Process Analytical Technology Market Report

Published Date: 31 January 2026 | Report Code: process-analytical-technology

Process Analytical Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Process Analytical Technology market, supplying insights on market size, trends, and forecasts from 2023 to 2033. Key sectors, regional dynamics, and leading players are examined to provide a detailed understanding of market opportunities and challenges.

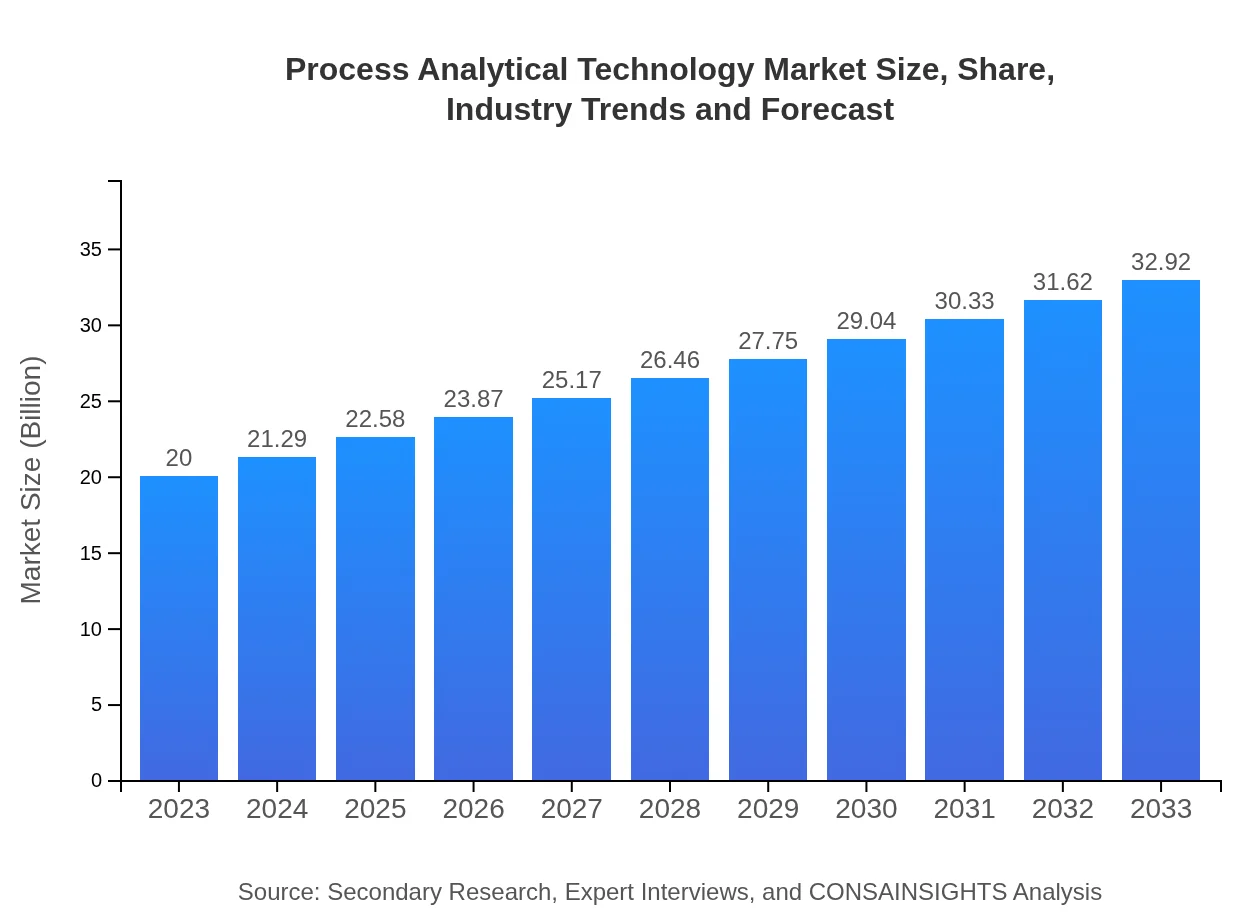

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Thermo Fisher Scientific, Siemens AG, Danaher Corporation, ABB Ltd. |

| Last Modified Date | 31 January 2026 |

Process Analytical Technology Market Overview

Customize Process Analytical Technology Market Report market research report

- ✔ Get in-depth analysis of Process Analytical Technology market size, growth, and forecasts.

