Processed Seafood Seafood Processing Equipment Market Report

Published Date: 31 January 2026 | Report Code: processed-seafood-seafood-processing-equipment

Processed Seafood Seafood Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Processed Seafood Seafood Processing Equipment market, covering insights from 2023 to 2033, including market size, growth trends, industry challenges, and potential opportunities, with detailed regional breakdowns and segment analyses.

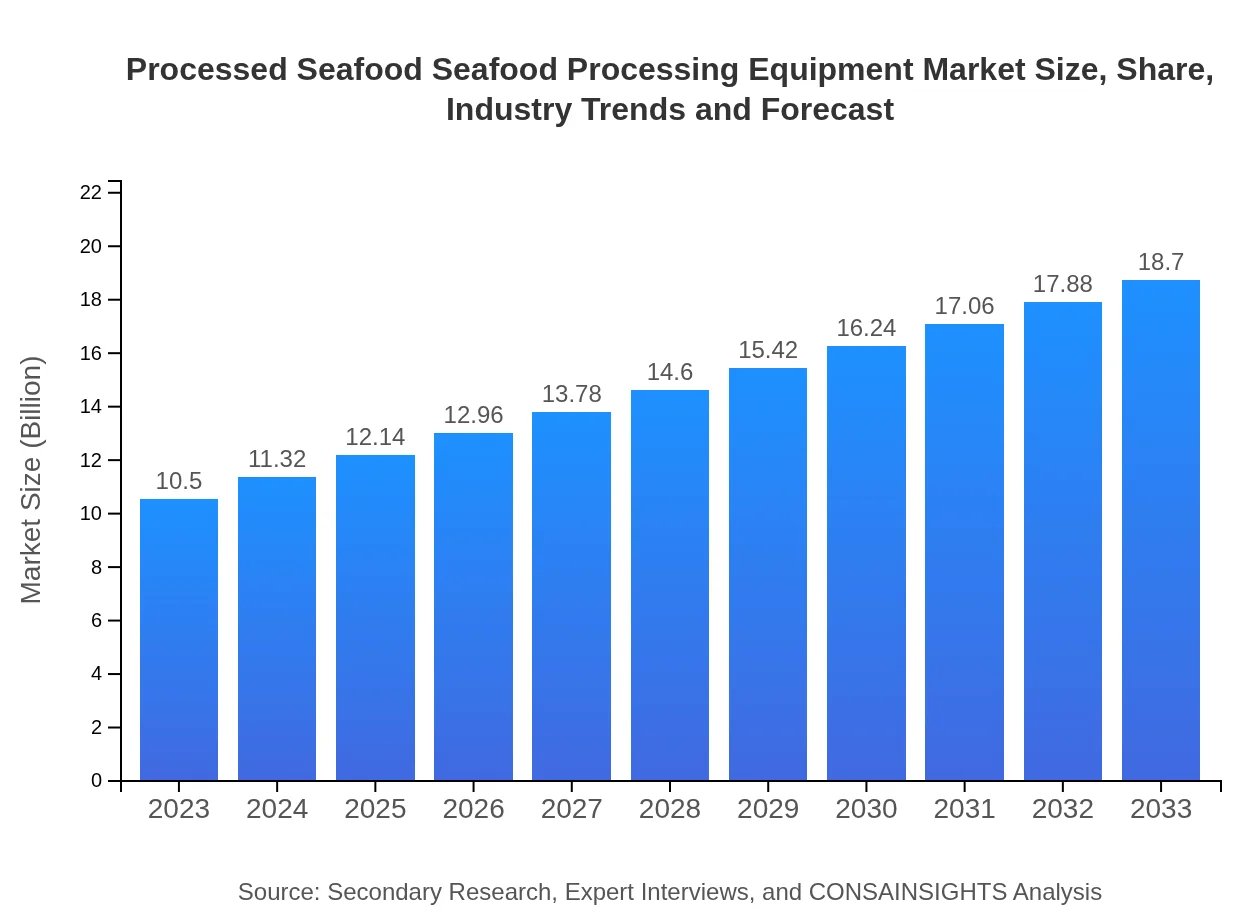

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Company A, Company B |

| Last Modified Date | 31 January 2026 |

Processed Seafood Seafood Processing Equipment Market Overview

Customize Processed Seafood Seafood Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Processed Seafood Seafood Processing Equipment market size, growth, and forecasts.

