Procurement As A Service Market Report

Published Date: 31 January 2026 | Report Code: procurement-as-a-service

Procurement As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Procurement As A Service market, offering insights into market trends, size, regional analysis, segmentation, and projections for the period 2023 - 2033.

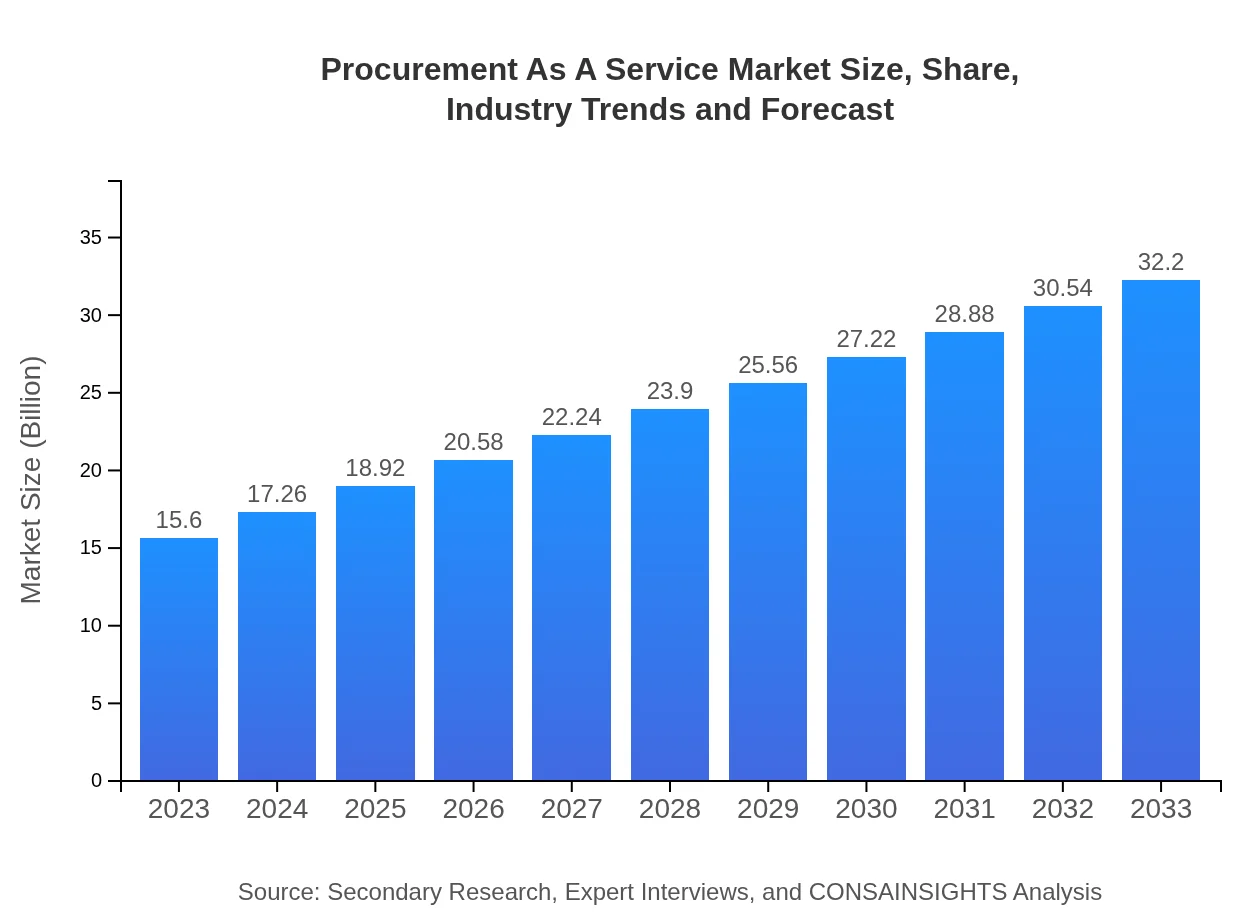

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $32.20 Billion |

| Top Companies | Accenture, Proxima, SAP Ariba, GEP |

| Last Modified Date | 31 January 2026 |

Procurement As A Service Market Overview

Customize Procurement As A Service Market Report market research report

- ✔ Get in-depth analysis of Procurement As A Service market size, growth, and forecasts.

