Pufa In Global Market Report

Published Date: 31 January 2026 | Report Code: pufa-in-global

Pufa In Global Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the PUFA market globally from 2023 to 2033, offering insights on the market size, industry trends, regional analysis, and key players. It also forecasts future growth trajectories based on current data and market dynamics.

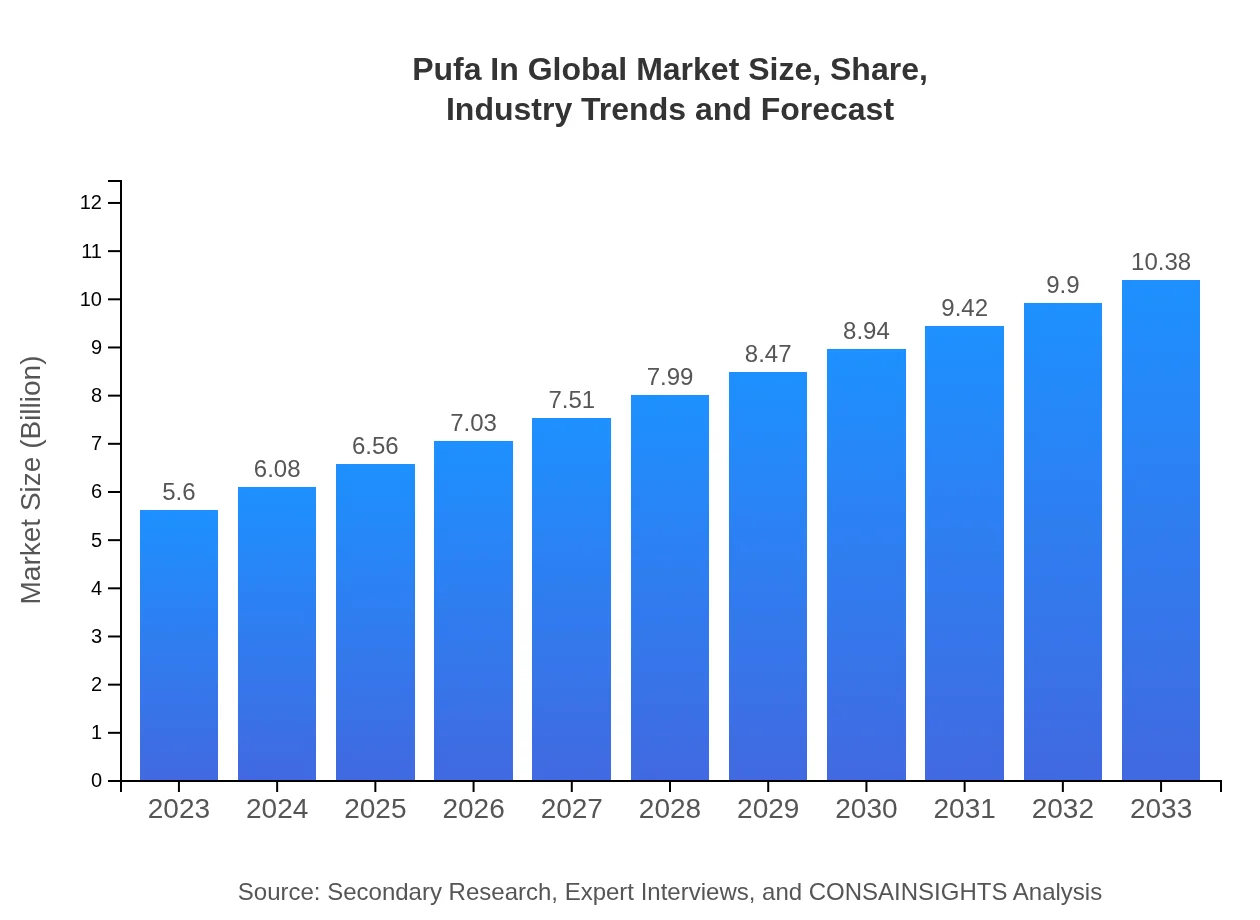

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Cargill, Incorporated, BASF SE, DSM Nutritional Products, Sabinsa Corporation, FMC Corporation |

| Last Modified Date | 31 January 2026 |

PUFA In Global Market Overview

Customize Pufa In Global Market Report market research report

- ✔ Get in-depth analysis of Pufa In Global market size, growth, and forecasts.

