Product Lifecycle Management Plm Software Market Report

Published Date: 22 January 2026 | Report Code: product-lifecycle-management-plm-software

Product Lifecycle Management Plm Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Product Lifecycle Management (PLM) Software market, covering market dynamics, growth trends, segmentation, regional insights, and key players from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

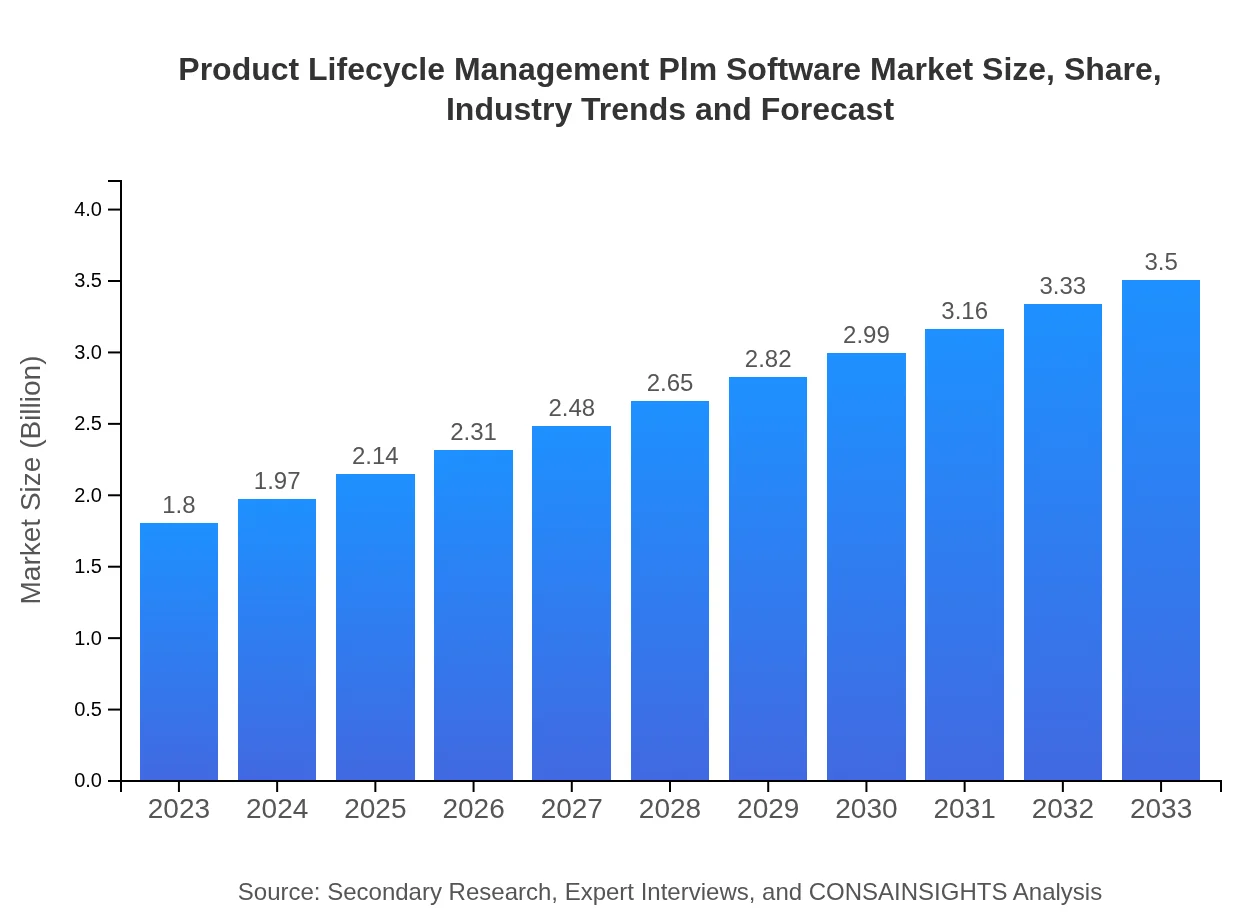

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $3.50 Billion |

| Top Companies | Siemens AG, PTC Inc., Dassault Systèmes, Oracle Corporation, SAP SE |

| Last Modified Date | 22 January 2026 |

Product Lifecycle Management Plm Software Market Overview

Customize Product Lifecycle Management Plm Software Market Report market research report

- ✔ Get in-depth analysis of Product Lifecycle Management Plm Software market size, growth, and forecasts.

