Processors For Iot And Wearables Market Report

Published Date: 31 January 2026 | Report Code: processors-for-iot-and-wearables

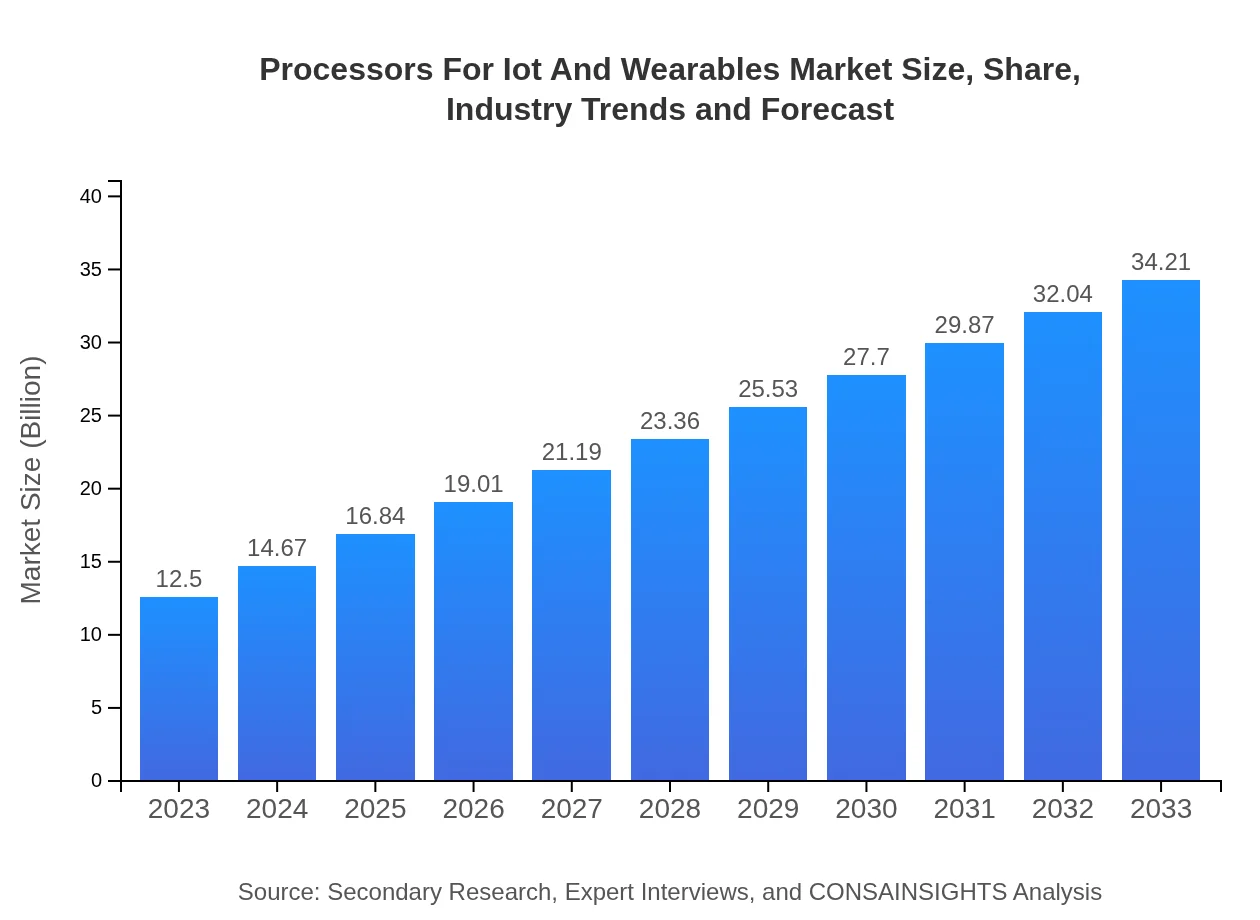

Processors For Iot And Wearables Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Processors for IoT and Wearables market, covering key insights, market size, regional analysis, and future forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $34.21 Billion |

| Top Companies | Qualcomm , Intel, NXP Semiconductors, Texas Instruments |

| Last Modified Date | 31 January 2026 |

Processors For IoT And Wearables Market Overview

Customize Processors For Iot And Wearables Market Report market research report

- ✔ Get in-depth analysis of Processors For Iot And Wearables market size, growth, and forecasts.

