Process Analytics Market Report

Published Date: 31 January 2026 | Report Code: process-analytics

Process Analytics Market Size, Share, Industry Trends and Forecast to 2033

This market report offers a comprehensive analysis of the Process Analytics sector, focusing on trends, regional insights, and segment performance from 2023 to 2033, aimed at deepening understanding and strategic planning for new entrants and existing players.

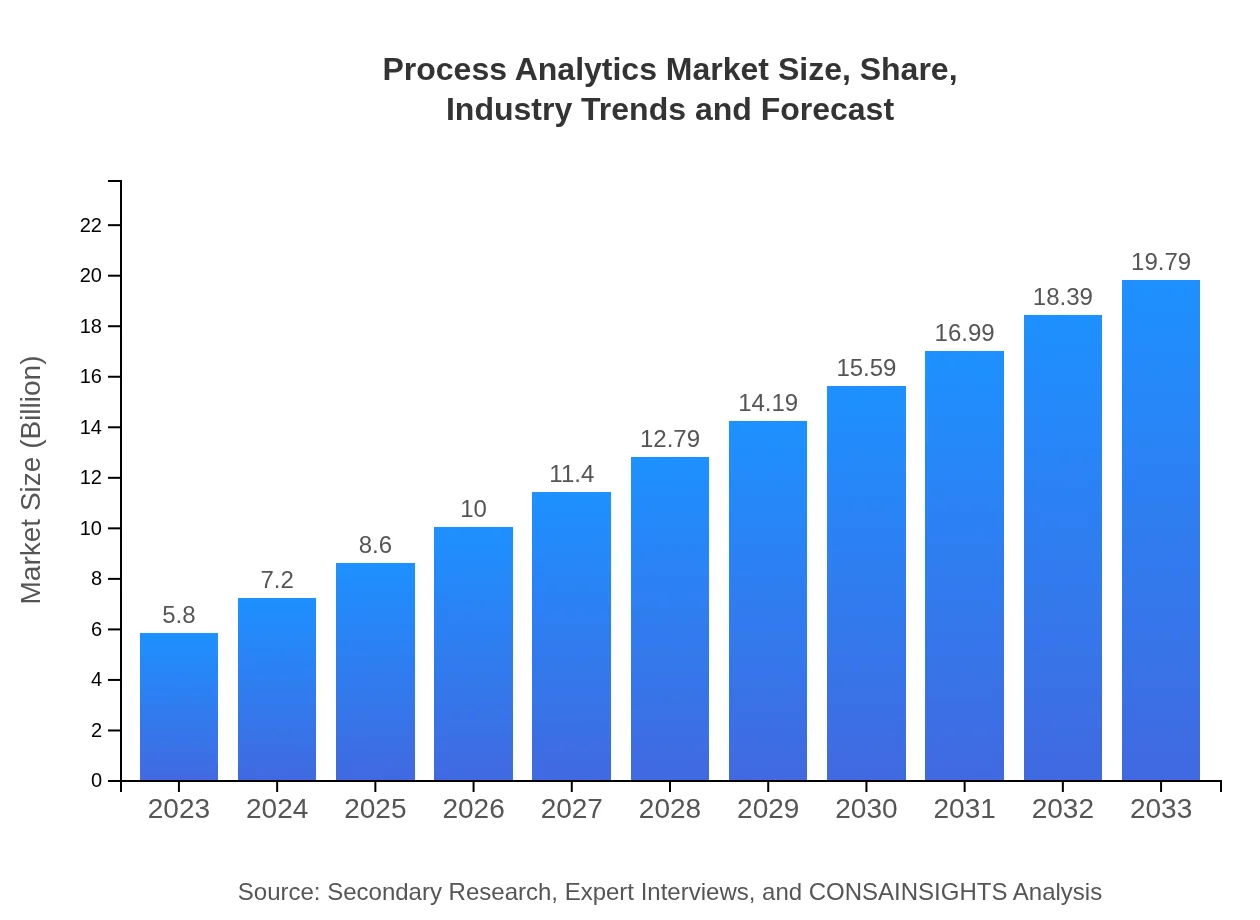

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $19.79 Billion |

| Top Companies | IBM, SAP, Oracle, Microsoft, Sisense |

| Last Modified Date | 31 January 2026 |

Process Analytics Market Overview

Customize Process Analytics Market Report market research report

- ✔ Get in-depth analysis of Process Analytics market size, growth, and forecasts.

