Process Analyzer Market Report

Published Date: 31 January 2026 | Report Code: process-analyzer

Process Analyzer Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Process Analyzer market, exploring key insights, trends, and data from 2023 to 2033. It covers market size, segmentation, regional insights, and forecasts to provide a detailed understanding of the industry landscape.

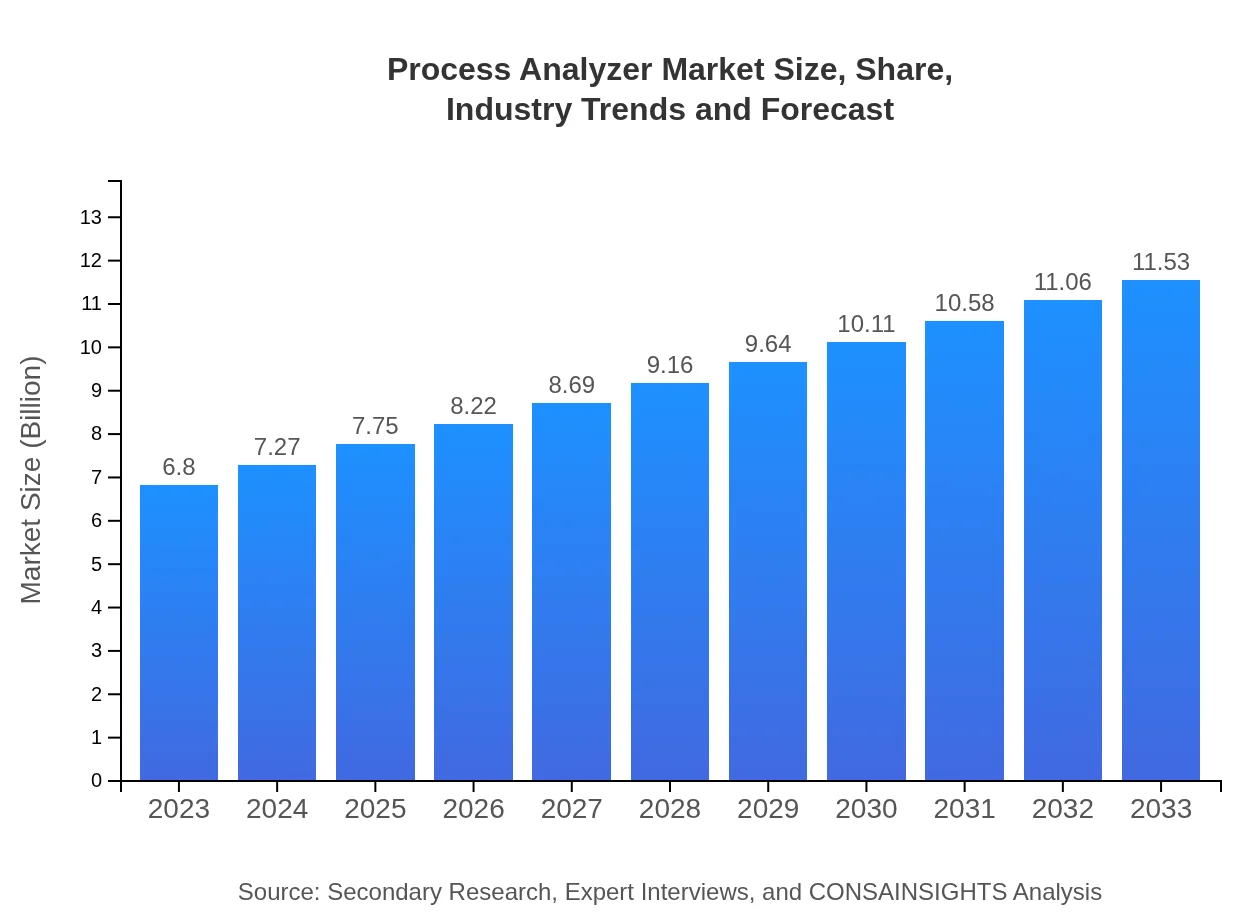

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $11.53 Billion |

| Top Companies | Emerson Electric Co., Siemens AG, Honeywell International Inc., ABB Ltd., GE Measurement & Control |

| Last Modified Date | 31 January 2026 |

Process Analyzer Market Overview

Customize Process Analyzer Market Report market research report

- ✔ Get in-depth analysis of Process Analyzer market size, growth, and forecasts.

