Processed Meat Market Report

Published Date: 31 January 2026 | Report Code: processed-meat

Processed Meat Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the processed meat market from 2023 to 2033, detailing market size, trends, segmentation, and growth forecasts along with insights into regional performance and industry challenges.

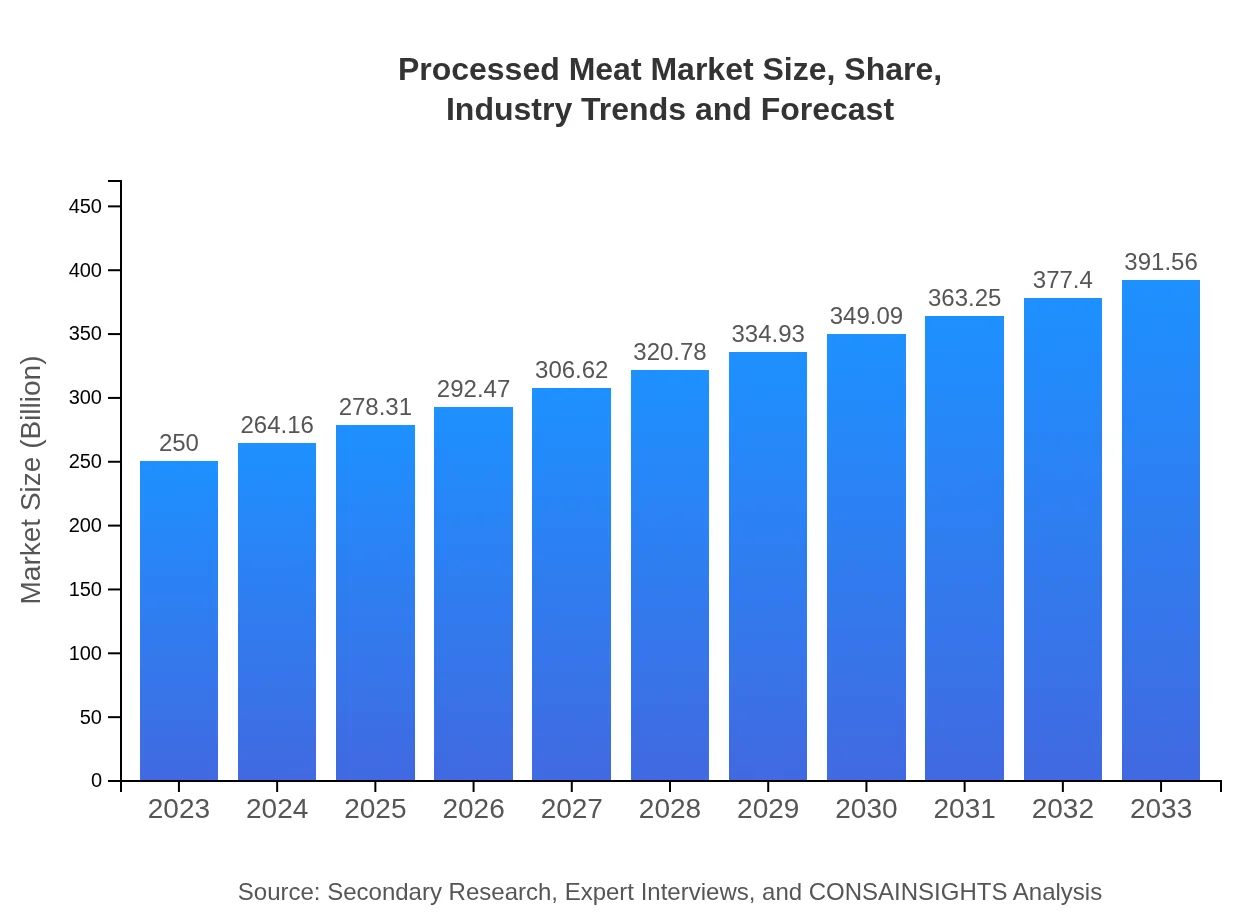

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $250.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $391.56 Billion |

| Top Companies | Tyson Foods, Inc., Hormel Foods Corporation, JBS USA Holdings, Inc., Smithfield Foods, Inc. |

| Last Modified Date | 31 January 2026 |

Processed Meat Market Overview

Customize Processed Meat Market Report market research report

- ✔ Get in-depth analysis of Processed Meat market size, growth, and forecasts.