- ✔ Understand Processed Seafood Seafood Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Processed Seafood Seafood Processing Equipment

What is the Market Size & CAGR of Processed Seafood Seafood Processing Equipment market in 2023?

Processed Seafood Seafood Processing Equipment Industry Analysis

Processed Seafood Seafood Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Processed Seafood Seafood Processing Equipment Market Analysis Report by Region

Europe Processed Seafood Seafood Processing Equipment Market Report:

The European processed seafood processing equipment market is valued at 3.26 billion USD in 2023, with projections reaching 5.81 billion USD by 2033, thanks to strict regulatory standards and an increase in consumer focus on health and sustainability in food products.Asia Pacific Processed Seafood Seafood Processing Equipment Market Report:

In 2023, the Asia Pacific processed seafood processing equipment market accounts for approximately 2.00 billion USD, projected to reach 3.57 billion USD by 2033, driven by rising economic growth, increasing seafood consumption, and significant investments in processing facilities across countries like China, Japan, and India.North America Processed Seafood Seafood Processing Equipment Market Report:

North America's market is valued at 3.65 billion USD in 2023 and is expected to grow to 6.50 billion USD by 2033, supported by robust demand from both retail and food service sectors, along with ongoing advancements in seafood processing technologies.South America Processed Seafood Seafood Processing Equipment Market Report:

The South American market for processed seafood processing equipment stands at 0.25 billion USD in 2023 and is anticipated to grow to 0.44 billion USD by 2033, propelled by the region's diverse marine resources and growing exports of seafood products.Middle East & Africa Processed Seafood Seafood Processing Equipment Market Report:

In 2023, the Middle East and Africa market stands at 1.33 billion USD, with a forecasted growth to 2.38 billion USD by 2033. This growth is driven by increasing investments in food processing infrastructure and the expanding seafood consumption in both regions.Tell us your focus area and get a customized research report.

