Probiotics Prebiotics As Compound Feed Ingredients Market Report

Published Date: 31 January 2026 | Report Code: probiotics-prebiotics-as-compound-feed-ingredients

Probiotics Prebiotics As Compound Feed Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Probiotics Prebiotics as Compound Feed Ingredients market from 2023 to 2033. It covers market dynamics, size projections, regional insights, technological advancements, and significant industry players, offering valuable insights for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

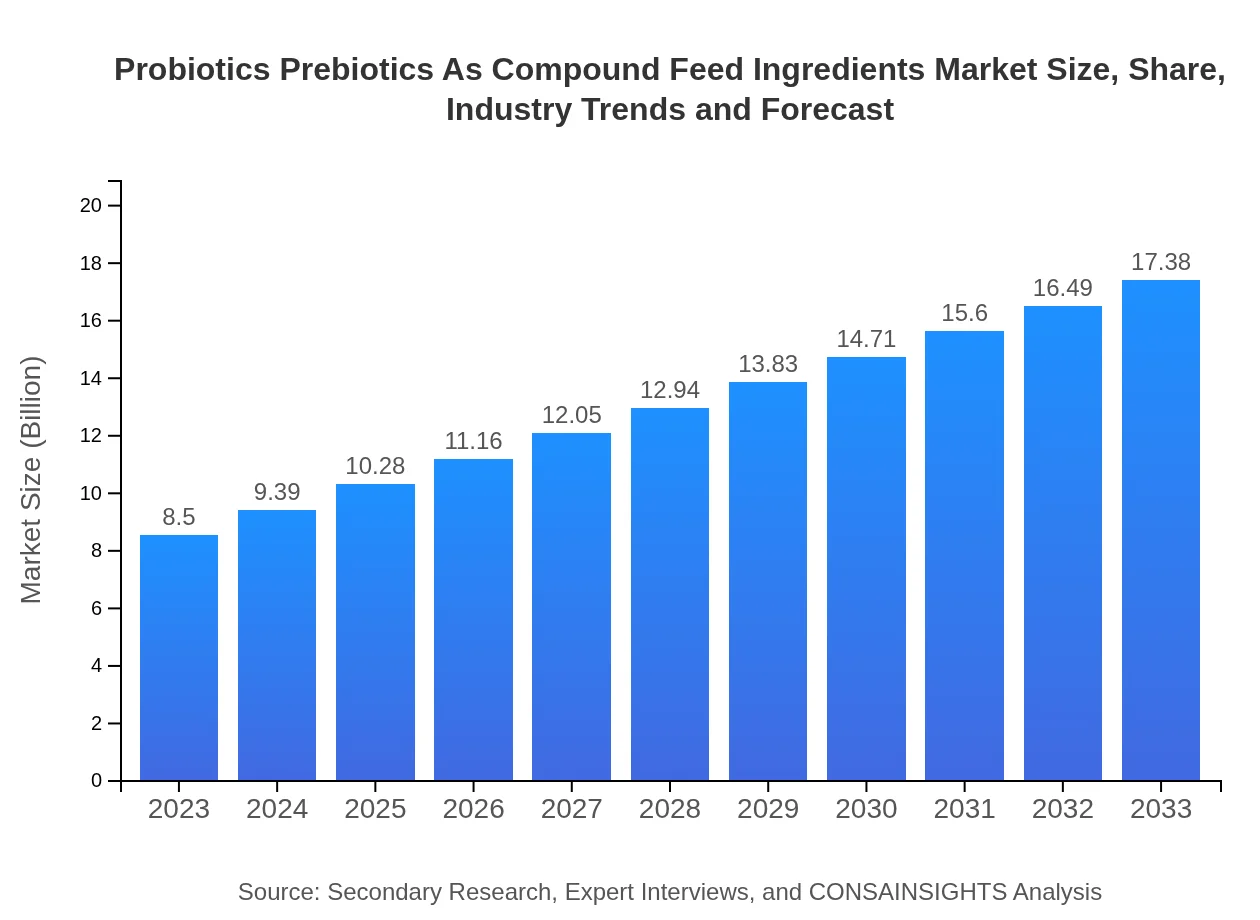

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $17.38 Billion |

| Top Companies | Chr. Hansen, BASF SE, DuPont de Nemours, Inc., Evonik Industries AG, Alltech |

| Last Modified Date | 31 January 2026 |

Probiotics Prebiotics As Compound Feed Ingredients Market Overview

Customize Probiotics Prebiotics As Compound Feed Ingredients Market Report market research report

- ✔ Get in-depth analysis of Probiotics Prebiotics As Compound Feed Ingredients market size, growth, and forecasts.

