Protein Ingredients Market Report

Published Date: 31 January 2026 | Report Code: protein-ingredients

Protein Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Protein Ingredients market, forecasting trends and growth from 2023 to 2033. It includes the market's current conditions, size, segmentation, and insights into key regions and leading companies.

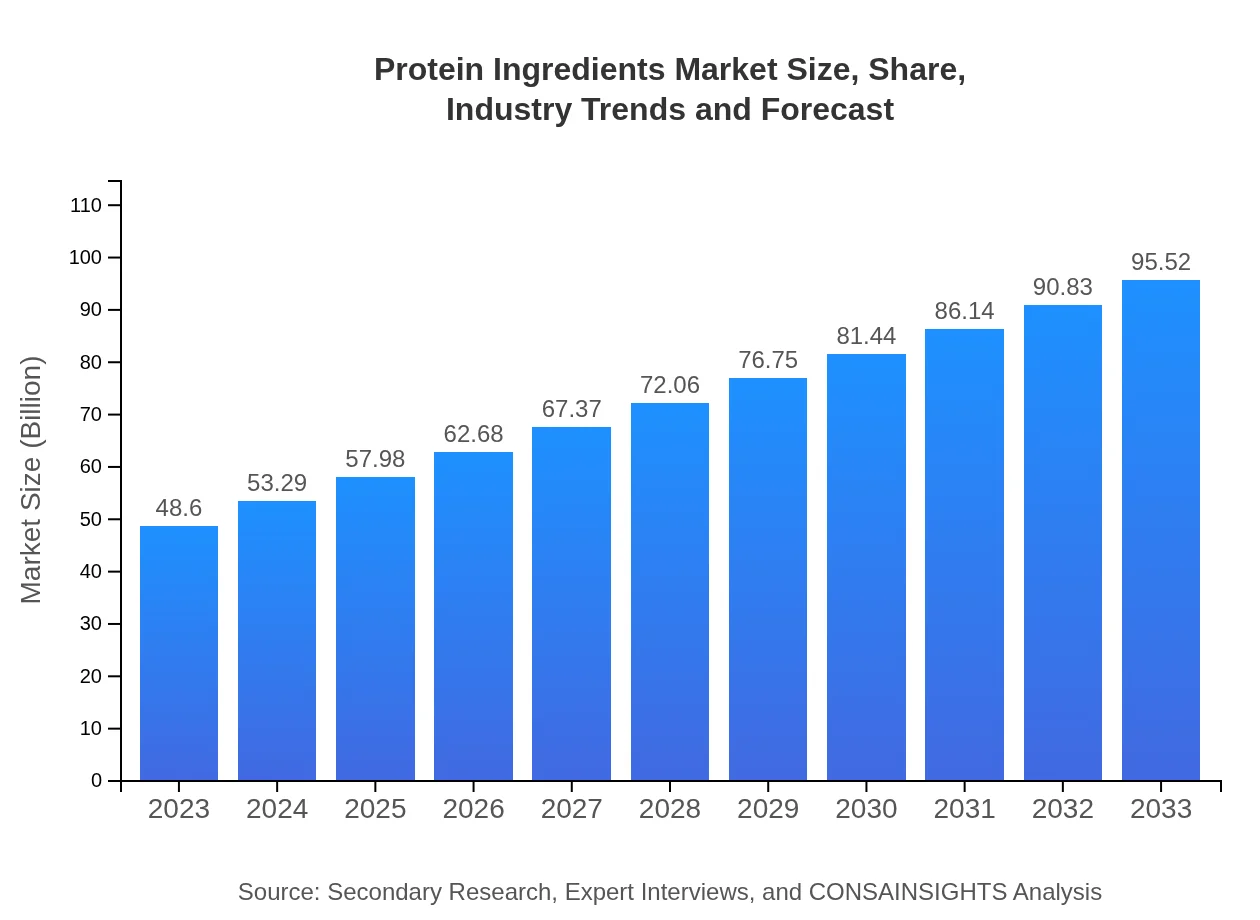

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $48.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $95.52 Billion |

| Top Companies | DuPont Nutrition & Biosciences, Cargill, Incorporated, ADM (Archer Daniels Midland Company), BASF SE, Fonterra Co-operative Group |

| Last Modified Date | 31 January 2026 |

Protein Ingredients Market Overview

Customize Protein Ingredients Market Report market research report

- ✔ Get in-depth analysis of Protein Ingredients market size, growth, and forecasts.

