Printed Sensors Market Report

Published Date: 31 January 2026 | Report Code: printed-sensors

Printed Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Printed Sensors market between 2023 and 2033, highlighting market trends, size, growth forecasts, and key segments. It covers regional insights and profiles leading companies in this rapidly evolving sector.

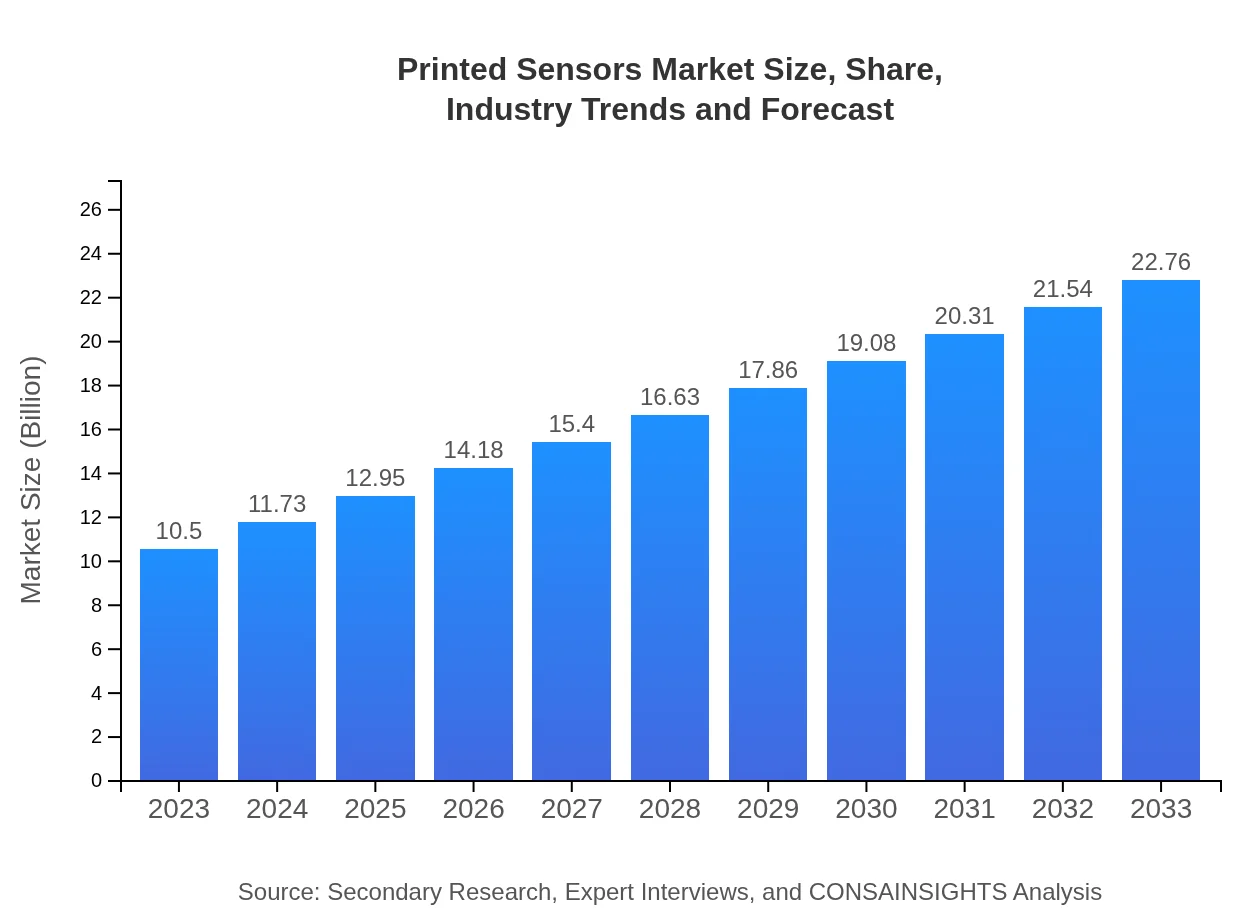

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | Thin Film Electronics, Avery Dennison, Nano Dimension, Novacentrix |

| Last Modified Date | 31 January 2026 |

Printed Sensors Market Overview

Customize Printed Sensors Market Report market research report

- ✔ Get in-depth analysis of Printed Sensors market size, growth, and forecasts.