- ✔ Understand Probiotics Prebiotics As Compound Feed Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Probiotics Prebiotics As Compound Feed Ingredients

What is the Market Size & CAGR of Probiotics Prebiotics As Compound Feed Ingredients market in 2023 & 2033?

Probiotics Prebiotics As Compound Feed Ingredients Industry Analysis

Probiotics Prebiotics As Compound Feed Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Probiotics Prebiotics As Compound Feed Ingredients Market Analysis Report by Region

Europe Probiotics Prebiotics As Compound Feed Ingredients Market Report:

Europe shows robust growth from USD 2.53 billion in 2023 to USD 5.17 billion by 2033. Strong regulatory frameworks promoting natural additives significantly enhance market potential throughout the region.Asia Pacific Probiotics Prebiotics As Compound Feed Ingredients Market Report:

In 2023, the Asia Pacific market is valued at USD 1.62 billion and projected to reach USD 3.30 billion by 2033, reflecting a strong CAGR. Key markets include China and India, driven by rising meat consumption and health awareness among farmers.North America Probiotics Prebiotics As Compound Feed Ingredients Market Report:

North America, valued at USD 2.83 billion in 2023, is expected to reach USD 5.78 billion by 2033. The market is supported by advanced livestock management practices and increasing adoption of probiotics by feed manufacturers.South America Probiotics Prebiotics As Compound Feed Ingredients Market Report:

The South American market is projected to grow from USD 0.85 billion in 2023 to USD 1.73 billion by 2033. Growing livestock production and a trend towards organic farming practices are significant contributors.Middle East & Africa Probiotics Prebiotics As Compound Feed Ingredients Market Report:

In 2023, the Middle East and Africa market value is USD 0.68 billion, predicted to grow to USD 1.39 billion by 2033. The expanding livestock sector necessitates efficient and health-promoting feed solutions.Tell us your focus area and get a customized research report.

