Process Analytical Instrumentation Market Report

Published Date: 22 January 2026 | Report Code: process-analytical-instrumentation

Process Analytical Instrumentation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Process Analytical Instrumentation market, covering 2023 to 2033. It offers insights on market size, growth trends, technological advancements, regional analysis, and competitor landscape, aimed at informing stakeholders of potential opportunities and challenges.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

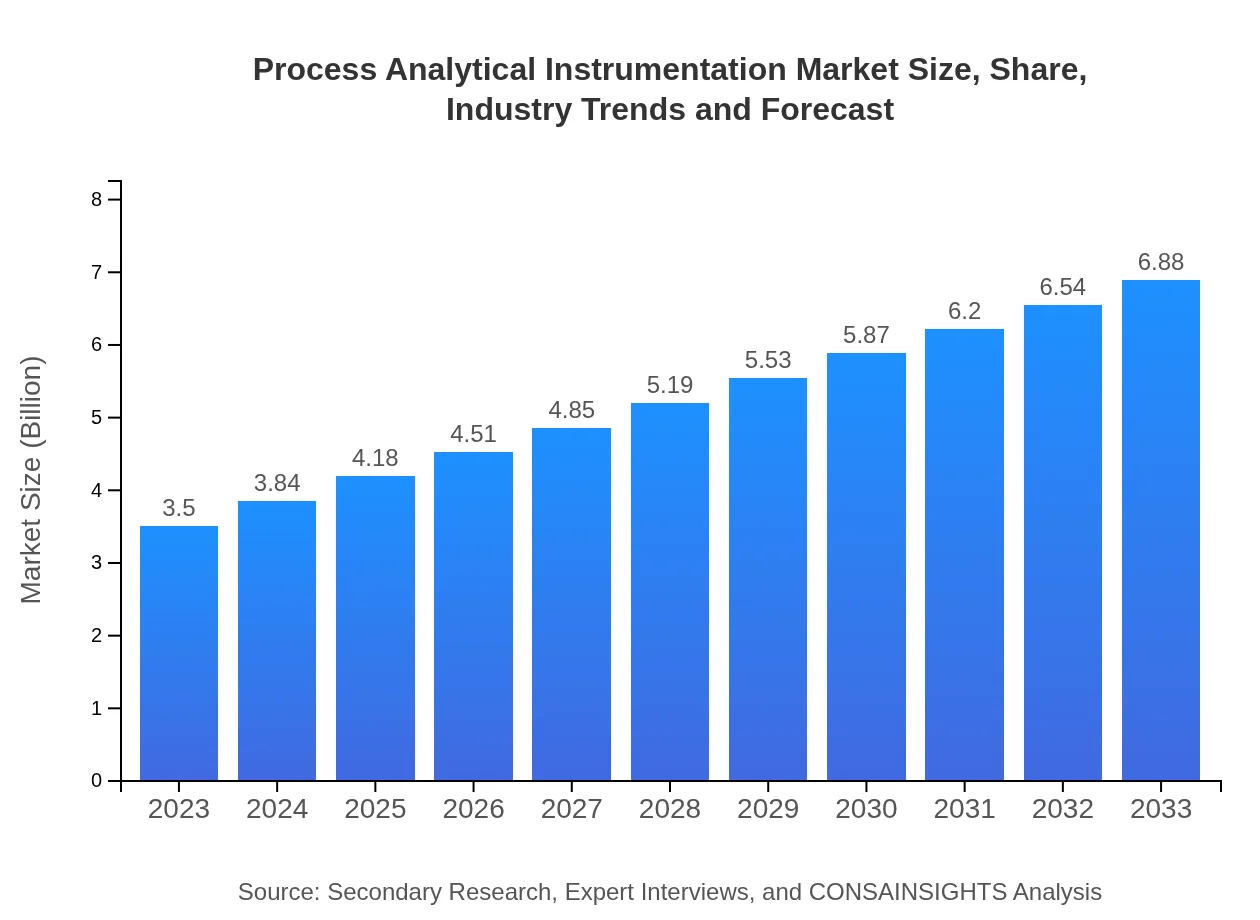

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | ABB Ltd., Siemens AG, Emerson Electric Co., Honeywell International Inc., Thermo Fisher Scientific Inc. |

| Last Modified Date | 22 January 2026 |

Process Analytical Instrumentation Market Overview

Customize Process Analytical Instrumentation Market Report market research report

- ✔ Get in-depth analysis of Process Analytical Instrumentation market size, growth, and forecasts.

