Pyrolysis Oil Market Report

Published Date: 02 February 2026 | Report Code: pyrolysis-oil

Pyrolysis Oil Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pyrolysis Oil market from 2023 to 2033, including market trends, growth forecasts, segmentation, regional insights, and key industry players.

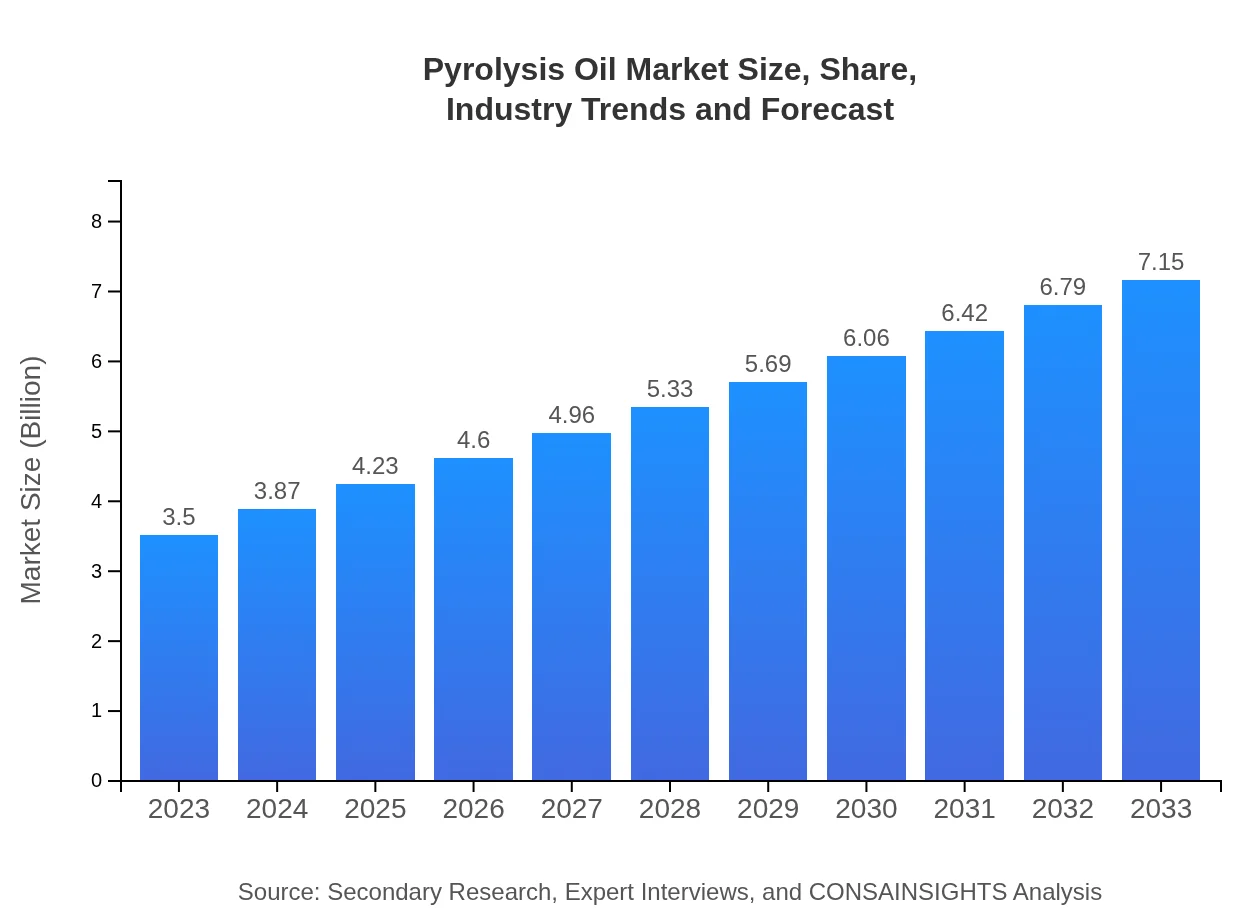

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | PyroGenesis, Agilyx Corporation, RES Polyflow |

| Last Modified Date | 02 February 2026 |

Pyrolysis Oil Market Overview

Customize Pyrolysis Oil Market Report market research report

- ✔ Get in-depth analysis of Pyrolysis Oil market size, growth, and forecasts.