- ✔ Understand Process Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Analytics

What is the Market Size & CAGR of Process Analytics market in 2023?

Process Analytics Industry Analysis

Process Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Analytics Market Analysis Report by Region

Europe Process Analytics Market Report:

Europe's Process Analytics market, currently valued at $1.83 billion in 2023, is estimated to reach $6.23 billion by 2033. The growing emphasis on regulatory compliance and efficiency in industries such as manufacturing and healthcare significantly drives demand in this region, supported by well-established technological infrastructures.Asia Pacific Process Analytics Market Report:

The Asia-Pacific region is anticipated to experience substantial growth, propelled by rapid digital transformation across emerging economies like India and China. In 2023, the market is valued at $1.00 billion and is projected to reach $3.41 billion by 2033, reflecting a fast adoption of analytics solutions in various sectors including manufacturing and finance.North America Process Analytics Market Report:

North America leads the Process Analytics market, with a valuation of $2.18 billion in 2023 projected to increase to $7.45 billion by 2033. The presence of advanced technologies and early adopters in industries like finance and healthcare is steering dominant growth, complemented by significant investments from major players in analytics technologies.South America Process Analytics Market Report:

In South America, the Process Analytics market is valued at approximately $0.51 billion in 2023 and is expected to grow to $1.73 billion by 2033. The region is witnessing a slow yet steady embrace of analytical tools, driven by improvements in technology infrastructure and an increase in local enterprises adopting data-driven decision-making processes.Middle East & Africa Process Analytics Market Report:

The Middle East and Africa show a burgeoning interest in Process Analytics, with the market valued at $0.28 billion in 2023, expected to grow to $0.97 billion by 2033. This growth is supported by increasing investments in technology and analytics from both governments and private sectors aiming to enhance operational effectiveness.Tell us your focus area and get a customized research report.