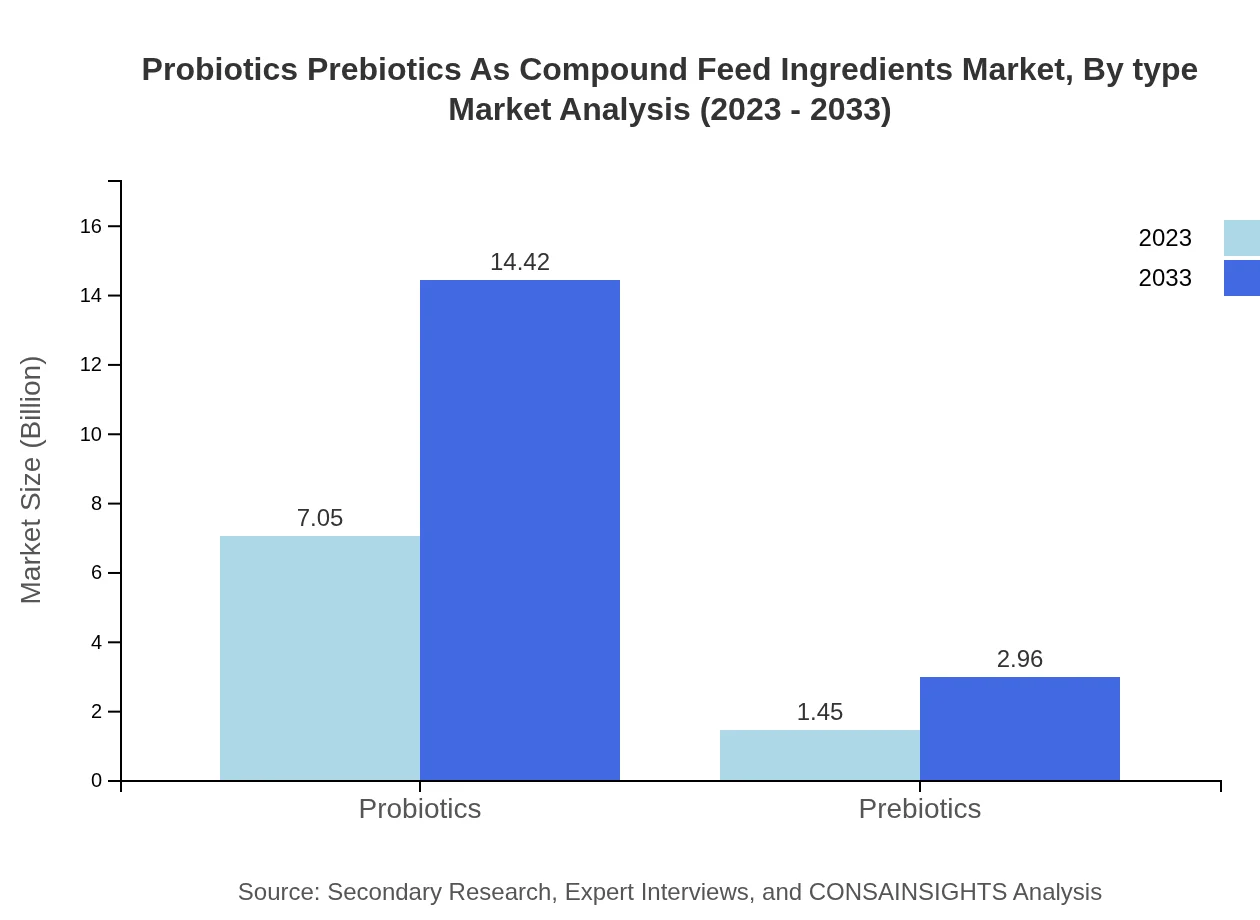

Probiotics Prebiotics As Compound Feed Ingredients Market Analysis By Type

Probiotics dominate the market with a size of USD 7.05 billion in 2023 compared to USD 1.45 billion for prebiotics. The segment is expected to grow to USD 14.42 billion and USD 2.96 billion respectively by 2033. Probiotics account for 82.97% of the market share, while prebiotics hold 17.03%.