- ✔ Understand Process Analytical Instrumentation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Analytical Instrumentation

What is the Market Size & CAGR of Process Analytical Instrumentation market in 2023?

Process Analytical Instrumentation Industry Analysis

Process Analytical Instrumentation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Analytical Instrumentation Market Analysis Report by Region

Europe Process Analytical Instrumentation Market Report:

Europe's market, valued at $1.07 billion in 2023, is projected to reach $2.11 billion by 2033. The emphasis on sustainability and stringent regulations surrounding product quality drive investments in advanced analytical technologies, particularly within the food and beverage and chemical industries.Asia Pacific Process Analytical Instrumentation Market Report:

In the Asia Pacific region, the Process Analytical Instrumentation market is anticipated to grow from $0.62 billion in 2023 to $1.22 billion by 2033. Factors driving this growth include rapid industrialization, rising middle-class population, and increasing demand for high-quality products. Countries like China and India are leading the growth, supported by expansions in the pharmaceutical and food industries.North America Process Analytical Instrumentation Market Report:

North America is the largest market for Process Analytical Instrumentation, expected to expand from $1.28 billion in 2023 to $2.51 billion by 2033. The region's well-established pharmaceutical and chemical industries, coupled with innovation-driven policies, strengthen demand for analytical instruments, further boosted by increasing automation.South America Process Analytical Instrumentation Market Report:

South America is witnessing a growth trajectory from $0.34 billion in 2023 to $0.66 billion in 2033. The increase in regulatory standards and investments in industrial projects are key drivers. However, the market is still maturing, and challenges such as supply chain issues could impact growth rates.Middle East & Africa Process Analytical Instrumentation Market Report:

The Middle East and Africa market is expected to grow from $0.19 billion in 2023 to $0.37 billion by 2033. Increased oil and gas exploration activities and investments in water treatment solutions significantly contribute to market growth, but the region still faces economic volatility.Tell us your focus area and get a customized research report.

