Process Spectroscopy Market Report

Published Date: 31 January 2026 | Report Code: process-spectroscopy

Process Spectroscopy Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Process Spectroscopy market, including insights on market trends, segmentation, regional performance, and forecasts from 2023 to 2033.

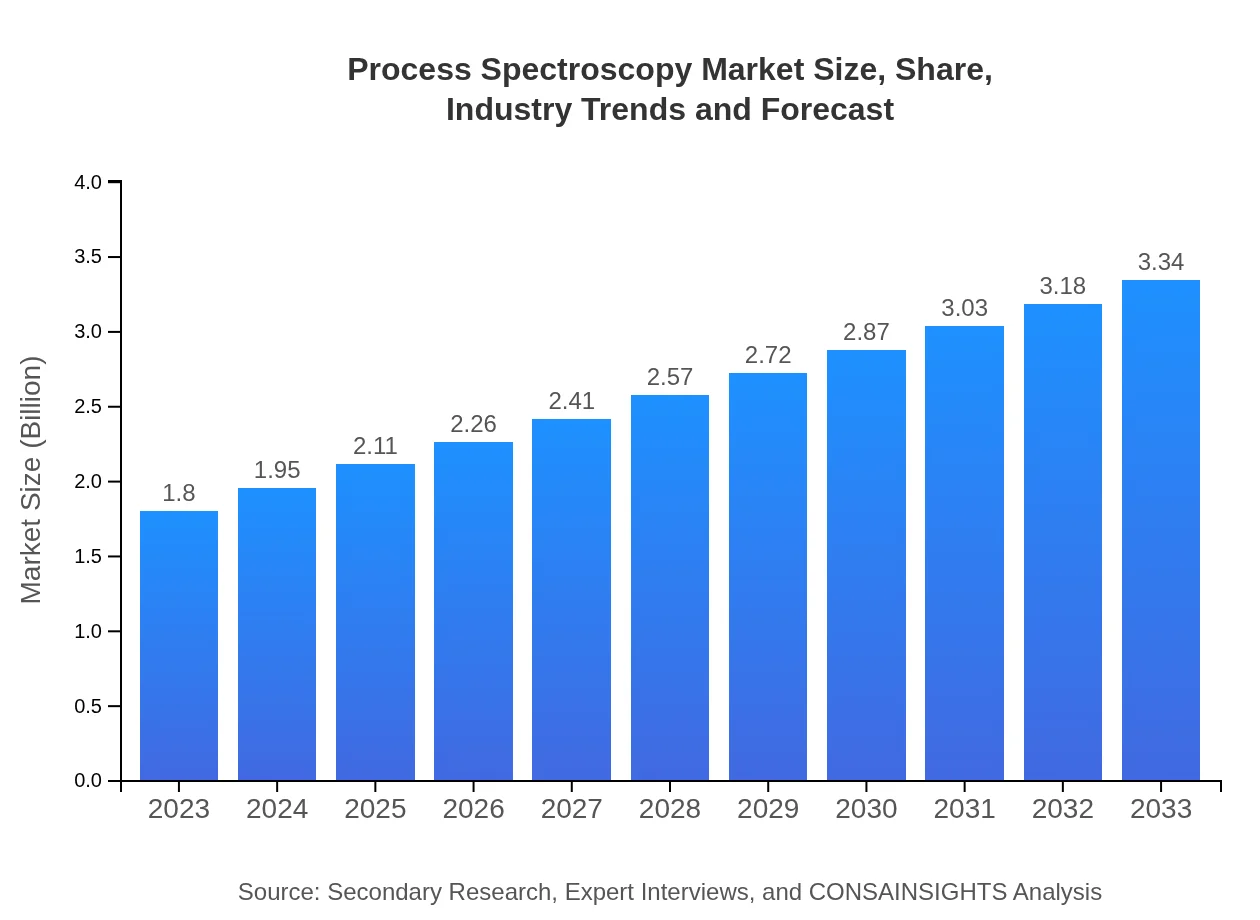

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Agilent Technologies Inc., PerkinElmer Inc. |

| Last Modified Date | 31 January 2026 |

Process Spectroscopy Market Overview

Customize Process Spectroscopy Market Report market research report

- ✔ Get in-depth analysis of Process Spectroscopy market size, growth, and forecasts.

