Professional Services Automation Market Report

Published Date: 31 January 2026 | Report Code: professional-services-automation

Professional Services Automation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Professional Services Automation (PSA) market from 2023 to 2033, covering market trends, segmentation, regional analysis, and forecasts for growth. Key insights into the industry's current conditions and future developments are also included.

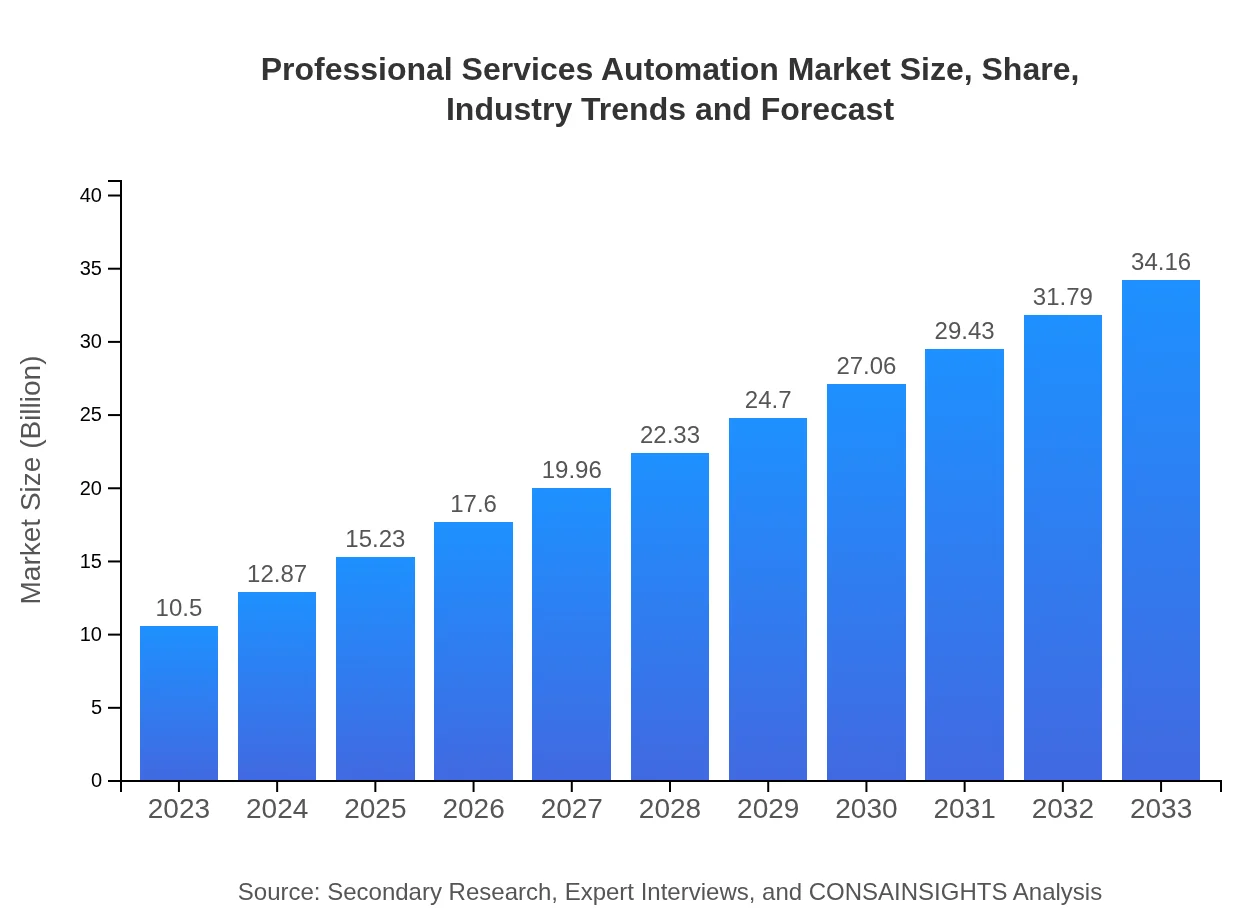

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $34.16 Billion |

| Top Companies | Autotask, Kimble Applications, Mavenlink, ConnectWise, NetSuite |

| Last Modified Date | 31 January 2026 |

Professional Services Automation Market Overview

Customize Professional Services Automation Market Report market research report

- ✔ Get in-depth analysis of Professional Services Automation market size, growth, and forecasts.

