Process Instrumentation Market Report

Published Date: 22 January 2026 | Report Code: process-instrumentation

Process Instrumentation Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of the Process Instrumentation industry from 2023 to 2033, covering market sizes, growth trends, and key players. Insights on market segmentation and regional performance are included to offer a comprehensive outlook for industry stakeholders.

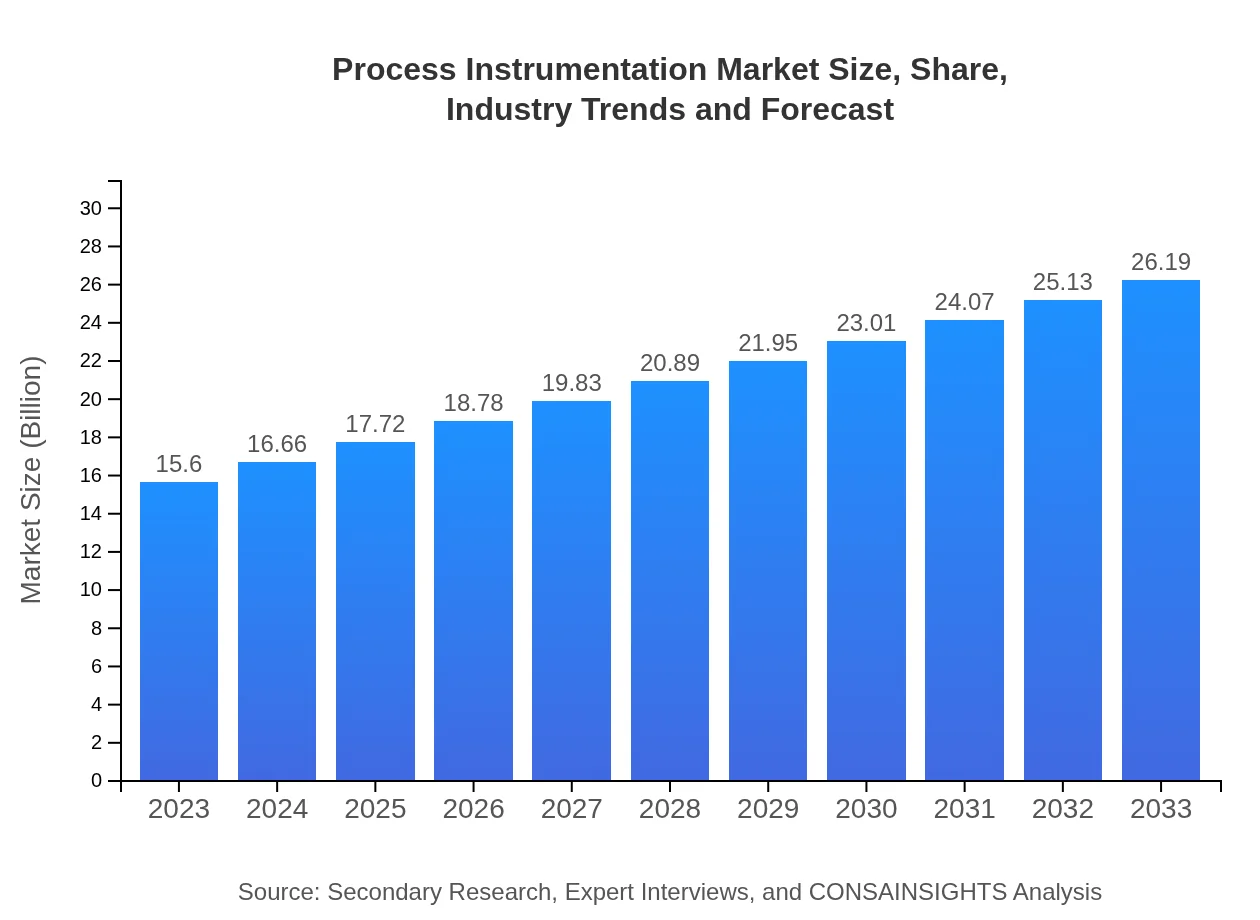

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | Emerson Electric Co., Siemens AG, Honeywell International Inc., Endress+Hauser |

| Last Modified Date | 22 January 2026 |

Process Instrumentation Market Overview

Customize Process Instrumentation Market Report market research report

- ✔ Get in-depth analysis of Process Instrumentation market size, growth, and forecasts.