- ✔ Understand Procurement As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Procurement As A Service

What is the Market Size & CAGR of Procurement As A Service market in 2023?

Procurement As A Service Industry Analysis

Procurement As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Procurement As A Service Market Analysis Report by Region

Europe Procurement As A Service Market Report:

Europe's market is expected to grow significantly from $4.90 billion in 2023 to $10.11 billion by 2033. The focus on sustainability and regulatory compliance is leading organizations to seek efficient procurement solutions, boosting market demand.Asia Pacific Procurement As A Service Market Report:

In the Asia Pacific region, the Procurement As A Service market is poised for substantial growth, expanding from $2.98 billion in 2023 to $6.15 billion by 2033. The proliferation of digital technologies and increasing governmental support for business digitization initiatives are driving this growth.North America Procurement As A Service Market Report:

The North American market is anticipated to be the largest, reaching $10.89 billion in 2033 from $5.28 billion in 2023. High adoption rates of innovative technologies and an increase in the number of service providers in this region will contribute to its robust growth.South America Procurement As A Service Market Report:

The South American market is expected to experience moderate growth, rising from $0.41 billion in 2023 to $0.85 billion by 2033. Factors such as increasing globalization of supply chains and advancements in procurement technologies will drive the adoption of PaaS in this region.Middle East & Africa Procurement As A Service Market Report:

The Middle East and Africa market will grow from $2.03 billion in 2023 to $4.20 billion by 2033. Increasing investments in infrastructure and digital solutions across various sectors are creating a conducive environment for PaaS adoption in this region.Tell us your focus area and get a customized research report.

