Process Equipment Market Report

Published Date: 02 February 2026 | Report Code: process-equipment

Process Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Process Equipment market from 2023 to 2033, highlighting market trends, key segments, regional insights, and leading companies. It also examines growth forecasts and industry challenges to guide stakeholders in strategic decision-making.

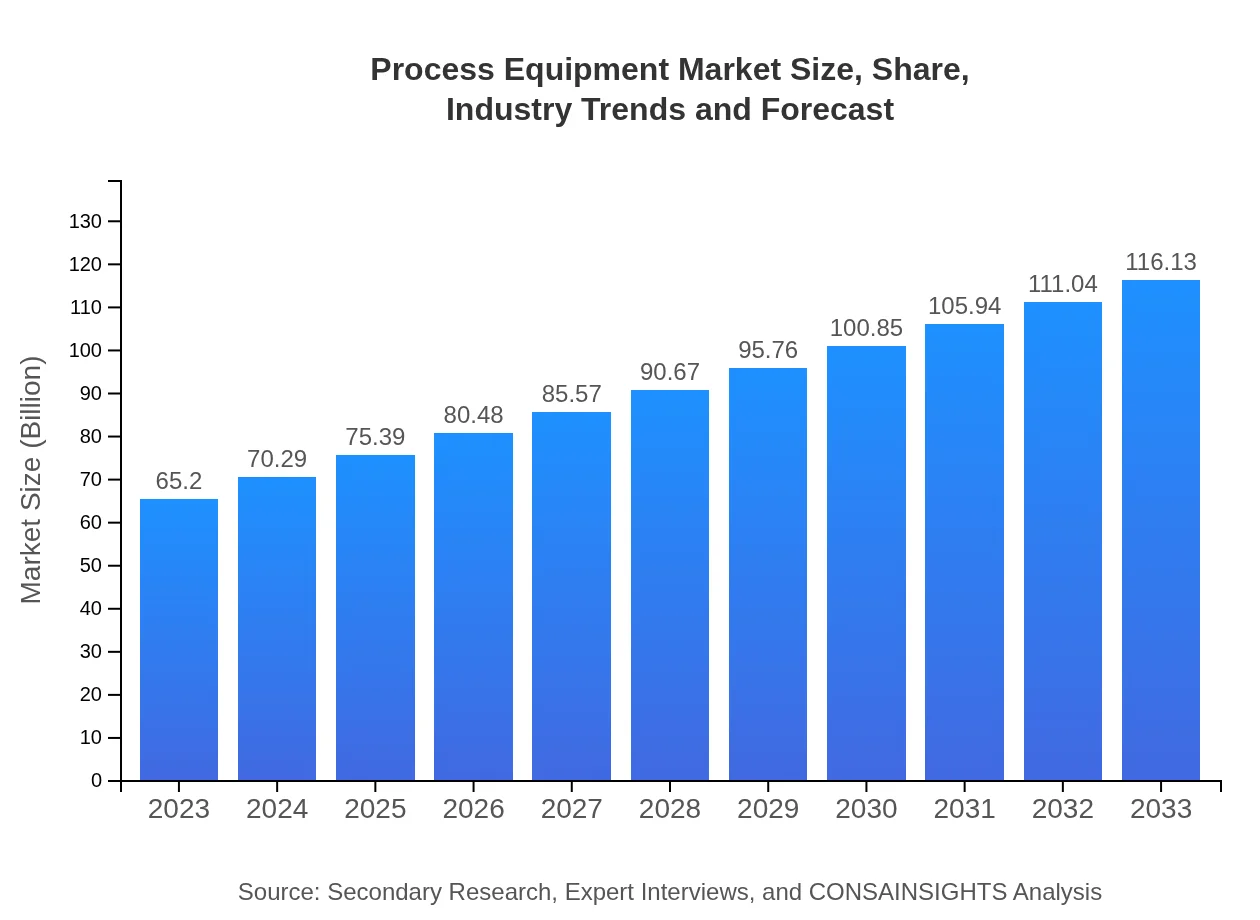

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $65.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $116.13 Billion |

| Top Companies | Siemens AG, GEA Group, Alfa Laval |

| Last Modified Date | 02 February 2026 |

Process Equipment Market Overview

Customize Process Equipment Market Report market research report

- ✔ Get in-depth analysis of Process Equipment market size, growth, and forecasts.

