Pyrethroid Insecticide Market Report

Published Date: 02 February 2026 | Report Code: pyrethroid-insecticide

Pyrethroid Insecticide Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pyrethroid Insecticide market from 2023 to 2033, focusing on market dynamics, size, segmentation, technology trends, and regional insights to guide stakeholders in strategic planning.

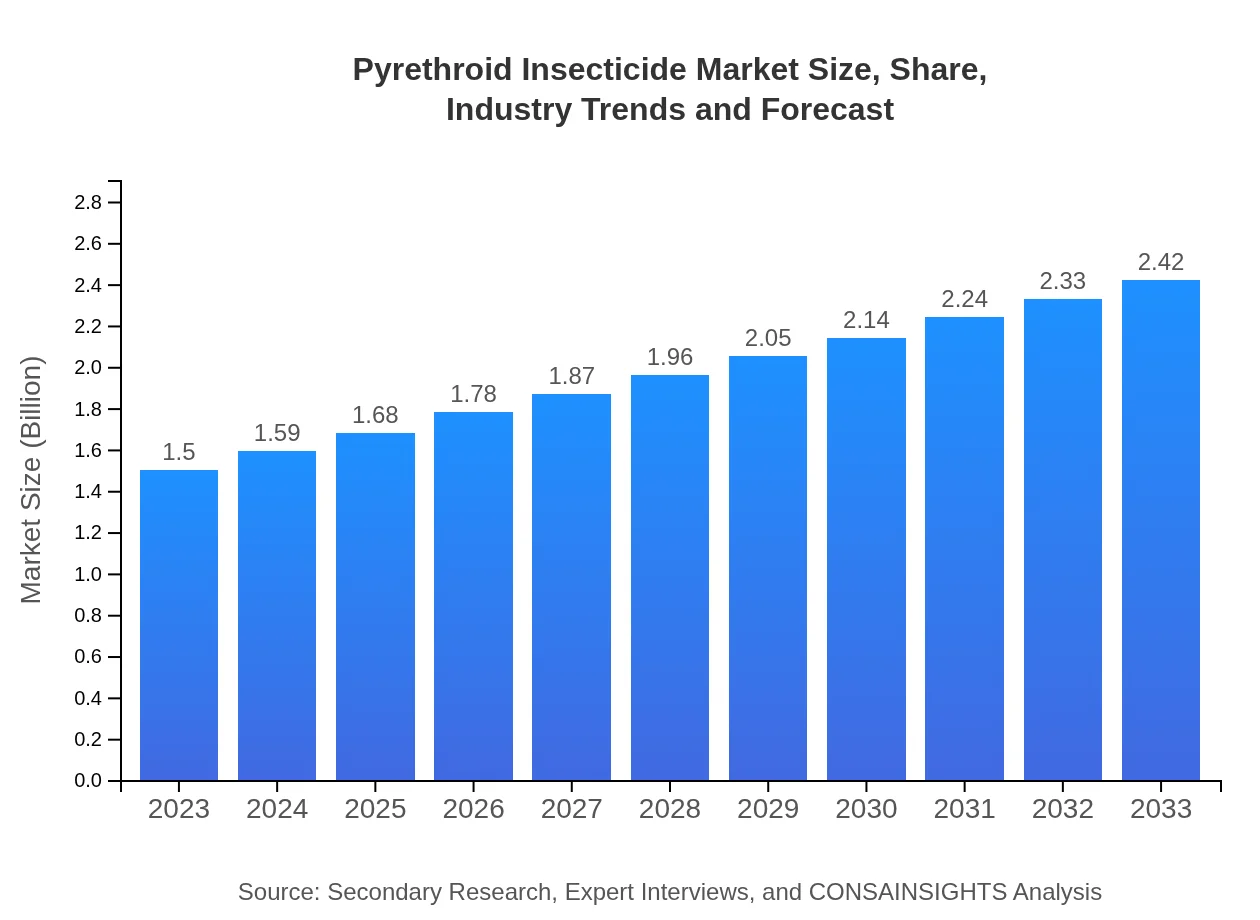

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $2.42 Billion |

| Top Companies | BASF SE, Syngenta AG, FMC Corporation, Dow AgroSciences, Adama Agricultural Solutions Ltd. |

| Last Modified Date | 02 February 2026 |

Pyrethroid Insecticide Market Overview

Customize Pyrethroid Insecticide Market Report market research report

- ✔ Get in-depth analysis of Pyrethroid Insecticide market size, growth, and forecasts.