- ✔ Understand Processors For Iot And Wearables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Processors For Iot And Wearables

What is the Market Size & CAGR of Processors For IoT And Wearables market in 2023?

Processors For IoT And Wearables Industry Analysis

Processors For IoT And Wearables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Processors For IoT And Wearables Market Analysis Report by Region

Europe Processors For Iot And Wearables Market Report:

The European market is anticipated to grow from $3.52 billion in 2023 to $9.64 billion by 2033. The focus on sustainability and energy-efficient technology drives demand for processors tailored for environmentally conscious products.Asia Pacific Processors For Iot And Wearables Market Report:

The Asia Pacific region is projected to witness substantial growth as a hub for technology manufacturing, with the market estimated to grow from $2.60 billion in 2023 to $7.12 billion by 2033. The increase in the number of smart device manufacturers and the rise of IoT solutions in smart cities are driving factors for this growth.North America Processors For Iot And Wearables Market Report:

North America holds a significant share of the market, with estimates of growth from $4.48 billion in 2023 to $12.25 billion by 2033. The region's advanced technological landscape and emphasis on innovation in IoT devices contribute to its strong growth potential.South America Processors For Iot And Wearables Market Report:

In South America, the market is expected to expand from $0.28 billion in 2023 to $0.76 billion in 2033. The growth is likely to be supported by the increasing adoption of wearable technology in fitness and healthcare applications.Middle East & Africa Processors For Iot And Wearables Market Report:

In the Middle East and Africa, the market is expected to expand from $1.62 billion in 2023 to $4.43 billion by 2033. The growth is driven by increased investments in smart infrastructure and IoT initiatives in the region.Tell us your focus area and get a customized research report.