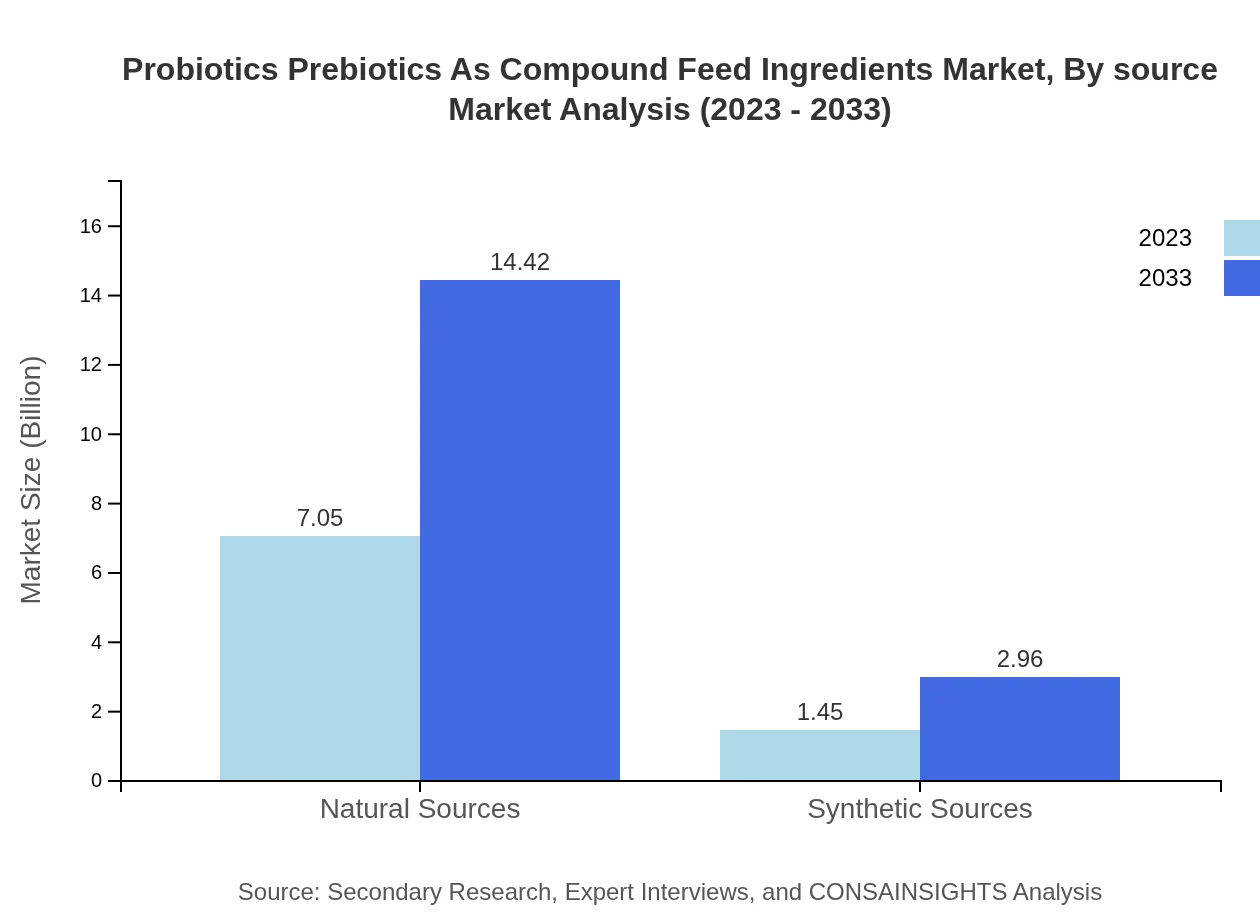

Probiotics Prebiotics As Compound Feed Ingredients Market Analysis By Source

Natural sources capture the largest portion at USD 7.05 billion in 2023, projected to grow to USD 14.42 billion by 2033, reflecting a growing consumer preference for natural ingredients. Synthetic sources currently contribute USD 1.45 billion, with an anticipated increase to USD 2.96 billion.