- ✔ Understand Processed Meat's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Processed Meat

What is the Market Size & CAGR of Processed Meat market in 2023?

Processed Meat Industry Analysis

Processed Meat Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Processed Meat Market Analysis Report by Region

Europe Processed Meat Market Report:

The European region is characterized by a dynamic market expected to grow from $71.58 billion in 2023 to $112.10 billion by 2033. Increased preference for convenience foods among busy consumers along with stringent food safety regulations influence both production and consumption patterns of processed meat products.Asia Pacific Processed Meat Market Report:

The Asia Pacific region is one of the fastest-growing markets for processed meat, expected to grow from $49.87 billion in 2023 to $78.12 billion by 2033. Increasing urbanization, dietary transitions toward protein-rich foods, and a burgeoning middle-class population are key drivers of this growth. Additionally, rising disposable incomes enable consumers to opt for processed meat options, while the trend of convenience foods has gained significant traction.North America Processed Meat Market Report:

North America, being a mature market, showcases a significant market for processed meat products, with expected growth from $88.65 billion in 2023 to $138.85 billion by 2033. Health trends, product innovation focusing on organic and less processed meats, and increasing consumer awareness towards food sourcing contribute to robust market dynamics.South America Processed Meat Market Report:

In South America, the processed meat market size is projected to increase from $12.40 billion in 2023 to $19.42 billion by 2033. Growth is driven by the region’s rich agricultural base and the increasing demand for meat products in both domestic and export markets. Furthermore, traditional culinary practices that include processed meats contribute to robust consumption rates.Middle East & Africa Processed Meat Market Report:

The Middle East and Africa market is projected to grow from $27.50 billion in 2023 to $43.07 billion by 2033. Rising population density, changing dietary patterns, and urbanization in major cities foster demand for processed meat. Additionally, there is an escalating trend towards western dietary patterns, which include increased consumption of processed and convenience food items.Tell us your focus area and get a customized research report.