- ✔ Understand Printed Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Printed Sensors

What is the Market Size & CAGR of Printed Sensors market in 2023?

Printed Sensors Industry Analysis

Printed Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Printed Sensors Market Analysis Report by Region

Europe Printed Sensors Market Report:

Europe is set to witness robust growth, starting from USD 3.50 billion in 2023, reaching up to USD 7.60 billion by 2033. Major drivers include the stringent regulations for health monitoring devices and the increasing use of printed sensors in packaging applications.Asia Pacific Printed Sensors Market Report:

The Asia Pacific region is a key player in the Printed Sensors market, with a market value of approximately USD 2.01 billion in 2023, expected to grow to USD 4.35 billion by 2033. This growth is driven by high demand in electronics manufacturing and significant investments in smart city projects, along with innovations in healthcare technologies.North America Printed Sensors Market Report:

North America holds a significant share of the Printed Sensors market, valued at USD 3.38 billion in 2023, with expectations to expand to USD 7.32 billion by 2033. The region's market strength is attributed to the high adoption of innovative technologies in healthcare and automotive sectors, along with significant R&D investments.South America Printed Sensors Market Report:

The South American market is relatively smaller but is showing promising growth, with a market size of USD 0.77 billion in 2023, projected to reach USD 1.66 billion by 2033. The rising focus on food safety systems and environmental monitoring is anticipated to drive growth within this region.Middle East & Africa Printed Sensors Market Report:

The market in the Middle East and Africa is also anticipated to grow from USD 0.84 billion in 2023 to USD 1.83 billion by 2033. Advancements in smart technologies and growing interest in smart materials for infrastructural applications are major contributing factors.Tell us your focus area and get a customized research report.

