Product Lifecycle Management Market Report

Published Date: 31 January 2026 | Report Code: product-lifecycle-management

Product Lifecycle Management Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Product Lifecycle Management (PLM) market from 2023 to 2033. It includes insights on market size, industry dynamics, regional trends, and forecasts to help stakeholders make informed decisions.

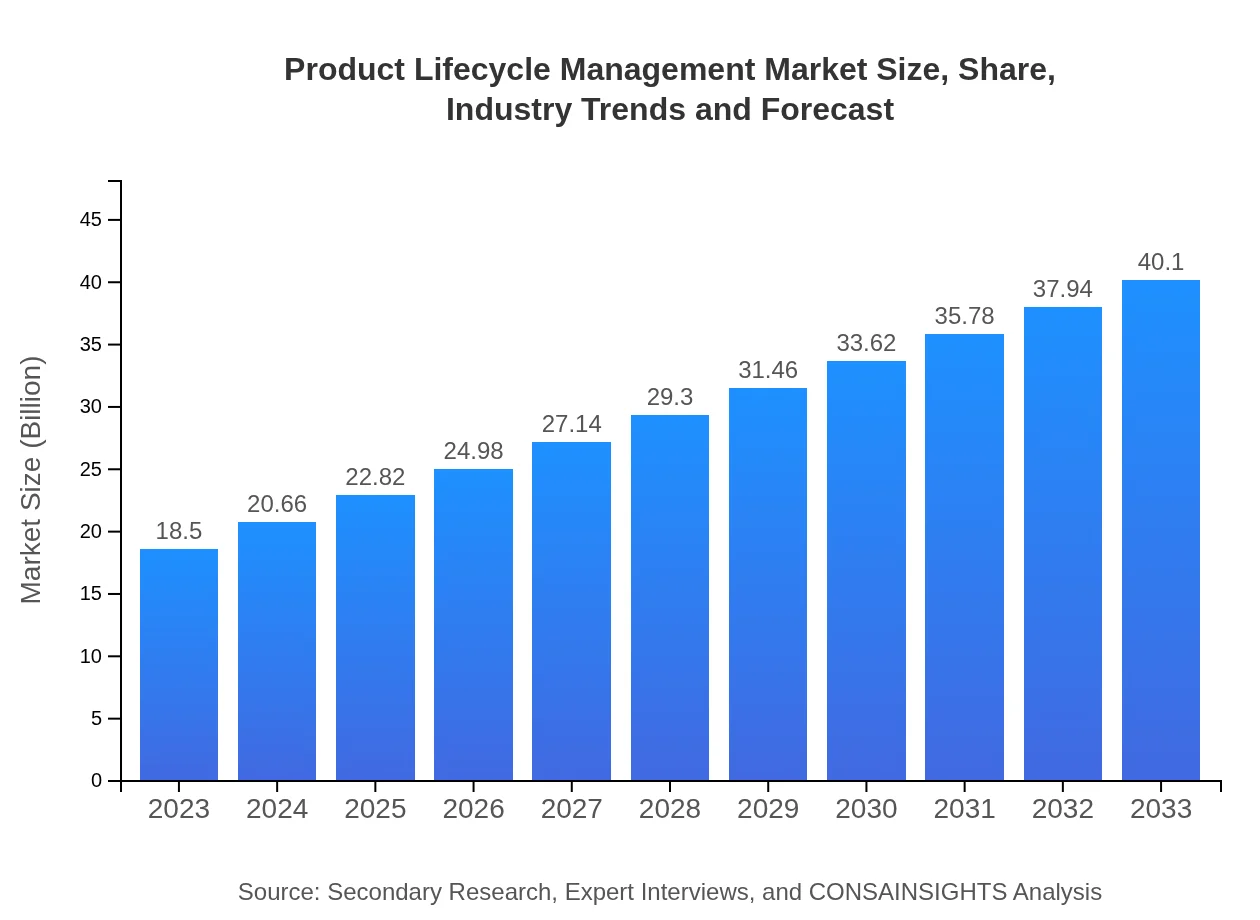

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $40.10 Billion |

| Top Companies | Siemens AG, PTC Inc., Dassault Systèmes, Oracle Corporation, SAP SE |

| Last Modified Date | 31 January 2026 |

Product Lifecycle Management Market Overview

Customize Product Lifecycle Management Market Report market research report

- ✔ Get in-depth analysis of Product Lifecycle Management market size, growth, and forecasts.

