Professional Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: professional-diagnostics

Professional Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Professional Diagnostics market, covering market trends, segmentation, regional insights, and forecasts from 2023 to 2033, along with key industry players and emerging technologies.

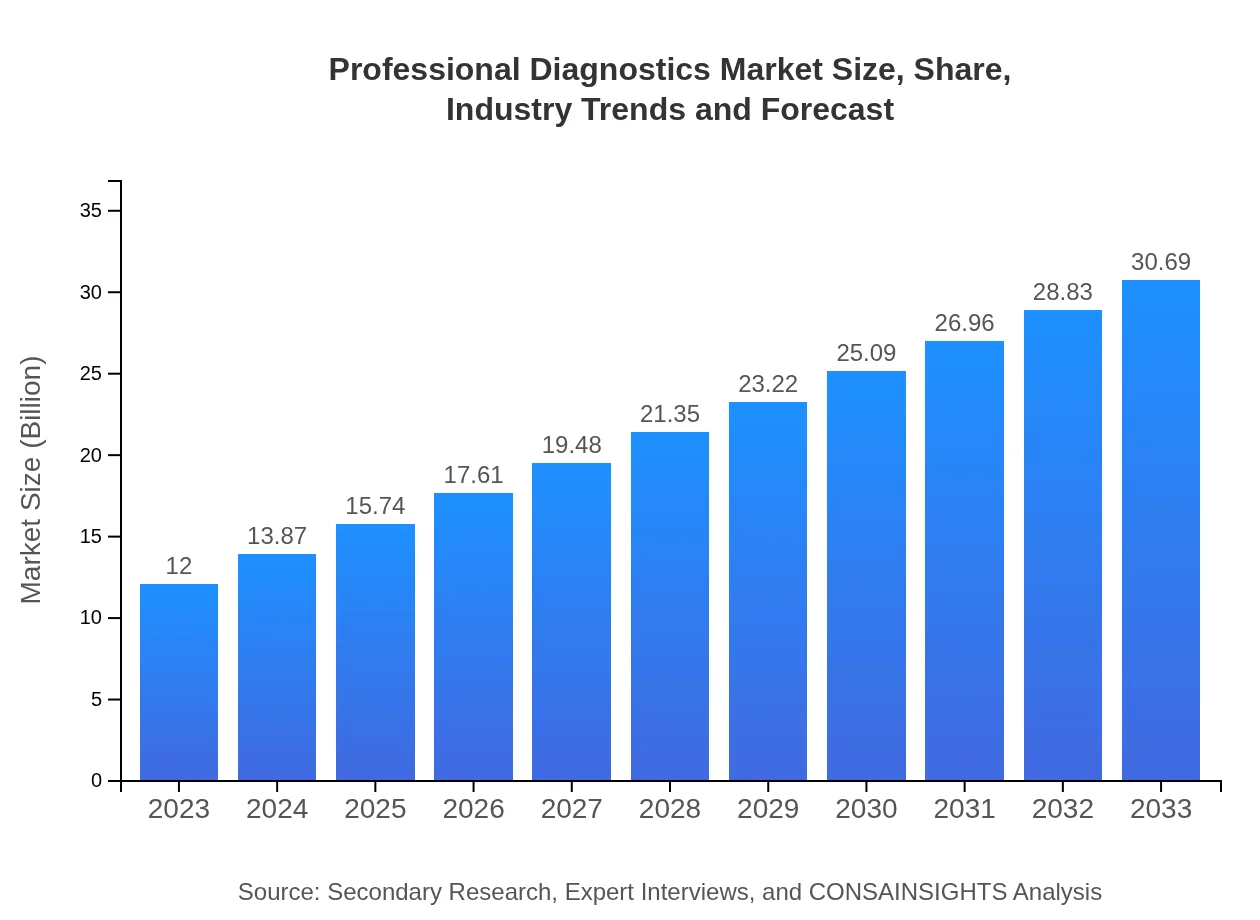

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

Professional Diagnostics Market Overview

Customize Professional Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Professional Diagnostics market size, growth, and forecasts.

- ✔ Understand Professional Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Professional Diagnostics

What is the Market Size & CAGR of Professional Diagnostics market in 2023?

