Processed Food Beverage Preservatives Market Report

Published Date: 31 January 2026 | Report Code: processed-food-beverage-preservatives

Processed Food Beverage Preservatives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Processed Food Beverage Preservatives market, highlighting key insights, industry trends, and forecasts for the period 2023 to 2033. It includes market size, growth projections, regional analysis, and key company profiles critical for stakeholders.

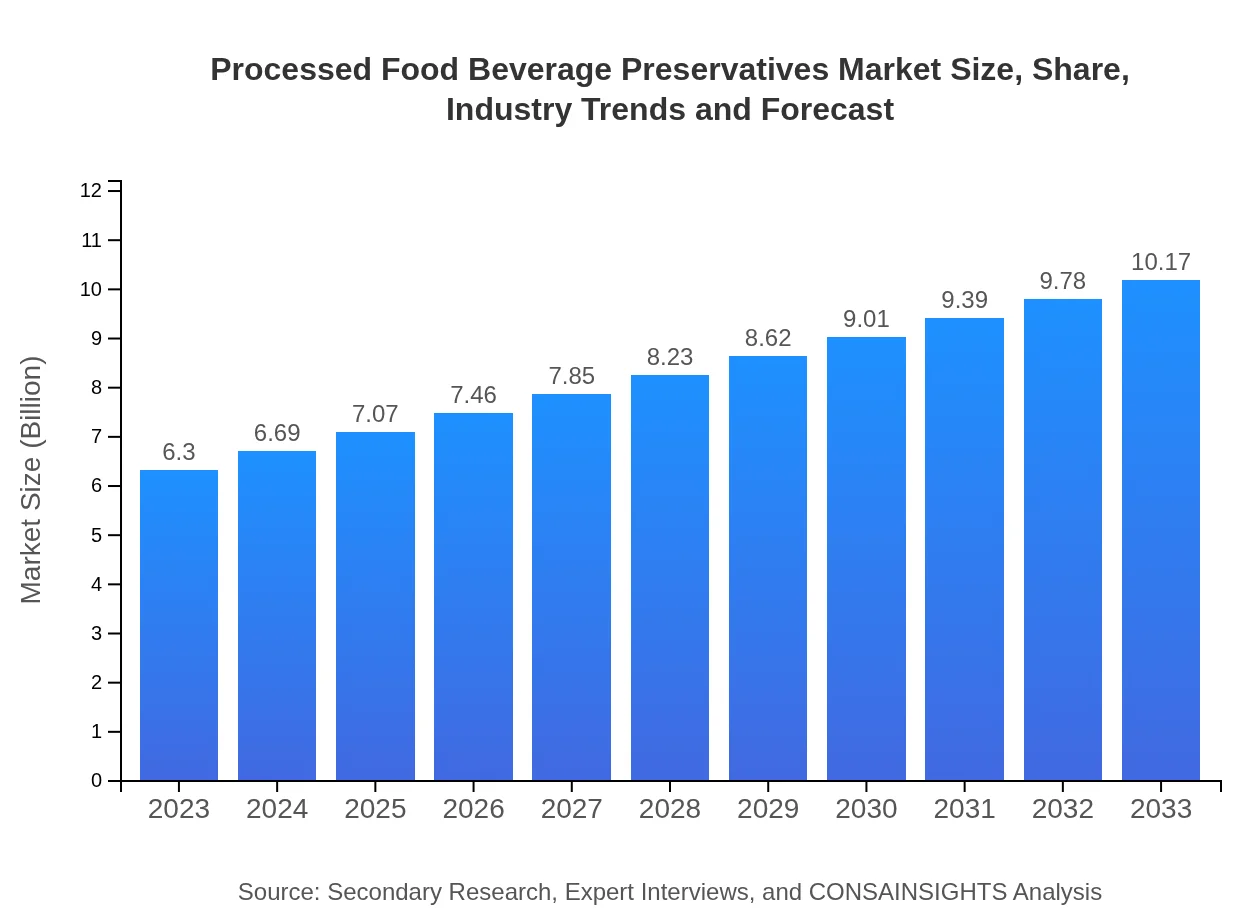

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.30 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $10.17 Billion |

| Top Companies | E.I. du Pont de Nemours and Company, Cargill, Incorporated, BASF SE |

| Last Modified Date | 31 January 2026 |

Processed Food Beverage Preservatives Market Overview

Customize Processed Food Beverage Preservatives Market Report market research report

- ✔ Get in-depth analysis of Processed Food Beverage Preservatives market size, growth, and forecasts.