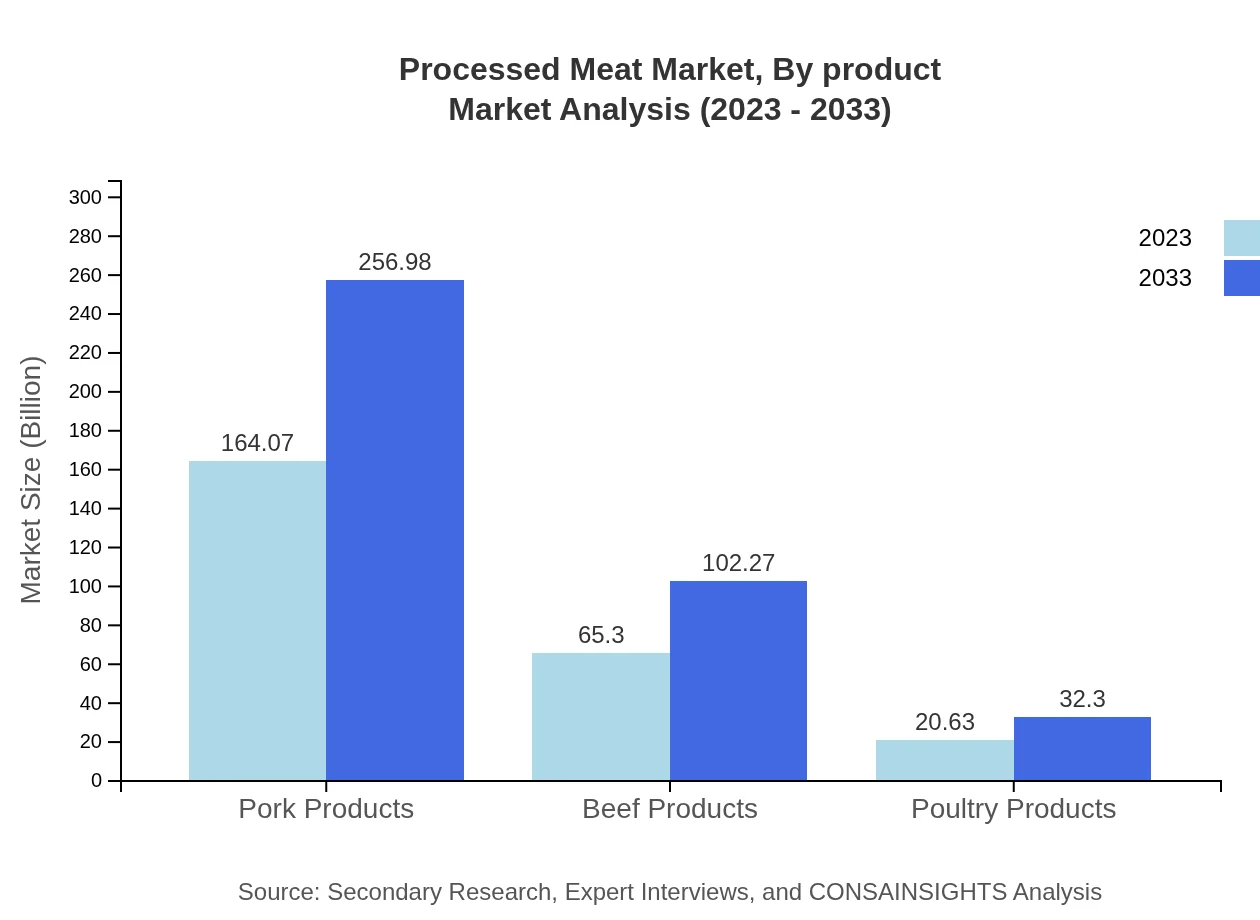

Processed Meat Market Analysis By Product

The processed meat market is primarily segmented into pork, beef, and poultry products. Pork products dominate the market with a size of $164.07 billion in 2023 and expected to reach $256.98 billion by 2033. Beef products follow closely, growing from $65.30 billion in 2023 to $102.27 billion by 2033. Poultry products, though smaller in market size, are projected to increase from $20.63 billion to $32.30 billion in the same period, reflecting diversified consumer preferences.