- ✔ Understand Product Lifecycle Management Plm Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Product Lifecycle Management Plm Software

What is the Market Size & CAGR of Product Lifecycle Management Plm Software market in 2023?

Product Lifecycle Management Plm Software Industry Analysis

Product Lifecycle Management Plm Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Product Lifecycle Management Plm Software Market Analysis Report by Region

Europe Product Lifecycle Management Plm Software Market Report:

The European PLM software market is expected to increase from USD 0.48 billion in 2023 to USD 0.94 billion by 2033. The region benefits from a strong manufacturing base, regulatory compliance requirements, and a focus on sustainability, which drives the need for robust PLM systems.Asia Pacific Product Lifecycle Management Plm Software Market Report:

The Asia Pacific PLM software market is experiencing robust growth, estimated at USD 0.39 billion in 2023 and projected to reach USD 0.76 billion by 2033. This growth is driven by rapid industrialization, growing manufacturing sectors, and increasing emphasis on digital transformation among corporations in countries like China and India.North America Product Lifecycle Management Plm Software Market Report:

North America remains one of the largest markets for PLM software, with revenues expected to grow from USD 0.62 billion in 2023 to USD 1.20 billion by 2033. The growth is attributed to early adoption of advanced manufacturing practices and substantial investments in research and development.South America Product Lifecycle Management Plm Software Market Report:

In South America, the market is projected to expand from USD 0.10 billion in 2023 to USD 0.20 billion by 2033. Growth is primarily driven by increased demand from the manufacturing and automotive industries, alongside expanding technology adoption in regional SMEs.Middle East & Africa Product Lifecycle Management Plm Software Market Report:

The Middle East and Africa region has a growing PLM software market anticipated to rise from USD 0.21 billion in 2023 to USD 0.40 billion by 2033. Key factors influencing this growth include increasing investments in technology and expanding manufacturing activities in various nations.Tell us your focus area and get a customized research report.