- ✔ Understand Processed Food Beverage Preservatives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Processed Food Beverage Preservatives

What is the Market Size & CAGR of Processed Food Beverage Preservatives market in 2023?

Processed Food Beverage Preservatives Industry Analysis

Processed Food Beverage Preservatives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Processed Food Beverage Preservatives Market Analysis Report by Region

Europe Processed Food Beverage Preservatives Market Report:

In Europe, the market size in 2023 is **$2.11 billion**, with projections to reach **$3.41 billion** by 2033. Strong regulatory frameworks promoting food safety measures and a shift towards natural preservatives contribute to sustained growth.Asia Pacific Processed Food Beverage Preservatives Market Report:

The Asia Pacific region exhibited a market size of **$1.13 billion** in 2023, anticipated to reach **$1.82 billion** by 2033. Rising population and urbanization, alongside changing dietary habits, are fuelling demand for processed foods, prompting increased use of preservatives.North America Processed Food Beverage Preservatives Market Report:

North America represented a market size of **$2.12 billion** in 2023, set to grow to **$3.42 billion** by 2033. The increasing consumer inclination towards processed food items and stringent regulations on food safety are positively impacting this market.South America Processed Food Beverage Preservatives Market Report:

The South American market was valued at **$0.62 billion** in 2023 and is projected to grow to **$1.00 billion** by 2033, supported by growing consumer awareness around health and food quality, as well as expanding retail food sectors.Middle East & Africa Processed Food Beverage Preservatives Market Report:

The Middle East and Africa market size stood at **$0.32 billion** in 2023, expected to grow to **$0.52 billion** by 2033, driven primarily by the expansion of the hospitality sector and increasing demand for convenience foods.Tell us your focus area and get a customized research report.

