Procurement Software Market Report

Published Date: 31 January 2026 | Report Code: procurement-software

Procurement Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Procurement Software market, detailing various insights on market size, growth trends, regional performance, and technological advancements from 2023 to 2033.

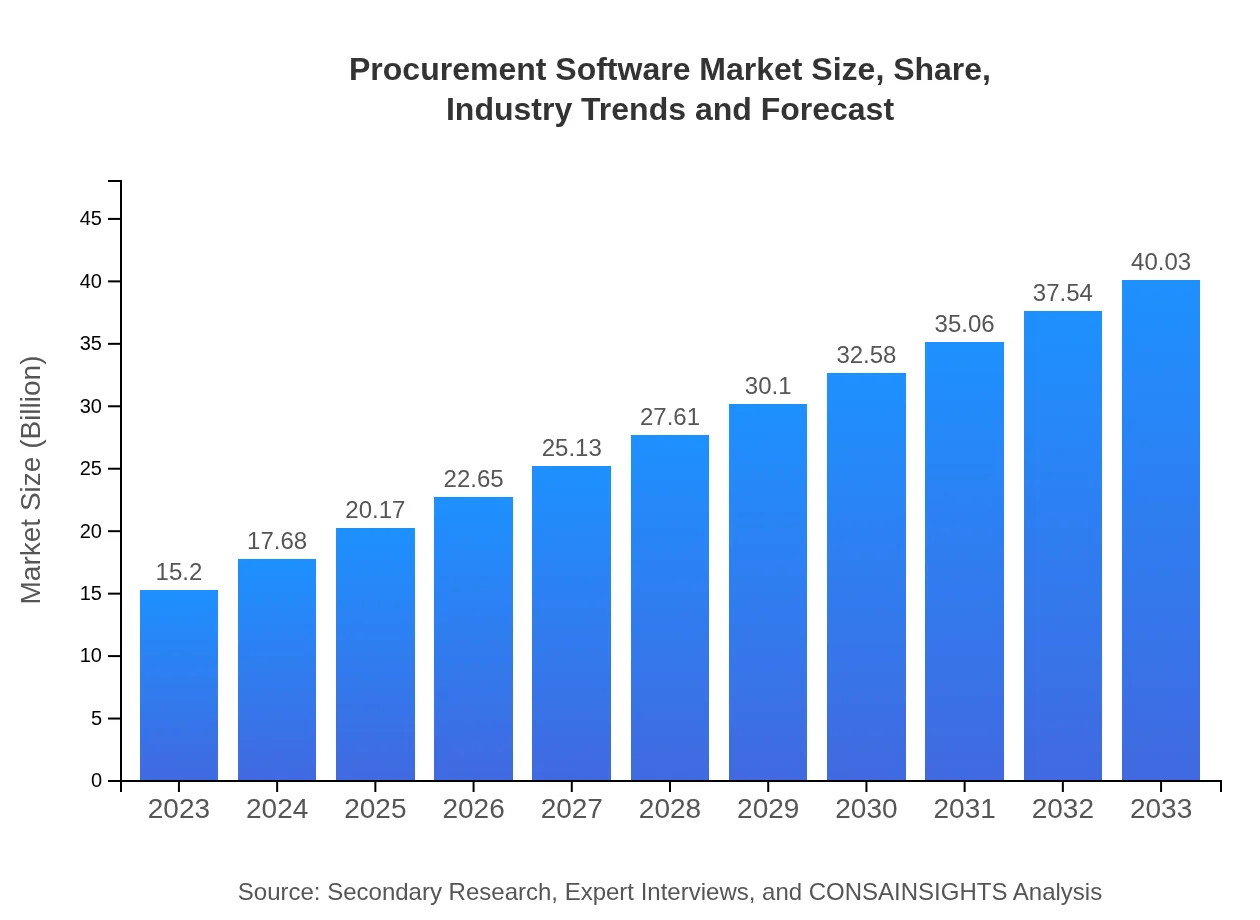

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $40.03 Billion |

| Top Companies | SAP, Oracle, Coupa, Jaggaer |

| Last Modified Date | 31 January 2026 |

Procurement Software Market Overview

Customize Procurement Software Market Report market research report

- ✔ Get in-depth analysis of Procurement Software market size, growth, and forecasts.