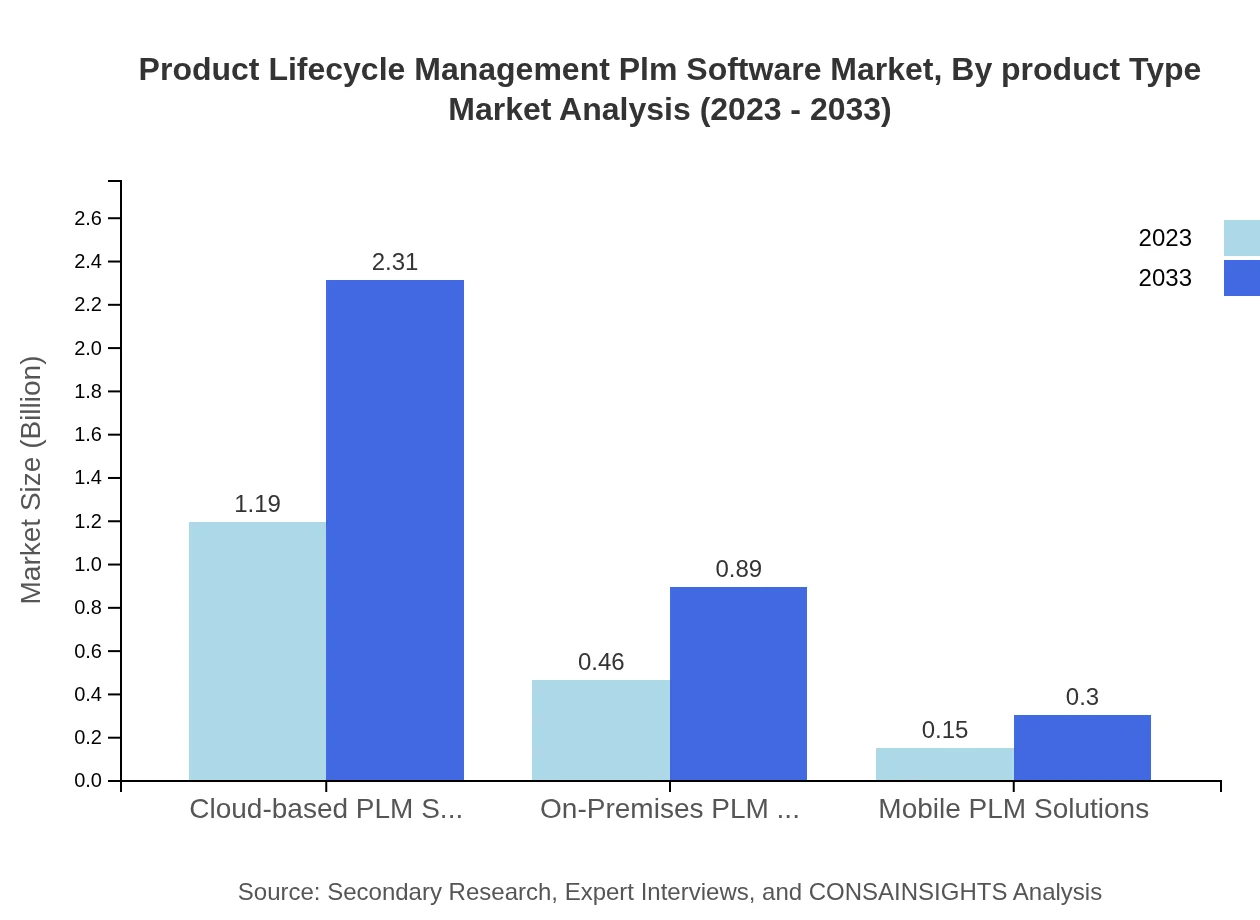

Product Lifecycle Management Plm Software Market Analysis By Product Type

By product type, the PLM market can be categorized into Cloud-based solutions, On-Premises solutions, and Mobile solutions. Cloud-based PLM is the leading segment with a market size of USD 1.19 billion in 2023, expected to grow to USD 2.31 billion by 2033, capturing a 66.01% market share. On-Premises solutions also contribute substantially, growing from USD 0.46 billion to USD 0.89 billion in the same period.