Professional Diagnostics Industry Analysis

Professional Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Professional Diagnostics Market Analysis Report by Region

Europe Professional Diagnostics Market Report:

In Europe, the market size is projected to rise from $3.67 billion in 2023 to $9.40 billion by 2033. The growth is fueled by increasing regulatory support for innovative diagnostic solutions and a growing geriatric population. The emphasis on personalized medicine and technological advancements further bolsters the market.Asia Pacific Professional Diagnostics Market Report:

The Asia Pacific region is poised for significant growth, with the market projected to increase from $2.20 billion in 2023 to nearly $5.64 billion by 2033. Factors such as rising healthcare expenditure, increasing prevalence of infectious diseases, and a growing focus on preventive healthcare are propelling this growth. Emerging economies in this region are investing in healthcare infrastructure, leading to a higher demand for innovative diagnostic solutions.North America Professional Diagnostics Market Report:

North America is expected to maintain its dominance in the Professional Diagnostics market, growing from $4.61 billion in 2023 to $11.80 billion by 2033. This growth is attributed to advanced healthcare infrastructure, high health insurance coverage, and a strong emphasis on research and development of innovative diagnostic technologies. The presence of leading market players in the region enhances its competitive landscape.South America Professional Diagnostics Market Report:

In South America, the Professional Diagnostics market is anticipated to grow from $0.66 billion in 2023 to approximately $1.68 billion by 2033. The growth is driven by increasing awareness about health management and a rising incidence of chronic diseases. However, challenges such as economic instability and varying healthcare access in different regions could impede growth.Middle East & Africa Professional Diagnostics Market Report:

The Middle East and Africa region is set to experience growth from $0.85 billion in 2023 to $2.18 billion by 2033. Factors such as rising health awareness initiatives, increased government spending on healthcare, and collaborations with global healthcare organizations are expected to drive the market forward.Tell us your focus area and get a customized research report.