- ✔ Understand Product Lifecycle Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Product Lifecycle Management

What is the Market Size & CAGR of Product Lifecycle Management market in 2023?

Product Lifecycle Management Industry Analysis

Product Lifecycle Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Product Lifecycle Management Market Analysis Report by Region

Europe Product Lifecycle Management Market Report:

The European market is valued at $5.79 billion in 2023, projected to expand to $12.55 billion by 2033. The push for sustainability and compliance in product management is driving investment in PLM solutions across industries.Asia Pacific Product Lifecycle Management Market Report:

In the Asia Pacific region, the PLM market is valued at $3.83 billion in 2023, projected to grow to $8.31 billion by 2033. The growth is driven by the rapid industrialization and digital transformation across countries like China, Japan, and India. Enhanced focus on retail and manufacturing sectors is also noted.North America Product Lifecycle Management Market Report:

North America leads the PLM market with a valuation of $6.09 billion in 2023 and is anticipated to reach $13.21 billion by 2033. Strong technological infrastructure and the presence of key industry players significantly contribute to market growth.South America Product Lifecycle Management Market Report:

In South America, the market size is $1.30 billion for 2023, expected to reach $2.82 billion by 2033. Brazil and Argentina are leading the investment in PLM solutions as businesses aim to improve productivity and reduce operational inefficiencies.Middle East & Africa Product Lifecycle Management Market Report:

The Middle East and Africa are experiencing notable growth in the PLM market, with a current valuation of $1.48 billion and an expected increase to $3.22 billion in 2033. Investment in infrastructure and digital initiatives is facilitating this growth.Tell us your focus area and get a customized research report.