- ✔ Understand Procurement Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Procurement Software

What is the Market Size & CAGR of Procurement Software market in 2023?

Procurement Software Industry Analysis

Procurement Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Procurement Software Market Analysis Report by Region

Europe Procurement Software Market Report:

Europe's market is projected to grow from $4.03 billion in 2023 to $10.62 billion by 2033. The rising compliance requirements and digital transformation initiatives across various sectors are fostering demand for sophisticated procurement solutions in this region.Asia Pacific Procurement Software Market Report:

The Asia Pacific region is witnessing rapid growth in the Procurement Software market, with the market size projected to increase from $2.99 billion in 2023 to $7.86 billion by 2033. This growth can be attributed to the rise of SMEs adopting digital procurement solutions to improve operational efficiency and cost management.North America Procurement Software Market Report:

North America remains the largest market for Procurement Software, expected to increase from $5.34 billion in 2023 to $14.06 billion by 2033. The region's advanced technological infrastructure and a high concentration of key industry players contribute significantly to its market prominence.South America Procurement Software Market Report:

In South America, the market is anticipated to grow from $1.00 billion in 2023 to $2.63 billion by 2033. The increasing focus on enhancing procurement processes within governments and sectors adapting to technological requirements is driving this growth.Middle East & Africa Procurement Software Market Report:

In the Middle East and Africa, the market is expected to grow from $1.84 billion in 2023 to $4.85 billion by 2033. The increasing emphasis on automating procurement processes in industries such as oil and gas and construction is propelling this growth.Tell us your focus area and get a customized research report.

