Procedure Trays Market Report

Published Date: 31 January 2026 | Report Code: procedure-trays

Procedure Trays Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Procedure Trays market from 2023 to 2033, covering market size, growth trends, regional insights, and key industry players. Insights into market segmentation and emerging technological trends are also included.

| Metric | Value |

|---|---|

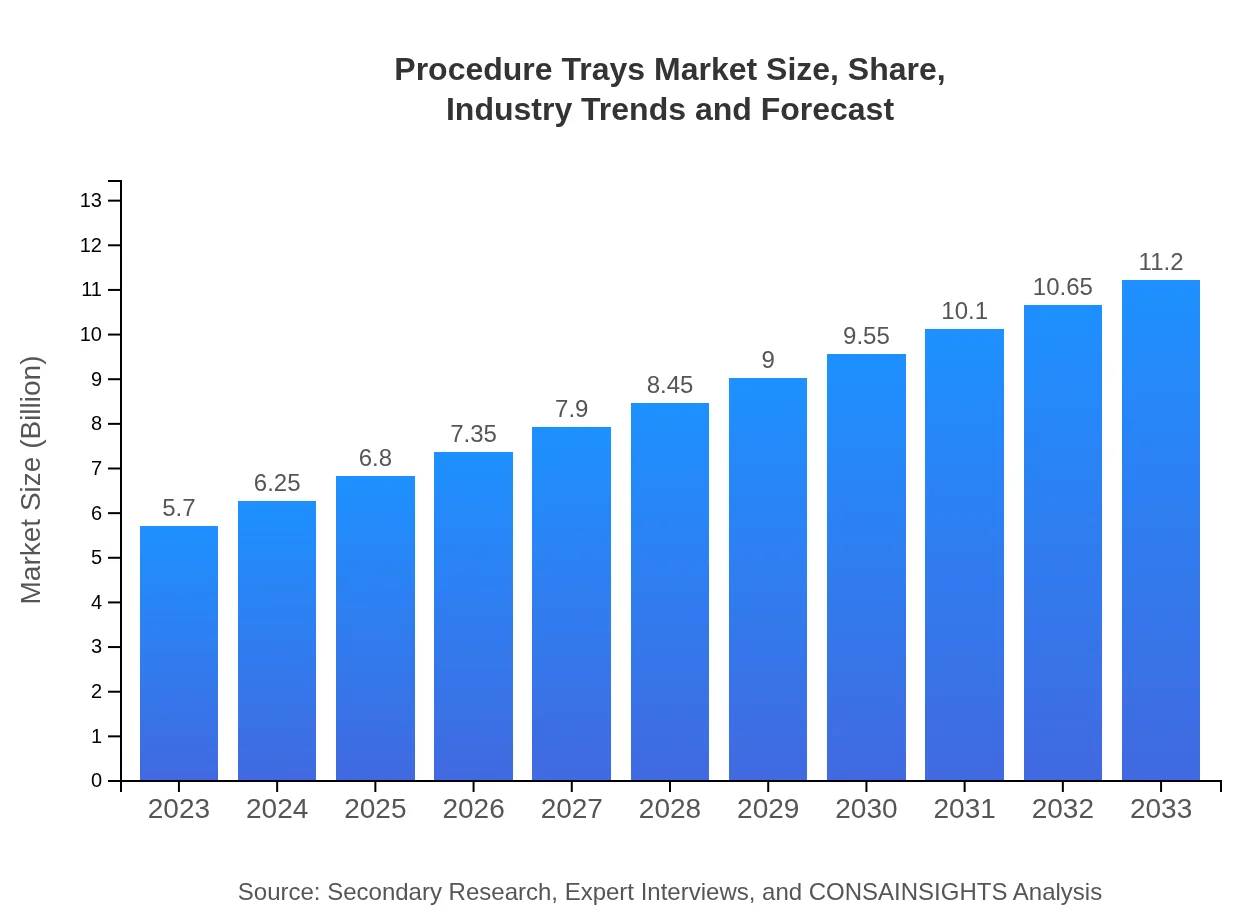

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.20 Billion |

| Top Companies | Medline Industries, Inc., Cardinal Health, Inc., Ansell Limited |

| Last Modified Date | 31 January 2026 |

Procedure Trays Market Overview

Customize Procedure Trays Market Report market research report

- ✔ Get in-depth analysis of Procedure Trays market size, growth, and forecasts.

