Private Lte Market Report

Published Date: 31 January 2026 | Report Code: private-lte

Private Lte Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Private LTE market, covering key insights, current trends, and future forecasts from 2023 to 2033. It highlights market size, growth rates, segmented analysis, and regional breakdowns, offering a comprehensive view for stakeholders in the industry.

| Metric | Value |

|---|---|

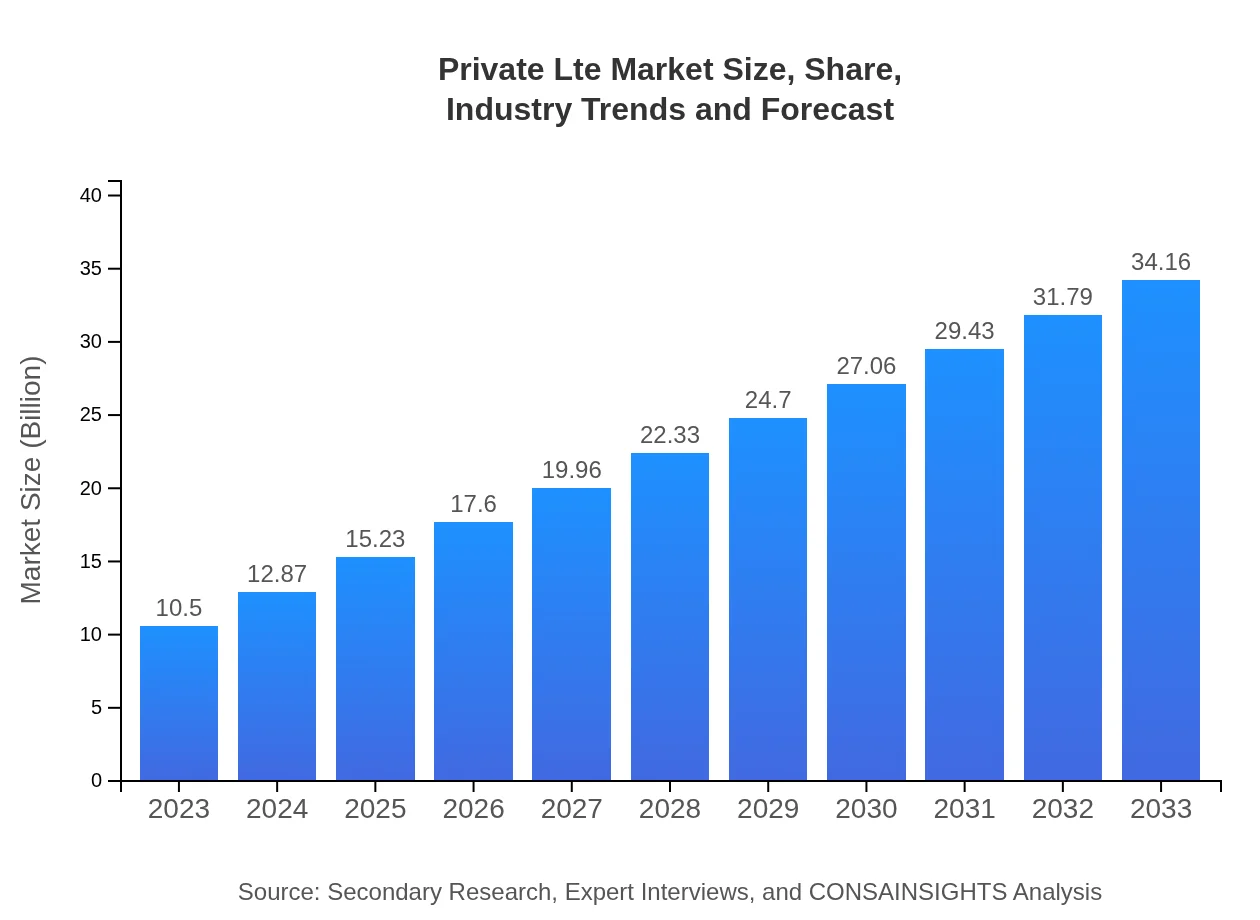

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $34.16 Billion |

| Top Companies | Ericsson , Nokia , Huawei , Samsung |

| Last Modified Date | 31 January 2026 |

Private LTE Market Overview

Customize Private Lte Market Report market research report

- ✔ Get in-depth analysis of Private Lte market size, growth, and forecasts.

- ✔ Understand Private Lte's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Private Lte

What is the Market Size & CAGR of Private LTE market in 2023?