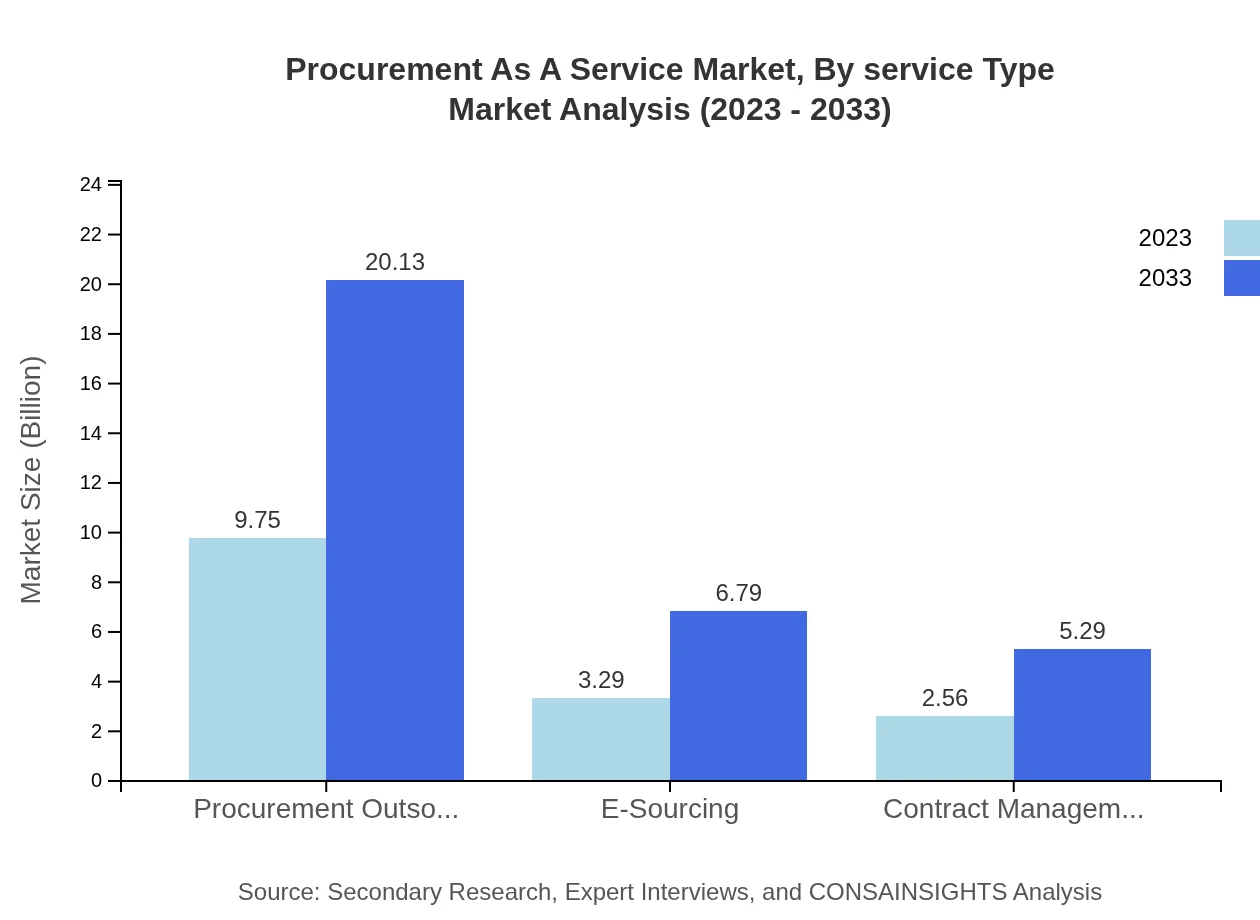

Procurement As A Service Market Analysis By Service Type

The market segmentation by service type includes procurement outsourcing, e-sourcing, and contract management. Procurement outsourcing is expected to dominate the market with a 62.51% share, while e-sourcing and contract management also play significant roles in enhancing procurement efficiency across various industries.