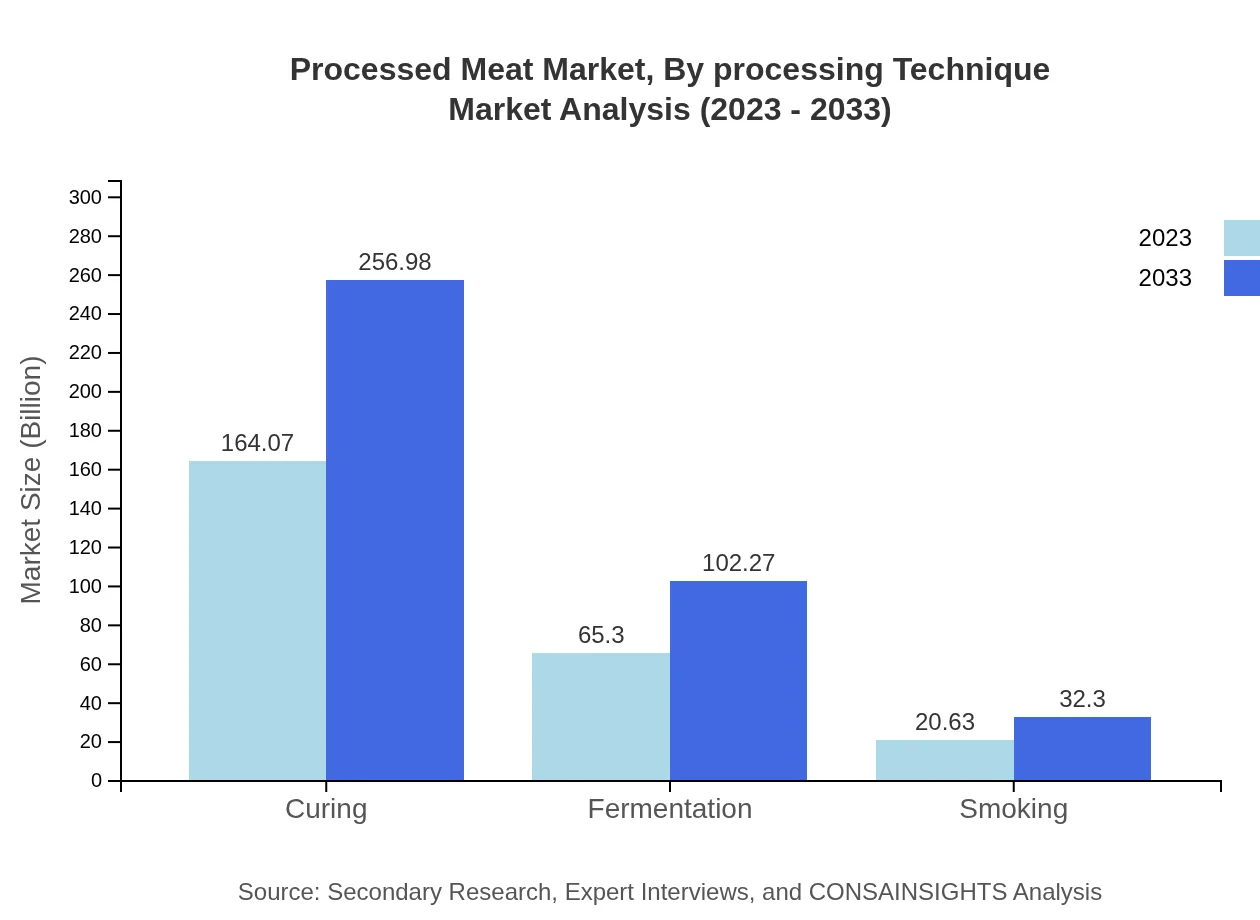

Processed Meat Market Analysis By Processing Technique

In terms of processing techniques, the market is segmented into curing, fermentation, and smoking. Curing remains the dominant technique, maintaining a market size of $164.07 billion in 2023, while projected to grow similarly. Fermentation and smoking techniques, though lesser in size, are experiencing growth alongside consumer interest in traditional preservation methods.