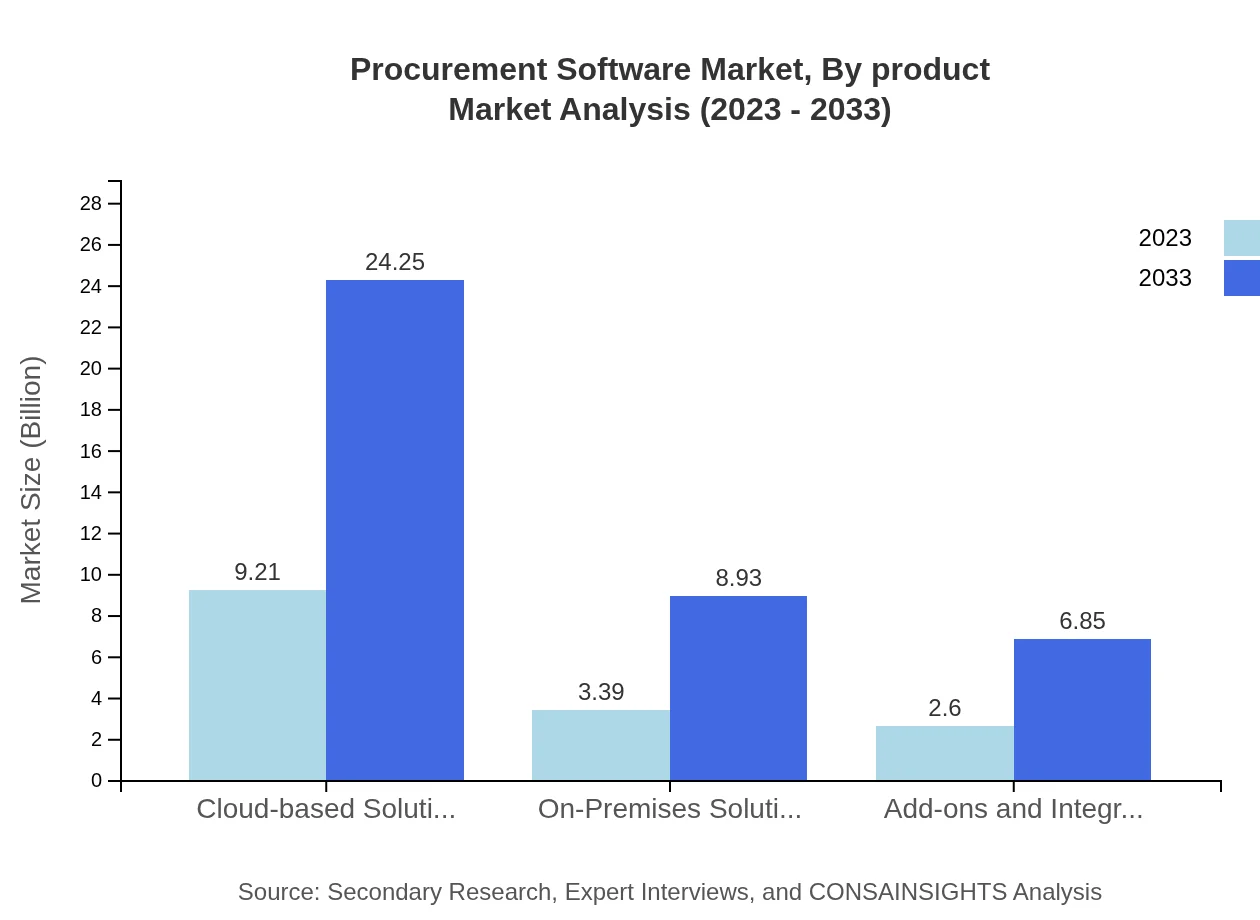

Procurement Software Market Analysis By Product

The Procurement Software market is led by cloud-based solutions, with expected growth from $9.21 billion in 2023 to $24.25 billion by 2033. These solutions dominate due to their flexibility and integration capabilities. On-premises solutions currently hold a significant market share but are projected to grow at a slower rate, from $3.39 billion to $8.93 billion during the same period.

