R And D Tax Credit Services

Published Date: 24 January 2026 | Report Code: r-and-d-tax-credit-services

R And D Tax Credit Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the R And D Tax Credit Services market, detailing its size, growth potential, and trends from 2023 to 2033. Insights include market segmentation, regional performance, and the impact of technology on the industry.

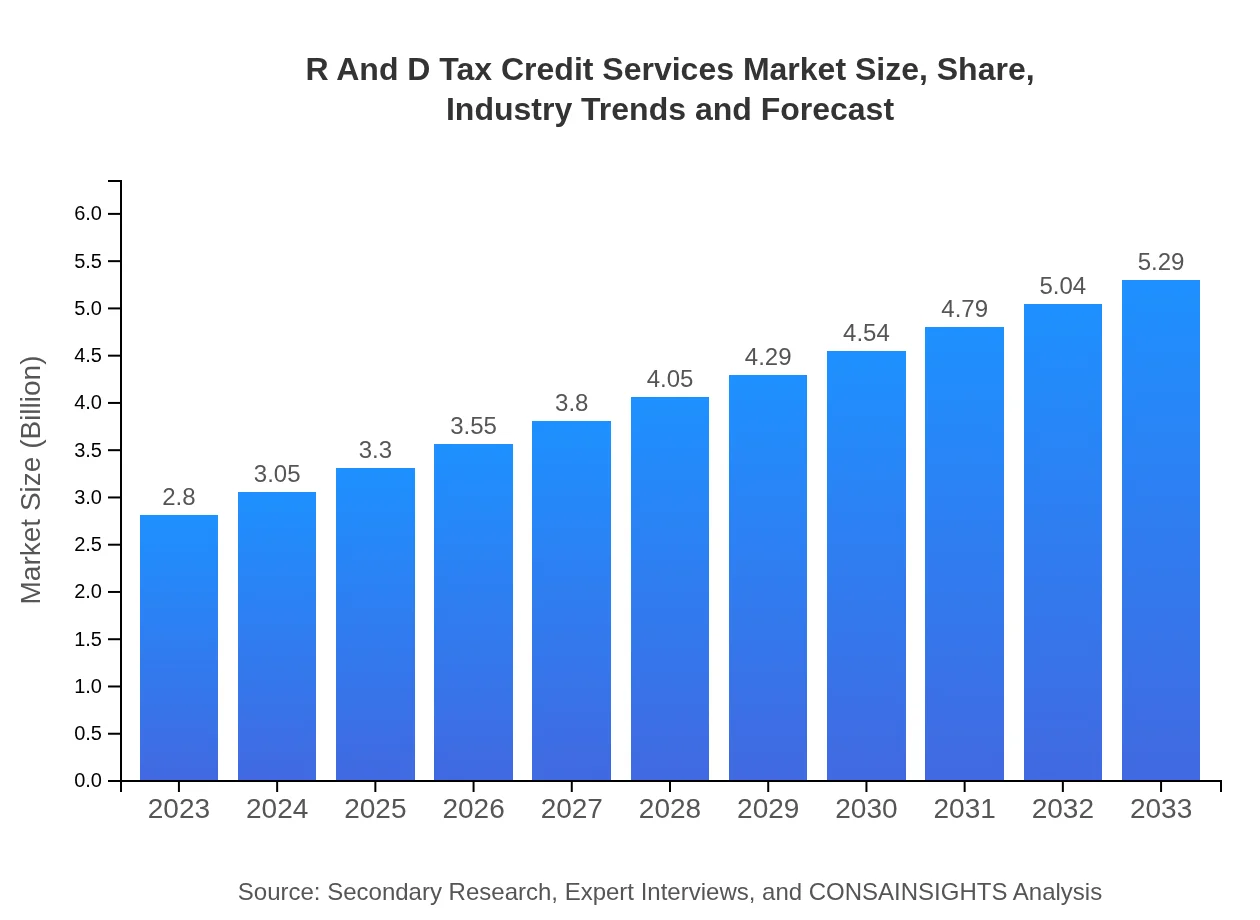

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.80 Billion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $5.29 Billion |

| Top Companies | R&D Tax Savvy, Innovation Refunds, Moss Adams |

| Last Modified Date | 24 January 2026 |

R And D Tax Credit Services Market Overview

Customize R And D Tax Credit Services market research report

- ✔ Get in-depth analysis of R And D Tax Credit Services market size, growth, and forecasts.