- ✔ Understand Pufa In Global's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pufa In Global

What is the Market Size & CAGR of PUFA In Global market in 2023?

PUFA In Global Industry Analysis

PUFA In Global Market Segmentation and Scope

Tell us your focus area and get a customized research report.

PUFA In Global Market Analysis Report by Region

Europe Pufa In Global Market Report:

In Europe, the market is forecasted to grow from $1.48 billion in 2023 to $2.74 billion by 2033 as consumers increasingly favor health-promoting natural ingredients. The EU's focus on sustainable food production processes is also playing a role.Asia Pacific Pufa In Global Market Report:

In the Asia Pacific region, the PUFA market is expected to grow from $1.13 billion in 2023 to $2.09 billion by 2033 due to increasing health awareness and dietary changes. China and Japan are leading markets in this region, with rising demand for functional foods.North America Pufa In Global Market Report:

The North American PUFA market, valued at $2.04 billion in 2023, is expected to reach $3.77 billion by 2033. This growth is underpinned by high consumer spending on dietary supplements and fortified foods, as well as increasing regulatory support for health claims.South America Pufa In Global Market Report:

In South America, the PUFA market is projected to grow from $0.56 billion in 2023 to $1.03 billion by 2033. The growth is attributed to the rising popularity of organic products and increased investment in health and wellness.Middle East & Africa Pufa In Global Market Report:

The Middle East and Africa region will see growth from $0.40 billion in 2023 to $0.75 billion by 2033, driven by rising health awareness campaigns and the introduction of diverse PUFA-rich products, particularly in the health food sectors.Tell us your focus area and get a customized research report.