- ✔ Understand Pyrolysis Oil's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pyrolysis Oil

What is the Market Size & CAGR of Pyrolysis Oil market in 2023?

Pyrolysis Oil Industry Analysis

Pyrolysis Oil Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pyrolysis Oil Market Analysis Report by Region

Europe Pyrolysis Oil Market Report:

The European market accounts for around $1.07 billion in 2023, projected to grow to $2.19 billion by 2033. The region is known for stringent environmental regulations and significant investments in alternative energy sources, encouraging the adoption of pyrolysis technologies as a part of the circular economy.Asia Pacific Pyrolysis Oil Market Report:

In 2023, the Pyrolysis Oil market in the Asia Pacific region was valued at approximately $0.7 billion, projected to grow to around $1.43 billion by 2033, driven by increasing urbanization, industrial growth, and government support for waste management initiatives. Countries like China and India are leading this growth through substantial investments in waste-to-energy projects.North America Pyrolysis Oil Market Report:

North America, with a market size of $1.2 billion in 2023, is forecasted to grow to approximately $2.45 billion by 2033. The increased focus on energy independence and sustainable practices among consumers and businesses contributes significantly to this increase. The U.S. leads with numerous pyrolysis plants and innovation hubs.South America Pyrolysis Oil Market Report:

The market in South America was valued at $0.12 billion in 2023 and is expected to reach $0.25 billion by 2033. This growth is influenced by the region's rising awareness regarding waste recycling and a push towards sustainable practices, particularly in Brazil and Argentina, where governmental policies favor renewable energy sources.Middle East & Africa Pyrolysis Oil Market Report:

The Middle East and Africa region's market was valued at $0.4 billion in 2023, with expectations to reach $0.83 billion by 2033. The growth in waste management practices and higher investments in renewable energy initiatives are pivotal in boosting market development across nations such as South Africa and the UAE.Tell us your focus area and get a customized research report.