Private LTE Industry Analysis

Private LTE Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Private LTE Market Analysis Report by Region

Europe Private Lte Market Report:

The European Private LTE market is expected to expand from $3.63 billion in 2023 to $11.82 billion by 2033. Regulations promoting digital and security initiatives across regions necessitate the adoption of Private LTE, particularly in industries requiring regulatory compliance.Asia Pacific Private Lte Market Report:

The Asia Pacific Private LTE market is set to grow from $1.87 billion in 2023 to $6.09 billion by 2033, driven by the rapid digitization of industries and increasing investments in telecommunications infrastructure. Countries such as China and India are leading the adoption of Private LTE as organizations aim to improve operational efficiency and expand their digital capabilities.North America Private Lte Market Report:

North America dominates the Private LTE market, forecasted to rise from $3.43 billion in 2023 to $11.15 billion by 2033. The robust adoption of LTE technology across manufacturing and healthcare sectors, combined with investments in smart factories and connected devices, fuels this growth.South America Private Lte Market Report:

In South America, the market is projected to increase from $0.95 billion in 2023 to $3.08 billion by 2033. The growing demand for reliable communication channels, particularly in energy and utilities sectors, is propelling the market as businesses prioritize private connectivity for business continuity.Middle East & Africa Private Lte Market Report:

The Middle East and Africa market is projected to evolve from $0.62 billion in 2023 to $2.03 billion by 2033, supported by increasing investments in telecommunications and the burgeoning need for industrial automation and smart solutions across various sectors.Tell us your focus area and get a customized research report.