- ✔ Understand Process Spectroscopy's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Process Spectroscopy

What is the Market Size & CAGR of Process Spectroscopy market in 2023?

Process Spectroscopy Industry Analysis

Process Spectroscopy Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Process Spectroscopy Market Analysis Report by Region

Europe Process Spectroscopy Market Report:

Europe's market is estimated to rise from $0.63 billion in 2023 to $1.17 billion in 2033, driven by strict regulations around pharmaceutical safety and quality. The region's emphasis on sustainability and process optimization in manufacturing is further bolstering growth.Asia Pacific Process Spectroscopy Market Report:

In the Asia Pacific region, the Process Spectroscopy market has seen steady growth, expected to increase from $0.34 billion in 2023 to $0.62 billion by 2033. Countries like China and India are investing in advanced manufacturing techniques and quality control processes, driving adoption in pharmaceuticals and food sectors.North America Process Spectroscopy Market Report:

North America holds a substantial share in the Process Spectroscopy market, projecting growth from $0.60 billion in 2023 to $1.12 billion by 2033. The presence of established pharmaceutical companies and a robust focus on R&D foster innovation and faster adoption of spectroscopy technologies.South America Process Spectroscopy Market Report:

The South American market, though smaller, is gradually expanding, moving from $0.05 billion in 2023 to $0.09 billion in 2033. Increased regulatory scrutiny in the pharmaceutical sector and growth in environmental analysis are propelling demand for process spectroscopy.Middle East & Africa Process Spectroscopy Market Report:

In the Middle East and Africa, the Process Spectroscopy market is expected to grow from $0.18 billion in 2023 to $0.33 billion by 2033. The region's focus on improving healthcare standards is leading to increased investments in analytical technologies.Tell us your focus area and get a customized research report.