- ✔ Understand Process Instrumentation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Instrumentation

What is the Market Size & CAGR of Process Instrumentation market in 2023?

Process Instrumentation Industry Analysis

Process Instrumentation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Instrumentation Market Analysis Report by Region

Europe Process Instrumentation Market Report:

The European market is anticipated to grow from $5.55 billion in 2023 to $9.32 billion by 2033. Stringent regulations, combined with a strong emphasis on energy efficiency and sustainability, are propelling the advancement of process instrumentation technologies.Asia Pacific Process Instrumentation Market Report:

The Asia Pacific region is expected to witness significant growth, driven by rapid industrialization and an increasing focus on automation in countries like China and India. The market value in 2023 is approximately $2.81 billion and is projected to reach $4.72 billion by 2033. Key sectors include manufacturing and utilities, benefiting from enhanced process visibility and control.North America Process Instrumentation Market Report:

North America holds a prominent position in the Process Instrumentation market with a valuation of $5.05 billion in 2023, projected to grow to $8.48 billion by 2033. The robust demand for advanced automation technologies in manufacturing and utilities is a key driver of this growth.South America Process Instrumentation Market Report:

In South America, the Process Instrumentation market is valued at $1.07 billion in 2023, with a forecasted increase to $1.79 billion by 2033. The region is investing in modernization of its infrastructure, particularly in oil and gas, driven by the need for improved operational efficiency.Middle East & Africa Process Instrumentation Market Report:

In the Middle East and Africa, the market is projected to expand from $1.12 billion in 2023 to $1.87 billion by 2033. This growth is predominantly propelled by the oil and gas sector and initiatives to enhance water management processes.Tell us your focus area and get a customized research report.