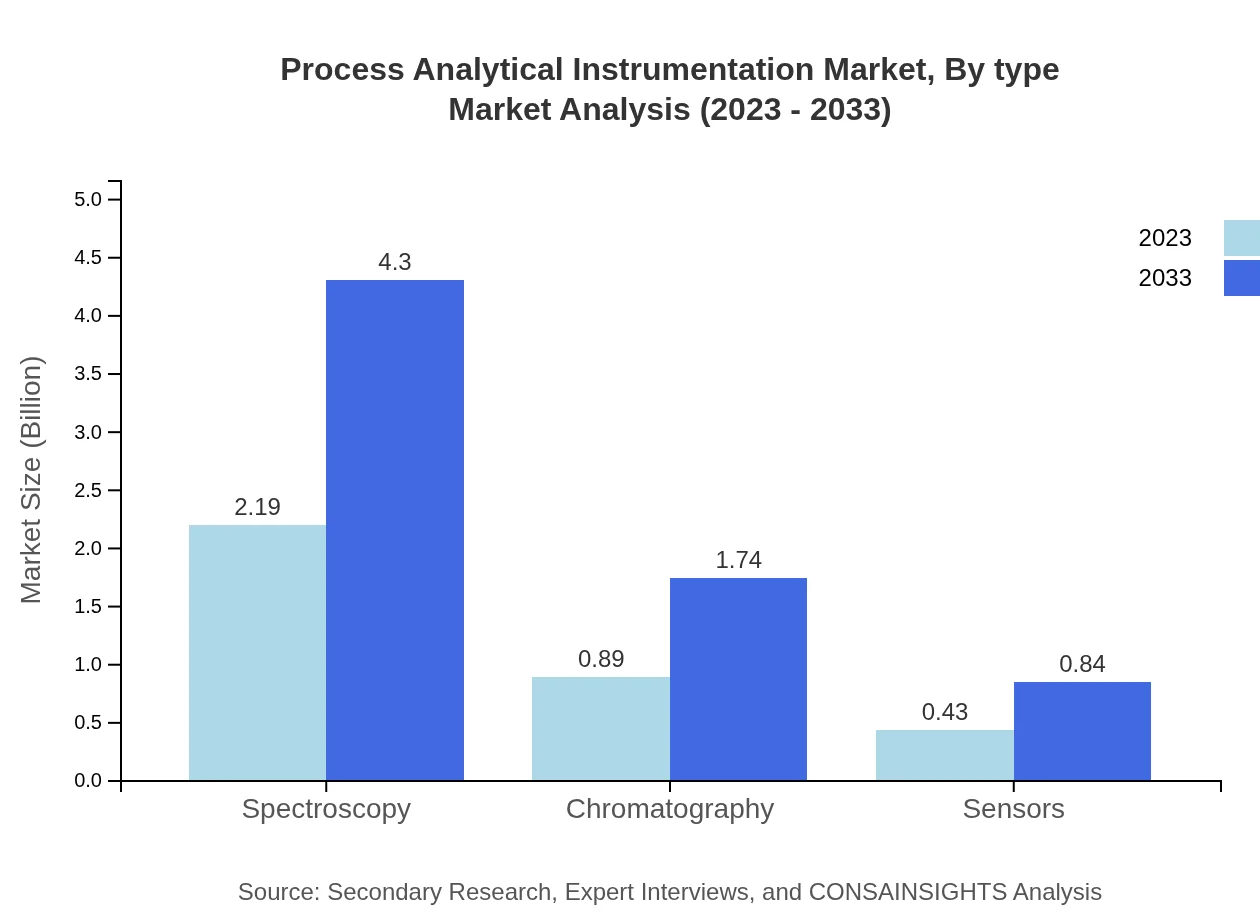

Process Analytical Instrumentation Market Analysis By Type

The market is significantly shaped by major types of instruments, including spectroscopy, chromatography, sensors, and online process analysis. Spectroscopy remains the largest segment, expected to grow from $2.19 billion in 2023 to $4.30 billion by 2033, capturing 62.46% market share. Chromatography is also critical, forecasted to grow from $0.89 billion to $1.74 billion, maintaining a 25.34% market share. Sensors and laboratory analysis follow, reflecting an ongoing trend toward integrated solutions.