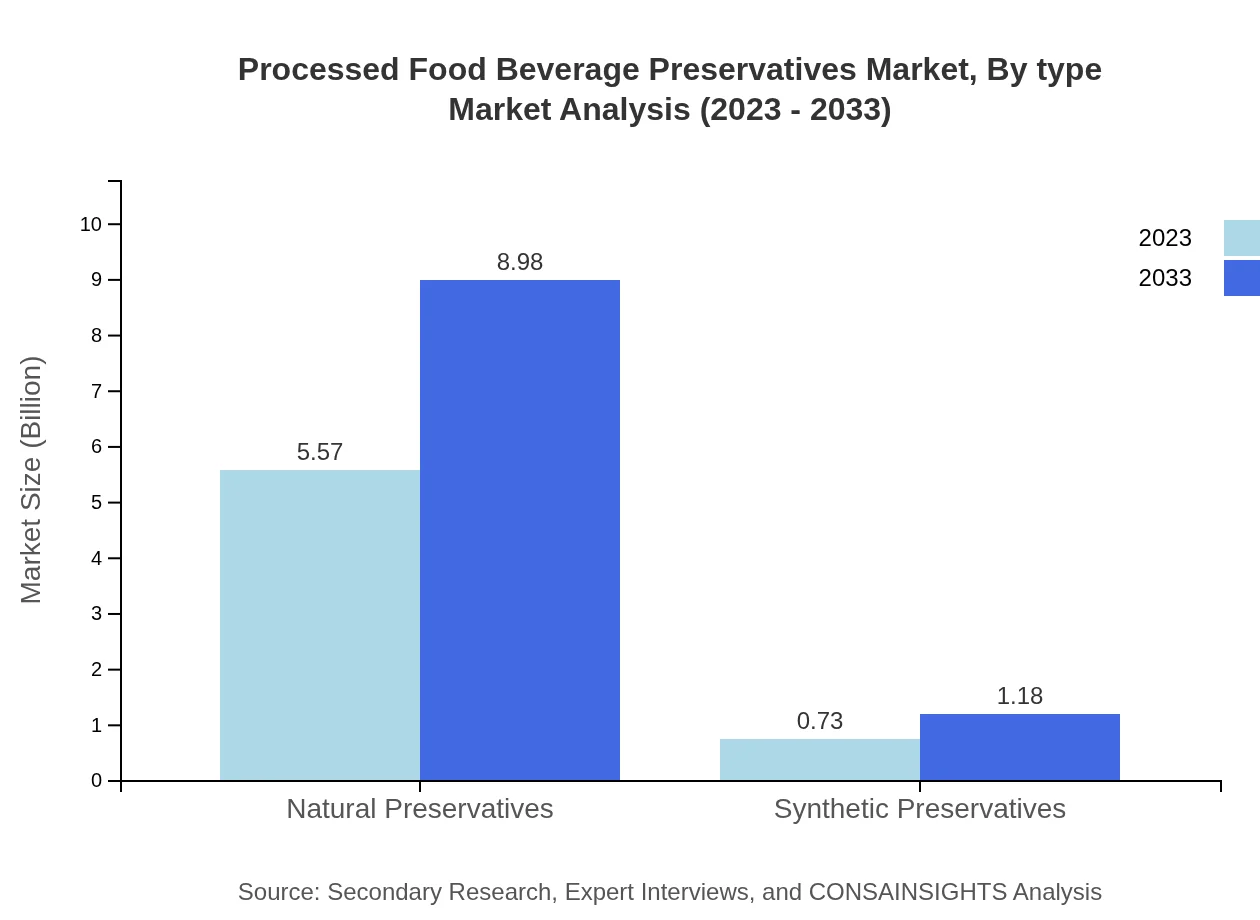

Processed Food Beverage Preservatives Market Analysis By Type

Natural preservatives dominate the market due to the increasing consumer demand for clean-label products, holding an **88.38%** market share in 2023. Synthetic preservatives, although smaller, are gaining traction in processed food applications due to their cost-effectiveness, commanding an **11.62%** share.