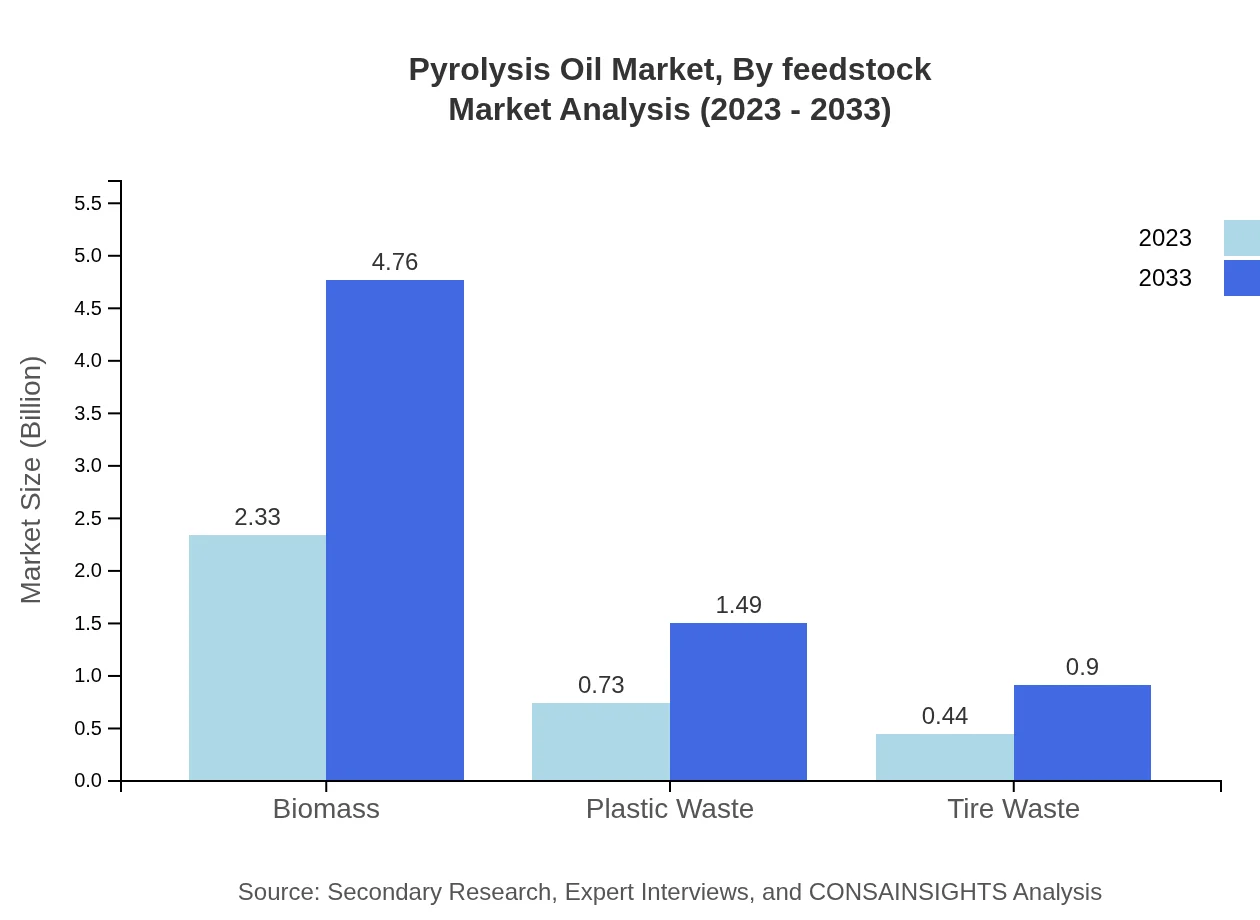

Pyrolysis Oil Market Analysis By Feedstock

The feedstock segment of the Pyrolysis Oil market is critical, comprising biomass, plastic waste, and tire waste. In 2023, biomass leads with a market size of $2.33 billion, projected to maintain a share of 66.59% in the coming years. The plastic waste segment is also burgeoning, with a size of $0.73 billion expected to reach $1.49 billion by 2033, reflecting the increasing focus on recycling initiatives.

