Processed Poultry Meat Market Report

Published Date: 31 January 2026 | Report Code: processed-poultry-meat

Processed Poultry Meat Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Processed Poultry Meat market, detailing key trends, growth forecasts, and market conditions from 2023 to 2033. Insights into market size, regional performance, segmentation, and competitive landscape are covered to inform stakeholders about future opportunities.

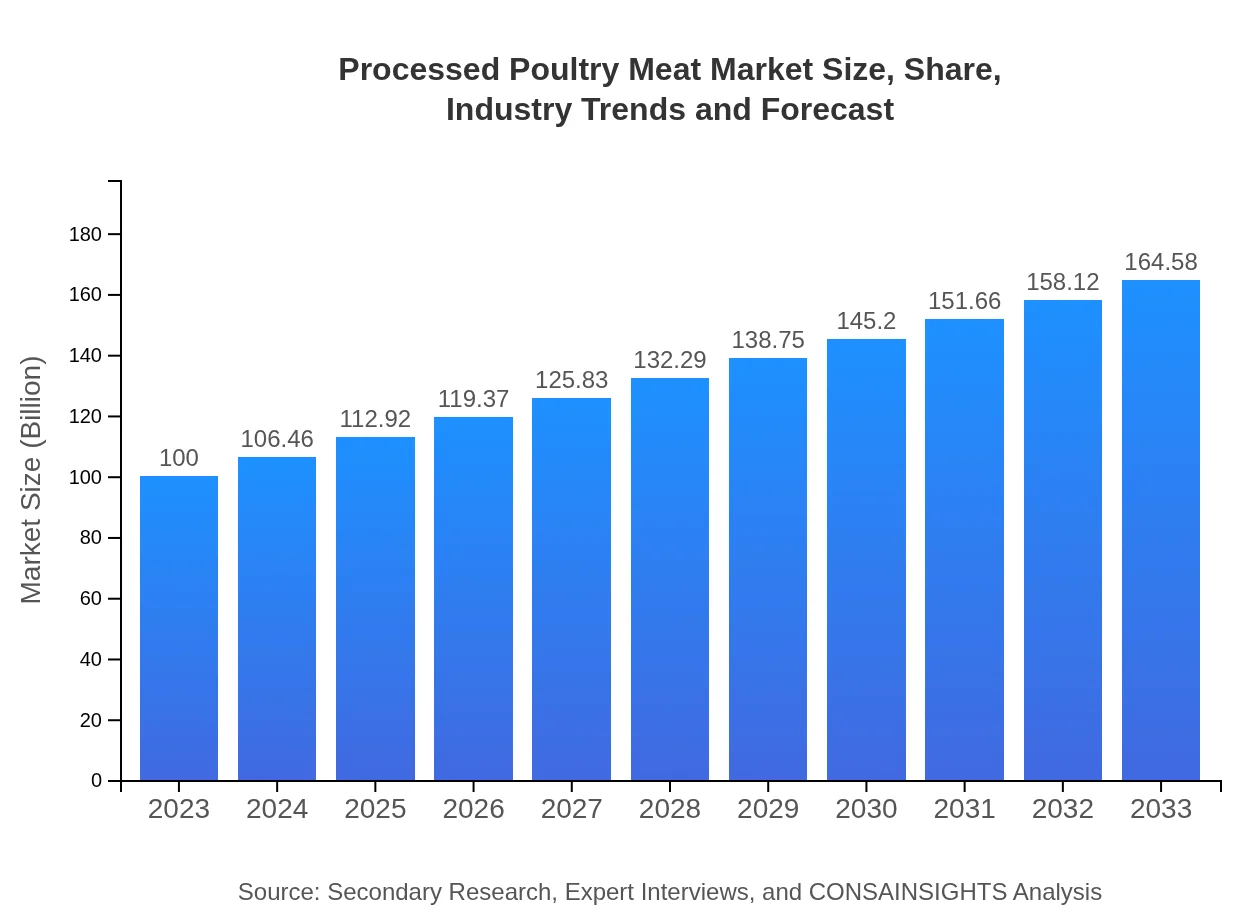

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Billion |

| Top Companies | Tyson Foods, Inc., Pilgrim's Pride Corporation, Sanderson Farms, Inc., Perdue Farms, Inc. |

| Last Modified Date | 31 January 2026 |

Processed Poultry Meat Market Overview

Customize Processed Poultry Meat Market Report market research report

- ✔ Get in-depth analysis of Processed Poultry Meat market size, growth, and forecasts.