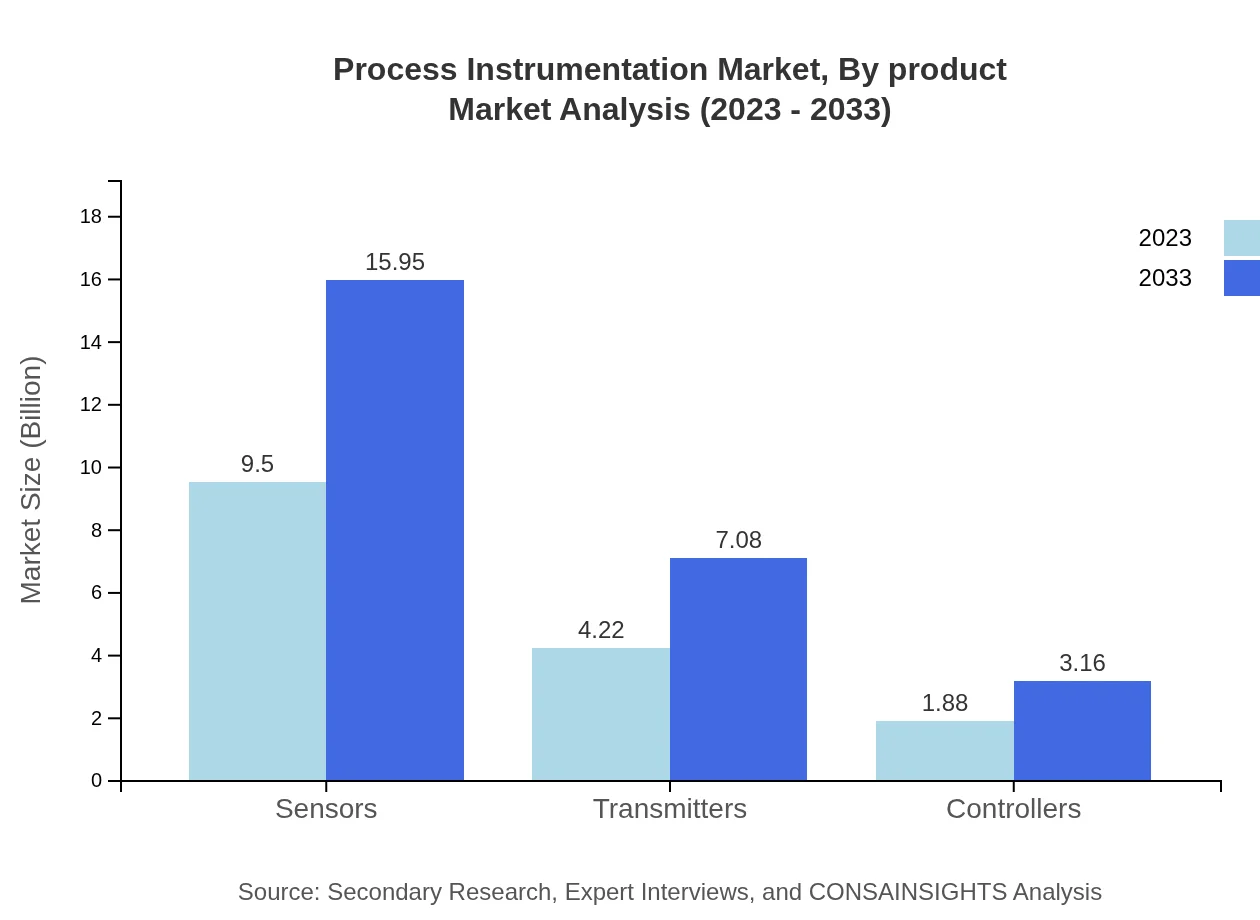

Process Instrumentation Market Analysis By Product

The product segment of the Process Instrumentation market is dominated by sensors, which are expected to grow from $9.50 billion in 2023 to $15.95 billion by 2033. Transmitters and controllers also play significant roles, with the transmitter market projected to increase from $4.22 billion to $7.08 billion, and controllers from $1.88 billion to $3.16 billion during the same period.

