Protective Cultures Market Report

Published Date: 31 January 2026 | Report Code: protective-cultures

Protective Cultures Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Protective Cultures market, covering its growth potential, industry dynamics, and regional analysis from 2023 to 2033. It includes market size projections, segmentation details, the finest companies in the industry, and trends shaping the future.

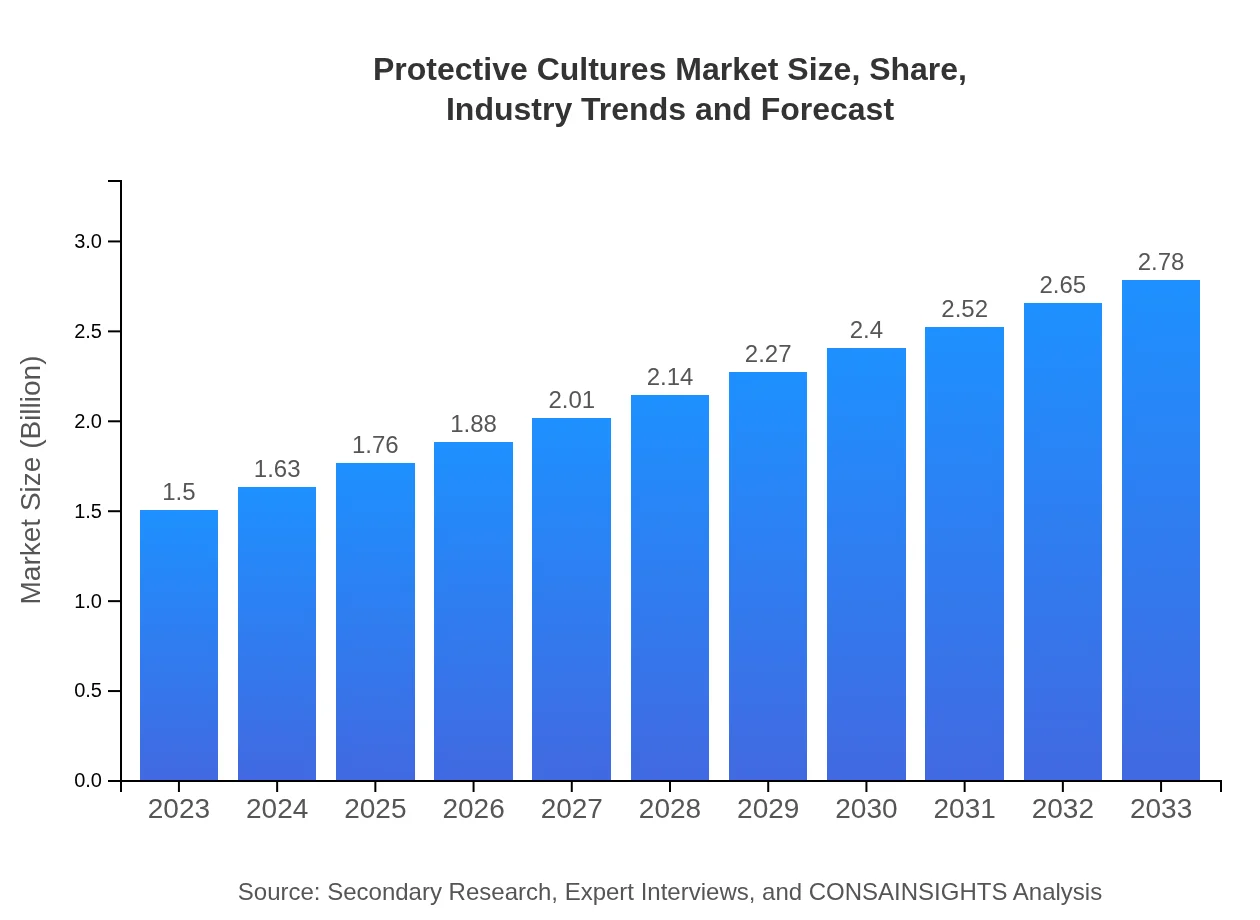

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | DuPont, Chr. Hansen, Yara International, Lallemand, Meiji Holdings |

| Last Modified Date | 31 January 2026 |

Protective Cultures Market Overview

Customize Protective Cultures Market Report market research report

- ✔ Get in-depth analysis of Protective Cultures market size, growth, and forecasts.