- ✔ Understand Processed Poultry Meat's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Processed Poultry Meat

What is the Market Size & CAGR of Processed Poultry Meat market in 2023?

Processed Poultry Meat Industry Analysis

Processed Poultry Meat Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Processed Poultry Meat Market Analysis Report by Region

Europe Processed Poultry Meat Market Report:

The European processed poultry meat market is set to grow from $30.16 billion in 2023 to $49.64 billion by 2033. Growth factors include rising health awareness and a shift towards healthier meat options. European nations are also modifying regulations to enhance food safety standards, further driving demand.Asia Pacific Processed Poultry Meat Market Report:

The Asia Pacific region is experiencing significant growth in the processed poultry meat market, expected to reach $30.76 billion by 2033 from $18.69 billion in 2023. Factors driving this include rising disposable incomes, urbanization, and a shift towards dietary preferences that include more protein-rich foods.North America Processed Poultry Meat Market Report:

The North American processed poultry meat market is expected to rise significantly from $37.27 billion in 2023 to $61.34 billion by 2033. The region benefits from strong demand for fast food, convenience products, and a culture that prioritizes protein-rich diets. Major companies in this region drive innovation in product offerings.South America Processed Poultry Meat Market Report:

In South America, the processed poultry meat market is projected to grow from $3.28 billion in 2023 to $5.40 billion by 2033. The growth is supported by increasing meat consumption and a rising trend in poultry-based diets, with countries like Brazil and Argentina leading the production and consumption.Middle East & Africa Processed Poultry Meat Market Report:

The Middle East and Africa will see growth from $10.60 billion in 2023 to $17.45 billion by 2033 in the processed poultry meat market. The increasing population and shifts towards Western dietary patterns are propelling demand, along with changes in food consumption habits.Tell us your focus area and get a customized research report.