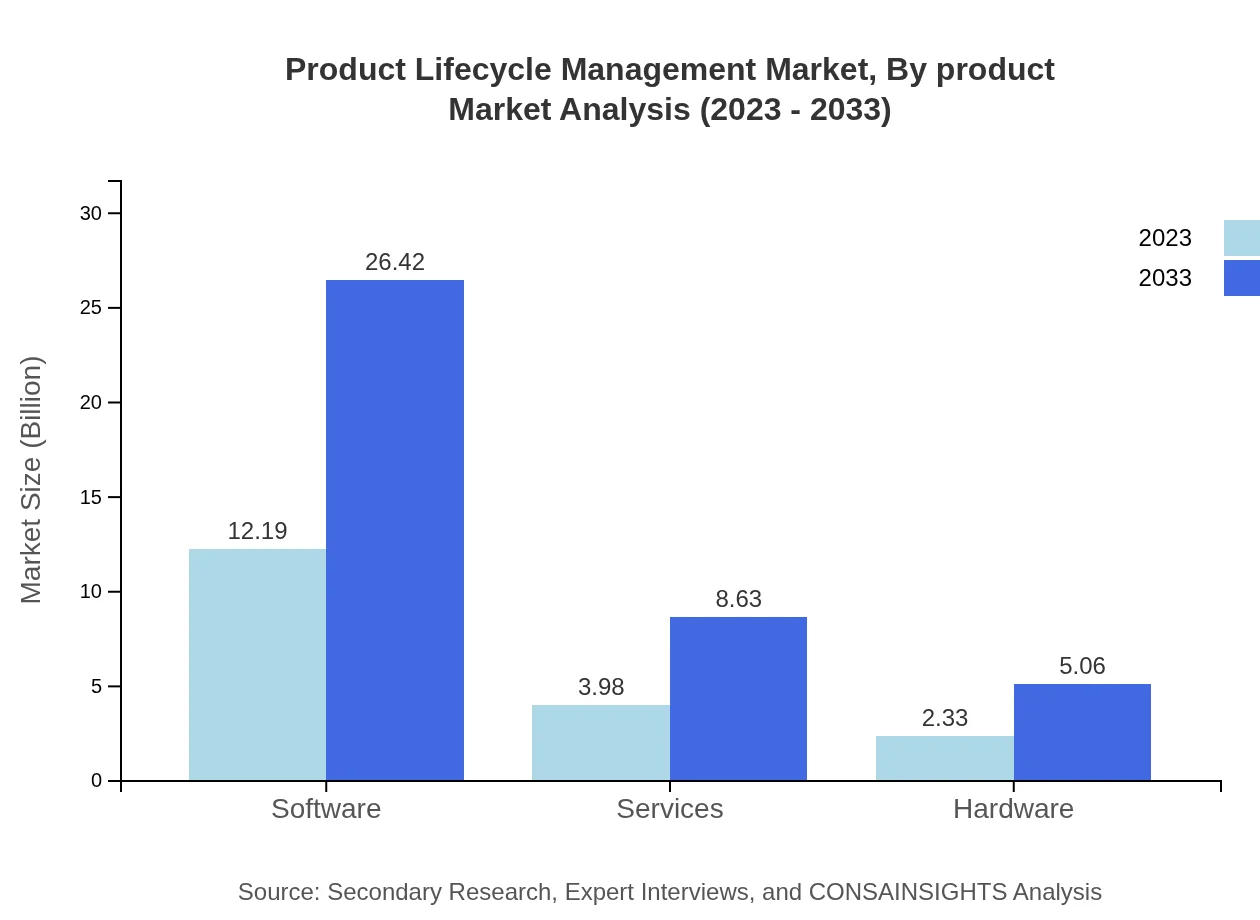

Product Lifecycle Management Market Analysis By Product

In 2023, Software dominates the PLM market with a value of $12.19 billion, expected to grow to $26.42 billion by 2033. Services contribute $3.98 billion, growing to $8.63 billion, while Hardware see remarkable growth from $2.33 billion to $5.06 billion over the same period.