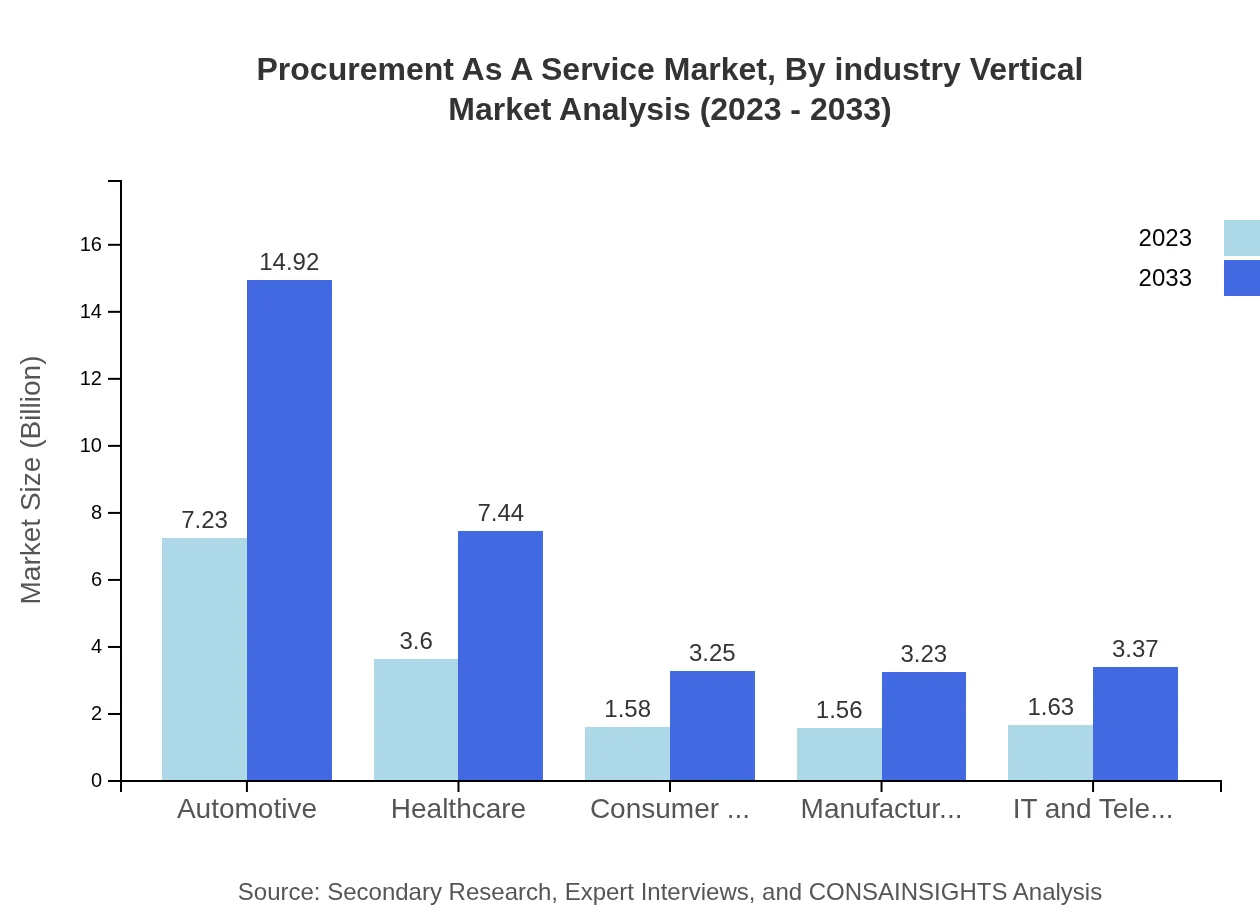

Procurement As A Service Market Analysis By Industry Vertical

Among industry verticals, the automotive sector leads with a market size of $7.23 billion in 2023, accounting for 46.32% of the overall market share. Healthcare follows closely, showcasing substantial growth potential, especially with advancements in digital health solutions.

