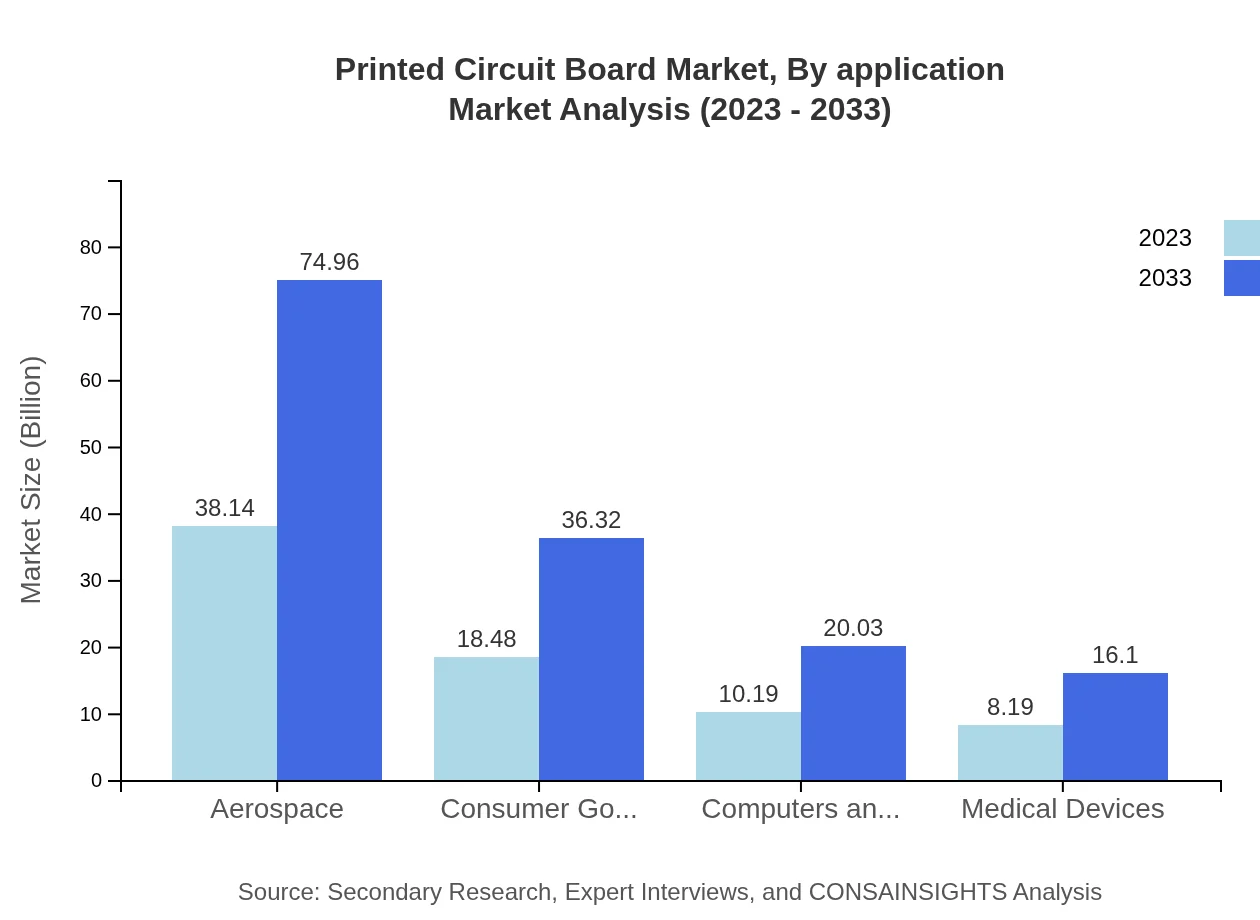

Single-sided PCBs represent the largest segment, with a market size of $38.14 billion in 2023 and projected to reach $74.96 billion by 2033. Double-sided and multilayer PCBs also show significant growth potential, catering to diverse electronic applications in consumer electronics and automotive.