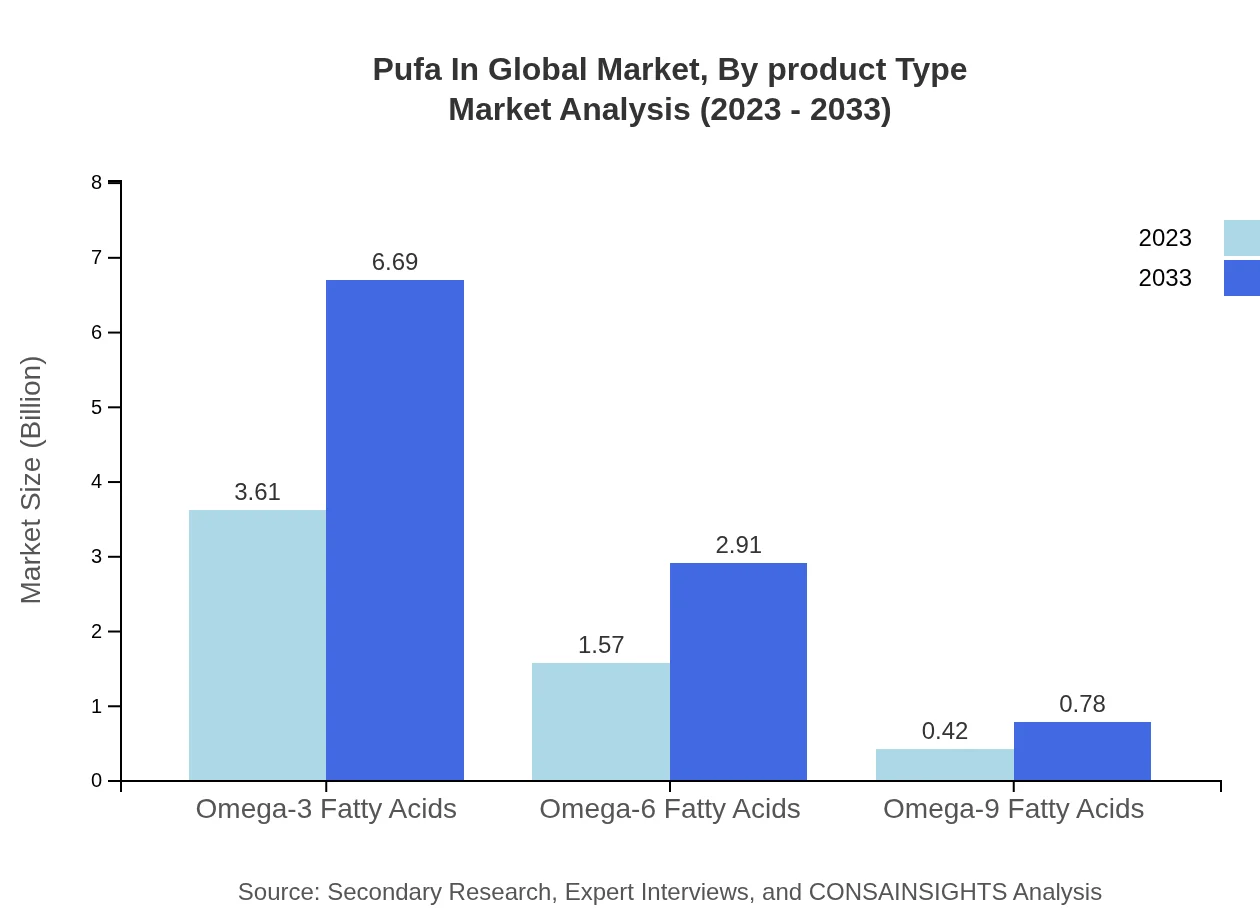

Pufa In Global Market Analysis By Product Type

In terms of product type, the Food and Beverage segment leads, projected to grow from $3.10 billion in 2023 to $5.74 billion by 2033, owing to the increasing incorporation of PUFA in health-oriented products. Pharmaceuticals also represent a key segment, growing from $1.38 billion in 2023 to $2.56 billion by 2033. Other product types, such as cosmetics and personal care, and animal feed also exhibit considerable growth trajectory.