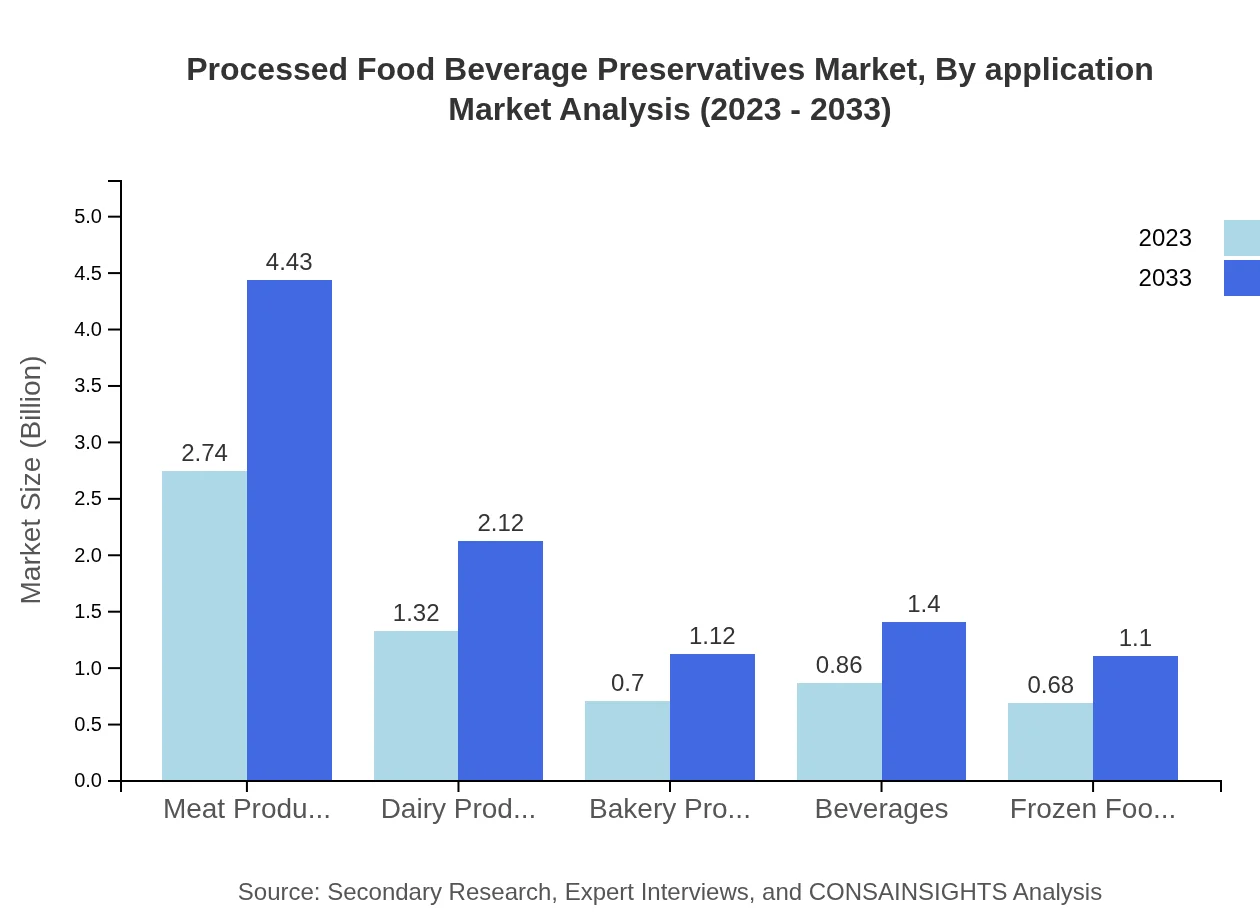

Processed Food Beverage Preservatives Market Analysis By Application

The food industry is significant, representing **58.16%** of the market share in 2023, while the beverage industry accounts for **21.53%**. The increasing production of ready-to-eat meals and bottling of beverages drives demand across these applications.

