Protein Labelling Market Report

Published Date: 31 January 2026 | Report Code: protein-labelling

Protein Labelling Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Protein Labelling market, covering market size, growth trends, and forecasts from 2023 to 2033. It includes insights into regional performance, technology trends, and key players in the industry.

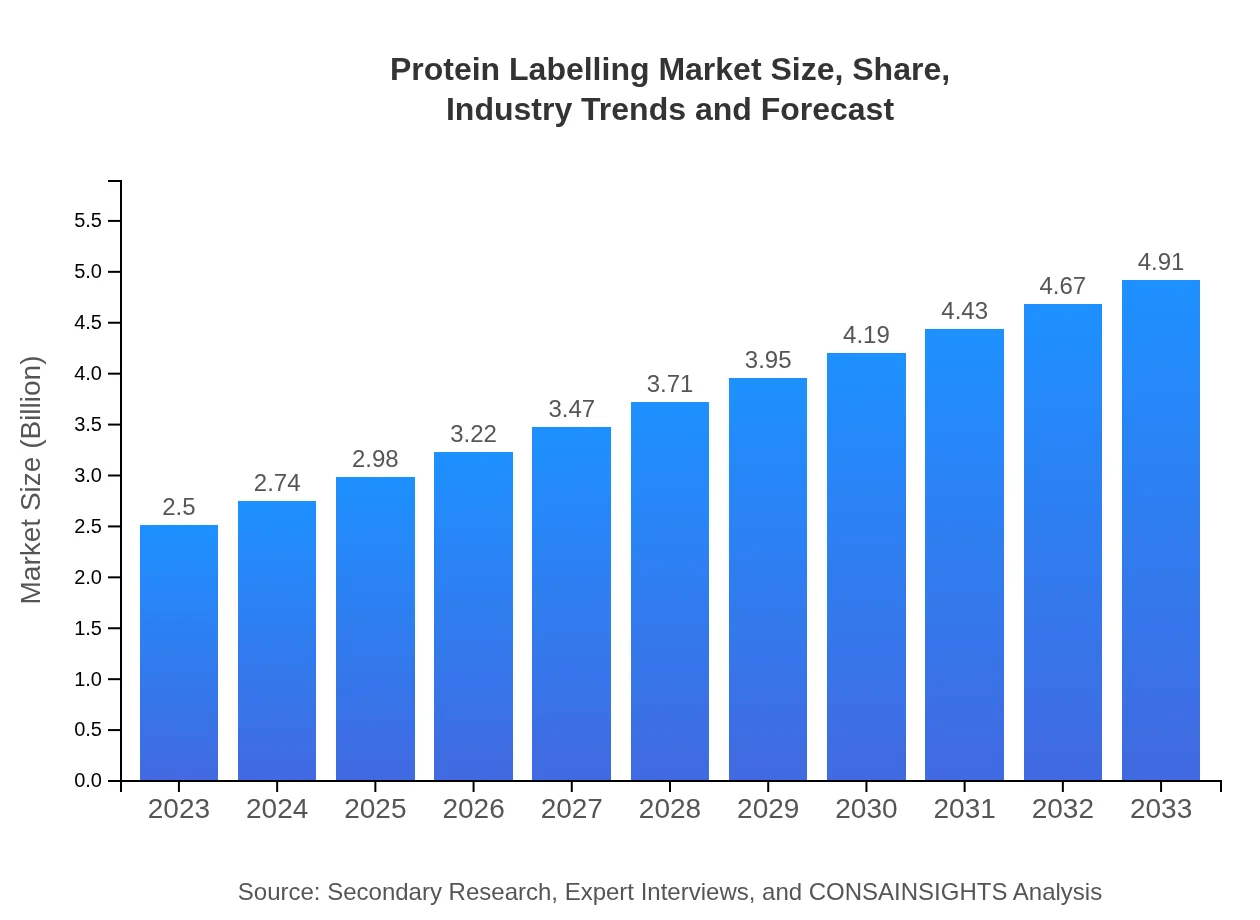

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Thermo Fisher Scientific, Agilent Technologies, Merck Group, PerkinElmer, Roche Diagnostics |

| Last Modified Date | 31 January 2026 |

Protein Labelling Market Overview

Customize Protein Labelling Market Report market research report

- ✔ Get in-depth analysis of Protein Labelling market size, growth, and forecasts.