- ✔ Understand R And D Tax Credit Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in R And D Tax Credit Services

What is the Market Size & CAGR of R And D Tax Credit Services market in 2023?

R And D Tax Credit Services Industry Analysis

R And D Tax Credit Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

R And D Tax Credit Services Market Analysis Report by Region

Europe R And D Tax Credit Services:

The European market is projected to grow from $0.90 billion in 2023 to $1.70 billion in 2033. The increasing number of companies taking advantage of EU-wide tax incentives and national programs fosters growth in R&D expenditures across various sectors.Asia Pacific R And D Tax Credit Services:

The R&D Tax Credit Services market in Asia Pacific is expected to grow from $0.51 billion in 2023 to $0.97 billion in 2033. Countries like China and India are ramping up their R&D spending, driving up the demand for tax credit services amid burgeoning innovation ecosystems.North America R And D Tax Credit Services:

North America is anticipated to see robust growth, with market values growing from $0.99 billion in 2023 to $1.87 billion in 2033. The United States remains the largest market globally, led by significant awareness and utilization of R&D tax credits, particularly among tech startups and established firms.South America R And D Tax Credit Services:

In South America, the market is forecasted to increase from $0.10 billion in 2023 to $0.19 billion by 2033. Countries such as Brazil and Argentina are enhancing their tax incentive frameworks, leading to an increased interest in R&D tax credit services.Middle East & Africa R And D Tax Credit Services:

The Middle East and Africa market is set to rise from $0.29 billion in 2023 to $0.56 billion by 2033. Governments in the region are increasingly aware of the importance of driving innovation, fostering an environment conducive to R&D investments, and enhancing claim services.Tell us your focus area and get a customized research report.