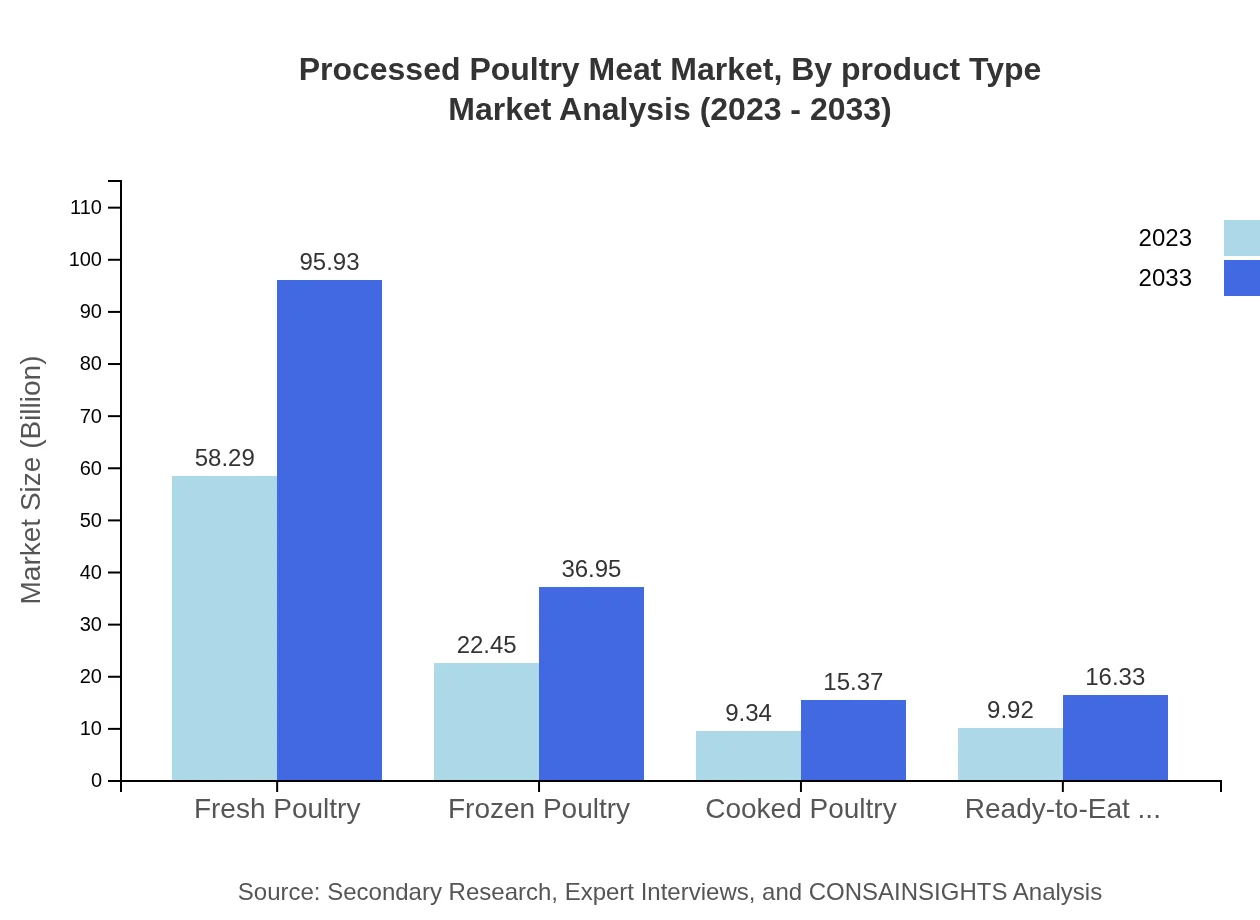

Processed Poultry Meat Market Analysis By Product Type

The processed poultry market is segmented into fresh, frozen, cooked, and ready-to-eat products. Fresh poultry dominates the market with a size of $58.29 billion in 2023, expected to increase to $95.93 billion by 2033, while frozen poultry is projected to grow from $22.45 billion to $36.95 billion. These segments show the rising consumer preference for convenience and product variety.