- ✔ Understand Process Analytical Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Analytical Technology

What is the Market Size & CAGR of Process Analytical Technology market in 2023?

Process Analytical Technology Industry Analysis

Process Analytical Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Analytical Technology Market Analysis Report by Region

Europe Process Analytical Technology Market Report:

In Europe, the Process Analytical Technology market stood at $4.80 billion in 2023, projected to grow to $7.90 billion by 2033. The European market is witnessing growth due to technological innovations and increased focus on ensuring product quality across various industries.Asia Pacific Process Analytical Technology Market Report:

In the Asia-Pacific region, the Process Analytical Technology market was valued at $4.03 billion in 2023 and is expected to reach $6.63 billion by 2033. The growth in this region is driven by an increase in pharmaceutical and food processing industries, coupled with rising investments in automation technologies.North America Process Analytical Technology Market Report:

With a market size of $7.29 billion in 2023, North America is expected to reach $12.00 billion by 2033. The region's growth is fueled by strong demand for high-quality pharmaceuticals and stringent regulations driving the adoption of PAT technologies.South America Process Analytical Technology Market Report:

The South American market for Process Analytical Technology was valued at $1.90 billion in 2023, projected to grow to $3.13 billion by 2033. This market is expanding due to the growing focus on improving production processes and regulatory compliance within the food and pharmaceuticals sectors.Middle East & Africa Process Analytical Technology Market Report:

The market in the Middle East and Africa is valued at $1.98 billion in 2023 and is anticipated to grow to $3.25 billion by 2033. The expansion is driven by increasing industrial activities and a focus on quality and safety in production processes.Tell us your focus area and get a customized research report.

