Prosthetics Market Report

Published Date: 31 January 2026 | Report Code: prosthetics

Prosthetics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global prosthetics market, exploring key trends, growth drivers, and projected growth from 2023 to 2033. It delves into regional performance, market segmentation, product types, and leading market players, providing valuable insights for stakeholders.

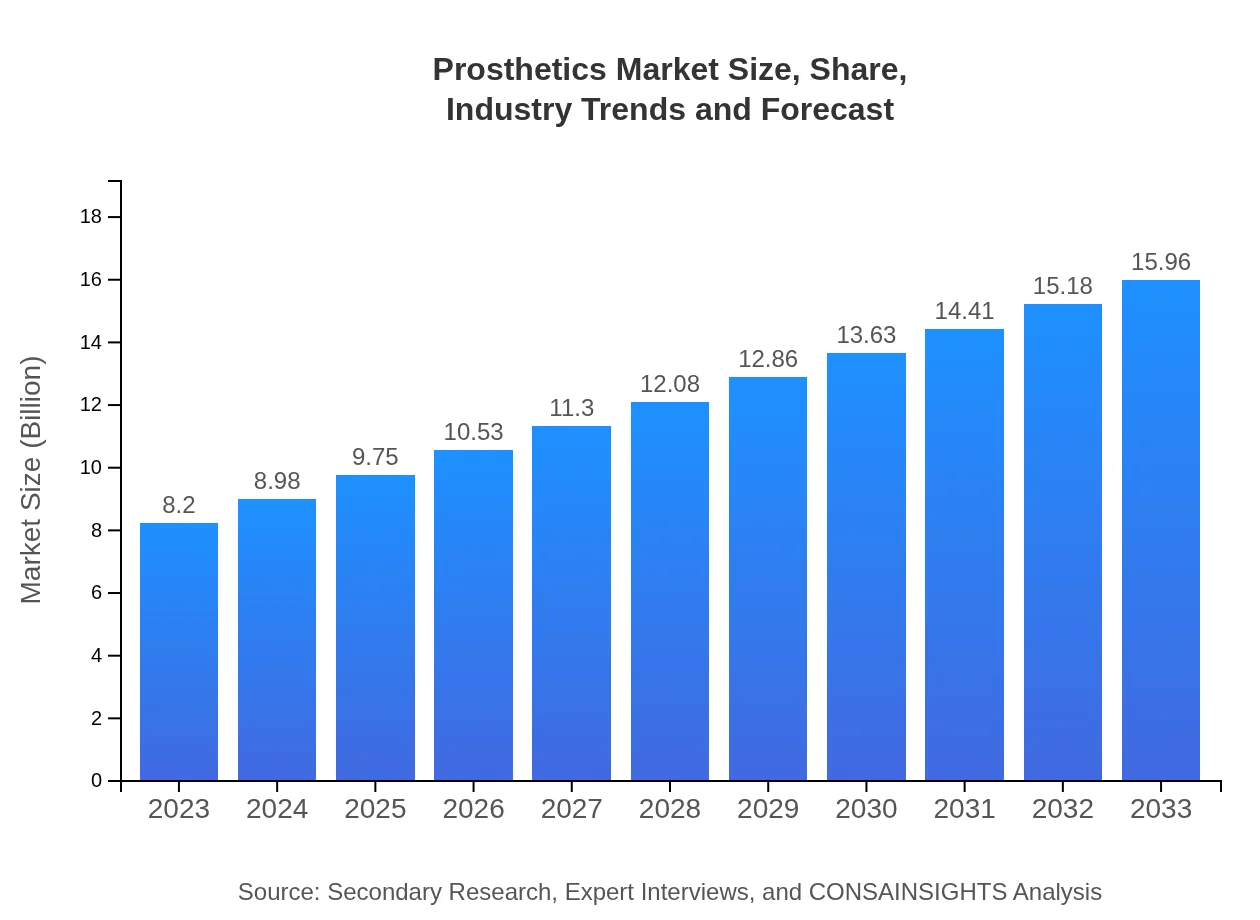

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.20 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $15.96 Billion |

| Top Companies | Ottobock, Blatchford, Darco International, Medtronic |

| Last Modified Date | 31 January 2026 |

Prosthetics Market Overview

Customize Prosthetics Market Report market research report

- ✔ Get in-depth analysis of Prosthetics market size, growth, and forecasts.