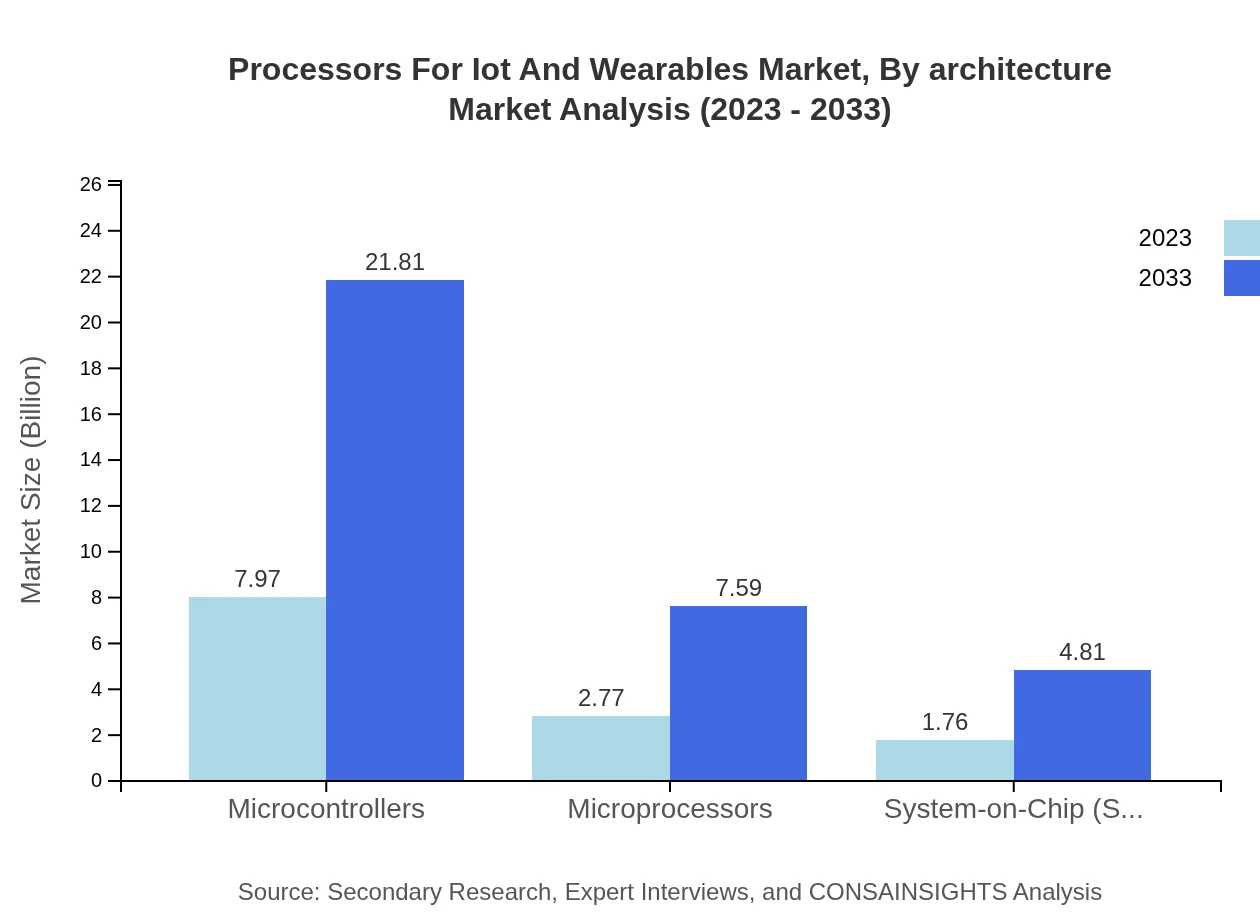

Processors For Iot And Wearables Market Analysis By Architecture

The architecture segment of the Processors for IoT and Wearables market includes microcontrollers, microprocessors, and System-on-Chip (SoC) solutions. Microcontrollers dominate the market, particularly for low-power applications, while microprocessors are preferred for higher processing tasks. SoCs are gaining traction due to their compact design, enabling seamless integration in various devices.