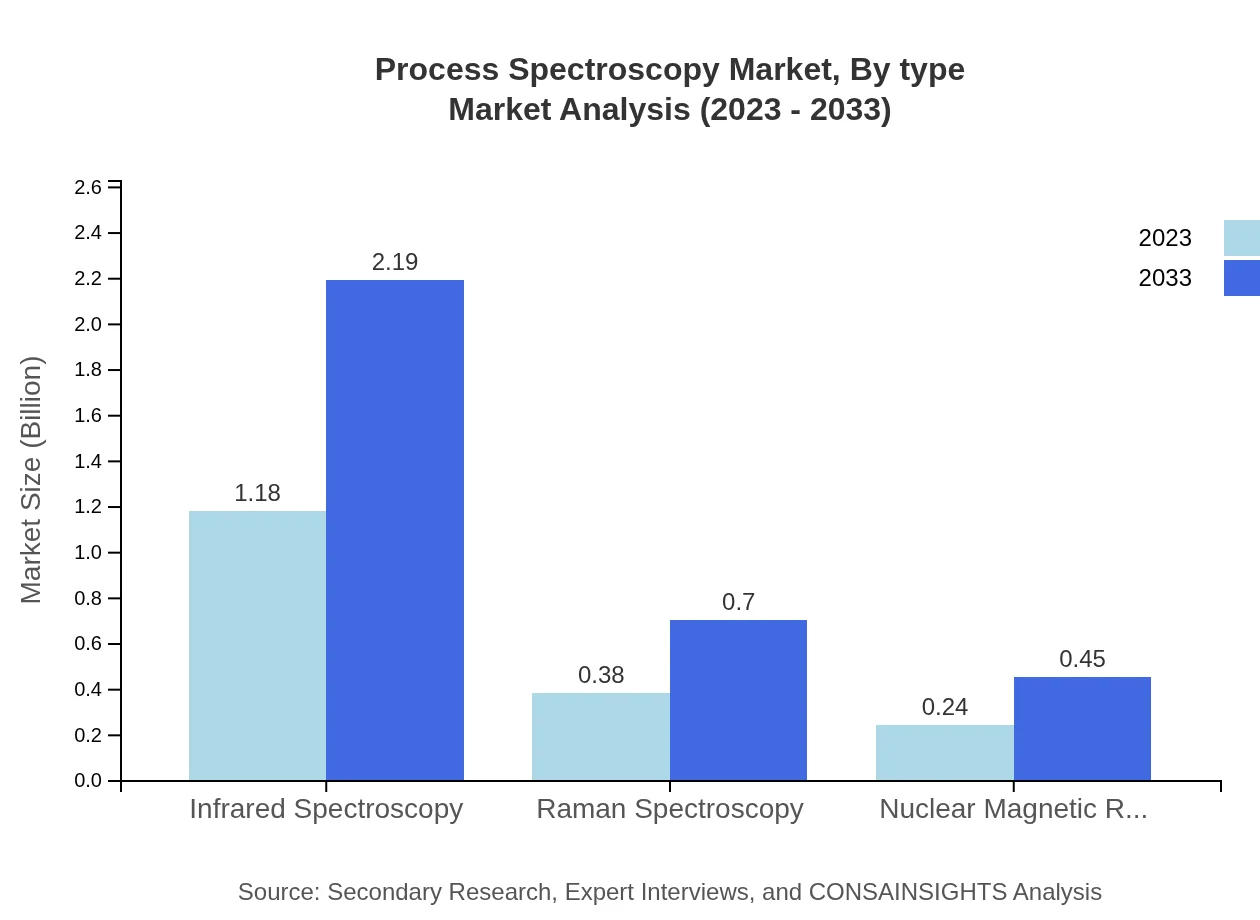

Process Spectroscopy Market Analysis By Type

The analysis of product types reveals that Infrared Spectroscopy dominates the market, accounting for approximately $1.18 billion in 2023 and projected to grow to $2.19 billion by 2033. This segment's share is about 65.54%. Raman Spectroscopy follows with a size of $0.38 billion in 2023, anticipated to reach $0.70 billion in 2033, holding a 21.1% share.