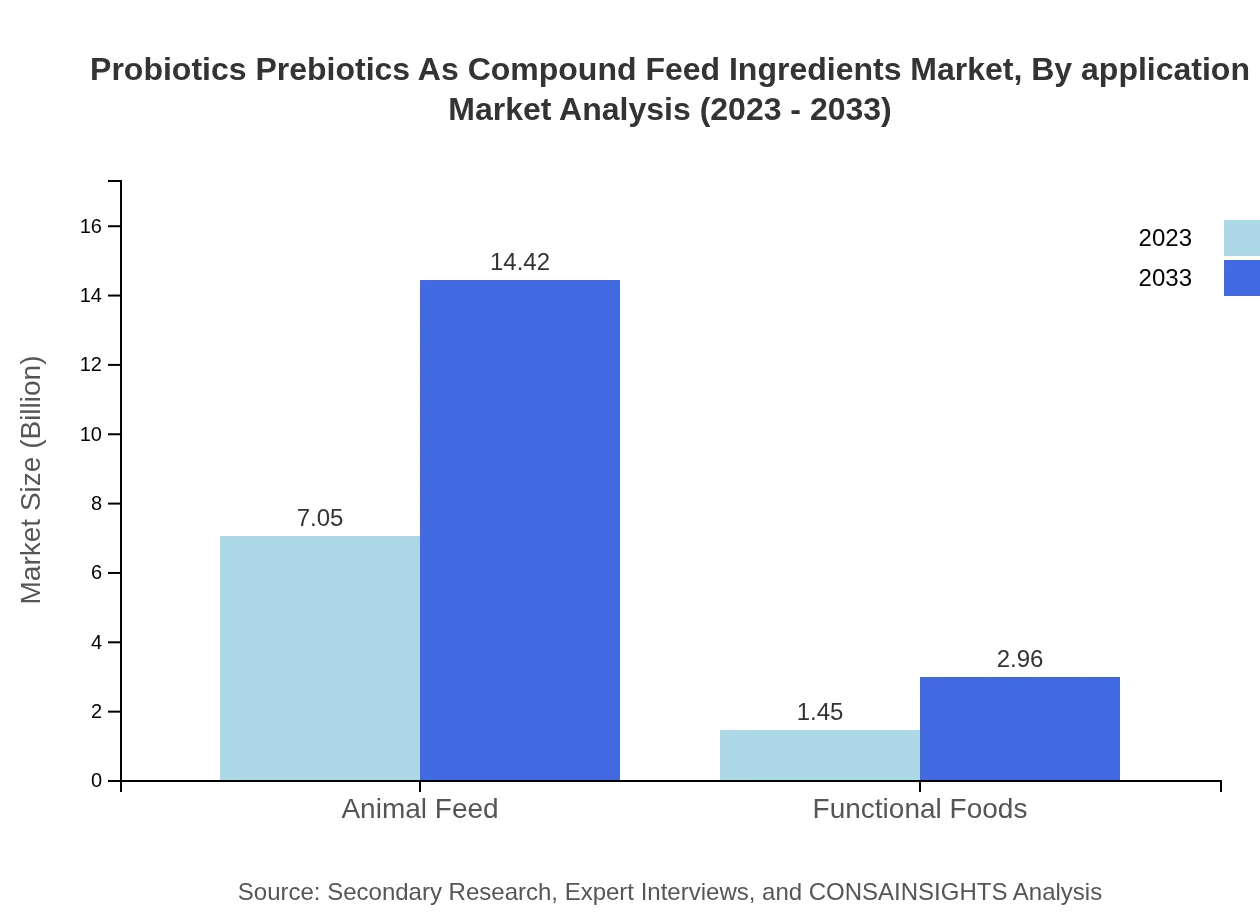

Probiotics Prebiotics As Compound Feed Ingredients Market Analysis By Application

Animal feed leads with a size of USD 7.05 billion in 2023, growing to USD 14.42 billion by 2033, accounting for 82.97% of the market share, while functional foods support secondary growth at USD 1.45 billion, increasing to USD 2.96 billion.