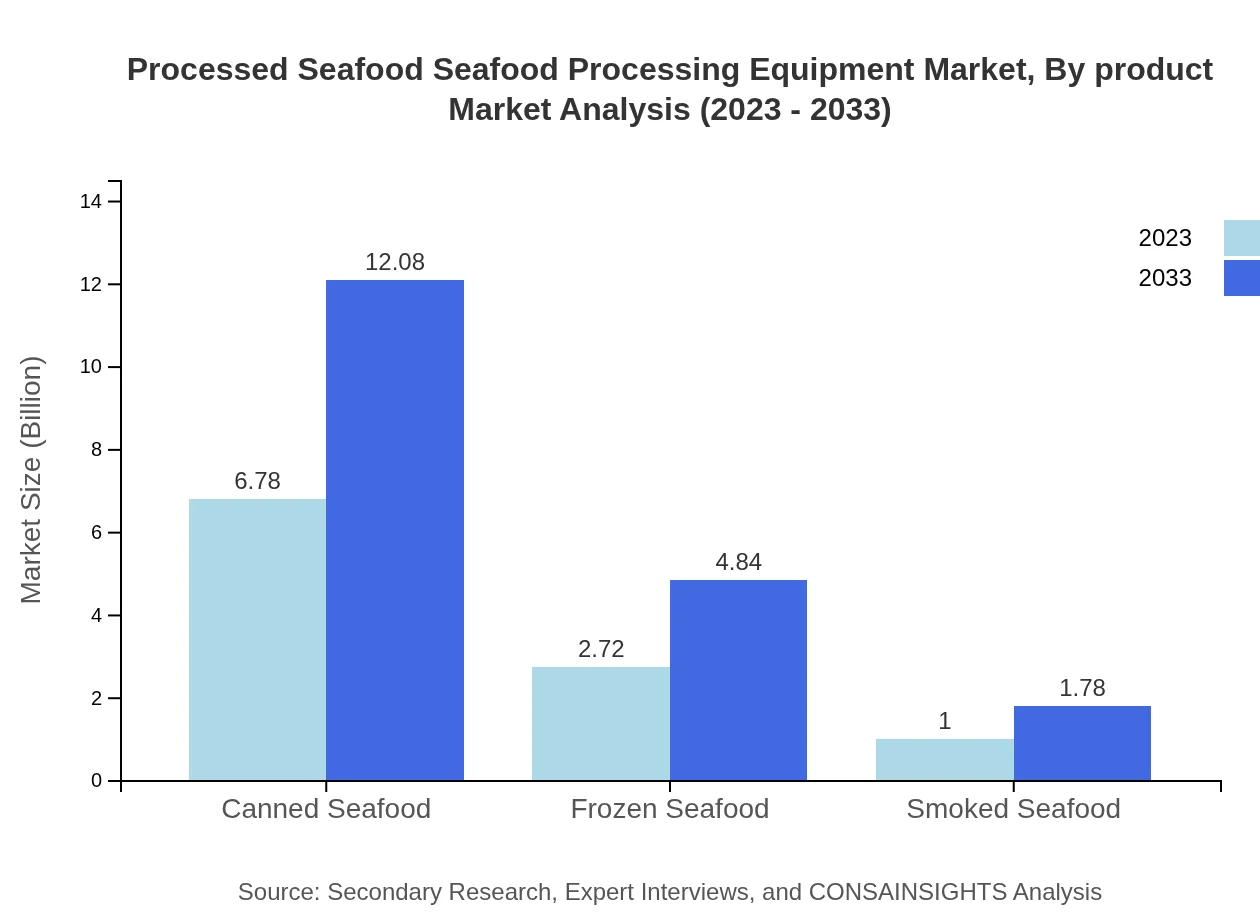

Processed Seafood Seafood Processing Equipment Market Analysis By Product

The canned seafood segment is the largest, size projected to grow from 6.78 billion USD in 2023 to 12.08 billion USD by 2033, holding about 64.59% of the market share. Frozen seafood follows closely, with a noticeable increase anticipated from 2.72 billion USD to 4.84 billion USD, capturing about 25.87% of the market. Smoked seafood remains niche but shows growth potential, reaching 1.78 billion USD by 2033.