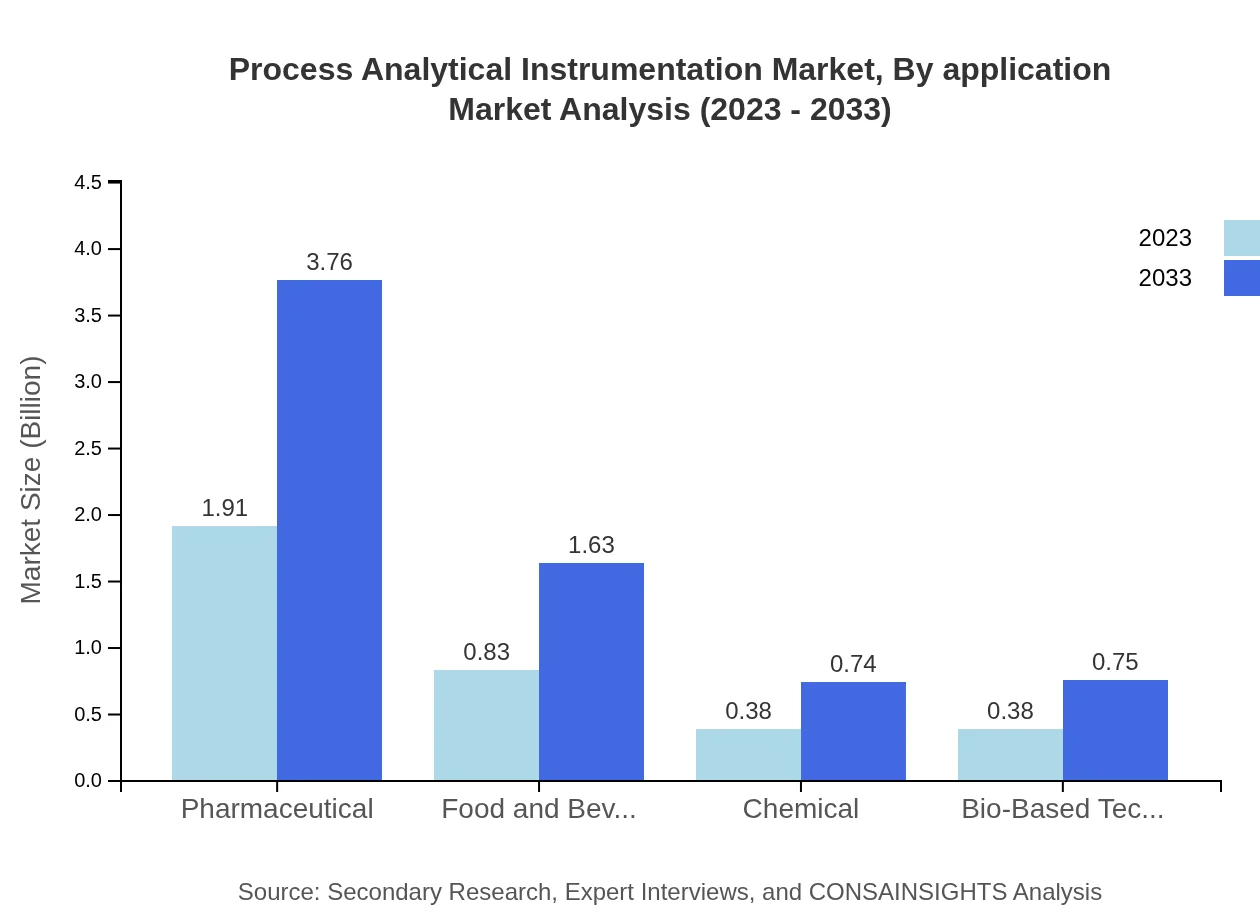

Process Analytical Instrumentation Market Analysis By Application

The applications of PAI are varied, with strong demand in pharmaceuticals, food and beverages, oil and gas, chemicals, and bio-based technology sectors. The pharmaceutical sector commands a significant share of 54.69%, projected from $1.91 billion to $3.76 billion by 2033. Food and beverage and chemical sectors also maintain relevant market positions, driven by requirements for safety and quality assurance.

