Printed Electronics Market Report

Published Date: 31 January 2026 | Report Code: printed-electronics

Printed Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Printed Electronics market, including market trends, size, segmentation, and forecasts from 2023 to 2033. It also delves into regional insights and examines key players shaping the industry.

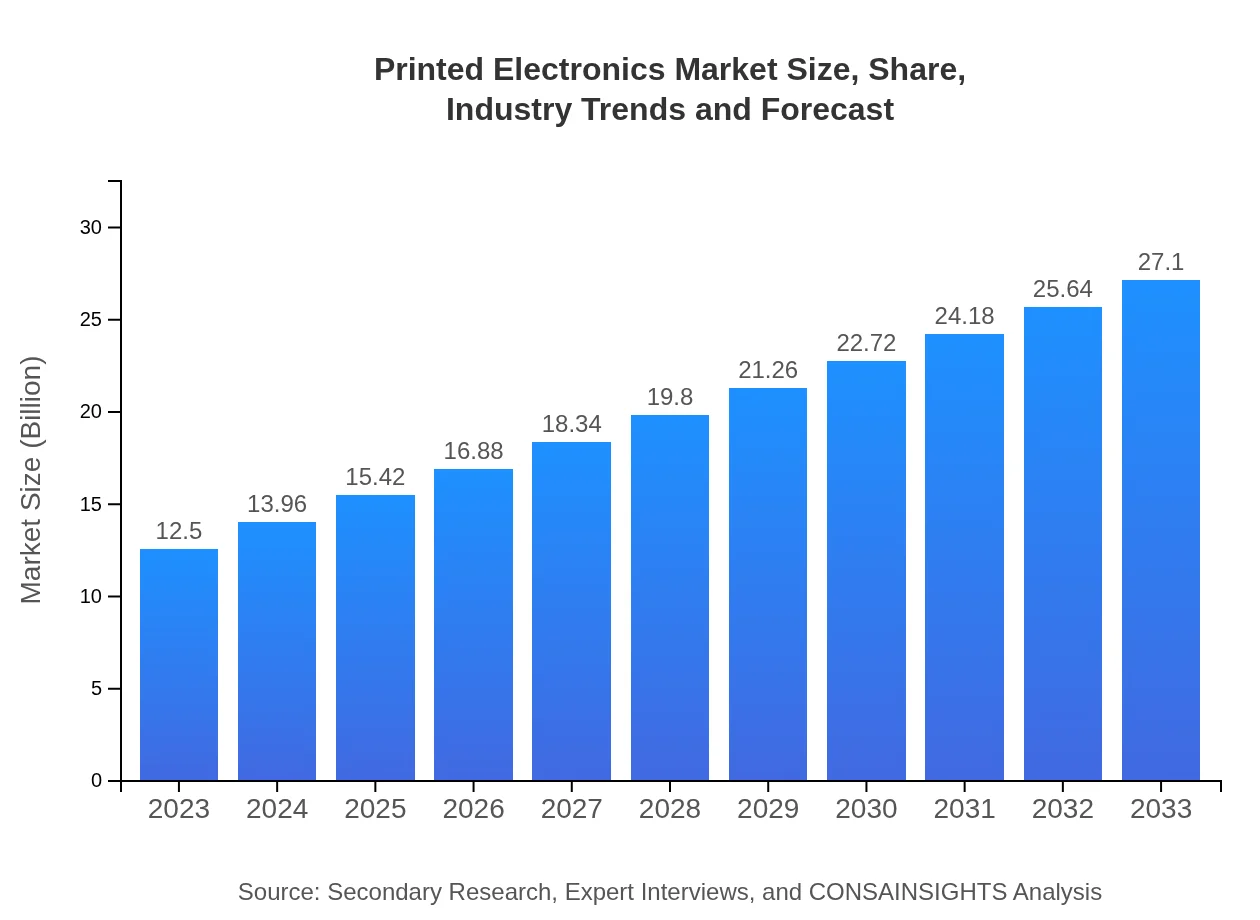

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $27.10 Billion |

| Top Companies | Eastman Kodak Company, Nano Dimension Ltd., Henkel AG & Co. KGaA, Thin Film Electronics ASA |

| Last Modified Date | 31 January 2026 |

Printed Electronics Market Overview

Customize Printed Electronics Market Report market research report

- ✔ Get in-depth analysis of Printed Electronics market size, growth, and forecasts.