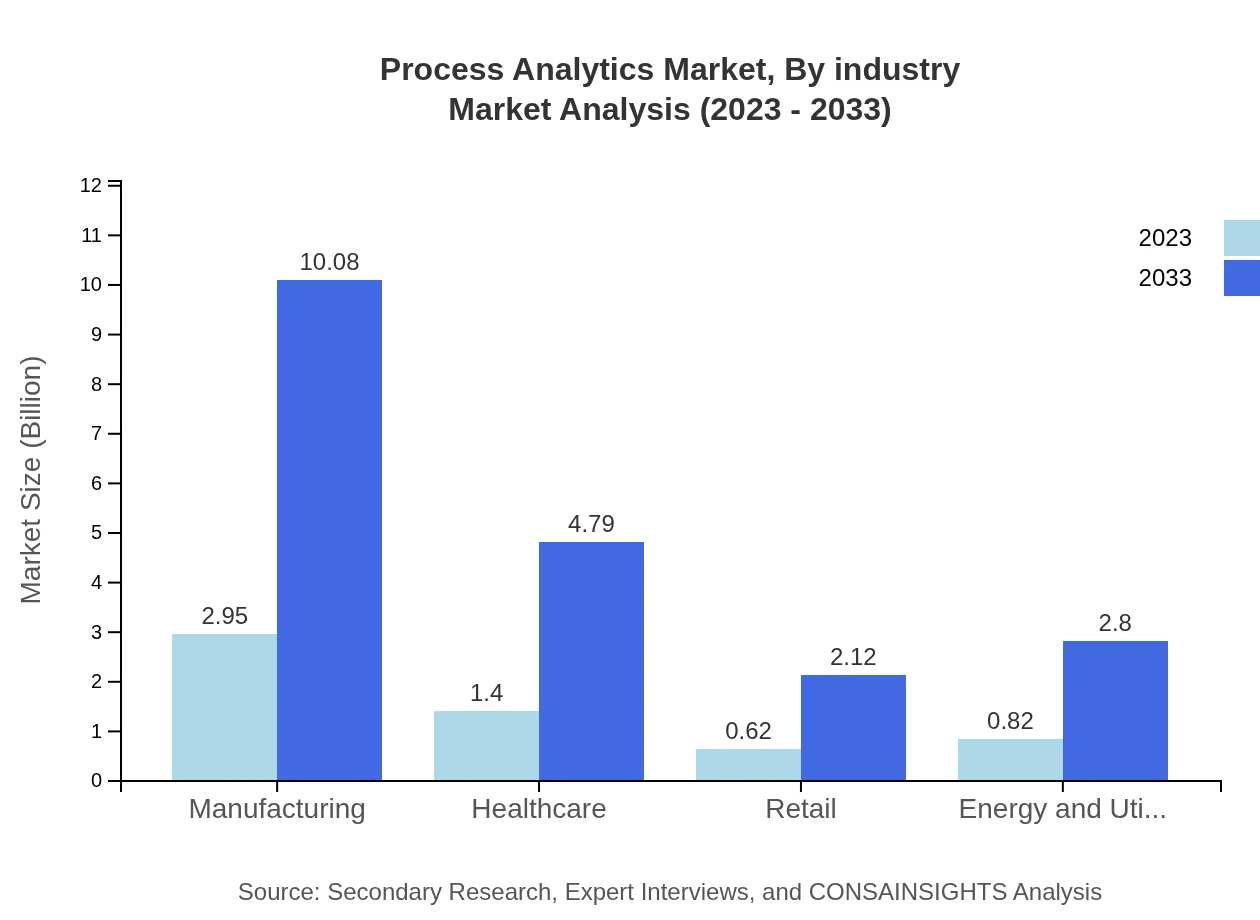

Process Analytics Market Analysis By Industry

The manufacturing sector represents a significant share of the Process Analytics market, with its size projected to rise from $2.95 billion in 2023 to $10.08 billion by 2033. Healthcare follows with a market value increasing from $1.40 billion to $4.79 billion over the same period. Other notable segments include Energy and Utilities, retail, and enterprise users, which see increasing adoption driven by the need for enhanced operational efficiencies and performance insights.