- ✔ Understand Protein Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Protein Ingredients

What is the Market Size & CAGR of Protein Ingredients market in 2023?

Protein Ingredients Industry Analysis

Protein Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Protein Ingredients Market Analysis Report by Region

Europe Protein Ingredients Market Report:

Europe is experiencing a growing trend toward plant-based diets and clean-label products, with the market size expected to almost double from $12.30 billion in 2023 to $24.17 billion in 2033. This shift indicates an increasing consumer preference for sustainable and healthy food choices.Asia Pacific Protein Ingredients Market Report:

The Asia Pacific region is witnessing rapid growth in the Protein Ingredients market, anticipated to reach $19.37 billion by 2033 from $9.86 billion in 2023, reflecting a strong CAGR as health awareness rises and the demand for functional foods increases.North America Protein Ingredients Market Report:

North America is the largest market, with estimates of $35.80 billion by 2033, starting from $18.22 billion in 2023. The demand for dietary supplements and protein-fortified foods fuels growth in this region, reflecting a culture centered around health and fitness.South America Protein Ingredients Market Report:

In South America, the market is projected to grow from $3.28 billion in 2023 to $6.45 billion by 2033. With increasing interest in protein-rich diets and fitness, the region supports a robust expansion of the Protein Ingredients sector.Middle East & Africa Protein Ingredients Market Report:

The Middle East and Africa market is poised to reach $9.73 billion by 2033 from $4.95 billion in 2023, driven by improving economic conditions and rising awareness of health benefits associated with protein intake.Tell us your focus area and get a customized research report.