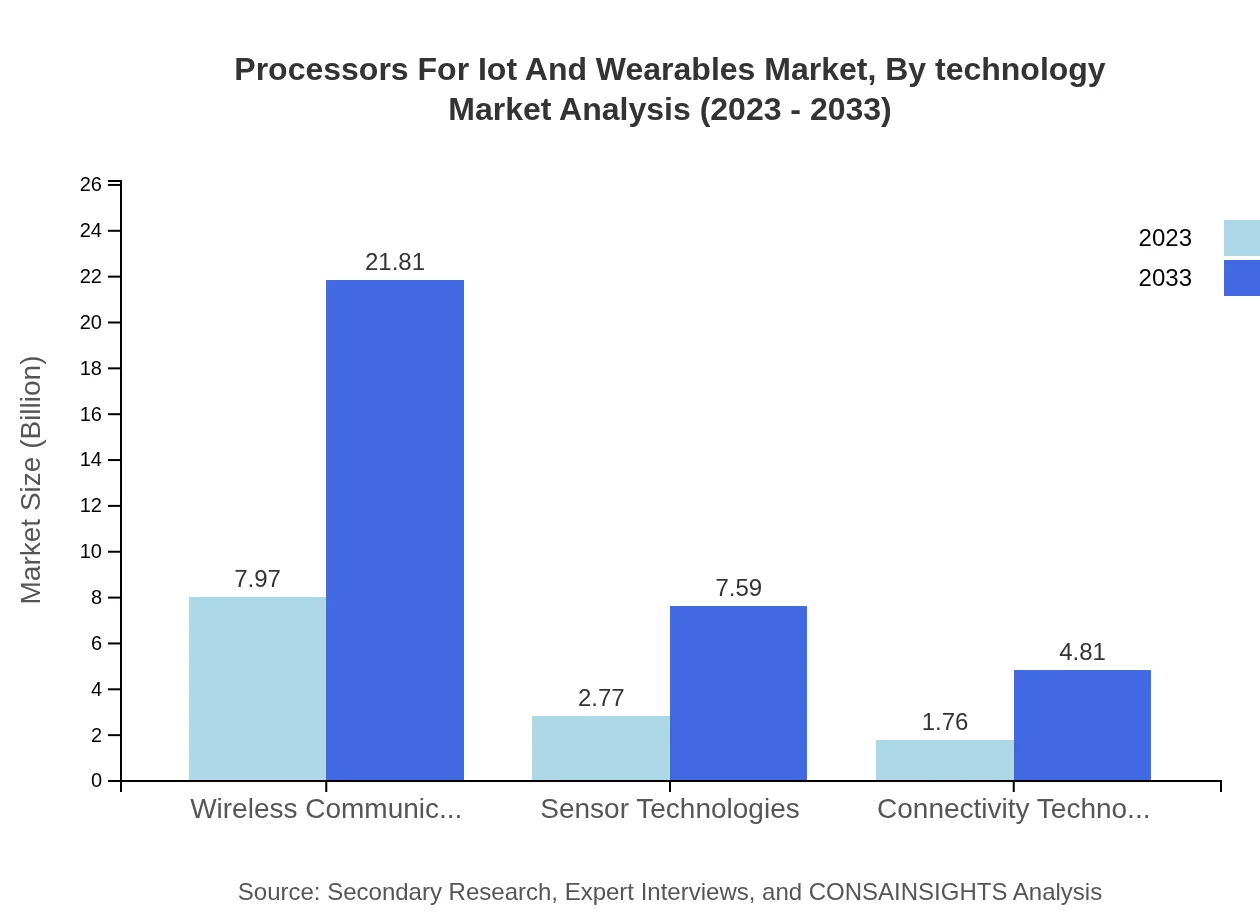

Processors For Iot And Wearables Market Analysis By Technology

The technology segment encapsulates various innovations that enhance device performance and connectivity. Key areas include wireless communication technologies, which account for 63.75% of the market share, and sensor technologies, instrumental in real-time data collection for applications across industries.