- ✔ Understand Process Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Equipment

What is the Market Size & CAGR of Process Equipment market in 2023?

Process Equipment Industry Analysis

Process Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Equipment Market Analysis Report by Region

Europe Process Equipment Market Report:

Europe is characterized by a market size of $20.65 billion in 2023, forecasted to expand to $36.78 billion by 2033. The region's focus on sustainability and high-quality manufacturing processes propels the growth of process equipment.Asia Pacific Process Equipment Market Report:

The Asia Pacific region accounted for a market size of $12.13 billion in 2023, projected to reach $21.61 billion by 2033. The growth is driven by rapid industrialization, increasing manufacturing activities, and a growing population demanding processed goods.North America Process Equipment Market Report:

North America is a leading market with a size of $22.64 billion in 2023, projected to grow to $40.32 billion by 2033. Key factors include a strong emphasis on technological advancement in manufacturing and stringent safety regulations driving equipment upgrades.South America Process Equipment Market Report:

In South America, the market size was approximately $5.71 billion in 2023, expected to grow to $10.16 billion by 2033. This surge is fueled by investments in infrastructure and an uptick in local manufacturing, particularly in the food sector.Middle East & Africa Process Equipment Market Report:

The Middle East and Africa market was valued at $4.08 billion in 2023, anticipated to grow to $7.26 billion by 2033. The region's growth is underpinned by oil and gas investments and increased focus on water treatment facilities.Tell us your focus area and get a customized research report.