- ✔ Understand Pyrethroid Insecticide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pyrethroid Insecticide

What is the Market Size & CAGR of Pyrethroid Insecticide market in 2023?

Pyrethroid Insecticide Industry Analysis

Pyrethroid Insecticide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pyrethroid Insecticide Market Analysis Report by Region

Europe Pyrethroid Insecticide Market Report:

Europe's market will see a rise from $0.40 billion in 2023 to $0.64 billion by 2033, primarily due to stringent regulations encouraging the use of effective insecticides in the agricultural industry.Asia Pacific Pyrethroid Insecticide Market Report:

The Asia Pacific region is projected to see a market size growth from $0.31 billion in 2023 to $0.49 billion by 2033, driven by increasing agricultural productivity and a push for effective pest control solutions amid rising pest resistance.North America Pyrethroid Insecticide Market Report:

North America demonstrates substantial growth, with an increase from $0.51 billion in 2023 to $0.83 billion by 2033, fueled by advances in formulation technology and heightened awareness of sustainable pest management.South America Pyrethroid Insecticide Market Report:

In South America, the market is expected to grow from $0.13 billion in 2023 to $0.21 billion in 2033. The rise in agricultural activities and adoption of modern farming practices are expected to drive market growth.Middle East & Africa Pyrethroid Insecticide Market Report:

The market in the Middle East and Africa is forecasted to grow from $0.16 billion in 2023 to $0.26 billion by 2033, driven by increasing domestic usage and agricultural development initiatives.Tell us your focus area and get a customized research report.