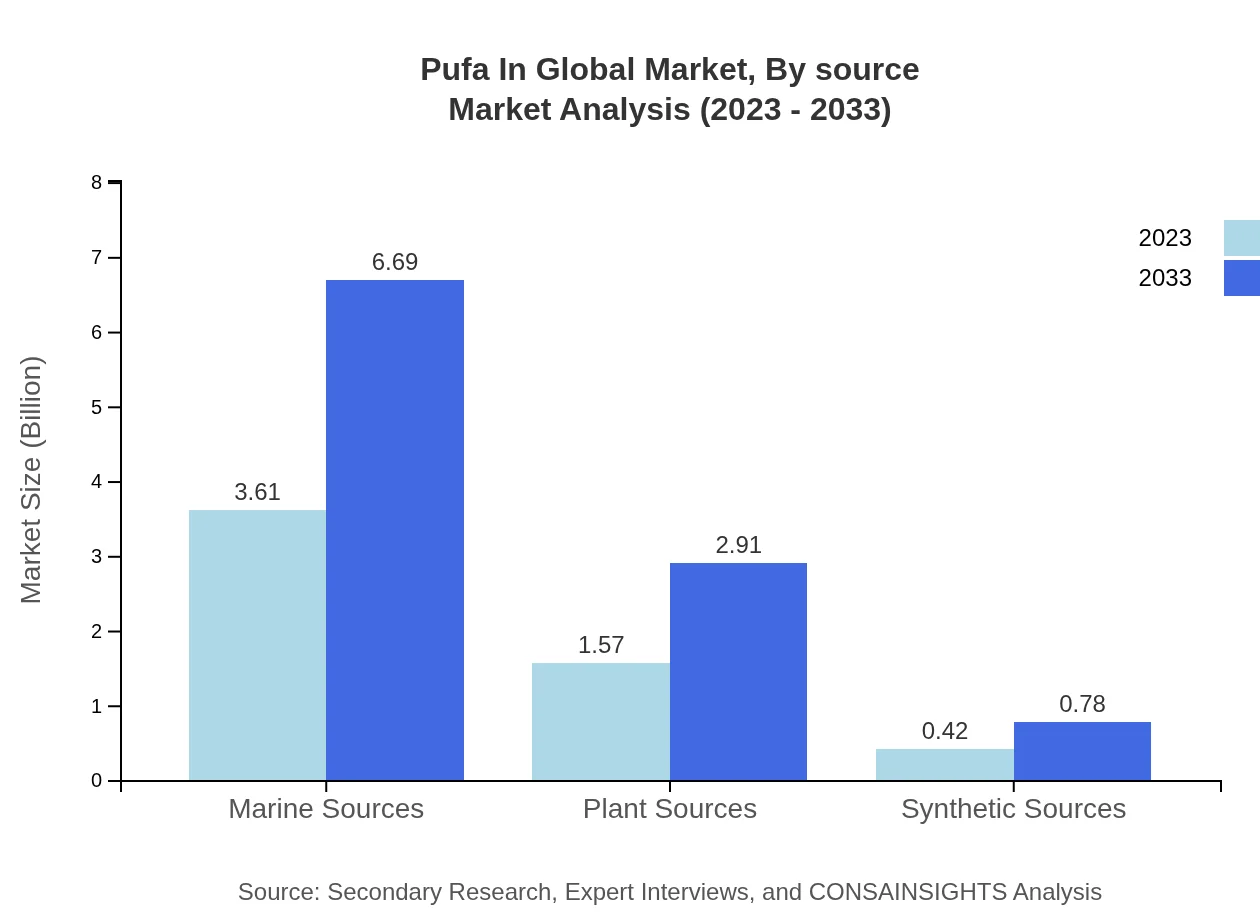

Pufa In Global Market Analysis By Source

The market's source segmentation reveals Marine Sources leading with a market size of $3.61 billion in 2023, expected to grow to $6.69 billion by 2033, maintaining a market share of 64.5%. Plant and Synthetic sources follow with growth rates of 1.57 billion to 2.91 billion and 0.42 billion to 0.78 billion, respectively. The increasing popularity of plant omega-3 fatty acids drives the growth of plant-based sources.