- ✔ Understand Professional Services Automation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Professional Services Automation

What is the Market Size & CAGR of Professional Services Automation market in 2023?

Professional Services Automation Industry Analysis

Professional Services Automation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Professional Services Automation Market Analysis Report by Region

Europe Professional Services Automation Market Report:

Europe's PSA market is anticipated to increase from $3.29 billion in 2023 to $10.70 billion by 2033. The region is witnessing robust growth driven by the digital transformation initiatives among various sectors, particularly consulting and legal services, focused on improving service delivery and client management.Asia Pacific Professional Services Automation Market Report:

In the Asia-Pacific region, the PSA market is expected to grow from $2.16 billion in 2023 to $7.02 billion by 2033, driven by rising demand from SMEs for automated solutions and increasing adoption of cloud technology. Countries like India and China are leading the way in this growth trajectory due to their expanding IT and services sectors.North America Professional Services Automation Market Report:

The North American PSA market will grow from $3.42 billion in 2023 to $11.13 billion by 2033, strengthening its position as a market leader due to the presence of major technology players, high adoption rates of advanced software solutions, and a strong focus on improving operational efficiency.South America Professional Services Automation Market Report:

The South American PSA market is projected to expand from $0.58 billion in 2023 to $1.90 billion by 2033. This growth will be fueled by increasing digitalization and the demand for efficient management solutions across various industries, including consulting and advertising.Middle East & Africa Professional Services Automation Market Report:

The Middle East and Africa PSA market is expected to grow from $1.05 billion in 2023 to $3.40 billion by 2033. The growth is attributed to the increasing emphasis on efficiency and productivity among organizations, particularly in sectors like engineering and consulting services.Tell us your focus area and get a customized research report.