- ✔ Understand Prosthetics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Prosthetics

What is the Market Size & CAGR of Prosthetics market in 2023?

Prosthetics Industry Analysis

Prosthetics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Prosthetics Market Analysis Report by Region

Europe Prosthetics Market Report:

The European market, valued at $2.31 billion in 2023, is expected to grow to $4.50 billion by 2033. Europe leads in innovation, supported by strong regulatory frameworks and healthcare policies aimed at improving quality of life for amputees.Asia Pacific Prosthetics Market Report:

In the Asia Pacific region, the prosthetics market is projected to grow from $1.66 billion in 2023 to $3.23 billion by 2033, driven by increased demand for advanced prosthetic solutions and enhanced healthcare infrastructure. Rising disposable incomes, challenges related to road traffic injuries, and a growing elderly population contribute to this growth.North America Prosthetics Market Report:

North America is the leading market for prosthetics, valued at $2.71 billion in 2023, with projections to reach $5.26 billion by 2033. Factors influencing this growth include rising healthcare expenditure, increased incidence of diabetes, and a robust emphasis on R&D in prosthetic technologies.South America Prosthetics Market Report:

In South America, the market size is expected to rise from $0.76 billion in 2023 to $1.48 billion by 2033, reflecting increased investment in healthcare technology and awareness programs. Regional governments are also focusing on improving accessibility to prosthetic solutions.Middle East & Africa Prosthetics Market Report:

In the Middle East and Africa, the market is projected to increase from $0.77 billion to $1.49 billion by 2033. This growth is attributed to improving healthcare services and increasing public-private partnerships aimed at enhancing rehabilitation services.Tell us your focus area and get a customized research report.