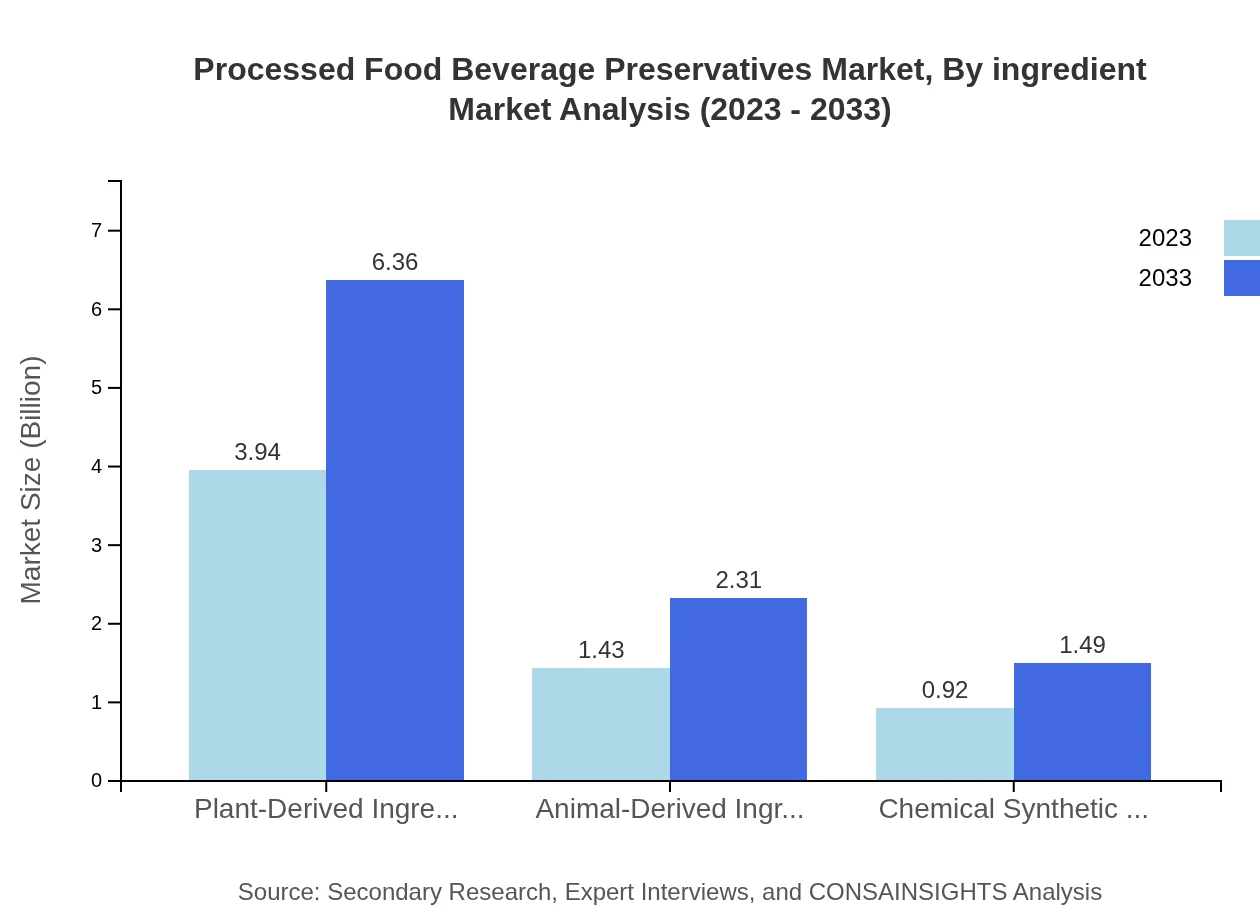

Processed Food Beverage Preservatives Market Analysis By Ingredient

Plant-derived preservatives lead the segment with an **88.38%** share, followed by animal-derived at **22.73%**. Chemical synthetic ingredients are also utilized but are less favored due to growing health concerns associated with synthetic additives.