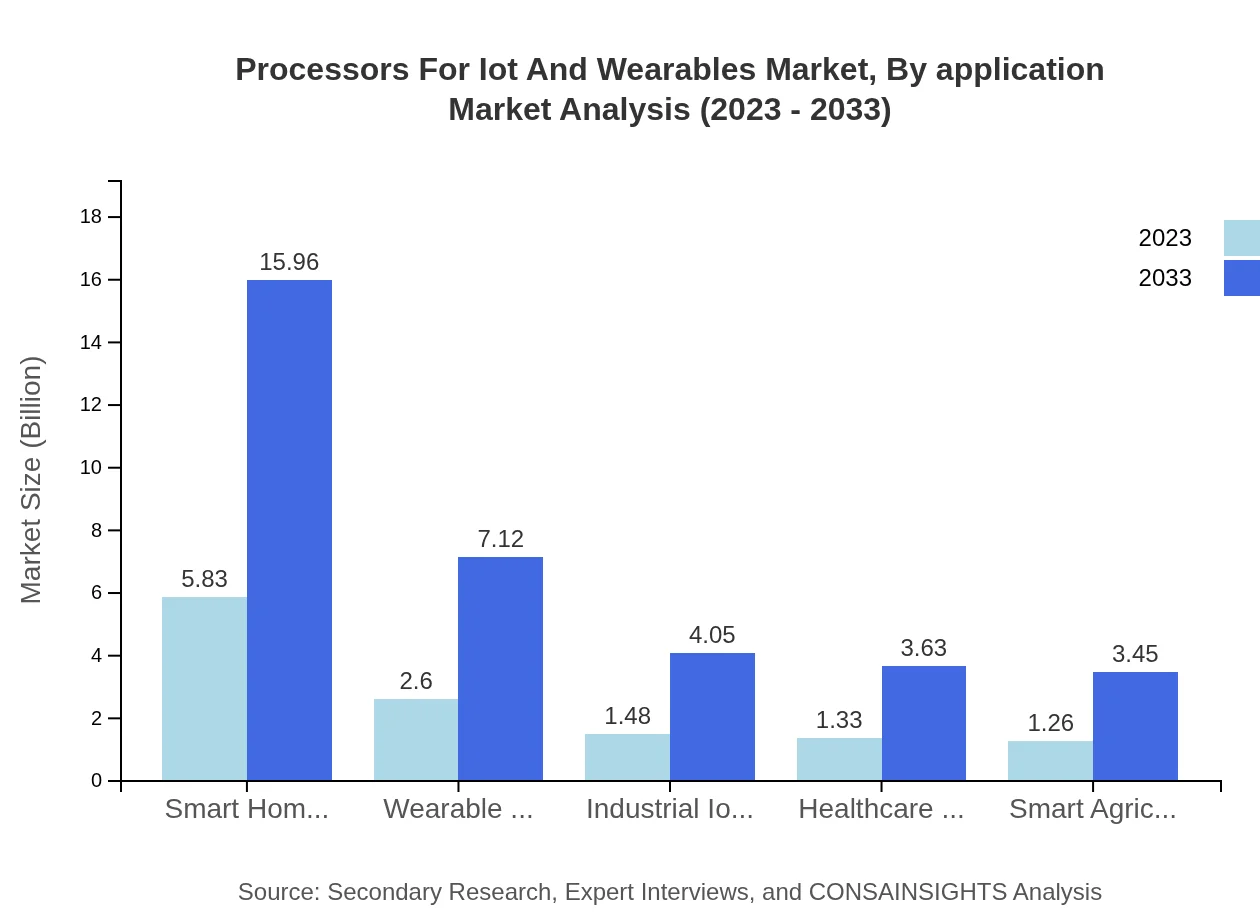

Processors For Iot And Wearables Market Analysis By Application

The application segment reveals diverse utilization in consumer electronics, healthcare, automotive, and smart home devices. Consumer electronics, led by the demand for smartphones and wearables, holds a significant market share, while healthcare applications are driving growth through health monitoring devices.