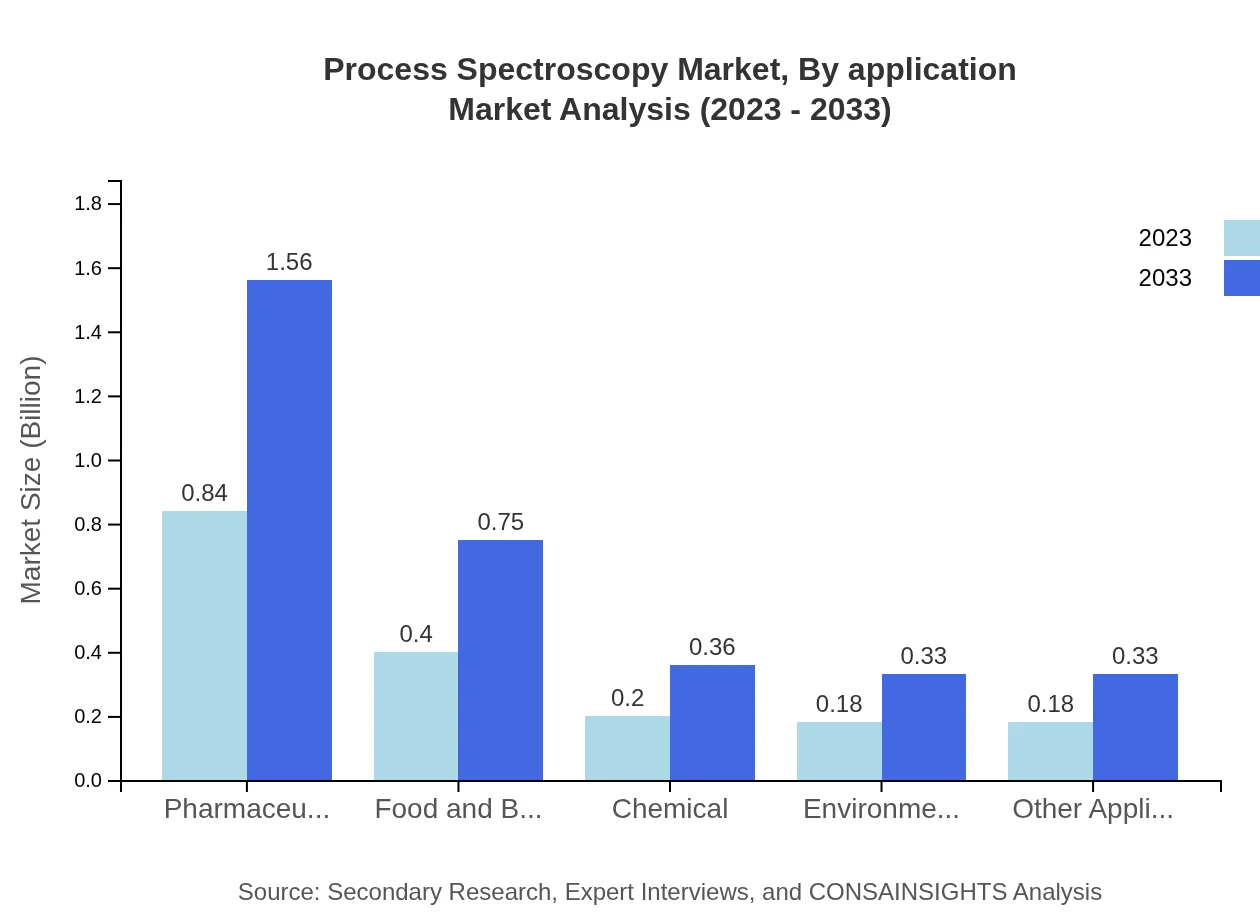

Process Spectroscopy Market Analysis By Application

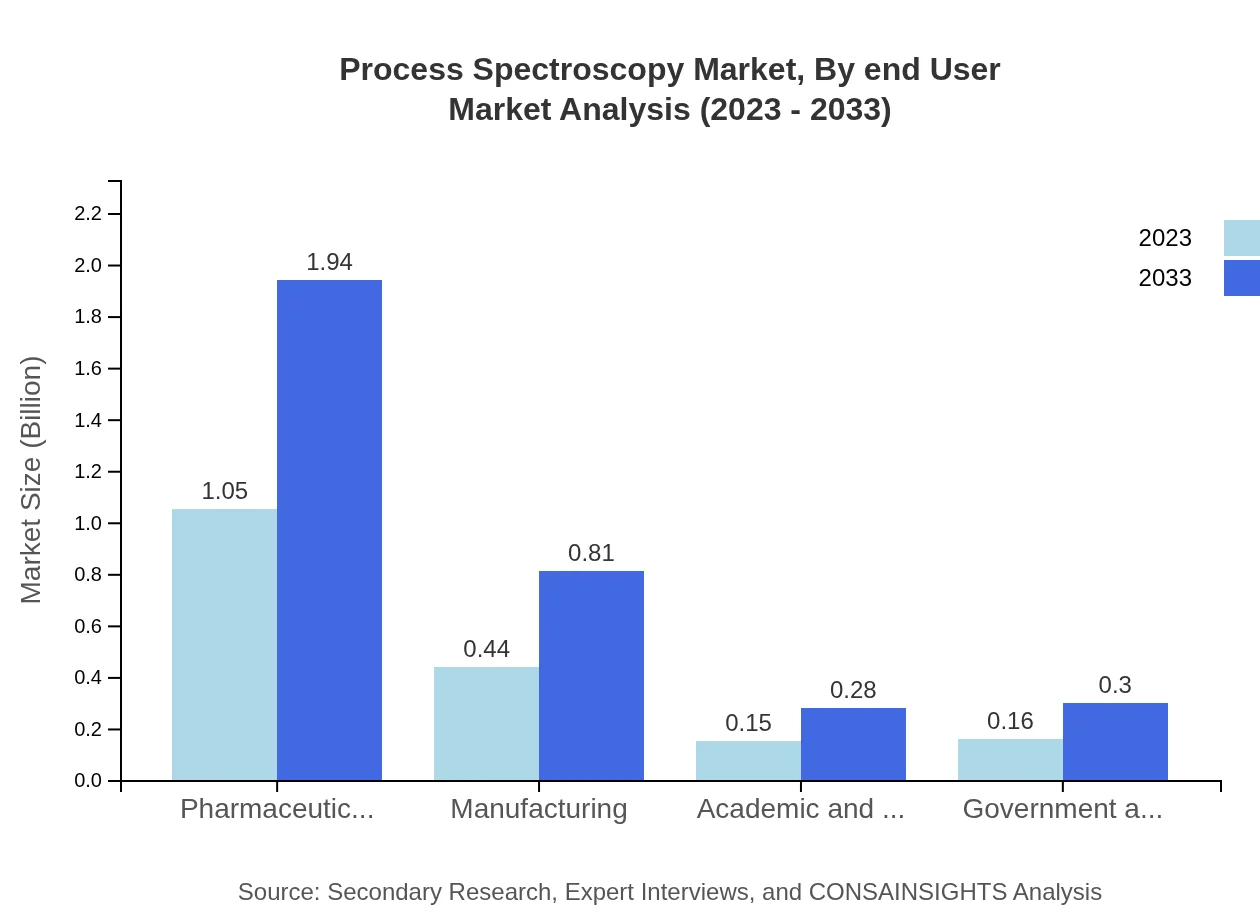

The application sector is led by Pharmaceutical and Biotechnology, with a market size of $1.05 billion in 2023, reaching $1.94 billion by 2033, representing 58.3%. Other significant segments include Food and Beverage, anticipated to grow from $0.40 billion to $0.75 billion, and Environmental applications, with a projected increase to $0.33 billion.

