Process Automation And Instrumentation Market Report

Published Date: 22 January 2026 | Report Code: process-automation-and-instrumentation

Process Automation And Instrumentation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Process Automation and Instrumentation market, exploring current trends, market size, segments, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

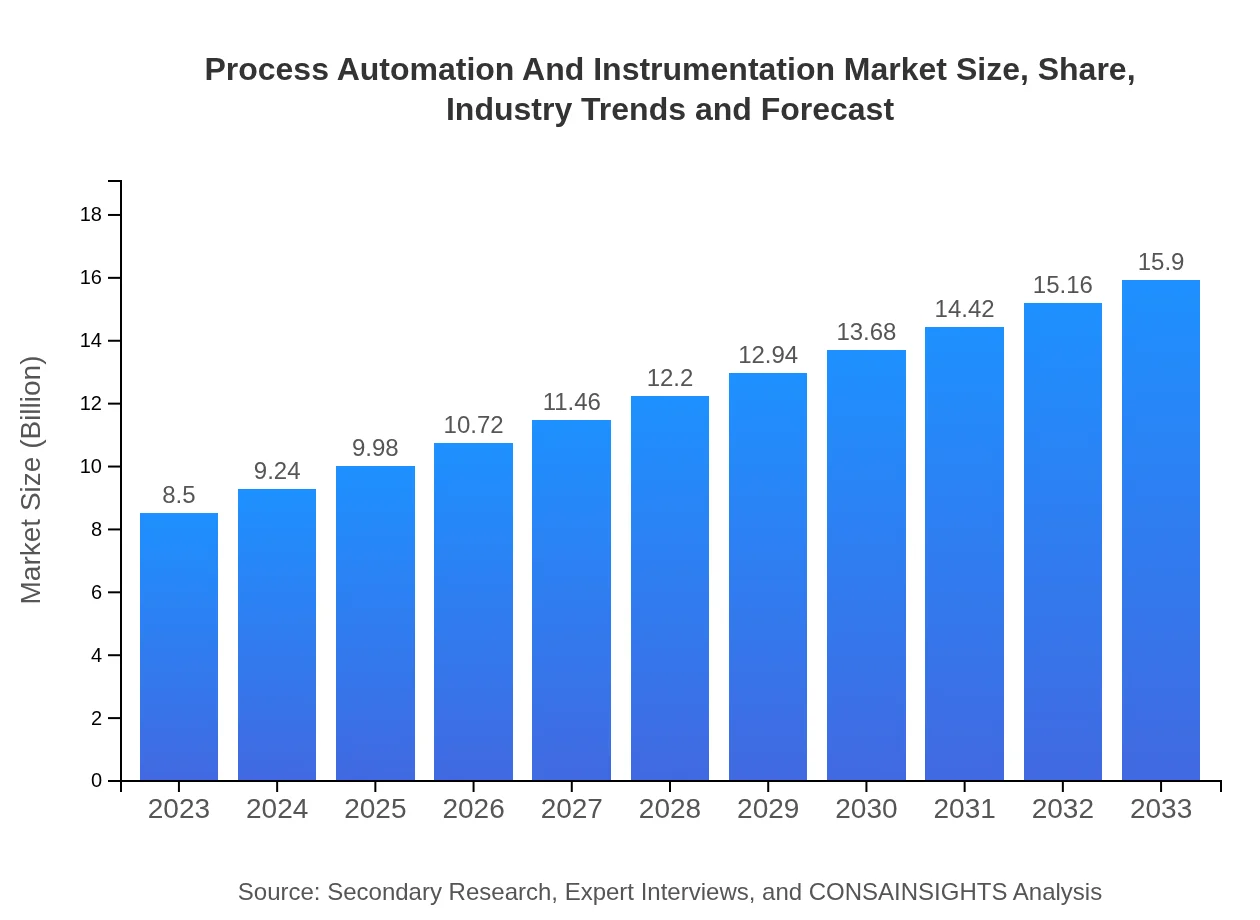

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $15.90 Billion |

| Top Companies | Siemens AG, ABB Ltd., Emerson Electric Co., Rockwell Automation, Inc., Honeywell International Inc. |

| Last Modified Date | 22 January 2026 |

Process Automation And Instrumentation Market Overview

Customize Process Automation And Instrumentation Market Report market research report

- ✔ Get in-depth analysis of Process Automation And Instrumentation market size, growth, and forecasts.