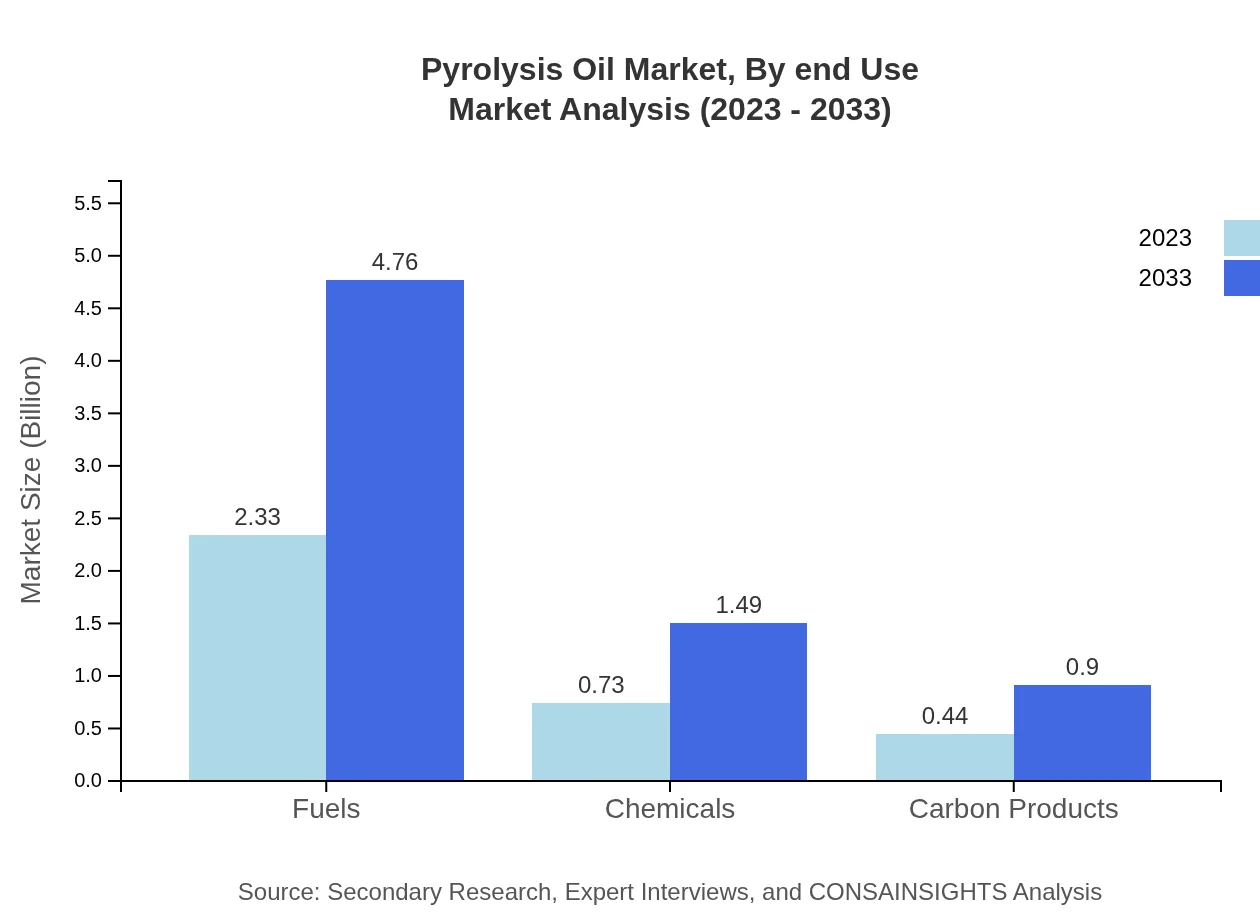

Pyrolysis Oil Market Analysis By End Use

End-use applications of Pyrolysis Oil primarily cater to fuels and chemicals. Fuels constitute approximately $2.33 billion market size in 2023, retaining a significant market share as industries seek to replace traditional fossil fuels with renewable options. Chemicals derived from pyrolysis oil are gaining traction, with segment revenue projected to grow from $0.73 billion in 2023 to $1.49 billion by 2033.