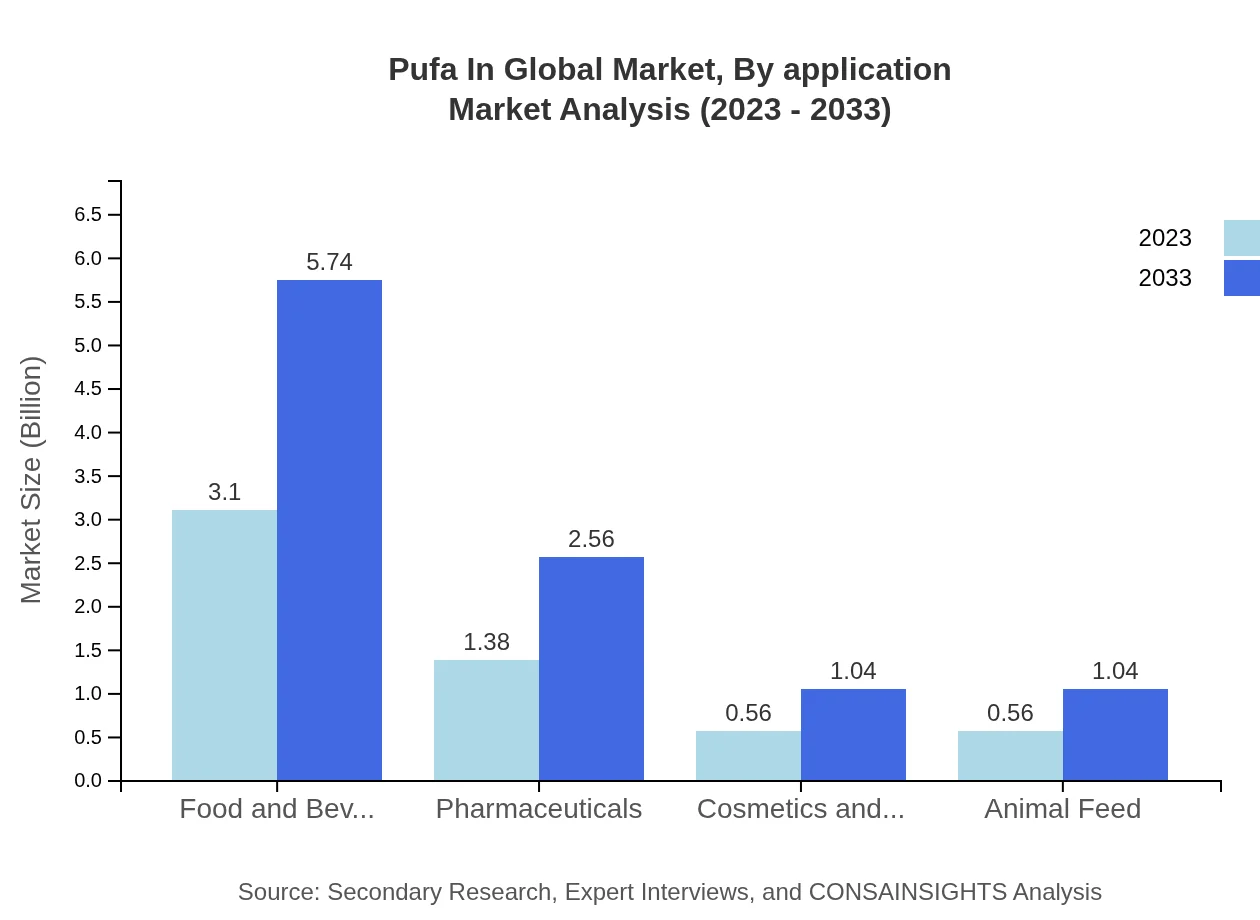

Pufa In Global Market Analysis By Application

The applications of PUFA span various industries, with the Food and Beverage segment occupying 55.32% of the market share in 2023. The Pharmaceuticals segment shows promising growth as consumers turn towards supplements targeting heart health and overall wellness, growing substantially from $1.38 billion in 2023 to $2.56 billion by 2033. Cosmetics, with a share of 10%, also reflects a notable interest as the trend towards natural ingredients grows.