- ✔ Understand Protective Cultures's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Protective Cultures

What is the Market Size & CAGR of Protective Cultures market in 2023?

Protective Cultures Industry Analysis

Protective Cultures Market Segmentation and Scope

Tell us your focus area and get a customized research report.

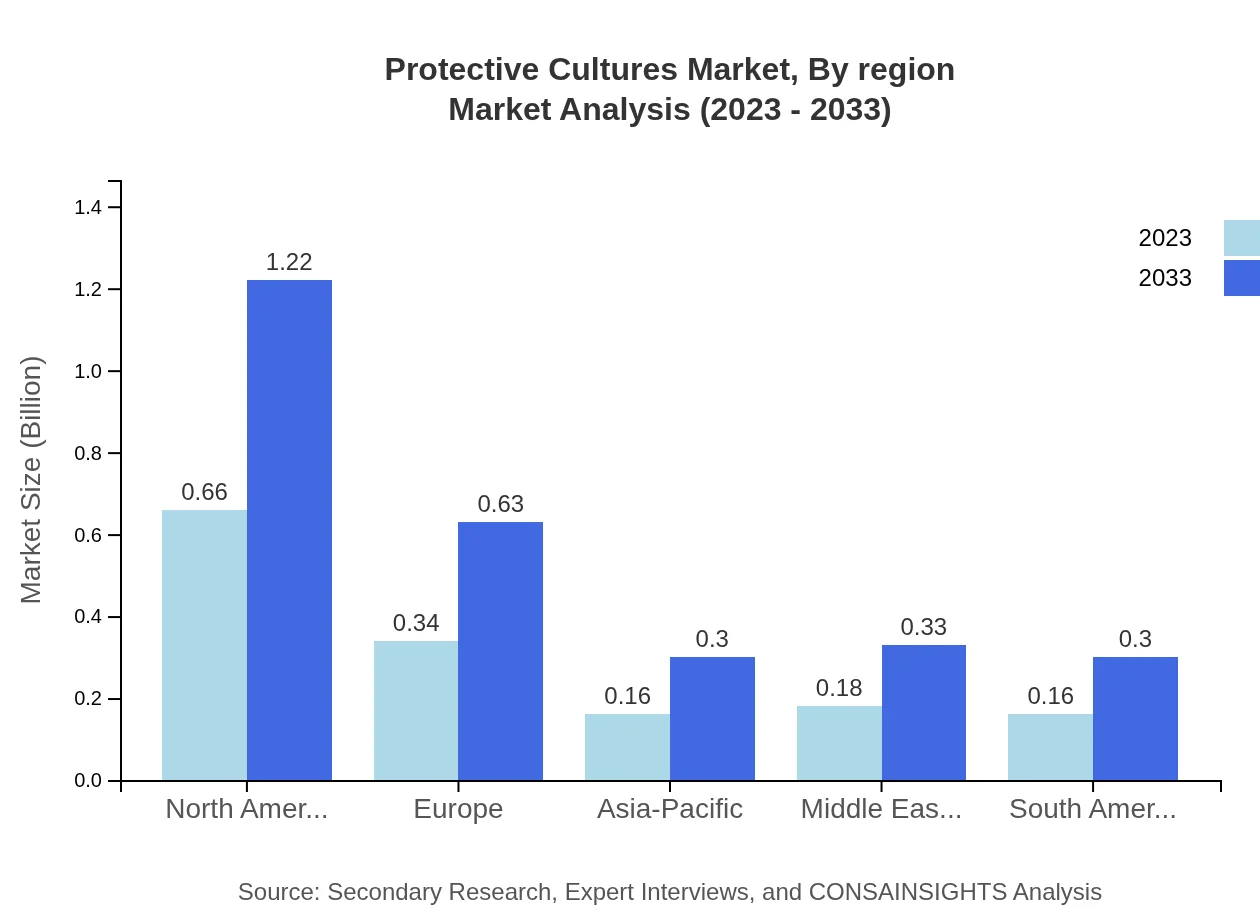

Protective Cultures Market Analysis Report by Region

Europe Protective Cultures Market Report:

The European Protective Cultures market is estimated at USD 0.47 billion in 2023, with a forecast of USD 0.87 billion by 2033. Ongoing regulatory advancements and consumer euros towards clean label products drive this region's expansion.Asia Pacific Protective Cultures Market Report:

In 2023, the Protective Cultures market in the Asia-Pacific region is valued at USD 0.25 billion, with expectations to reach USD 0.46 billion by 2033, showcasing a healthy growth trend fueled by rising meat consumption and investments in food safety technologies.North America Protective Cultures Market Report:

North America presents a significant market opportunity with a value of USD 0.58 billion in 2023, projected to expand to USD 1.07 billion by 2033. The region's robust food industry and consumer inclination towards healthier preserved products fuel its growth.South America Protective Cultures Market Report:

The South American market, though smaller at USD 0.01 billion in 2023, is expected to grow steadily as consumer focus shifts toward food quality and preservation, anticipated to remain at USD 0.01 billion by 2033 due to unique regional challenges.Middle East & Africa Protective Cultures Market Report:

In the Middle East and Africa, the market was valued at USD 0.20 billion in 2023 and is expected to grow to USD 0.36 billion by 2033, as the demand for improved food safety standards intensifies in line with consumer awareness initiatives.Tell us your focus area and get a customized research report.