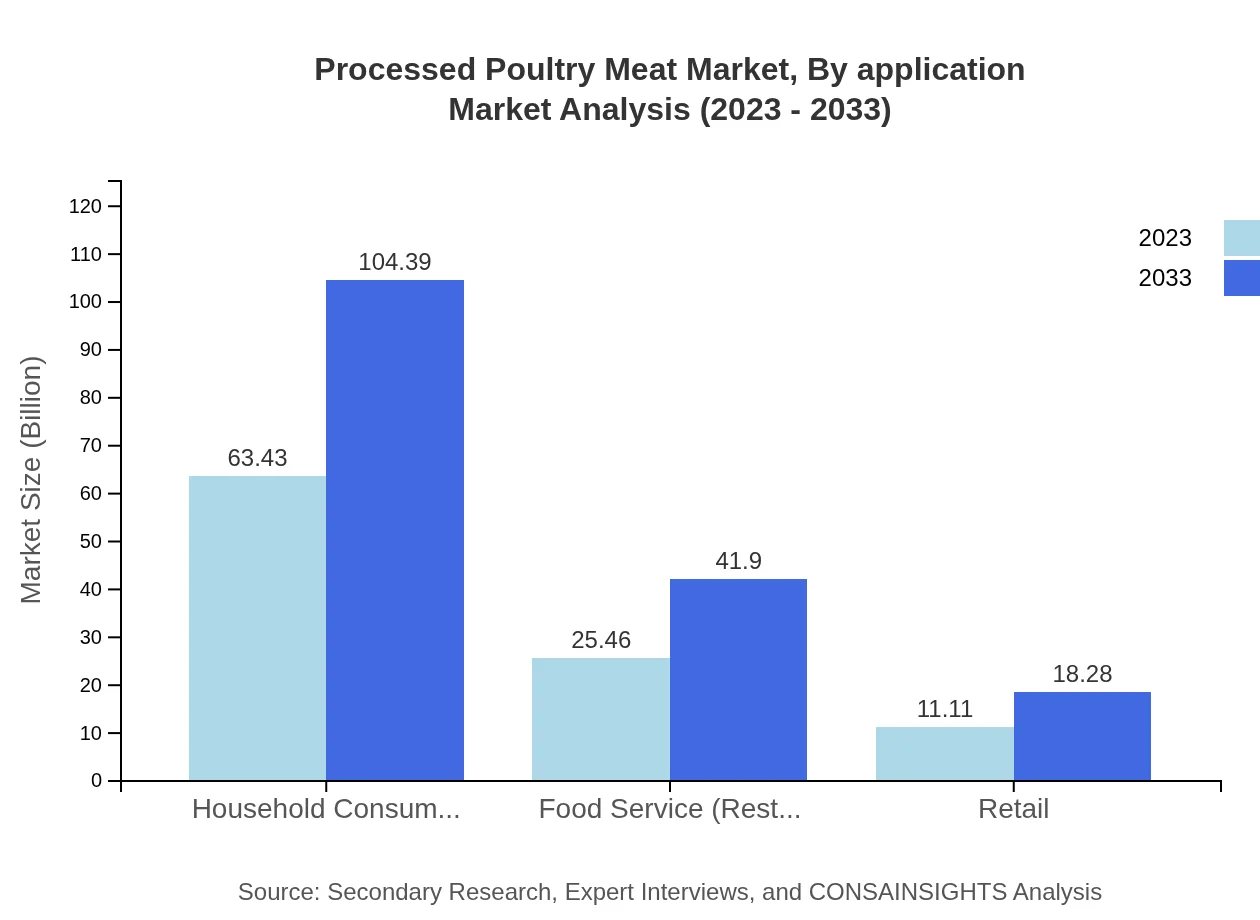

Processed Poultry Meat Market Analysis By Application

Household consumption represents a significant portion of the processed poultry meat market, valued at $63.43 billion in 2023, anticipated to rise to $104.39 billion by 2033. The food service sector is also substantial, growing from $25.46 billion to $41.90 billion, reflecting increasing adoption in restaurants and food chains.