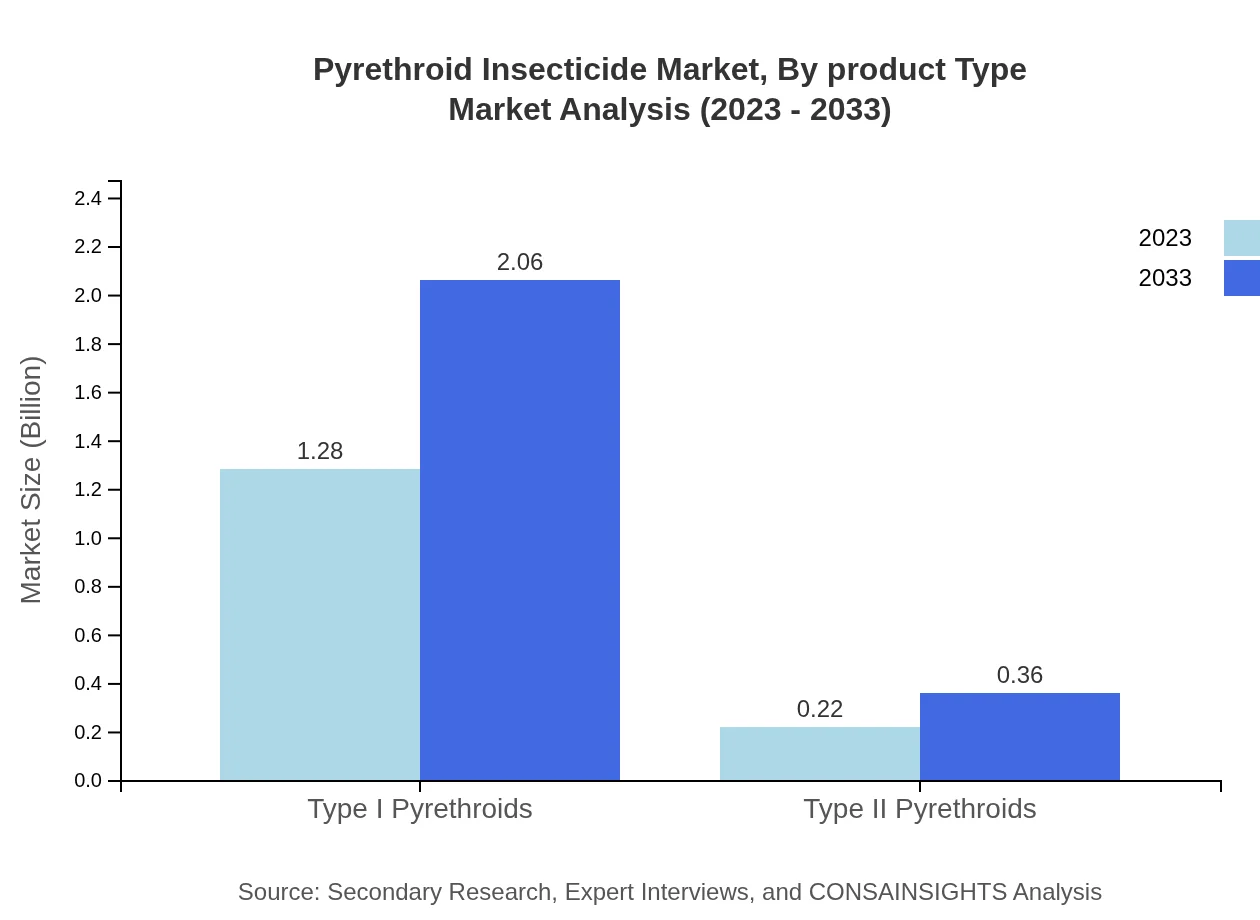

Pyrethroid Insecticide Market Analysis By Product Type

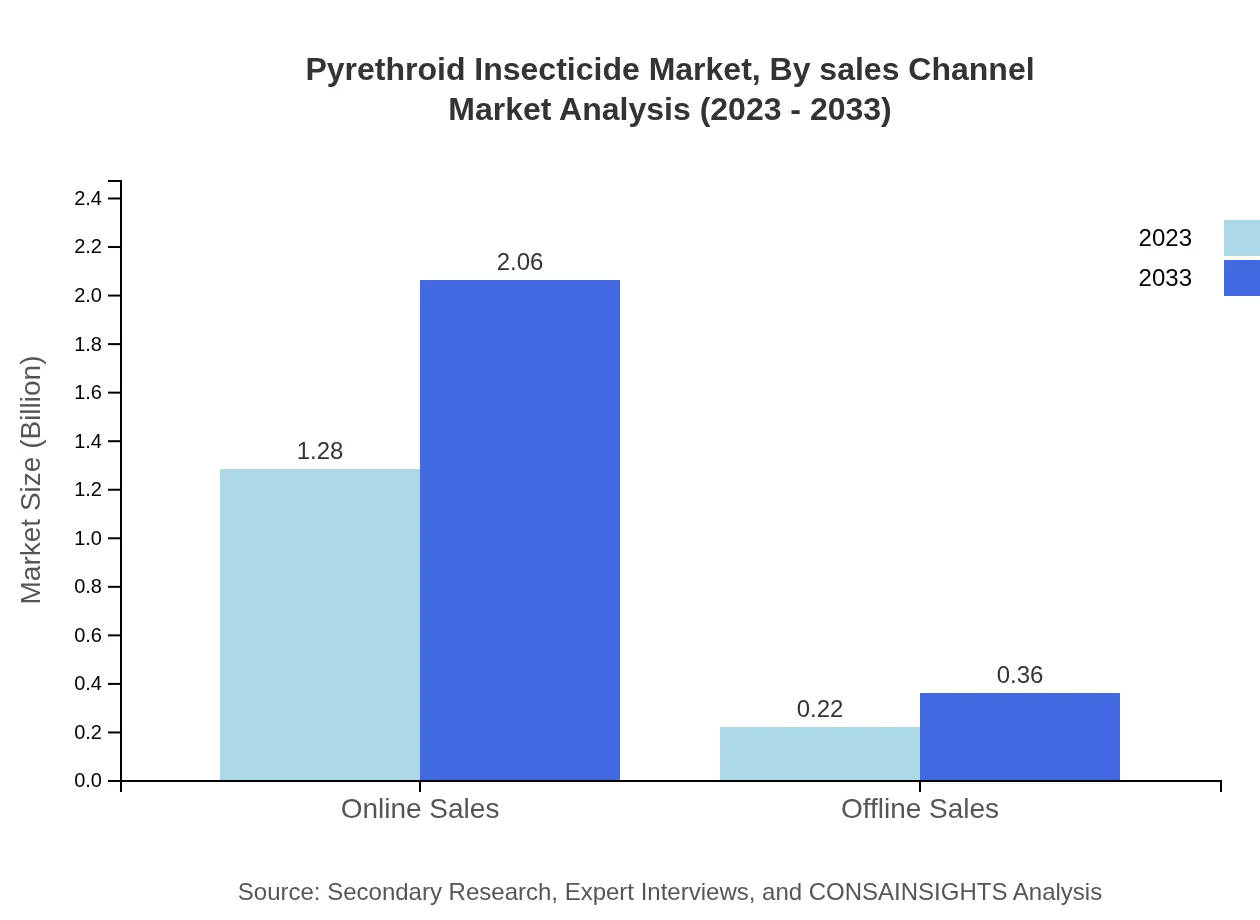

The Pyrethroid Insecticide market is dominated by Liquid Formulations, which are projected to grow from $1.28 billion in 2023 to $2.06 billion by 2033, accounting for a share of 85.12%. Solid Formulations comprise 14.88% of the market, anticipated to reach $0.36 billion by 2033 from $0.22 billion in 2023.