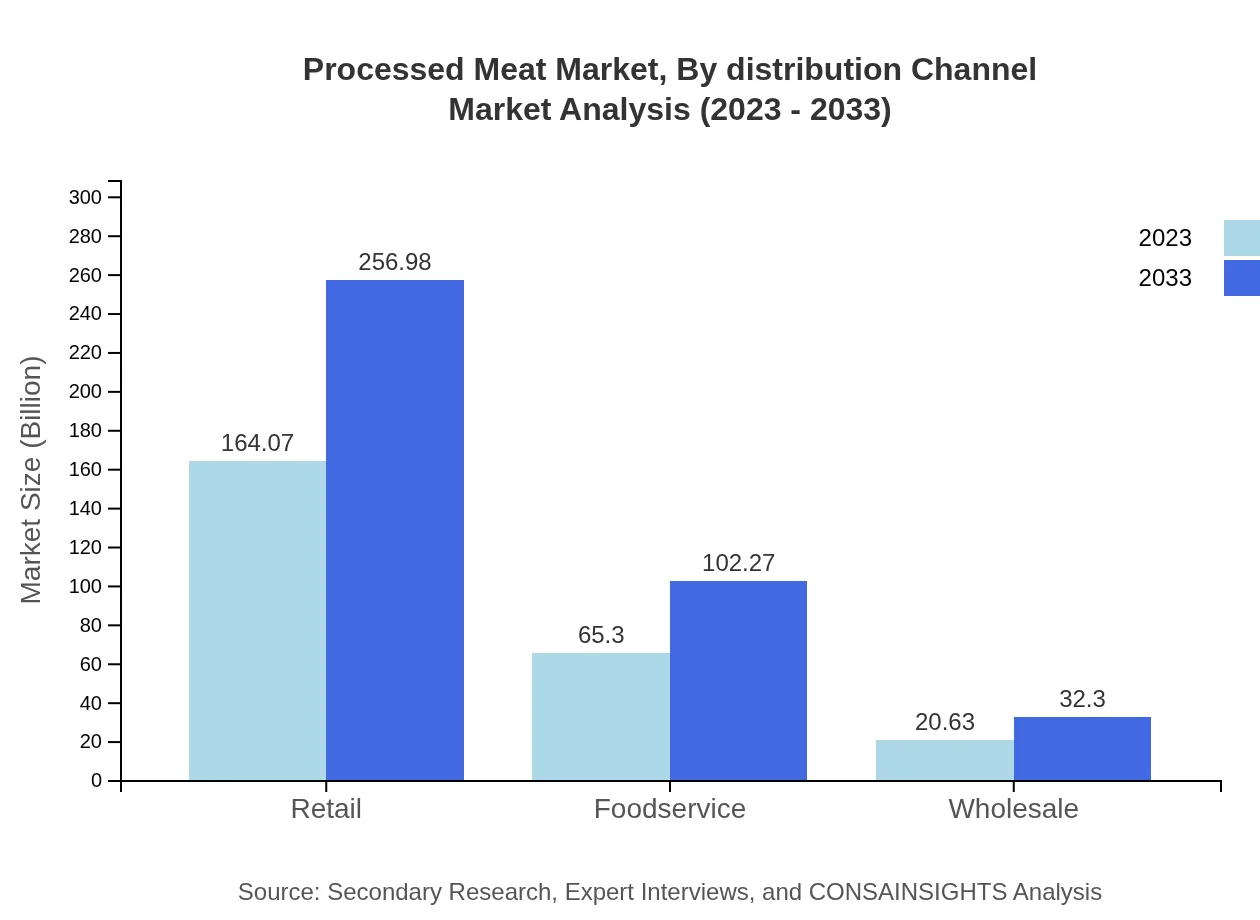

Processed Meat Market Analysis By Distribution Channel

The processed meat market is distributed through various channels, with retail being the largest at $164.07 billion in 2023, expected to grow to $256.98 billion by 2033. Foodservice and wholesale segments, while smaller, are also significant, reflecting the industry's adaptability to consumer purchasing behaviors and instances of convenience dining.