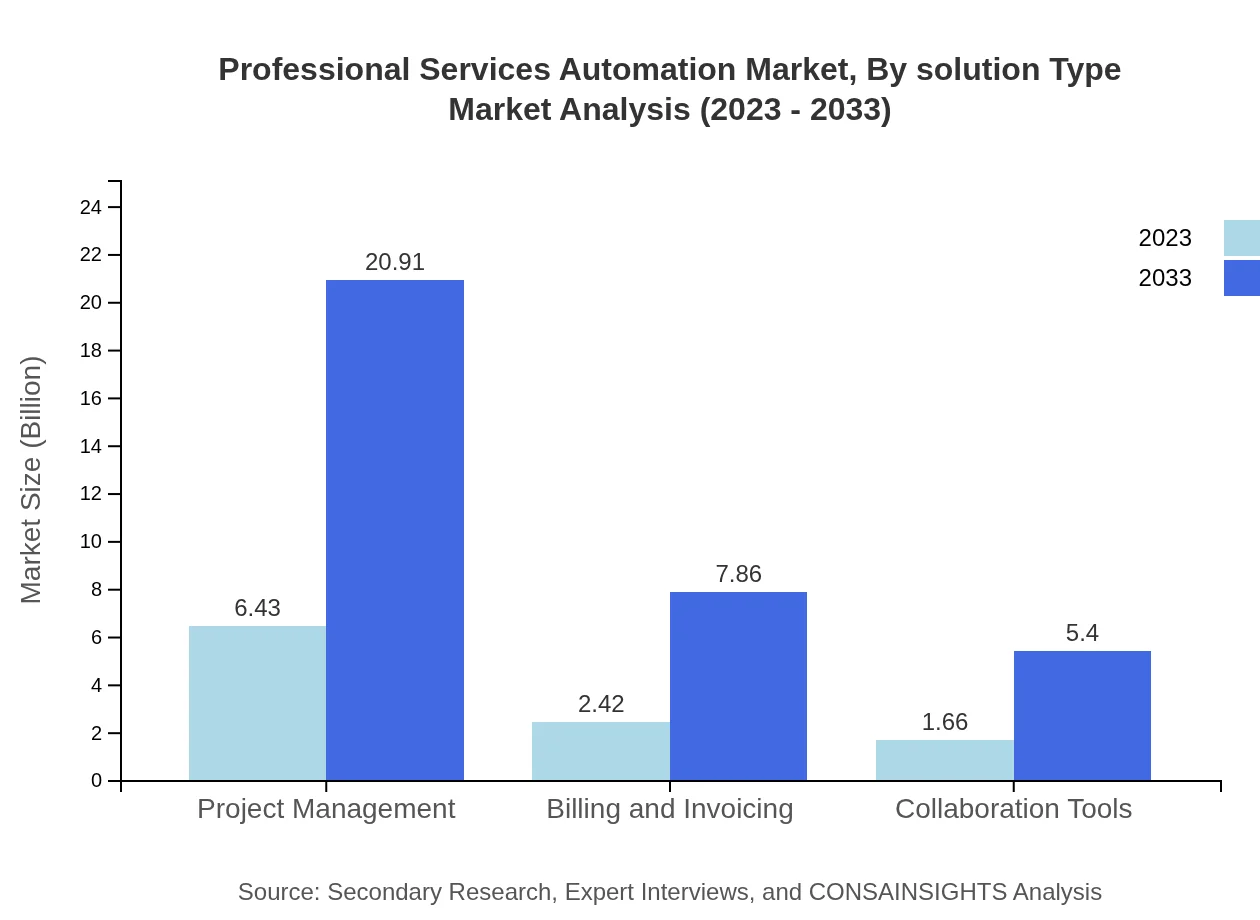

Professional Services Automation Market Analysis By Solution Type

The Professional Services Automation market can be segmented by solution type, with key areas including project management, billing and invoicing, collaboration tools, and cloud-based solutions. As of 2023, cloud-based solutions dominate the market with a size of $9.14 billion, accounting for 87.02% market share, reflecting the industry's shift towards scalable and flexible solutions. Project management tools follow closely, valued at $6.43 billion, representing 61.2% of the market share. Other solutions like collaboration tools ($1.66 billion) and billing and invoicing ($2.42 billion) also contribute significantly to the market landscape.