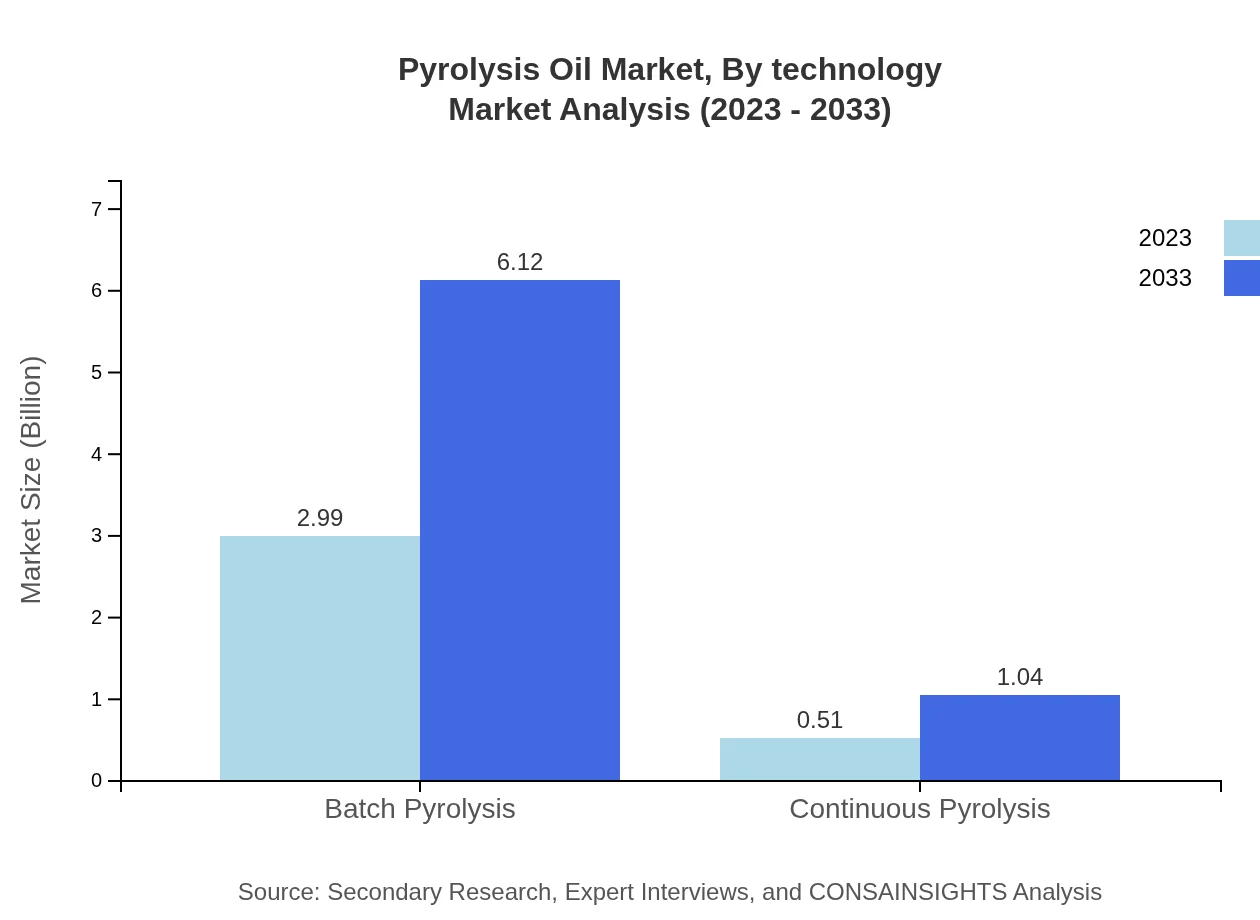

Pyrolysis Oil Market Analysis By Technology

Market technologies encompass batch and continuous pyrolysis. Batch pyrolysis dominates the market, accounting for a size of around $2.99 billion in 2023. Continuous pyrolysis holds promise for future growth due to its efficiency, indicating an increasing share as technological advancements are made.