- ✔ Understand Printed Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Printed Electronics

What is the Market Size & CAGR of Printed Electronics market in 2023?

Printed Electronics Industry Analysis

Printed Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Printed Electronics Market Analysis Report by Region

Europe Printed Electronics Market Report:

Europe's market for Printed Electronics is forecasted to grow from USD 3.34 billion in 2023 to USD 7.25 billion by 2033. The focus on sustainability and smart technologies, along with regulatory support towards green electronics, is expected to bolster market prospects.Asia Pacific Printed Electronics Market Report:

In 2023, the Asia Pacific Printed Electronics market is projected to reach USD 2.74 billion, expanding to USD 5.95 billion by 2033, largely driven by the booming electronics manufacturing sector, especially in countries like China and Japan. The region's focus on smart cities and IoT is further promoting the adoption of printed electronics technologies.North America Printed Electronics Market Report:

In North America, the market is set to grow from USD 4.45 billion in 2023 to USD 9.64 billion by 2033. The increasing demand for innovative solutions in healthcare and consumer electronics, coupled with significant investments in R&D, positions North America as a leader in the printed electronics space.South America Printed Electronics Market Report:

The South American Printed Electronics market is estimated at USD 0.30 billion in 2023 and is expected to grow to USD 0.64 billion by 2033. The rise in regional interest for sustainable materials in electronics and a growing middle class are contributing factors to this growth.Middle East & Africa Printed Electronics Market Report:

The Middle East and Africa Printed Electronics market is anticipated to grow from USD 1.67 billion in 2023 to USD 3.62 billion by 2033. This growth is largely attributed to advancements in mobile technologies and increasing investments in renewable energy sectors.Tell us your focus area and get a customized research report.