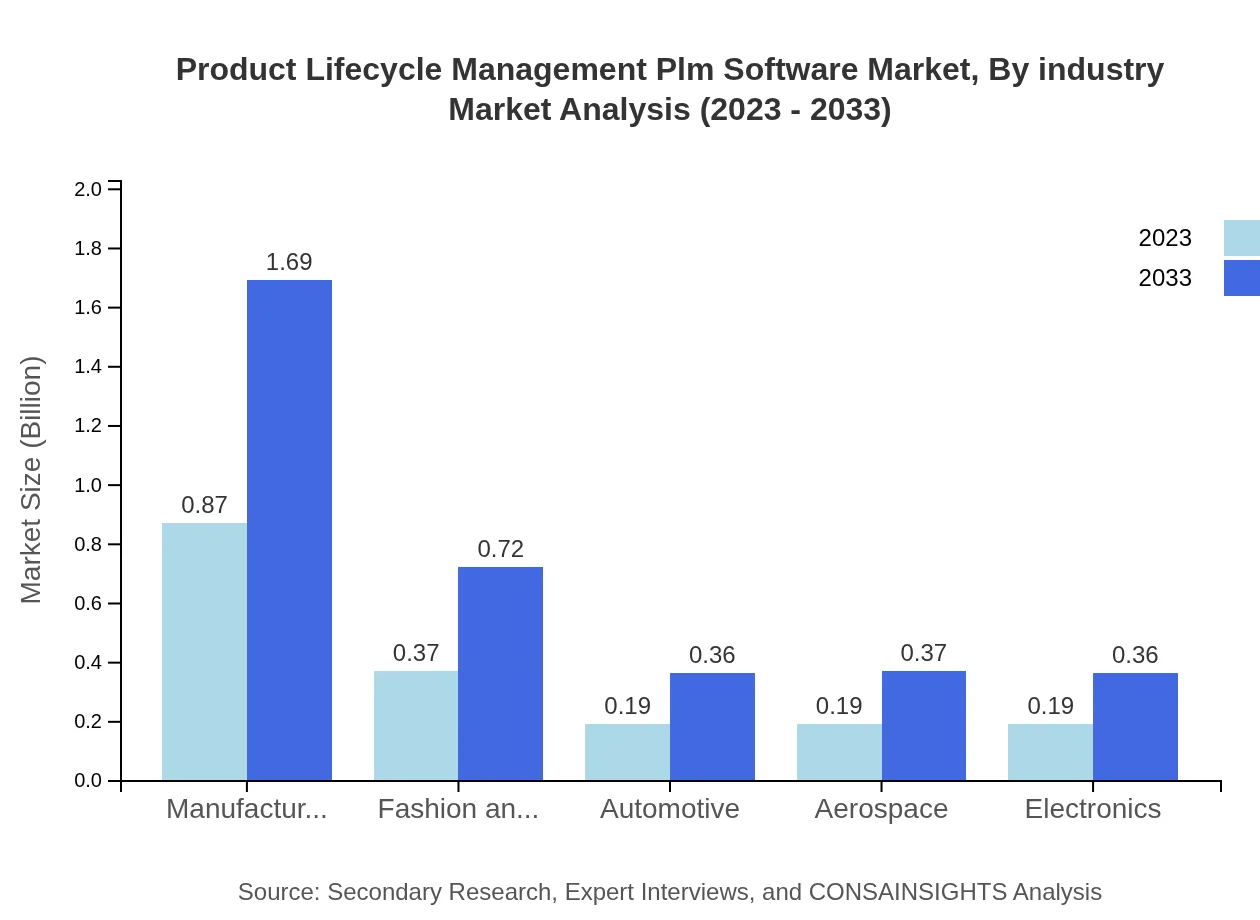

Product Lifecycle Management Plm Software Market Analysis By Industry

The market is segmented by industries including Manufacturing, Fashion and Apparel, Automotive, Aerospace, and Electronics. Manufacturing leads the sectors with a market size of USD 0.87 billion in 2023, potentially reaching USD 1.69 billion by 2033. The Automotive and Aerospace segments also showcase healthy growth rates, reflecting their reliance on efficient product lifecycle management.