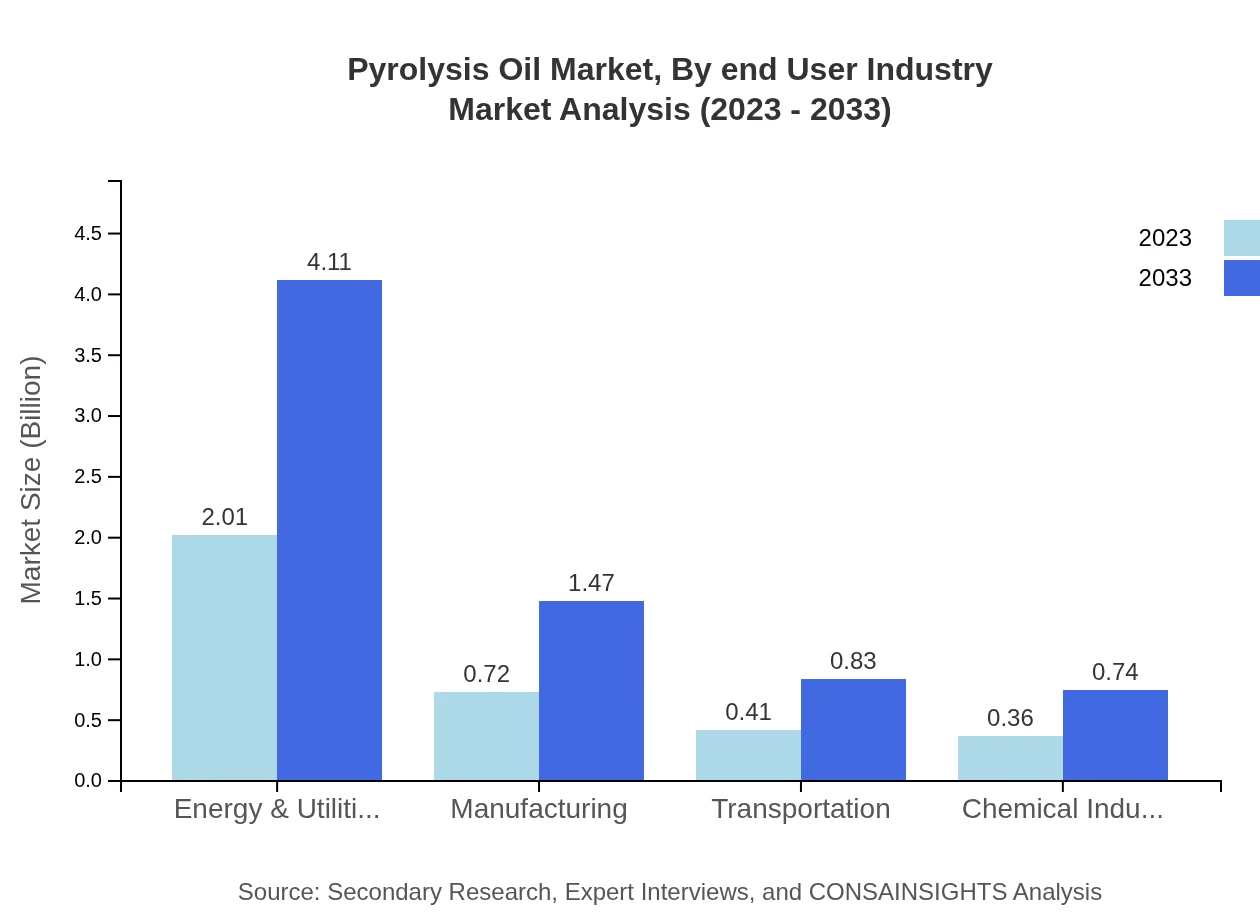

Pyrolysis Oil Market Analysis By End User Industry

End-user industries include energy & utilities, manufacturing, and transportation, with energy and utilities leading the market due to high demand for renewable energy sources. In 2023, this segment represented around $2.01 billion. The manufacturing industry follows with $0.72 billion, demonstrating significant potential growth.