- ✔ Understand Process Automation And Instrumentation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Automation And Instrumentation

What is the Market Size & CAGR of Process Automation And Instrumentation market in 2023?

Process Automation And Instrumentation Industry Analysis

Process Automation And Instrumentation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Automation And Instrumentation Market Analysis Report by Region

Europe Process Automation And Instrumentation Market Report:

Europe's market is valued at $2.04 billion in 2023 and is anticipated to grow to $3.82 billion by 2033. The emphasis on energy efficiency and sustainability is influencing investments in automation and instrumentation technologies across various industries in the region.Asia Pacific Process Automation And Instrumentation Market Report:

In 2023, the Asia Pacific Process Automation and Instrumentation market is valued at $1.71 billion and is projected to grow to $3.20 billion by 2033. The region's rapid industrialization, especially in countries like China and India, is a significant driver, alongside a push towards smart manufacturing.North America Process Automation And Instrumentation Market Report:

North America leads with a market size of $2.75 billion in 2023, projected to grow to $5.15 billion by 2033. The USA's technological advancement and the swift adoption of smart technologies significantly propel this growth.South America Process Automation And Instrumentation Market Report:

The South American market is estimated at $0.83 billion in 2023, expected to reach $1.55 billion by 2033. Increased investment in infrastructure and energy sectors, particularly in Brazil and Argentina, presents considerable growth opportunities.Middle East & Africa Process Automation And Instrumentation Market Report:

In the Middle East and Africa, the market is projected to grow from $1.17 billion in 2023 to $2.18 billion by 2033. The region's increasing focus on industrialization and infrastructure development is expected to drive the adoption of automated solutions.Tell us your focus area and get a customized research report.