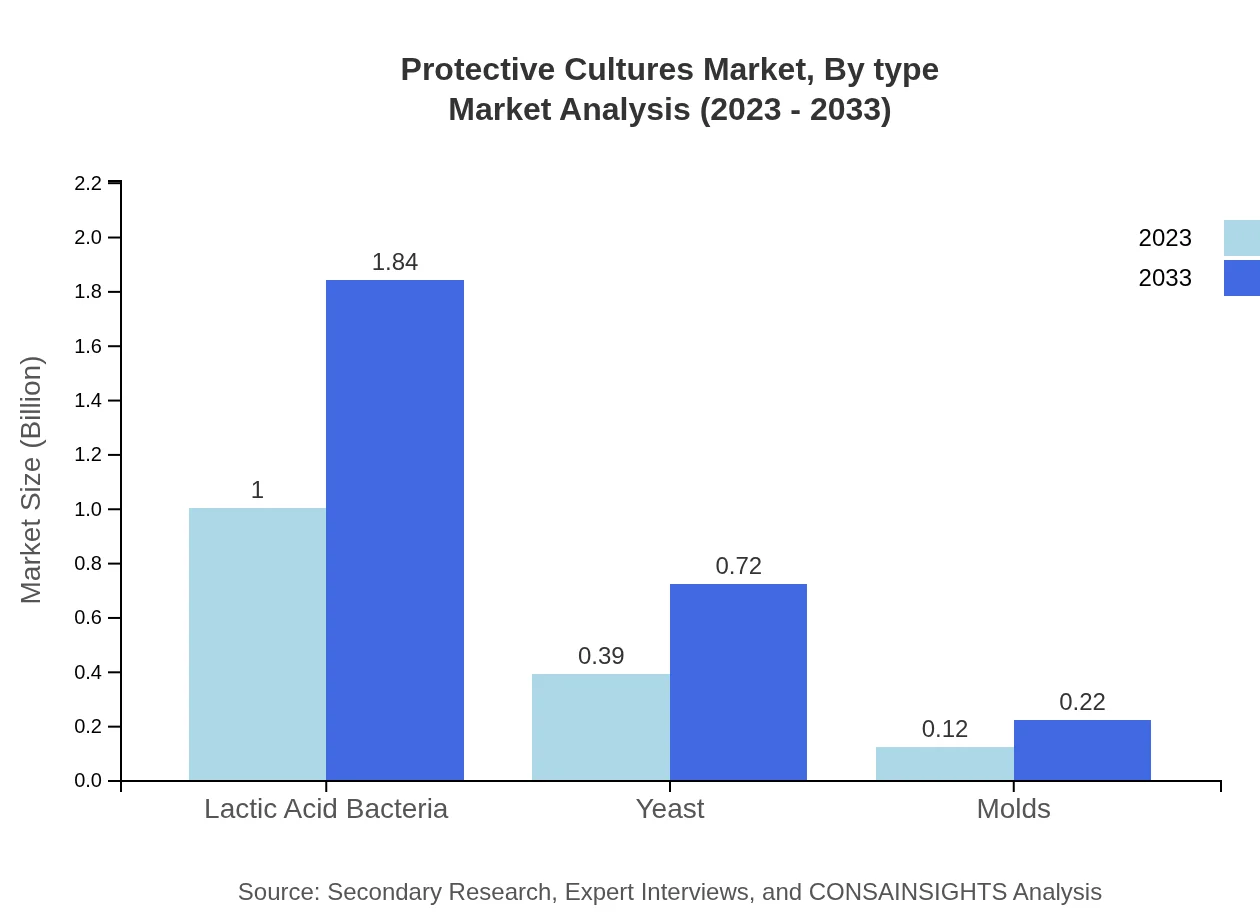

Protective Cultures Market Analysis By Type

By type, the Protective Cultures market consists of lactic acid bacteria, yeast, and molds. Lactic acid bacteria accounted for a dominant market share of approximately 66.37%, owing to their extensive application in dairy and meat preservation. Similarly, yeast is significant in the baking and beverage sectors, holding about 25.74% of the share, while molds, though smaller, serve specific niche markets.