Private Lte Market Analysis By Industry

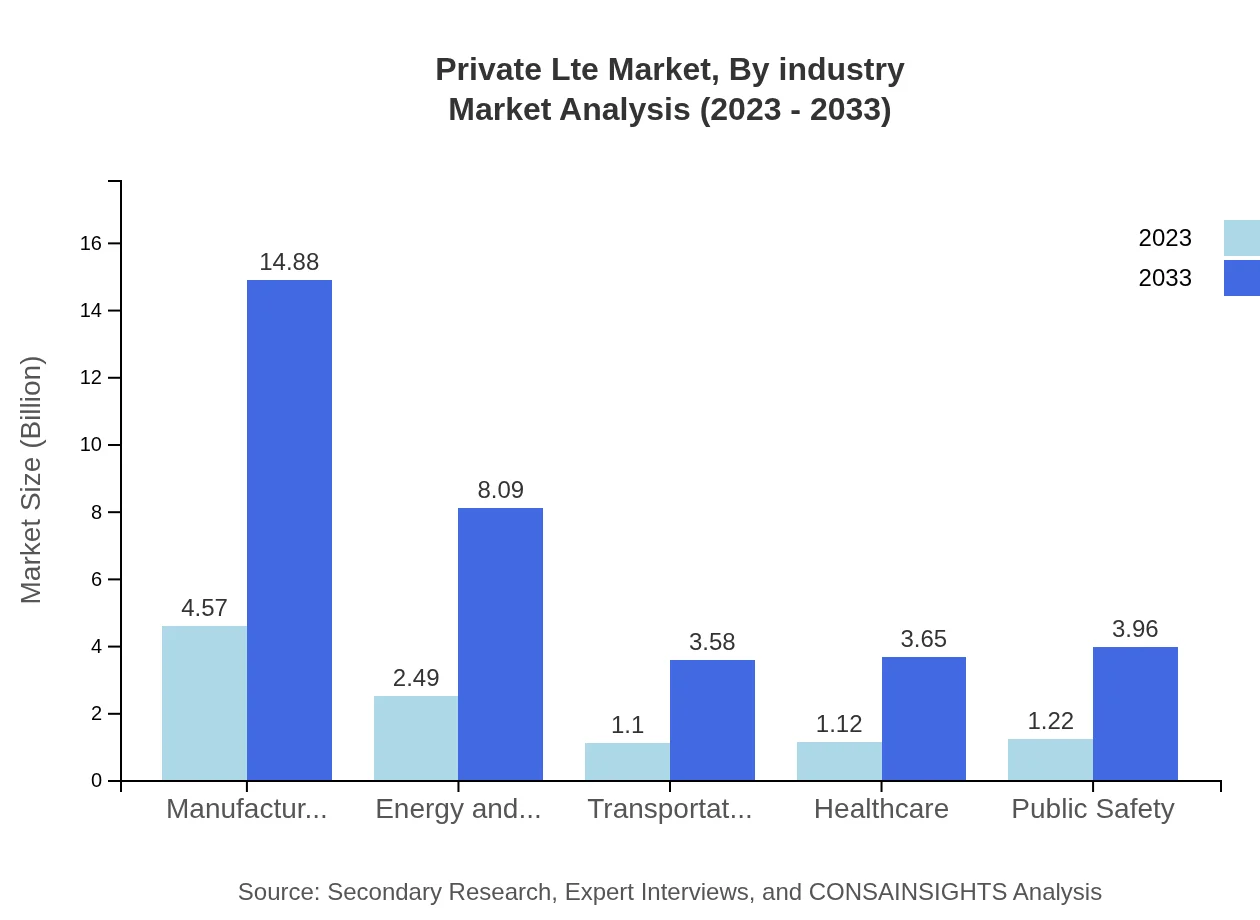

The Private LTE market within the manufacturing industry is estimated at $4.57 billion in 2023, growing to $14.88 billion by 2033, representing a consistent share of 43.55%. This highlights the critical role of Private LTE in facilitating automation and connectivity in manufacturing environments.

Private Lte Market Analysis By Industry

In the energy and utilities sector, the market is projected to grow from $2.49 billion in 2023 to $8.09 billion by 2033 with a consistent market share of 23.68%. Increased reliance on connected devices for monitoring and maintenance underscores the significance of Private LTE.

Private Lte Market Analysis By Industry

The Private LTE market within transportation is growing from $1.10 billion in 2023 to $3.58 billion by 2033, holding a stable share of 10.48%. This segment benefits from enhanced logistics and fleet management solutions realized through private network deployments.

Private Lte Market Analysis By Industry

The healthcare segment is projected to expand from $1.12 billion in 2023 to $3.65 billion by 2033, maintaining a share of 10.69%. The increasing need for secure patient data sharing and connected medical devices fuels this growth.

Private Lte Market Analysis By Industry

In public safety, the market size is expected to grow from $1.22 billion in 2023 to $3.96 billion by 2033, with a market share of 11.6%. Enhanced communication systems for emergency services highlight the importance of Private LTE adoption in this segment.

Private Lte Market Analysis By Industry

The segment for equipment manufacturers is anticipated to grow from $8.93 billion in 2023 to $29.06 billion by 2033, with a share of 85.08%. This segment encompasses key players supplying LTE infrastructure essential for private network deployments.

Private Lte Market Analysis By Industry

Service providers are expected to grow from $1.57 billion in 2023 to $5.10 billion by 2033, maintaining a share of 14.92%. They provide essential support for organizations transitioning to Private LTE networks.

Private LTE Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Private LTE Industry

Ericsson :

Ericsson is a global leader in telecommunications technology and services, providing Private LTE solutions that enhance connectivity and efficiency in various sectors.Nokia :

Nokia offers advanced Private LTE solutions, focusing on industrial IoT applications and driving innovation across sectors such as manufacturing and transportation.Huawei :

Huawei is a prominent player in the telecommunications sector, providing comprehensive Private LTE networks with a focus on enhancing operational efficiency in various industries.Samsung :

Samsung provides robust Private LTE solutions that support high-performance applications for enterprises seeking secure and reliable connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of private Lte?

The private LTE market is projected to reach 10.5 billion by 2033, showcasing a compound annual growth rate (CAGR) of 12%. As businesses increasingly seek tailored connectivity solutions, substantial growth is anticipated over the next decade.

What are the key market players or companies in this private Lte industry?

Key players in the private LTE market include Ericsson, Nokia, Huawei, Cisco Systems, and Qualcomm, among others. These companies are leading innovations and implementing solutions across various sectors to drive connectivity and reliability.

What are the primary factors driving the growth in the private Lte industry?

Factors driving growth in the private LTE industry include the surge in IoT applications, demand for enhanced network coverage, need for improved security, and the transition to Industry 4.0, boosting automation and digital transformation processes.

Which region is the fastest Growing in the private Lte?

The fastest-growing region for private LTE is Europe, expected to expand from 3.63 billion in 2023 to 11.82 billion by 2033. This growth reflects increasing investments in smart city initiatives and industrial automation.

Does ConsaInsights provide customized market report data for the private Lte industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the private LTE industry, enabling businesses to access detailed insights, forecasts, and competitive analyses relevant to their objectives.

What deliverables can I expect from this private Lte market research project?

Deliverables from the private LTE market research project typically include comprehensive reports, market forecasts, insights into competitive landscapes, segmented analysis, and actionable recommendations based on industry trends.

What are the market trends of private Lte?

Trends in the private LTE market include increasing adoption of IoT for industrial applications, a shift towards cloud-based solutions, and a growing emphasis on network security and reliability across sectors like manufacturing and transportation.