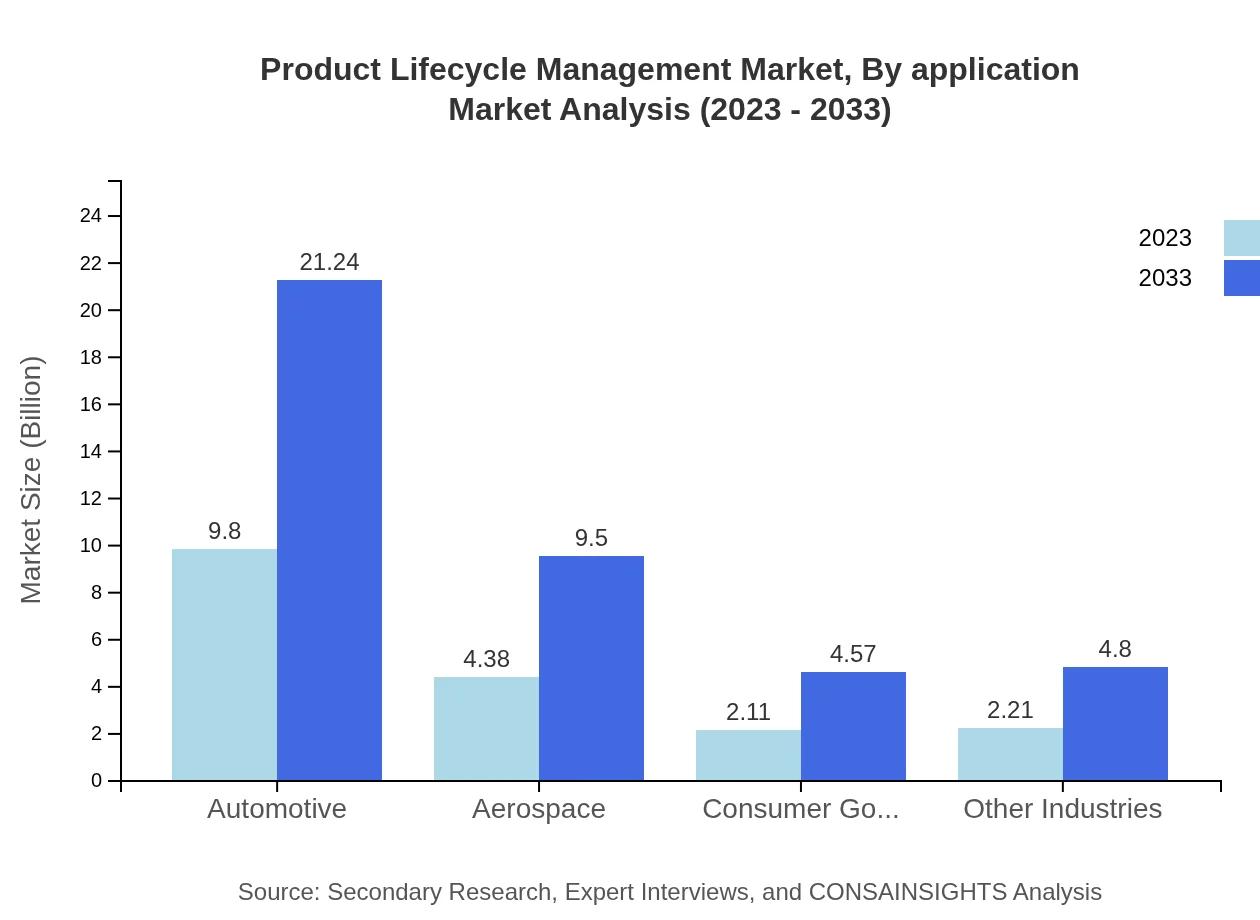

Product Lifecycle Management Market Analysis By Application

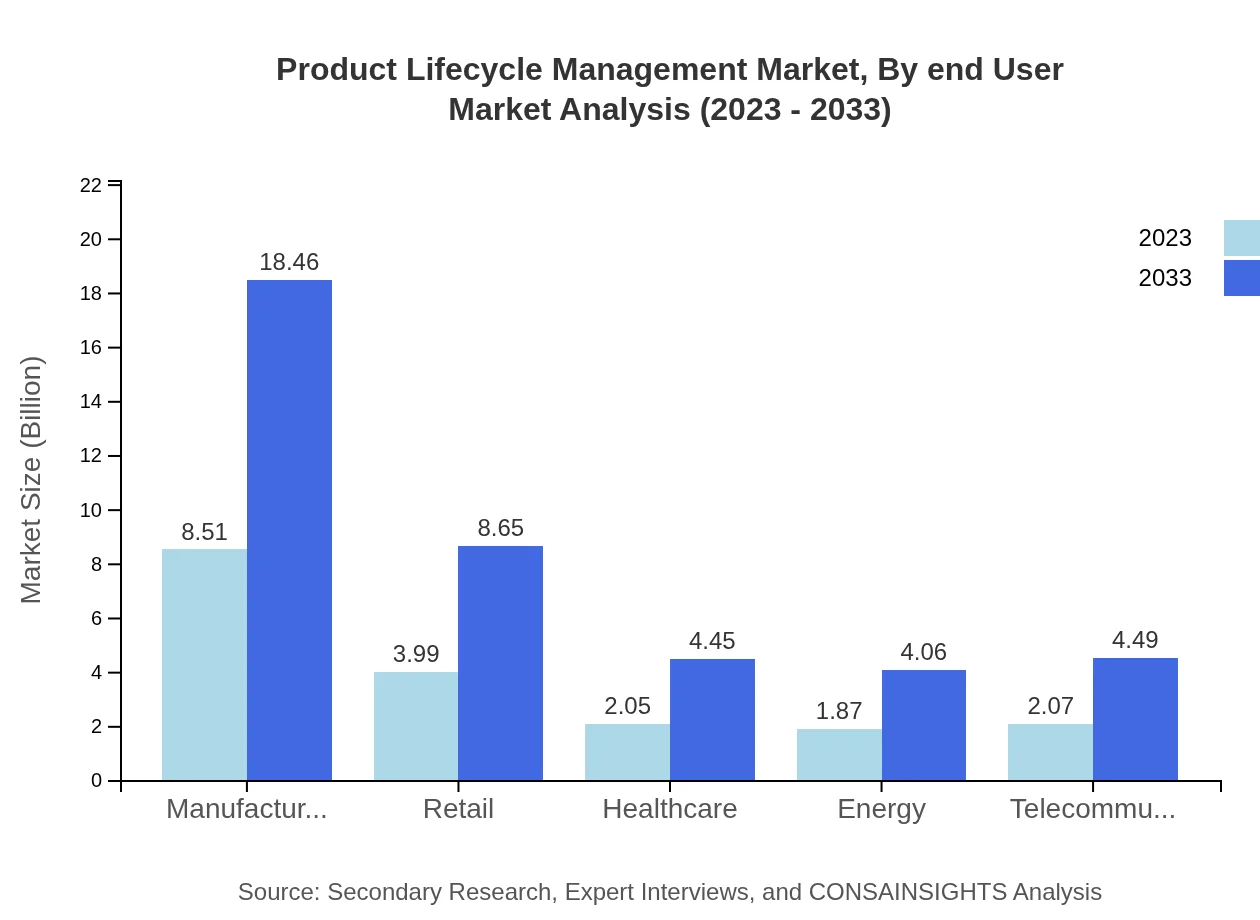

The Manufacturing segment leads with $8.51 billion in 2023, forecasted to grow to $18.46 billion. The Automotive industry follows suit, with a strong position holding $9.80 billion, projected to reach $21.24 billion by 2033. Other sectors like Healthcare, Retail, and Telecommunications are also gaining traction.