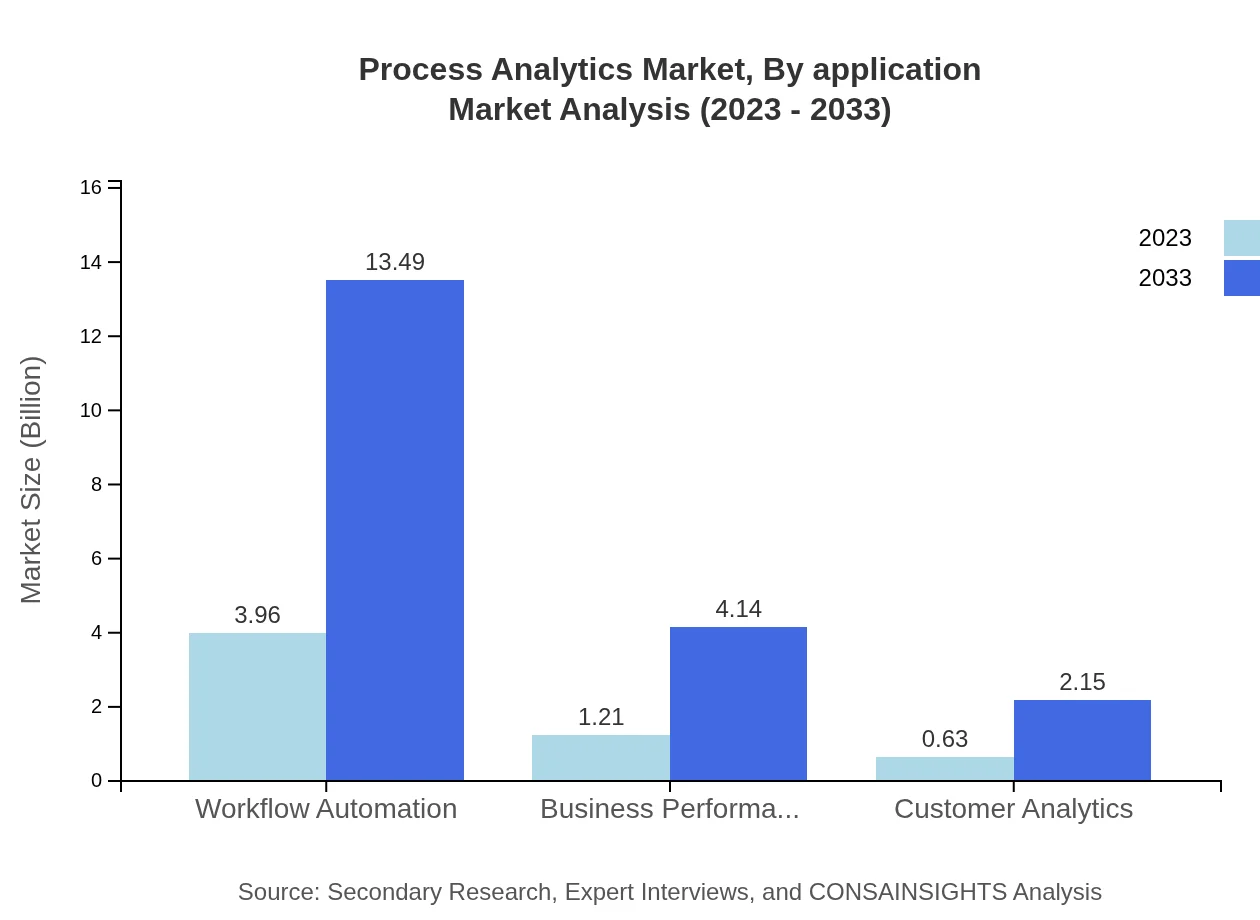

Process Analytics Market Analysis By Application

Applications in Workflow Automation dominate the Process Analytics market, with a significant size increase from $3.96 billion in 2023 to $13.49 billion in 2033. Business Performance Management and Customer Analytics also play crucial roles, reflecting the increasing focus on data-driven decision-making across organizations. The segment illustrates the shift towards optimizing operational performance through advanced analytics applications.