- ✔ Understand Process Analyzer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Analyzer

What is the Market Size & CAGR of Process Analyzer market in 2023?

Process Analyzer Industry Analysis

Process Analyzer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Analyzer Market Analysis Report by Region

Europe Process Analyzer Market Report:

Europe’s market is anticipated to rise from $2.41 billion in 2023 to $4.08 billion by 2033. The focus on sustainability and stringent environmental laws drive the adoption of efficient analytical tools in numerous industries.Asia Pacific Process Analyzer Market Report:

In the Asia Pacific region, the Process Analyzer market is expected to grow from $1.22 billion in 2023 to $2.07 billion by 2033, driven by the expansion of manufacturing hubs and increasing investments in automation. Countries like China and India are significant contributors due to their emphasis on industrialization.North America Process Analyzer Market Report:

North America holds a substantial share of the process analyzer market, growing from $2.18 billion in 2023 to $3.70 billion by 2033. The region emphasizes regulatory compliance and safety, propelling investment in process analyzers, particularly in the energy sector.South America Process Analyzer Market Report:

The South American market is projected to grow from $0.51 billion in 2023 to $0.86 billion by 2033. The growth is attributed to rising demand in the oil and gas industry alongside increased environmental regulations pushing for effective monitoring solutions.Middle East & Africa Process Analyzer Market Report:

The Middle East and Africa are projected to grow from $0.48 billion in 2023 to $0.81 billion by 2033. The market growth is closely tied to advancements in oil and gas extraction technologies and increasing investments in infrastructure development.Tell us your focus area and get a customized research report.