- ✔ Understand Procedure Trays's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Procedure Trays

What is the Market Size & CAGR of Procedure Trays market in 2023?

Procedure Trays Industry Analysis

Procedure Trays Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Procedure Trays Market Analysis Report by Region

Europe Procedure Trays Market Report:

The European Procedure Trays market is anticipated to experience robust growth, increasing from $1.87 billion in 2023 to $3.67 billion by 2033. This increase can be attributed to strict regulatory standards for healthcare facilities, an ongoing emphasis on patient safety, and advancements in medical technologies. Countries like Germany, France, and the UK exhibit strong market performance.Asia Pacific Procedure Trays Market Report:

The Asia-Pacific region is poised for growth, with a market size expected to increase from $1.01 billion in 2023 to $1.98 billion by 2033. Factors contributing to this growth include a rising population, increasing healthcare investments, and the expanding number of surgical procedures. Countries like China and India are leading the way in terms of demand, driven by their rapidly evolving healthcare infrastructure.North America Procedure Trays Market Report:

North America holds a significant share of the global Procedure Trays market, valued at $2.03 billion in 2023, expected to rise to $3.99 billion by 2033. The region's advanced healthcare infrastructure, high surgical volume, and continued technological advancements are major growth drivers. Regulatory support for medical innovations and heightened focus on infection control further enhance the market environment.South America Procedure Trays Market Report:

In South America, the Procedure Trays market is projected to grow from $0.27 billion in 2023 to $0.53 billion by 2033. The growth is driven by improving healthcare facilities and rising awareness of proper procedures and equipment usage. However, challenges such as economic fluctuations and policy regulations may affect market growth.Middle East & Africa Procedure Trays Market Report:

The Middle East and Africa region is projected to see growth from $0.53 billion in 2023 to $1.03 billion by 2033. This growth is propelled by increasing investments in healthcare infrastructure, economic development, and improvements in health awareness. However, political instability and varying levels of healthcare access across countries remain challenges.Tell us your focus area and get a customized research report.