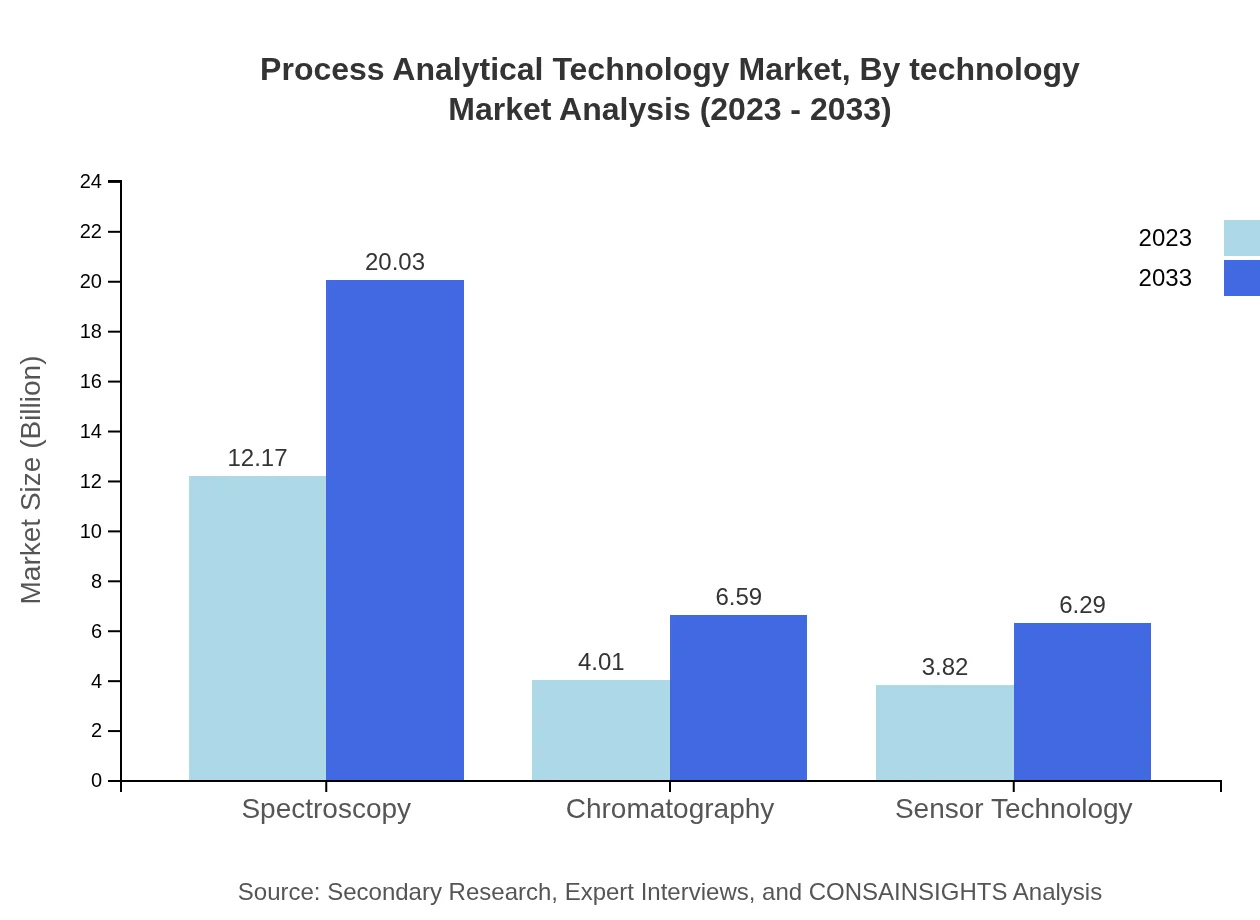

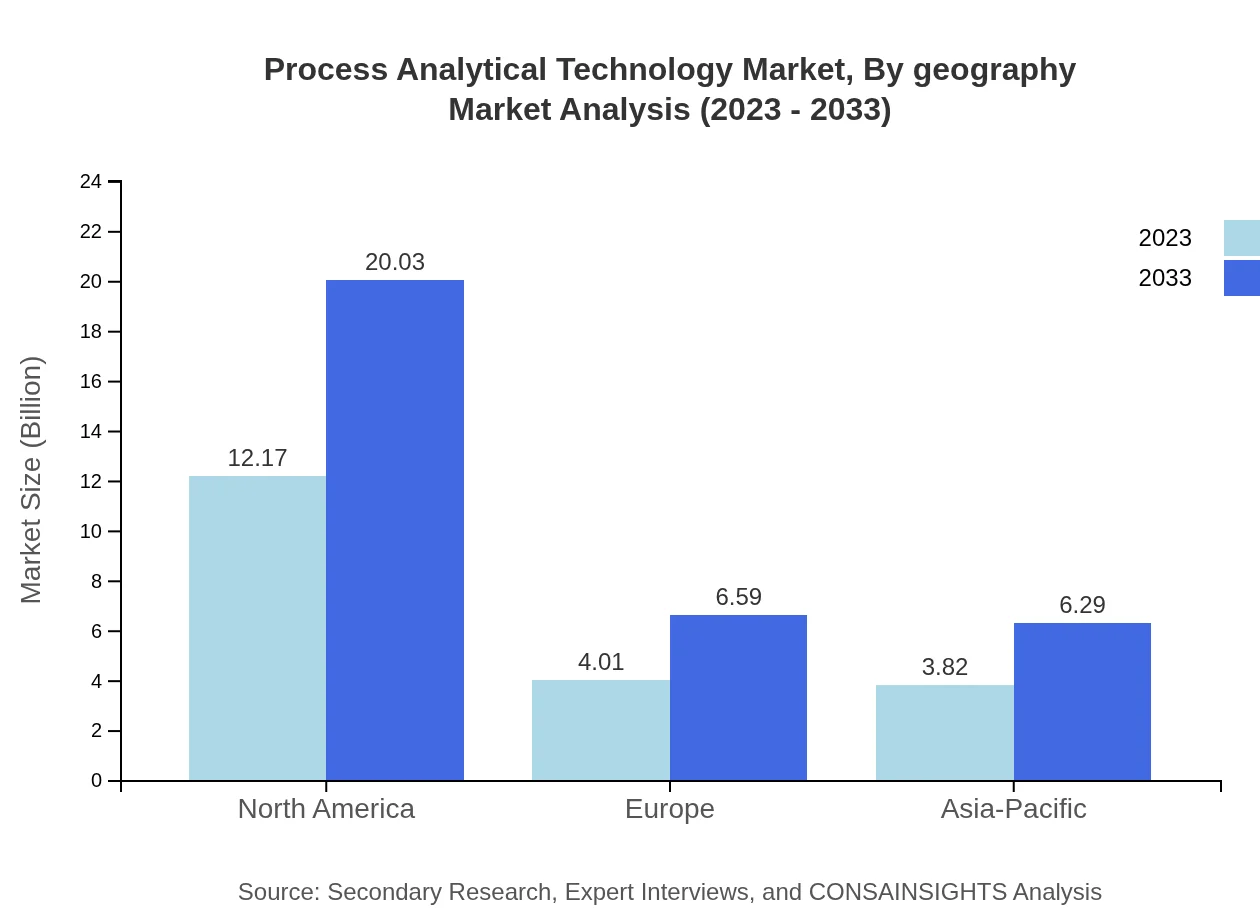

Process Analytical Technology Market Analysis By Technology

The largest segment by technology in the PAT market is Spectroscopy, which generated approximately $12.17 billion in 2023 and is expected to reach $20.03 billion by 2033, holding a market share of 60.85%. Chromatography follows with a market size of $4.01 billion in 2023 and projected growth to $6.59 billion by 2033, maintaining a market share of 20.03%. Sensor Technology also presents significant growth potential, increasing from $3.82 billion in 2023 to $6.29 billion by 2033.