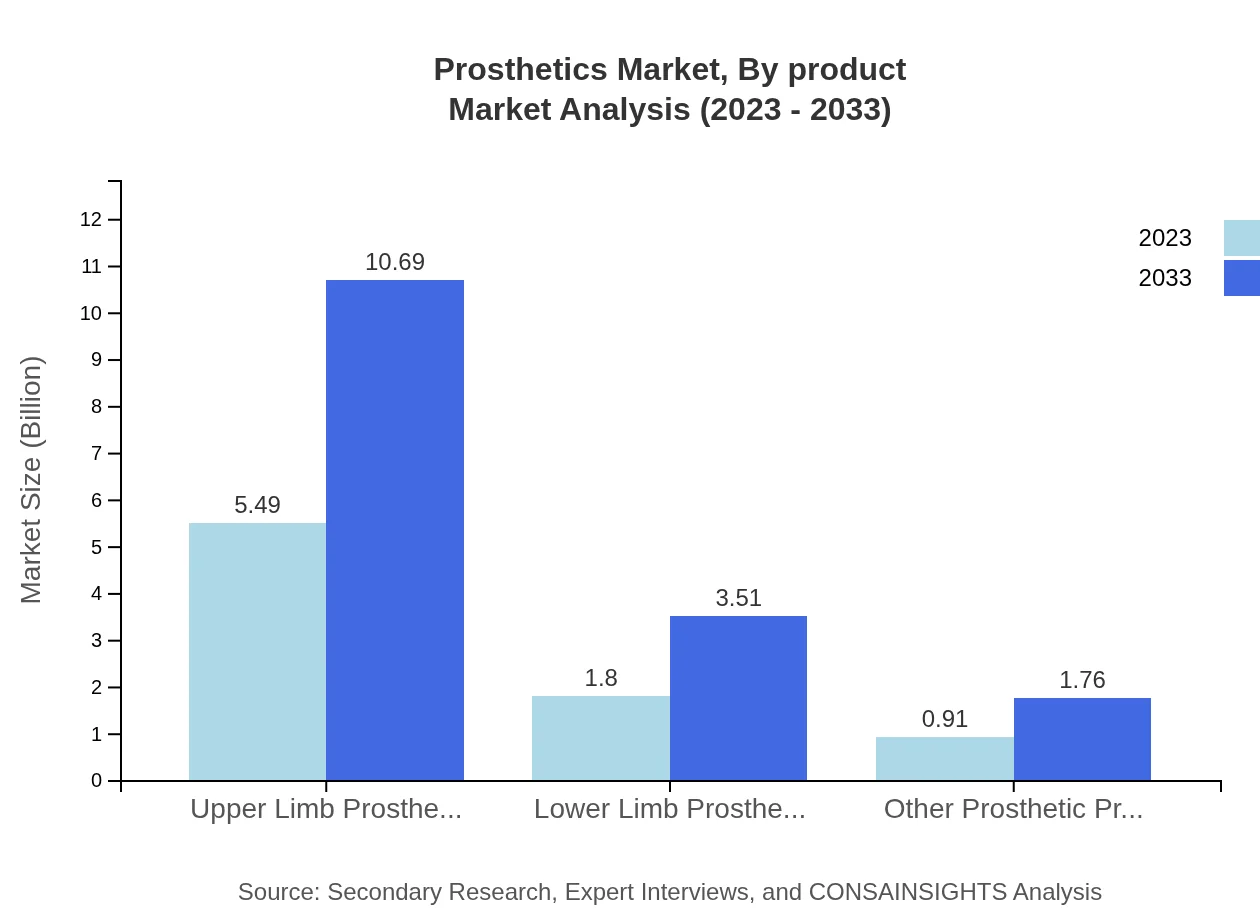

Prosthetics Market Analysis By Product

Upper limb prosthetics dominate the market, expected to grow from $5.49 billion in 2023 to $10.69 billion by 2033, maintaining a share of 66.97%. Conversely, lower limb prosthetics are anticipated to increase from $1.80 billion to $3.51 billion with a 21.98% share. Other prosthetic products are projected to expand from $0.91 billion to $1.76 billion, with an 11.05% market share.