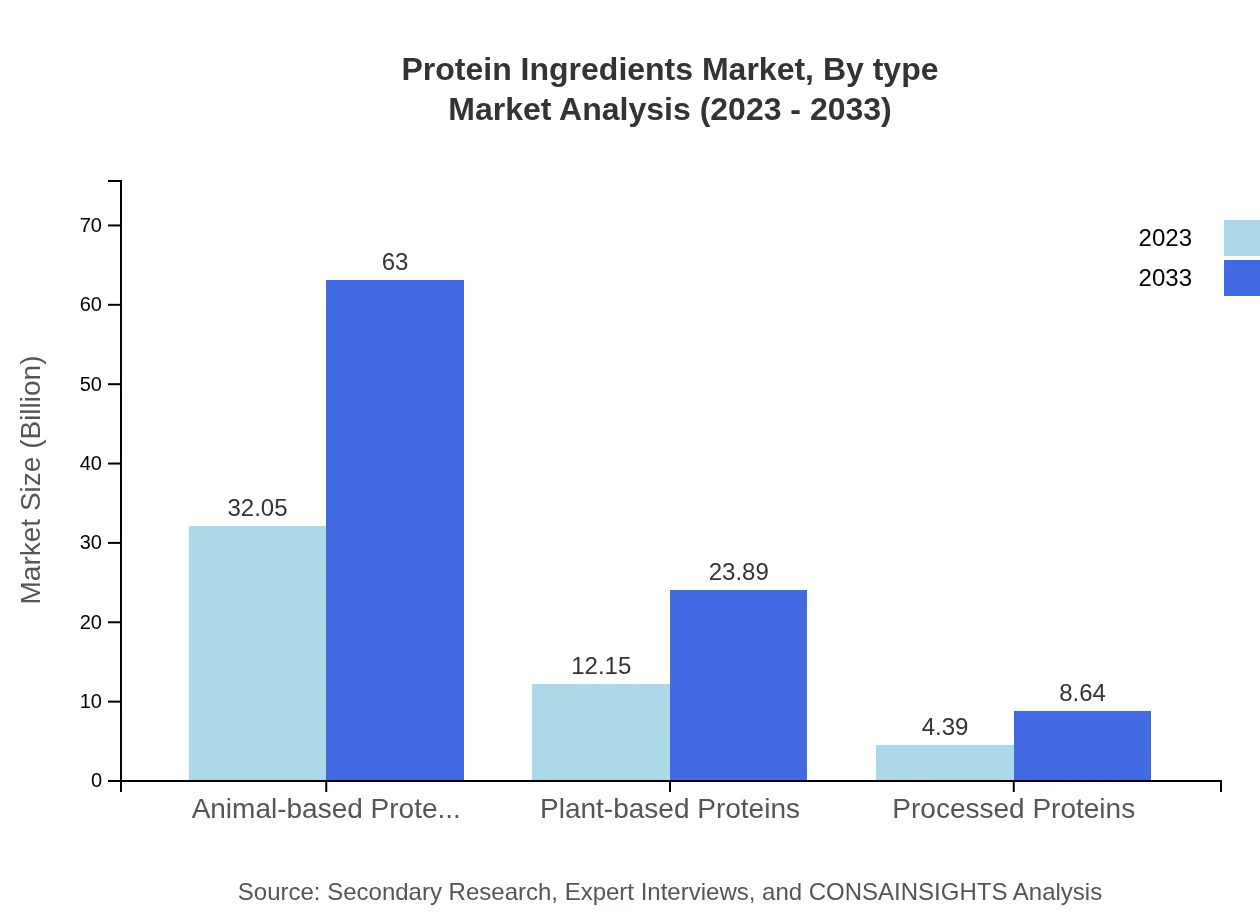

Protein Ingredients Market Analysis By Type

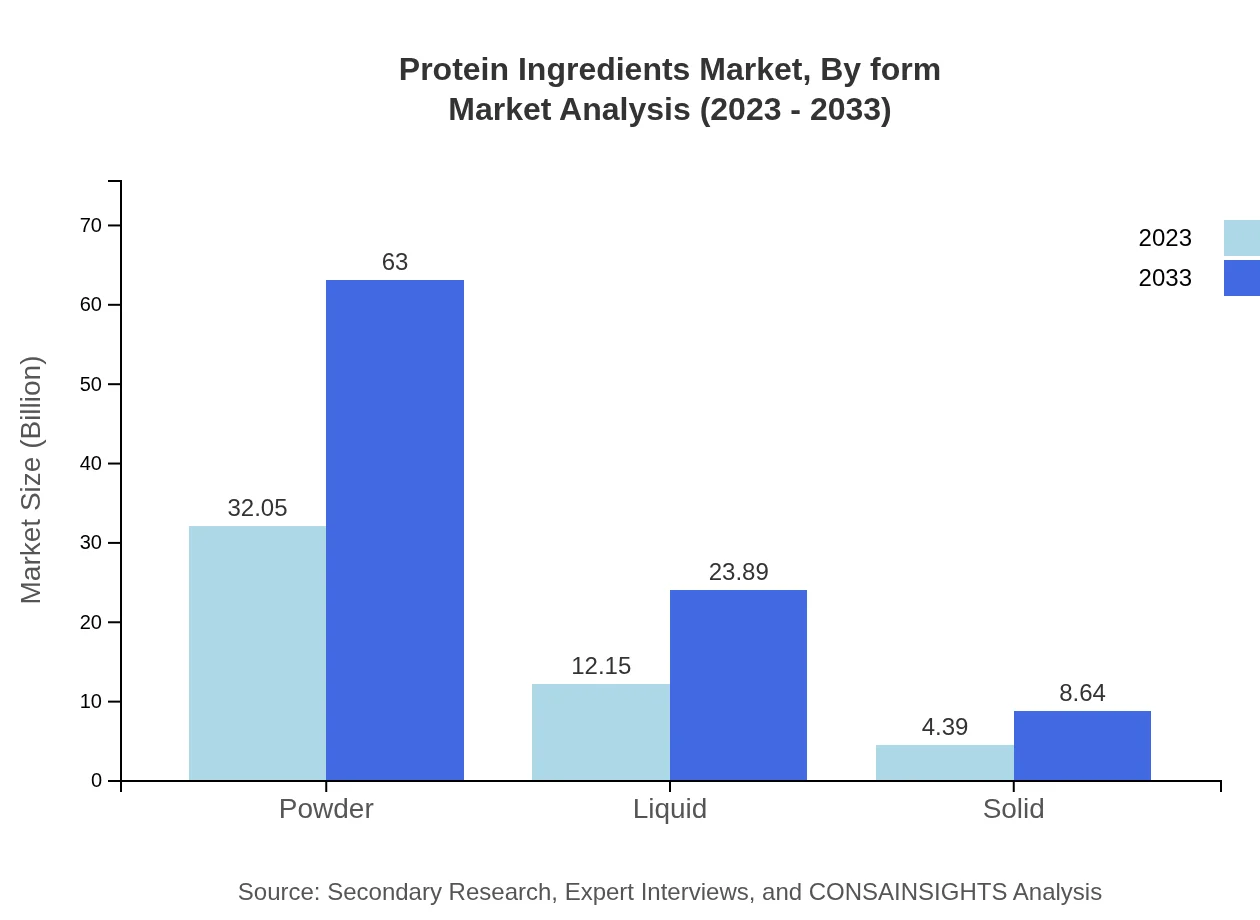

The Protein Ingredients market is primarily divided into powders, liquids, and solids. Powders dominate the market, projected to grow from $32.05 billion in 2023 to $63.00 billion by 2033, holding a market share of 65.95%. Liquid protein products will also see growth from $12.15 billion to $23.89 billion. Solid protein forms will have lower growth, emphasizing the dominant role of powder-based proteins.