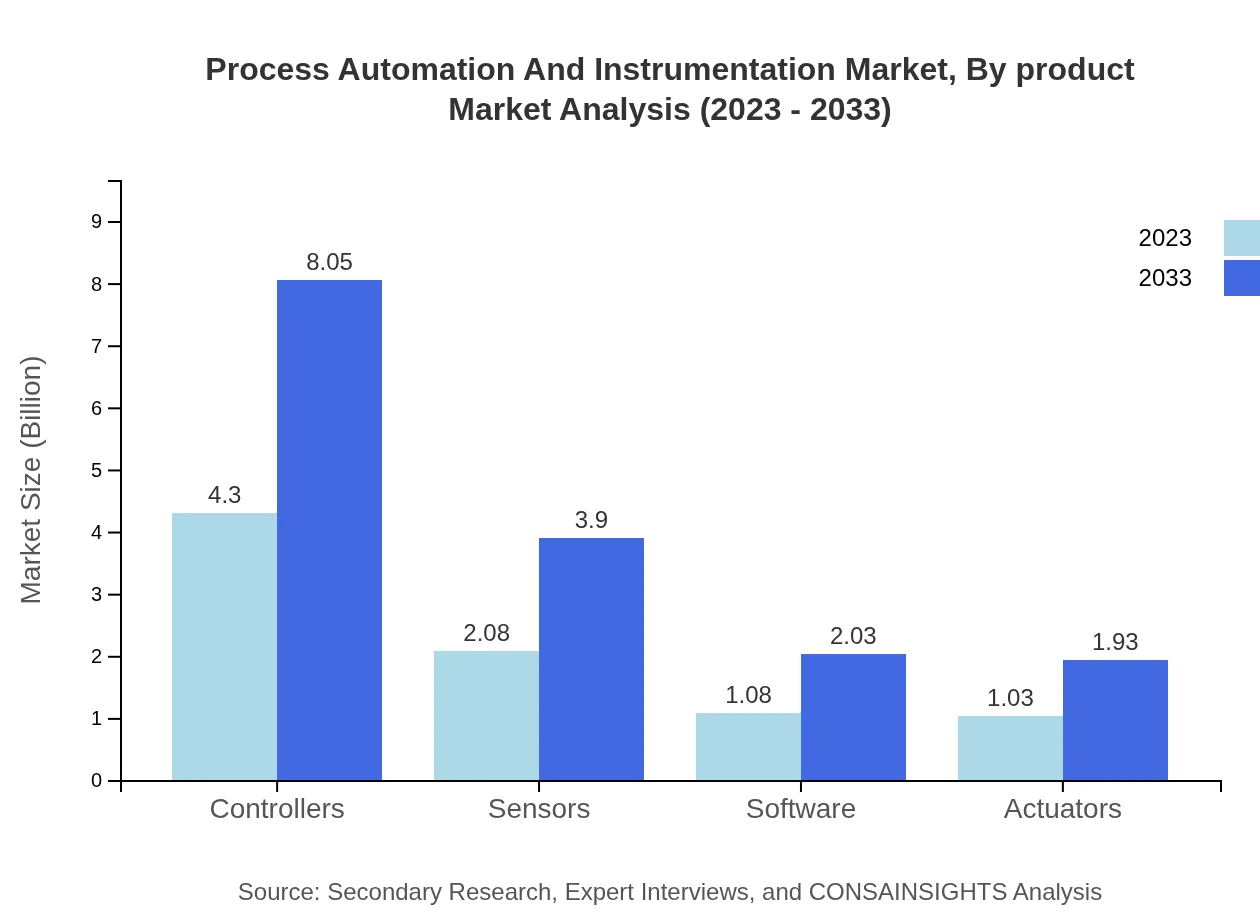

Process Automation And Instrumentation Market Analysis By Product

The product segmentation indicates Controllers as the leading segment with a market size of $4.30 billion in 2023, expected to reach $8.05 billion by 2033, accounting for about 50.63% market share. Sensors follow, with a size of $2.08 billion in 2023, projected at $3.90 billion by 2033, maintaining a 24.5% market share.