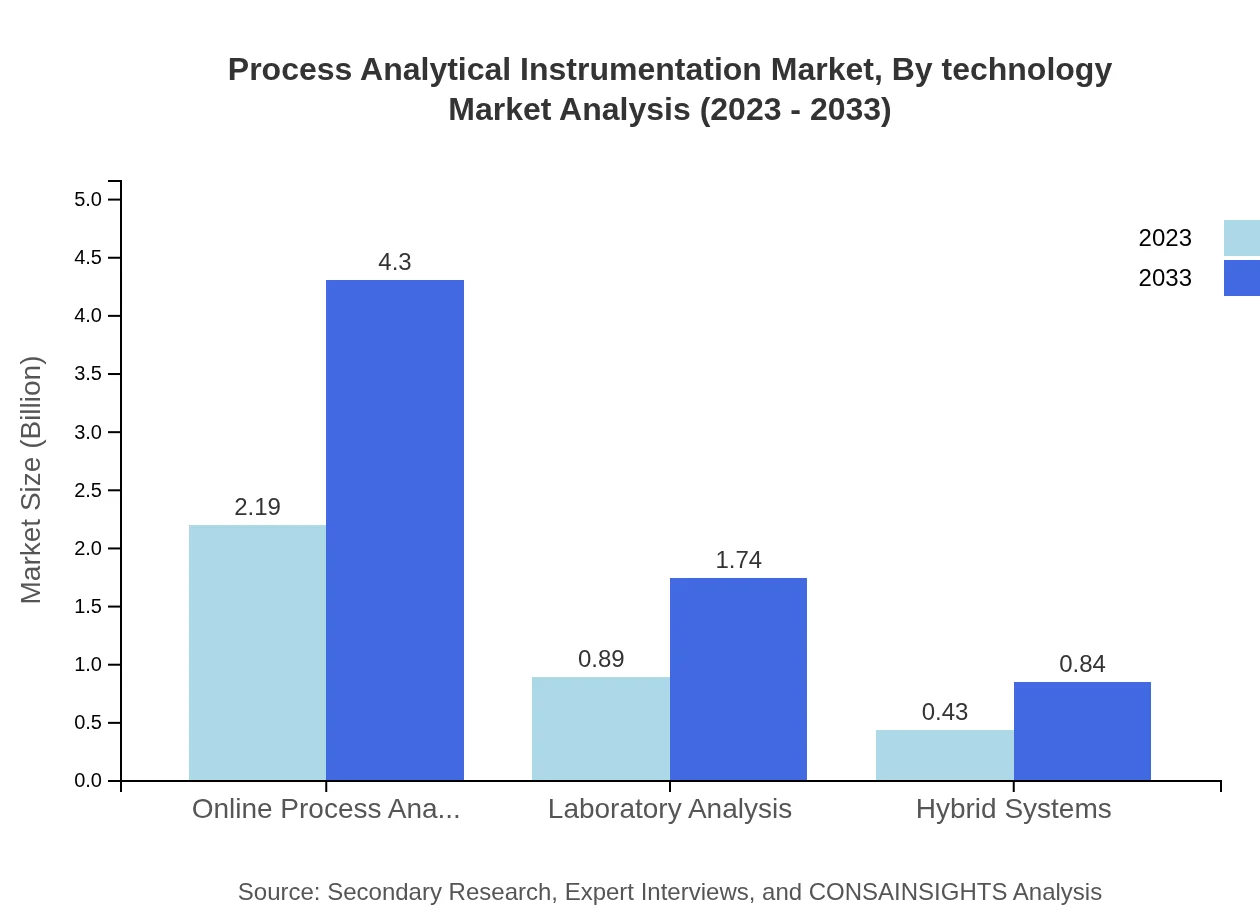

Process Analytical Instrumentation Market Analysis By Technology

Technological innovations play a pivotal role in shaping the PAI market, with trends focusing on real-time monitoring, integration with IoT solutions, and automation. Online process analysis technology is predicted to grow at a rapid pace, reflecting a shift toward greater efficiency. Hybrid systems are also gaining traction as industries look for versatile solutions that enhance productivity while meeting regulatory demands.