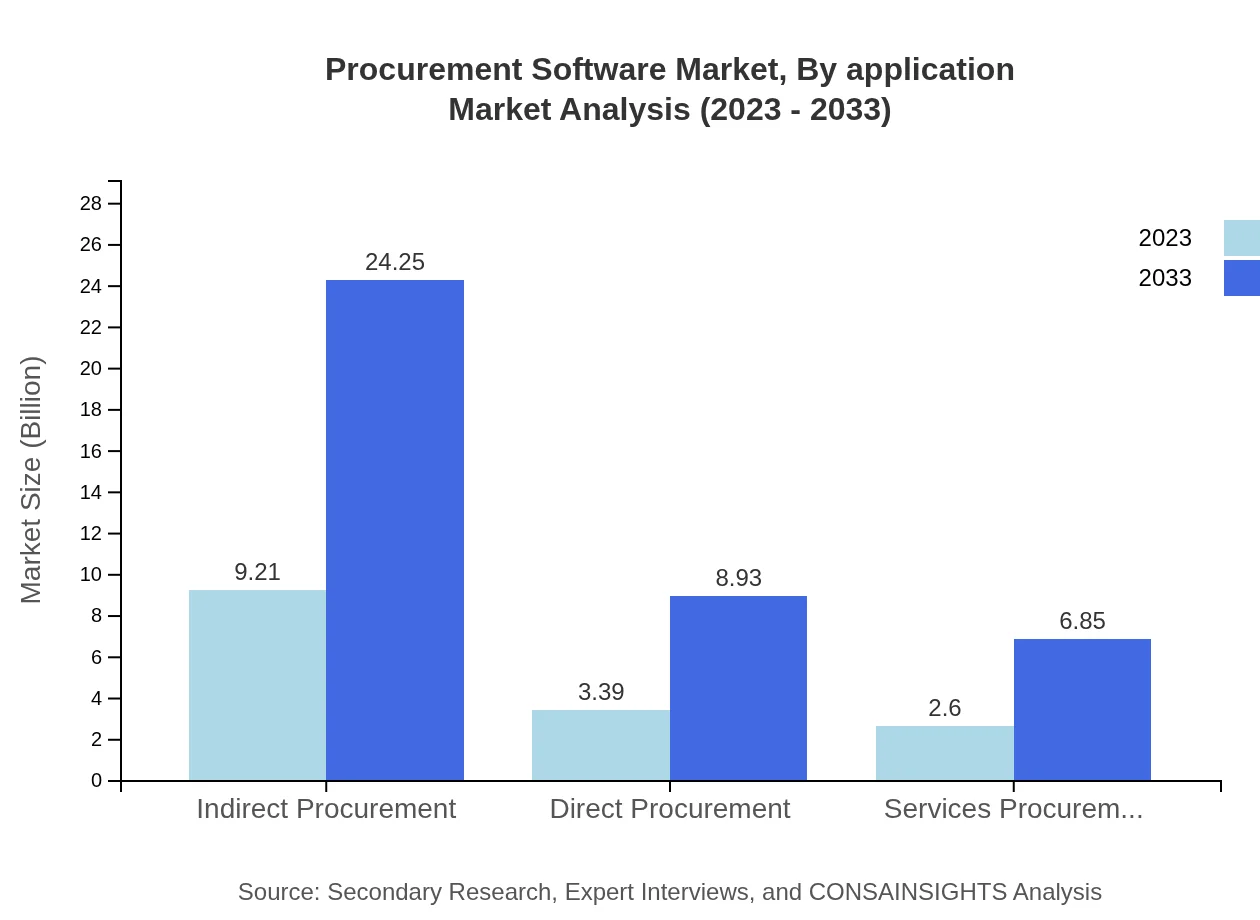

Procurement Software Market Analysis By Application

Applications in the Procurement Software market encompass indirect and direct procurement, with indirect procurement leading the market. It is expected to rise from $9.21 billion in 2023 to $24.25 billion by 2033, reflecting a steady adoption trend. Direct procurement solutions will also see growth, increasing from $3.39 billion to $8.93 billion.