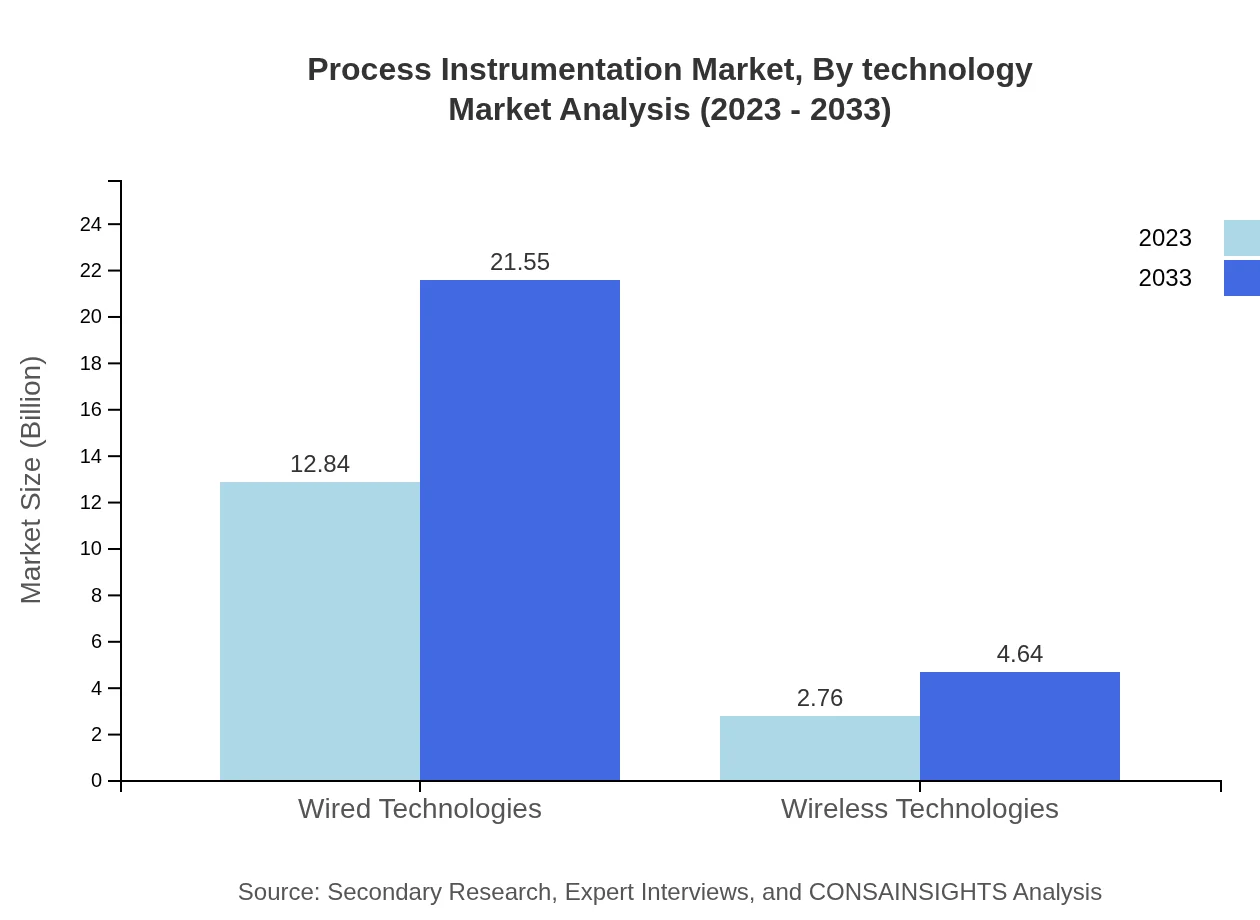

Process Instrumentation Market Analysis By Technology

Wired technologies represent the majority market share, growing from $12.84 billion in 2023 to $21.55 billion by 2033, sustaining an 82.29% market share. Wireless technologies, projected to see growth from $2.76 billion to $4.64 billion, will continue to gain traction as manufacturers adopt more flexible and cost-effective monitoring solutions.