Professional Services Automation Market Analysis By Deployment Model

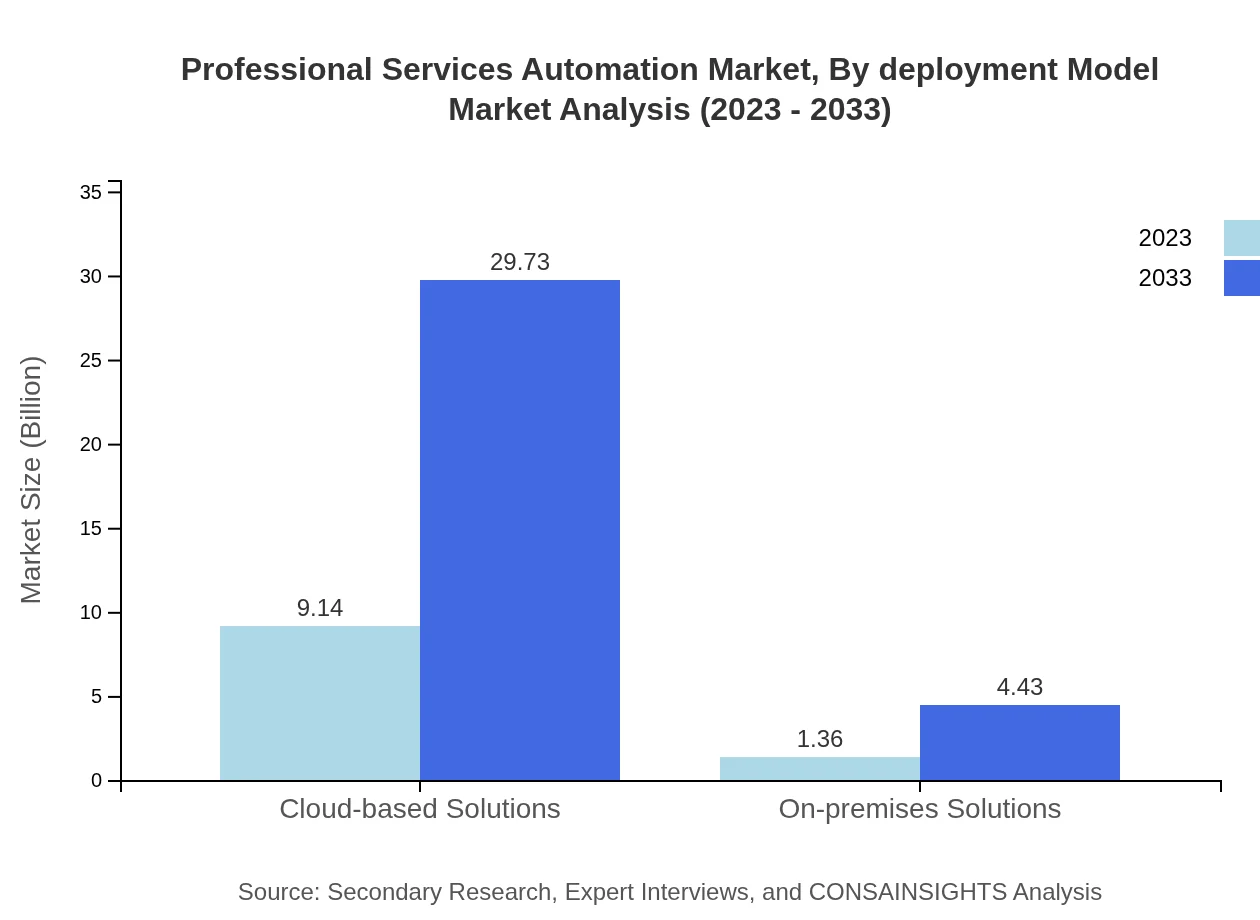

The deployment model in the PSA market is primarily categorized into cloud-based and on-premises solutions. In 2023, cloud-based solutions are projected to lead the market with a value of $9.14 billion, demonstrating the demand for flexible and cost-effective deployment options. On-premises solutions account for $1.36 billion, catering to organizations with strict data security requirements. By 2033, the expected shift towards cloud technologies will further enhance market growth, emphasizing the importance of accessibility and scalability in PSA solutions.