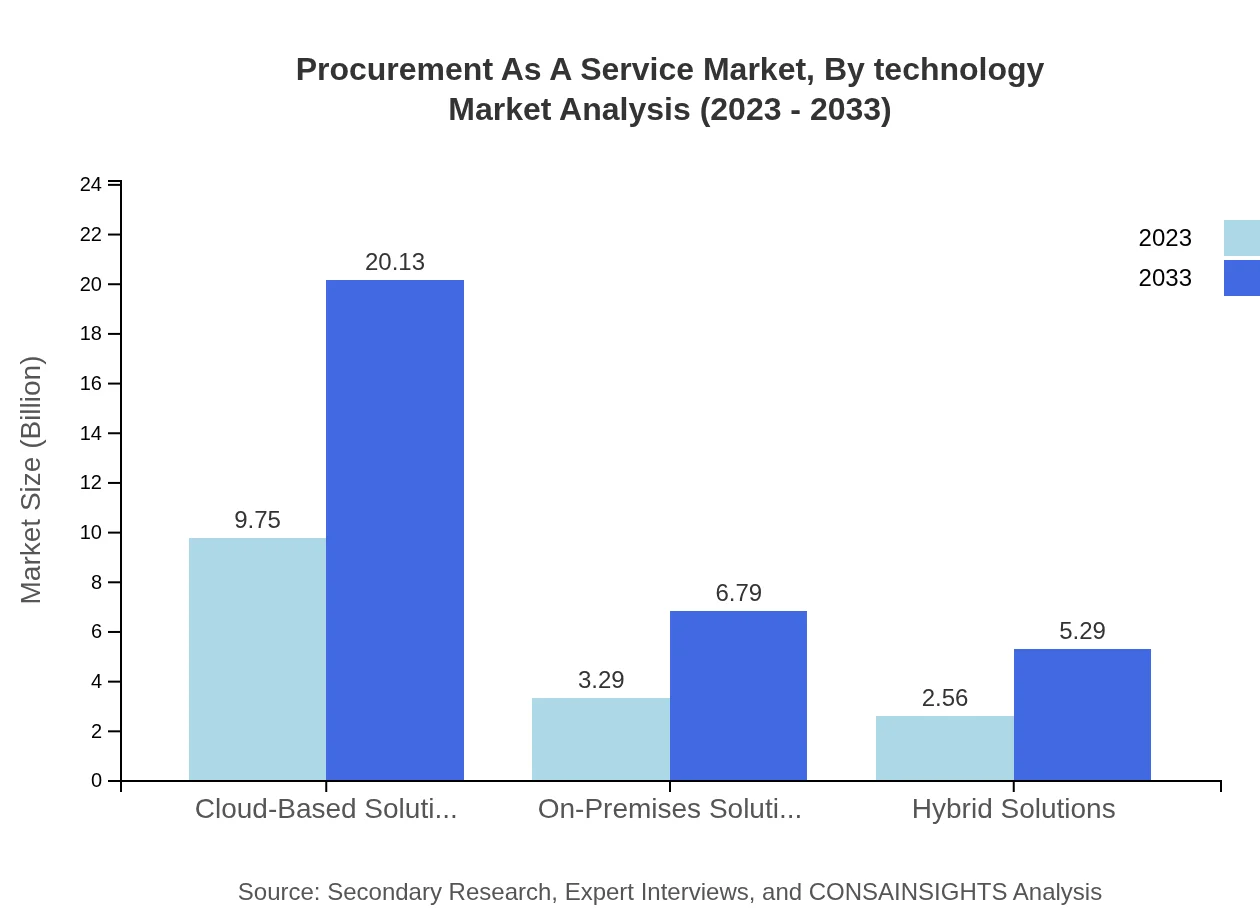

Procurement As A Service Market Analysis By Technology

Cloud-based solutions dominate the technology segment, representing over 62.51% of the market share due to their scalability and flexibility. On-premises and hybrid solutions are slowly gaining traction as businesses explore different implementation strategies for procurement.