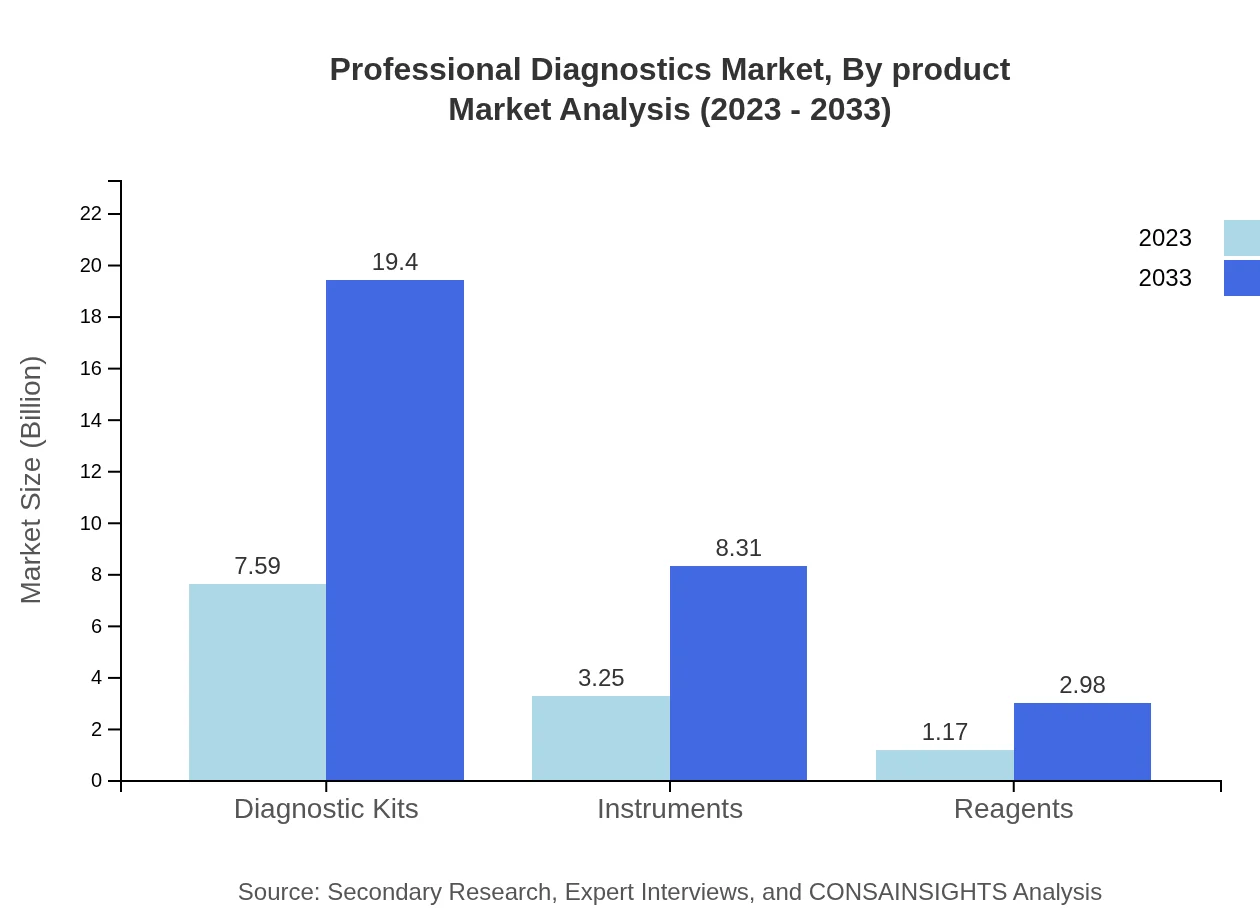

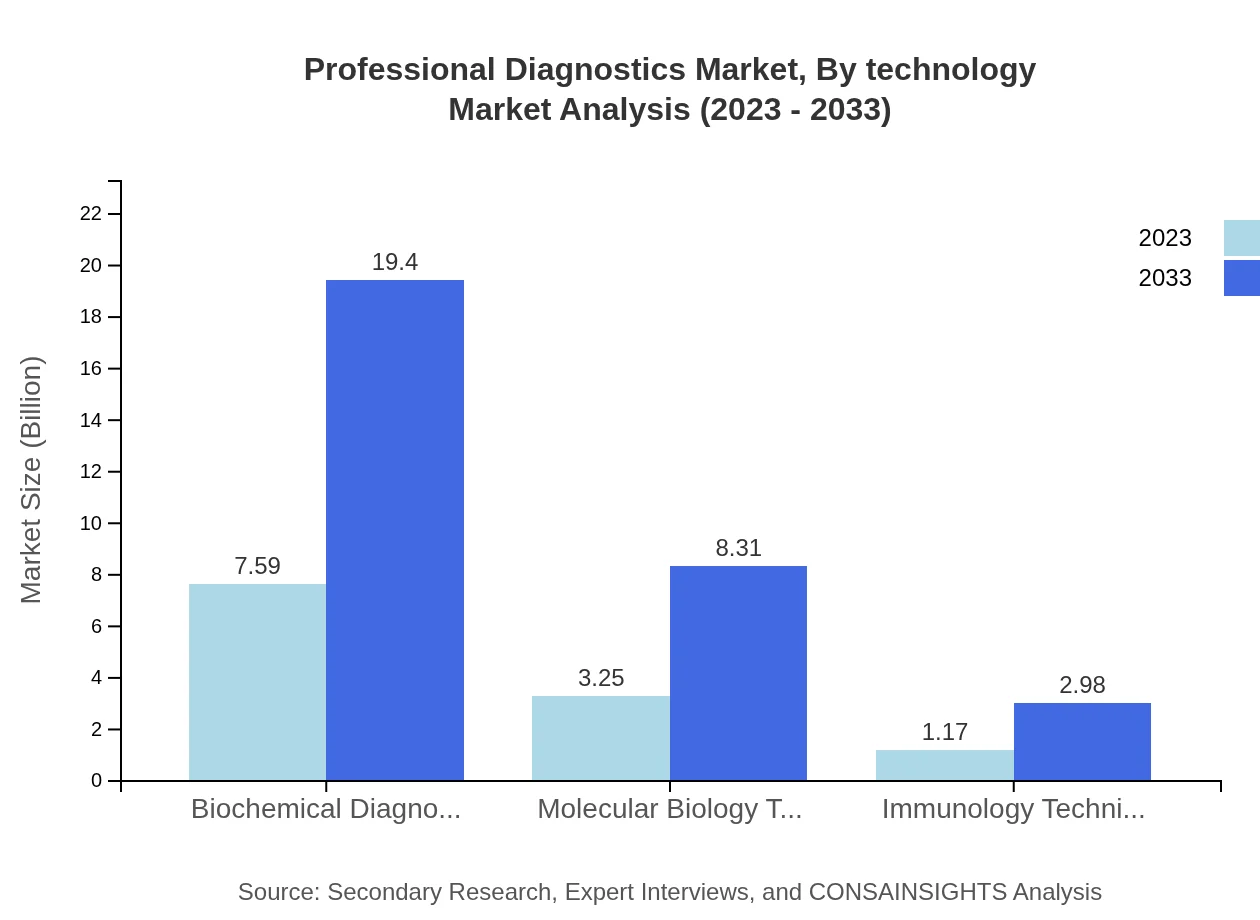

Professional Diagnostics Market Analysis By Product

In 2023, the diagnostic kits segment dominates the market, valued at $7.59 billion, and is expected to grow to $19.40 billion by 2033. Diagnostic kits are vital due to the increasing demand for quick and reliable test results. Instruments hold a significant share at $3.25 billion in 2023, projected to reach $8.31 billion by 2033. Reagents contribute $1.17 billion in 2023 and are expected to grow to $2.98 billion, indicating their essential role in laboratory diagnostics.