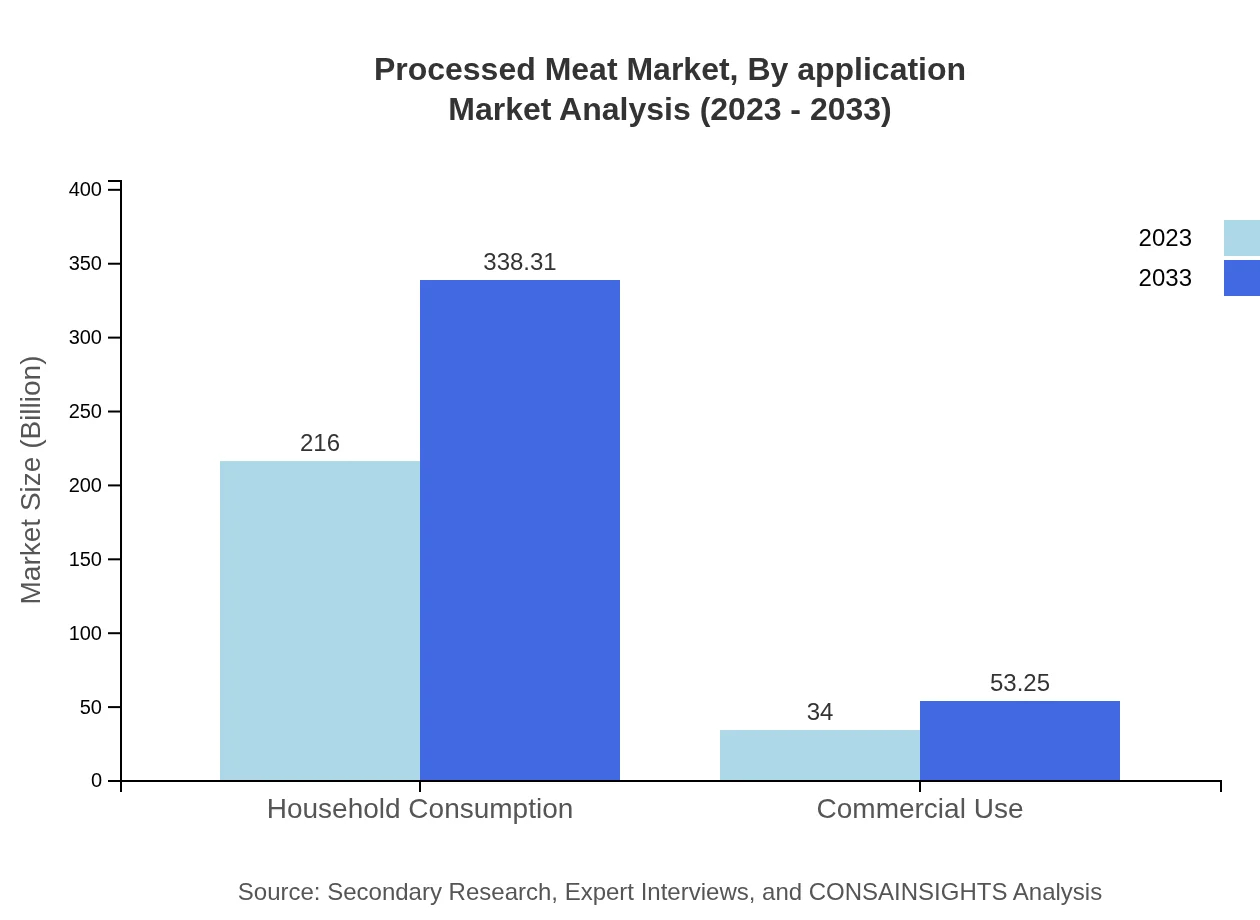

Processed Meat Market Analysis By Application

Household consumption, composing the bulk of processed meat sales, is set at $216.00 billion in 2023, projected to reach $338.31 billion by 2033. Commercial use—including hospitality and institutional food service—is anticipated to grow from $34.00 billion to $53.25 billion, demonstrating the market's reliance on the hospitality sector.