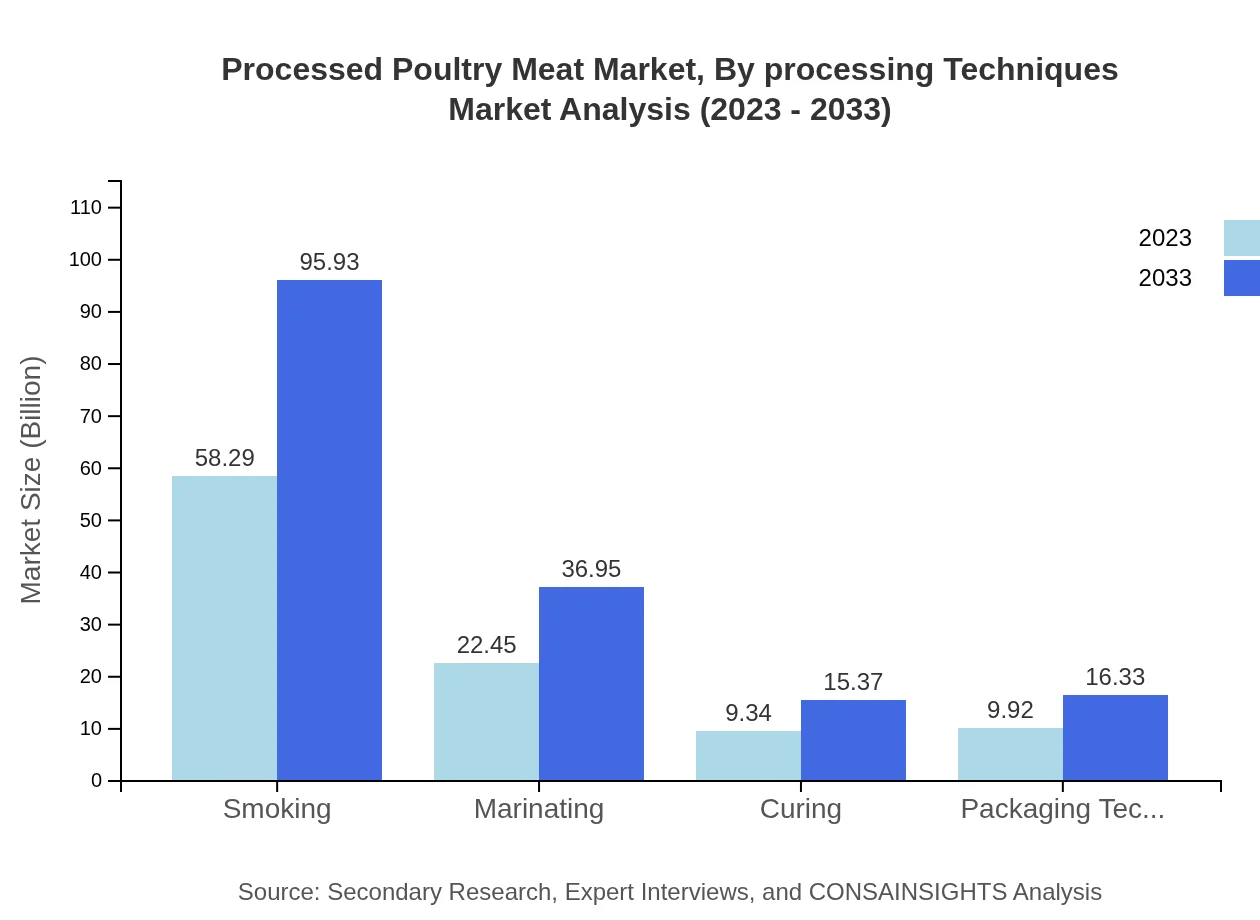

Processed Poultry Meat Market Analysis By Processing Techniques

Techniques such as smoking, marinating, and curing are pivotal. Smoking, valued at $58.29 billion in 2023, is expected to grow to $95.93 billion, driven by its popularity among consumers looking for flavor enhancements. Marinating also shows healthy growth, from $22.45 billion to $36.95 billion.