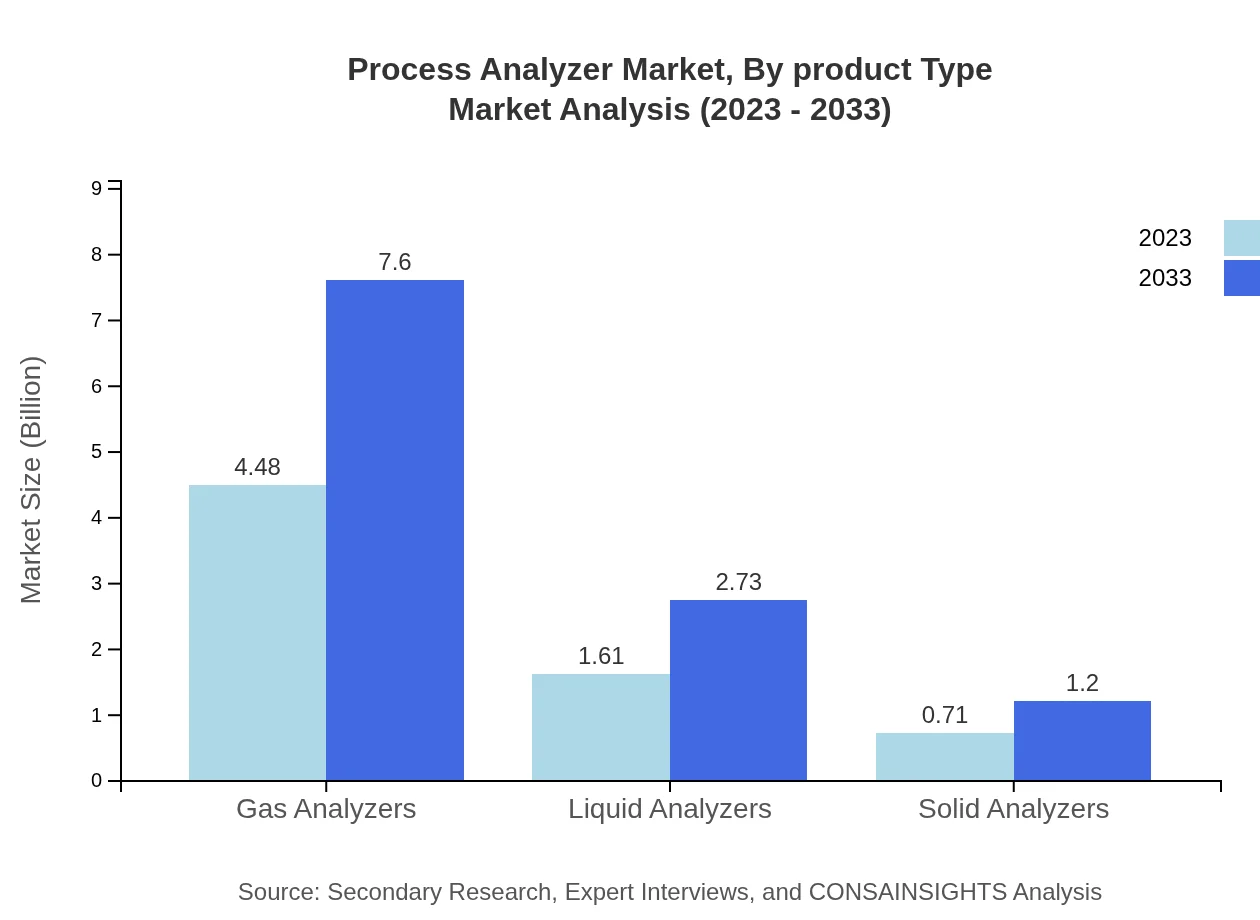

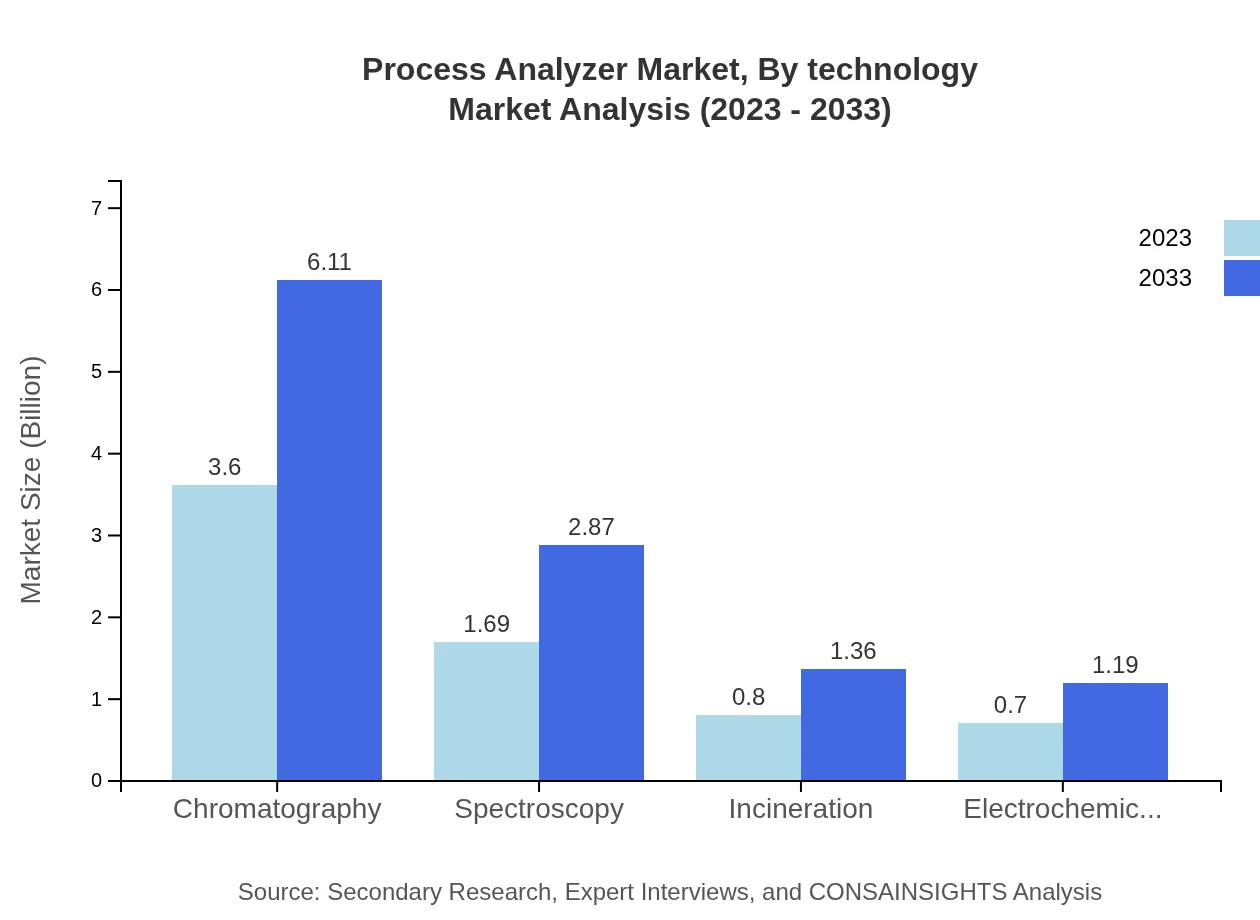

Process Analyzer Market Analysis By Product Type

The chromatography segment leads the market size at $3.60 billion in 2023 and is projected to grow to $6.11 billion by 2033, representing 52.96% of the total market share. Similarly, spectrometry holds a significant share of 24.89%, expected to increase from $1.69 billion to $2.87 billion during the same period.