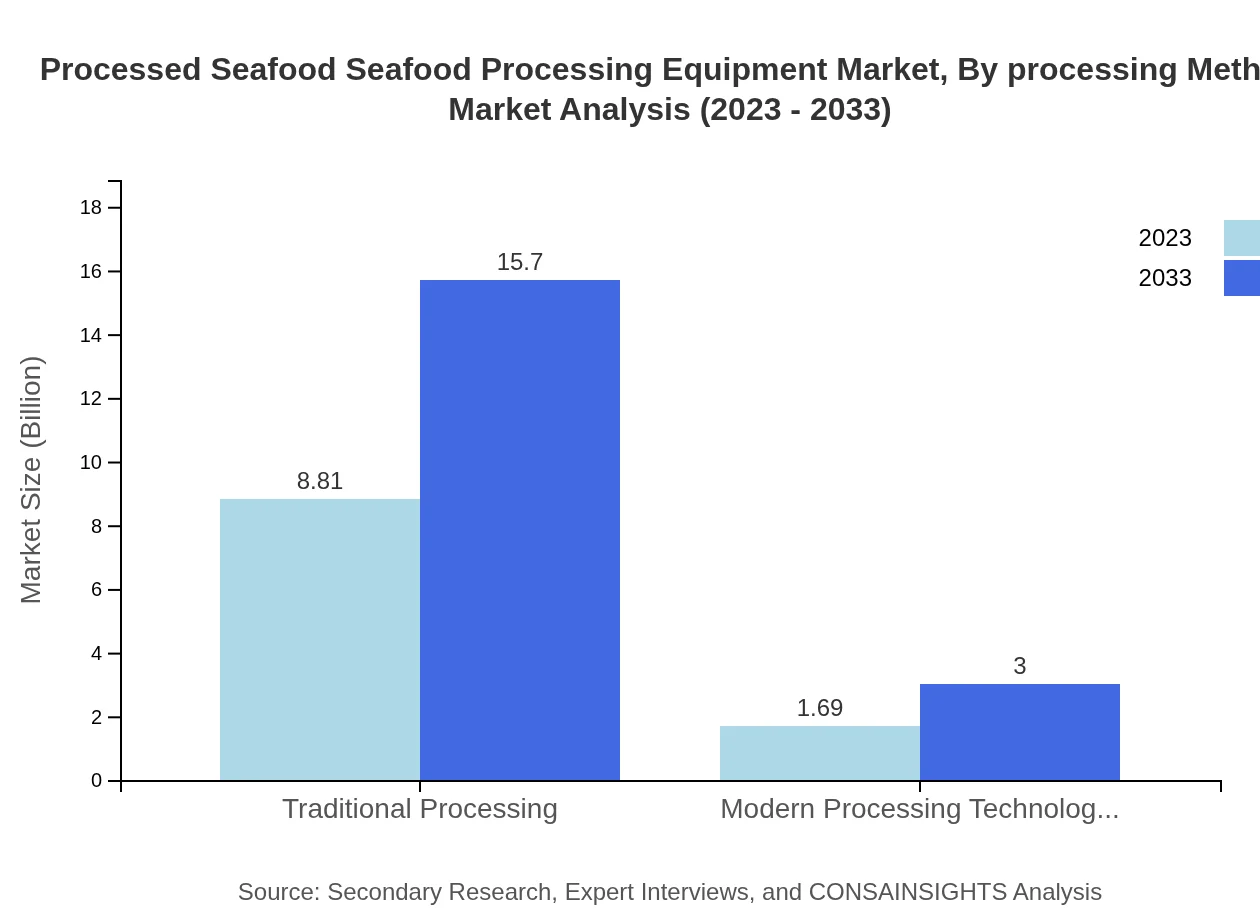

Processed Seafood Seafood Processing Equipment Market Analysis By Processing Method

Traditional processing remains dominant, holding an 83.94% market share in 2023. However, modern processing technologies, albeit at a lower market size of 1.69 billion USD, are expected to grow to 3.00 billion USD over the forecast period due to rising demand for efficient and safe processing methods.