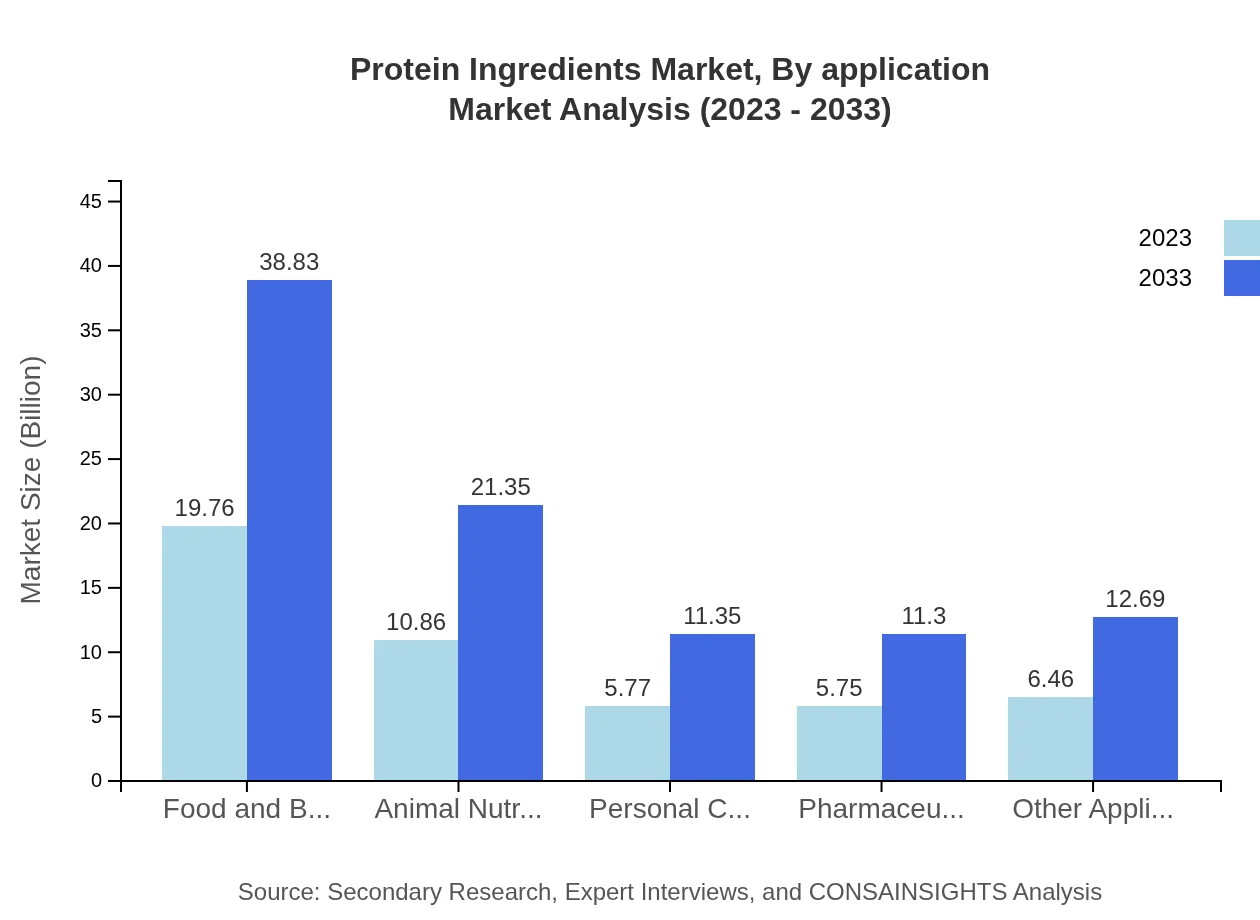

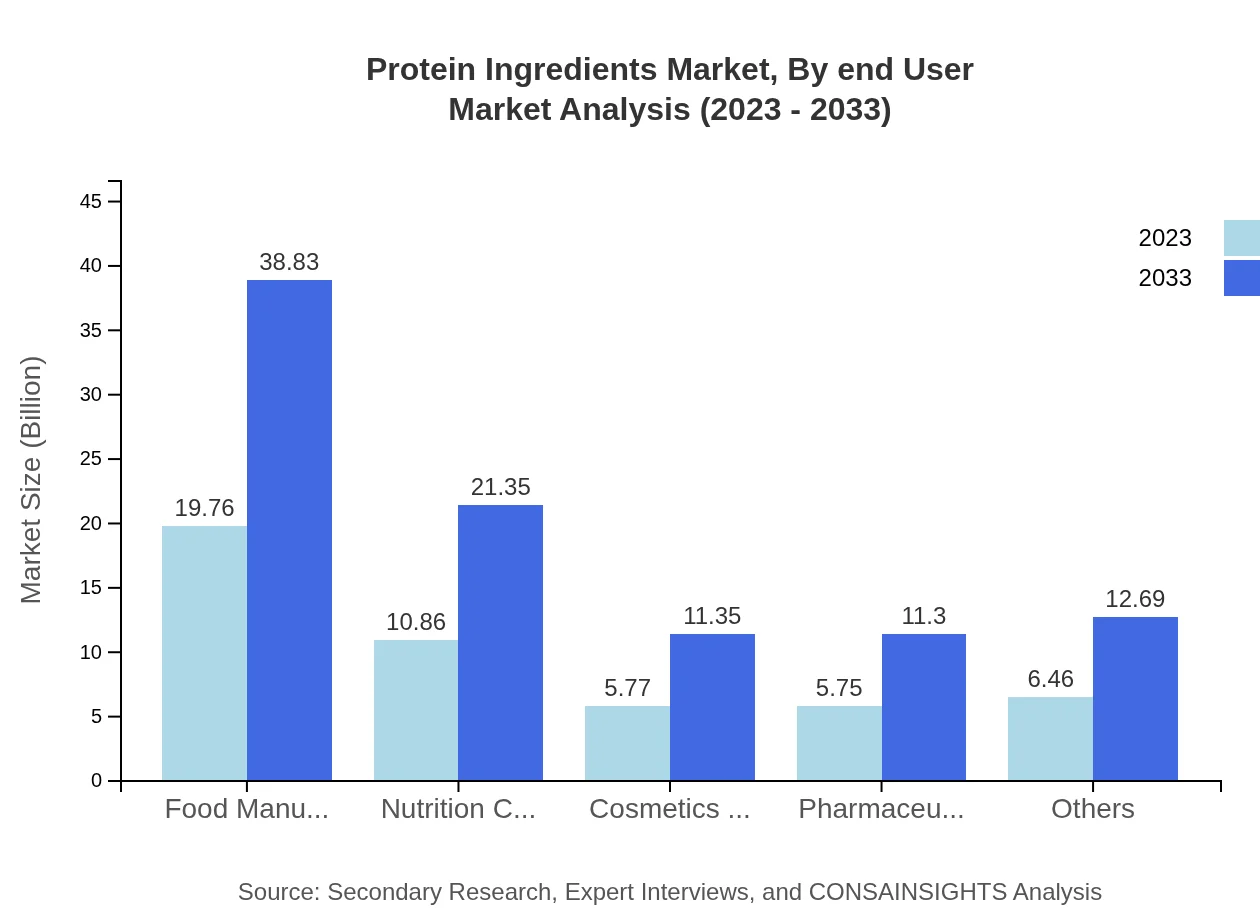

Protein Ingredients Market Analysis By Application

The primary applications of Protein Ingredients include food and beverages, nutrition companies, cosmetics, pharmaceuticals, and more. The food and beverage sector leads, expanding from $19.76 billion in 2023 to $38.83 billion by 2033. Nutrition companies also display significant growth, highlighting the importance of protein-enriched foods and functional products.