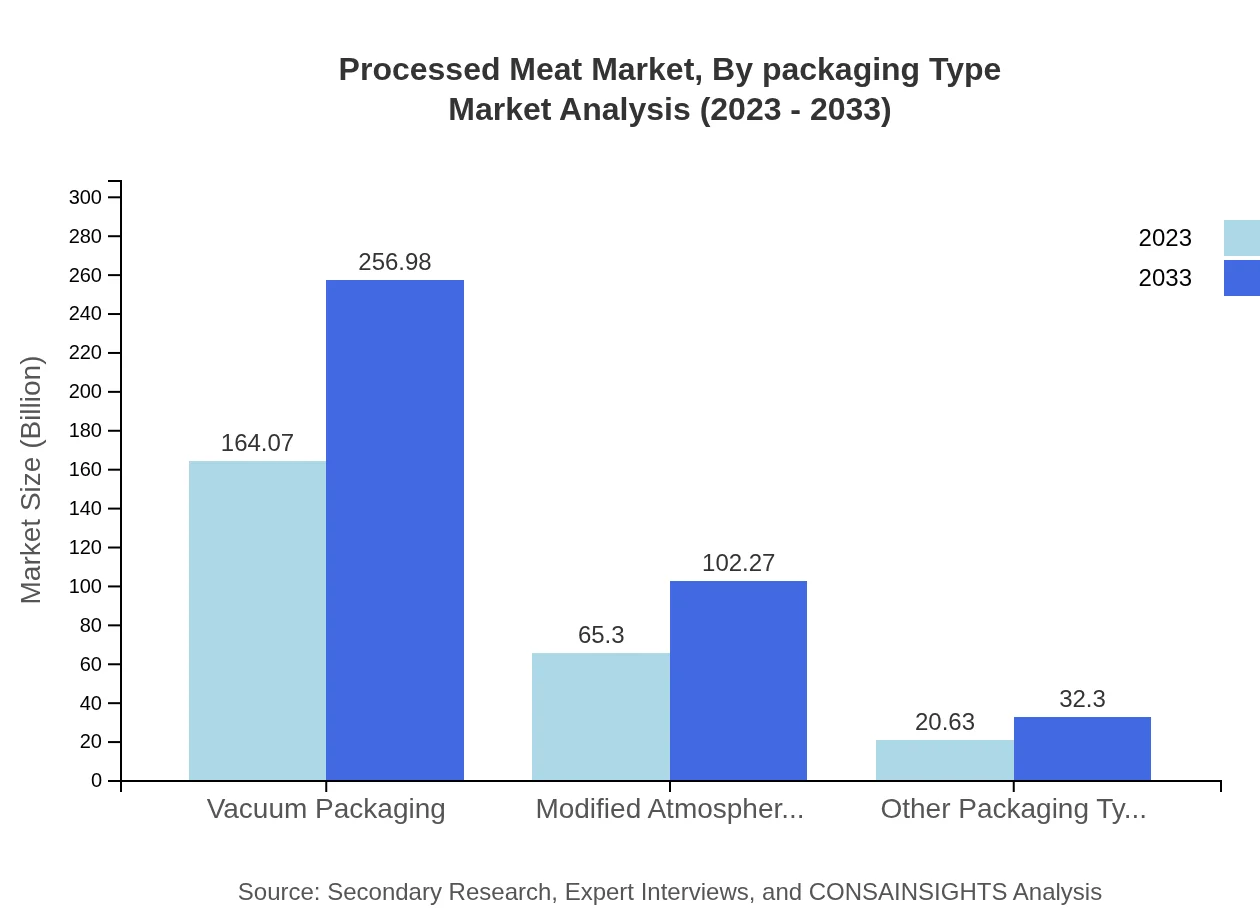

Processed Meat Market Analysis By Packaging Type

In packaging types, vacuum packaging leads at $164.07 billion in 2023 with an anticipated rise to $256.98 billion by 2033. Modified atmosphere packaging follows closely, beginning at $65.30 billion, growing significantly as fresh perceptions of shelf-life and quality take precedence in consumer choices.

Processed Meat Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Processed Meat Industry

Tyson Foods, Inc.:

Tyson Foods is one of the world's largest meat processors and marketers, specializing in the production of chicken, beef, and pork, focusing on high-quality products and sustainability.Hormel Foods Corporation:

Hormel Foods is recognized for producing various protein-based products, including processed meats. The company focuses on innovation and continuously improves its product offerings to meet changing consumer preferences.JBS USA Holdings, Inc.:

JBS USA is a leading global exporter of beef and pork products, known for its extensive operations and commitment to enhancing food safety and sustainability in meat production.Smithfield Foods, Inc.:

Smithfield Foods leads the pork industry and provides quality meat products, with a corporate strategy centered on responsible sourcing and community engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of processed Meat?

The global processed meat market size is projected to reach approximately $250 billion by 2033, growing at a CAGR of 4.5%. This increase reflects rising demand in both household and commercial consumption of various meat products.

What are the key market players or companies in this processed Meat industry?

Key market players in the processed meat industry include major companies like Tyson Foods, JBS S.A., Smithfield Foods, and Hormel Foods. These companies dominate the market landscape through innovation and extensive distribution networks.

What are the primary factors driving the growth in the processed Meat industry?

Factors driving growth in the processed meat industry include increasing urbanization, rising disposable incomes, and a growing preference for convenience foods. Health trends also influence product development, with a focus on quality and sourcing.

Which region is the fastest Growing in the processed Meat?

The Asia Pacific region is the fastest-growing area for processed meat, with market size projected to increase from $49.87 billion in 2023 to $78.12 billion by 2033, driven by changing dietary habits and population growth.

Does ConsaInsights provide customized market report data for the processed Meat industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications, providing in-depth insights into specific segments, regional trends, and consumer behavior in the processed meat market.

What deliverables can I expect from this processed Meat market research project?

Deliverables from the processed meat market research project typically include detailed market analysis reports, trend forecasts, competitor analysis, and comprehensive insights into consumer preferences across various segments and regions.

What are the market trends of processed Meat?

Key trends in the processed meat market include a shift towards healthier alternatives, a rise in demand for organic and natural meat products, and innovations in meat packaging technologies aimed at extending shelf life and improving quality.