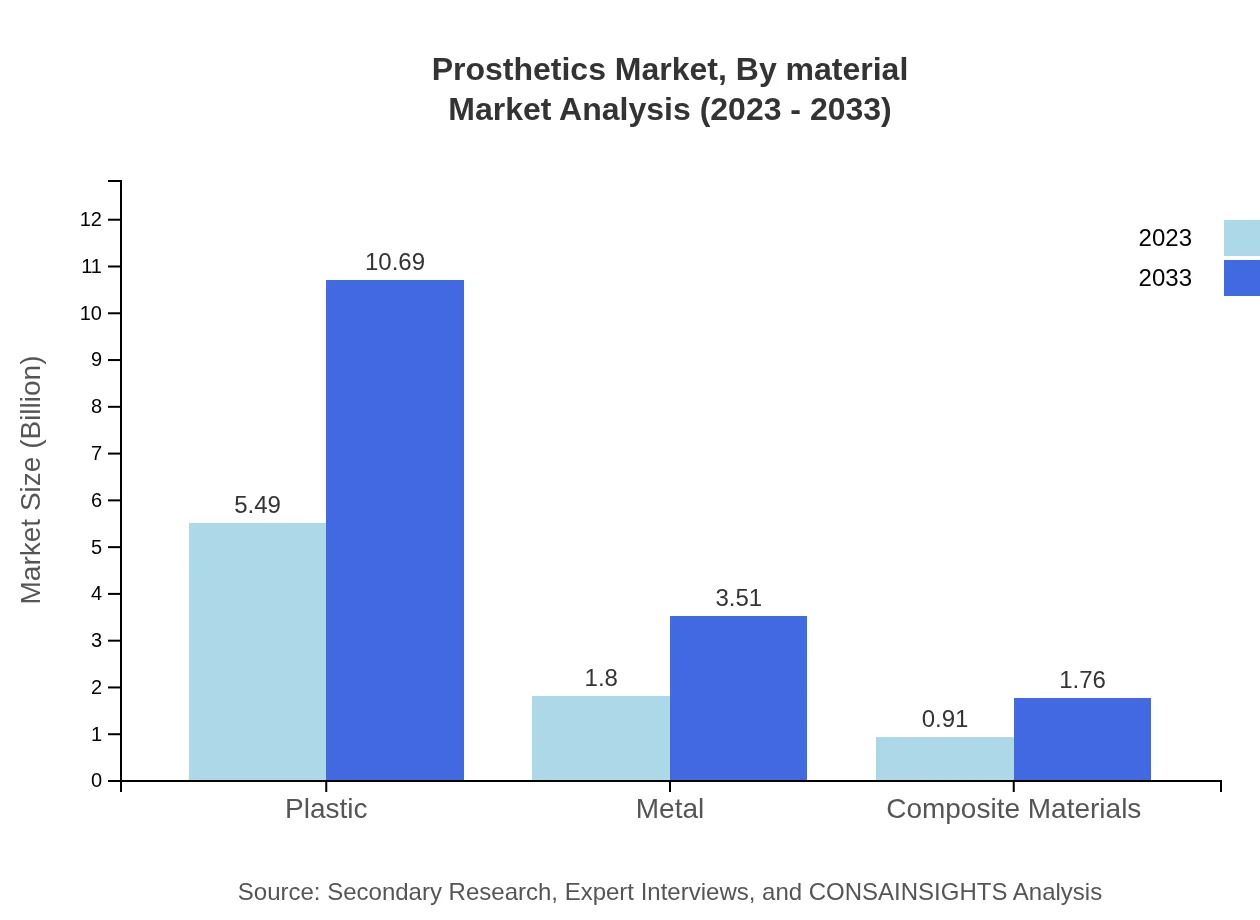

Prosthetics Market Analysis By Material

The material segment is crucial for the overall performance of prosthetic devices. Mechanical prosthetics dominate with a forecasted growth from $5.49 billion to $10.69 billion by 2033, holding a 66.97% market share. Electronic prosthetics will likely grow from $1.80 billion to $3.51 billion, representing 21.98%, while smart prosthetics will see growth from $0.91 billion to $1.76 billion at 11.05%.