Printed Circuit Board Market Analysis By End User

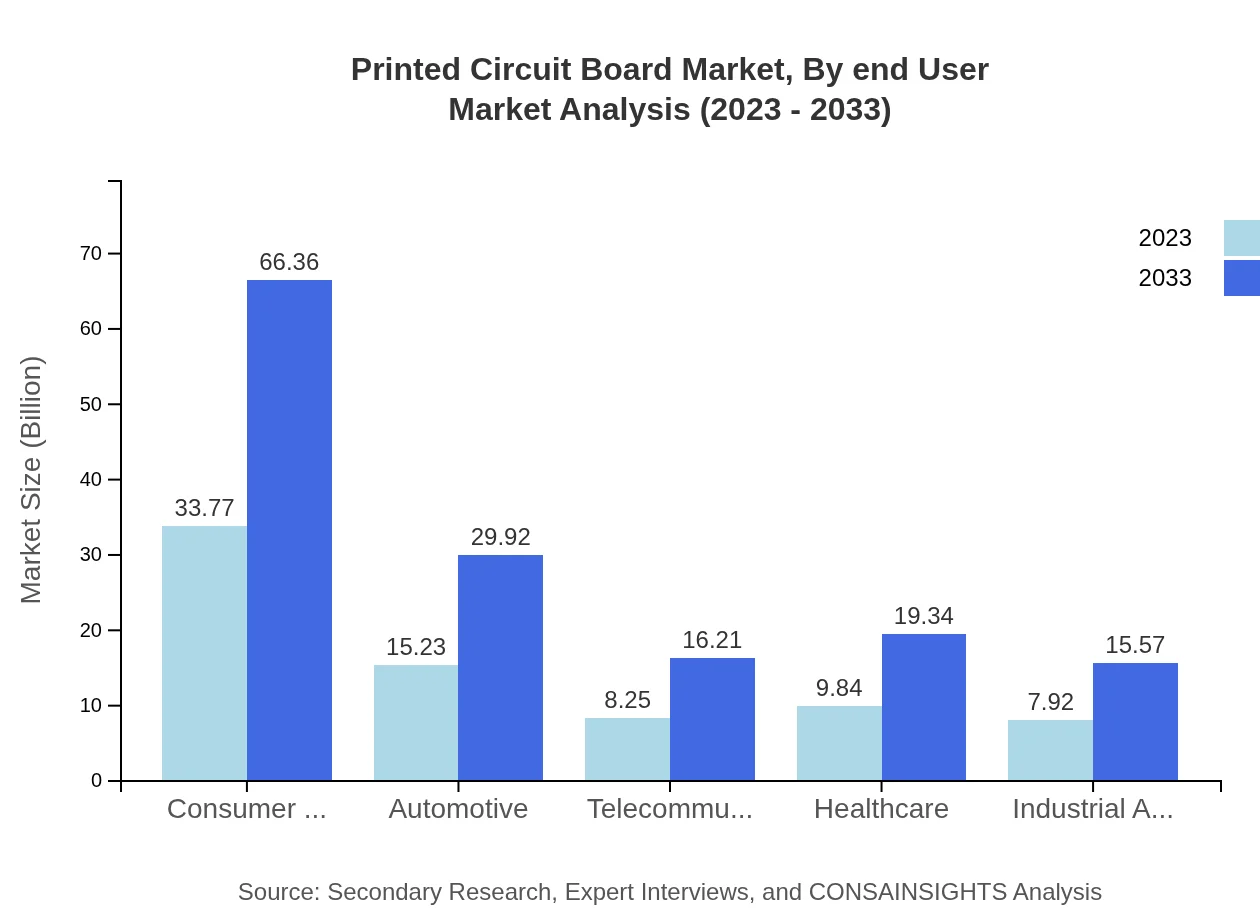

The consumer electronics segment holds a considerable share of the PCB market, accounting for 45.02% in 2023, and is expected to grow significantly due to the proliferation of smartphones and smart devices. The automotive and healthcare industries are also substantial end-users, contributing to the demand for advanced PCB designs.