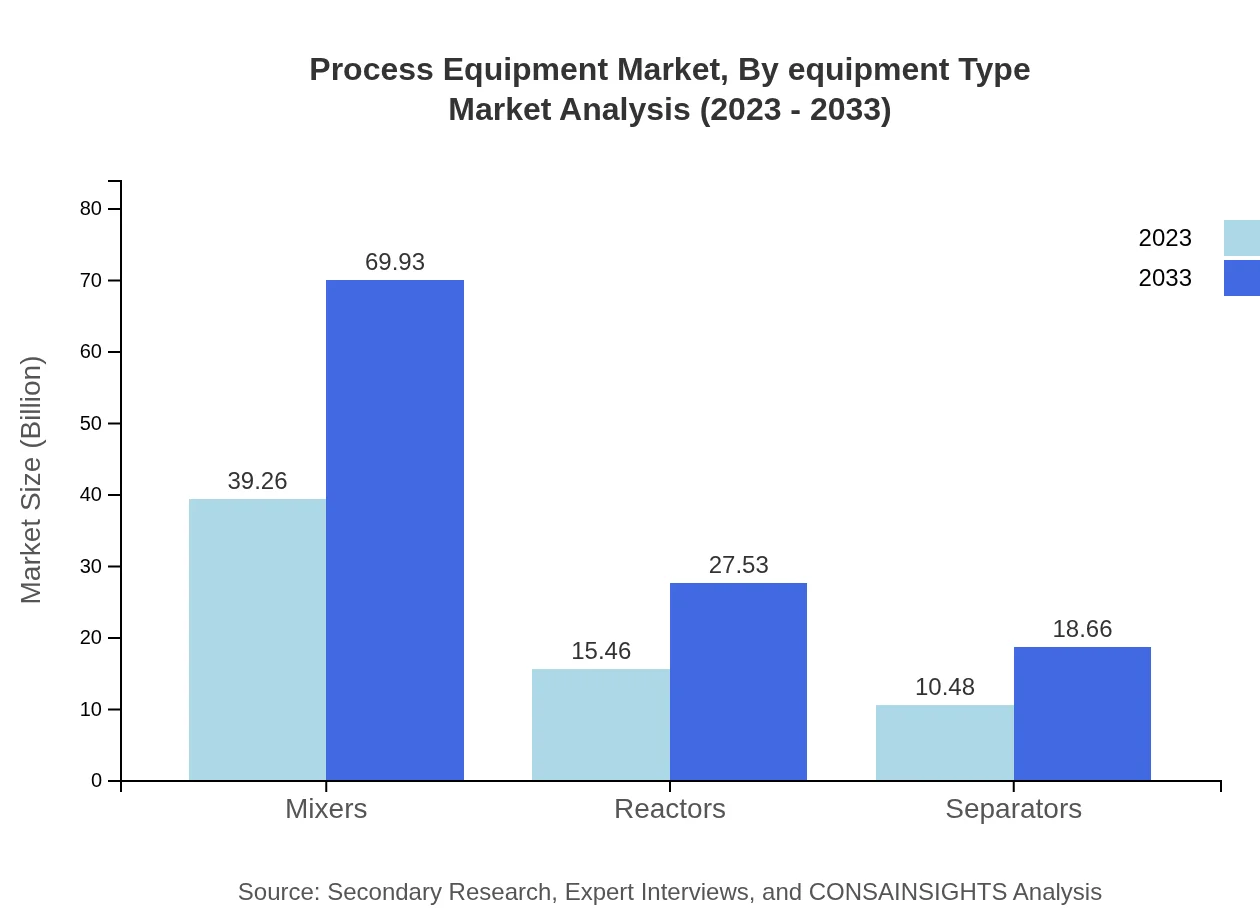

Process Equipment Market Analysis By Equipment Type

The Process Equipment market by equipment type highlights the critical roles of Mixers, Reactors, and Separators, which contributed significantly to the overall market. For instance, in 2023, Mixers accounted for a size of $39.26 billion, expected to rise to $69.93 billion by 2033, driven by demand in food and beverage industries.