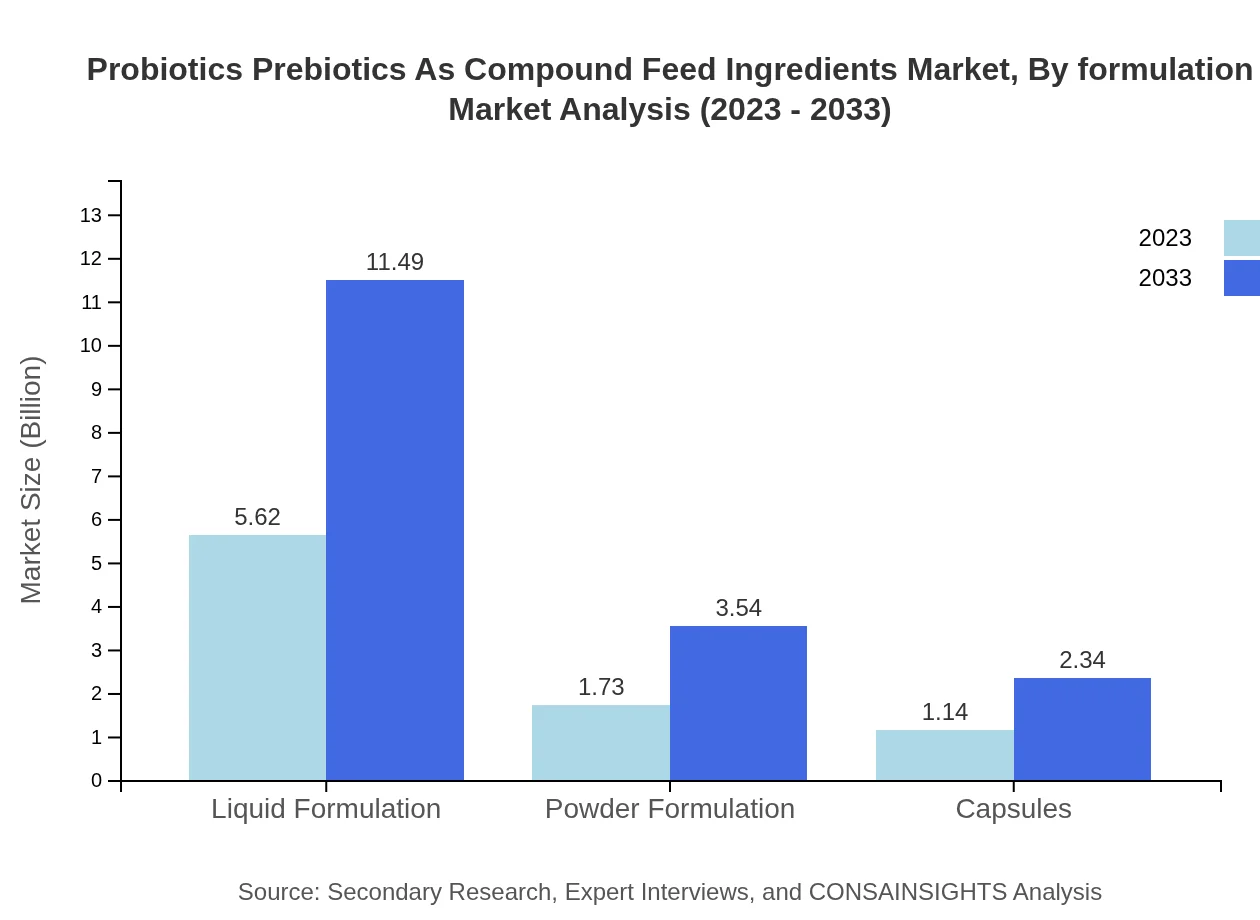

Probiotics Prebiotics As Compound Feed Ingredients Market Analysis By Formulation

Liquid formulations dominate with USD 5.62 billion in 2023, slated for growth to USD 11.49 billion. Powder and capsule formulations are also significant, with respective values of USD 1.73 billion and USD 1.14 billion anticipated to reach USD 3.54 billion and USD 2.34 billion by 2033.

Probiotics Prebiotics As Compound Feed Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Probiotics Prebiotics As Compound Feed Ingredients Industry

Chr. Hansen:

A global leader in natural ingredients and probiotics for animal feed, Chr. Hansen specializes in enzymes and cultures that enhance animal health.BASF SE:

A major player in chemical production, BASF offers innovative feed solutions that leverage their extensive research in animal nutrition.DuPont de Nemours, Inc.:

DuPont provides advanced probiotics and prebiotics with a strong focus on sustainability and enhancing animal performance.Evonik Industries AG:

Evonik is recognized for its extensive portfolio in animal nutrition solutions, combining probiotics and nutritional science to promote livestock health.Alltech:

Alltech specializes in animal health and nutrition products. Their solutions are designed to optimize gut health and enhance animal nutrition.We're grateful to work with incredible clients.

FAQs

What is the market size of probiotics Prebiotics As Compound Feed Ingredients?

The probiotics-prebiotics-as-compound-feed-ingredients market is valued at approximately $8.5 billion in 2023, with a compound annual growth rate (CAGR) of 7.2% projected through 2033.

What are the key market players or companies in this probiotics Prebiotics As Compound Feed Ingredients industry?

Key players in the probiotics-prebiotics compound feed ingredients market include major firms involved in agricultural biotechnology and feed manufacturing, such as ADM, BASF, and DuPont, among others.

What are the primary factors driving the growth in the probiotics Prebiotics As Compound Feed Ingredients industry?

The growth is primarily driven by increasing demand for sustainable animal nutrition, rising awareness about gut health, and the shift towards natural feed additives from synthetic ones.

Which region is the fastest Growing in the probiotics Prebiotics As Compound Feed Ingredients?

Asia Pacific is the fastest-growing region in this market, expected to increase from $1.62 billion in 2023 to approximately $3.30 billion by 2033.

Does ConsaInsights provide customized market report data for the probiotics Prebiotics As Compound Feed Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the probiotics-prebiotics-as-compound-feed-ingredients industry, ensuring relevant insights.

What deliverables can I expect from this probiotics Prebiotics As Compound Feed Ingredients market research project?

Deliverables typically include comprehensive market analysis reports, trend forecasts, competitor landscape assessments, and data detailing regional and segment performance.

What are the market trends of probiotics Prebiotics As Compound Feed Ingredients?

Key trends include a growing preference for natural ingredients, innovations in feed formulations, and increasing investments in research and development for probiotic and prebiotic products.