- ✔ Understand Protein Labelling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Protein Labelling

What is the Market Size & CAGR of Protein Labelling market in 2023?

Protein Labelling Industry Analysis

Protein Labelling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Protein Labelling Market Analysis Report by Region

Europe Protein Labelling Market Report:

Europe's Protein Labelling market is projected to grow from USD 0.65 billion in 2023 to USD 1.28 billion in 2033. Increasing collaborations between academic institutions and industry players in the region are propelling market advancements, specifically in Germany and the UK.Asia Pacific Protein Labelling Market Report:

In the Asia Pacific region, the Protein Labelling market is estimated at USD 0.48 billion in 2023 and projected to reach USD 0.95 billion by 2033. Increased investments in biotechnology and a focus on advancing healthcare infrastructure are driving this growth, particularly in countries like China and India.North America Protein Labelling Market Report:

The North American market is anticipated to expand from USD 0.80 billion in 2023 to USD 1.58 billion by 2033. This surge is primarily due to the presence of key biotechnology and pharmaceutical companies, coupled with robust government funding for biomedical research.South America Protein Labelling Market Report:

The South American Protein Labelling market is valued at USD 0.25 billion in 2023, expected to rise to USD 0.48 billion by 2033. Growth in research funding and a rising number of academic institutions focusing on biomolecular research contribute to this positive trajectory.Middle East & Africa Protein Labelling Market Report:

In the Middle East and Africa, the market size is expected to grow from USD 0.32 billion in 2023 to USD 0.62 billion by 2033, driven largely by improvements in healthcare and biotechnological research initiatives in regions like the UAE and South Africa.Tell us your focus area and get a customized research report.