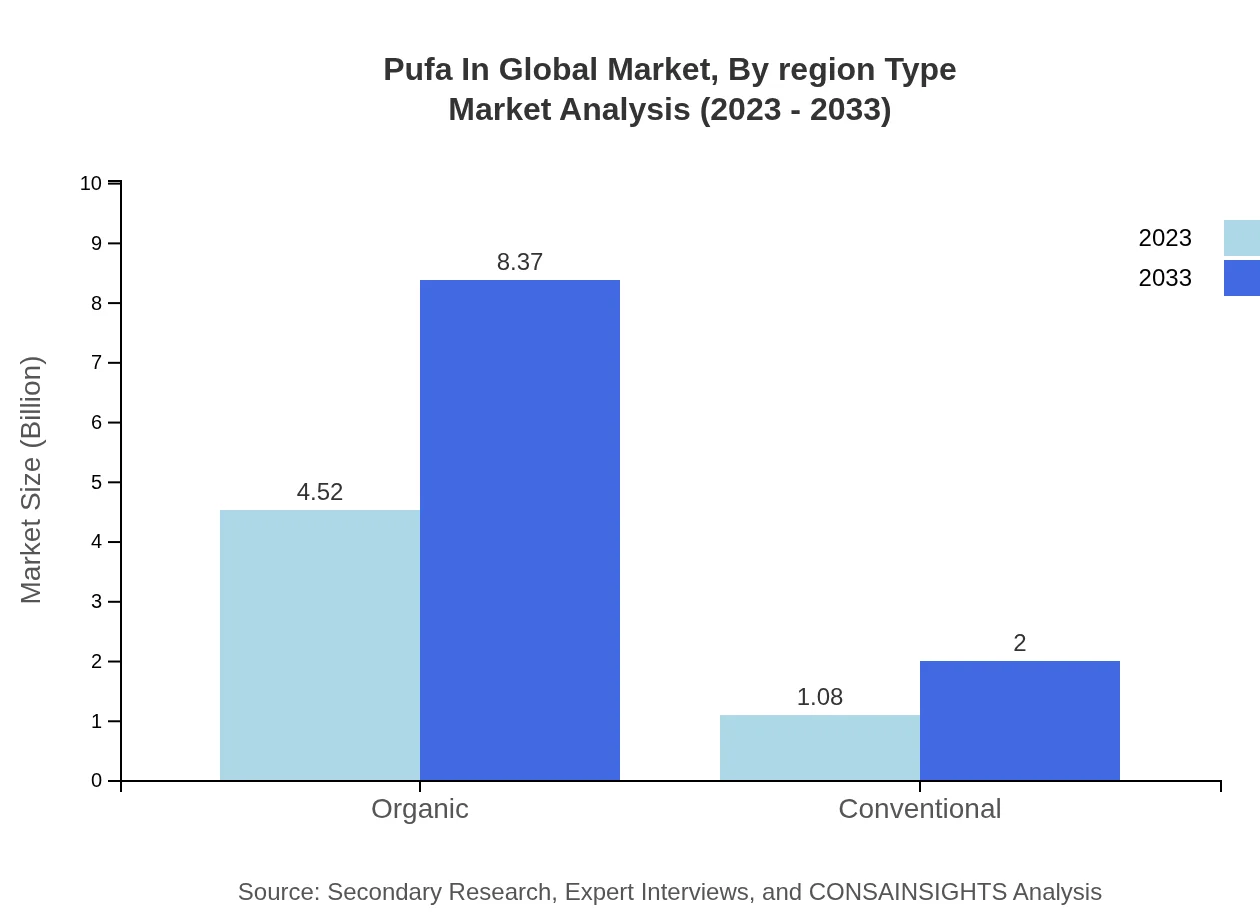

Pufa In Global Market Analysis By Region Type

The regional analysis displays varying growth rates across markets, driven by consumer preferences, regulatory frameworks, and supply chain dynamics. North America and Europe are currently the largest markets, but Asia Pacific is expected to witness substantial growth due to demographic shifts, increasing incomes, and rising health consciousness.

PUFA In Global Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in PUFA In Global Industry

Cargill, Incorporated:

A major player in the PUFA market, Cargill focuses on sustainable food solutions and provides a broad portfolio of innovative products for health and nutrition.BASF SE:

BASF is recognized for its chemical expertise and is a leading provider of omega-3 and omega-6 fatty acids, significantly contributing to the PUFA landscape.DSM Nutritional Products:

DSM is known for its innovative nutritional solutions and is at the forefront of developing specialized PUFA products for diverse health applications.Sabinsa Corporation:

Sabinsa focuses on natural products and health supplements, offering a variety of PUFA-rich oils that cater to health-conscious consumers.FMC Corporation:

FMC presents a range of advanced agronomic solutions including PUFA, driving innovations in sustainable food and nutrition.We're grateful to work with incredible clients.

FAQs

What is the market size of pufa In Global?

The global PUFA market was valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 6.2% through 2033. This growth reflects increasing consumer demand for nutritional products enriched with polyunsaturated fatty acids.

What are the key market players or companies in this pufa In Global industry?

Key players in the PUFA market include major companies such as DSM Nutritional Products, BASF SE, Cargill, Marine Ingredients, and Omega Protein. These companies lead in production and innovation of PUFA products across various applications.

What are the primary factors driving the growth in the pufa In Global industry?

Key drivers of growth in the PUFA market include rising health awareness, increasing demand for functional foods, and growth in dietary supplements. Additionally, the surge in vegan and vegetarian diets expands the market for plant-based PUFAs.

Which region is the fastest Growing in the pufa In Global?

The fastest-growing region in the PUFA market is Asia Pacific, expecting substantial growth from $1.13 billion in 2023 to $2.09 billion in 2033. This growth is driven by the increasing health consciousness among consumers in emerging economies.

Does ConsaInsights provide customized market report data for the pufa In Global industry?

Yes, ConsaInsights offers customized market report data tailored to specific inquiries in the PUFA sector, ensuring relevant insights that meet client-specific needs for strategic decision-making.

What deliverables can I expect from this pufa In Global market research project?

Deliverables from the PUFA market research project include comprehensive reports detailing market analysis, growth forecasts, trend identification, competitive benchmarking, and detailed segmentation data to inform strategy and investment.

What are the market trends of pufa In Global?

Current trends in the PUFA market involve increased interest in sustainable and organic sources, innovations in extraction methods, and growth in applications across food, pharmaceuticals, and personal care industries, indicating a diversified market.