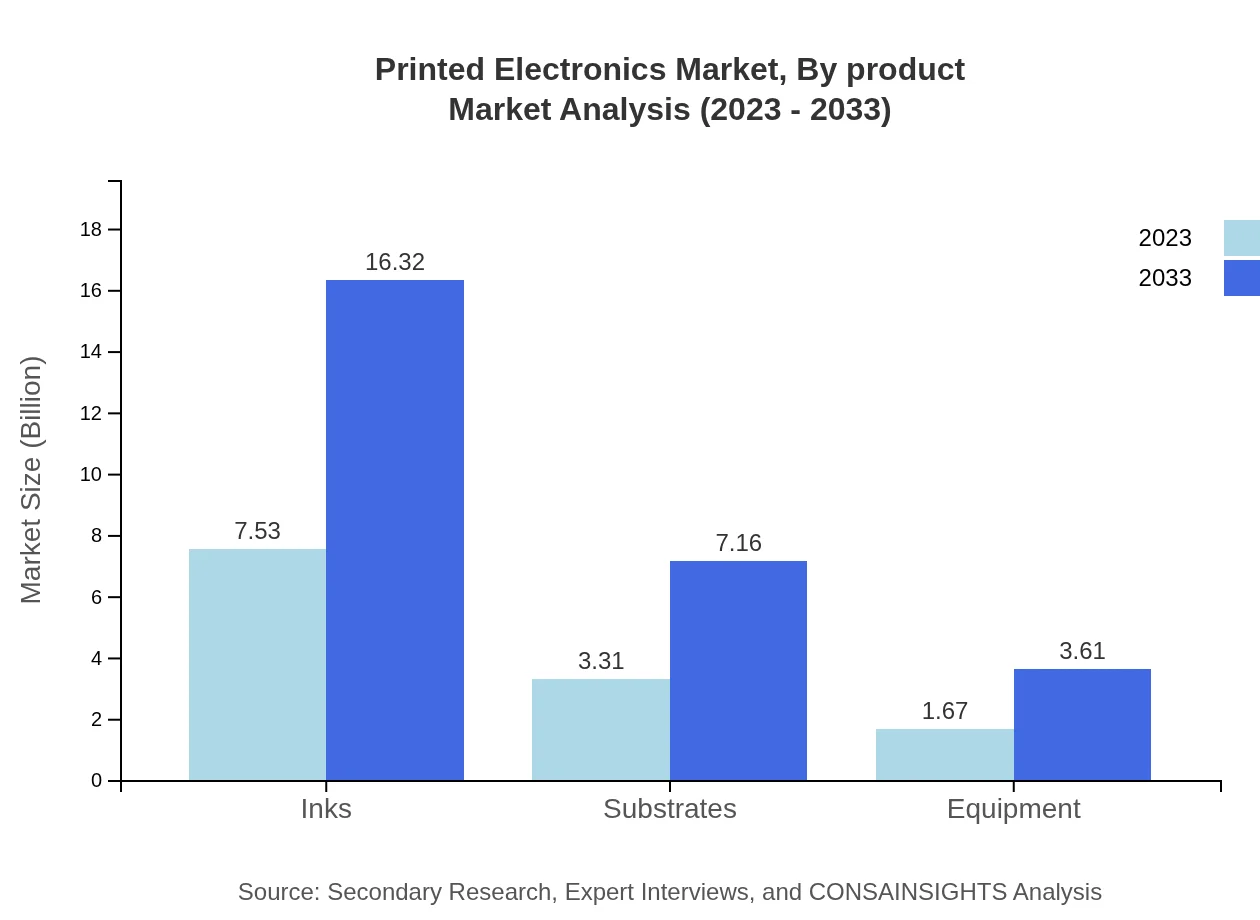

Printed Electronics Market Analysis By Product

The Printed Electronics market, by product, highlights the significant roles of inks, substrates, and equipment. Inks are the largest segment, generating USD 7.53 billion in 2023 and projected to grow to USD 16.32 billion by 2033. Substrates are also crucial, with a forecast growth from USD 3.31 billion in 2023 to USD 7.16 billion by 2033. Equipment, while smaller in scale, represents a growing interest in manufacturing capabilities as adoption increases.