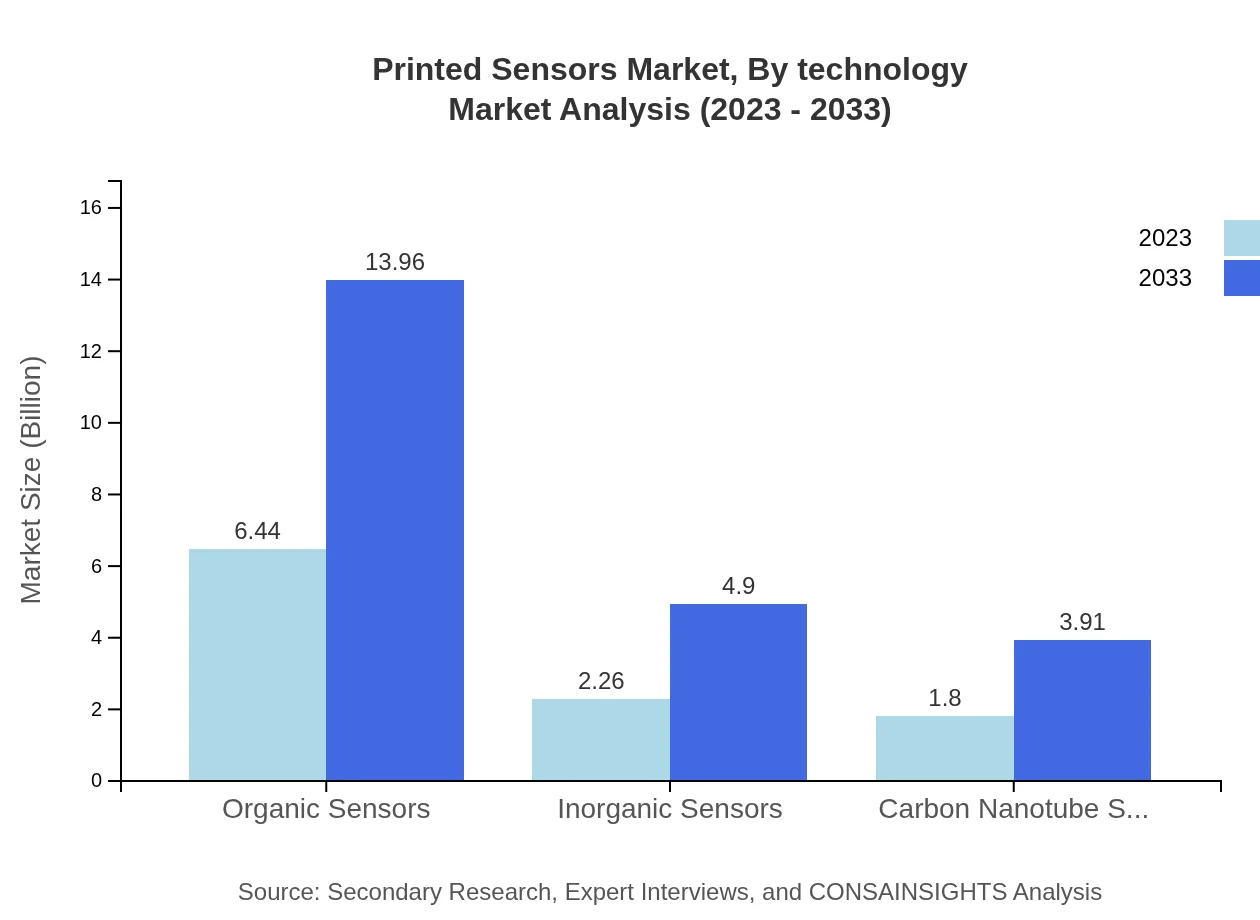

Printed Sensors Market Analysis By Technology

The market for Printed Sensors by technology is dominated by conductive inks, valued at USD 6.44 billion in 2023, expected to grow to USD 13.96 billion by 2033, accounting for 61.31% market share. Organic sensors follow, reflecting a similar trend, while substrates represent a smaller yet significant segment. This sector plays a foundational role in the production of flexible sensors, contributing to the overall growth of the market.

