Property And Casualty Insurance Market Report

Published Date: 24 January 2026 | Report Code: property-and-casualty-insurance

Property And Casualty Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Property and Casualty Insurance market, covering market dynamics, segmentation, regional insights, and future trends through 2033.

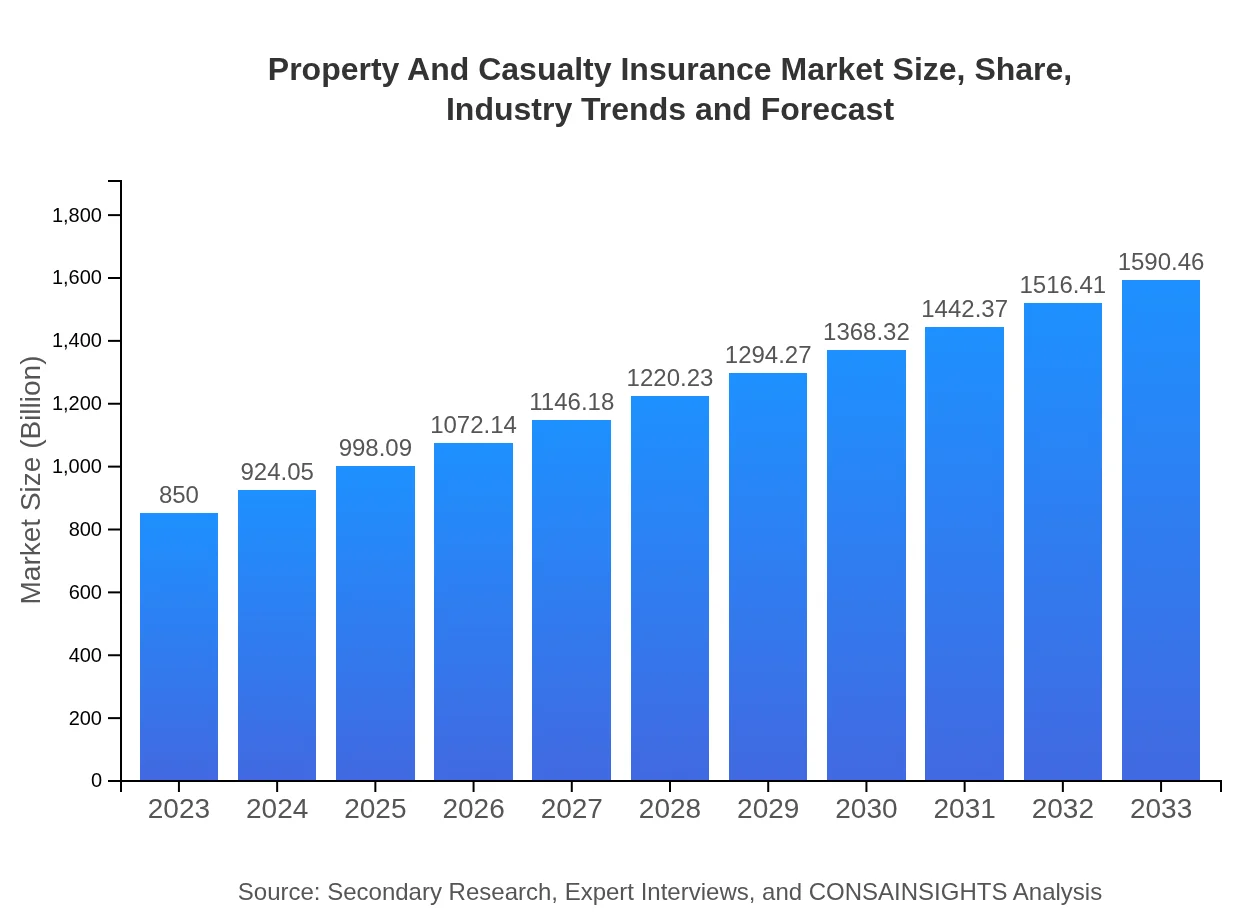

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $850.00 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $1590.46 Billion |

| Top Companies | State Farm, Allianz, AXA, Zurich Insurance Group, Berkshire Hathaway |

| Last Modified Date | 24 January 2026 |

Property And Casualty Insurance Market Overview

Customize Property And Casualty Insurance Market Report market research report

- ✔ Get in-depth analysis of Property And Casualty Insurance market size, growth, and forecasts.