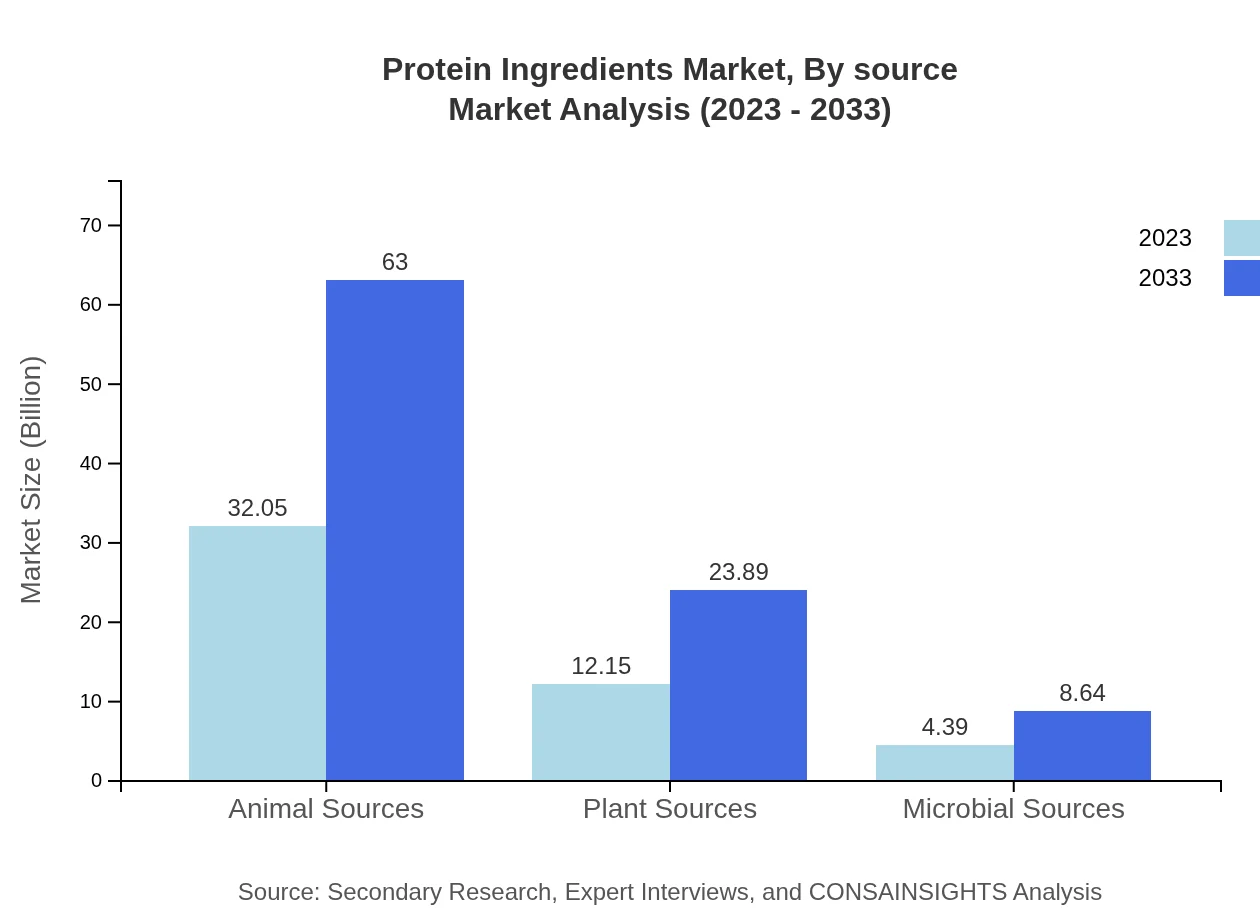

Protein Ingredients Market Analysis By Source

Sources of protein include animal-based, plant-based, and microbial sources. Animal-based proteins dominate this segment, from $32.05 billion in 2023 to $63.00 billion in 2033, maintaining a substantial 65.95% market share. Plant-based proteins are growing rapidly, expected to double within this forecast period.

Protein Ingredients Market Analysis By Form

The Protein Ingredients market comprises powdered, liquid, and solid forms. Powders are significant due to their versatile usage across various applications. Liquid formulations are increasingly popular in ready-to-consume products, whereas solids cater to diverse consumer preferences.

Protein Ingredients Market Analysis By End User

End-user industries include food and beverages, pharmaceuticals, and personal care. Each sector emphasizes different protein benefits, with food and beverage leading the market. The pharmaceutical sector's growth, along with personal care applications, shows diverse opportunities for protein ingredient utilization.

Protein Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Protein Ingredients Industry

DuPont Nutrition & Biosciences:

DuPont offers a wide range of protein solutions for food applications, focusing on sustainable protein sources and innovative formulations that enhance nutritional profiles.Cargill, Incorporated:

Cargill is a global leader in food production and has a substantial portfolio of protein ingredients, including plant-based proteins, catering to various food and nutrition segments.ADM (Archer Daniels Midland Company):

ADM distributes various protein products and emphasizes commitment to innovation in protein sources, aligned with health and wellness trends.BASF SE:

BASF focuses on sustainable protein ingredients, developing innovative solutions for the food and nutrition sectors and enhancing product development.Fonterra Co-operative Group:

Fonterra specializes in dairy-based protein ingredients, supplying high-quality protein products to support health and nutrition.We're grateful to work with incredible clients.

FAQs

What is the market size of protein Ingredients?

The global protein ingredients market is valued at approximately $48.6 billion in 2023, with an expected CAGR of 6.8% projected through 2033.

What are the key market players or companies in the protein Ingredients industry?

Key players include multinational food and beverage corporations, nutrition companies, and major pharmaceutical firms, engaging in production and distribution of protein-based products across diverse applications.

What are the primary factors driving the growth in the protein ingredients industry?

Growth is driven by rising demand for plant and animal proteins, health consciousness among consumers, innovation in food formulations, and expanding applications in food, nutrition, and personal care sectors.

Which region is the fastest Growing in the protein ingredients market?

North America is the fastest-growing region, expected to increase from $18.22 billion in 2023 to $35.80 billion by 2033, driven by high consumption and innovative product developments.

Does ConsaInsights provide customized market report data for the protein ingredients industry?

Yes, ConsaInsights offers tailored market reports, allowing clients to access specific data and insights relevant to the protein ingredients industry based on unique requirements.

What deliverables can I expect from this protein ingredients market research project?

Deliverables include comprehensive market analysis reports, data on market size and segmentation, growth forecasts, competitive landscape insights, and strategic recommendations.

What are the market trends of protein ingredients?

Current trends include a shift towards plant-based sources, innovations in formulations, sustainability considerations, and increasing incorporation of protein across various industries.