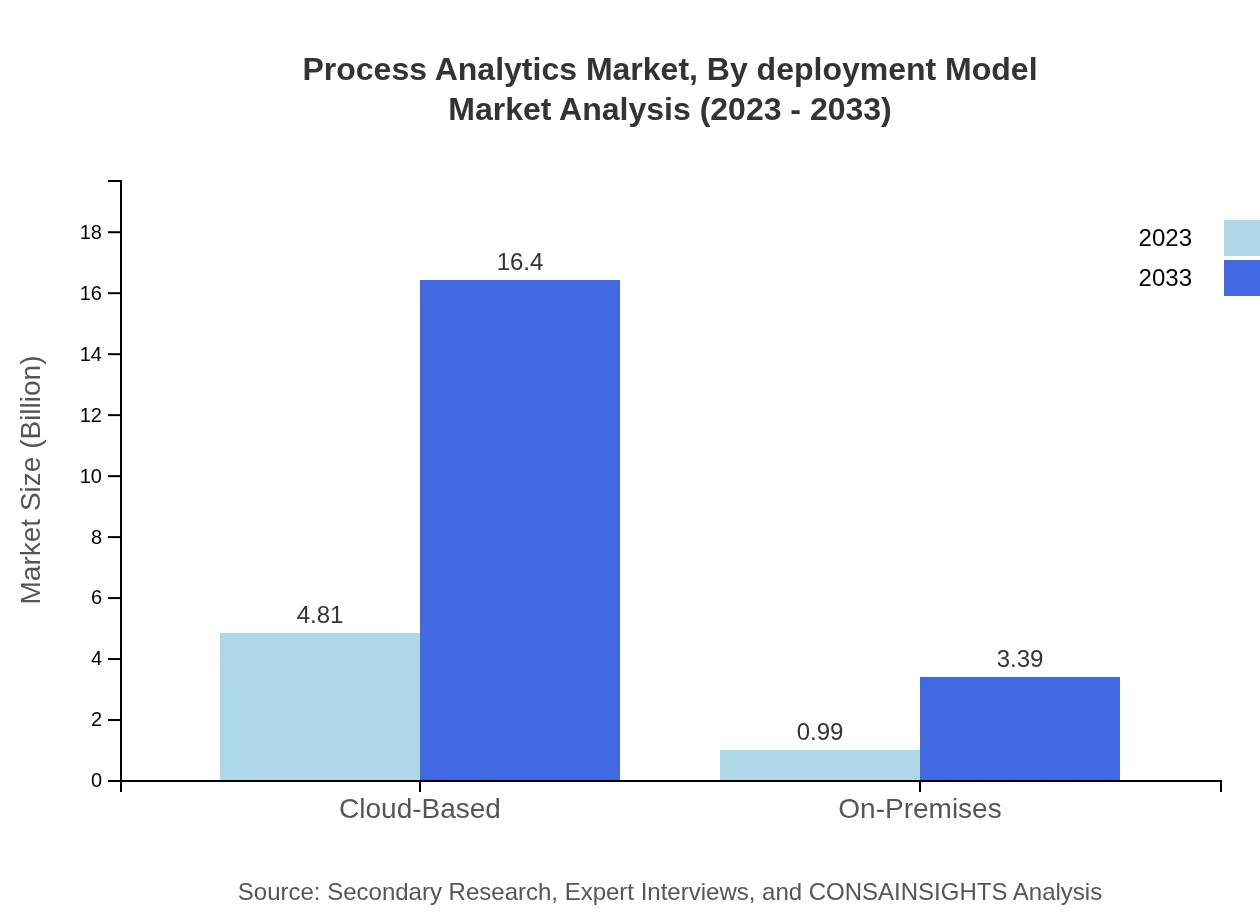

Process Analytics Market Analysis By Deployment Model

The cloud-based deployment model significantly leads the Process Analytics market, poised for expansion from $4.81 billion in 2023 to $16.40 billion by 2033, highlighting the trend towards flexible and scalable solutions. Conversely, on-premises systems cater to organizations prioritizing complete control over their data and analytics, albeit at a smaller share of the market.