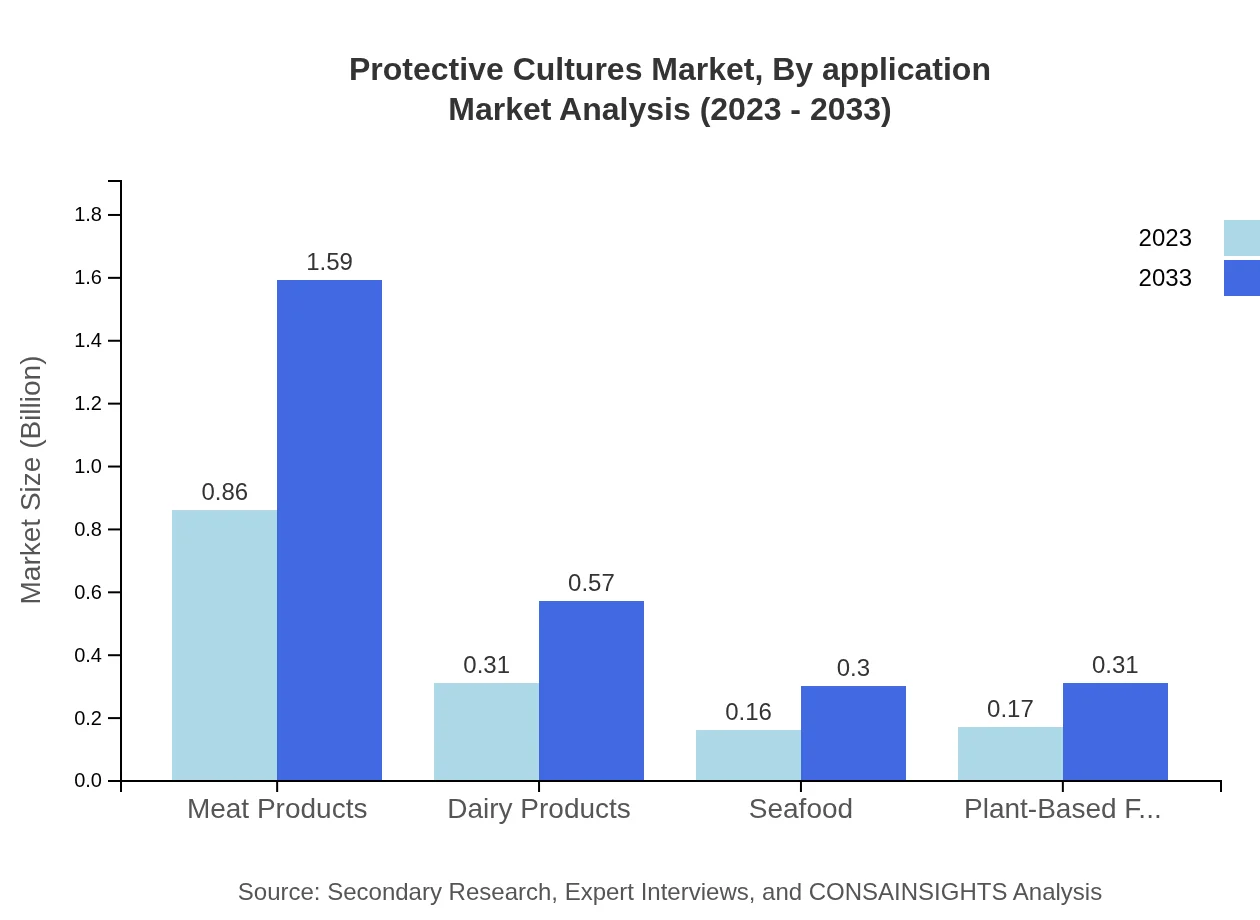

Protective Cultures Market Analysis By Application

The application of protective cultures spans across various segments including meat products, dairy products, seafood, and plant-based foods. Meat products represent the largest segment, expected to maintain a share of 57.32% due to the high demand for safer, extended shelf-life options. Dairy products follow at 20.49%, highlighting their essential role in enhancing flavor and safety.