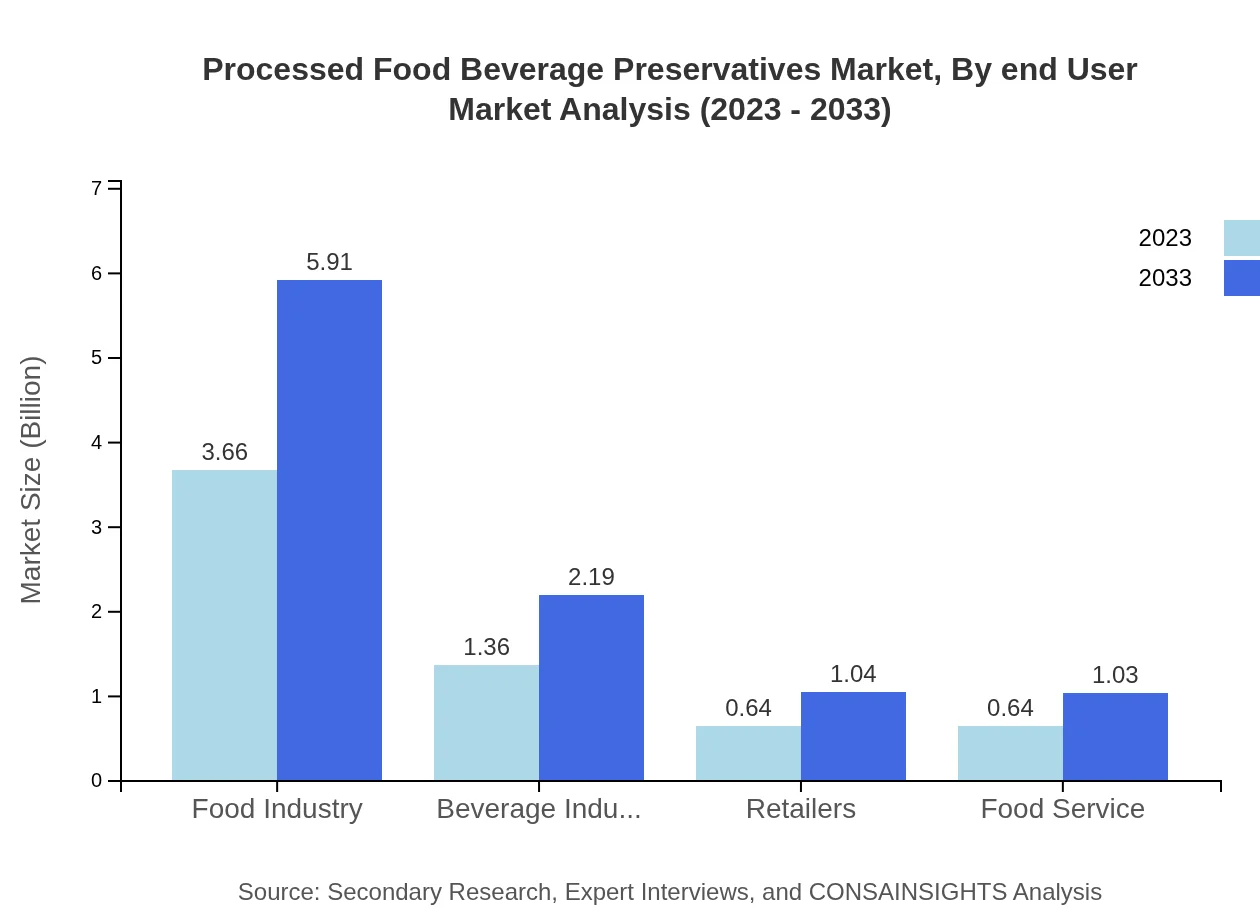

Processed Food Beverage Preservatives Market Analysis By End User

The retailer segment holds a substantial market share of **10.21%**, while the food service sector contributes **10.1%**. These channels are critical for wide consumer outreach regarding new preservative innovations.