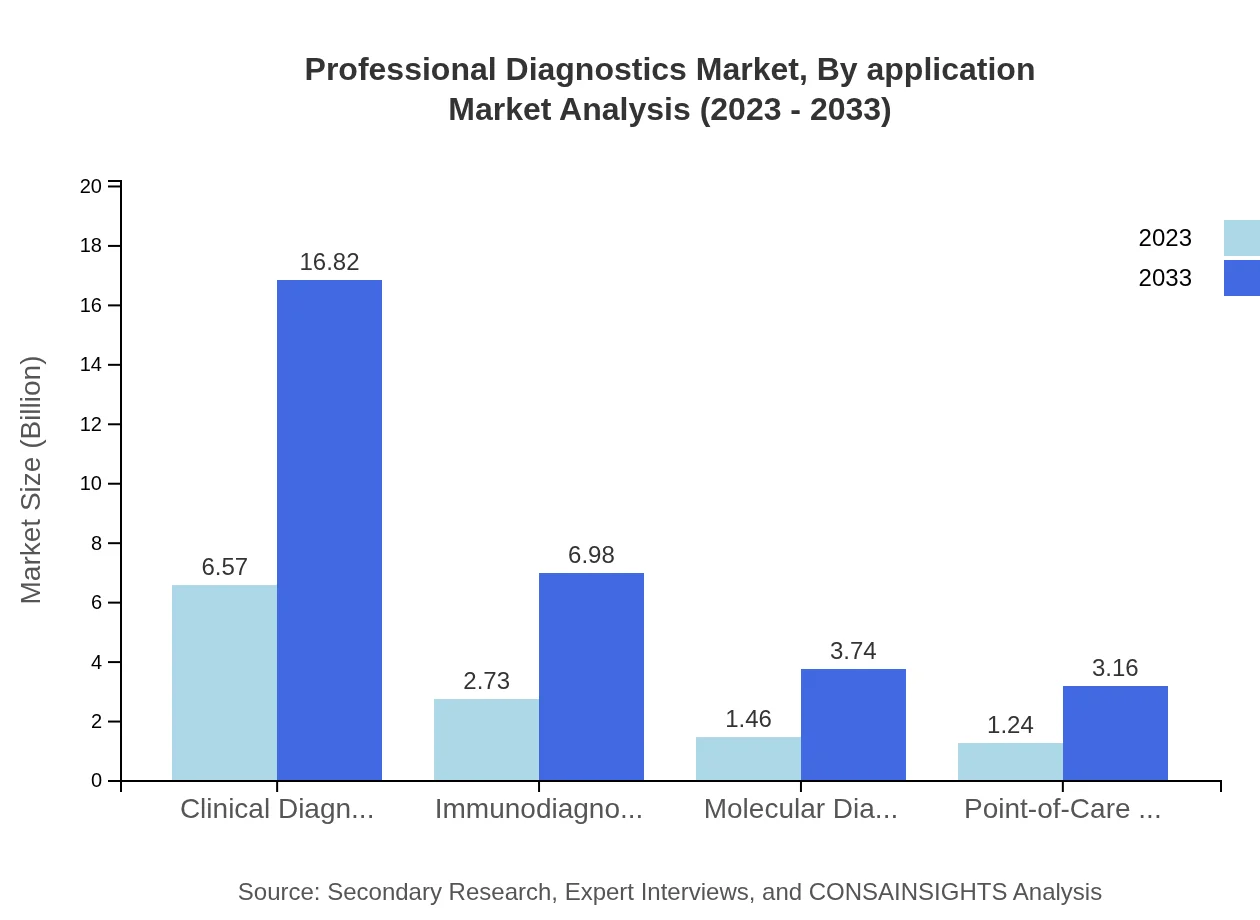

Professional Diagnostics Market Analysis By Application

Clinical diagnostics remain a critical segment, accounting for $6.57 billion in 2023 and expected to grow to $16.82 billion by 2033. Other significant applications include biochemical diagnostics and molecular diagnostics, reflecting an increasing demand for innovative and precise testing methodologies.