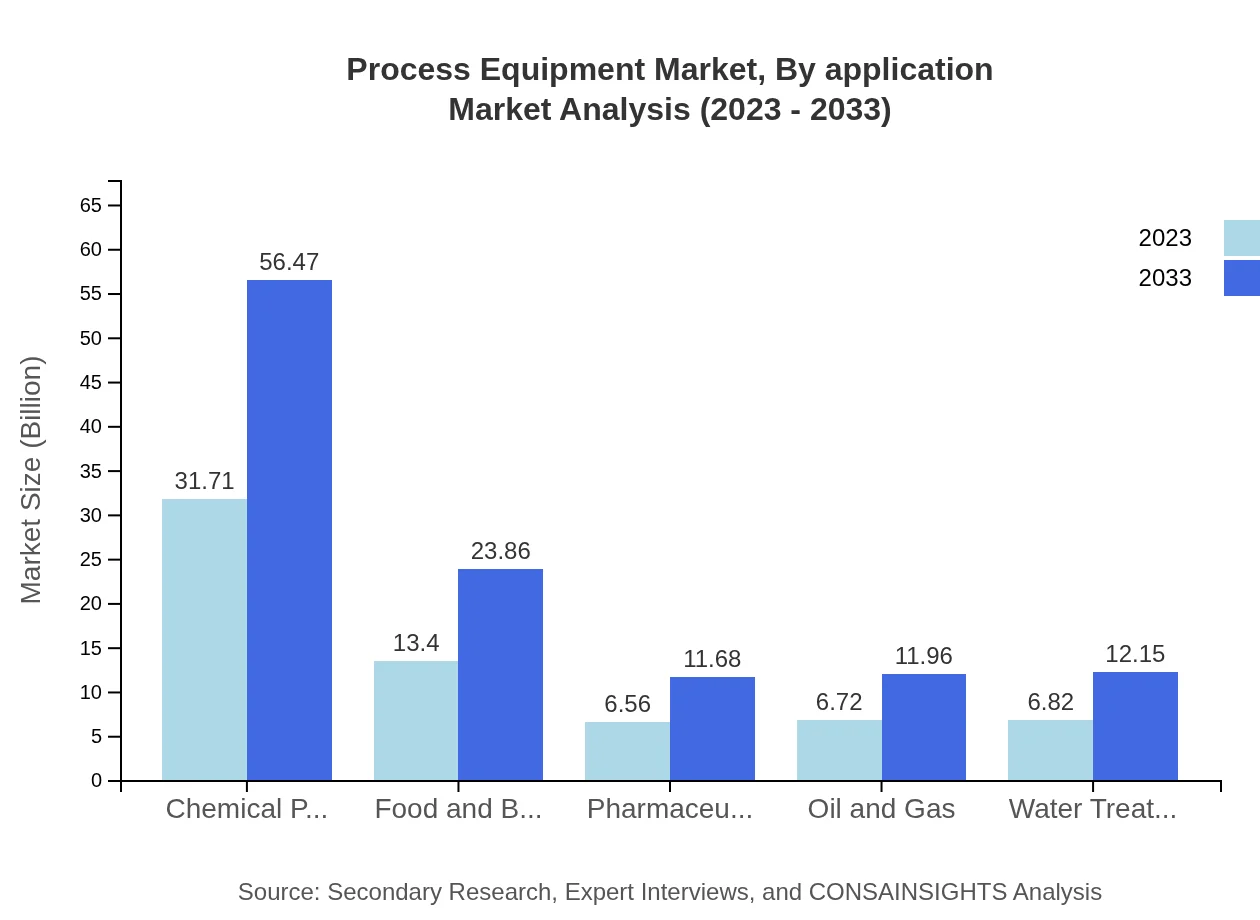

Process Equipment Market Analysis By Application

The application segment demonstrates varied market demands from industries such as Chemical Processing, Food and Beverage, and Pharmaceuticals. Chemical Processing alone is projected to grow from $31.71 billion in 2023 to $56.47 billion by 2033, indicating its vast relevance in industrial applications.