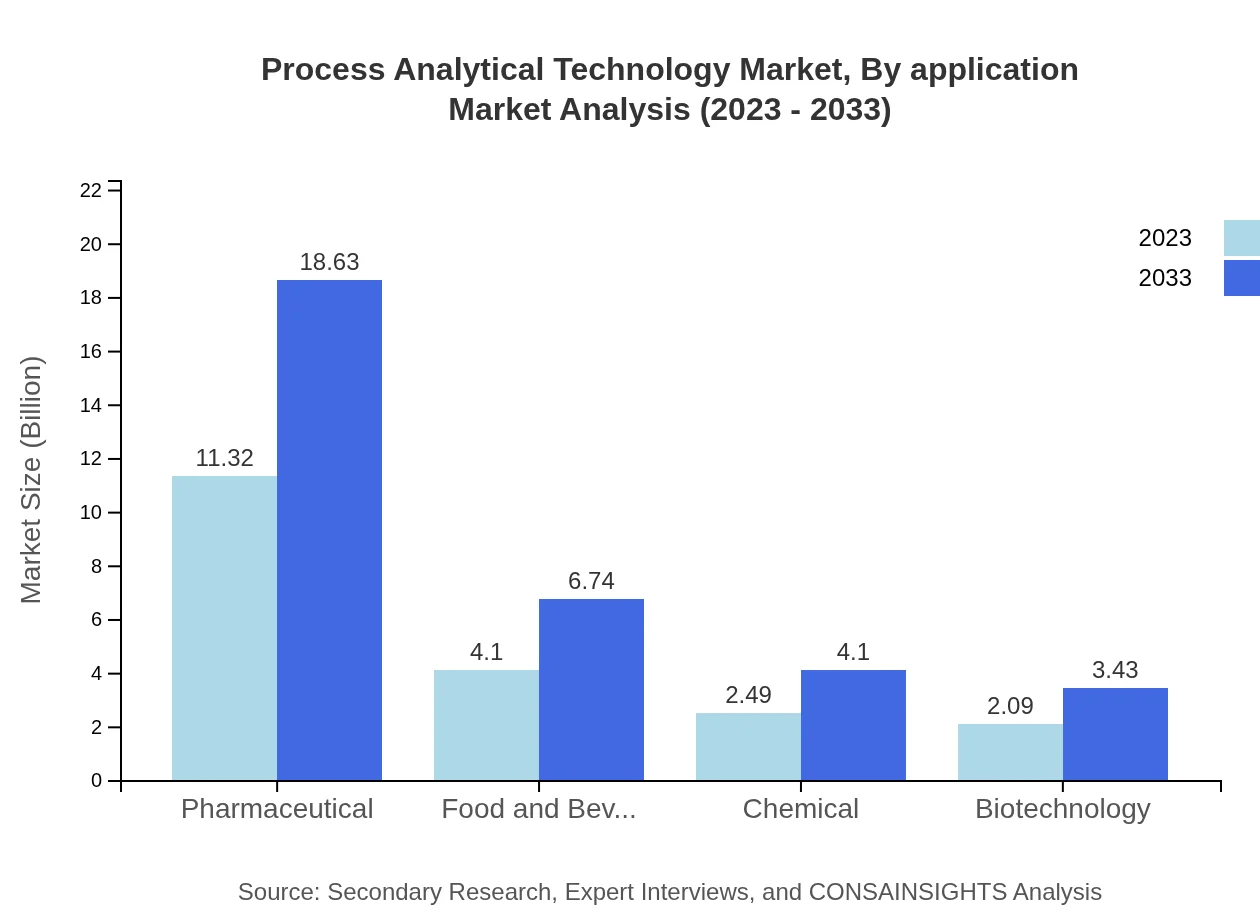

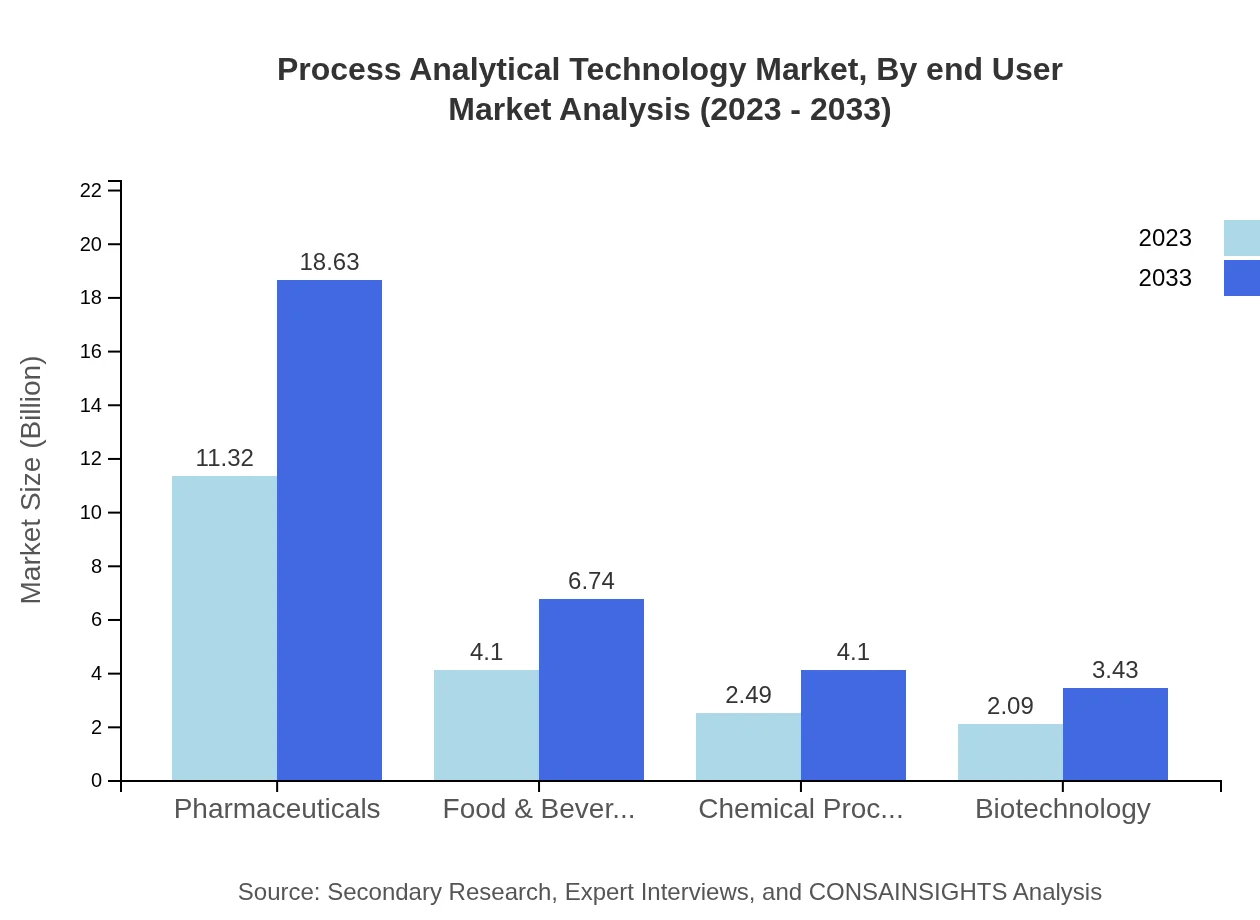

Process Analytical Technology Market Analysis By Application

The pharmaceutical application segment is the largest, with a size of $11.32 billion in 2023 and a future estimate of $18.63 billion by 2033, covering 56.61% market share. The food and beverage segment is also considerable, with a market of $4.10 billion in 2023 and a forecast of $6.74 billion by 2033, holding a 20.49% share. The chemical processing segment is valued at $2.49 billion, with a future projection of $4.10 billion by 2033.