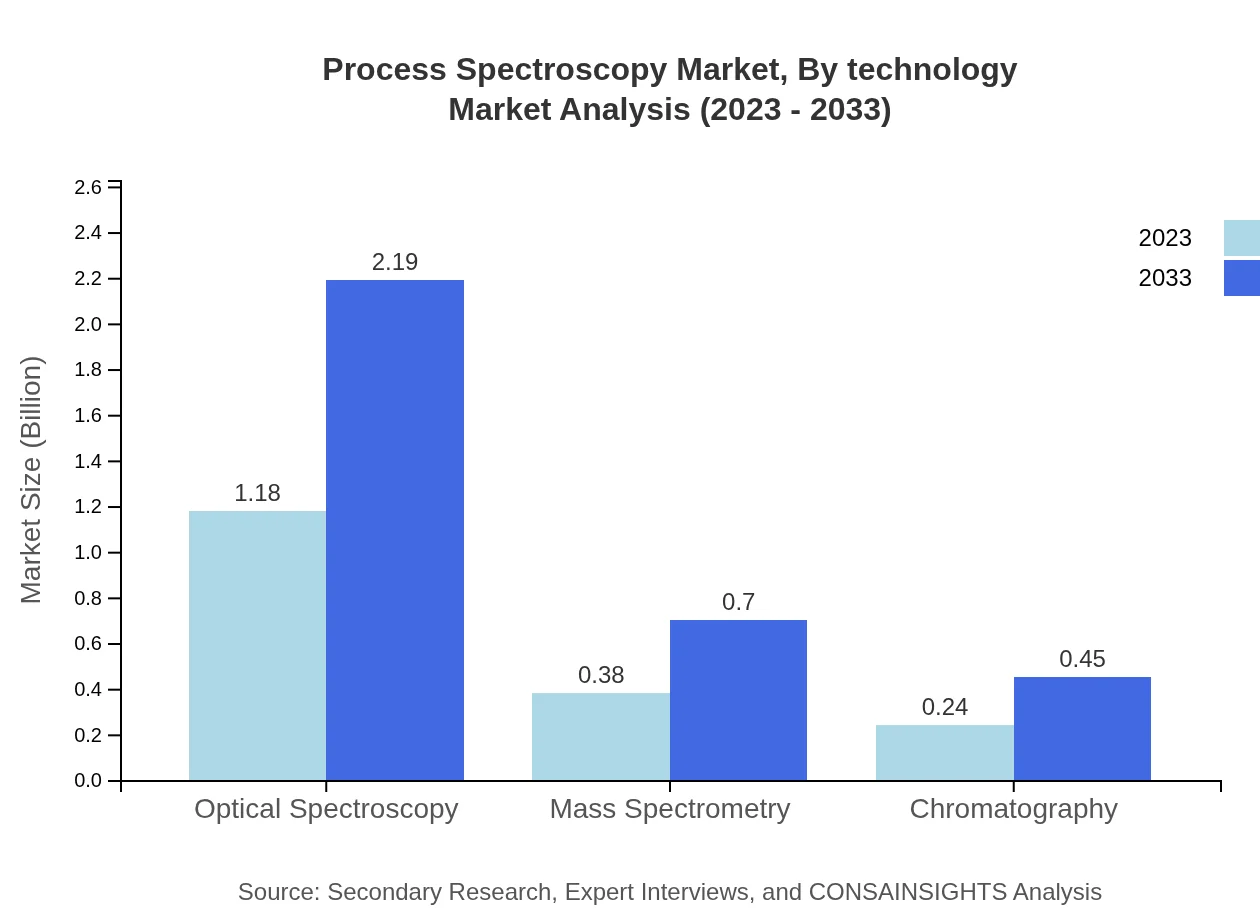

Process Spectroscopy Market Analysis By Technology

Leading technological advancements in spectroscopy include Optical Spectroscopy, which dominates with sizes expected to rise from $1.18 billion in 2023 to $2.19 billion by 2033, maintaining a 65.54% share. Mass Spectrometry holds a respected segment size, growing from $0.38 billion to $0.70 billion, representing 21.1% share.

Process Spectroscopy Market Analysis By End User

In terms of end-users, the Pharmaceutical industry commands the largest market share, valued at $0.84 billion in 2023 and anticipated to reach $1.56 billion by 2033. The Chemical industry and Food & Beverage sectors are also significant contributors, exhibiting consistent growth patterns alongside advancements in process analytical technologies.

Process Spectroscopy Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Process Spectroscopy Industry

Agilent Technologies Inc.:

Agilent is a key player in the field of life sciences, diagnostics, and applied chemical markets, providing advanced spectroscopy solutions that enhance laboratory productivity and efficiency.PerkinElmer Inc.:

PerkinElmer specializes in innovative technologies in diagnostics and life sciences. Their spectroscopy systems are integral in research, as well as testing in sectors such as pharmaceuticals and food safety.We're grateful to work with incredible clients.

FAQs

What is the market size of process Spectroscopy?

The Process Spectroscopy market is valued at $1.8 billion in 2023 with a projected CAGR of 6.2% through 2033, indicating sustained growth driven by advancements in spectroscopy technologies and increased demand across various sectors.

What are the key market players or companies in this process Spectroscopy industry?

Key players in the process-spectroscopy industry include major firms specializing in analytical instruments and data analytics, playing critical roles in innovation and market expansion with their advanced product offerings and strategic partnerships.

What are the primary factors driving the growth in the process Spectroscopy industry?

Key growth factors include technological advancements in spectroscopy instruments, increased adoption in pharmaceutical and biotechnology applications, and a growing focus on quality control and process optimization in manufacturing.

Which region is the fastest Growing in the process Spectroscopy?

The fastest-growing region is North America, with market expansion from $0.60 billion in 2023 to $1.12 billion by 2033, driven by heightened demand for advanced analytical techniques and stringent regulatory requirements.

Does ConsaInsights provide customized market report data for the process Spectroscopy industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the process-spectroscopy industry, enabling clients to gain insights pertinent to their unique market conditions and opportunities.

What deliverables can I expect from this process Spectroscopy market research project?

Deliverables include comprehensive market analysis, detailed regional breakdowns, segment-specific insights, competitive landscape evaluations, and actionable recommendations to enhance strategic decision-making.

What are the market trends of process Spectroscopy?

Current market trends include the integration of AI in spectroscopy analytics, increasing application in food safety testing, and a shift towards portable and user-friendly spectroscopy devices, enhancing accessibility for various industries.