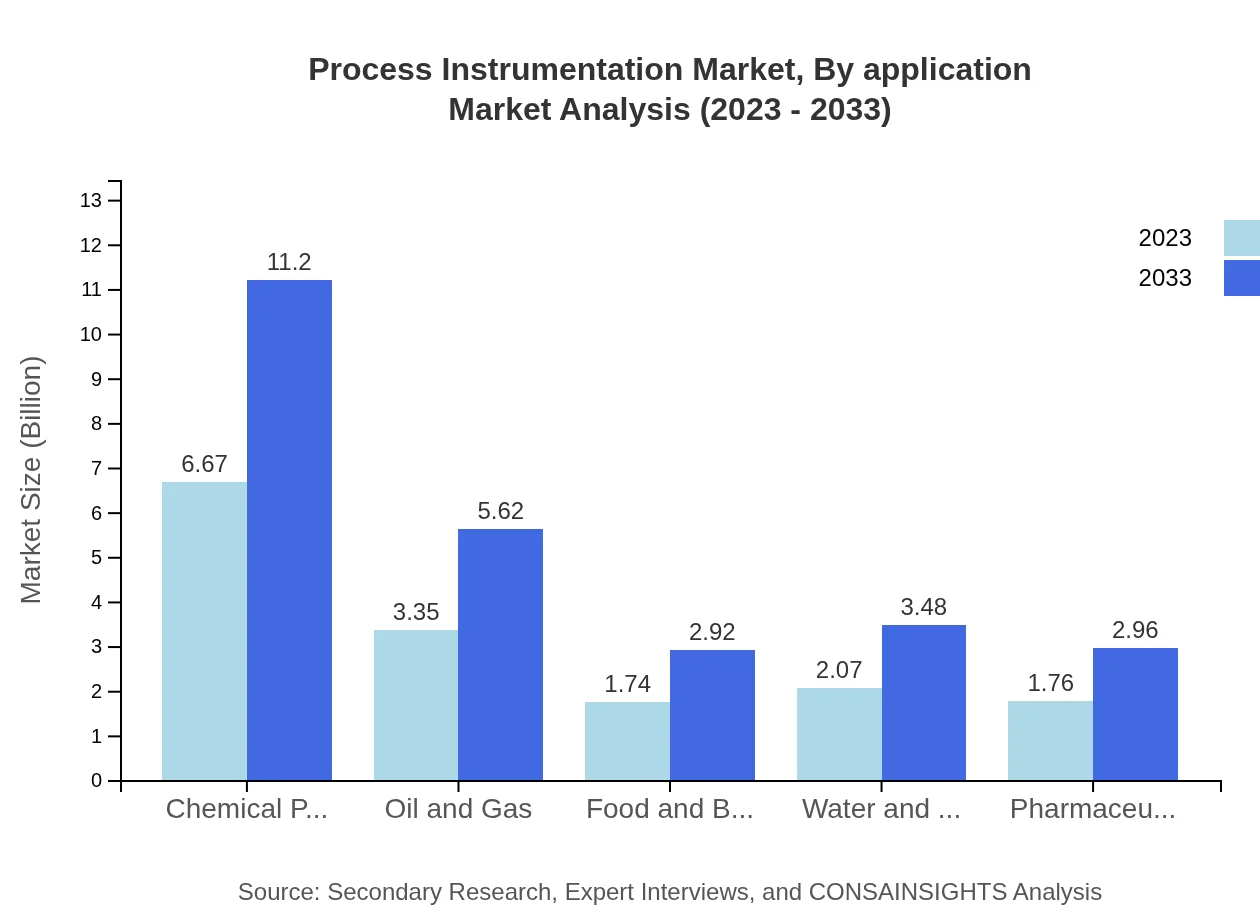

Process Instrumentation Market Analysis By Application

The Chemical Processing application segment dominates the market with a share of 42.77%, showing growth from $6.67 billion in 2023 to $11.20 billion by 2033. Other notable applications include oil and gas, which will increase from $3.35 billion to $5.62 billion, and food and beverage, growing from $1.74 billion to $2.92 billion.