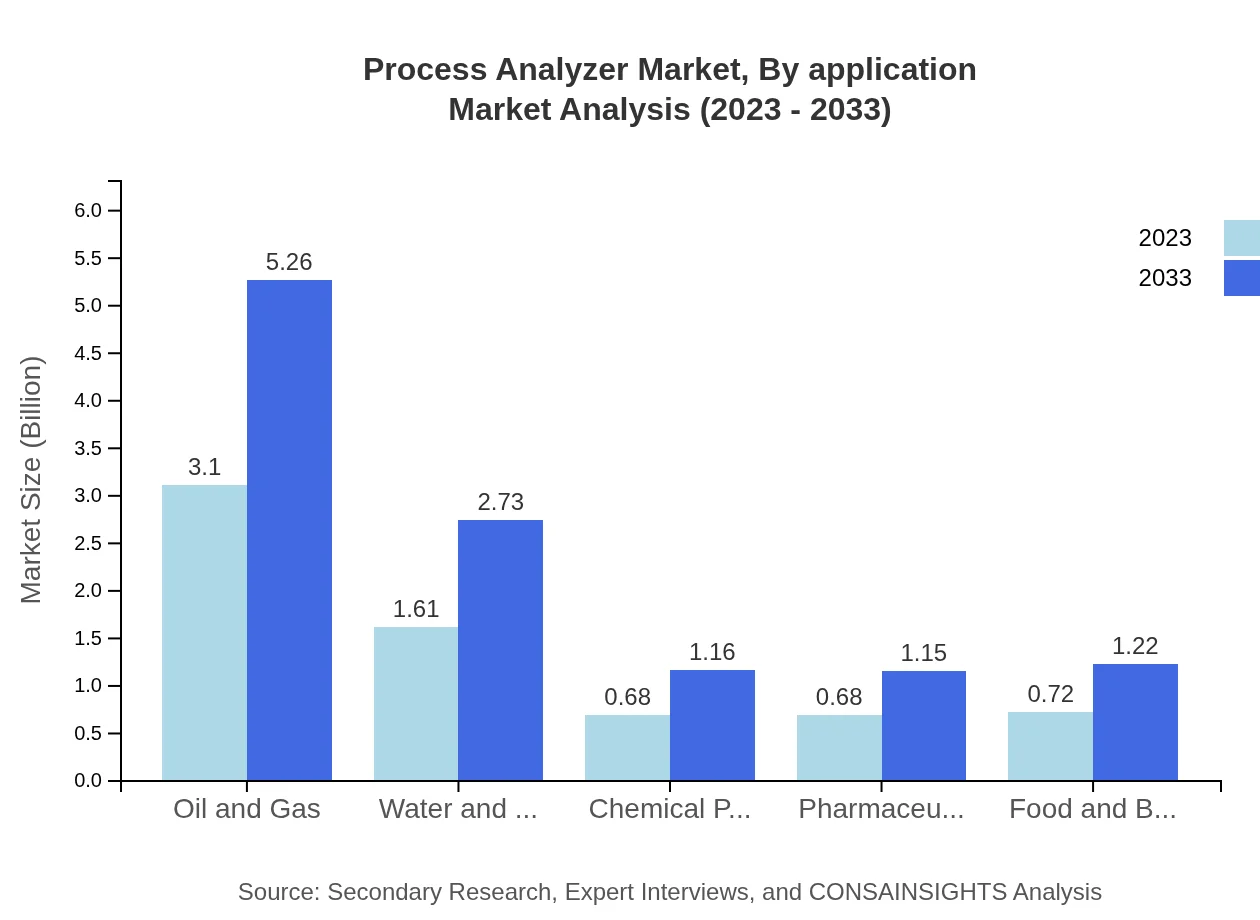

Process Analyzer Market Analysis By Application

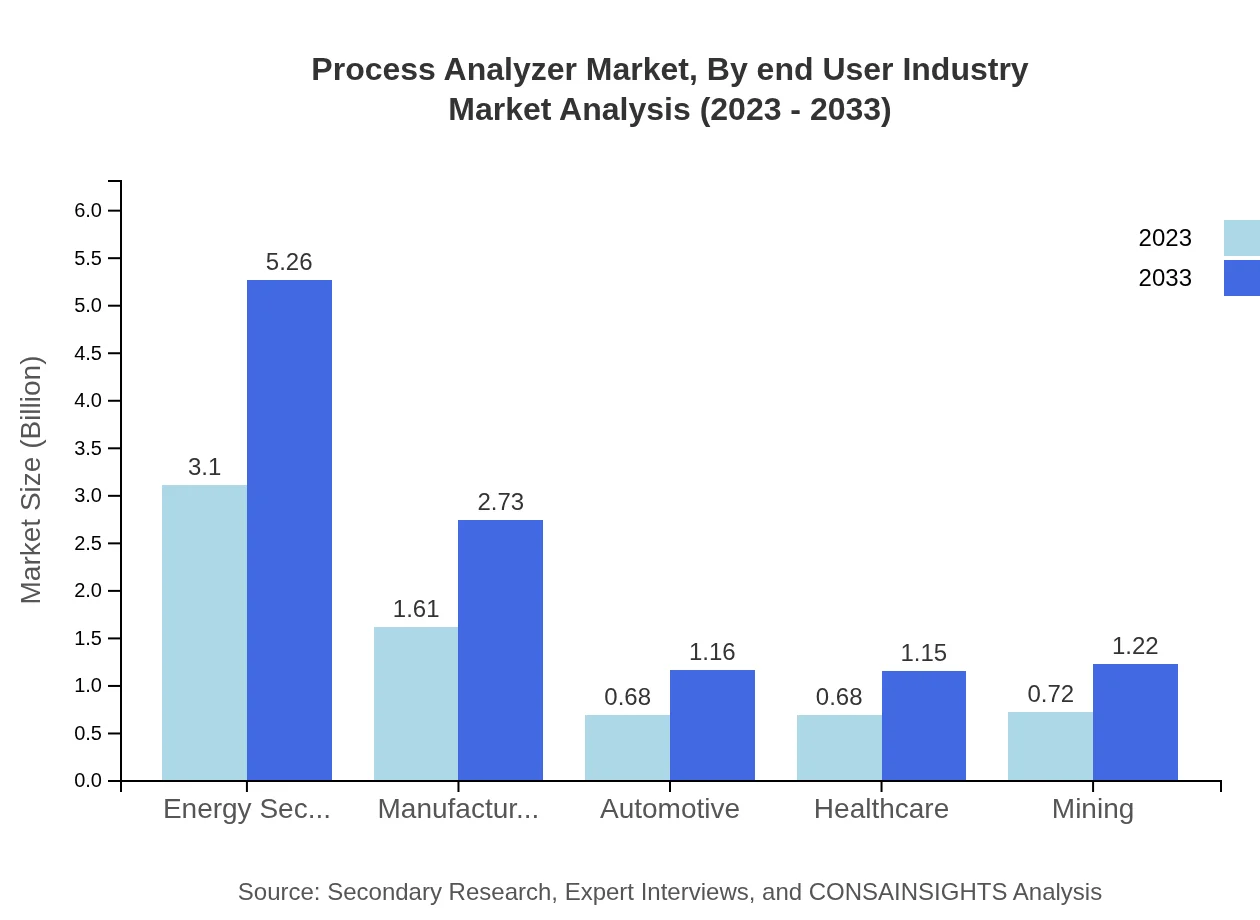

The oil and gas sector dominates the application segments with a market share of 45.66% in 2023, projected to grow from $3.10 billion to $5.26 billion by 2033. Water and wastewater analysis follows, holding 23.72% and increasing from $1.61 billion to $2.73 billion, propelled by rising environmental concerns.

Process Analyzer Market Analysis By Technology

Real-time monitoring technologies are gaining momentum in the market, allowing industries to carry out predictive maintenance and reduce operational costs. IoT-enabled analyzers are also becoming popular as they provide more connectivity and data analysis capabilities.

Process Analyzer Market Analysis By End User Industry

Manufacturing and energy sectors are the largest end-users of process analyzers, significantly contributing to overall growth. In 2023, manufacturing holds a share of 23.72% with expected growth driven by automating processes and ensuring quality control across production lines.