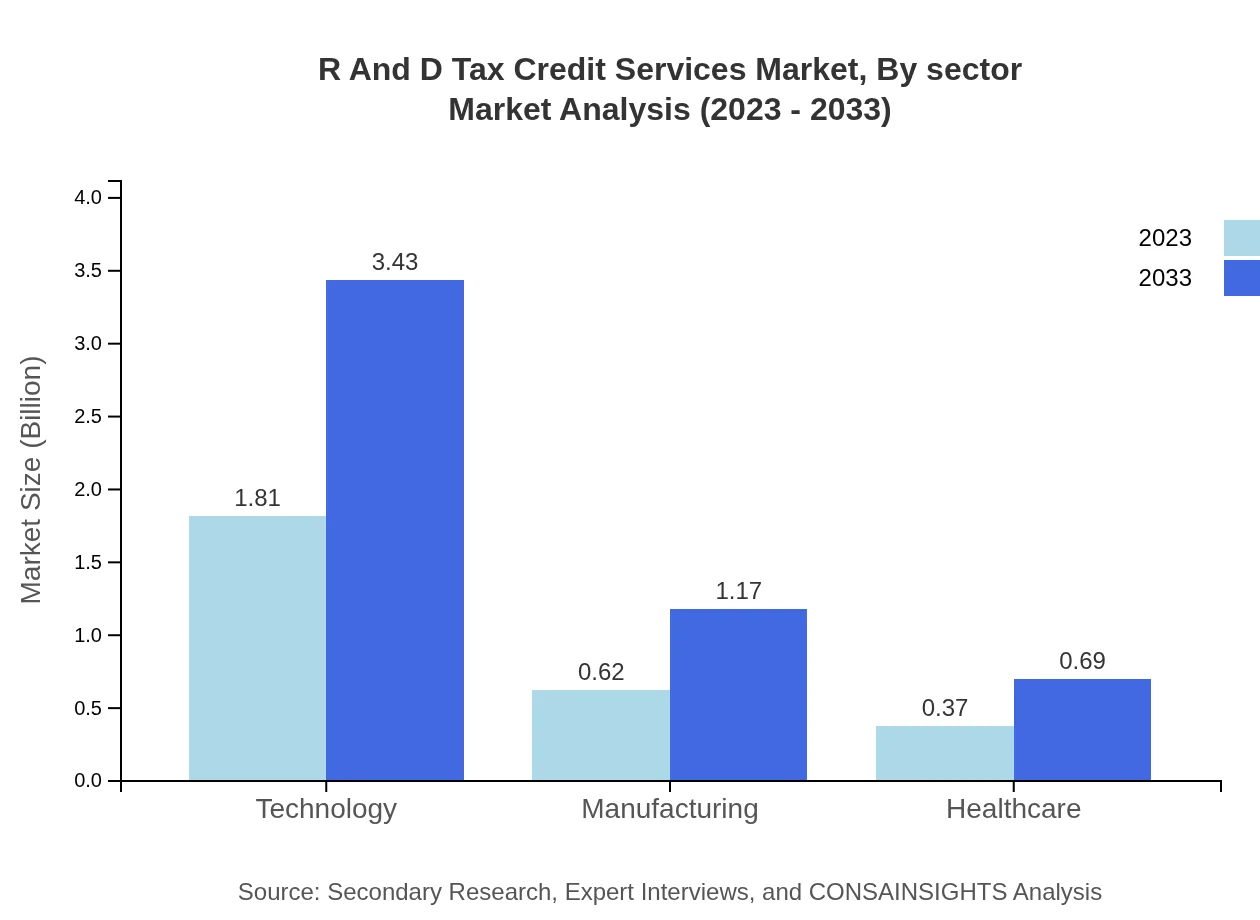

R And D Tax Credit Services Market Analysis By Sector

The R&D Tax Credit Services market is segmented by sector, including technology, manufacturing, and healthcare. The technology sector continues to lead in terms of claiming credits due to high investment levels in R&D activities. In 2023, the technology segment accounted for the largest share, contributing 64.77%, valued at $1.81 billion, and is expected to reach $3.43 billion in 2033.