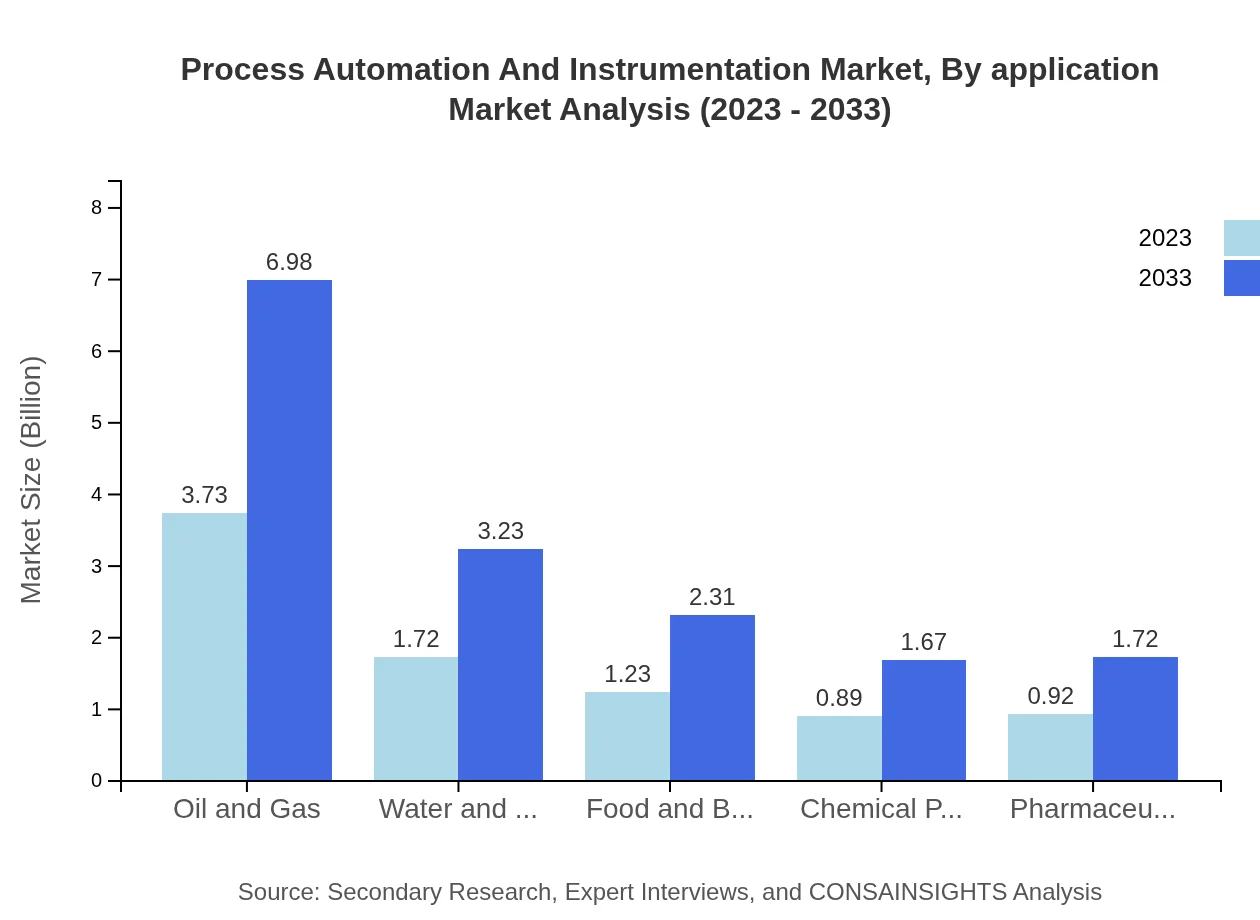

Process Automation And Instrumentation Market Analysis By Application

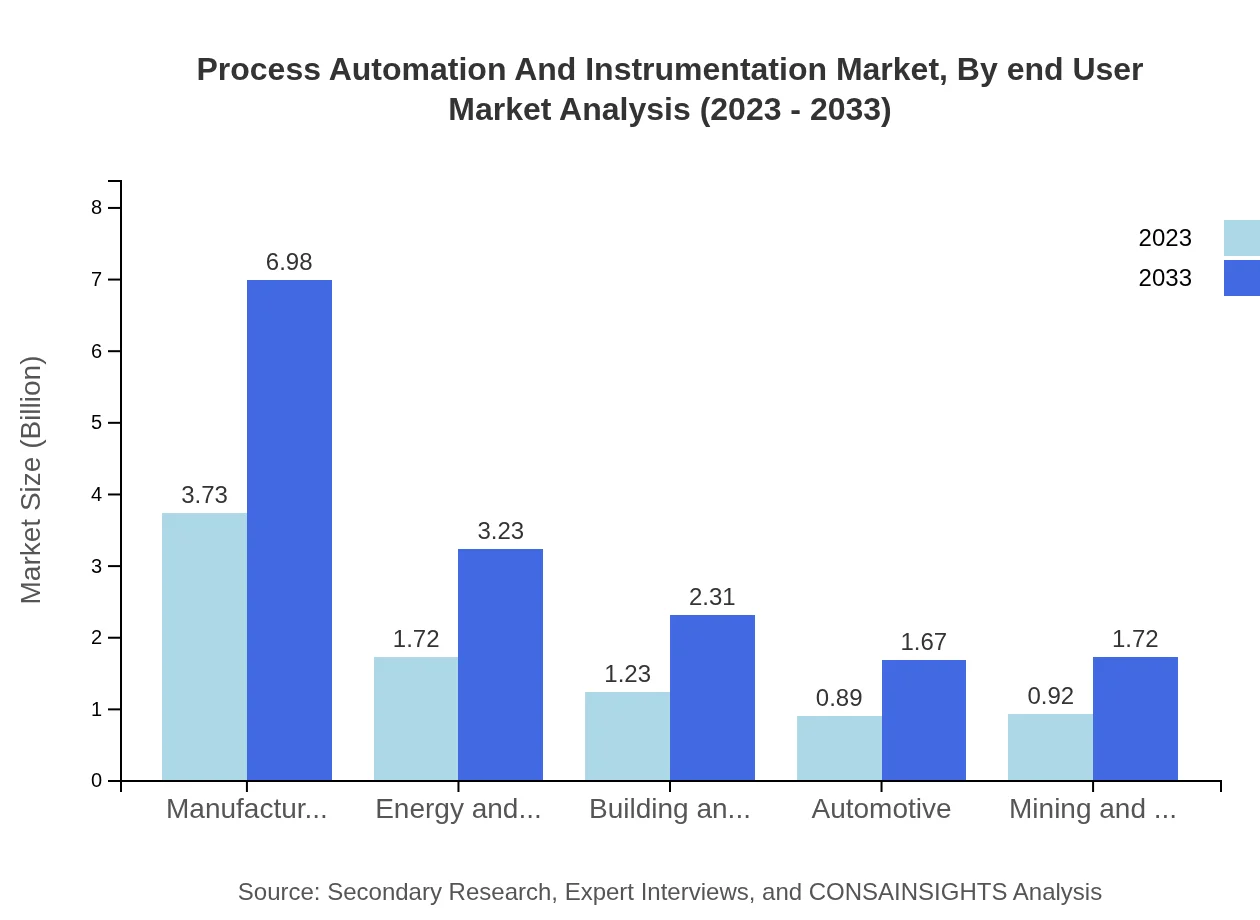

The application segmentation identifies Manufacturing as the largest sector, projected to grow from $3.73 billion in 2023 to $6.98 billion by 2033, holding a market share of 43.88%. This growth is fueled by increasing automation in production lines. Energy and Power is another critical application, expected to grow from $1.72 billion in 2023 to $3.23 billion by 2033.

Process Automation And Instrumentation Market Analysis By End User

The key end-user industries driving the Process Automation market include Oil and Gas, which holds a share of 43.88%, and Manufacturing, with a significant market presence. Other notable sectors include Pharmaceuticals and Food and Beverage, continually expanding their automation capacities to improve efficiency and compliance.