- ✔ Understand Property And Casualty Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Property And Casualty Insurance

What is the Market Size & CAGR of Property And Casualty Insurance market in 2023?

Property And Casualty Insurance Industry Analysis

Property And Casualty Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Property And Casualty Insurance Market Analysis Report by Region

Europe Property And Casualty Insurance Market Report:

The European market is expected to experience growth from $238.85 billion in 2023 to $446.92 billion by 2033, influenced by a high density of insurance providers and evolving customer needs for multi-line insurance products.Asia Pacific Property And Casualty Insurance Market Report:

The Property and Casualty Insurance market in the Asia Pacific region is projected to grow from $160.91 billion in 2023 to approximately $301.07 billion by 2033, driven by economic growth, increasing middle-class consumer base, and urbanization.North America Property And Casualty Insurance Market Report:

North America leads the market with a projected growth from $323.08 billion in 2023 to $604.53 billion by 2033. The strong regulatory environment and established insurance industry drive advancements and customer trust.South America Property And Casualty Insurance Market Report:

In South America, the market size is expected to increase from $43.27 billion in 2023 to $80.95 billion in 2033. Growing awareness about insurance and government initiatives to boost the insurance sector contribute to this growth.Middle East & Africa Property And Casualty Insurance Market Report:

The Middle East and Africa market size is predicted to grow from $83.89 billion in 2023 to $156.98 billion by 2033, propelled by rising awareness and the gradual shift towards comprehensive insurance solutions.Tell us your focus area and get a customized research report.