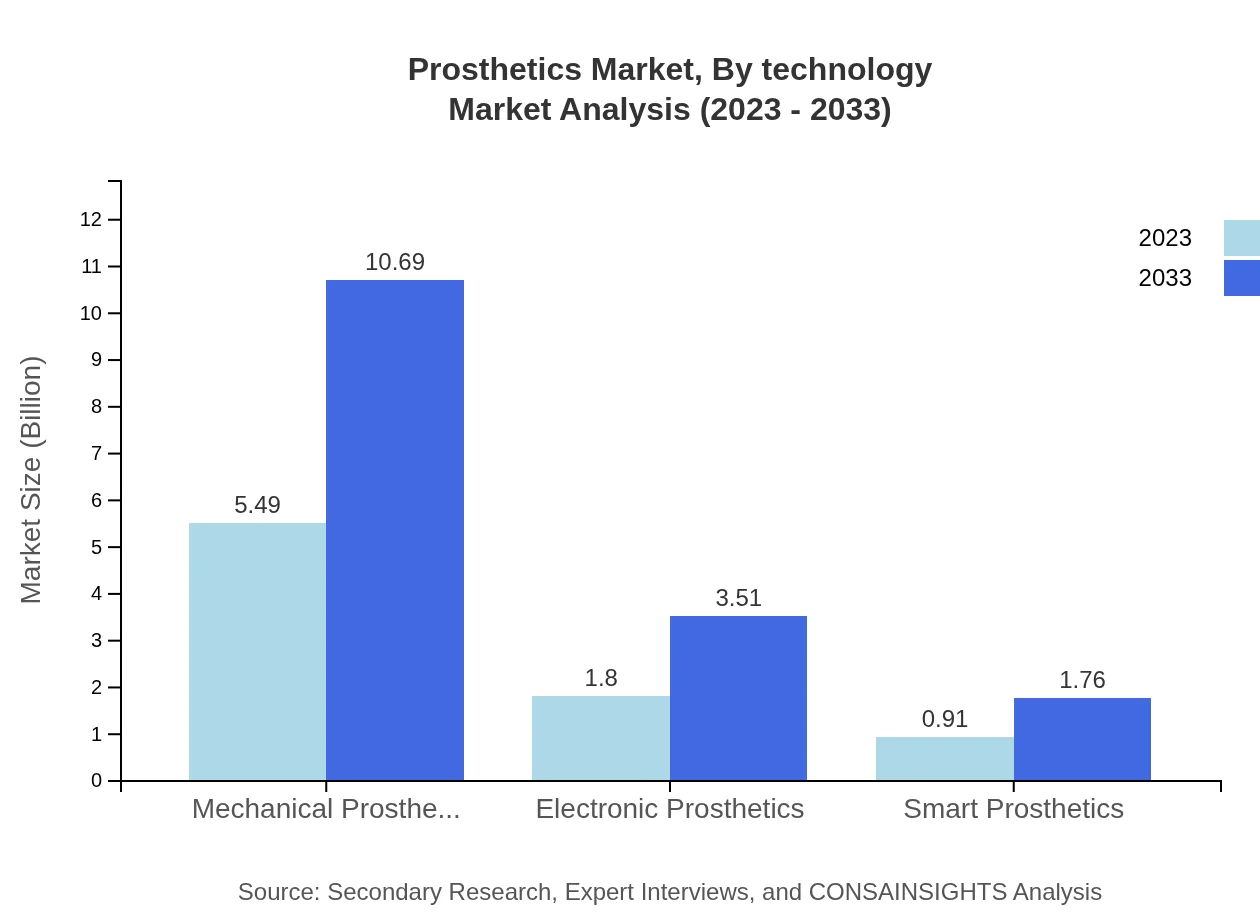

Prosthetics Market Analysis By Technology

Technological advancements play a significant role in market development. Mechanical and electronic prosthetics are the leading segments due to their efficacy and advancements in robotics and control systems. Smart prosthetics, though still emerging, showcase substantial potential with a focus on integration with digital health solutions.