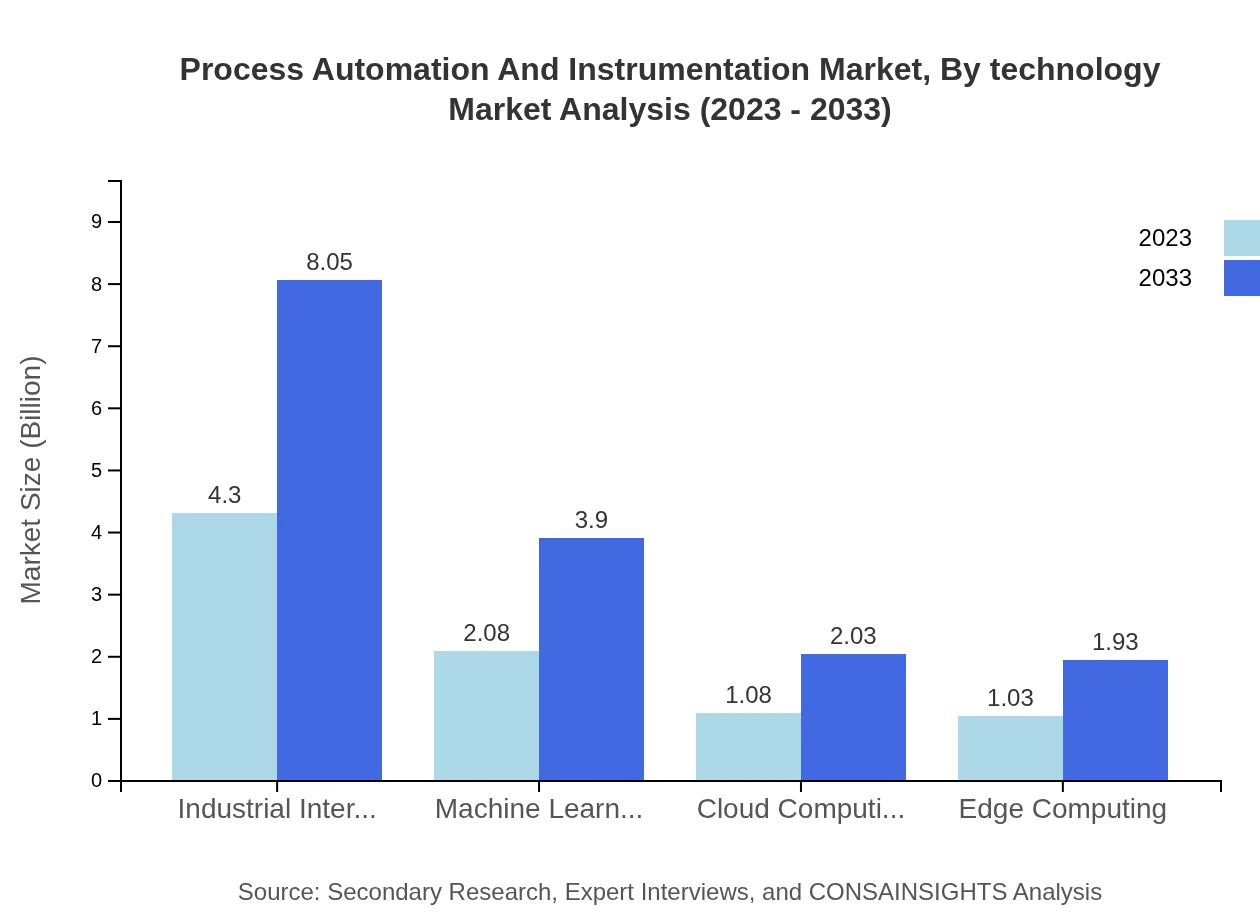

Process Automation And Instrumentation Market Analysis By Technology

Emerging technologies like IIoT and AI are pivotal in shaping the Process Automation and Instrumentation market. The IIoT segment is projected to grow from $4.30 billion in 2023 to $8.05 billion by 2033, underlining a trend towards connected automation systems that enhance data-driven decision-making and operational insights.