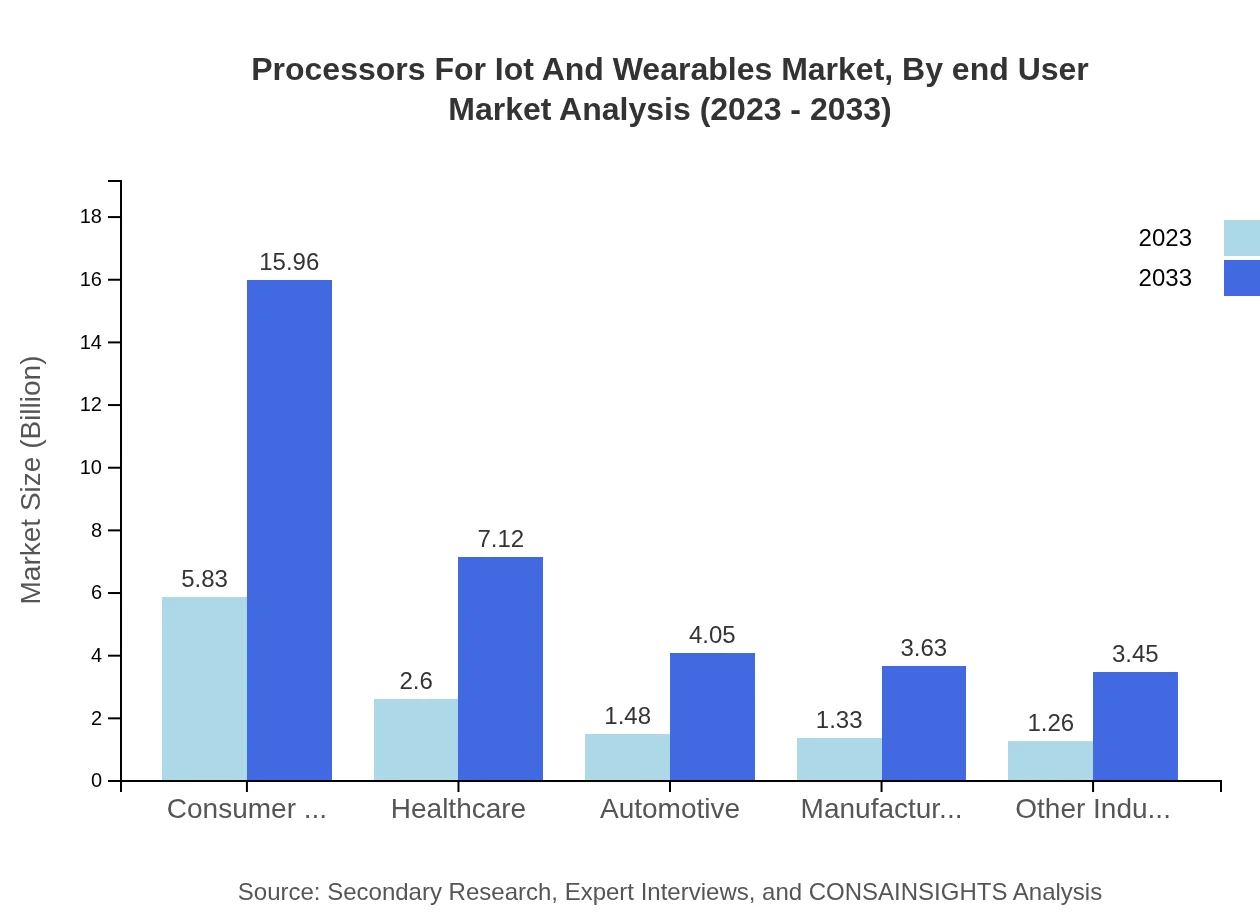

Processors For Iot And Wearables Market Analysis By End User

End-user segmentation shows strong demand in sectors such as manufacturing, healthcare, and automotive, driven by the push for automation and data-driven decision-making. With increasing adoption rates, these sectors are expected to significantly influence market dynamics in the coming years.

Processors For IoT And Wearables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Processors For IoT And Wearables Industry

Qualcomm :

A leader in the mobile chip industry, Qualcomm provides processors that power a range of IoT devices, focusing on connectivity and processing power.Intel:

Known for its microprocessors, Intel is integrating its technology in wearable devices to enhance performance and capabilities.NXP Semiconductors:

NXP focuses on secure connectivity solutions for processors in IoT applications, making significant advancements in low-power technologies.Texas Instruments:

With a strong presence in analog and embedded processing, Texas Instruments delivers processors that cater to various applications within the IoT ecosystem.We're grateful to work with incredible clients.

FAQs

What is the market size of processors For Iot And Wearables?

The global market size of processors for IoT and wearables is projected to reach USD 12.5 billion by 2033, growing at a CAGR of 10.2% from 2023 to 2033. This indicates a robust demand driven by advancements in technology and widespread adoption.

What are the key market players or companies in this processors For Iot And Wearables industry?

Key players in the processors for IoT and wearables market include major technology companies such as Qualcomm, Intel, ARM, NXP Semiconductors, and Texas Instruments. These companies drive innovation and competitiveness within the market, influencing trends and product developments.

What are the primary factors driving the growth in the processors for iot and wearables industry?

Factors driving growth include increased demand for connected devices, advancements in wireless technologies, improved consumer electronics, and the rise in adoption of IoT solutions across industries. Particularly, wearable health devices are gaining traction among consumers.

Which region is the fastest Growing in the processors for iot and wearables market?

Asia-Pacific is anticipated to be the fastest-growing region, with market expansion from USD 2.60 billion in 2023 to USD 7.12 billion by 2033. This growth is propelled by a surge in IoT adoption and technological advancements across manufacturing and electronics sectors.

Does ConsaInsights provide customized market report data for the processors for iot and wearables industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the processors for IoT and wearables industry. Clients can request detailed insights addressing particular market segments, geographic regions, and competitive analysis.

What deliverables can I expect from this processors for iot and wearables market research project?

Deliverables from this market research project typically include a comprehensive market report, executive summary, detailed data analysis, trends forecast, regional insights, and actionable recommendations to guide business strategies in the processors for IoT and wearables sector.

What are the market trends of processors for iot and wearables?

Key market trends include the increasing integration of AI in wearables, the rising demand for smart home devices, enhancements in battery life, and the focus on health monitoring capabilities in wearables. These trends are reshaping product offerings and market dynamics.