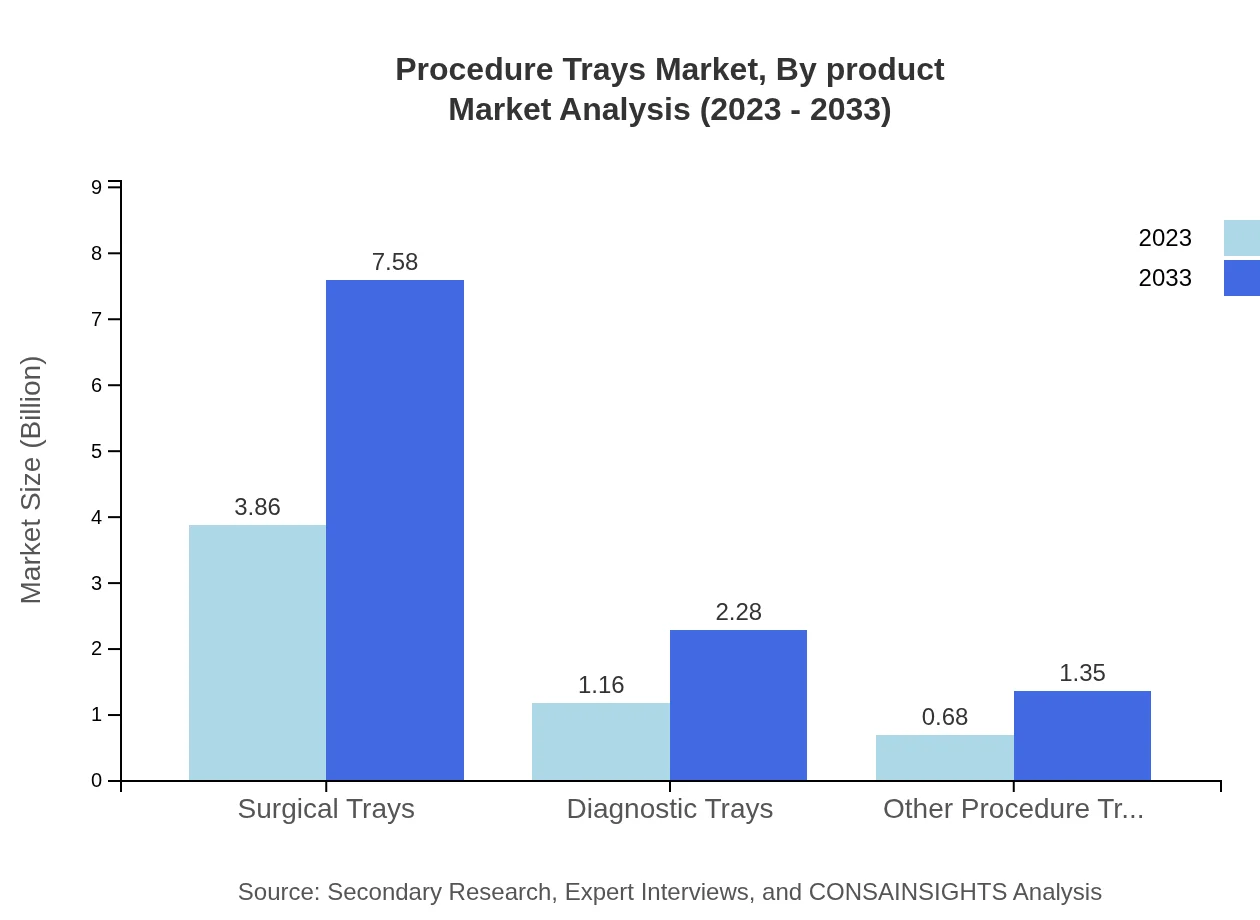

Procedure Trays Market Analysis By Product

The Procedure Trays market is led by surgical trays, projected to increase from $3.86 billion in 2023 to $7.58 billion by 2033, capturing a dominant share of 67.68%. In contrast, diagnostic trays and other procedure trays hold smaller shares, but are still crucial to overall market dynamics. As surgical practices evolve, the demand for customized trays designed for specific procedures is also rising.