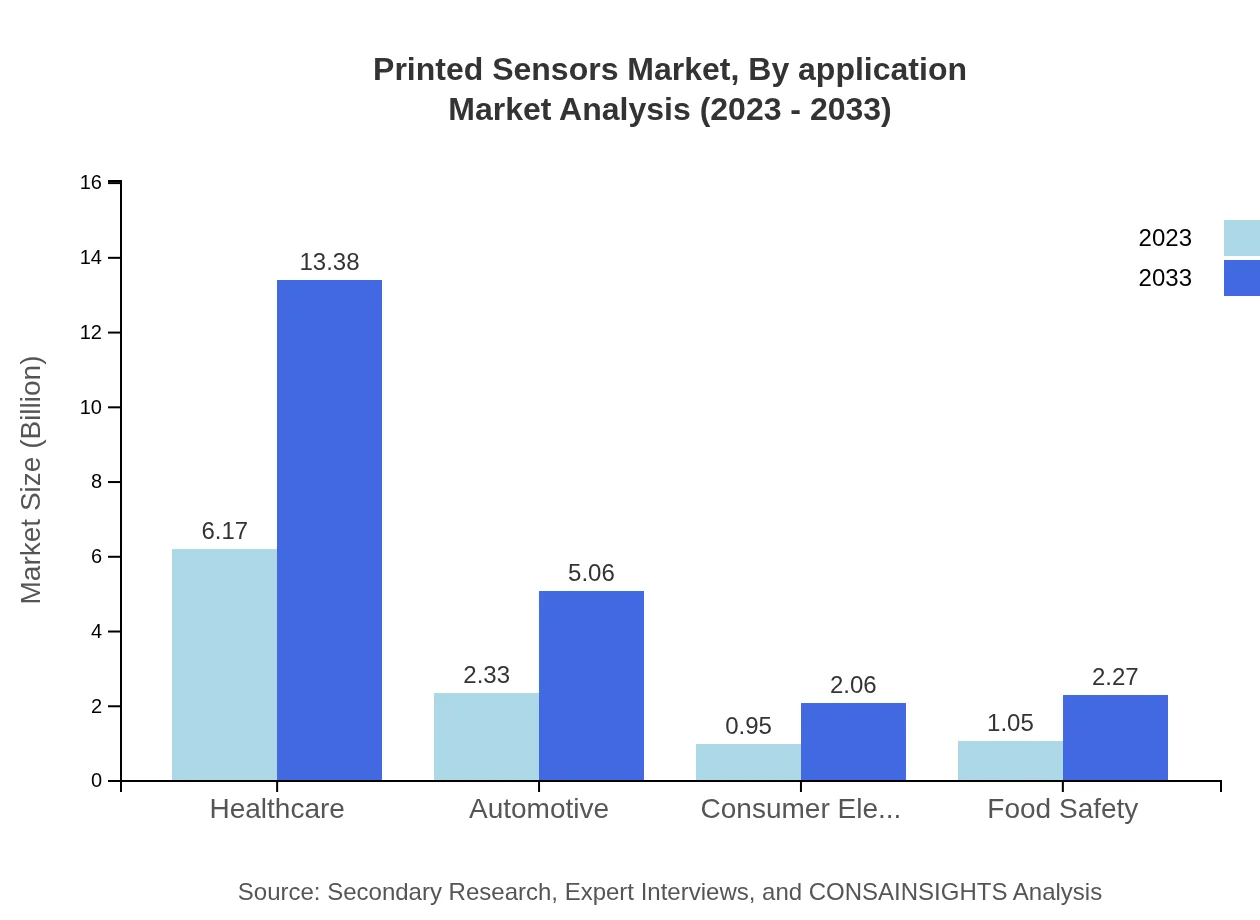

Printed Sensors Market Analysis By Application

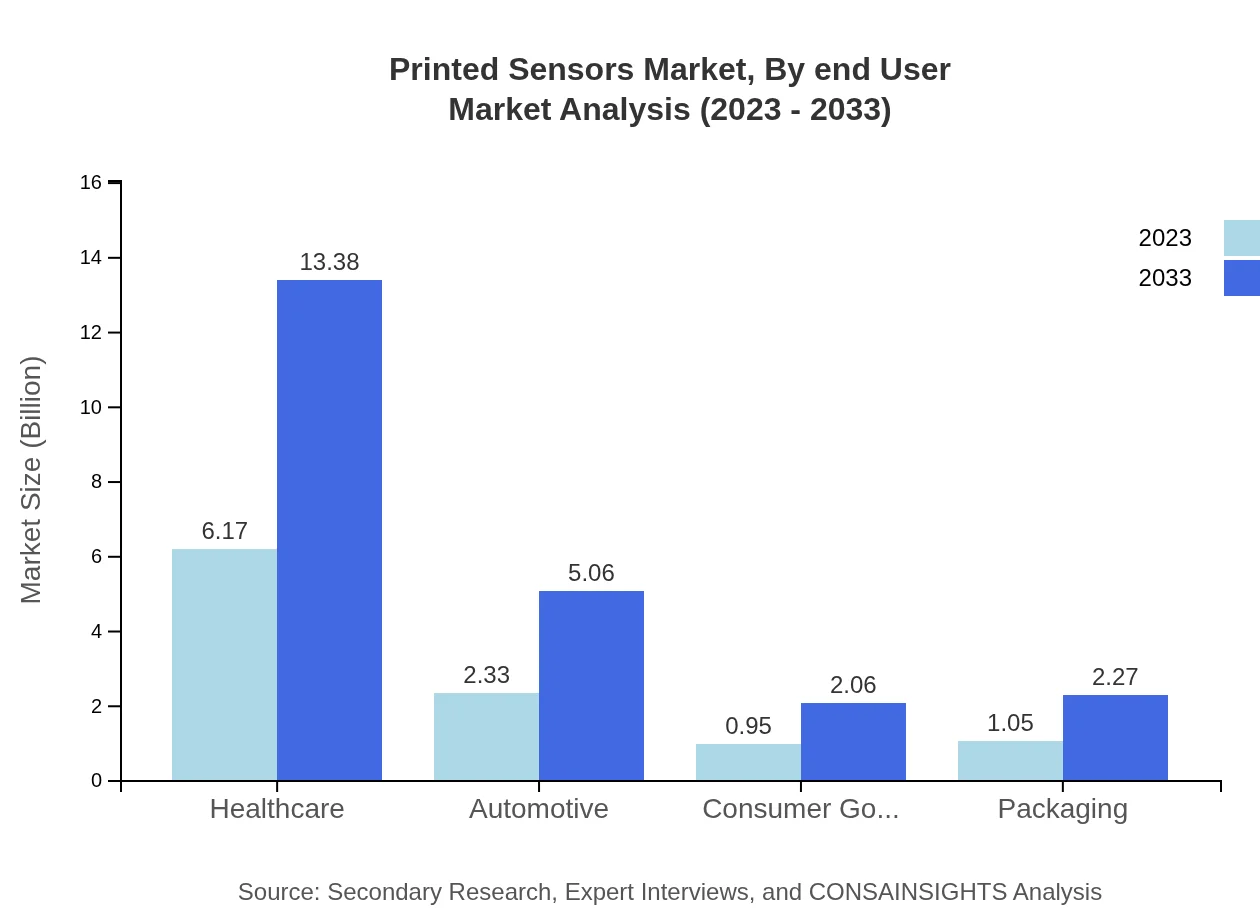

In terms of application, healthcare leads the market, valued at USD 6.17 billion in 2023 and expected to reach USD 13.38 billion by 2033, maintaining a 58.78% market share. The automotive sector follows with substantial growth projections, doubling its market from USD 2.33 billion to USD 5.06 billion over the same period. Consumer electronics and food safety also represent growth sectors, enhancing the overall adoption of printed sensors.