Professional Services Automation Market Analysis By Industry

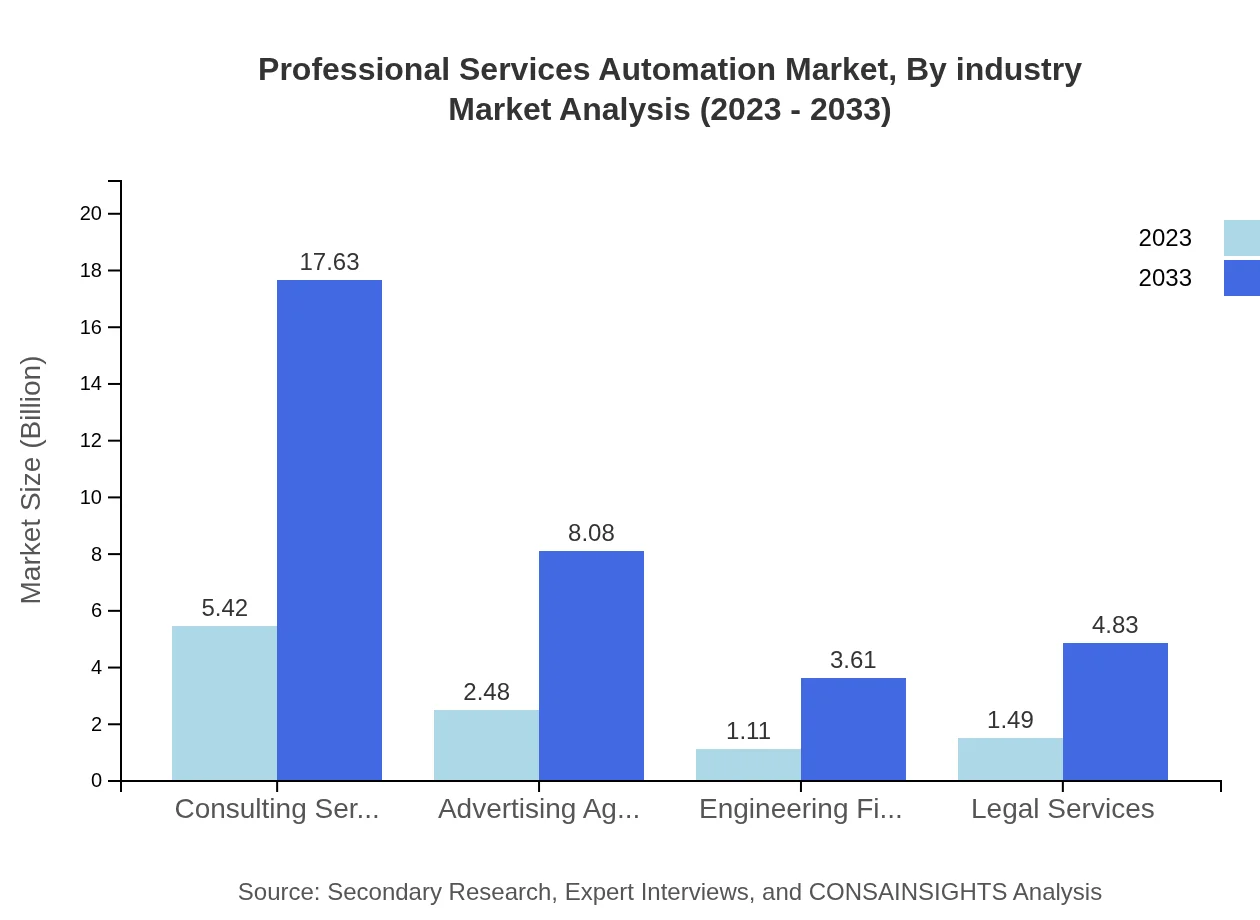

The PSA market is segmented by industry, with significant contributions from consulting services, legal services, engineering firms, and advertising agencies. Consulting services are leading with a market size of $5.42 billion in 2023 (51.61% share). Legal services and engineering firms also play vital roles, garnering market segments worth $1.49 billion (14.15% share) and $1.11 billion (10.58% share) respectively. These industries are increasingly adopting PSA solutions to optimize project execution and enhance customer interactions.