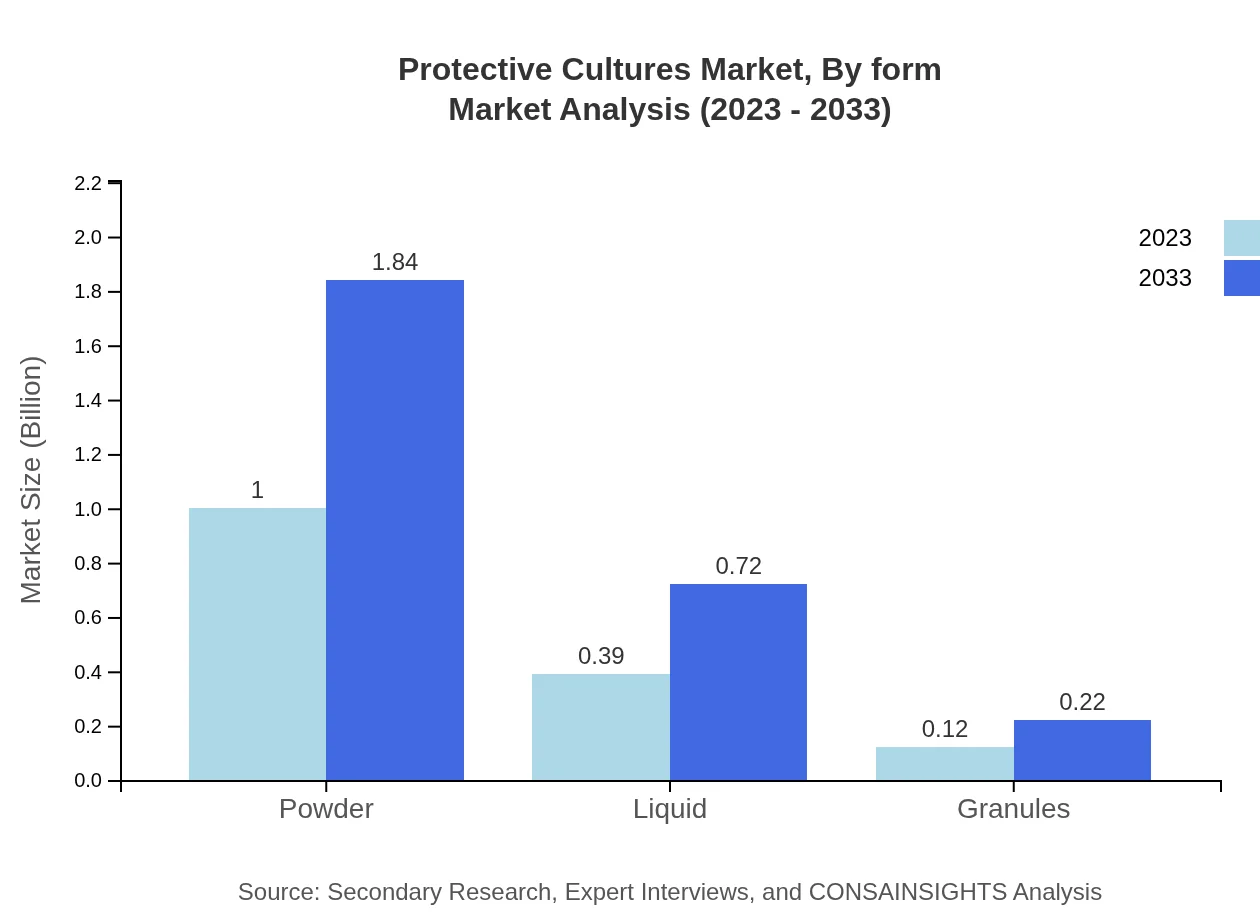

Protective Cultures Market Analysis By Form

In terms of form, the powders segment holds the largest market share of approximately 66.37%, with a projected market size of USD 1.00 billion in 2023, evolving to USD 1.84 billion by 2033. Liquids capture a substantial demand as well, especially in the dairy sector, representing 25.74% of the market share, while granules account for a minor segment at 7.89%.

Protective Cultures Market Analysis By Region

Each region demonstrates distinct growth trajectories and preferences for protective cultures. North America leads in terms of market size and growth rate, while Europe's regulations enhance market adaptivity. Asia Pacific's increasing meat consumption and awareness of food safety issues contribute significantly to the overall market dynamics.