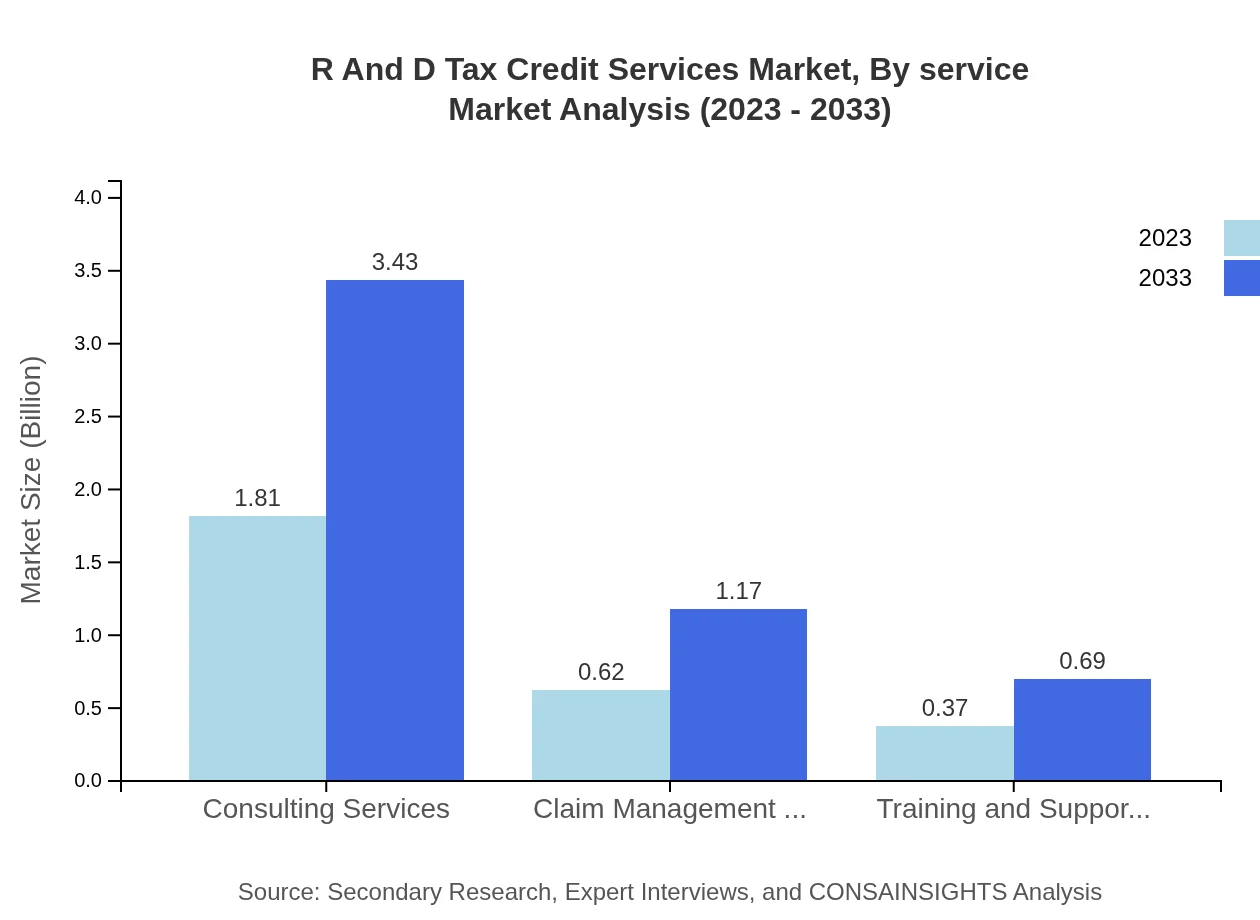

R And D Tax Credit Services Market Analysis By Service

In the service type segment, consulting services are dominant, representing 64.77% of the market share in 2023, valued at $1.81 billion. Claim management services and training support, making up 22.11% and 13.12% respectively, provide critical support for businesses navigating the R&D tax credit landscape, reflecting a trend towards comprehensive service offerings.