Process Analyzer Market Analysis By Distribution Channel

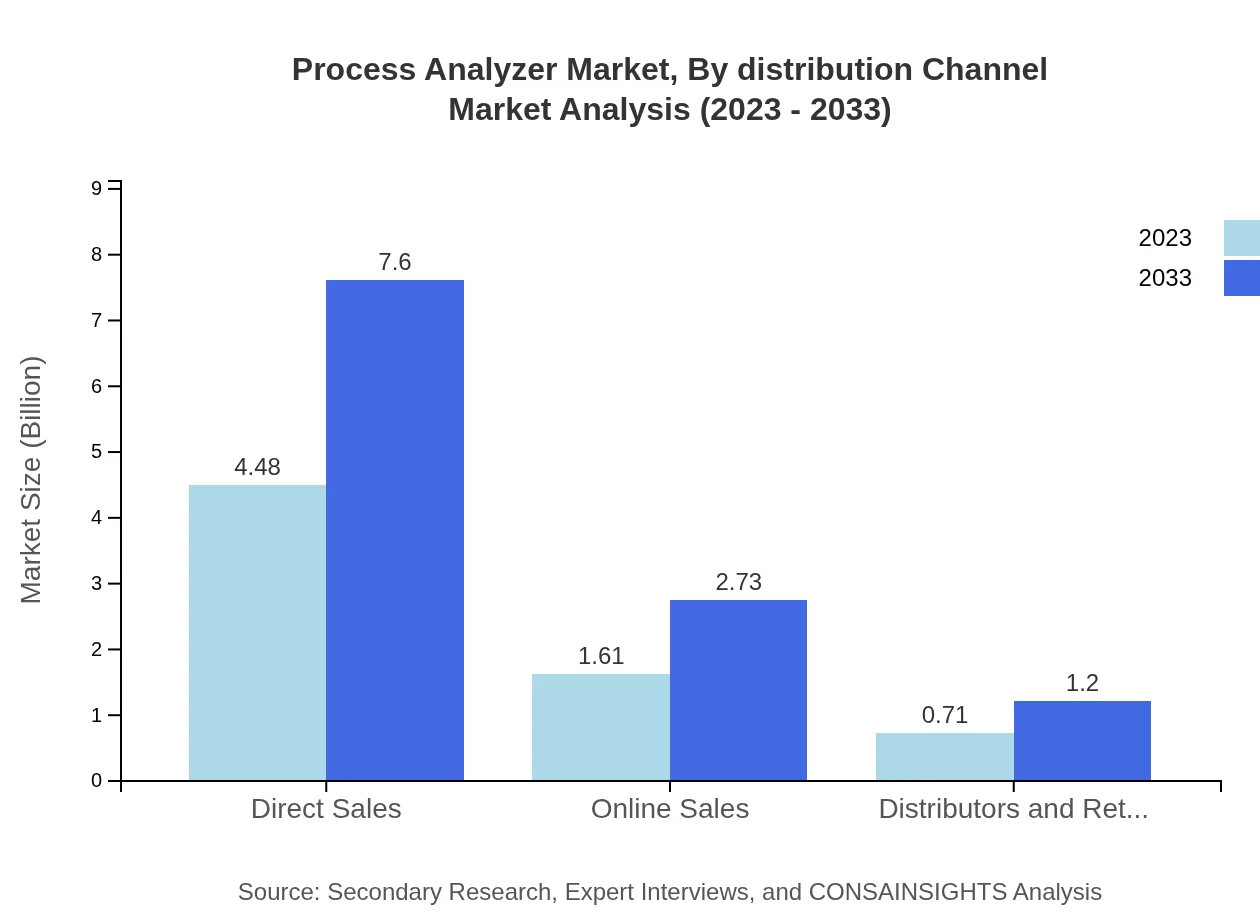

Direct sales dominate the distribution channels, capturing 65.9% of the market share. This is attributed to strong relationships between manufacturers and industrial customers, enhancing service delivery and customer satisfaction.

Process Analyzer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Analyzer Industry

Emerson Electric Co.:

Emerson is a pioneer in automation solutions. Its process analyzers enhance efficiency in areas such as the chemical and oil industries.Siemens AG:

Siemens is recognized for its innovative technology in process instrumentation, providing state-of-the-art analyzers across various sectors.Honeywell International Inc.:

Honeywell provides solutions for environmental compliance and process control, leading to enhanced productivity and safety.ABB Ltd.:

ABB aims to integrate electrification, automation, and digitalization in the process analyzer field, propelling growth across industries.GE Measurement & Control:

With a focus on high-tech industrial solutions, GE Measurement & Control provides comprehensive process analysis to enhance operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of the Process Analyzer?

The global Process Analyzer market is valued at approximately $6.8 billion in 2023 and is projected to grow at a CAGR of 5.3% through 2033.

What are the key market players or companies in the Process Analyzer industry?

Key players in the Process Analyzer industry include Emerson Electric Co., Siemens AG, and ABB Ltd., which dominate segments related to process automation, ensuring precise measurements and controls across industries.

What are the primary factors driving the growth in the Process Analyzer industry?

Growth drivers include increasing automation in manufacturing, heightened environmental regulations, and technological advancements in sensor technologies, enabling real-time monitoring for efficiency and compliance.

Which region is the fastest Growing in the Process Analyzer market?

Asia Pacific is the fastest-growing region in the Process Analyzer market, expected to increase from $1.22 billion in 2023 to $2.07 billion by 2033, driven by expanding industrial activities.

Does ConsaInsights provide customized market report data for the Process Analyzer industry?

Yes, ConsaInsights offers customized market reporting tailored to specific client needs, including detailed analytics and forecasts for the Process Analyzer industry.

What deliverables can I expect from this Process Analyzer market research project?

Expect comprehensive deliverables such as market trends, forecasts, competitive analysis, and segment-specific insights, ensuring a thorough understanding of the Process Analyzer landscape.

What are the market trends of the Process Analyzer?

Current trends include rising demand for real-time data analytics, integration of IoT in process analyzers, and increased emphasis on sustainability and process efficiency across various sectors.