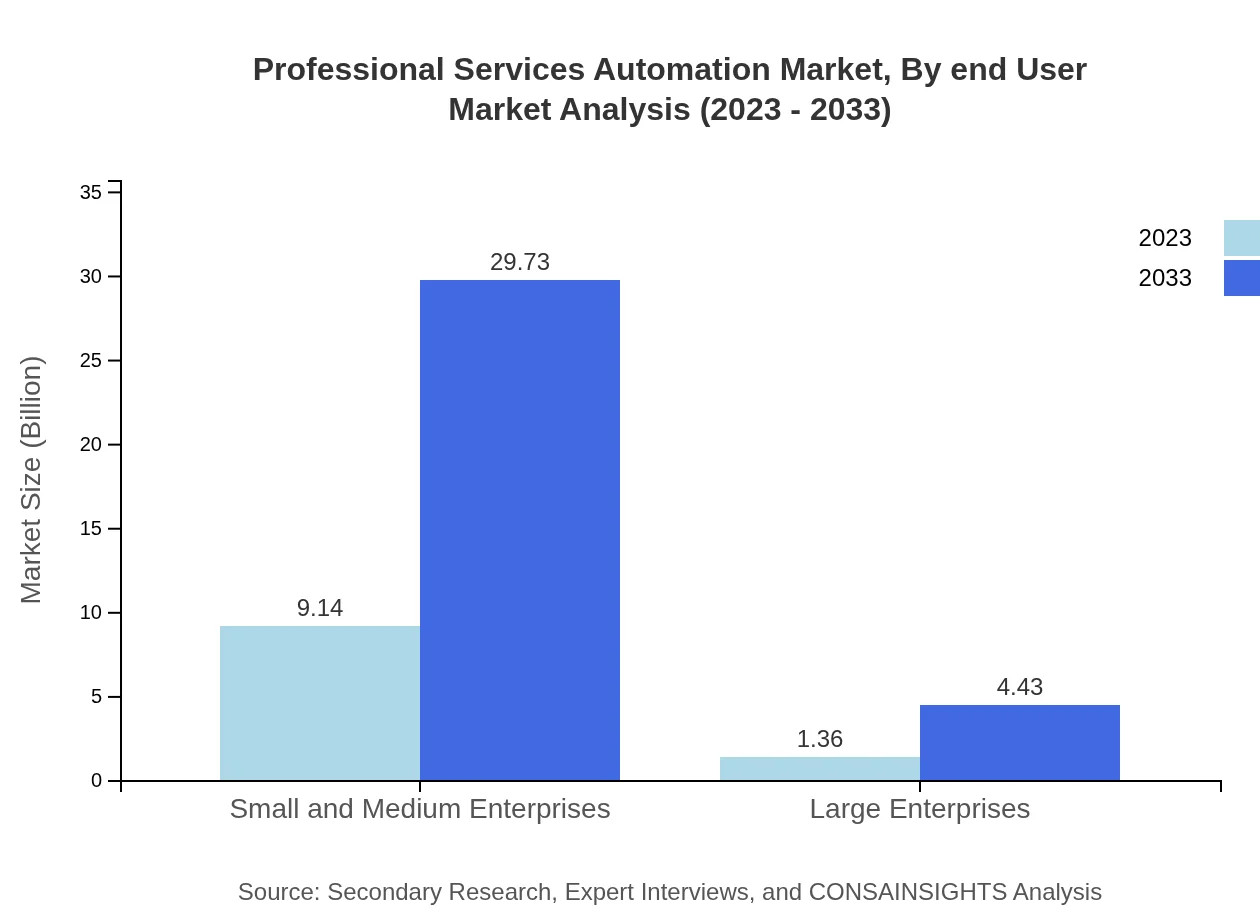

Professional Services Automation Market Analysis By End User

The end-user segment of the PSA market includes both small and medium enterprises (SMEs) and large enterprises. SMEs represent a significant portion with a market size of $9.14 billion in 2023, reflecting 87.02% of the total market share. Large enterprises, while smaller in share, have a substantial market size of $1.36 billion, representing 12.98% of the market. The increasing digital needs and budget flexibility among SMEs are driving the adoption of PSA tools, while large enterprises continue to enhance their operational frameworks with advanced PSA capabilities.

Professional Services Automation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Professional Services Automation Industry

Autotask:

A leading provider of PSA solutions, Autotask offers cloud-based platforms that streamline project management and service delivery for IT service providers.Kimble Applications:

Kimble Applications specializes in PSA software that integrates with CRM systems, focusing on delivering data-driven insights to enhance project success rates.Mavenlink:

Mavenlink provides a comprehensive PSA platform that enables organizations to manage projects, resources, and finances in a single solution.ConnectWise:

ConnectWise delivers a suite of PSA tools designed for IT and service industries, helping organizations increase efficiency through automation.NetSuite:

As part of Oracle, NetSuite offers extensive PSA solutions that combine ERP functionality with project management features, enhancing visibility across enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of professional Services Automation?

The market size of professional services automation is projected to reach $10.5 billion by 2033, growing at a CAGR of 12%. This robust growth reflects the increasing adoption of automated solutions across various sectors.

What are the key market players or companies in this professional Services Automation industry?

Key players in the professional services automation industry include SAP, Oracle, and Microsoft, among others. These companies dominate the market with innovative solutions that cater to diverse organizational needs.

What are the primary factors driving the growth in the professional Services Automation industry?

Key growth factors include the increasing demand for operational efficiency, a rise in project complexity, and the need for real-time analytics. Additionally, the shift towards cloud-based solutions is significantly contributing to market expansion.

Which region is the fastest Growing in the professional Services Automation?

The fastest-growing region in the professional services automation market is North America, expected to grow from $3.42 billion in 2023 to $11.13 billion by 2033. This growth is driven by technological advancement and high adoption rates.

Does ConsaInsights provide customized market report data for the professional Services Automation industry?

Yes, ConsaInsights offers customized market report data for the professional services automation industry, allowing clients to tailor their research based on specific needs and market segments.

What deliverables can I expect from this professional Services Automation market research project?

Deliverables include comprehensive market analysis, detailed regional insights, competitive landscape overview, and trend projections, helping stakeholders make informed decisions. Regular updates and tailored insights are also part of the offering.

What are the market trends of professional Services Automation?

Key trends include the migration towards cloud-based solutions, increasing integration of AI and machine learning, and a growing focus on enhancing customer experience. These trends reflect a broader digital transformation across industries.