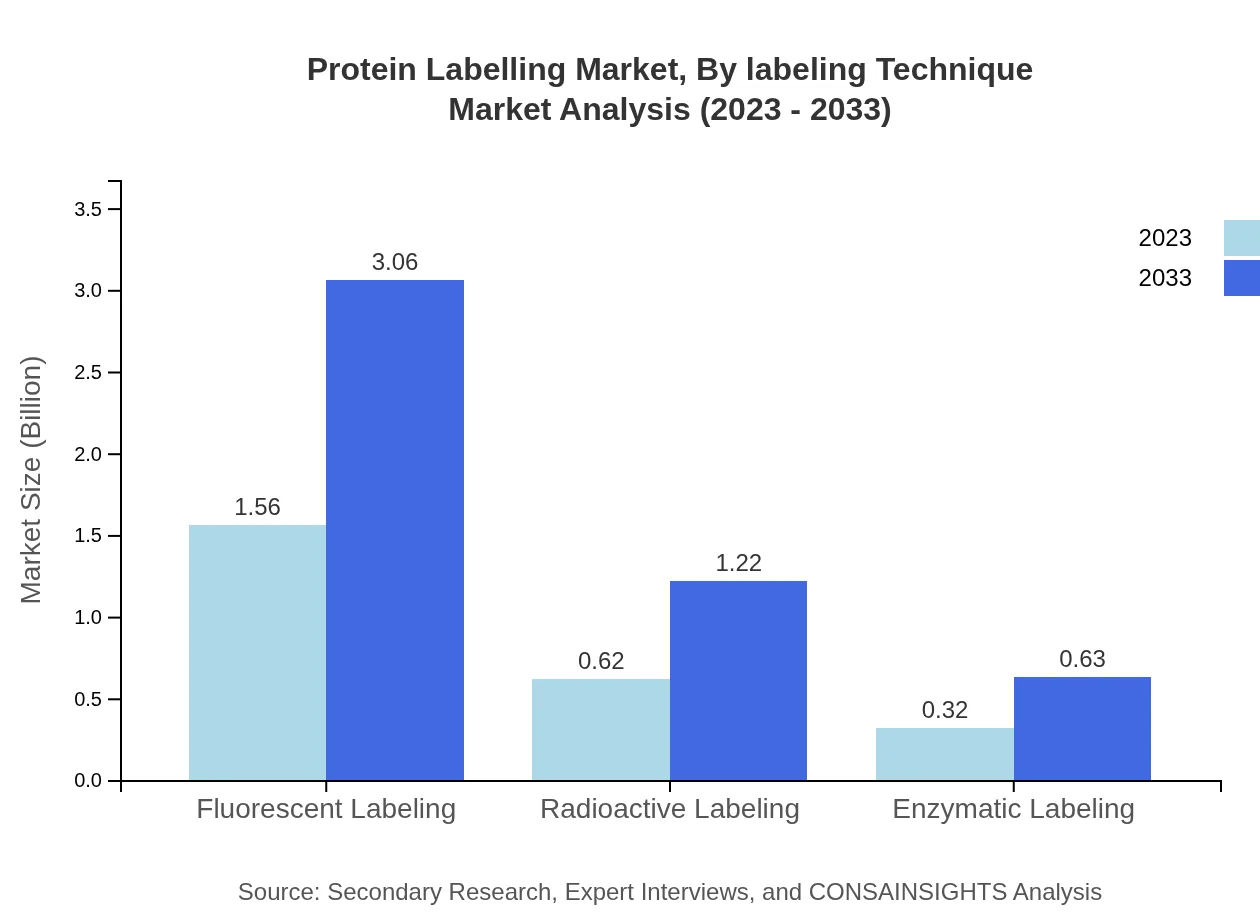

Protein Labelling Market Analysis By Labeling Technique

The Protein Labelling market by labeling technique includes major segments such as fluorescent, radioactive, and enzymatic labeling. Fluorescent labeling dominates the market, accounting for a significant share of over 62.33% in 2023. Advances in fluorescence technology have expanded its application in various fields including diagnostics and drug discovery, ensuring its continued significance.