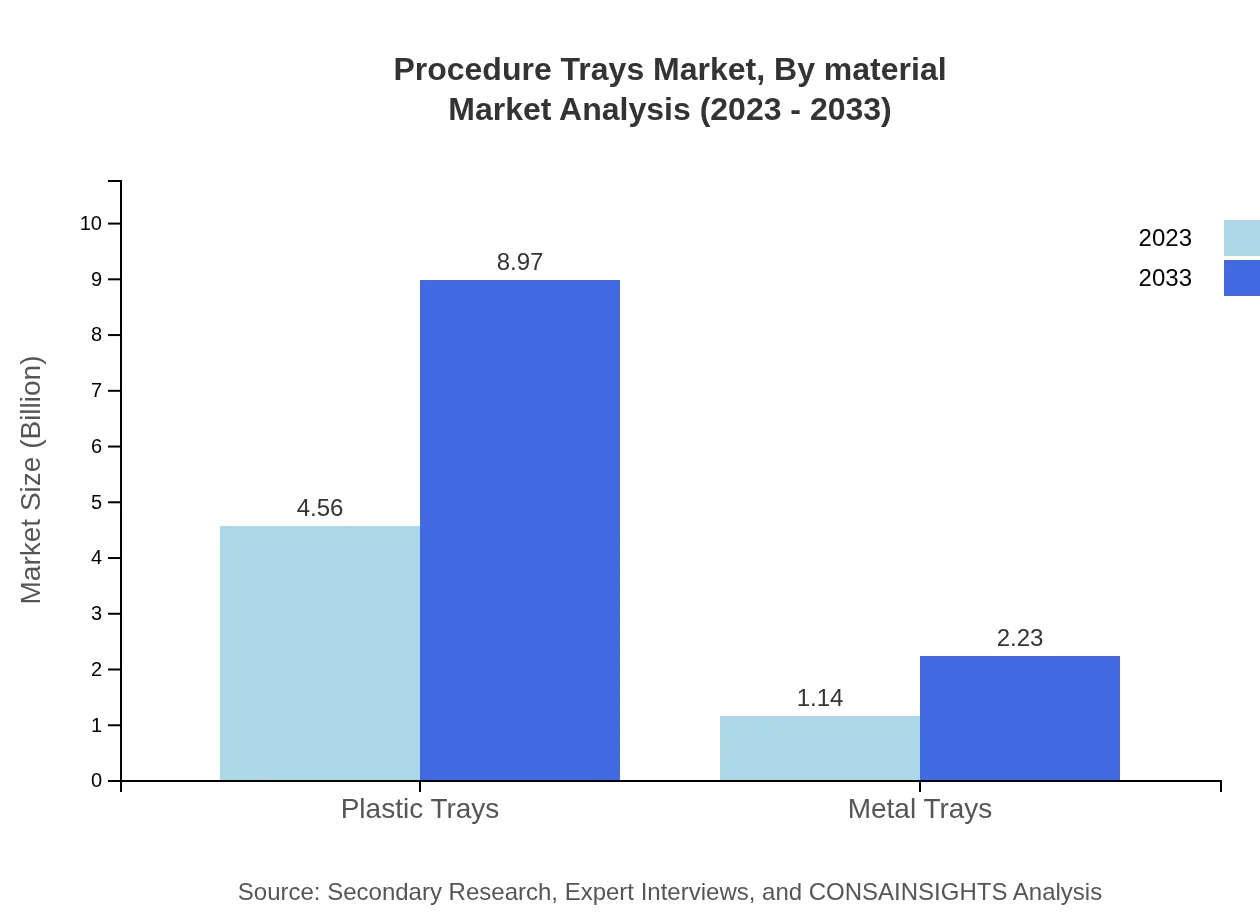

Procedure Trays Market Analysis By Material

Plastic trays dominate the market, representing a size of $4.56 billion in 2023, expected to grow to $8.97 billion by 2033, equating to 80.08% market share. Metal trays, while in demand, showcase a decline in preference due to the rising trend for disposables. An emphasis on sustainability is pushing plastic alternatives that meet safety standards.