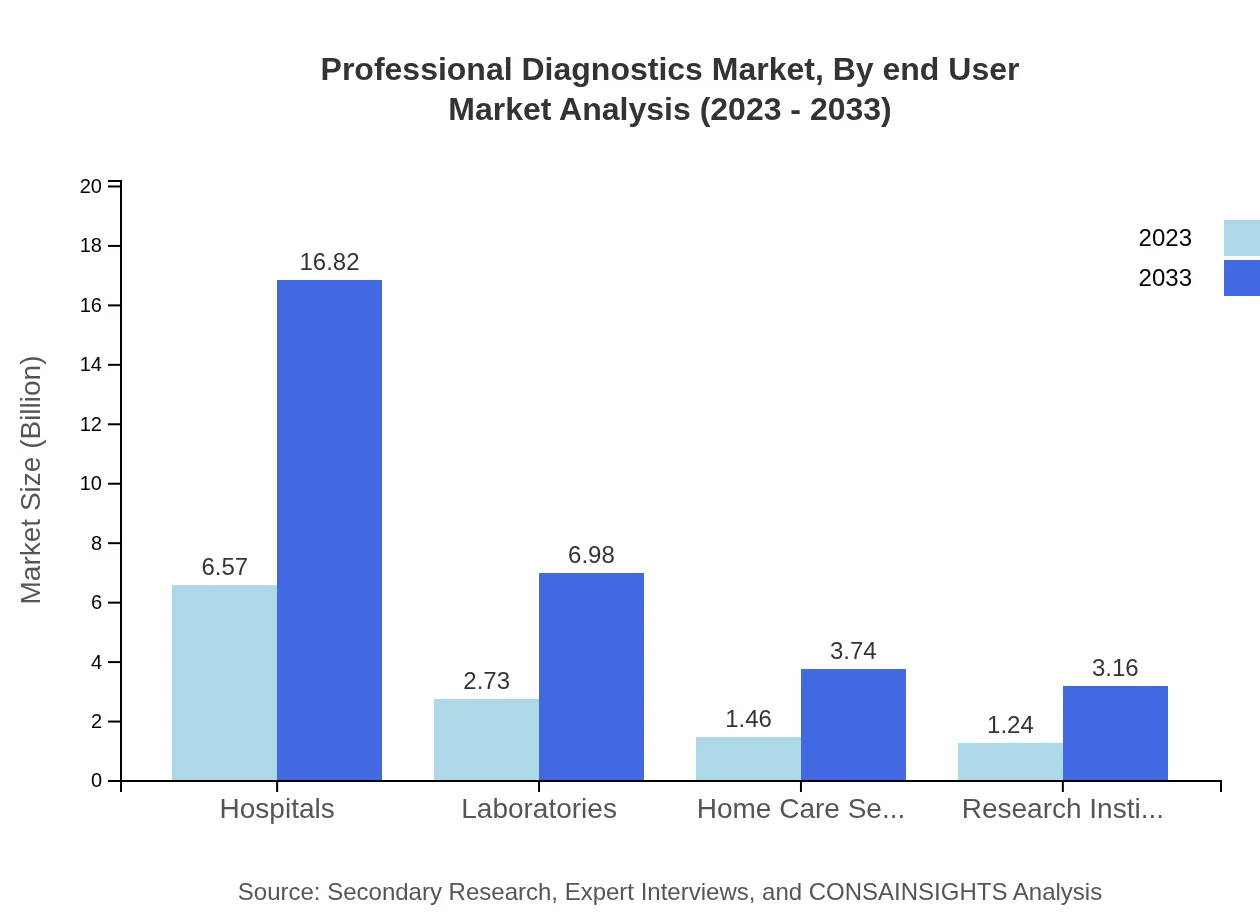

Professional Diagnostics Market Analysis By End User

Hospitals account for a substantial market share, valued at $6.57 billion in 2023 and expected to reach $16.82 billion by 2033. Laboratories and home care settings are also essential segments, adapting to changing healthcare delivery models and increasing emphasis on point-of-care testing.

Professional Diagnostics Market Analysis By Technology

Innovative technologies such as molecular biology techniques and immunodiagnostics are gaining traction. The molecular biology segment is expected to grow from $1.46 billion in 2023 to $3.74 billion by 2033, reflecting the rapid advancement of diagnostic technologies aimed at higher accuracy.

Professional Diagnostics Market Analysis By Region

Global Professional Diagnostics Market, By Region Market Analysis (2023 - 2033)

Regional analysis reveals diverse growth patterns, with North America leading the market size, followed by Europe and Asia Pacific. Emerging markets in Asia Pacific and Latin America present significant opportunities due to increased investment in healthcare infrastructure and growing patient awareness.

Professional Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Professional Diagnostics Industry

Roche Diagnostics:

A leading player in the diagnostics market, Roche is known for its innovative diagnostics solutions offering a wide range of tests for various diseases.Abbott Laboratories:

Abbott is recognized for its advanced diagnostics technologies, focusing on point-of-care testing and laboratory diagnostics.Siemens Healthineers:

Siemens Healthineers provides comprehensive diagnostic services and products, emphasizing quality and precision in healthcare.Thermo Fisher Scientific:

A prominent provider of analytical instruments and reagents, Thermo Fisher supports a wide range of research and clinical diagnostics.We're grateful to work with incredible clients.

FAQs

What is the market size of professional diagnostics?

The global professional diagnostics market is valued at approximately $12 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.5% through 2033, indicating robust sector growth in the upcoming years.

What are the key market players or companies in this professional diagnostics industry?

Key players in the professional diagnostics industry include Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Danaher Corporation, and Thermo Fisher Scientific, which are instrumental in advancements and innovations in diagnostic technologies.

What are the primary factors driving the growth in the professional diagnostics industry?

Growth drivers in the professional diagnostics industry include increasing demand for early disease diagnosis, advancements in diagnostic technologies, and rising healthcare expenditure, leading to improved access and better healthcare outcomes globally.

Which region is the fastest Growing in the professional diagnostics market?

North America is anticipated to be the fastest-growing region in the professional diagnostics market, with projections indicating growth from $4.61 billion in 2023 to $11.80 billion by 2033, fueled by technological advancements and healthcare infrastructure improvements.

Does ConsaInsights provide customized market report data for the professional diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the professional diagnostics industry, ensuring detailed analysis and insights that meet diverse client requirements and objectives.

What deliverables can I expect from this professional diagnostics market research project?

Deliverables from the professional diagnostics market research project include comprehensive reports with market size data, growth forecasts, competitive analysis, and segmented insights that are actionable for strategic decision-making.

What are the market trends of professional diagnostics?

Current trends in the professional diagnostics market include the rise of point-of-care testing, increased adoption of molecular diagnostics, and a shift towards home care testing solutions, reflecting evolving consumer preferences and technological advancements.