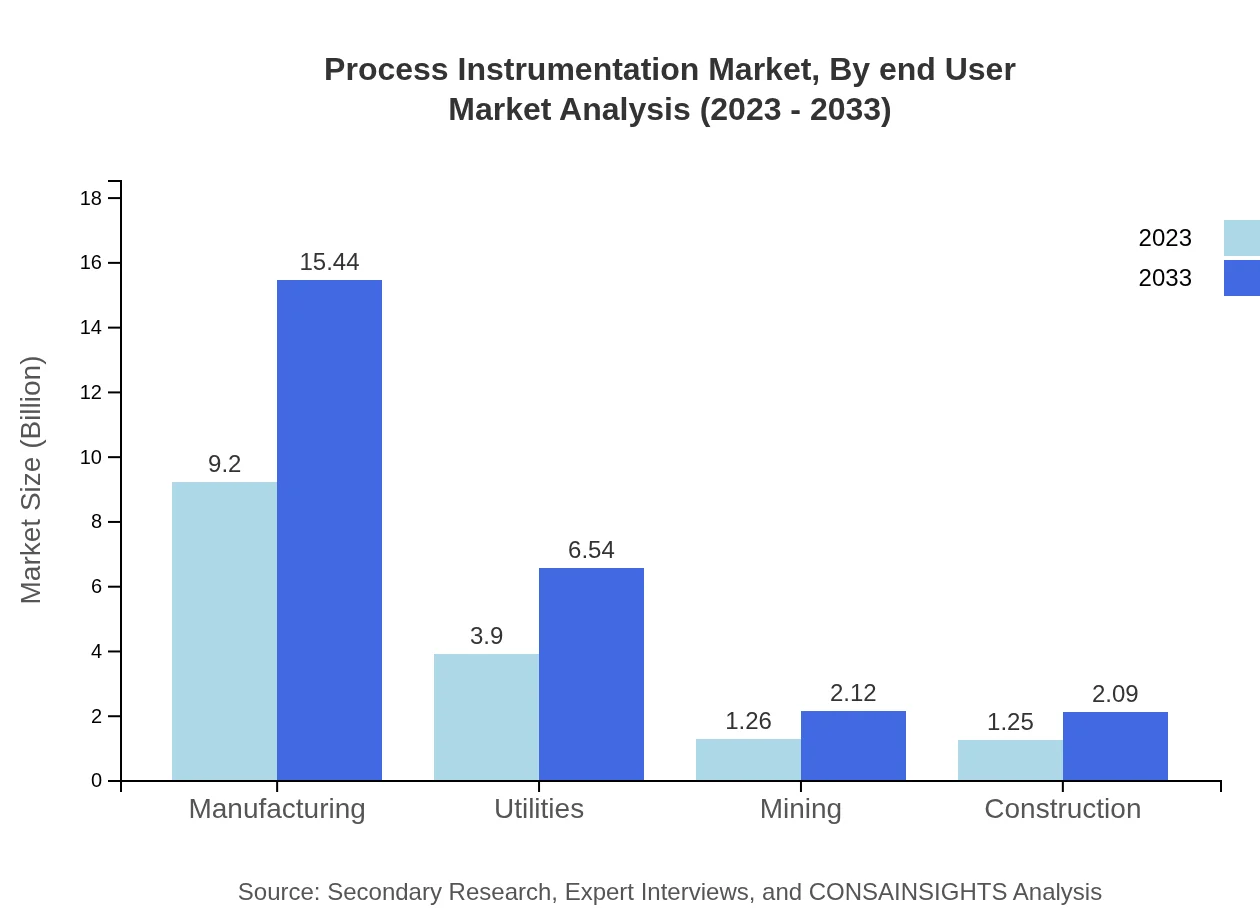

Process Instrumentation Market Analysis By End User

The market is significantly driven by end-user industries such as manufacturing, which makes up 58.95% of the total market, growing from $9.20 billion in 2023 to $15.44 billion by 2033. Utilities and mining sectors also contribute substantially, with utilities valued at $3.90 billion and mining at $1.26 billion in 2023.

Process Instrumentation Market Analysis By Distribution Channel

Direct sales remain the leading distribution channel, commanding a share of 60.91% and growing from $9.50 billion to $15.95 billion by 2033. Distributors and online sales channels are also important, with shares of 27.02% and 12.07%, respectively, reflecting a shift in purchasing preferences.

Process Instrumentation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Instrumentation Industry

Emerson Electric Co.:

A global leader in automation solutions, Emerson provides innovative process instrumentation systems that enhance operational performance across various industries.Siemens AG:

Siemens is a major player in process automation technologies, offering extensive solutions that integrate hardware and software for efficient operations.Honeywell International Inc.:

Honeywell leads the market with its robust process instrumentation technologies that cater to safety, efficiency, and productivity across sectors.Endress+Hauser:

Known for high-quality measurement and automation solutions, Endress+Hauser specializes in process instrumentation that enhances productivity and optimizes operations.We're grateful to work with incredible clients.

FAQs

What is the market size of process instrumentation?

The global process instrumentation market size was valued at approximately $15.6 billion in 2023, with a projected CAGR of 5.2% from 2023-2033, indicating robust growth in this sector.

What are the key market players or companies in the process instrumentation industry?

Key players in the process instrumentation industry include major corporations, such as Emerson Electric, Siemens, Honeywell, Yokogawa Electric, and Endress+Hauser, which are recognized for their innovative technologies and solutions.

What are the primary factors driving the growth in the process instrumentation industry?

Growth in the process instrumentation market is driven by the increasing demand for automation, advancements in sensor technology, the need for efficient operations in manufacturing and processing, and the adoption of Industry 4.0 technologies.

Which region is the fastest Growing in the process instrumentation market?

The Asia Pacific region is expected to be the fastest-growing market for process instrumentation, with its market size expanding from $2.81 billion in 2023 to $4.72 billion by 2033, driven by industrial growth and technological advancements.

Does ConsaInsights provide customized market report data for the process instrumentation industry?

Yes, ConsaInsights offers customized market report data for the process instrumentation industry, allowing clients to access tailored insights and analytics based on specific needs and business objectives.

What deliverables can I expect from this process instrumentation market research project?

Key deliverables from the process instrumentation market research project include comprehensive reports with market size, growth forecasts, competitive analysis, segment insights, and detailed regional studies tailored to your needs.

What are the market trends of process instrumentation?

Current trends in the process instrumentation market include increased adoption of IoT solutions, a shift towards smart manufacturing systems, advancements in data analytics, and a heightened focus on sustainability and energy efficiency.