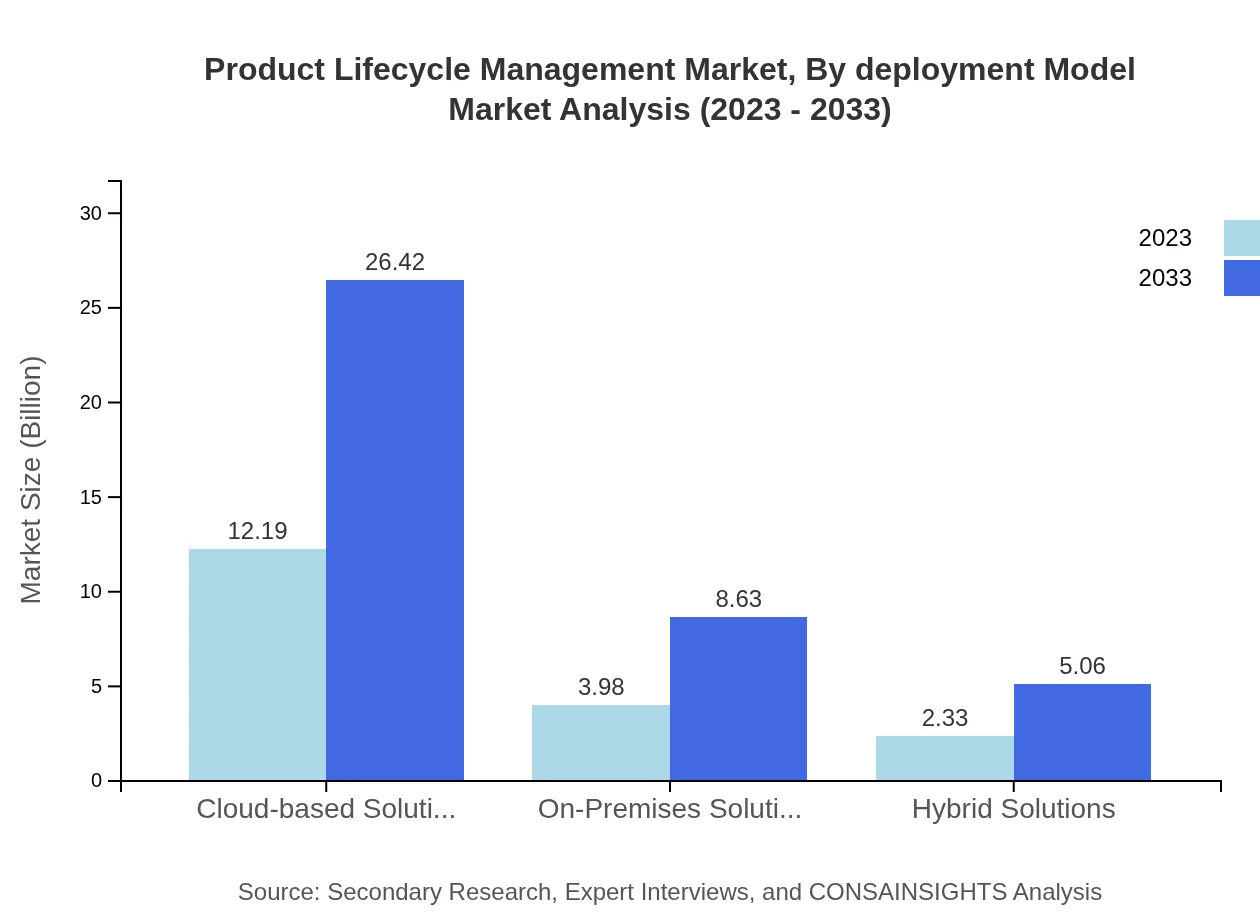

Product Lifecycle Management Market Analysis By Deployment Model

Cloud-based Solutions are expected to maintain a significant share, providing flexibility and improved collaborations. The size for 2023 stands at $12.19 billion, growing to $26.42 billion by 2033. On-Premises Solutions and Hybrid Solutions represent $3.98 billion and $2.33 billion respectively.