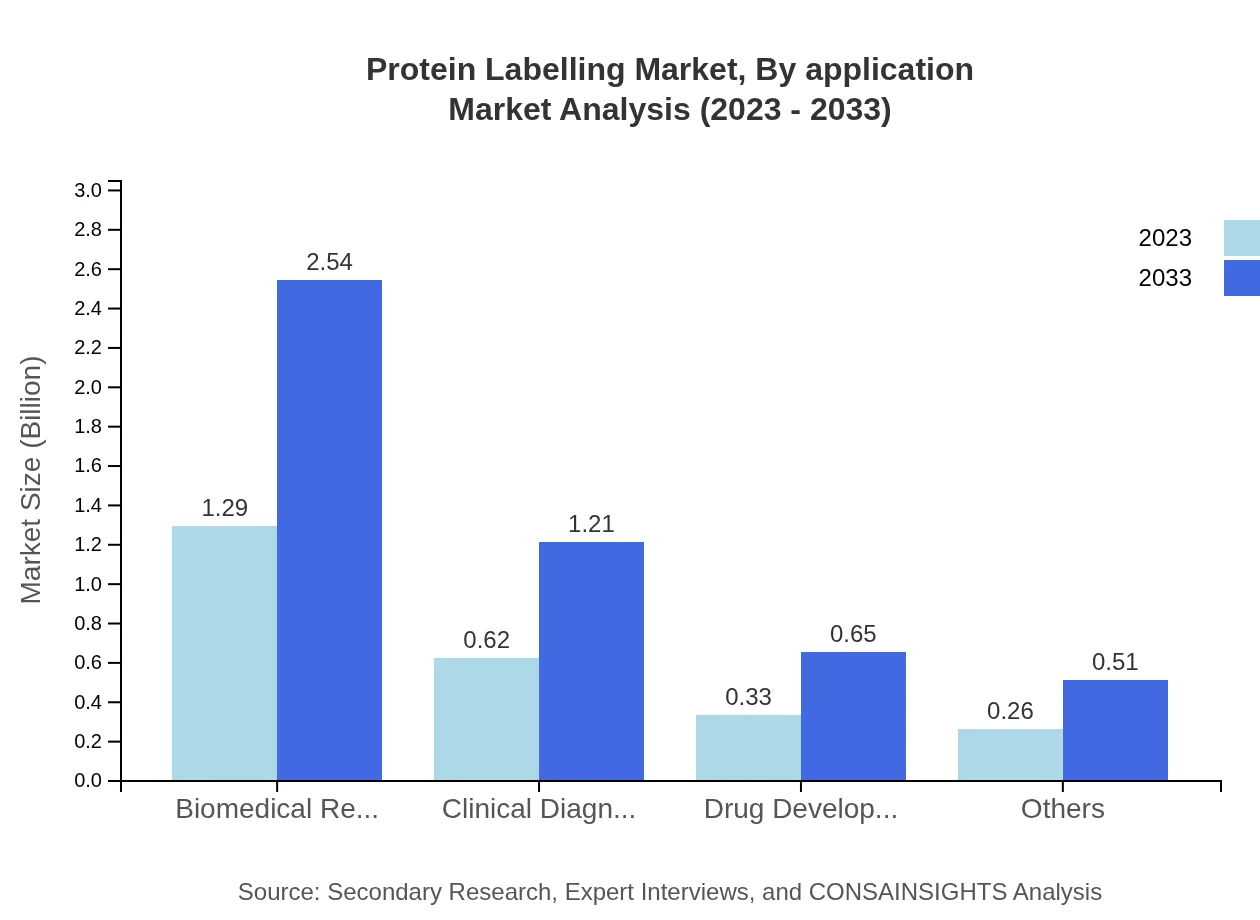

Protein Labelling Market Analysis By Application

In terms of application, academic research institutes are the largest segment, representing 51.72% share in 2023, with a steady growth projection due to consistent funding in educational research. Pharmaceutical companies also hold a vital market position with 24.6% share, reflecting the rise in drug development activities requiring precise protein analysis.