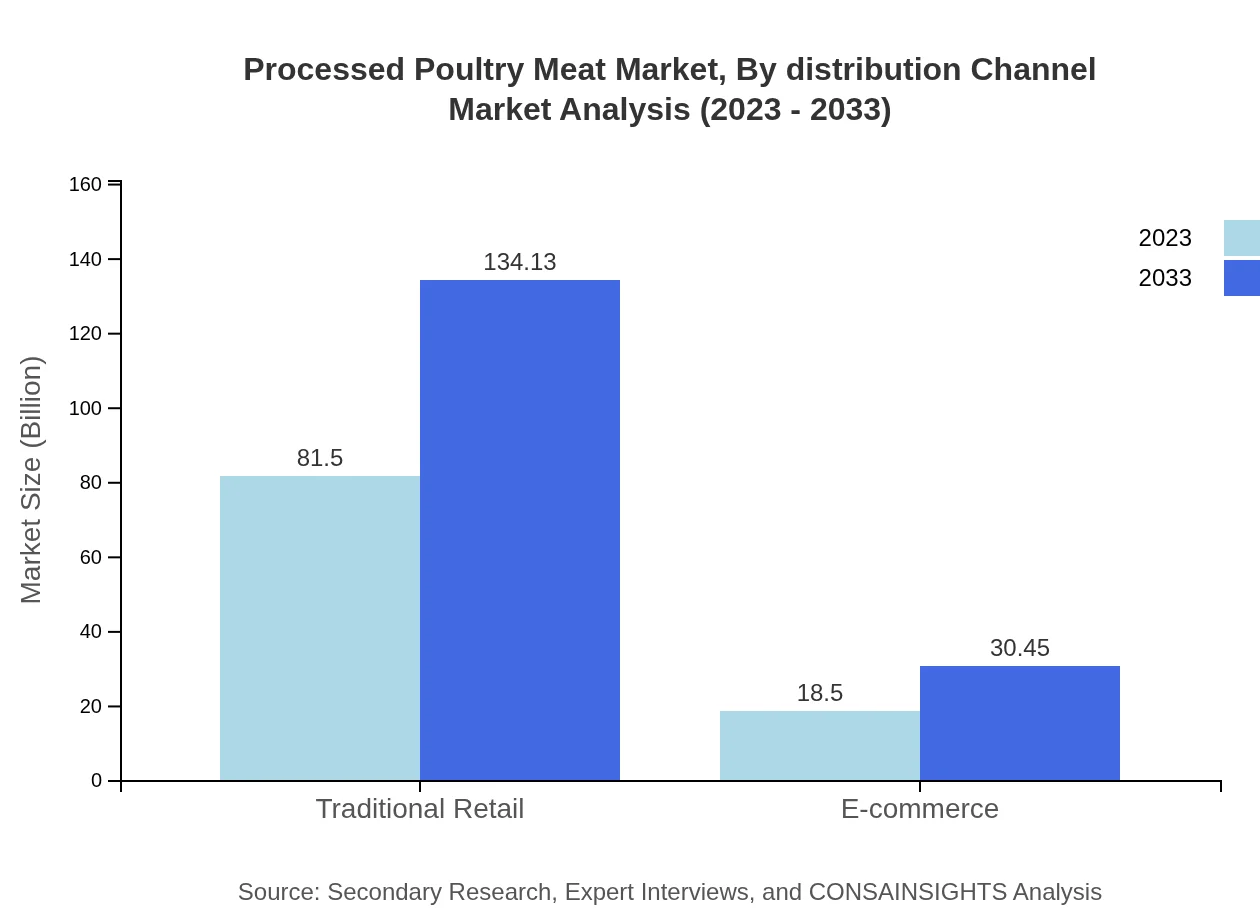

Processed Poultry Meat Market Analysis By Distribution Channel

The distribution channels for processed poultry include traditional retail and e-commerce. Traditional retail accounts for a substantial share, with market size expected to grow from $81.50 billion to $134.13 billion by 2033. E-commerce is also on the rise, projected to grow from $18.50 billion to $30.45 billion, reflecting changing consumer shopping habits.

Processed Poultry Meat Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Processed Poultry Meat Industry

Tyson Foods, Inc.:

Tyson Foods is one of the world's largest processors and marketers of chicken, beef, and pork. The company leads the market through innovation and a wide product range, including fresh, frozen, and prepared poultry products.Pilgrim's Pride Corporation:

Pilgrim's Pride is a key player in the poultry processing industry, offering a variety of products to retailers and food service providers. The company focuses on sustainability practices and high-quality standards.Sanderson Farms, Inc.:

Sanderson Farms is a major poultry producer recognized for its focus on quality and freshness of its products. The company markets a diverse range of chicken products and adheres to strict food safety protocols.Perdue Farms, Inc.:

Perdue Farms specializes in chicken and turkey products, known especially for its organic and natural lines. The company is dedicated to innovation in production methods and environmental stewardship.We're grateful to work with incredible clients.

FAQs

What is the market size of processed poultry meat?

The global processed poultry meat market is currently valued at approximately $100 billion and is projected to grow at a CAGR of 5% from 2023 to 2033. This growth reflects the increasing demand for convenient and ready-to-eat poultry products.

What are the key market players or companies in the processed poultry meat industry?

Key players in the processed poultry meat industry include major companies like Tyson Foods, Pilgrim's Pride, Sanderson Farms, and Perdue Farms. These companies dominate market share through extensive distribution networks and a variety of product offerings.

What are the primary factors driving the growth in the processed poultry meat industry?

Growth in the processed poultry meat industry is driven by rising health awareness, increasing disposable incomes, and the growing trend of outsourcing meals, leading to higher demand for convenient and value-added poultry products.

Which region is the fastest Growing in the processed poultry meat?

North America is currently the fastest-growing region in the processed poultry meat market, with a value of $61.34 billion projected by 2033, up from $37.27 billion in 2023. This growth is attributed to high consumption rates and strong retail infrastructure.

Does ConsaInsights provide customized market report data for the processed poultry meat industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the processed poultry meat industry. These personalized reports provide insights based on unique requirements and market variables.

What deliverables can I expect from this processed poultry meat market research project?

Deliverables from the market research project include detailed reports, executive summaries, regional market analysis, competitive landscape assessments, and forecasts that highlight trends and insights specific to processed poultry meat.

What are the market trends of processed poultry meat?

Current trends in the processed poultry meat market include a shift towards healthier eating patterns, an increase in the popularity of ready-to-eat products, and advancements in preservation and packaging techniques to enhance product longevity.