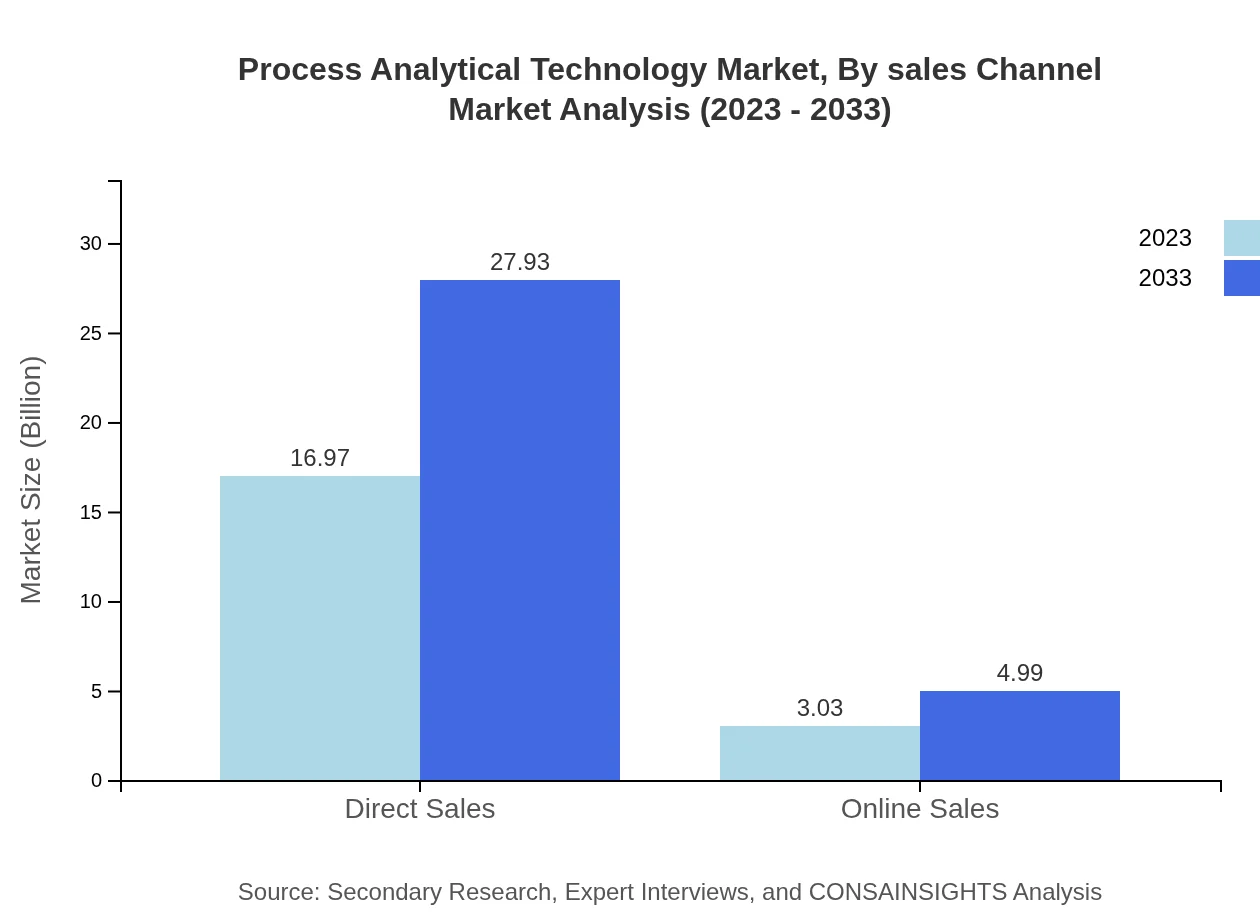

Process Analytical Technology Market Analysis By Sales Channel

Direct sales dominate the PAT market, reaching $16.97 billion in 2023 and expected to grow to $27.93 billion by 2033, representing an 84.84% market share. Online sales are estimated at $3.03 billion in 2023 and projected to rise to $4.99 billion by 2033, accounting for 15.16% of the market.

Process Analytical Technology Market Analysis By End User

Key end-user industries for PAT include pharmaceuticals, with significant usage in drug manufacturing processes, and food & beverage sectors, focusing on quality and safety. The PAT technology assists in ensuring compliance with health regulations and standards, driving its adoption across these industries.

Process Analytical Technology Market Analysis By Geography

The global distribution across regions highlights North America as the leading market. However, emerging markets in Asia-Pacific and Latin America show rapid growth potential due to increasing industrialization and investment in process improvements.

Process Analytical Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Analytical Technology Industry

Thermo Fisher Scientific:

A leader in serving science, Thermo Fisher offers advanced PAT solutions for pharmaceuticals and biotech applications, focusing on improving process efficiency and product quality.Siemens AG:

Siemens provides innovative PAT solutions that improve operational efficiency and compliance in various sectors, particularly in manufacturing and process industries.Danaher Corporation:

Danaher is a key player in providing analytical solutions that advance process control across industries such as food and beverage and pharmaceuticals.ABB Ltd.:

ABB specializes in automation and control technologies, offering PAT solutions designed for optimizing production and enhancing product quality.We're grateful to work with incredible clients.

FAQs

What is the market size of process Analytical Technology?

The process analytical technology market is expected to reach approximately $20 billion by 2033, growing at a compound annual growth rate (CAGR) of 5%. This indicates strong growth in the sector, driven by increasing demand for efficiency in production processes.

What are the key market players or companies in this process Analytical Technology industry?

Key players include major companies like Siemens, ABB, and Emerson. These firms dominate the market through innovations in technology and strong partnerships with industries such as pharmaceuticals, food and beverage, and chemical processing.

What are the primary factors driving the growth in the process Analytical Technology industry?

Growth drivers include the rise of automation in production, increasing regulatory standards in pharmaceuticals, and the demand for real-time data analytics, which enhances operational efficiency and product quality across various sectors.

Which region is the fastest Growing in the process Analytical Technology?

Among various regions, North America is the fastest-growing market for process analytical technology, projected to reach $12 billion in 2033, up from $7.29 billion in 2023, reflecting an increasing investement in advanced manufacturing technologies.

Does ConsaInsights provide customized market report data for the process Analytical Technology industry?

Yes, ConsaInsights offers tailored market reports specific to the process analytical technology industry, allowing clients to obtain detailed data and analysis according to their unique business needs and strategic objectives.

What deliverables can I expect from this process Analytical Technology market research project?

Deliverables include comprehensive market analysis, trend reports, forecast data, segmentation insights, competitor profiles, and actionable recommendations to help stakeholders make informed decisions in the process analytical technology market.

What are the market trends of process Analytical Technology?

Trends include increased adoption of digital technologies, growth in predictive analytics, a shift towards sustainable practices, and enhanced demand for integrated solutions in pharmaceuticals and food industries, indicating a dynamic future for this market.