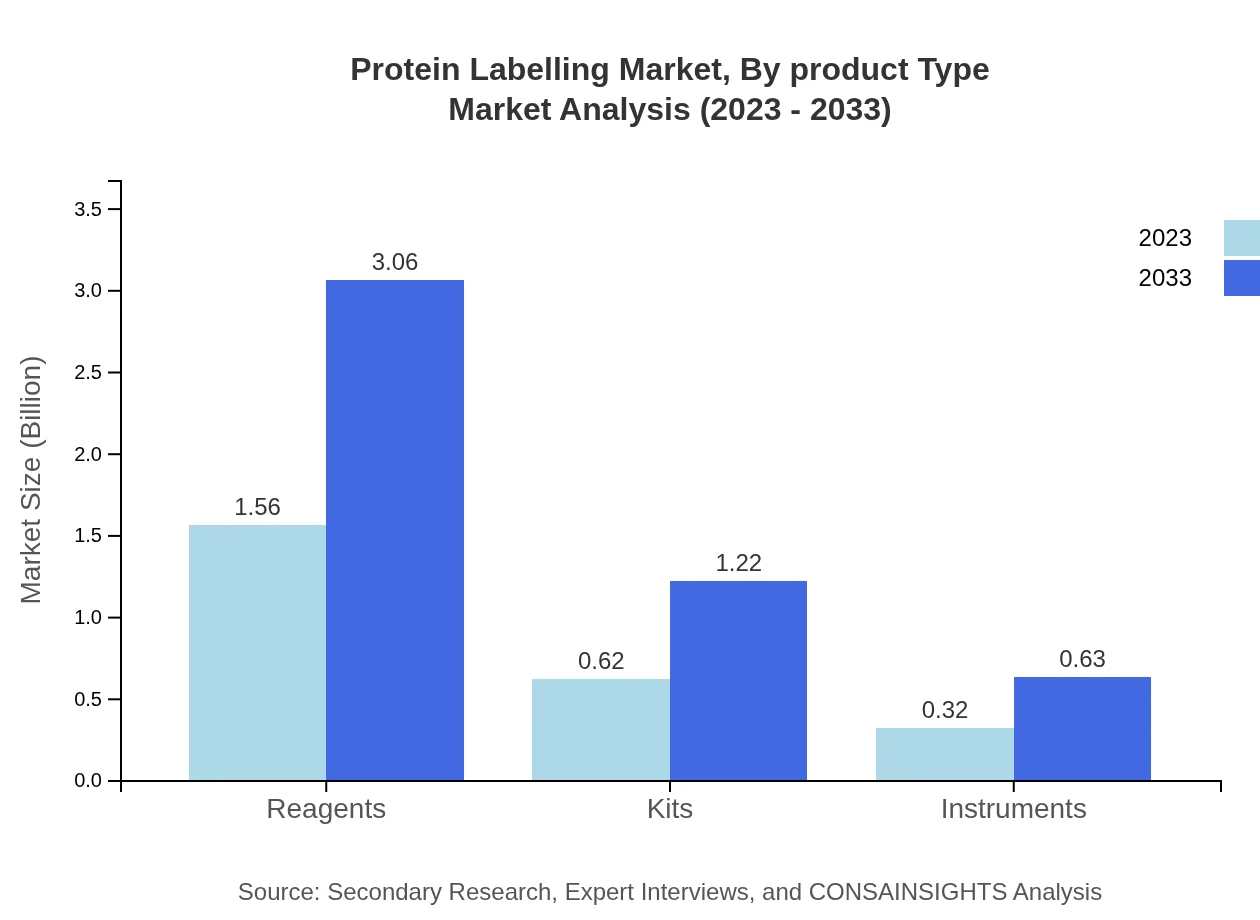

Protein Labelling Market Analysis By Product Type

The protein labeling market by product type emphasizes reagents, which represent a majority share of 62.33% in 2023. The growth of this segment is driven by the demand for high-quality reagents that are essential in research applications. Kits and instruments follow closely, like the kits, having a 24.86% market share, reflecting their importance in streamlined research processes.