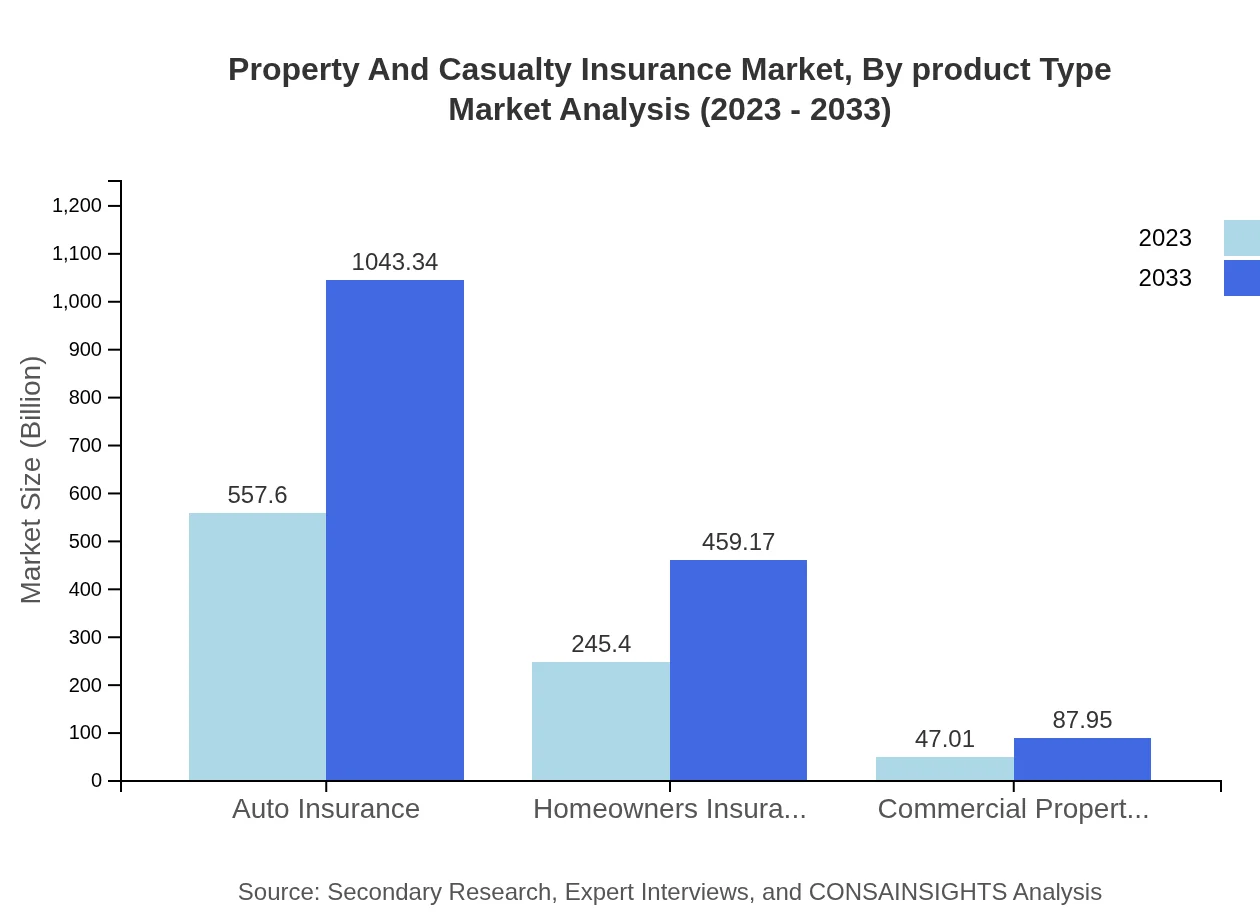

Property And Casualty Insurance Market Analysis By Product Type

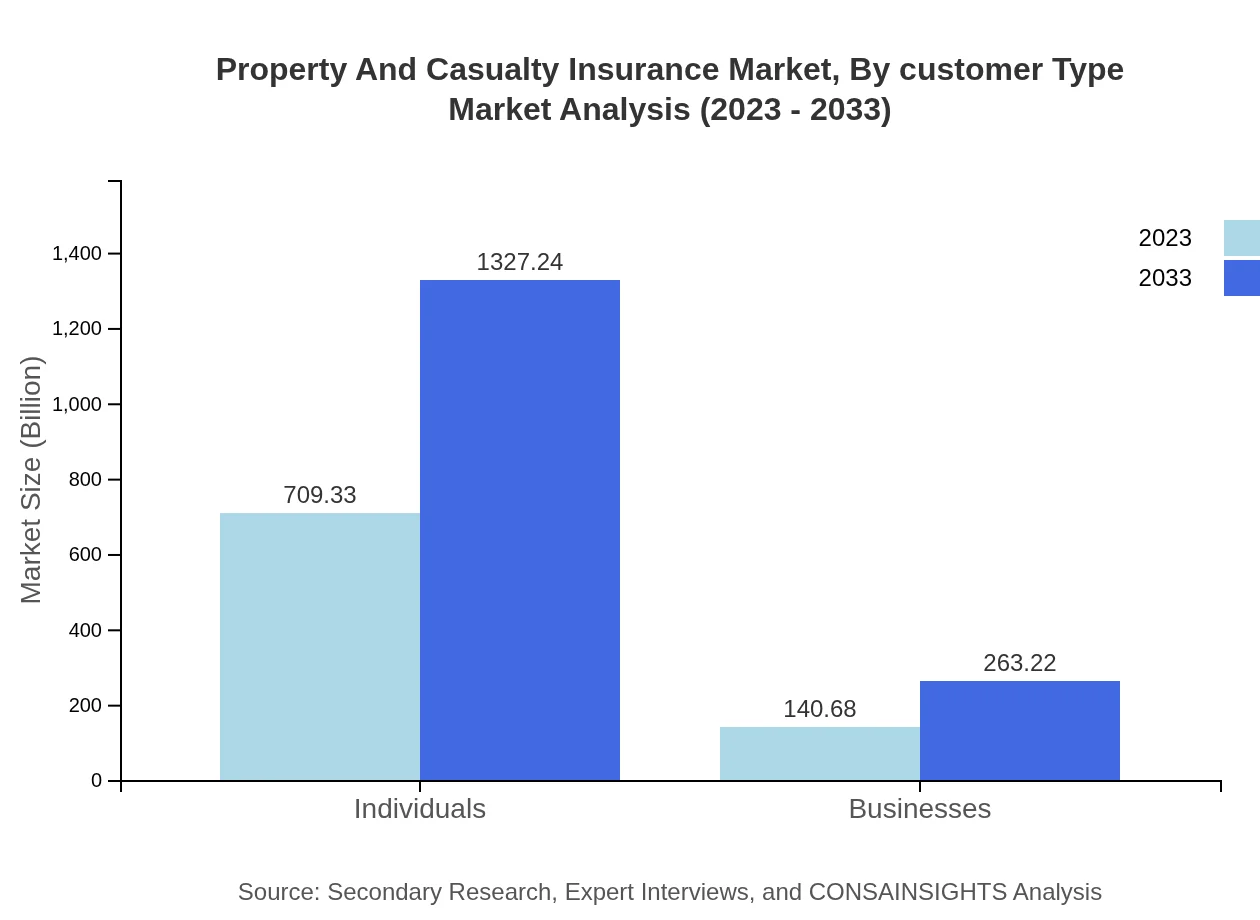

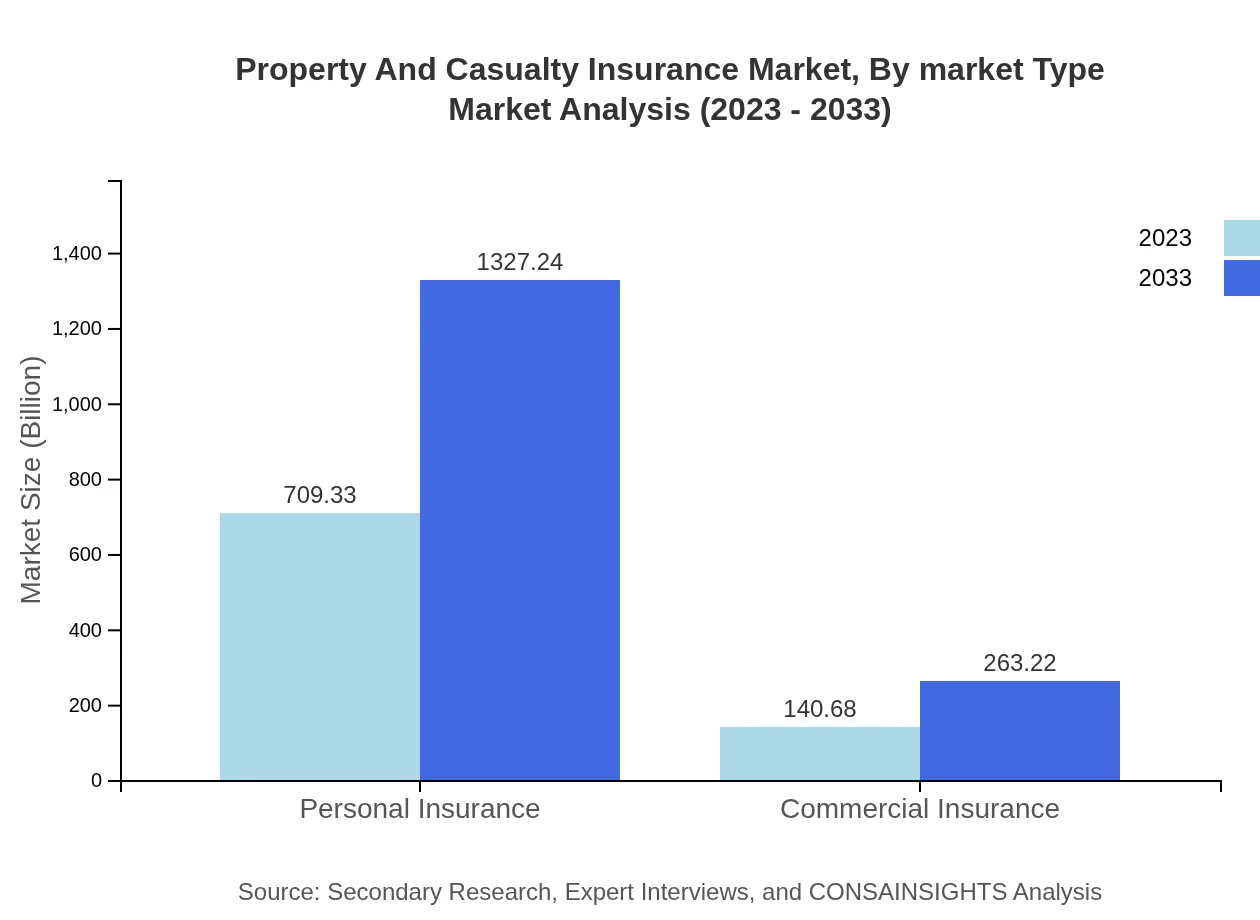

The product type segmentation reveals that personal insurance dominates the market, with a size of $709.33 billion in 2023, projected to reach $1,327.24 billion by 2033. Commercial insurance, including auto and property coverage, shows significant growth potential as businesses increasingly recognize the necessity for comprehensive coverage.