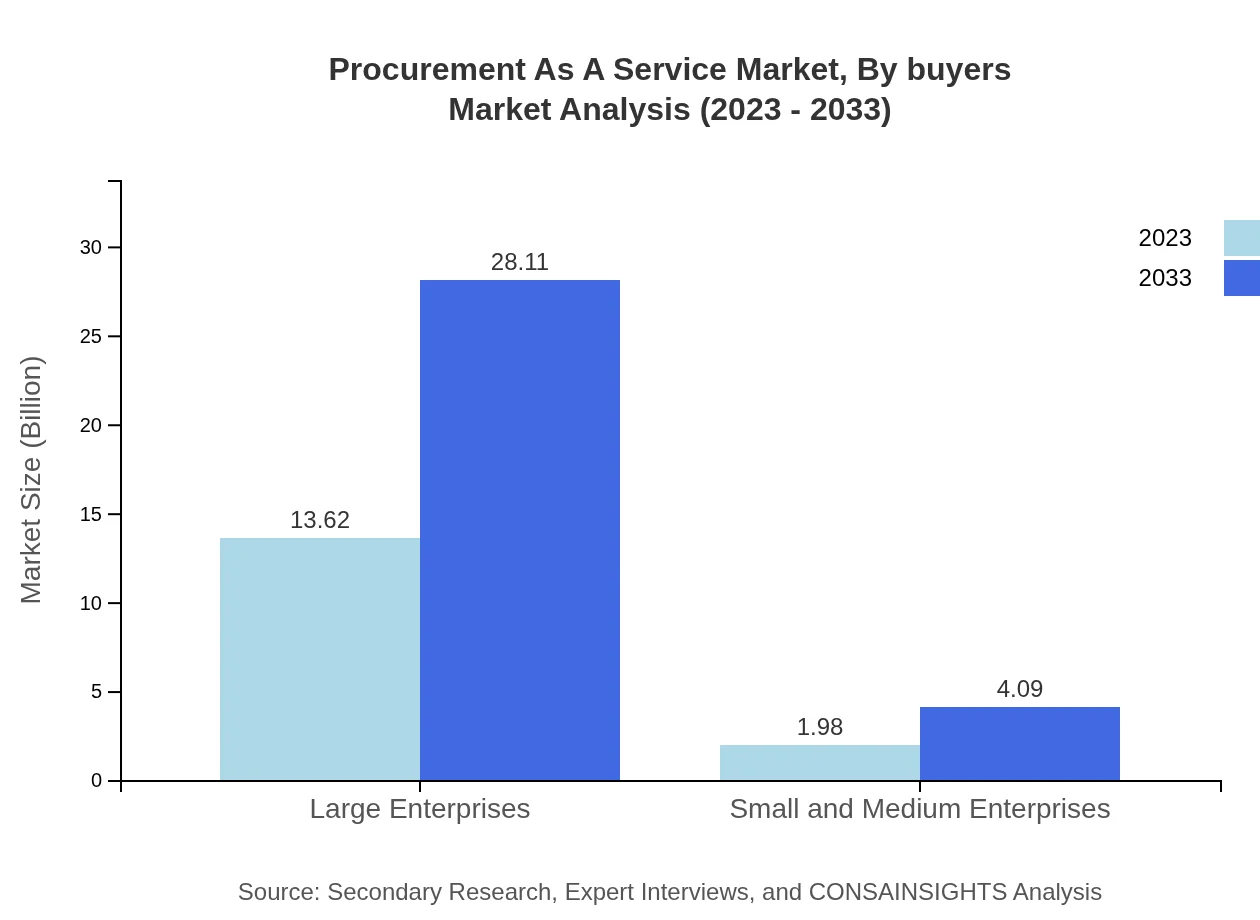

Procurement As A Service Market Analysis By Buyers

Large enterprises represent the bulk of the customer base in the Procurement As A Service market, with a 87.29% share in terms of revenue. Small and medium enterprises are increasingly seeking outsourced procurement solutions to optimize their operations and drive growth.