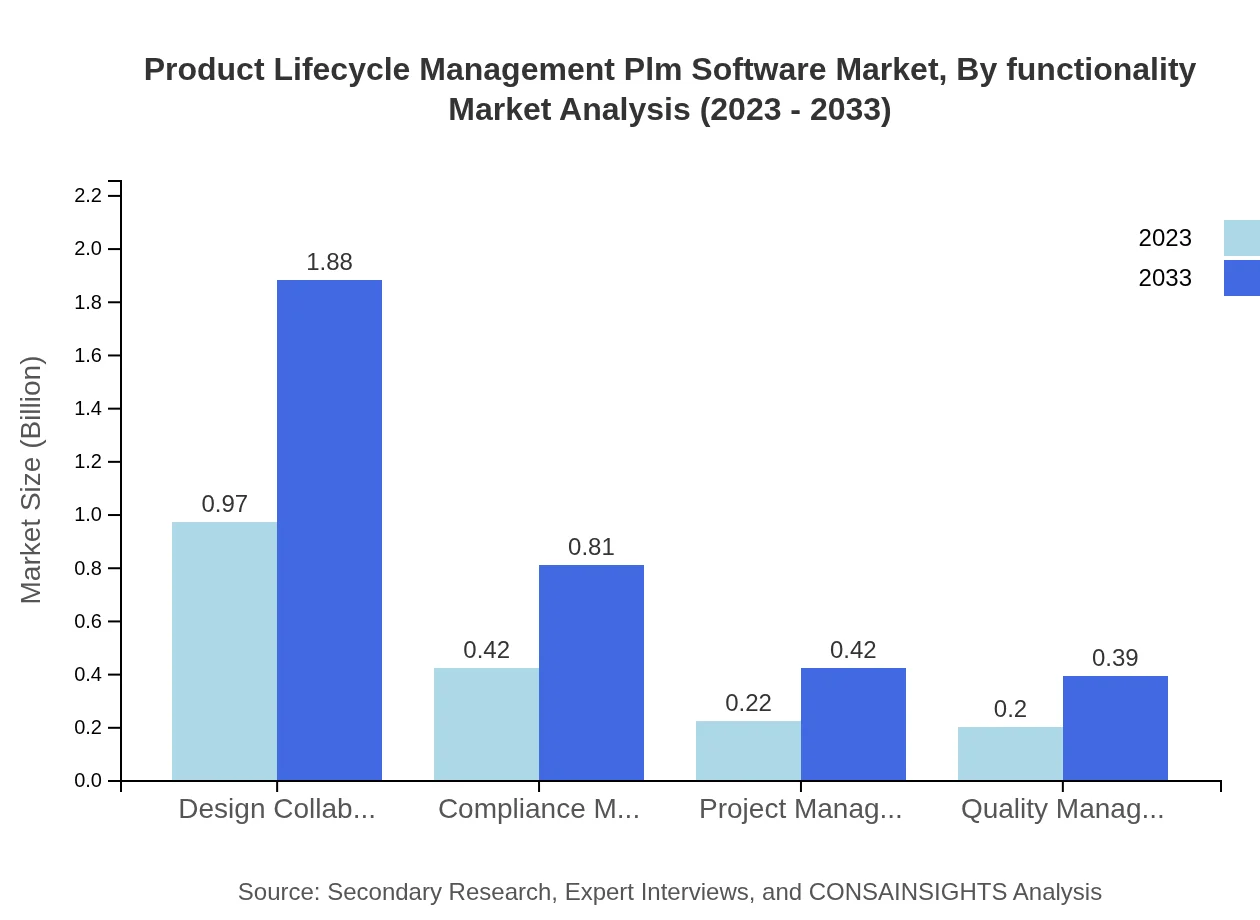

Product Lifecycle Management Plm Software Market Analysis By Functionality

PLM solutions can be analyzed based on their functionality including Design Collaboration, Compliance Management, Project Management, and Quality Management tools. Design Collaboration Tools top the functionality category with a size of USD 0.97 billion in 2023, anticipated to grow to USD 1.88 billion by 2033, reflecting a critical aspect of product development.