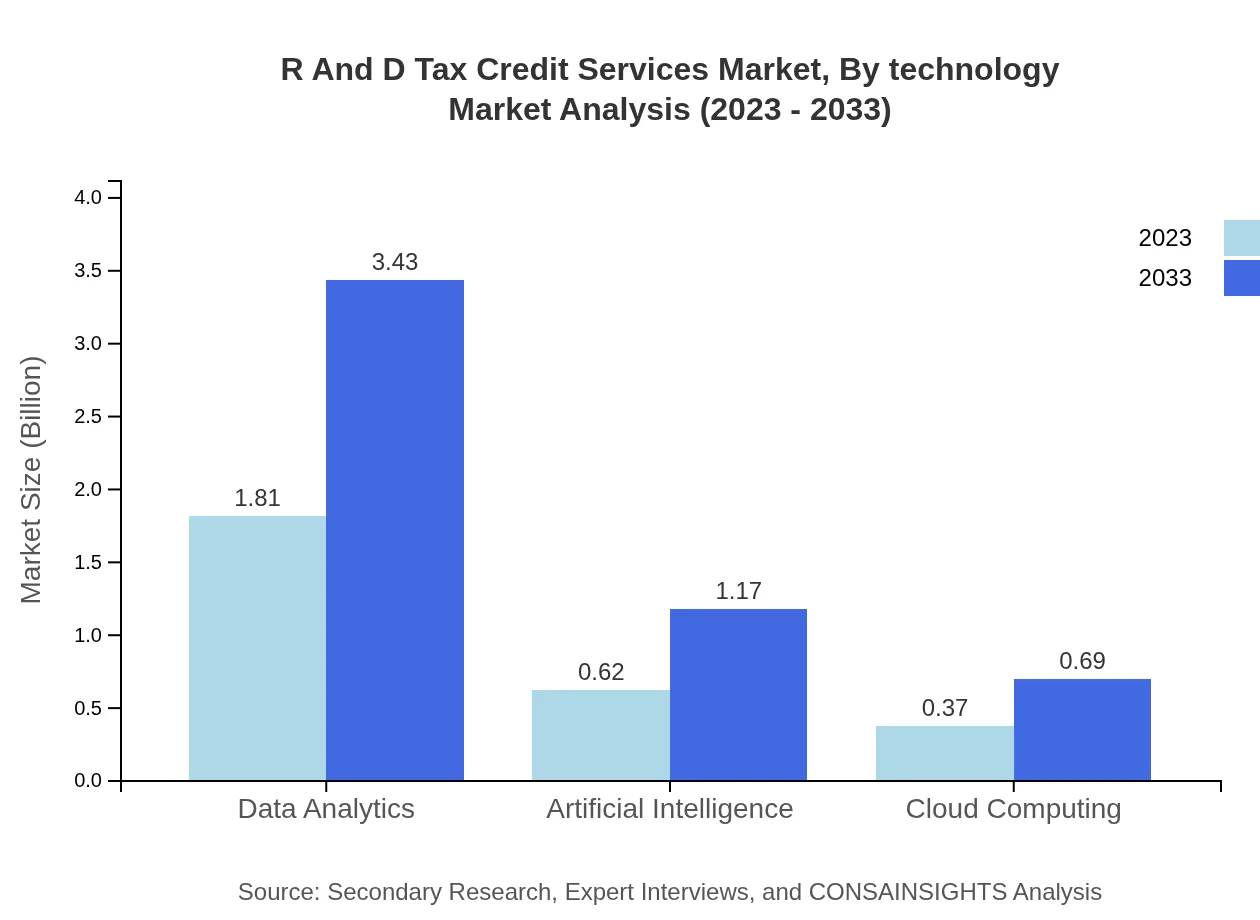

R And D Tax Credit Services Market Analysis By Technology

Technological advancements are significantly influencing the R&D tax credit services market, particularly with data analytics, artificial intelligence, and cloud computing enhancing firms' ability to effectively claim credits. In 2023, data analytics drove growth, with a market size of $1.81 billion, and is projected to hit $3.43 billion by 2033.