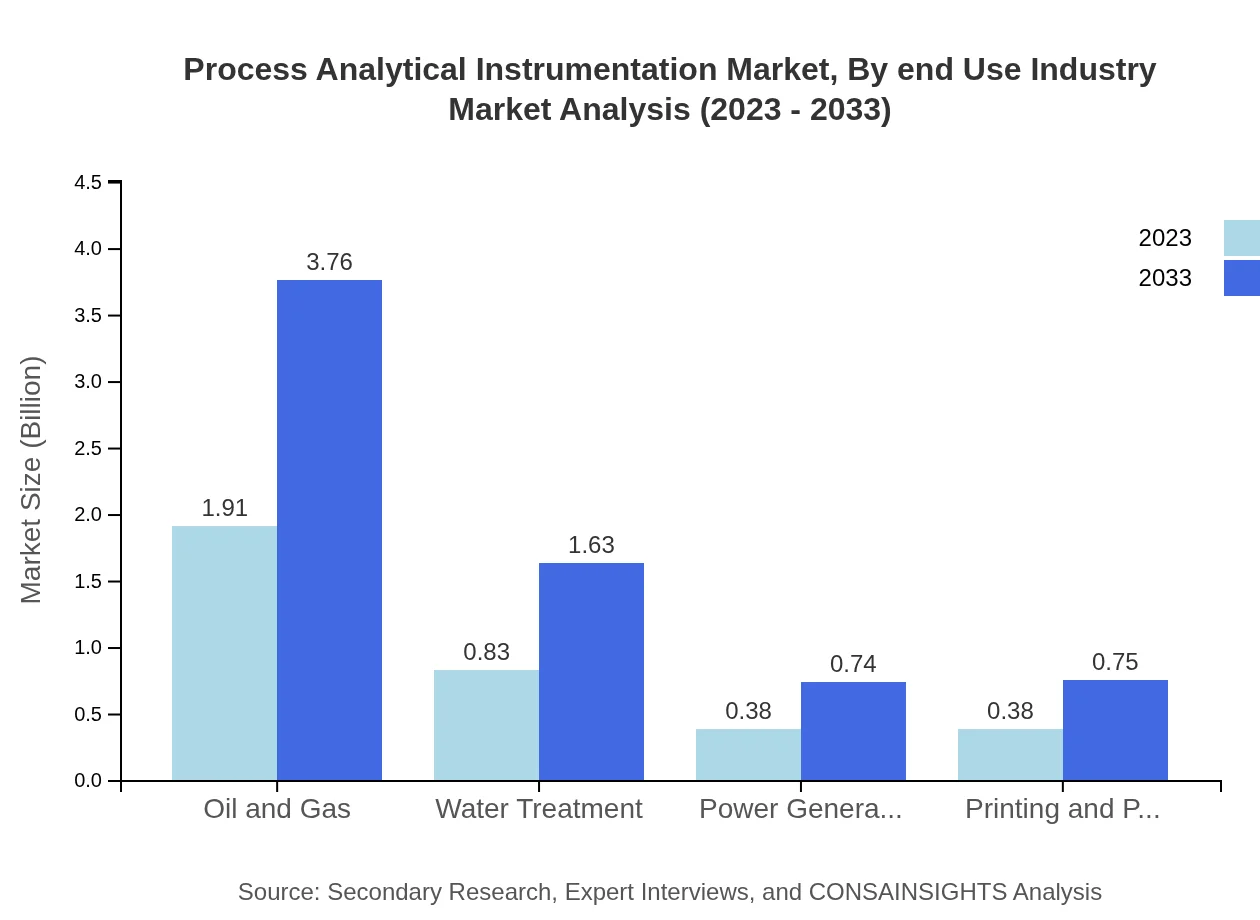

Process Analytical Instrumentation Market Analysis By End Use Industry

End-use industries, including pharma, food and beverage, and oil and gas, represent significant segments for the PAI market. The pharmaceutical industry is expected to witness the most substantial growth due to the increasing need for quality control and regulatory compliance. The food and beverage sector is also progressively investing in PAI to ensure safety and quality.

Process Analytical Instrumentation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Analytical Instrumentation Industry

ABB Ltd.:

ABB is a global leader in automation and power technologies, continuously innovating to provide leading-edge process analysis solutions.Siemens AG:

Siemens AG offers comprehensive solutions in industrial automation, including a wide array of instrumentation and control technologies for process analytics.Emerson Electric Co.:

Emerson Electric Co. specializes in process automation and technology, focusing on enhancing productivity and efficiency through advanced analytical instruments.Honeywell International Inc.:

Honeywell is a recognized leader in industrial solutions, providing high-performance analytical instruments that meet stringent requirements across various sectors.Thermo Fisher Scientific Inc.:

Thermo Fisher Scientific offers a broad spectrum of analytical instruments dedicated to biomedical research and industrial processing.We're grateful to work with incredible clients.

FAQs

What is the market size of Process Analytical Instrumentation?

The Process Analytical Instrumentation market is valued at approximately $3.5 billion in 2023, with an estimated CAGR of 6.8% projected through 2033. This growth signifies strong demand in various sectors utilizing advanced analytical technologies.

What are the key market players or companies in this Process Analytical Instrumentation industry?

Key players in the Process Analytical Instrumentation market include industry leaders like Siemens, Emerson Electric Co., and ABB. These companies dominate through innovation and technology, continually enhancing their analytical solutions to meet industry demands.

What are the primary factors driving the growth in the Process Analytical Instrumentation industry?

Growth in the Process Analytical Instrumentation market is primarily driven by increased automation in industries, the demand for high-quality products, and regulatory compliance in sectors such as pharmaceuticals. Technological advancements further fuel this growth.

Which region is the fastest Growing in the Process Analytical Instrumentation?

The North America region is currently the fastest-growing in the Process Analytical Instrumentation market, with projected growth from $1.28 billion in 2023 to $2.51 billion in 2033, due to technological advancements and increased investments in automation.

Does ConsaInsights provide customized market report data for the Process Analytical Instrumentation industry?

Yes, ConsaInsights provides tailored market reports for the Process Analytical Instrumentation industry, allowing clients to obtain specific insights, data, and analyses that fit their business needs, addressing individual market conditions.

What deliverables can I expect from this Process Analytical Instrumentation market research project?

Expect comprehensive deliverables including detailed market analysis, growth projections, competitive landscapes, and segment breakdowns of the Process Analytical Instrumentation market, helping you understand market dynamics and strategic opportunities.

What are the market trends of Process Analytical Instrumentation?

Key trends in the Process Analytical Instrumentation market include increasing integration of IoT technologies, emphasis on real-time data analytics, and a growing focus on sustainability and efficiency within manufacturing processes.