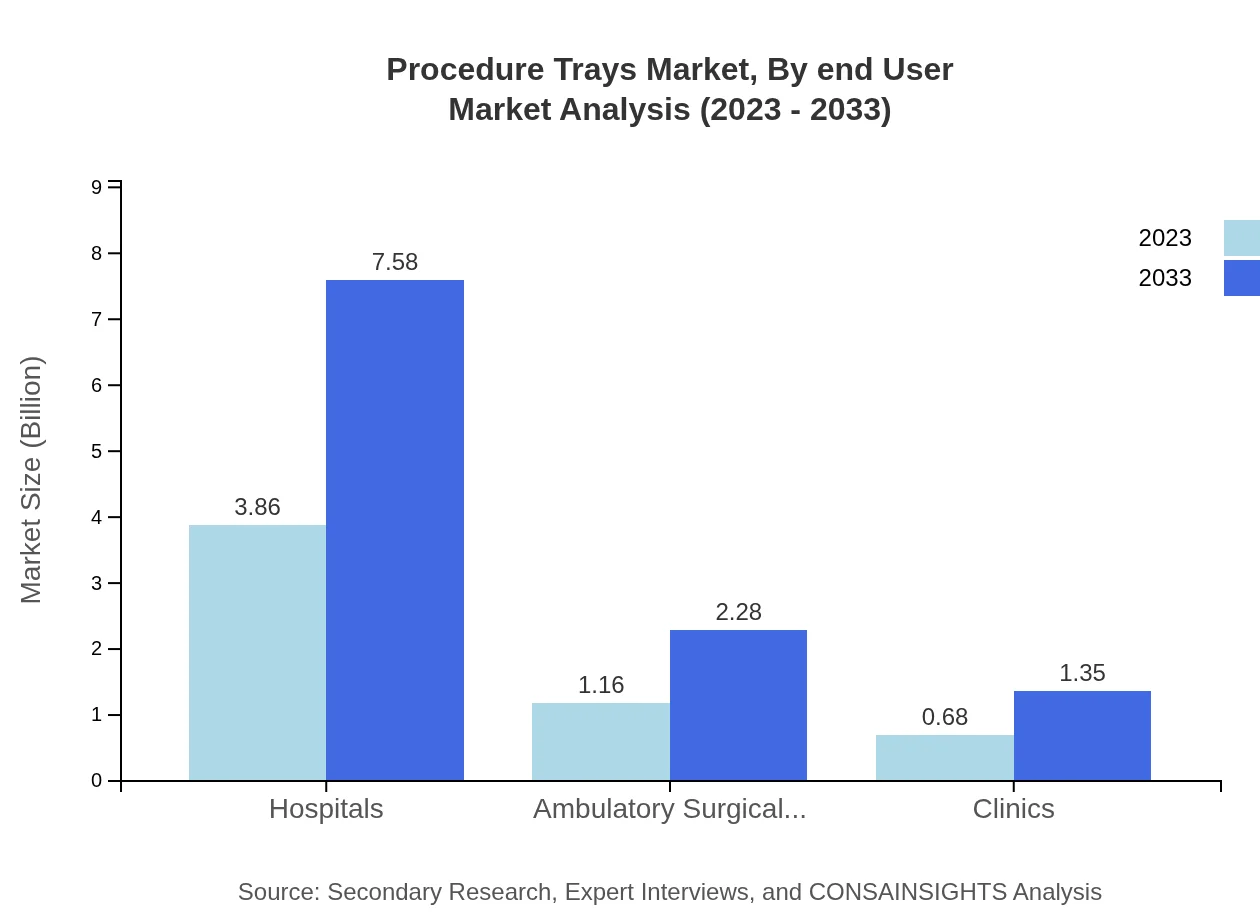

Procedure Trays Market Analysis By End User

Hospitals account for the largest share at 67.68%, with a market size anticipated to rise from $3.86 billion in 2023 to $7.58 billion by 2033. Ambulatory surgical centers follow with 20.31%, measuring $1.16 billion in 2023 and projected to reach $2.28 billion in 2033. Clinics also contribute significantly while showcasing a growing trend toward efficiency and procedure management.