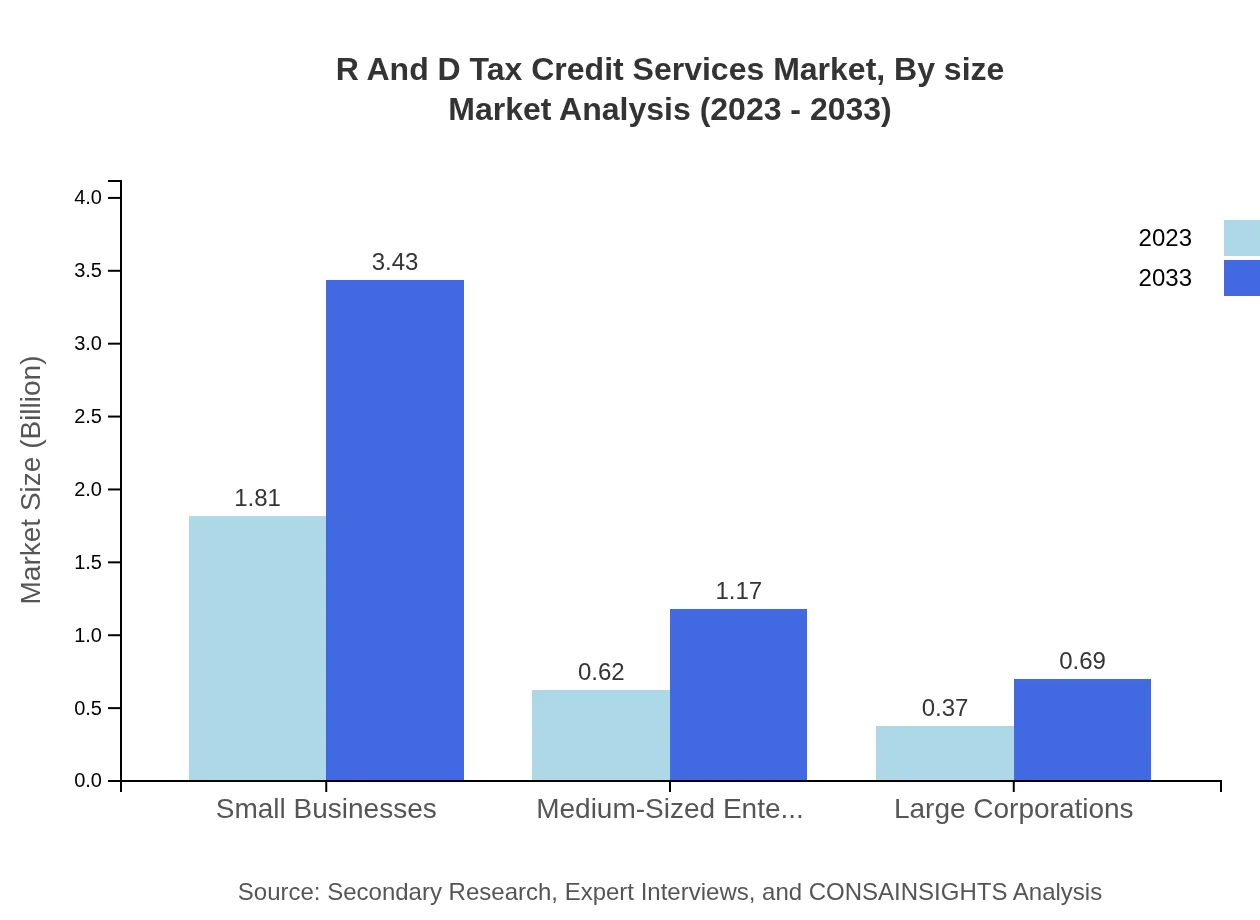

R And D Tax Credit Services Market Analysis By Size

The market is further categorized by company size, with small businesses leading the way with a whooping 64.77% share in 2023 at $1.81 billion, and expected to rise to $3.43 billion by 2033. Medium-sized enterprises and large corporations are also providing substantial contributions, reflecting a holistic market expansion across sizes.

R And D Tax Credit Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in R And D Tax Credit Services Industry

R&D Tax Savvy:

R&D Tax Savvy specializes in helping clients maximize their eligible tax credits through comprehensive consultation and extensive knowledge of tax legislation.Innovation Refunds:

Innovation Refunds is a leading provider of R&D tax credit services, leveraging a unique technology platform to streamline the application process for businesses.Moss Adams:

Moss Adams is a well-respected accounting firm providing extensive services in R&D tax credits, focusing on various industries and comprehensive tax strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of R&D Tax Credit Services?

The global market size for R&D tax credit services is estimated to be $2.8 billion in 2023, with a projected CAGR of 6.4% through 2033. This growth reflects the increasing demand for R&D tax recovery solutions.

What are the key market players or companies in the R&D Tax Credit Services industry?

Key players include major consulting firms, specialized R&D tax credit service providers, and accounting firms. These companies are known for expertise in identifying eligible R&D activities and optimizing client tax credits.

What are the primary factors driving the growth in the R&D Tax Credit Services industry?

Drivers include increased government incentives for R&D, rising awareness of tax credit opportunities, and the growing complexity of R&D activities within companies, prompting businesses to seek expert guidance.

Which region is the fastest Growing in the R&D Tax Credit Services?

North America is the fastest-growing region, projected to increase from $0.99 billion in 2023 to $1.87 billion by 2033. Europe and Asia Pacific also exhibit significant growth, reflecting increasing R&D investments.

Does ConsaInsights provide customized market report data for the R&D Tax Credit Services industry?

Yes, ConsaInsights offers tailored market report data, catering to specific client needs. Customized analysis can help businesses better understand market dynamics and competitive landscapes in the R&D tax credit sector.

What deliverables can I expect from this R&D Tax Credit Services market research project?

Deliverables include comprehensive market reports, detailed competitive analysis, segmentation insights, forecasting data, and strategic recommendations tailored to informed decision-making and investment planning.

What are the market trends of R&D Tax Credit Services?

Key trends encompass growing digital transformation in R&D processes, increased utilization of data analytics for optimizing tax credit claims, and a rising emphasis on collaboration between tax and R&D functions within organizations.