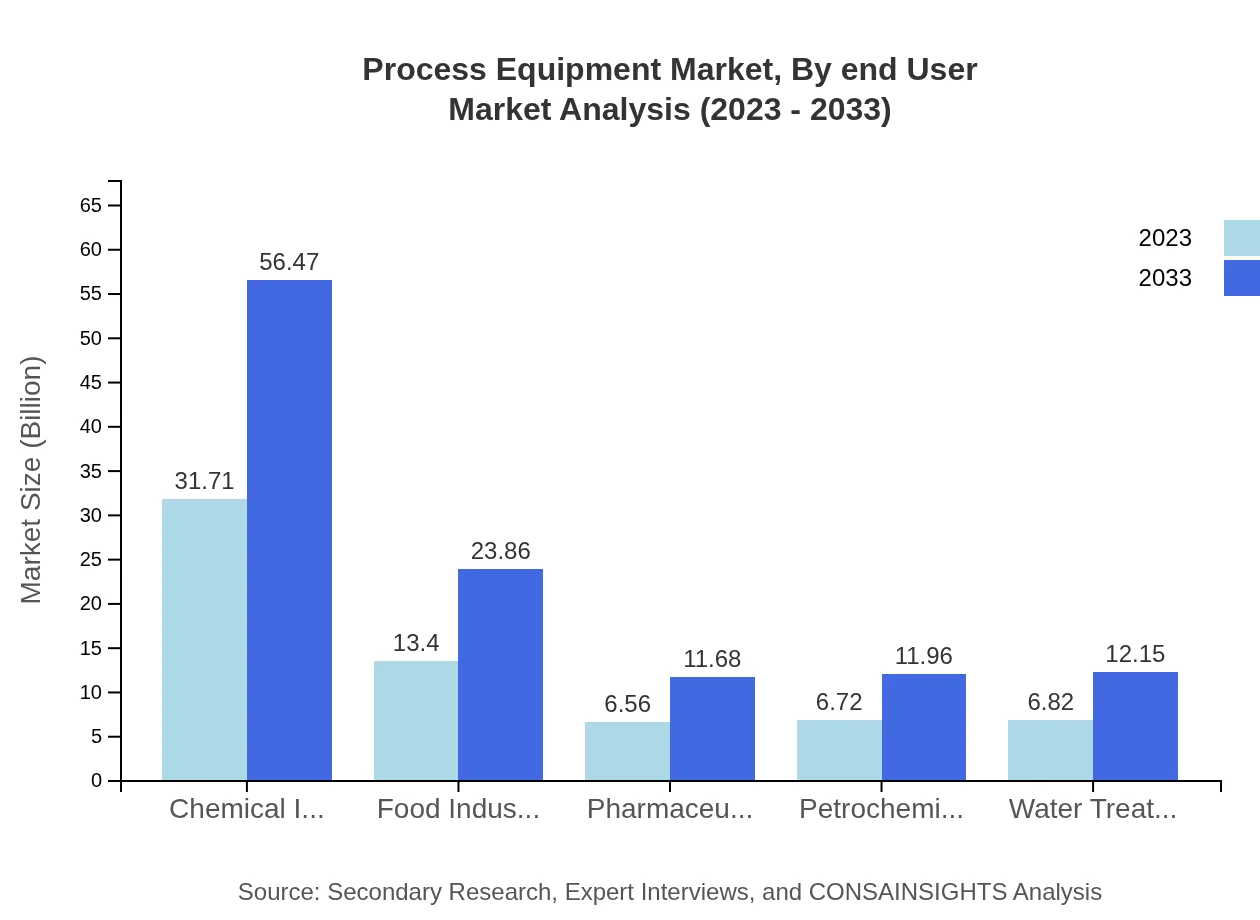

Process Equipment Market Analysis By End User

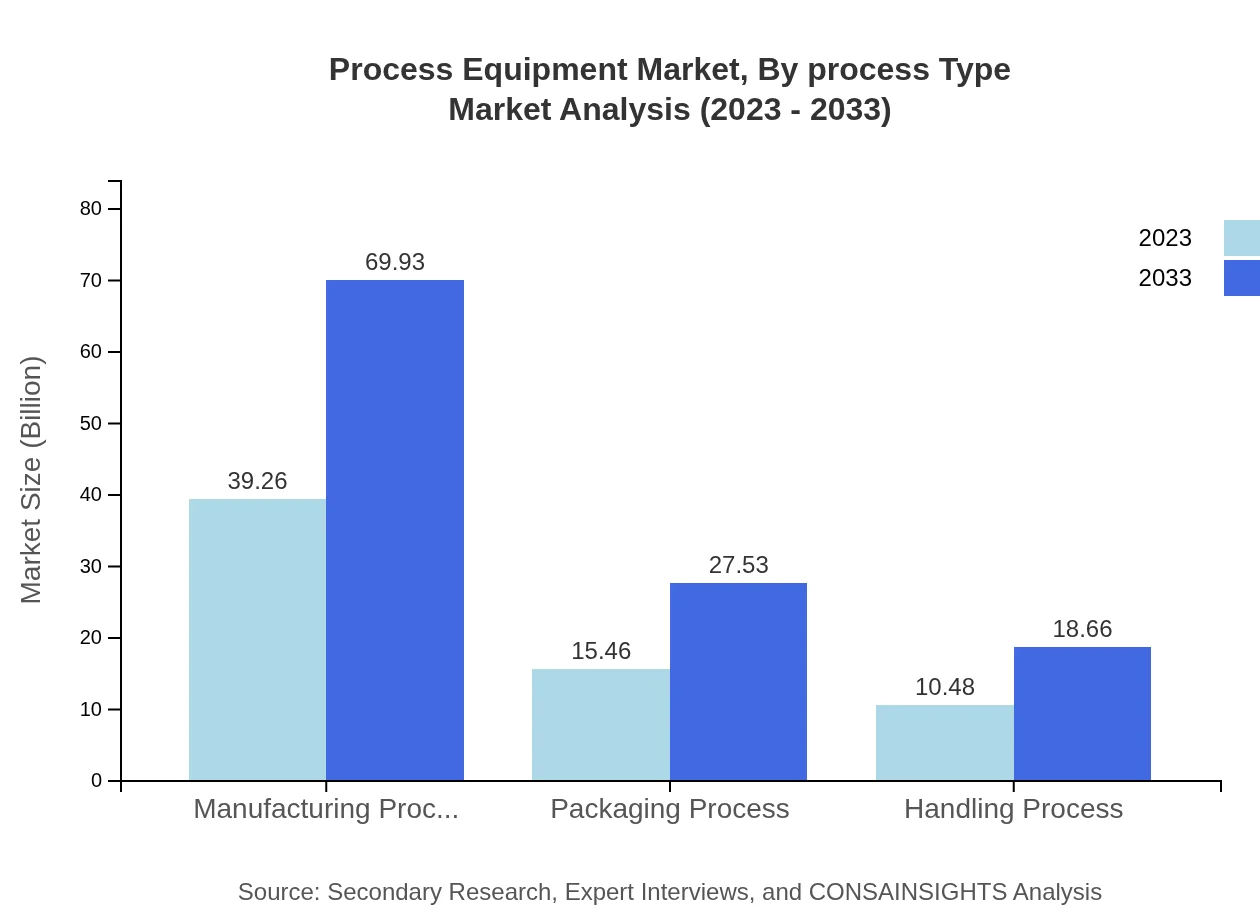

End-user sectors significantly shape demand; notably, Manufacturing Processes contributed $39.26 billion in 2023, set to reach $69.93 billion by 2033, reflecting its necessity in large-scale production environments.