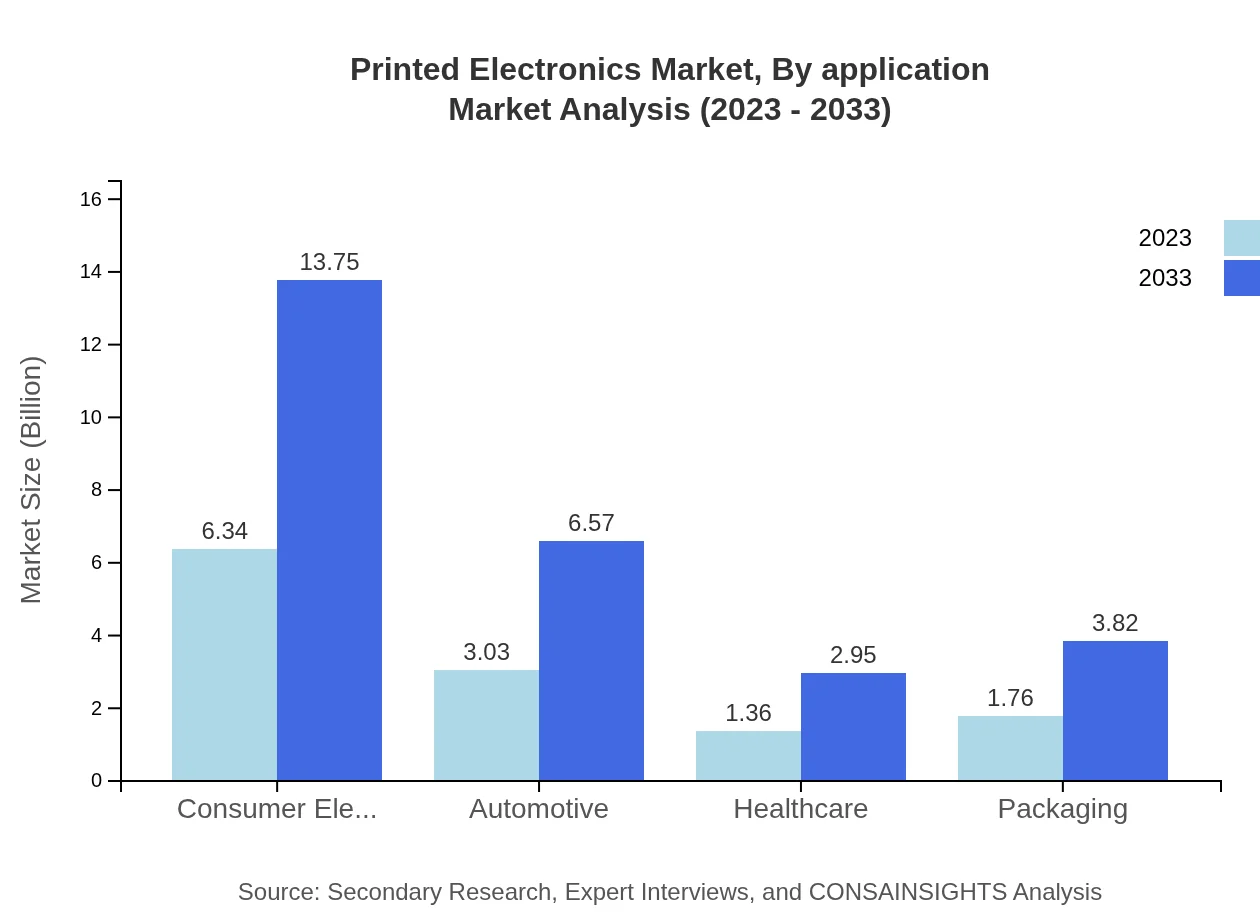

Printed Electronics Market Analysis By Application

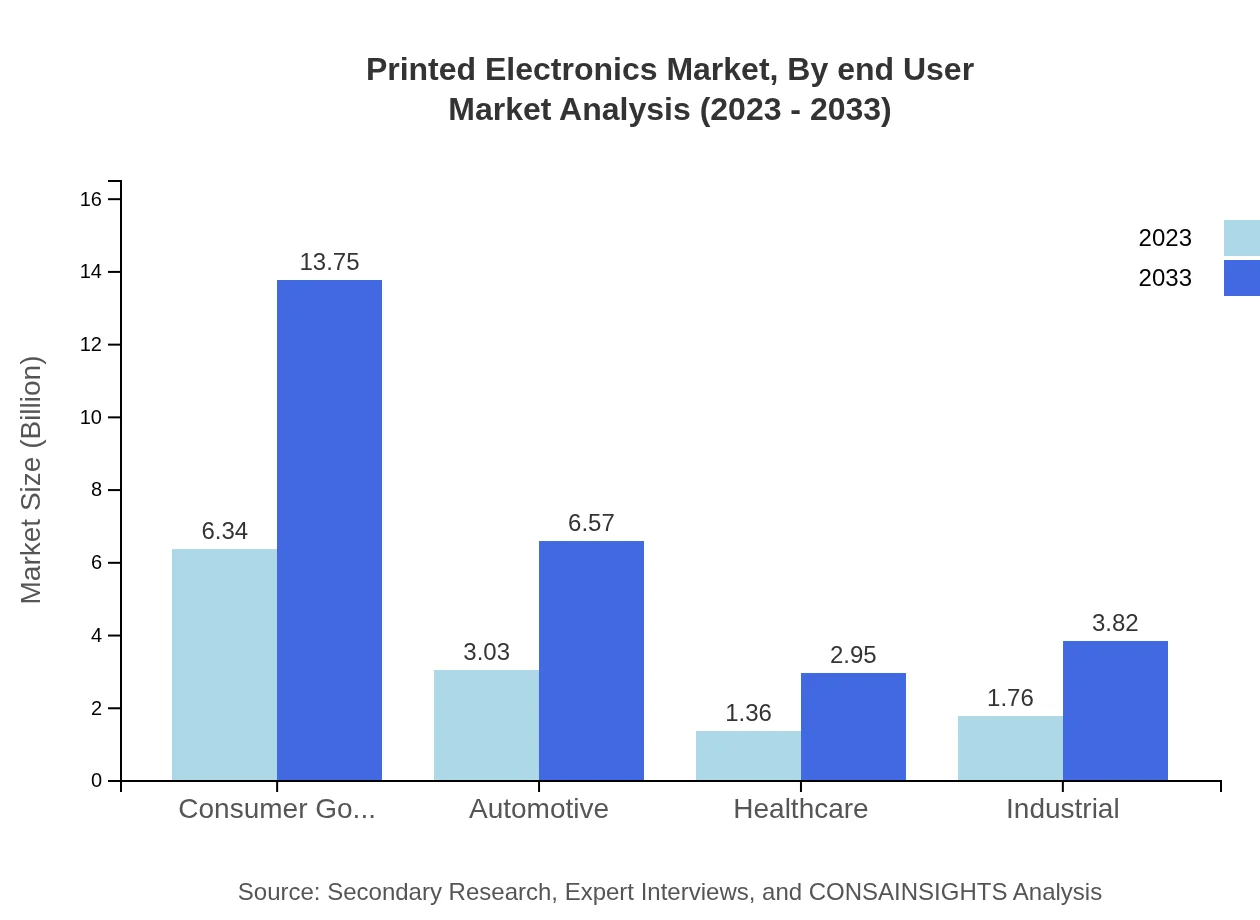

Application-wise, consumer goods remain the dominant force in the Printed Electronics market, expanding from USD 6.34 billion in 2023 to USD 13.75 billion by 2033, accounting for 50.75% market share. Automotive and healthcare applications also show robust growth potential, with anticipated increases from USD 3.03 billion to USD 6.57 billion and USD 1.36 billion to USD 2.95 billion, respectively.