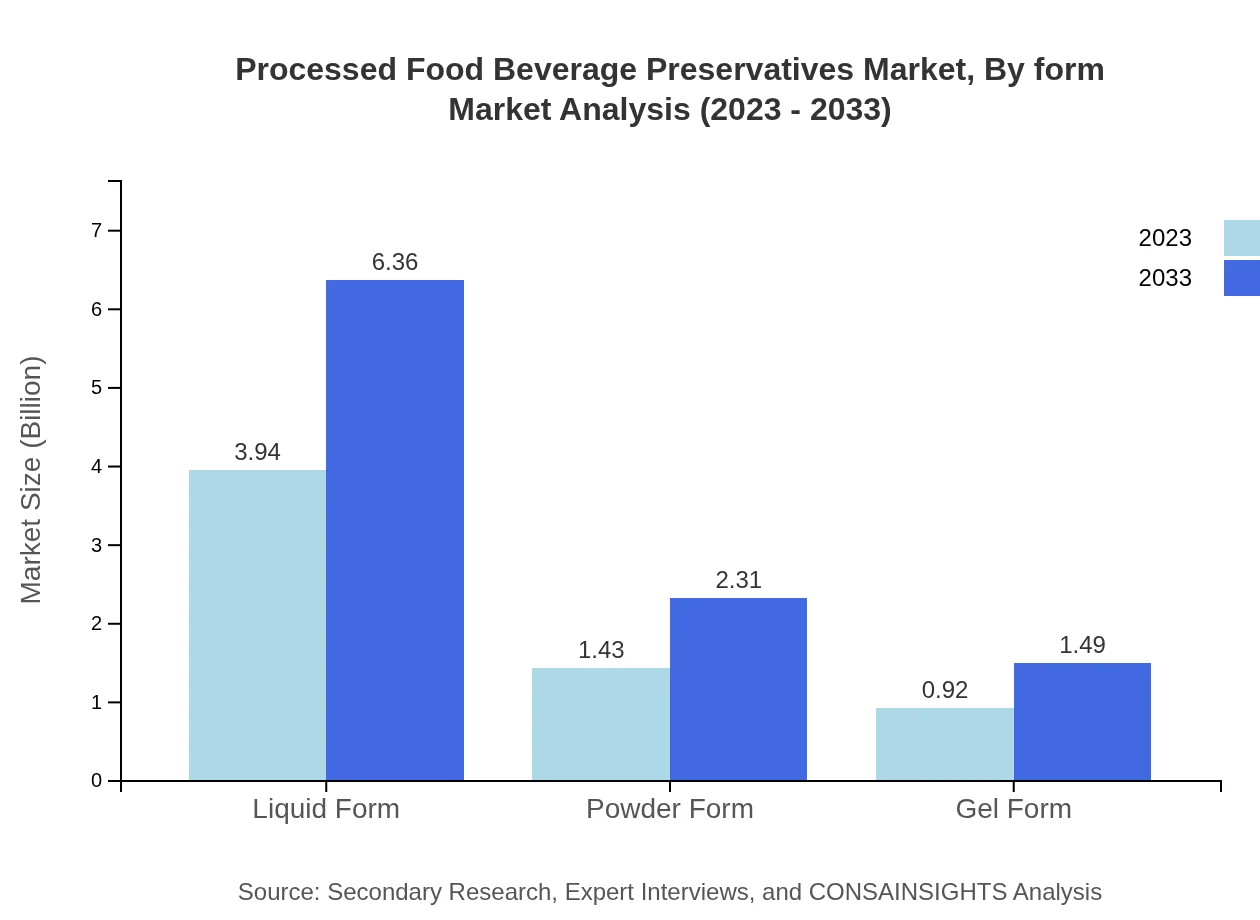

Processed Food Beverage Preservatives Market Analysis By Form

In terms of forms, liquid preservatives dominate with a **62.61%** market share, due to their versatile application in various food products. Powder and gel forms also have a presence, catering to specific demands within the industry.

Processed Food Beverage Preservatives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Processed Food Beverage Preservatives Industry

E.I. du Pont de Nemours and Company:

DuPont is a leader in food science and biotechnology, providing innovative solutions and preservatives essential for extending shelf life and maintaining food safety.Cargill, Incorporated:

Cargill is a global provider of food ingredients, specializing in meat and beverage preservatives that meet both safety regulations and consumer expectations for quality.BASF SE:

BASF is a chemical company that produces a variety of preservatives, focusing on natural alternatives that comply with modern consumer preferences and health trends.We're grateful to work with incredible clients.

FAQs

What is the market size of processed Food Beverage Preservatives?

The global processed food beverage preservatives market is valued at approximately $6.3 billion in 2023. This market is projected to grow at a CAGR of 4.8%, reaching significant economic benchmarks by 2033.

What are the key market players or companies in this processed Food Beverage Preservatives industry?

Key players in the processed food beverage preservatives industry include multinational corporations and local manufacturers specializing in food technology and preservation. These players innovate on product formulations, often focusing on natural and synthetic preservatives to meet diverse consumer needs.

What are the primary factors driving the growth in the processed food beverage preservatives industry?

Significant growth drivers for the processed food beverage preservatives industry include rising consumer awareness about food safety, increasing demand for convenience foods, and regulatory pressures advocating for longer shelf life and cleaner labels in product formulations.

Which region is the fastest Growing in the processed food beverage preservatives?

The fastest-growing region in the processed food beverage preservatives market is Europe, which is expected to grow from $2.11 billion in 2023 to $3.41 billion in 2033, reflecting a robust demand for advanced food preservation solutions.

Does ConsaInsights provide customized market report data for the processed Food Beverage Preservatives industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of stakeholders in the processed food beverage preservatives industry, facilitating informed decision-making based on unique business requirements and market dynamics.

What deliverables can I expect from this processed Food Beverage Preservatives market research project?

Deliverables from the processed food beverage preservatives market research project include comprehensive market analysis reports, segment data, regional insights, competitive landscape reviews, and forecasts that empower strategic planning and investment.

What are the market trends of processed Food Beverage Preservatives?

Key market trends include a shift towards natural preservatives, rising demand for organic food products, and innovations in preservation technology, reflecting consumer preferences for healthier and longer-lasting food options.