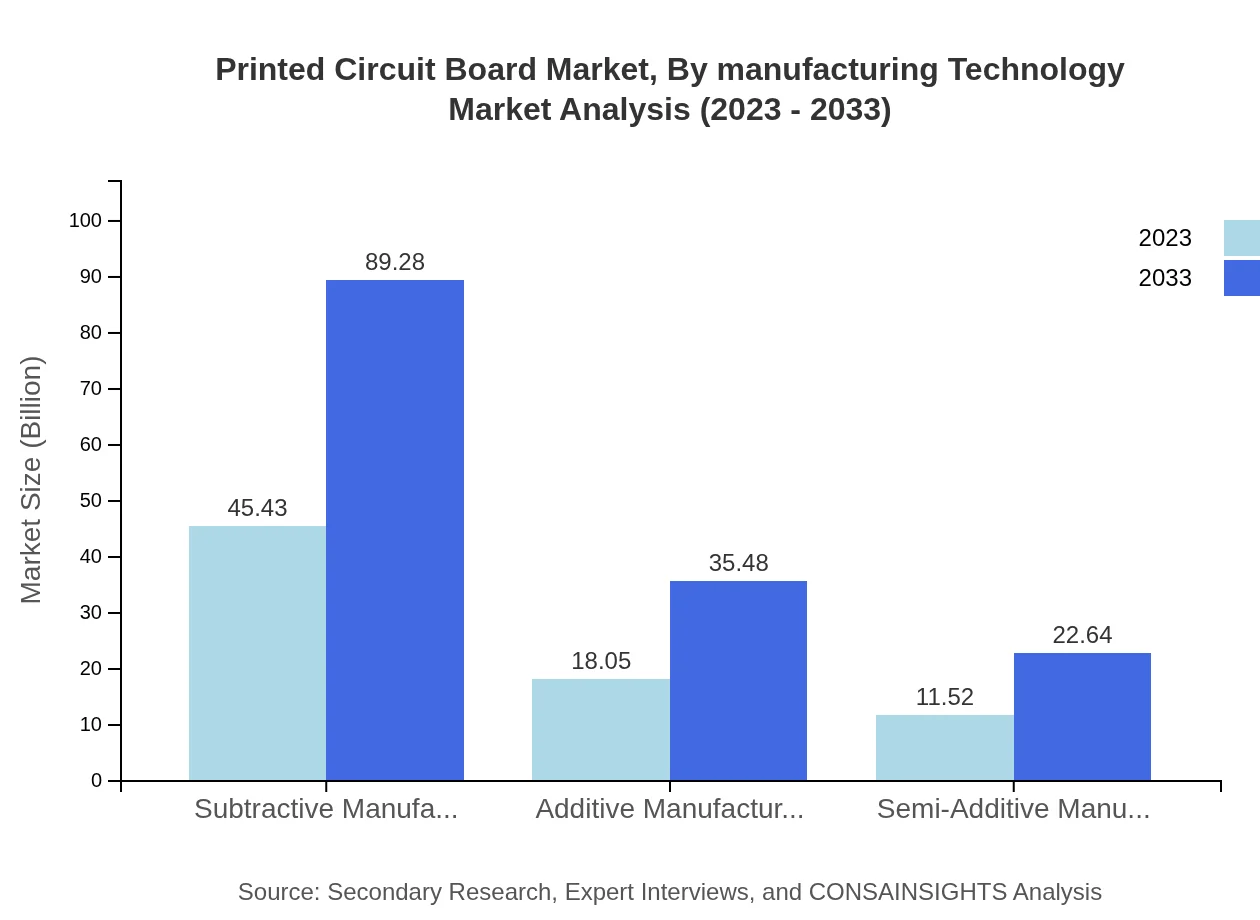

Printed Circuit Board Market Analysis By Manufacturing Technology

Subtractive manufacturing dominates the PCB market, with a significant share of 60.57% in 2023. However, additive manufacturing is gaining traction, especially in prototyping and low-volume production runs, reflecting the industry's shift towards more flexible manufacturing solutions.

Printed Circuit Board Market Analysis By Application

Aerospace, automotive, and telecommunications are key application segments for PCBs, showcasing advanced technological applications that require specific design and performance features. Growing trends in electric vehicles and 5G are further enhancing the requirement for specialized PCB solutions.

Printed Circuit Board Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Printed Circuit Board Industry

Taiyo Yuden Co., Ltd.:

A leading manufacturer of electronic components, Taiyo Yuden is well-known for its innovative PCB solutions, especially in multilayer boards and high-density interconnects.Jabil Inc.:

Jabil provides comprehensive manufacturing services, including PCB production, focusing on customized solutions for various industries, including healthcare and automotive.Zhen Ding Technology Holding Limited:

A major global supplier of PCBs, Zhen Ding specializes in advanced technology and services for electronic interconnection products, catering to consumer electronics and communication sectors.Aptiv PLC:

Aptiv focuses on smart mobility solutions and is a key player in providing PCBs tailored for automotive applications, particularly in electric and autonomous vehicles.We're grateful to work with incredible clients.

FAQs

What is the market size of printed Circuit Board?

The printed circuit board market is projected to reach $75 billion by 2033, growing at a CAGR of 6.8% from 2023. This growth is driven by increasing demand across various sectors, including consumer electronics and automotive.

What are the key market players or companies in this printed Circuit Board industry?

Key players in the printed circuit board industry include major manufacturers such as Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and Intel Corporation. These companies play critical roles in driving technological advancements and market trends.

What are the primary factors driving the growth in the printed Circuit Board industry?

Growth in the printed circuit board industry is primarily driven by technological innovations, the rise of consumer electronics, increased automotive electronics, and the expansion of IoT devices. These factors highlight the industry's adaptation to changing market dynamics.

Which region is the fastest Growing in the printed Circuit Board?

The Asia Pacific region is the fastest-growing market for printed circuit boards, with a projected increase from $16.07 billion in 2023 to $31.57 billion by 2033. This growth reflects the region's robust electronics manufacturing base and rising demand.

Does ConsaInsights provide customized market report data for the printed Circuit Board industry?

Yes, ConsaInsights offers customized market report data for the printed circuit board industry, tailored to specific client needs. This customization allows companies to gain valuable insights relevant to their strategic planning and market positioning.

What deliverables can I expect from this printed Circuit Board market research project?

From this market research project, you can expect detailed industry analysis reports, market forecasts, segment data, competitive analysis, and tailored recommendations that provide insights for strategic decision-making in the printed circuit board sector.

What are the market trends of printed Circuit Board?

Current market trends in the printed circuit board industry include a shift towards eco-friendly materials, advancements in lightweight designs, and an increased focus on high-frequency PCBs. Furthermore, digital transformation and 5G technology adoption are significant trend drivers.