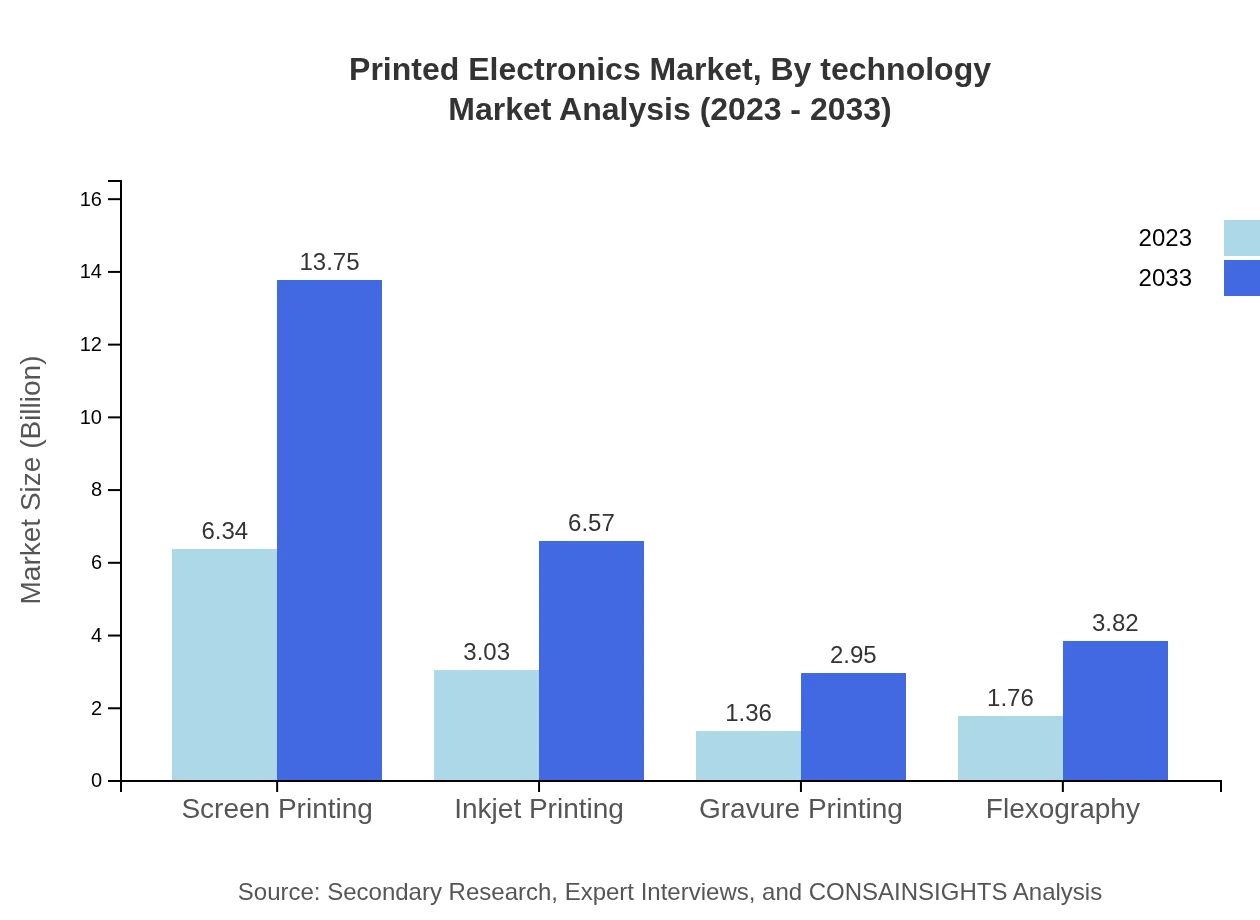

Printed Electronics Market Analysis By Technology

The report categorizes the Printed Electronics market based on technology, including screen printing, inkjet, gravure, and flexography. Screen printing is expected to retain the largest market share, with a growth trajectory from USD 6.34 billion to USD 13.75 billion from 2023 to 2033, while inkjet printing and gravure printing will see similar expansions, reflecting the overall shift towards efficient printing technologies.

Printed Electronics Market Analysis By End User

End-user analysis showcases diverse applications across healthcare, automotive, consumer electronics, and packaging. Consumer electronics generate significant revenue, amounting to USD 6.34 billion in 2023 and projected to reach USD 13.75 billion by 2033, highlighting the strong integration of printed electronics into everyday devices.

Printed Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Printed Electronics Industry

Eastman Kodak Company:

Kodak is a pioneer in printing technology, actively involved in the development of printed electronics solutions, including conductive inks and flexible substrates.Nano Dimension Ltd.:

Nano Dimension specializes in additive manufacturing and printed electronics, offering innovative solutions for creating 3D printed circuit boards and advanced electronic devices.Henkel AG & Co. KGaA:

A leading materials science company, Henkel produces advanced adhesives, sealants, and coatings, including innovative conductive inks for printed electronics.Thin Film Electronics ASA:

Thin Film is a global leader in printed electronics, focusing on developing low-cost, printed, and integrated electronic circuits for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of printed Electronics?

The printed electronics market is projected to reach $12.5 billion by 2033, growing at a CAGR of 7.8% from its current value. This growth showcases the increasing adoption of printed technologies across various applications.

What are the key market players or companies in this printed Electronics industry?

Key players in the printed electronics market include companies like NovaCentrix, Thinfilm, and Envision AESC. These companies are known for their innovative technologies and contributions to the growth of the printed electronics sector.

What are the primary factors driving the growth in the printed electronics industry?

The growth of the printed electronics industry is driven by rising demand for flexible displays, advancements in ink technology, and increased investment in sustainable manufacturing practices. These elements foster innovation and market expansion.

Which region is the fastest Growing in the printed electronics market?

The Asia Pacific region is the fastest-growing market for printed electronics, projected to grow from $2.74 billion in 2023 to $5.95 billion by 2033, reflecting increasing manufacturing and technological adoption across the region.

Does ConsaInsights provide customized market report data for the printed electronics industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the printed electronics industry, ensuring relevant insights and detailed analysis that cater to individual business objectives.

What deliverables can I expect from this printed electronics market research project?

Expect comprehensive deliverables including market analysis reports, trend assessments, competitive landscape insights, and customized data presentations tailored to specific market segments in the printed electronics field.

What are the market trends of printed electronics?

Current trends in printed electronics include sustainability efforts, advancements in miniaturization, and diversification across consumer goods, automotive, and healthcare sectors, indicating a broadening of applications and innovative uses of printed technologies.