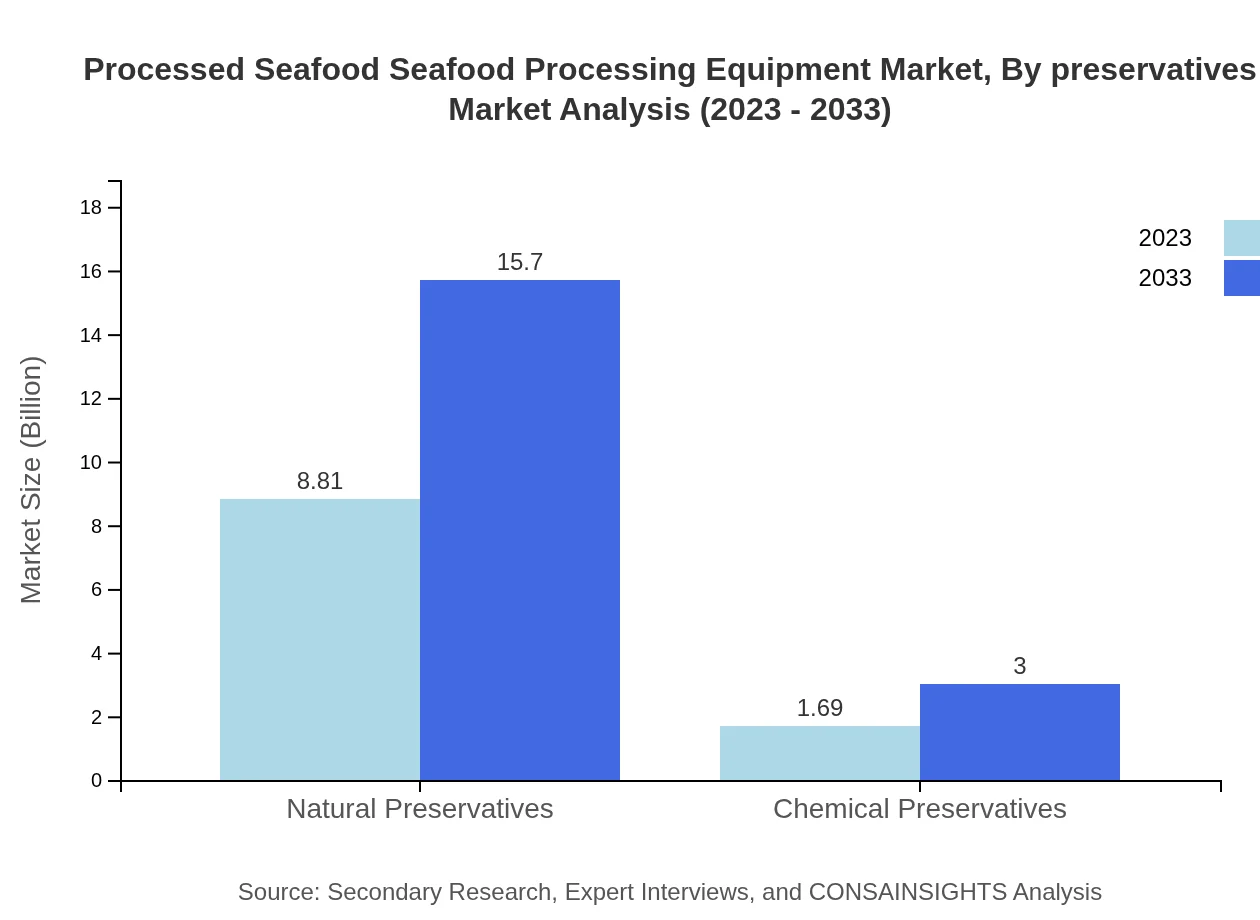

Processed Seafood Seafood Processing Equipment Market Analysis By Preservatives

Natural preservatives dominate the market with 83.94% market share and a growth projection from 8.81 billion USD in 2023 to 15.70 billion USD by 2033. Chemical preservatives are growing slowly, reflecting consumer preferences leaning toward healthier options.