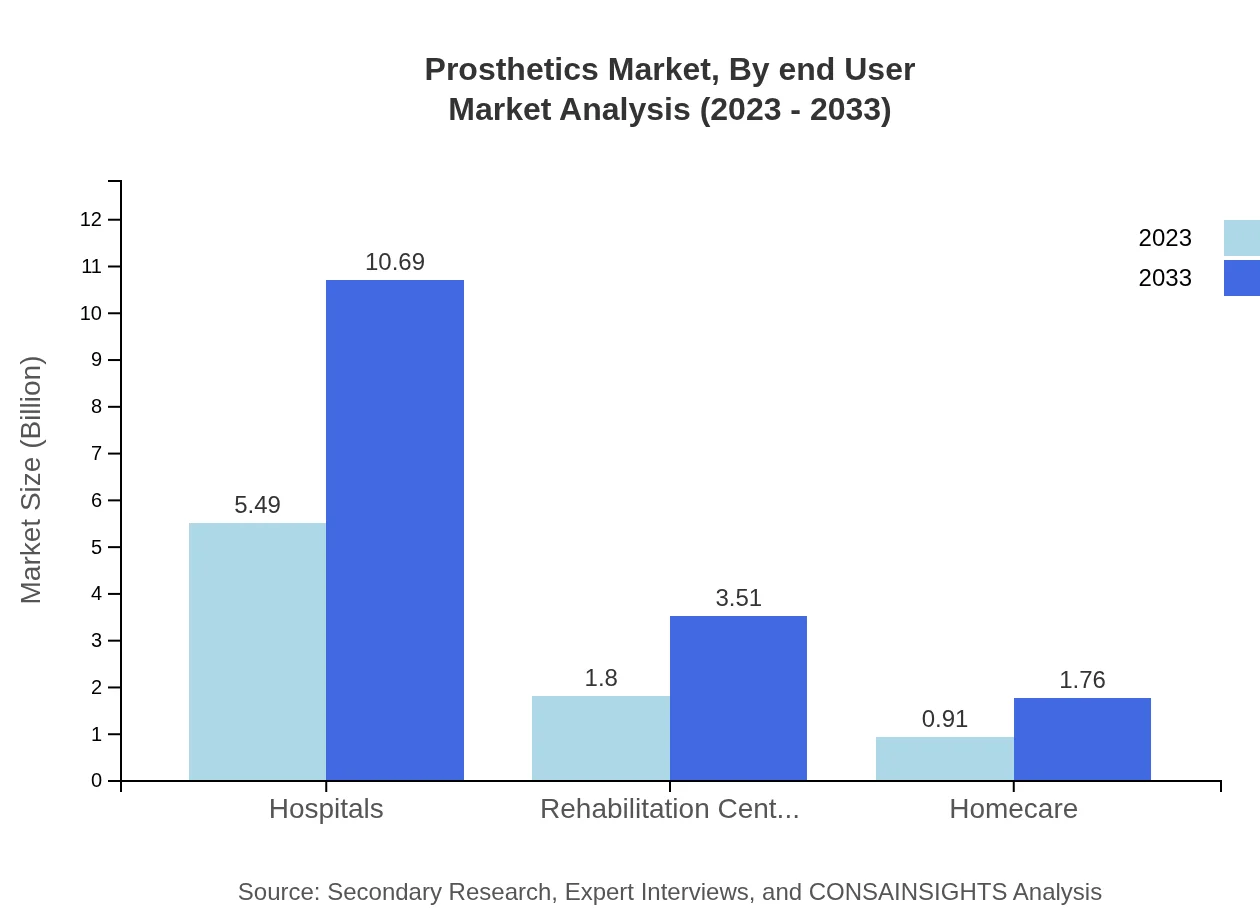

Prosthetics Market Analysis By End User

Hospitals are the largest segment, representing $5.49 billion in 2023 and projected to grow to $10.69 billion by 2033, maintaining a 66.97% share. Rehabilitation centers and homecare environments also see growth, rising from $1.80 billion to $3.51 billion (21.98% share) and from $0.91 billion to $1.76 billion (11.05% share), respectively.