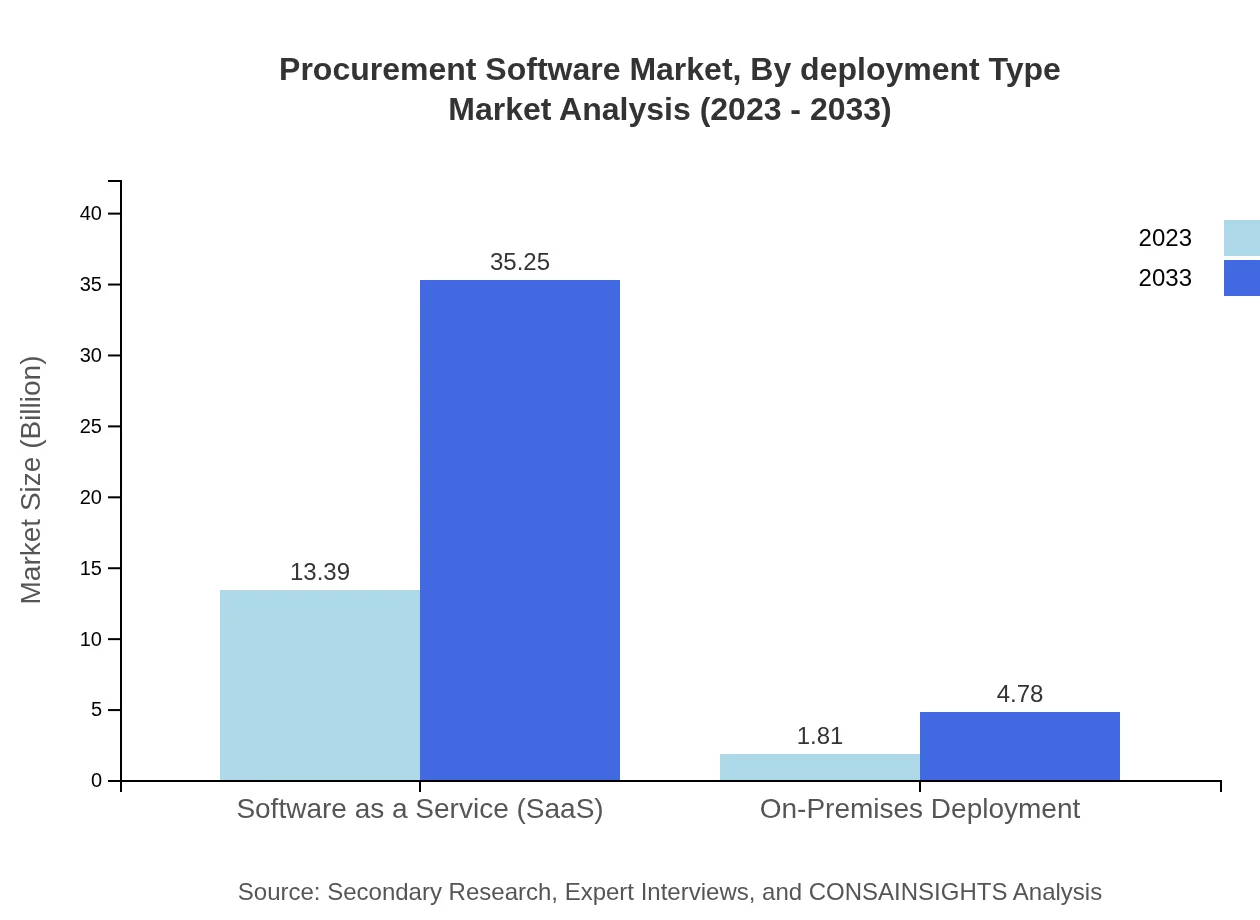

Procurement Software Market Analysis By Deployment Type

The deployment type segmentation reveals a strong inclination towards Software as a Service (SaaS), expected to grow from $13.39 billion in 2023 to $35.25 billion by 2033, dominating with an impressive 88.06% market share. On-premises deployment, while still relevant, is projected to experience slower growth, from $1.81 billion to $4.78 billion.