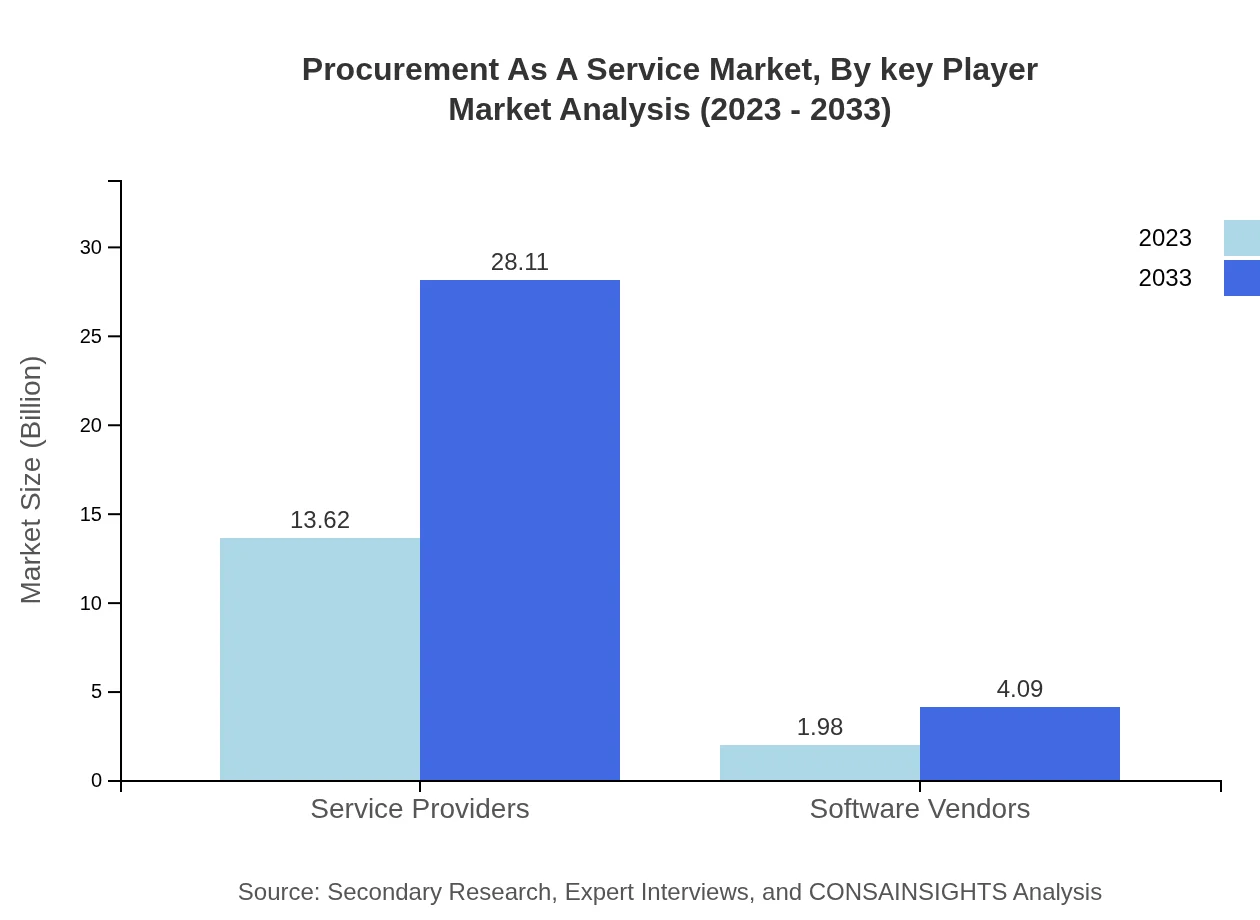

Procurement As A Service Market Analysis By Key Player

Key players in the Procurement As A Service space include major firms offering comprehensive solutions tailored to various industries. These companies are driving innovation in procurement through technology and service enhancements.

Procurement As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Procurement As A Service Industry

Accenture:

Accenture is a leading global professional services company providing consulting and technology services, with a strong focus on procurement solutions tailored for diverse industries.Proxima:

Proxima is an established procurement consultancy that specializes in providing strategic procurement services, helping clients improve purchasing efficiency and supplier relationships.SAP Ariba:

SAP Ariba offers cloud-based procurement solutions that facilitate efficient sourcing and spend management, empowering organizations to streamline procurement operations.GEP:

GEP is a global provider of procurement software and services, known for its innovative approach and strong service delivery across industries.We're grateful to work with incredible clients.

FAQs

What is the market size of procurement As A Service?

The procurement-as-a-service market is currently valued at approximately $15.6 billion with a projected compound annual growth rate (CAGR) of 7.3%. By 2033, it is expected to significantly expand, highlighting its growing importance in business operations.

What are the key market players or companies in this procurement As A Service industry?

Key players in the procurement-as-a-service market include prominent companies such as Accenture, IBM, GEP Worldwide, and Ariba. Their innovative solutions and extensive networks enhance procurement processes for various sectors.

What are the primary factors driving the growth in the procurement As A Service industry?

The growth in procurement-as-a-service is driven by increasing demand for cost savings, efficiency gains through automation, and flexibility in procurement processes. Furthermore, businesses are looking for strategic advantages and improved supplier management.

Which region is the fastest Growing in the procurement As A Service?

Europe is the fastest-growing region in the procurement-as-a-service market, expected to grow from $4.90 billion in 2023 to $10.11 billion by 2033. This growth is propelled by increased adoption of digital procurement solutions.

Does ConsaInsights provide customized market report data for the procurement As A Service industry?

Yes, ConsaInsights offers customized market report data for the procurement-as-a-service industry. Clients can request tailored reports that provide specific insights based on their unique needs and market focus.

What deliverables can I expect from this procurement As A Service market research project?

Deliverables from the procurement-as-a-service market research project typically include comprehensive market analysis, competitive landscape assessments, trend analysis, and actionable insights that support strategic decision-making.

What are the market trends of procurement As A Service?

Market trends in procurement-as-a-service include a growing preference for cloud-based solutions, the rise of e-sourcing platforms, and increased emphasis on data analytics to drive procurement efficiencies. These trends demonstrate a digital transformation within the sector.