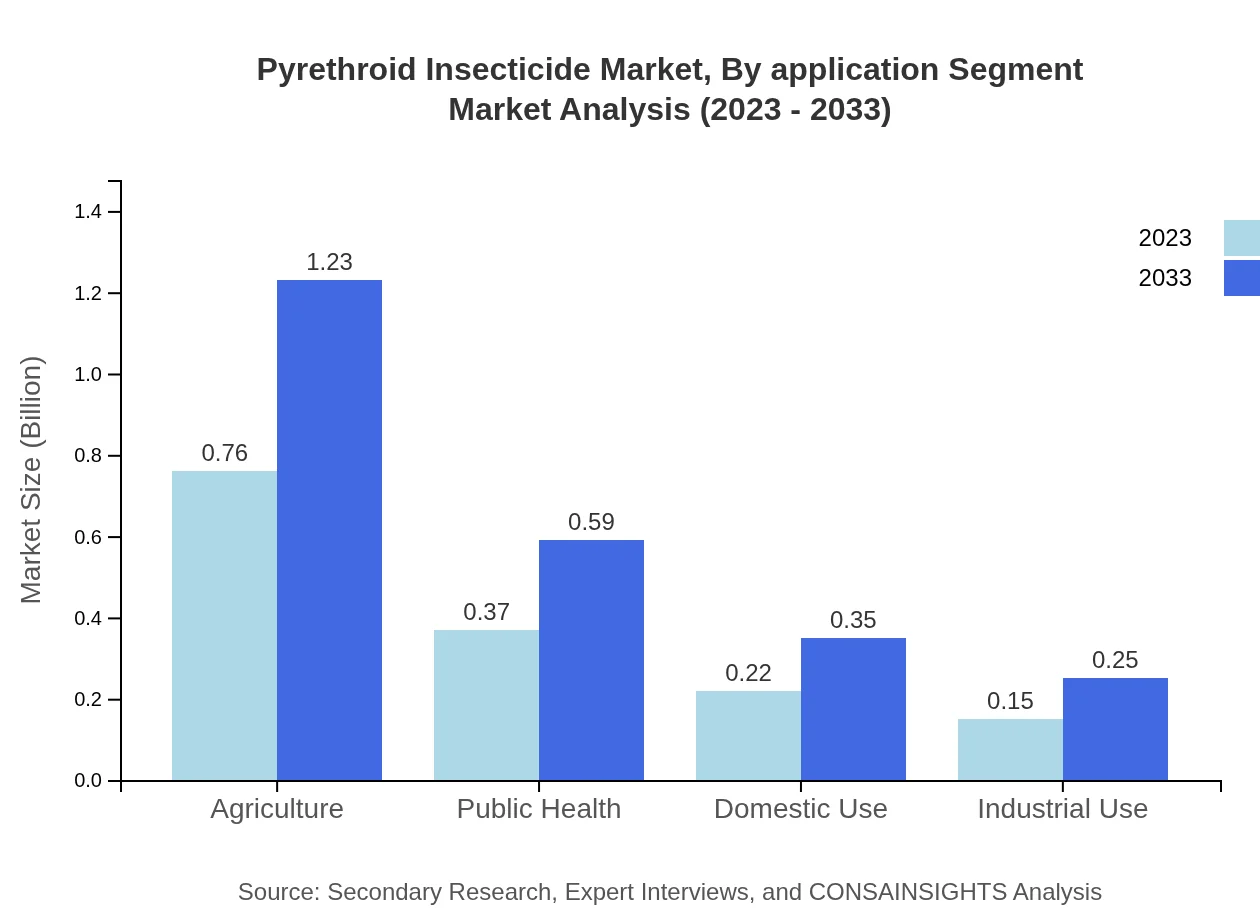

Pyrethroid Insecticide Market Analysis By Application Segment

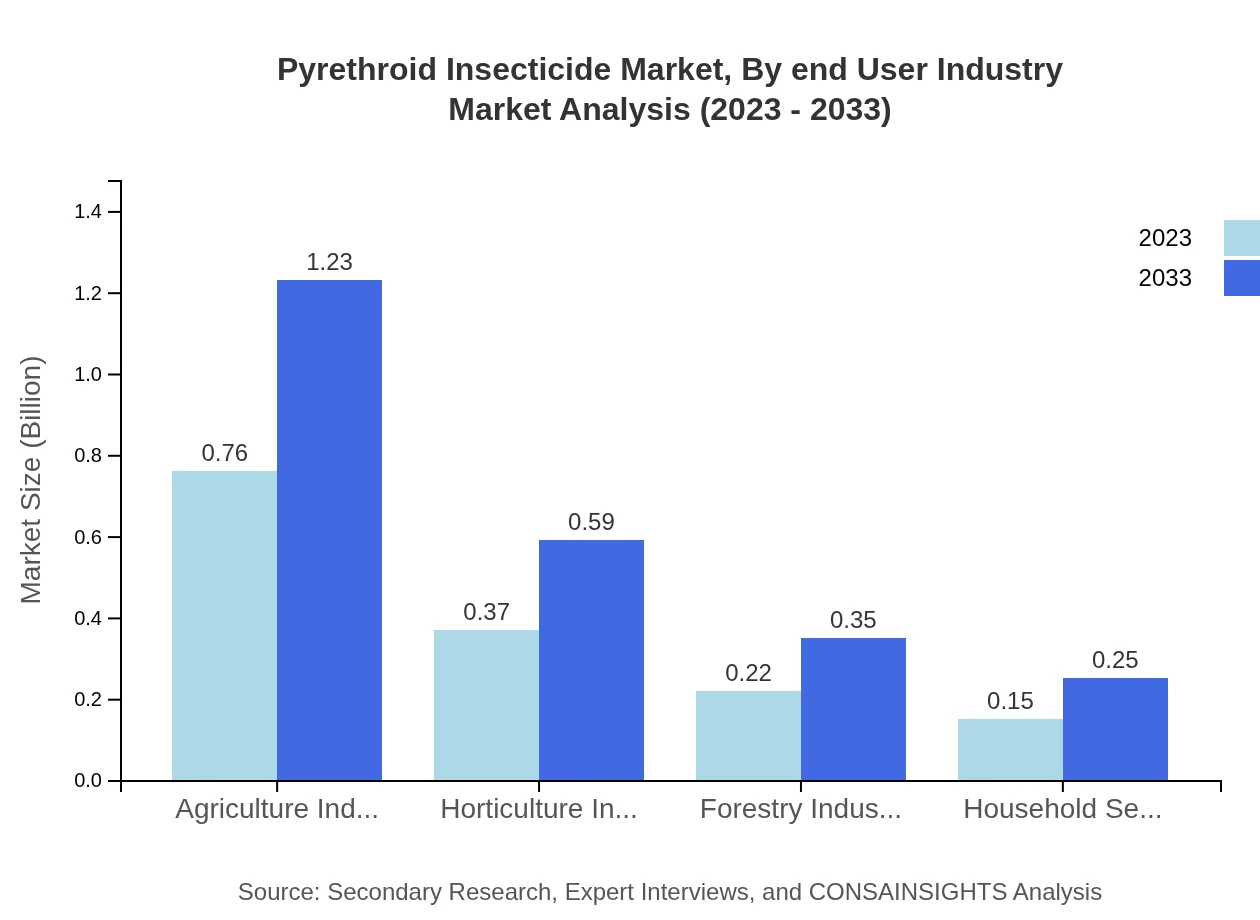

In terms of application, the Agriculture Industry leads with a market size evolving from $0.76 billion in 2023 to $1.23 billion by 2033, holding 50.79% of the market. The public health sector will also experience growth, moving from $0.37 billion to $0.59 billion during the same period.