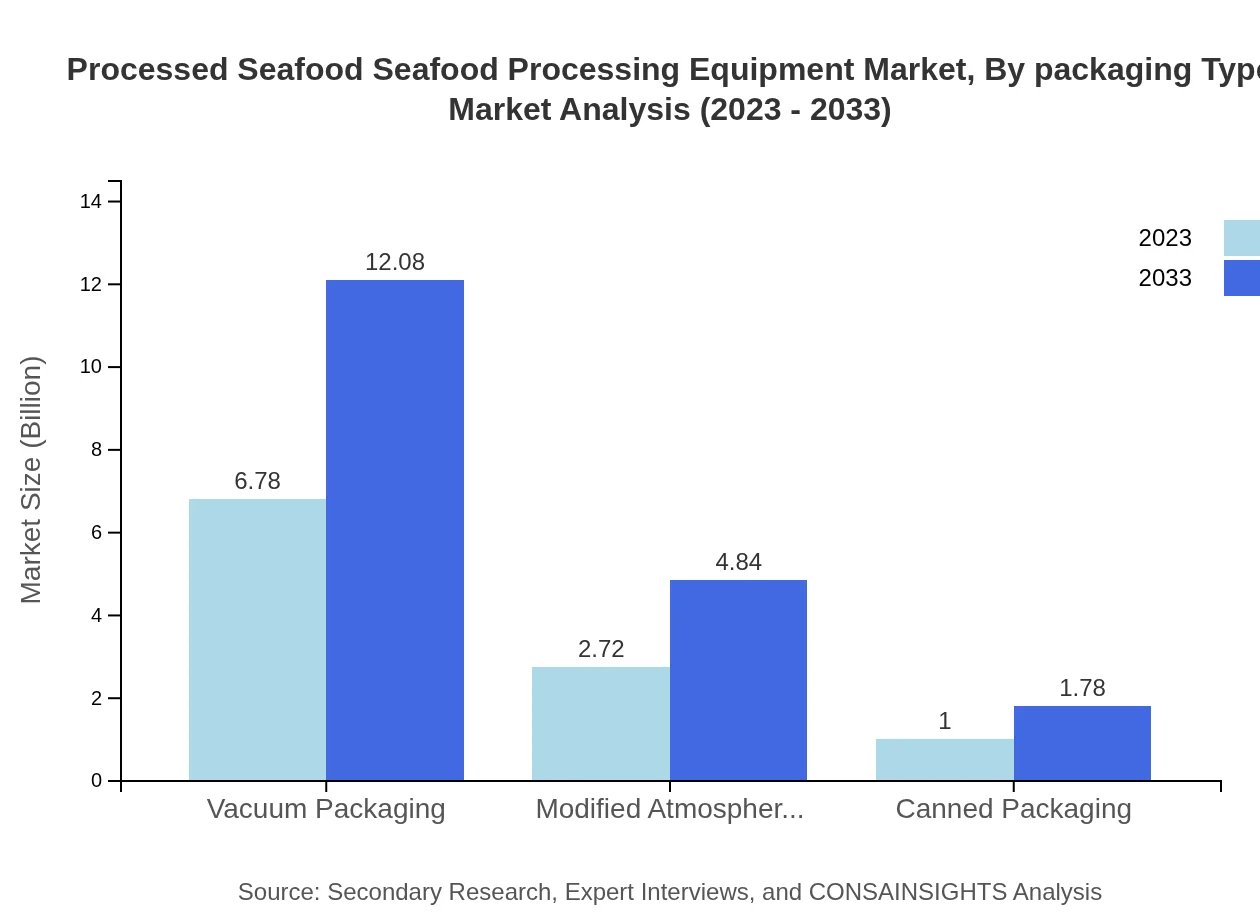

Processed Seafood Seafood Processing Equipment Market Analysis By Packaging Type

Packaging technologies like vacuum packaging lead the way, with expected market growth from 6.78 billion USD to 12.08 billion USD. However, modified atmosphere packaging is gaining traction, with a significant increase from 2.72 billion USD to 4.84 billion USD, driven by sustainability trends.