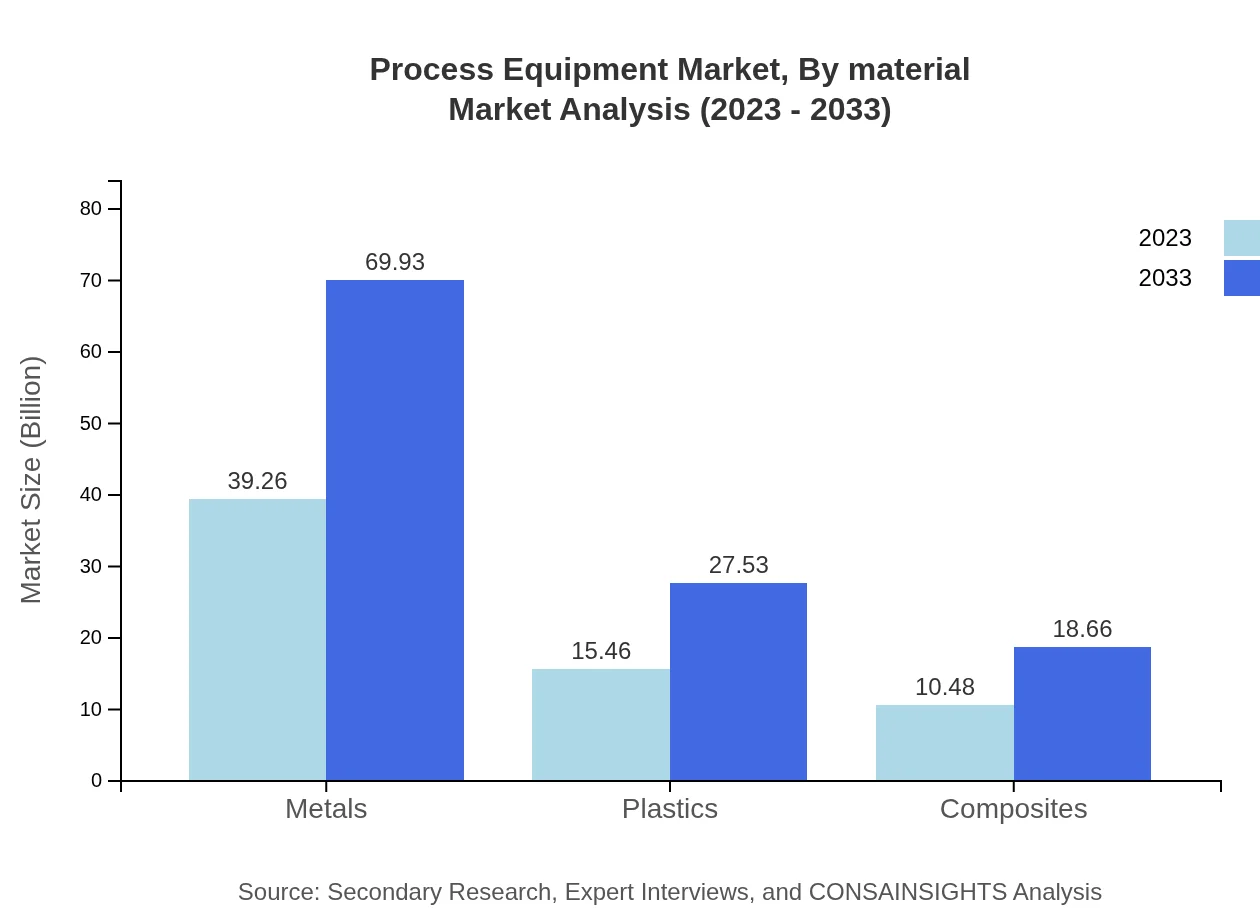

Process Equipment Market Analysis By Material

Materials used in process equipment, like metals, composites, and plastics, are crucial for durability and performance. Metals lead the segment with a substantial share, confirming their importance in manufacturing robust and efficient equipment.

Process Equipment Market Analysis By Process Type

The process types include standard operations such as mixing, reaction, and separation processes. Their significance stems from their application across varied industries, with reactors and separators witnessing high demand due to their critical functions in production lines.

Process Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Equipment Industry

Siemens AG:

A leading player in automation and control systems, Siemens offers innovative process equipment solutions enhancing efficiency and sustainability in global industries.GEA Group:

Specializing in food processing and pharmaceuticals, GEA provides advanced process equipment that optimizes production capabilities and adheres to safety standards.Alfa Laval:

Well-known for heat transfer, separation, and fluid handling, Alfa Laval's equipment is integral to diverse sectors including energy, food, and wastewater treatment.We're grateful to work with incredible clients.

FAQs

What is the market size of Process Equipment?

The Process Equipment market is valued at approximately USD 65.2 billion in 2023, with a projected CAGR of 5.8%. By 2033, the market is expected to expand significantly, driven by increasing industrial applications.

What are the key market players or companies in the Process Equipment industry?

Key players in the Process Equipment industry include major manufacturing corporations like Emerson Electric Co., Siemens AG, Honeywell International Inc., and GE. These companies lead in innovation and market share, providing a range of process equipment solutions.

What are the primary factors driving the growth in the Process Equipment industry?

The growth of the Process Equipment industry is primarily driven by increasing demand for automation in manufacturing, growing environmental regulations, and the need for efficient water treatment solutions, alongside rising global industrialization.

Which region is the fastest Growing in the Process Equipment?

Asia Pacific is recognized as the fastest-growing region in the Process Equipment industry, with the market size projected to grow from USD 12.13 billion in 2023 to USD 21.61 billion by 2033, showcasing robust industrial activity.

Does ConsaInsights provide customized market report data for the Process Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Process Equipment industry, ensuring businesses receive relevant insights to optimize their strategies.

What deliverables can I expect from this Process Equipment market research project?

Deliverables from the Process Equipment market research project typically include comprehensive reports, market trends analysis, competitive landscape assessments, and segmented data, providing a thorough understanding of current market dynamics.

What are the market trends of Process Equipment?

Key market trends in the Process Equipment industry include increased investments in automation technology, a shift towards sustainable manufacturing practices, and the rising importance of smart water treatment solutions in response to environmental concerns.