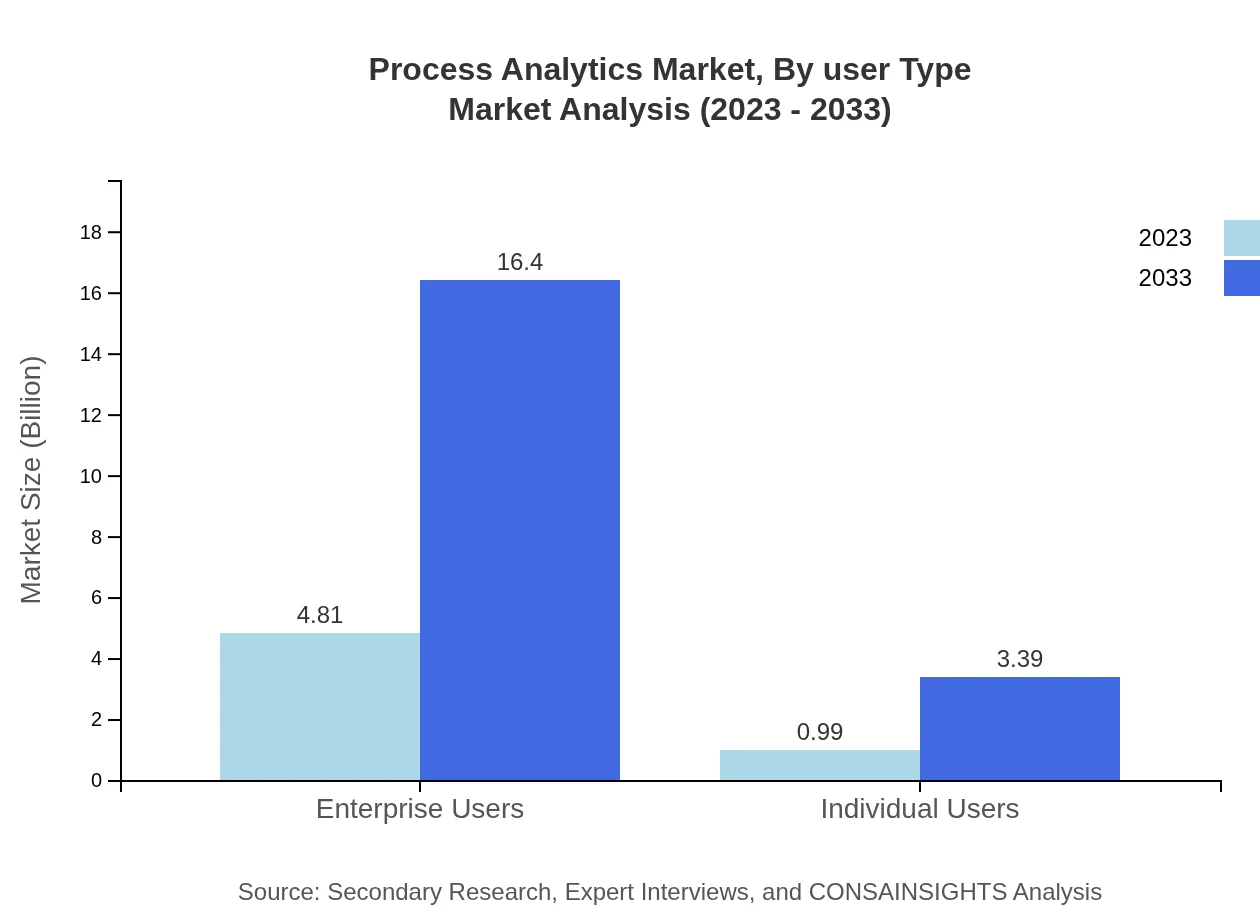

Process Analytics Market Analysis By User Type

Enterprise users dominate the Process Analytics market, with significant growth anticipated from $4.81 billion in 2023 to $16.40 billion by 2033, highlighting their dependency on comprehensive analytics solutions. Individual users, while comprising a smaller share, show a forecasted increase from $0.99 billion to $3.39 billion, representing a growing interest in analytics tools for personal or small business use.