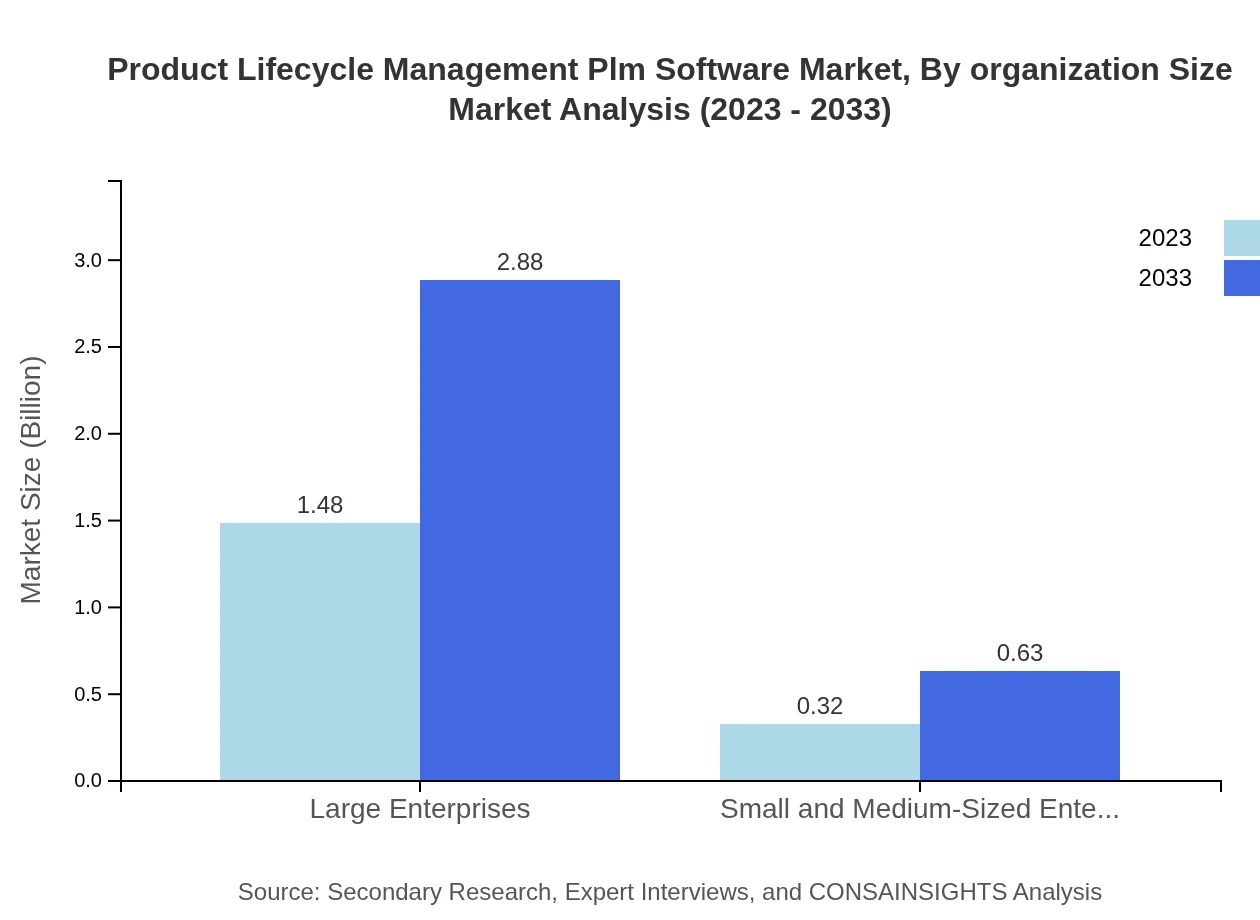

Product Lifecycle Management Plm Software Market Analysis By Organization Size

In terms of organization size, the market can be divided into Large Enterprises and Small & Medium-sized Enterprises (SMEs). Large Enterprises dominate the market with a size of USD 1.48 billion in 2023, projected to reach USD 2.88 billion by 2033. In contrast, SMEs are also witnessing gradual growth, increasing from USD 0.32 billion to USD 0.63 billion.

Product Lifecycle Management Plm Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Product Lifecycle Management Plm Software Industry

Siemens AG:

Siemens is a leading global engineering and technology company known for its advanced PLM software, Teamcenter. Siemens' solutions focus on improving product development efficiency and promoting collaboration.PTC Inc.:

PTC provides innovative PLM solutions such as Windchill, which help organizations manage product complexities and improve workflow through robust digital tools.Dassault Systèmes:

Known for its 3DEXPERIENCE platform, Dassault Systèmes leads the industry in simulation and design capabilities, providing comprehensive PLM solutions for various sectors.Oracle Corporation:

Oracle offers cloud-based PLM solutions that streamline product development processes while focusing on analytics integration and data management.SAP SE:

SAP delivers enterprise resource planning solutions with integrated PLM functionalities that help organizations achieve operational excellence.We're grateful to work with incredible clients.

FAQs

What is the market size of product Lifecycle Management Plm Software?

The product lifecycle management (PLM) software market is currently valued at $1.8 billion in 2023, with a projected CAGR of 6.7% through 2033, indicating significant growth and expansion opportunity for stakeholders.

What are the key market players or companies in the product Lifecycle Management Plm Software industry?

Key players in the PLM software market include major firms such as Siemens AG, PTC, Dassault Systèmes, and Autodesk, which dominate the industry through technological advancements and comprehensive solutions.

What are the primary factors driving the growth in the product Lifecycle Management Plm Software industry?

Growth drivers for the PLM software market include increasing demand for automation in product development, rising investments in cloud solutions, and the need for enhanced collaboration across global teams.

Which region is the fastest Growing in the product Lifecycle Management Plm Software?

The fastest-growing region in the PLM software market is North America, projected to grow from $0.62 billion in 2023 to $1.20 billion by 2033, reflecting increased adoption of advanced technologies.

Does ConsaInsights provide customized market report data for the product Lifecycle Management Plm Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific requests and industry needs, enabling clients to gain precise insights into the PLM software market.

What deliverables can I expect from this product Lifecycle Management Plm Software market research project?

Deliverables from the PLM market research project include detailed market analysis reports, segmentation data, trend forecasting, and actionable insights to aid decision-making.

What are the market trends of product Lifecycle Management Plm Software?

Current market trends include a shift towards cloud-based PLM solutions, increased investment in AI and IoT integrations, and growing emphasis on compliance and quality management tools.