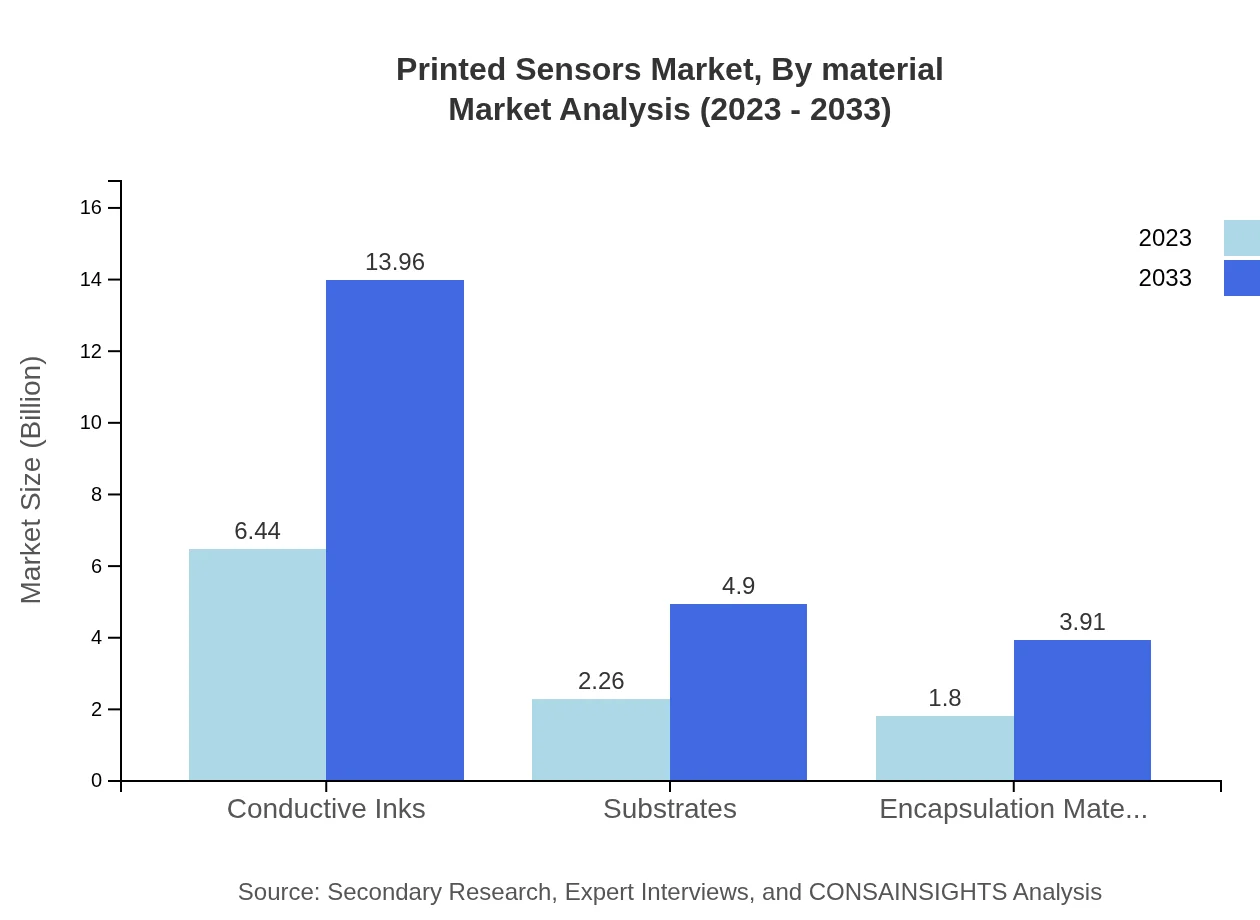

Printed Sensors Market Analysis By Material

The materials used in printed sensors reveal significant trends, with conductive inks leading the market and projected to grow alongside organic and inorganic materials. The demand for sustainable materials is influencing the selection and usage of these sensors across various applications.

Printed Sensors Market Analysis By End User

Major end-users include healthcare, automotive, and packaging sectors, where printed sensors are seeing high demand due to their cost-effectiveness and adaptability. The rapid evolution in smart packaging technologies and telehealth solutions is broadening the business horizon for printed sensors.

Printed Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Printed Sensors Industry

Thin Film Electronics:

A leader in printed electronics, Thin Film Electronics develops solutions focusing on smart packaging and NFC-enabled products, enhancing product tracking and connectivity.Avery Dennison:

Avery Dennison specializes in intelligent labels that integrate printed sensors for various applications, including tracking and monitoring within retail and logistics.Nano Dimension:

Focusing on advanced additive manufacturing technologies, Nano Dimension produces printed sensors for diverse applications, especially in professional electronics and aerospace.Novacentrix:

Novacentrix offers innovative solutions in printed electronics, with a focus on improving the efficiency and capabilities of conductive inks used in various sensor applications.We're grateful to work with incredible clients.

FAQs

What is the market size of printed Sensors?

The printed sensors market is currently valued at approximately $10.5 billion, with a projected CAGR of 7.8% from 2023 to 2033. This growth indicates a robust demand for innovative sensor technologies across various industries.

What are the key market players or companies in the printed Sensors industry?

Key players in the printed sensors market include major companies like Thin Film Electronics, Agfa-Gevaert, and DuPont. These companies are at the forefront of innovation, developing new materials, applications, and manufacturing techniques.

What are the primary factors driving the growth in the printed sensors industry?

The growth of the printed sensors industry is driven by advancements in IoT technologies, increasing demand for smart packaging, and the need for efficient healthcare monitoring solutions. Additionally, the push for sustainable manufacturing methods also plays a vital role.

Which region is the fastest Growing in the printed sensors market?

The fastest-growing region in the printed sensors market is Europe, with projections indicating market growth from $3.50 billion in 2023 to $7.60 billion by 2033. This region's robust technological advancements and investment in smart technologies are key contributors.

Does ConsaInsights provide customized market report data for the printed sensors industry?

Yes, ConsaInsights offers customized market report data tailored to individual client needs in the printed sensors industry. This ensures clients receive insights specific to their target market segment and regional focus.

What deliverables can I expect from this printed sensors market research project?

Clients can expect a comprehensive report detailing market trends, regional analyses, segment data, and competitive landscapes. Additionally, insights on consumer behavior and future forecasts are included for strategic decision-making.

What are the market trends of printed sensors?

Current trends in the printed sensors market include an increasing shift towards flexible and wearable sensors, rising healthcare applications, and the integration of printed electronics in consumer goods, which are set to enhance functionality and user experience.