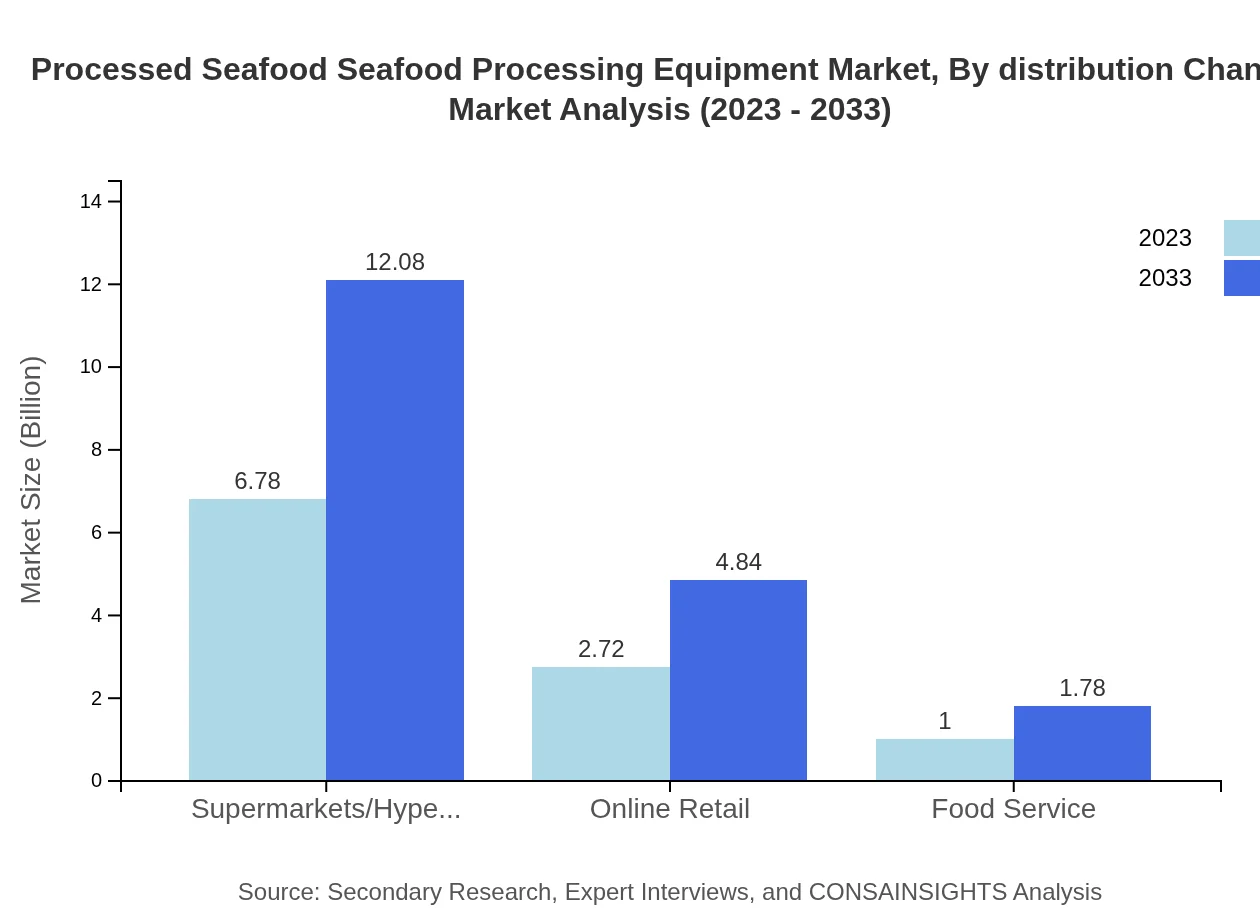

Processed Seafood Seafood Processing Equipment Market Analysis By Distribution Channel

Supermarkets and hypermarkets account for a substantial share, expected to remain at 64.59% in 2023, while online retail channels show promising growth from 2.72 billion USD to 4.84 billion USD due to increasing e-commerce trends in food sales.

Processed Seafood Seafood Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Processed Seafood Seafood Processing Equipment Industry

Company A:

A leading provider of processed seafood technologies, Company A specializes in innovative equipment solutions designed to enhance production efficiency and quality.Company B:

Company B focuses on sustainable seafood processing solutions and plays a significant role in advancing food technology in the seafood industry.We're grateful to work with incredible clients.

FAQs

What is the market size of processed Seafood Seafood Processing Equipment?

The processed seafood seafood processing equipment market is valued at approximately $10.5 billion in 2023, with a projected growth at a CAGR of 5.8% through to 2033, indicating significant potential for expansion within the industry.

What are the key market players or companies in this processed Seafood Seafood Processing Equipment industry?

Key players in the processed seafood seafood processing equipment industry include leading manufacturers specializing in high-efficiency processing machinery, automation technology, and sustainable packaging solutions catering to the growing demand for processed seafood products.

What are the primary factors driving the growth in the processed Seafood Seafood Processing Equipment industry?

Growth drivers include increasing consumer demand for convenience food, rising awareness of health benefits associated with seafood, technological advancements in processing equipment, and expansion in the distribution channels, facilitating broader market access.

Which region is the fastest Growing in the processed Seafood Seafood Processing Equipment?

The fastest-growing region is North America, projected to rise from $3.65 billion in 2023 to $6.50 billion by 2033, driven by robust demand for processed seafood and advancements in processing technologies.

Does ConsaInsights provide customized market report data for the processed Seafood Seafood Processing Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs in the processed seafood seafood processing equipment industry, allowing stakeholders to make informed decisions based on detailed market insights.

What deliverables can I expect from this processed Seafood Seafood Processing Equipment market research project?

Deliverables typically include comprehensive market analysis reports, detailed segment data, regional insights, competitive landscape assessments, and forecasts that assist businesses in strategic planning and operational adjustments.

What are the market trends of processed Seafood Seafood Processing Equipment?

Key trends indicate a shift toward sustainable packaging solutions, advances in automation technology, increasing use of natural preservatives, and a rising preference for online retail platforms as consumers embrace convenience and eco-friendliness in food procurement.