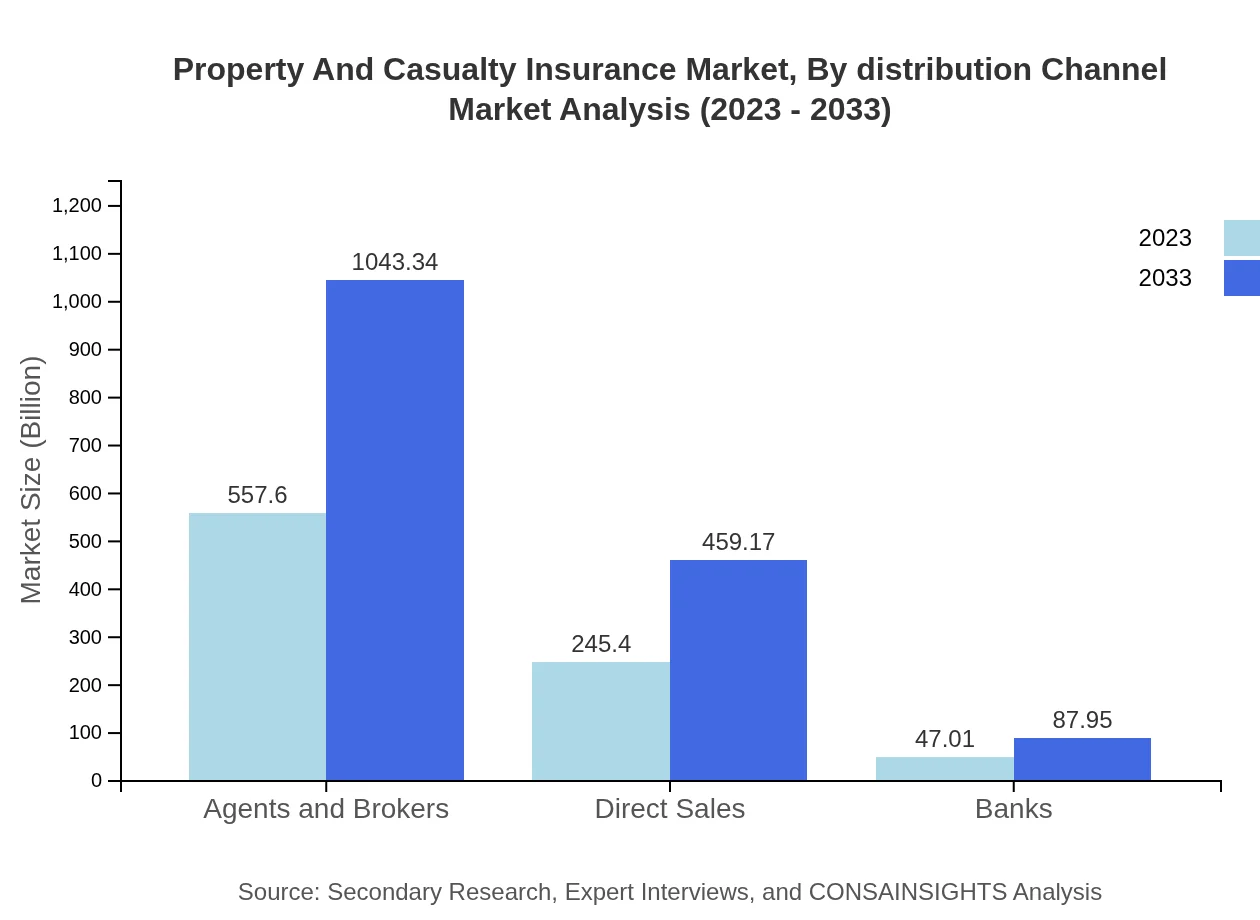

Property And Casualty Insurance Market Analysis By Distribution Channel

Distribution channels profoundly influence the innovation and accessibility of insurance products. Direct sales are forecasted to grow to $459.17 billion by 2033, while agents and brokers continue to play a critical role in customer education and policy customization.

Property And Casualty Insurance Market Analysis By Customer Type

The segmentation by customer type shows that individual buyers account for a substantial market share with $709.33 billion in 2023, growing to $1,327.24 billion. Businesses are gradually increasing their insurance investments, expected to reach $263.22 billion, indicating a shift towards risk management.