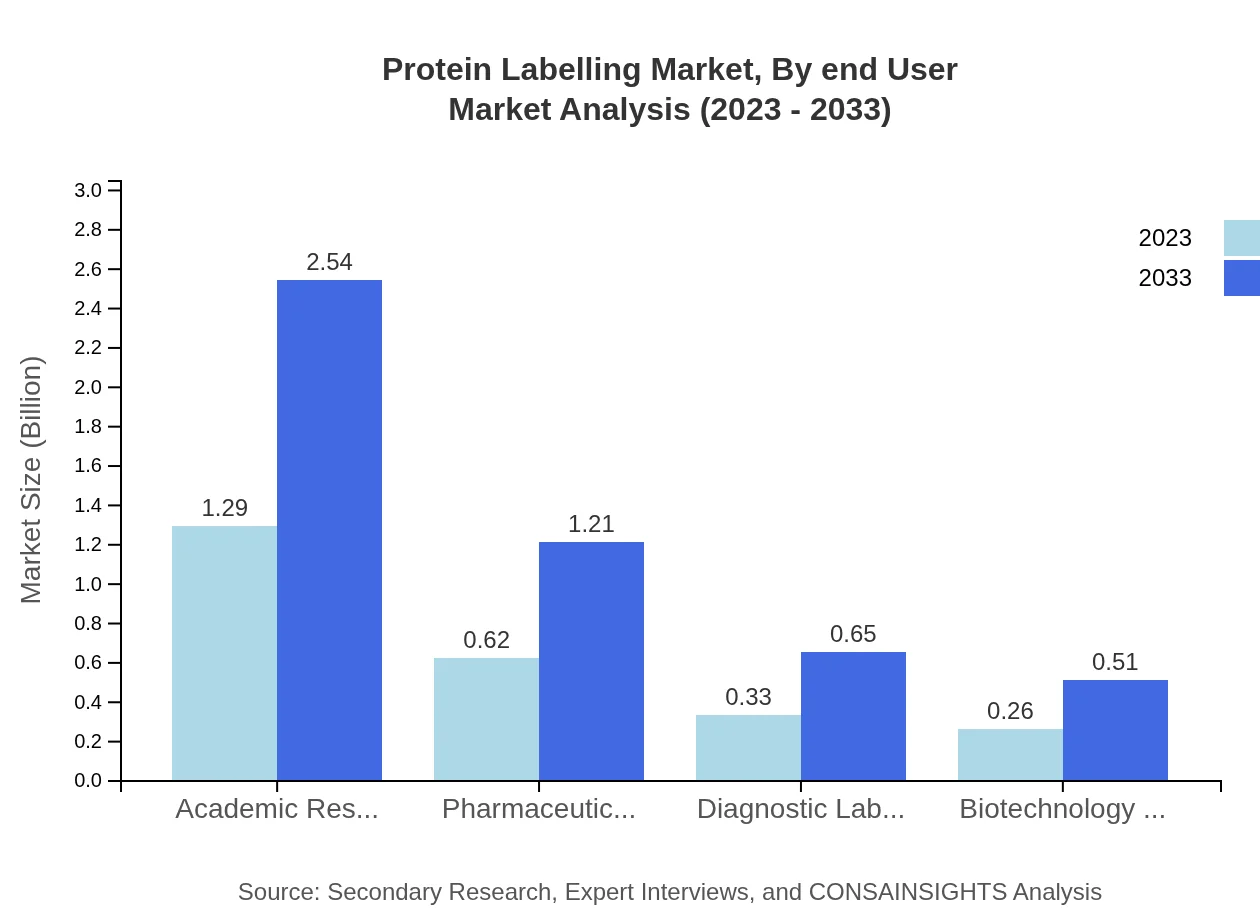

Protein Labelling Market Analysis By End User

The end-user segmentation shows that academic research institutes lead the market with a representation of over 51.72% in 2023, indicating a strong emphasis on educational research. Pharmaceutical and biotech companies follow, contributing significantly due to the need for protein analysis in diagnostics and therapeutic development.

Protein Labelling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Protein Labelling Industry

Thermo Fisher Scientific:

A leading player in the protein labeling market, Thermo Fisher Scientific offers a comprehensive range of products including reagents and kits that cater to diverse research needs.Agilent Technologies:

Agilent Technologies is renowned for its innovative solutions in the life sciences sector, providing cutting-edge instruments and labeling technologies that enhance research outcomes.Merck Group:

Merck Group excels in biotechnology and life science research with a robust portfolio of reagents, kits, and instruments for effective protein analysis.PerkinElmer:

PerkinElmer is recognized for its high-performance analytical technologies, contributing significantly to the protein labeling segment through its advanced diagnostic tools.Roche Diagnostics:

Roche Diagnostics leads in medical diagnostics and healthcare, offering protein labeling solutions that push the boundaries of clinical research.We're grateful to work with incredible clients.

FAQs

What is the market size of Protein Labelling?

The protein labelling market is currently valued at approximately $2.5 billion in 2023, with expectations to grow at a compound annual growth rate (CAGR) of 6.8%, potentially reaching substantial values by 2033.

What are the key market players or companies in the Protein Labelling industry?

Key players in the protein labelling market include major biotech firms, pharmaceutical companies, and specialized assay developers. Their innovations drive the market dynamics and enhance the competitive landscape across various applications and regions.

What are the primary factors driving the growth in the Protein Labelling industry?

Growth in the protein labelling industry is driven by increasing research activities, advancing technologies in bioassays, demand for personalized medicine, and rising healthcare expenditures. These factors collectively enhance the adoption across diverse applications.

Which region is the fastest Growing in the Protein Labelling?

The fastest-growing region in the protein labelling market is North America, projected to grow from $0.80 billion in 2023 to $1.58 billion by 2033, driven by significant investments in biotech research and development.

Does ConsInsights provide customized market report data for the Protein Labelling industry?

Yes, ConsInsights offers customized market report data tailored specifically to the protein labelling industry, allowing businesses to access unique insights and actionable data relevant to their strategic needs.

What deliverables can I expect from this Protein Labelling market research project?

Upon completion of the market research project, you can expect comprehensive analyses, market forecasts, competitive landscape assessments, and detailed segmentation data to empower informed decision-making.

What are the market trends of Protein Labelling?

Current trends in protein labelling include the growing preference for fluorescent and enzymatic labelling techniques, advancements in multi-label assays, and increasing integration of automation in laboratory processes, shaping the future of research capabilities.