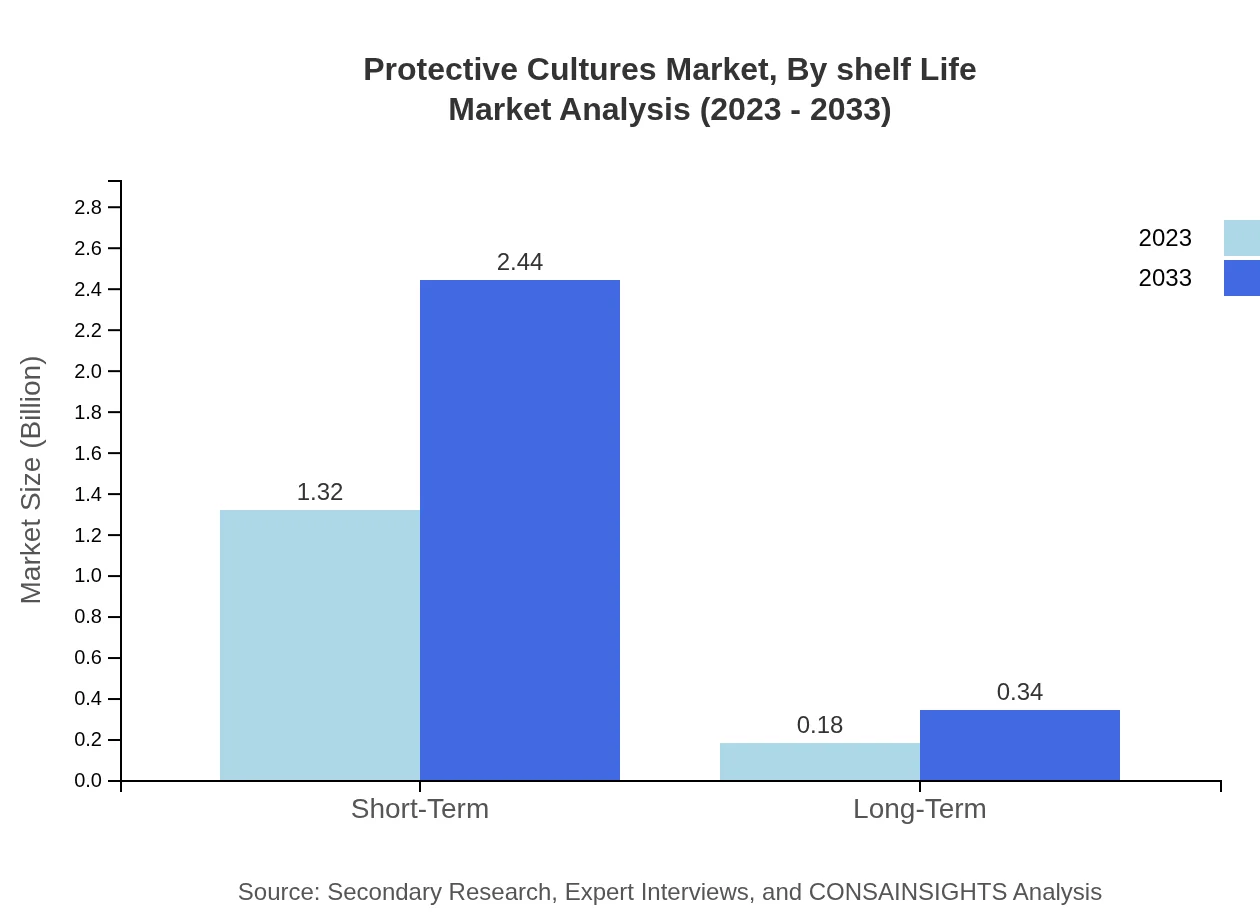

Protective Cultures Market Analysis By Shelf Life

The market is further segmented by shelf life into short-term and long-term offerings. Short-term protective cultures dominate the market, accounting for an overwhelming share of 87.88%, primarily utilized in instant and ready-to-eat products, while long-term options make up only 12.12%, catering to specialized applications.

Protective Cultures Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Protective Cultures Industry

DuPont:

DuPont, a global leader in biotechnology, plays a significant role in providing innovative protective cultures aimed at improving food safety and prolonging shelf life in various food categories.Chr. Hansen:

Chr. Hansen specializes in biosolutions and is recognized for its cutting-edge protective cultures that enhance flavor, safety, and quality in dairy and meat products.Yara International:

Yara is known for its commitment to sustainable agricultural solutions, offering protective cultures that resonate with modern food safety practices.Lallemand:

Lallemand is a key player in the microbiological solutions market, providing various protective cultures designed to meet the rising demand for safe food products worldwide.Meiji Holdings:

Meiji Holdings focuses on developing dairy and food products and offers protective cultures that contribute to the enhancement of texture and flavor while ensuring food safety.We're grateful to work with incredible clients.

FAQs

What is the market size of protective Cultures?

The protective cultures market is currently valued at approximately $1.5 billion, with a projected CAGR of 6.2%. By 2033, the market is expected to grow significantly, reflecting increasing demand in various sectors.

What are the key market players or companies in this protective Cultures industry?

Key players in the protective cultures industry include established fermentation companies, industrial microbiologists, food preservative producers, and biotechnology firms. They are crucial for innovations and supply chain management within the sector.

What are the primary factors driving the growth in the protective Cultures industry?

Key growth factors include rising consumer demand for food safety, increased shelf-life for perishable products, and advancements in fermentation technology. Regulatory support and a shift toward healthier food options also contribute to market growth.

Which region is the fastest Growing in the protective Cultures?

North America is currently the fastest growing region in the protective cultures market, expanding from $0.58 billion in 2023 to $1.07 billion by 2033, driven by innovation in food preservation technologies and growing health consciousness.

Does ConsaInsights provide customized market report data for the protective Cultures industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, including detailed analyses, regional insights, and segmentation data on the protective cultures industry, enabling informed decision-making.

What deliverables can I expect from this protective Cultures market research project?

Expect detailed reports including market size analysis, growth trends, competitive landscape, regional breakdown data, and projections. Additionally, insights into consumer behavior and product segmentation will be provided.

What are the market trends of protective Cultures?

Market trends show a shift towards clean-label ingredients, increased use of protective cultures in plant-based foods, and innovation in biopreservation methods. Companies are increasingly focusing on sustainable practices to attract health-conscious consumers.