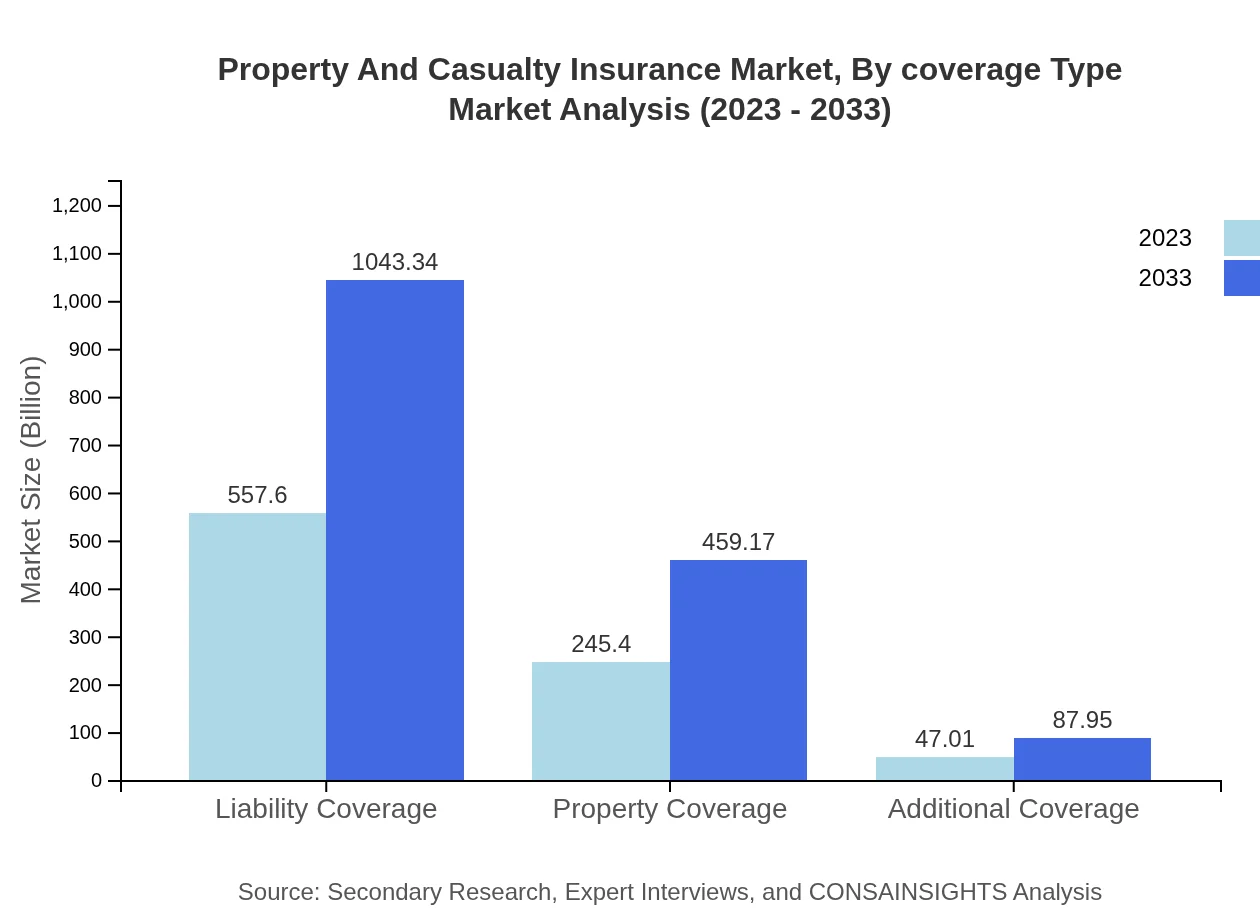

Property And Casualty Insurance Market Analysis By Coverage Type

Coverage type analysis shows liability coverage remains significant, with a market size of $557.60 billion projected to increase to $1,043.34 billion by 2033. Property and additional coverage are key drivers, reflecting consumer preferences for comprehensive policies.

Property And Casualty Insurance Market Analysis By Market Type

The analysis indicates a marked increase in the overall market size, with personal insurance maintaining an 83.45% share in 2023. The commercial insurance segment is also witnessing growth, albeit currently holding only a 16.55% market share.

Property And Casualty Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Property And Casualty Insurance Industry

State Farm:

A leading provider of auto, home, and property insurance in the United States, recognized for its customer service and wide range of products.Allianz:

One of the world's largest insurers, providing a diverse range of insurance and asset management products across all regions.AXA:

A French multinational insurance firm, offering personal and commercial insurance solutions worldwide.Zurich Insurance Group:

A global insurer that provides a variety of general insurance and life insurance products.Berkshire Hathaway:

Known for its diverse portfolio, including Geico, this conglomerate offers a wide array of insurance services.We're grateful to work with incredible clients.

FAQs

What is the market size of property And Casualty Insurance?

The property and casualty insurance market size is projected to reach approximately $850 billion by 2033, growing at a CAGR of 6.3% from 2023 onward. This significant market growth reflects increasing insurance needs across various sectors.

What are the key market players or companies in the property And Casualty Insurance industry?

Key players in the property and casualty insurance industry include major global insurers like State Farm, Allstate, Berkshire Hathaway, and Progressive. These companies dominate market share and influence industry trends through their extensive service offerings and innovation.

What are the primary factors driving the growth in the property And Casualty Insurance industry?

The growth in the property and casualty insurance industry is driven by factors like increasing awareness of risk management, regulatory changes, advancements in technology, and growth in property ownership. These trends create higher demand for comprehensive insurance coverage.

Which region is the fastest Growing in the property And Casualty Insurance?

North America is the fastest-growing region in the property and casualty insurance market, projected to expand from $323.08 billion in 2023 to $604.53 billion by 2033. This growth is fueled by the strong insurance infrastructure and increasing consumer demands.

Does ConsaInsights provide customized market report data for the property And Casualty Insurance industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the property and casualty insurance industry. This customization allows clients to gain insights relevant to their unique business strategies and market conditions.

What deliverables can I expect from this property And Casualty Insurance market research project?

Deliverables from the property and casualty insurance market research project typically include comprehensive reports, data analysis, trend forecasting, competitive analysis, and strategic recommendations to guide investment and business strategies in the insurance sector.

What are the market trends of property And Casualty Insurance?

Key market trends in the property and casualty insurance include increased digitization of services, rising demand for personalized insurance products, and greater focus on sustainability and risk mitigation strategies. These trends indicate a significant shift towards innovation in insurance offerings.