Procedure Trays Market Analysis By Region

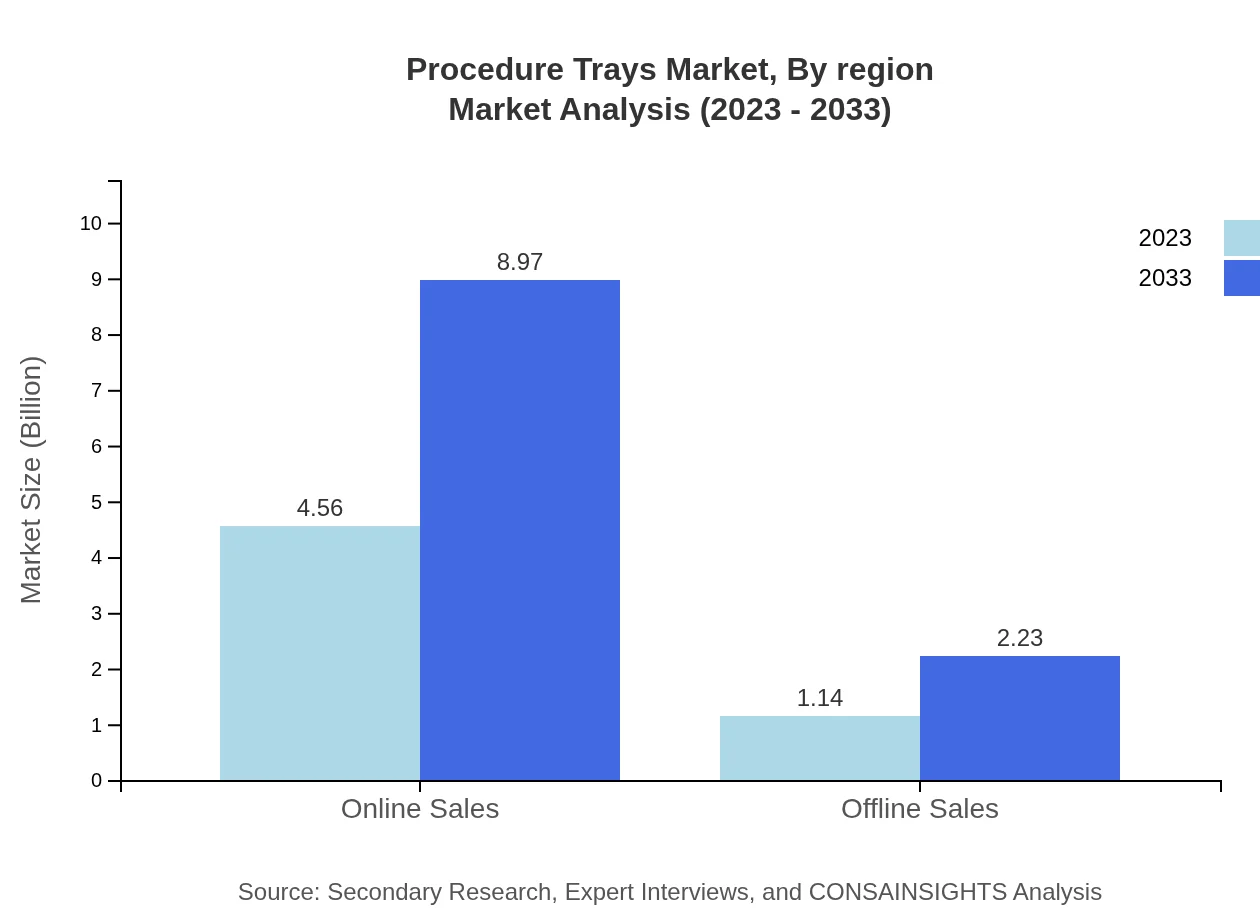

The growing trend towards online sales has gained momentum, projected to grow from $4.56 billion in 2023 to $8.97 billion by 2033, holding an 80.08% market share. Offline sales, on the other hand, will see moderate growth from $1.14 billion to $2.23 billion as distribution channels adapt to changing consumer preferences.

Procedure Trays Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Procedure Trays Industry

Medline Industries, Inc.:

A leading manufacturer and distributor of medical supplies and equipment, Medline offers a range of procedure trays tailored to various surgical and diagnostic needs.Cardinal Health, Inc.:

With a global presence, Cardinal Health is essential in medical supply distribution, providing high-quality procedure trays that enhance efficiency in healthcare settings.Ansell Limited:

Ansell specializes in protective medical solutions, contributing effectively to procedure tray development with a focus on materials enhancing safety and hygiene.We're grateful to work with incredible clients.

FAQs

What is the market size of procedure Trays?

The global procedure trays market is valued at approximately $5.7 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%. By 2033, the market will expand significantly, aligning with increased healthcare needs and technological advancements.

What are the key market players or companies in this procedure Trays industry?

Key players in the procedure trays industry include major medical device manufacturers, healthcare conglomerates, and specialized suppliers. These companies are leveraging innovative technologies and strategic partnerships to enhance product offerings and market share.

What are the primary factors driving the growth in the procedure trays industry?

Growth in the procedure trays market is driven by factors such as rising healthcare expenditure, an increasing number of surgeries, a growing geriatric population, and technological advancements in medical devices, which improve procedural efficiency and safety.

Which region is the fastest Growing in the procedure trays?

The fastest-growing region in the procedure trays market is projected to be Europe, with market size increasing from $1.87 billion in 2023 to $3.67 billion by 2033. Other emerging markets include North America and Asia-Pacific, each contributing significant growth.

Does ConsaInsights provide customized market report data for the procedure trays industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the procedure trays industry, enabling clients to focus on particular segments, regions, or trends, enhancing strategic decision-making.

What deliverables can I expect from this procedure trays market research project?

Expected deliverables for the procedure trays market research project include comprehensive reports, detailed analyses of market trends, regional performance data, company profiles, and actionable insights for strategic planning.

What are the market trends of procedure trays?

Market trends in the procedure trays industry include a shift towards minimalistic design for efficiency, growth in online sales channels, and increasing demand for customized trays, reflecting changing healthcare protocols and patient needs.