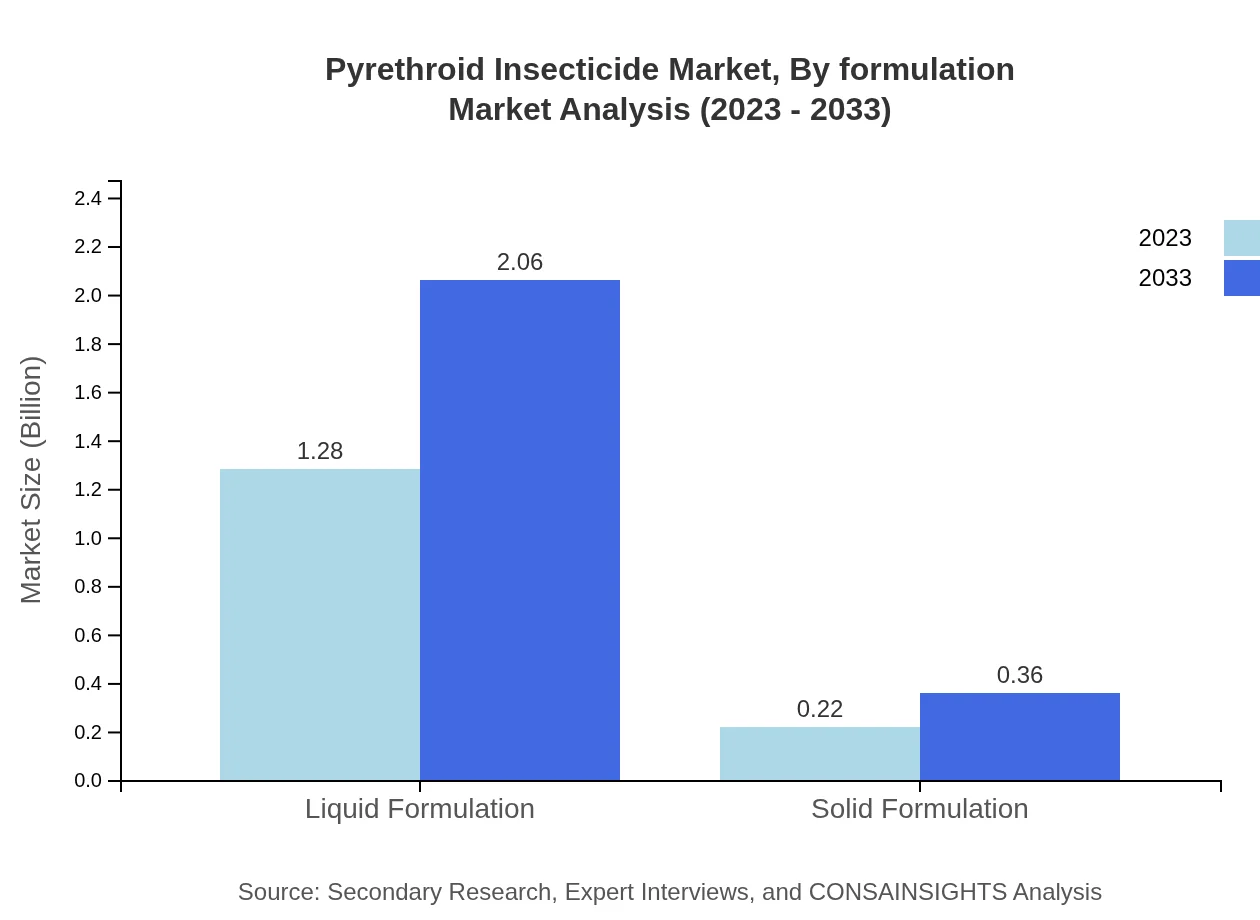

Pyrethroid Insecticide Market Analysis By Formulation

Liquid formulations represent the largest segment, anticipated to maintain its dominance throughout the forecast period. Solid formulations are projected to capture a smaller yet vital share within the market.

Pyrethroid Insecticide Market Analysis By End User Industry

End-user industries include agriculture, horticulture, forestry, and household sectors, with agriculture holding the largest share due to its extensive application in crop protection and pest management.

Pyrethroid Insecticide Market Analysis By Sales Channel

Online sales of Pyrethroid Insecticides are projected to grow favorably, increasing from $1.28 billion in 2023 to $2.06 billion by 2033, while offline sales are anticipated to evolve from $0.22 billion to $0.36 billion.

Pyrethroid Insecticide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pyrethroid Insecticide Industry

BASF SE:

BASF SE is a leading global chemical company that produces a wide range of agrochemicals including Pyrethroids, focusing on innovation and sustainability.Syngenta AG:

Syngenta AG is a prominent player in crop protection, well-known for its extensive portfolio of Pyrethroid insecticides addressing various pest challenges.FMC Corporation:

FMC Corporation offers a range of insecticides including Pyrethroids, emphasizing environmental stewardship and product efficacy.Dow AgroSciences:

Dow AgroSciences produces high-performing Pyrethroid insecticides tailored for both agricultural and urban pest management solutions.Adama Agricultural Solutions Ltd.:

Adama provides diverse agricultural solutions and is notable for its line of Pyrethroid insecticides aimed at maximizing yields.We're grateful to work with incredible clients.

FAQs

What is the market size of pyrethroid Insecticide?

The pyrethroid insecticide market is projected to reach approximately $1.5 billion by 2033, with a compound annual growth rate (CAGR) of 4.8%. This growth reflects rising demand in agricultural and public health applications.

What are the key market players or companies in this pyrethroid Insecticide industry?

Key market players include major chemical manufacturing firms specializing in agricultural and household pest control solutions. Companies such as BASF, Syngenta, and FMC Corporation lead the market through innovation and product development.

What are the primary factors driving the growth in the pyrethroid Insecticide industry?

Growth is driven by increasing agricultural practices, heightened concern for pest control in public health, and the effectiveness of pyrethroids in targeting a broad range of pests. Regulatory support also enhances market expansion.

Which region is the fastest Growing in the pyrethroid Insecticide?

The North American region is anticipated to experience the fastest growth, increasing from $0.51 billion in 2023 to $0.83 billion by 2033, driven by advancements in agricultural practices and regulatory support.

Does ConsaInsights provide customized market report data for the pyrethroid Insecticide industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the pyrethroid insecticide industry, ensuring insights into market size, trends, and forecasts.

What deliverables can I expect from this pyrethroid Insecticide market research project?

Deliverables include a comprehensive market report featuring detailed analysis of market size, growth projections, competitive landscape, and regional insights, along with tailored recommendations for strategic decision-making.

What are the market trends of pyrethroid Insecticide?

Current trends include an increased preference for liquid formulations, with significant market share, alongside the rise in online sales channels. Additionally, the agriculture sector is leveraging pyrethroid products for pest management.