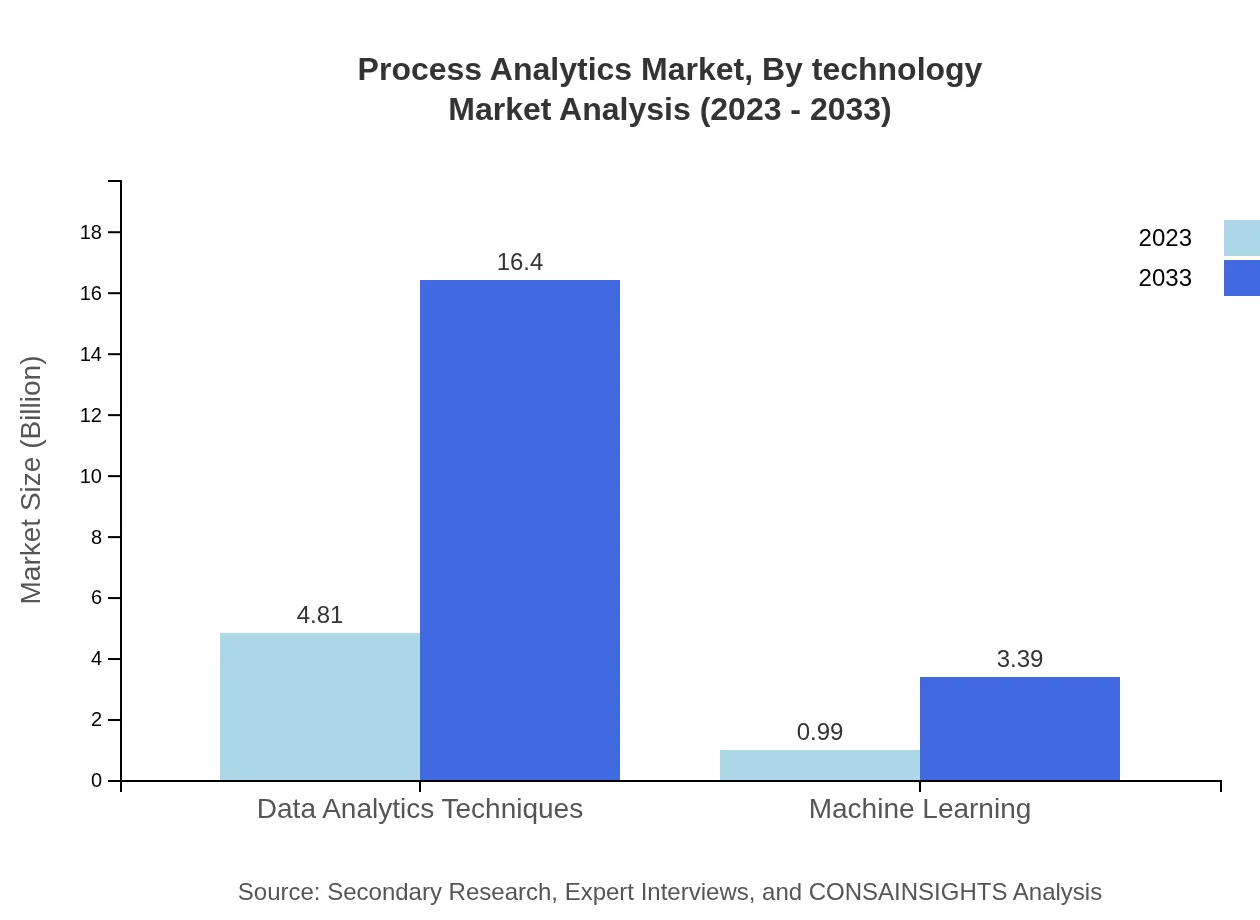

Process Analytics Market Analysis By Technology

Technology such as Data Analytics Techniques and Machine Learning is transforming the Process Analytics market, with expected growth driven by their efficiency and predictive capabilities. The integration of advanced technologies empowers organizations to derive deeper insights, resulting in better-informed decision-making processes across industries.

Process Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Analytics Industry

IBM:

IBM is a leader in analytics solutions, providing a comprehensive suite of Process Analytics tools that leverage AI and machine learning to enhance business processes.SAP:

SAP offers robust analytics and business process management software, helping organizations optimize their workflows through sophisticated data insights.Oracle:

Oracle's suite of analytics solutions provides powerful tools to unlock process efficiencies and drive better business outcomes through data insights.Microsoft:

Microsoft supports a multitude of analytics applications that integrate seamlessly with its cloud services, thus enhancing collaborative data analytics capabilities.Sisense:

Sisense specializes in business intelligence and analytics, enabling data-driven decision-making through innovative process analytics products.We're grateful to work with incredible clients.

FAQs

What is the market size of process Analytics?

The global process analytics market is valued at 5.8 billion in 2023, with a projected CAGR of 12.5%. This growth is anticipated to expand the market significantly by 2033.

What are the key market players or companies in the process Analytics industry?

Key players in the process analytics market include software vendors, tech solution providers, and consulting firms that focus on data analytics and business intelligence.

What are the primary factors driving the growth in the process Analytics industry?

Growth factors include the increasing need for data-driven decision-making, adoption of advanced analytics technologies, and the rise of automation across sectors.

Which region is the fastest Growing in the process Analytics?

The fastest-growing region is North America, projected to grow from 2.18 billion in 2023 to 7.45 billion by 2033, driven by technological advancements and increased enterprise adoption.

Does ConsaInsights provide customized market report data for the process Analytics industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the process analytics sector, ensuring relevant insights for various business applications.

What deliverables can I expect from this process Analytics market research project?

Deliverables may include comprehensive market analysis, segmented data insights, competitive landscapes, forecasts, and customized strategic recommendations.

What are the market trends of process Analytics?

Current trends include a shift toward cloud-based solutions, the integration of machine learning, and a focus on workflow automation to enhance efficiency and effectiveness.