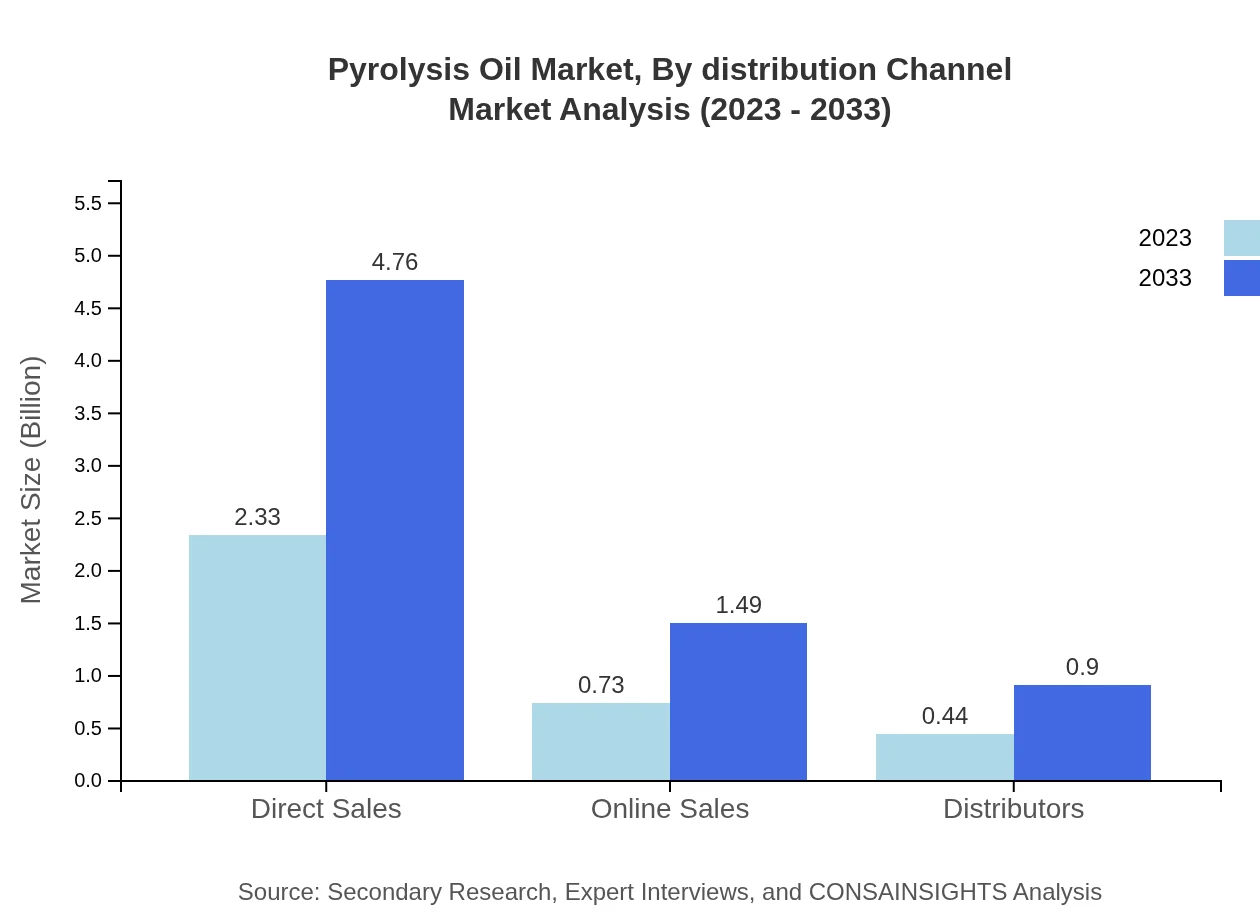

Pyrolysis Oil Market Analysis By Distribution Channel

Distribution channels for Pyrolysis Oil include direct sales, online sales, and distributors. Direct sales dominate with $2.33 billion in 2023, reflecting the established relationships between producers and large-scale consumers. Online sales are growing, representing a market size of $0.73 billion, as E-commerce redefines sales dynamics.

Pyrolysis Oil Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pyrolysis Oil Industry

PyroGenesis:

A leader in advanced plasma technology providing solutions for waste management, PyroGenesis offers proprietary technologies for pyrolysis oil production from waste materials.Agilyx Corporation:

Agilyx is renowned for its pioneering technology in converting plastic waste into high-quality pyrolysis oil, establishing a significant presence in the renewable energy sector.RES Polyflow:

Specializing in the development of waste-to-energy solutions, RES Polyflow focuses on converting various wastes into valuable materials, including pyrolysis oil.We're grateful to work with incredible clients.

FAQs

What is the market size of pyrolysis Oil?

The global pyrolysis oil market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 7.2% through 2033. This growth reflects increasing demand for sustainable fuel alternatives.

What are the key market players or companies in the pyrolysis Oil industry?

Key players in the pyrolysis oil industry include companies specializing in waste-to-energy technologies and renewable fuels, although specific company names may vary. These players are crucial in advancing pyrolysis technology and expanding market reach.

What are the primary factors driving the growth in the pyrolysis Oil industry?

Major growth drivers include increasing demand for renewable energy sources, government regulations favoring environmentally sustainable practices, and advancements in pyrolysis technology enhancing efficiency and product yield in oil production.

Which region is the fastest Growing in the pyrolysis Oil?

The fastest-growing region in the pyrolysis oil market is Europe, projected to expand from $1.07 billion in 2023 to $2.19 billion by 2033, driven by robust renewable energy initiatives and policy support.

Does ConsaInsights provide customized market report data for the pyrolysis Oil industry?

Yes, ConsaInsights offers customized market report data tailored to specific queries and requirements within the pyrolysis-oil industry, providing unique insights and detailed analyses to support decision-making.

What deliverables can I expect from this pyrolysis Oil market research project?

Deliverables from the pyrolysis-oil market research project may include comprehensive reports, trend analyses, segmented market insights, competitor analysis, and growth forecasts that provide strategic insights into the industry.

What are the market trends of pyrolysis Oil?

Current trends in the pyrolysis oil market show a shift towards enhanced efficiency in production methods, increased applications in renewable energy sectors, and a growing focus on waste management solutions, particularly in biofuels and chemicals.