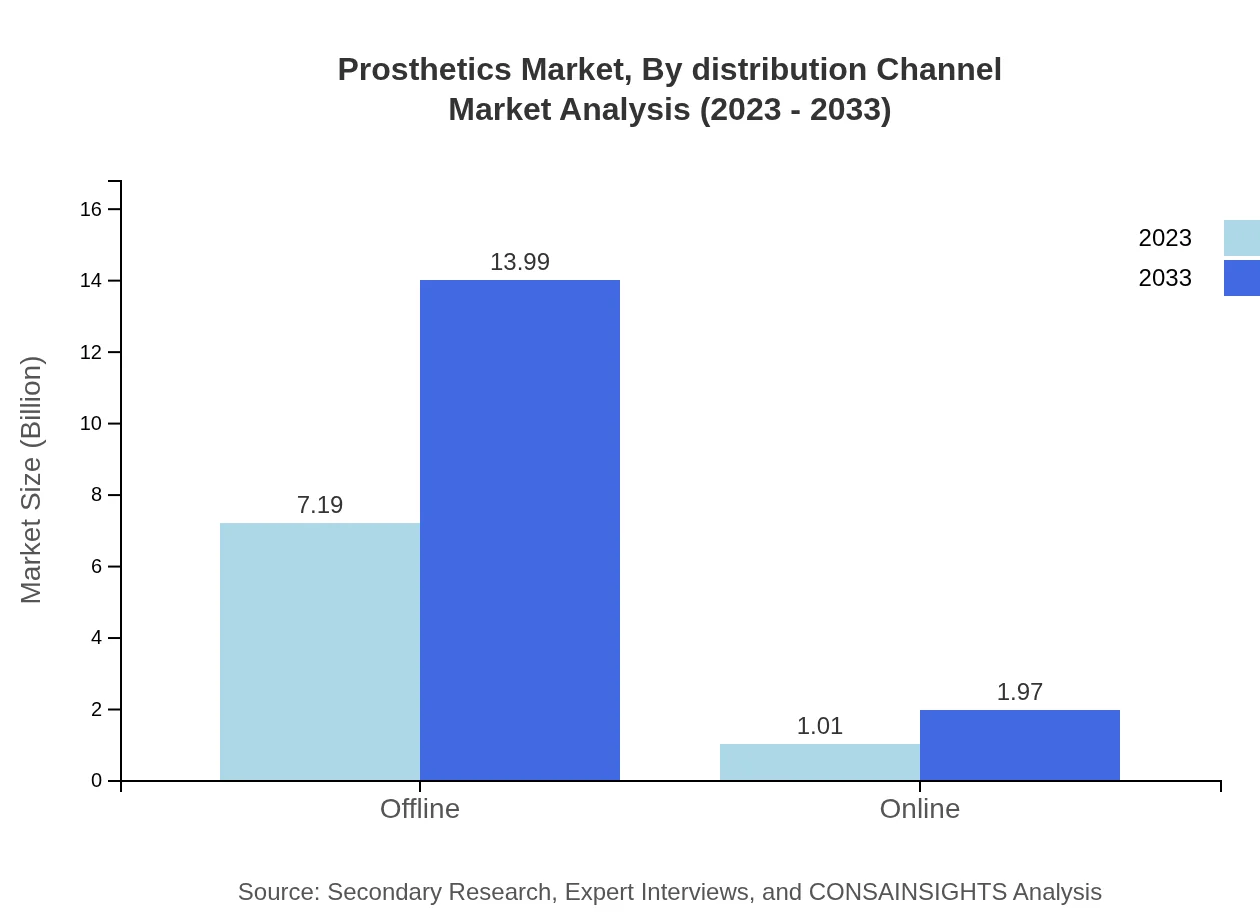

Prosthetics Market Analysis By Distribution Channel

The distribution landscape indicates strong offline channels accounting for $7.19 billion in 2023, forecasted to grow to $13.99 billion by 2033, representing 87.64% share. Online distribution is growing swiftly with expectations of reaching $1.97 billion by 2033 from $1.01 billion, indicating the shifting dynamics of consumer behavior and preferences.

Prosthetics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Prosthetics Industry

Ottobock:

Ottobock is a leading manufacturer of prosthetic limbs and orthotics, renowned for their innovative approaches to rehabilitation and care. They emphasize technology integration within their devices to enhance user experience.Blatchford:

Blatchford specializes in prosthetic and orthotic solutions, particularly for lower limb functionality. They are committed to sustainability and ensuring accessibility in their product offerings.Darco International:

Darco focuses on specialized medical devices, including prosthetics, offering advanced solutions to improve treatment outcomes and aid rehabilitation.Medtronic :

Medtronic, a global leader in medical technology, also targets advanced prosthetic solutions that cater to specific health needs, contributing significantly to overall healthcare advancements.We're grateful to work with incredible clients.

FAQs

What is the market size of prosthetics?

The global prosthetics market is valued at approximately $8.2 billion in 2023, with a projected CAGR of 6.7% from 2023 to 2033, indicating robust growth driven by advancements in technology and an increasing aging population.

What are the key market players or companies in the prosthetics industry?

Key players in the prosthetics market include Ottobock, Össur, Blatchford, Smith & Nephew, and Hanger, Inc. These companies specialize in innovative designs and technologies aimed at improving patient outcomes.

What are the primary factors driving the growth in the prosthetics industry?

The growth in the prosthetics market is primarily driven by advancements in technology, increasing incidence of amputations, aging demographics, and rising awareness about prosthetic options and their benefits.

Which region is the fastest Growing in the prosthetics market?

The Asia-Pacific region is the fastest-growing market for prosthetics, with the market expected to grow from $1.66 billion in 2023 to $3.23 billion by 2033, reflecting a strong demand driven by healthcare advancements.

Does ConsaInsights provide customized market report data for the prosthetics industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs in the prosthetics industry, allowing clients to obtain insights that match their particular focus areas and objectives.

What deliverables can I expect from this prosthetics market research project?

Deliverables from the prosthetics market research include detailed market analyses, segment breakdowns, trends, forecasts, competitive landscape reviews, and actionable insights tailored to support strategic decision-making.

What are the market trends of prosthetics?

Current trends in the prosthetics market include the rise of smart prosthetics, increased adoption of 3D printing technology, and a growing emphasis on patient-centered design, which seeks to enhance user experience and product functionality.