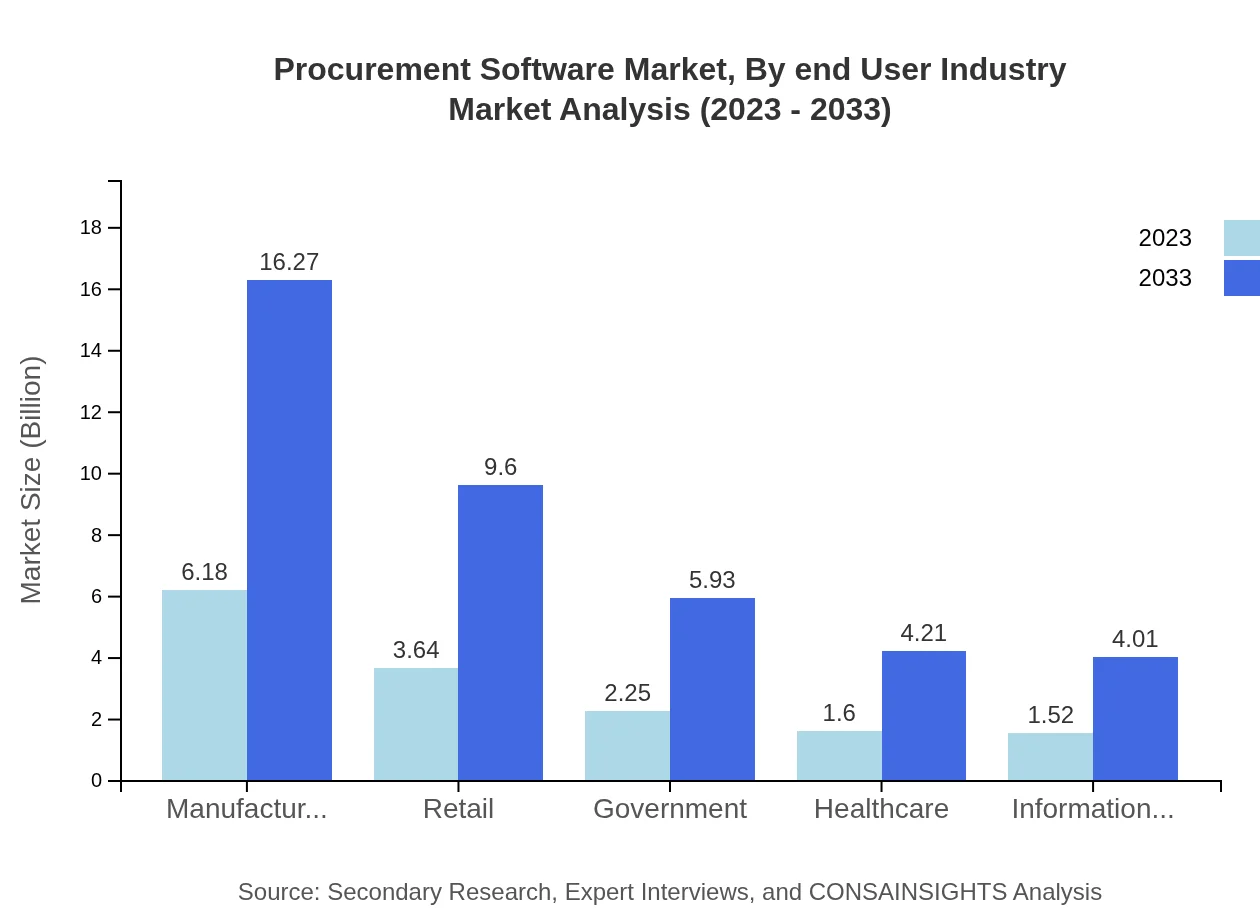

Procurement Software Market Analysis By End User Industry

The manufacturing sector is currently the largest end-user of procurement software, anticipated to grow from $6.18 billion to $16.27 billion over the forecast period. The retail sector and public government institutions are also key contributors, showing gradual growth trends, indicating a broadening adoption across diverse industries.

Procurement Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Procurement Software Industry

SAP:

SAP is a leading global provider of enterprise software, offering comprehensive procurement solutions that enable organizations to procure goods and services efficiently and cost-effectively.Oracle:

Oracle offers robust procurement software solutions that help organizations automate their purchasing processes, providing streamlined workflows and analytics for better decision-making.Coupa:

Coupa is known for its cloud-based spend management platform which includes procurement software features, aimed at providing visibility and control over procurement activities.Jaggaer:

Jaggaer specializes in procurement solutions for direct, indirect, and services procurement, delivering value through its comprehensive software suite tailored to enhance procurement competitiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of procurement Software?

The procurement software market size is projected to reach $15.2 billion by 2033, growing at a CAGR of 9.8% from $4.03 billion in Europe and $5.34 billion in North America in 2023.

What are the key market players or companies in this procurement Software industry?

Key players in the procurement software market include SAP Ariba, Oracle Procurement Cloud, Coupa Software, and Jaggaer. These companies dominate the industry with innovative solutions and a strong market presence.

What are the primary factors driving the growth in the procurement software industry?

Factors driving growth include increasing digitization, the need for efficiency and cost reduction, and the rise in eProcurement solutions. Companies seek to optimize supply chain management, leading to higher software adoption.

Which region is the fastest Growing in the procurement Software?

The Asia Pacific region is the fastest-growing in the procurement software market, expected to expand from $2.99 billion in 2023 to $7.86 billion by 2033, reflecting a surge in digital adoption and procurement practices.

Does Consalnsights provide customized market report data for the procurement Software industry?

Yes, Consalnsights provides customized market reports tailored to specific client needs within the procurement software industry, ensuring relevant insights and data adaptability.

What deliverables can I expect from this procurement Software market research project?

Deliverables will include detailed market insights, growth forecasts, competitive analysis, regional breakdowns, and segment data, offering comprehensive market evaluations for informed decision-making.

What are the market trends of procurement Software?

Current trends include the shift towards cloud-based solutions, an emphasis on automation and AI integration, and a growing focus on sustainability and compliance in procurement practices.