Product Lifecycle Management Market Analysis By End User

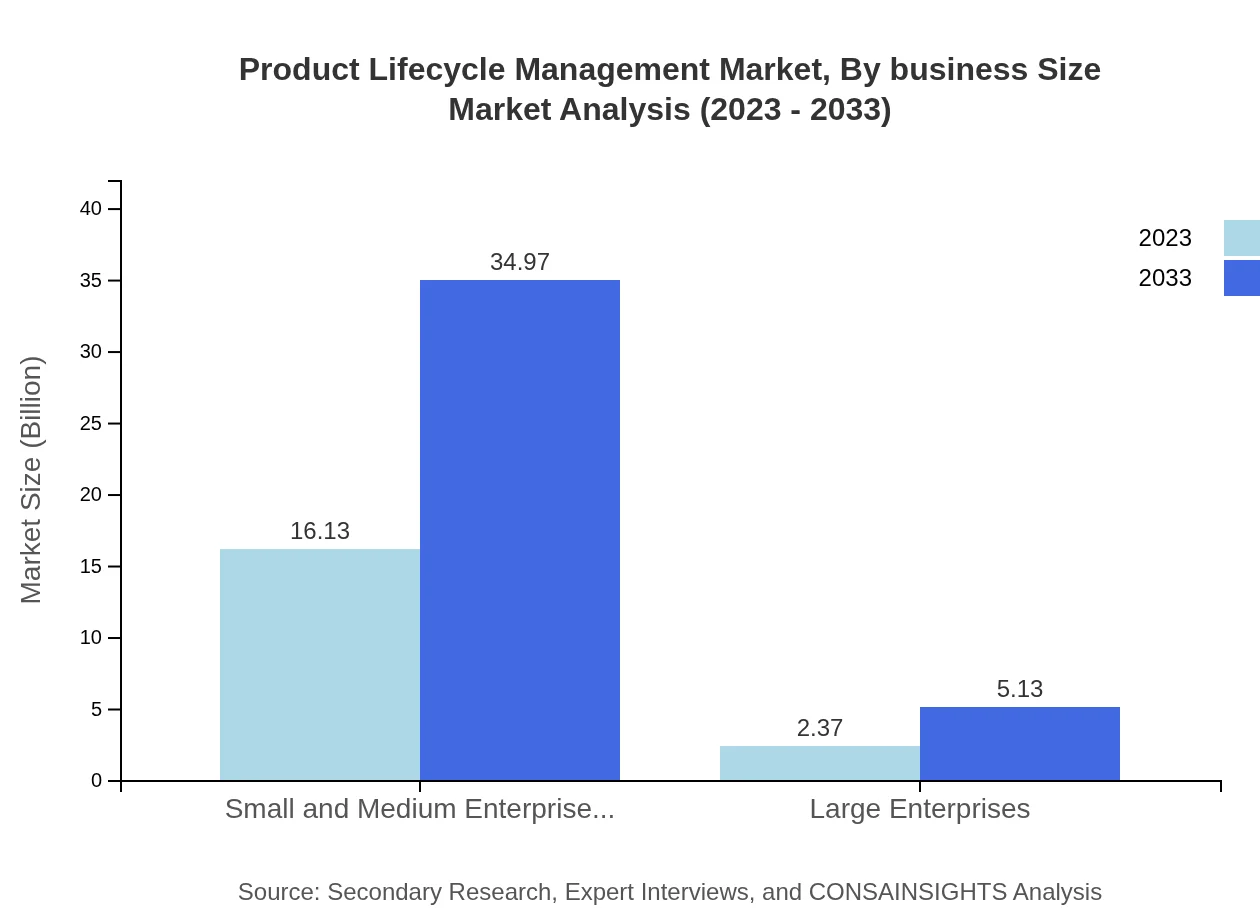

The market shows a strong inclination towards Small and Medium Enterprises (SMEs), holding 87.2% market share worth $16.13 billion in 2023 and projected to expand fiercely. Large Enterprises also contribute significantly with a market size of $2.37 billion.

Product Lifecycle Management Market Analysis By Business Size

Small and Medium Enterprises (SMEs) signify a dominant segment in demand for PLM solutions, expected to grow from $16.13 billion to $34.97 billion by 2033. In contrast, Large Enterprises will grow from $2.37 billion to $5.13 billion, reflecting a steady demand.

Product Lifecycle Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Product Lifecycle Management Industry

Siemens AG:

Siemens is a global leader in PLM solutions, facilitating digital industries through the integration of automation hardware, software, and advanced digital services.PTC Inc.:

PTC offers comprehensive PLM software solutions that help companies manage product data, develop their products intelligently, and improve operational efficiency.Dassault Systèmes:

Dassault provides a broad range of PLM solutions, focusing on 3D design, digital mock-up, and product lifecycle software for various industries.Oracle Corporation:

Oracle's PLM cloud solutions enhance collaboration and speed to market, aiding in product innovation and compliance management.SAP SE:

SAP offers integrated PLM solutions allowing organizations to synchronize manufacturing, supply chain, and product innovation, driving customer satisfaction.We're grateful to work with incredible clients.

FAQs

What is the market size of Product Lifecycle Management?

The global Product Lifecycle Management market is valued at approximately $18.5 billion in 2023. With a projected CAGR of 7.8%, the market is expected to grow significantly over the next decade.

What are the key market players or companies in this Product Lifecycle Management industry?

Key players in the Product Lifecycle Management market include Siemens PLM Software, PTC, Dassault Systèmes, and SAP. These companies lead the industry through continuous innovation and comprehensive solutions tailored for various sectors.

What are the primary factors driving the growth in the Product Lifecycle Management industry?

Growth in the Product Lifecycle Management industry is driven by increasing demand for efficient product management solutions, adoption of cloud technologies, and the need for faster time-to-market in product development processes.

Which region is the fastest Growing in the Product Lifecycle Management?

The Asia-Pacific region is poised to be the fastest-growing market for Product Lifecycle Management, expected to grow from $3.83 billion in 2023 to $8.31 billion by 2033, driven by rapid industrialization and technology adoption.

Does ConsaInsights provide customized market report data for the Product Lifecycle Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Product Lifecycle Management industry, ensuring relevant insights for decision-making and strategy development.

What deliverables can I expect from this Product Lifecycle Management market research project?

From the Product Lifecycle Management market research project, clients can expect detailed reports including market size analysis, growth forecasts, competitive landscape, and segment-specific insights to inform strategic initiatives.

What are the market trends of Product Lifecycle Management?

Current trends in the Product Lifecycle Management market include increased digital transformation, the growth of cloud-based solutions, and heightened focus on sustainability within product development processes.