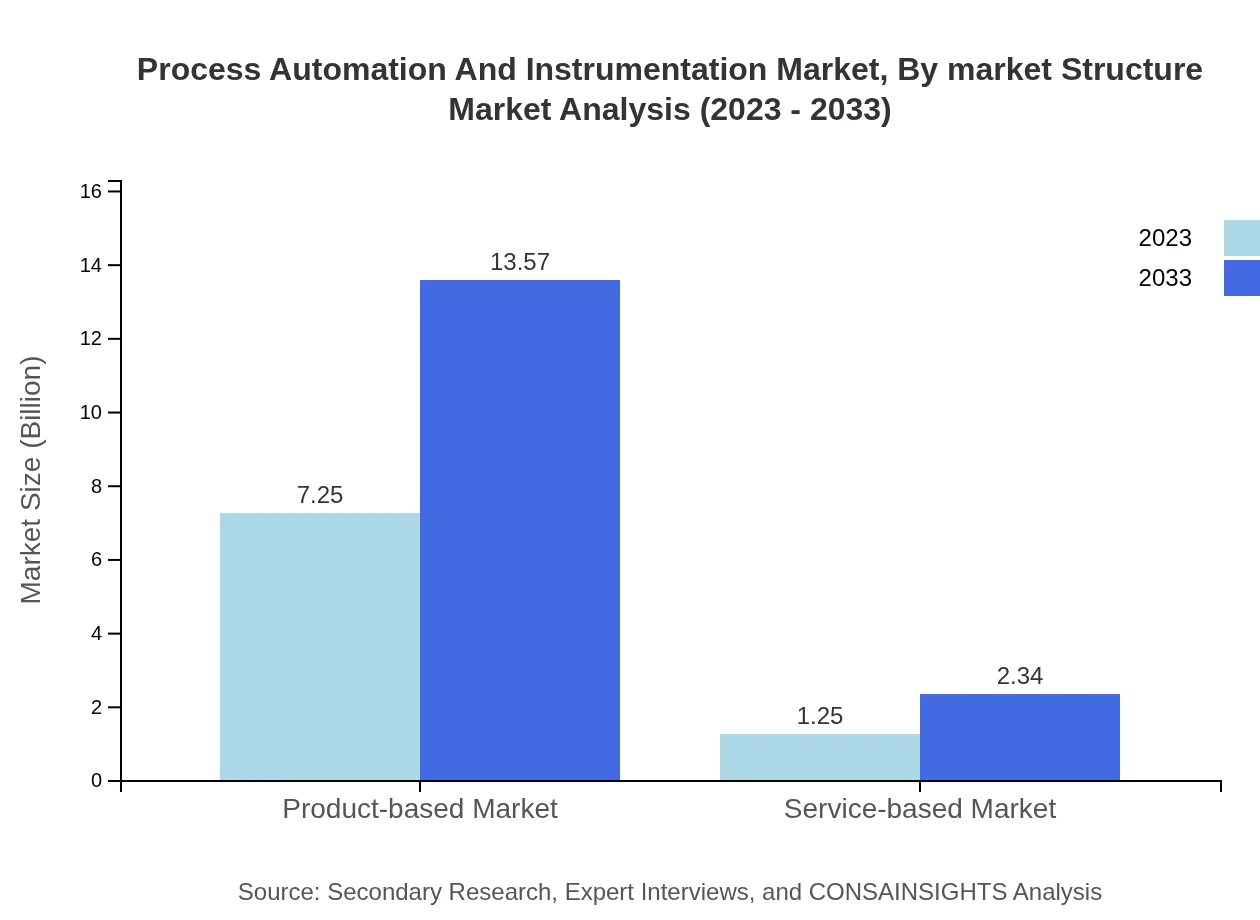

Process Automation And Instrumentation Market Analysis By Market Structure

The market can be categorized into product-based and service-based segments. The product-based segment leads with a market size of $7.25 billion in 2023, projected to grow to $13.57 billion by 2033, representing 85.29% of the overall market. The service-based segment, while smaller, is expected to grow steadily from $1.25 billion to $2.34 billion over the same period.

Process Automation And Instrumentation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Automation And Instrumentation Industry

Siemens AG:

Siemens is a global technology company offering a wide range of automation and control solutions that enhance industrial processes and improve operational efficiency.ABB Ltd.:

ABB is a leader in power and automation technologies, integrating engineering expertise with the digitalization of industries here and now.Emerson Electric Co.:

Emerson is known for its automation solutions that optimize manufacturing processes across various sectors, enhancing productivity and safety.Rockwell Automation, Inc.:

Rockwell Automation specializes in industrial automation solutions and offers products and services tailored to industries around the globe.Honeywell International Inc.:

Honeywell provides advanced automation solutions, focusing on safety, efficiency, and reliability in process industries.We're grateful to work with incredible clients.

FAQs

What is the market size of process automation and instrumentation?

The global process automation and instrumentation market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 6.3% through 2033, indicating robust growth in the sector.

What are the key market players or companies in this process automation and instrumentation industry?

Key players in the process automation and instrumentation market include Siemens AG, Honeywell International Inc., Emerson Electric Co., ABB Ltd., and Schneider Electric. These companies lead in technological innovation and market presence.

What are the primary factors driving the growth in the process automation and instrumentation industry?

The growth of the process automation and instrumentation industry is driven by increasing demand for operational efficiency, advancements in IoT and AI technologies, and the need for compliance in industries like manufacturing and energy.

Which region is the fastest Growing in process automation and instrumentation?

The Asia Pacific region is projected to be the fastest-growing market for process automation and instrumentation, with its market size expected to grow from $1.71 billion in 2023 to $3.20 billion by 2033.

Does ConsaInsights provide customized market report data for the process automation and instrumentation industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the process automation and instrumentation industry, ensuring relevant insights and data for strategic decision-making.

What deliverables can I expect from this process automation and instrumentation market research project?

Deliverables typically include comprehensive market analysis reports, detailed segmentations by application and region, forecast data, competitive landscape evaluations, and actionable insights for strategic planning.

What are the market trends of process automation and instrumentation?

Current trends include increased integration of AI and machine learning in automation processes, heightened emphasis on sustainability, and the adoption of advanced analytics for improved decision-making and efficiency.