Radar Sensors Market Report

Published Date: 31 January 2026 | Report Code: radar-sensors

Radar Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the dynamic Radar Sensors market, offering insights into its current status, forecasts from 2023 to 2033, and comprehensive analyses of trends, technologies, and key industry players.

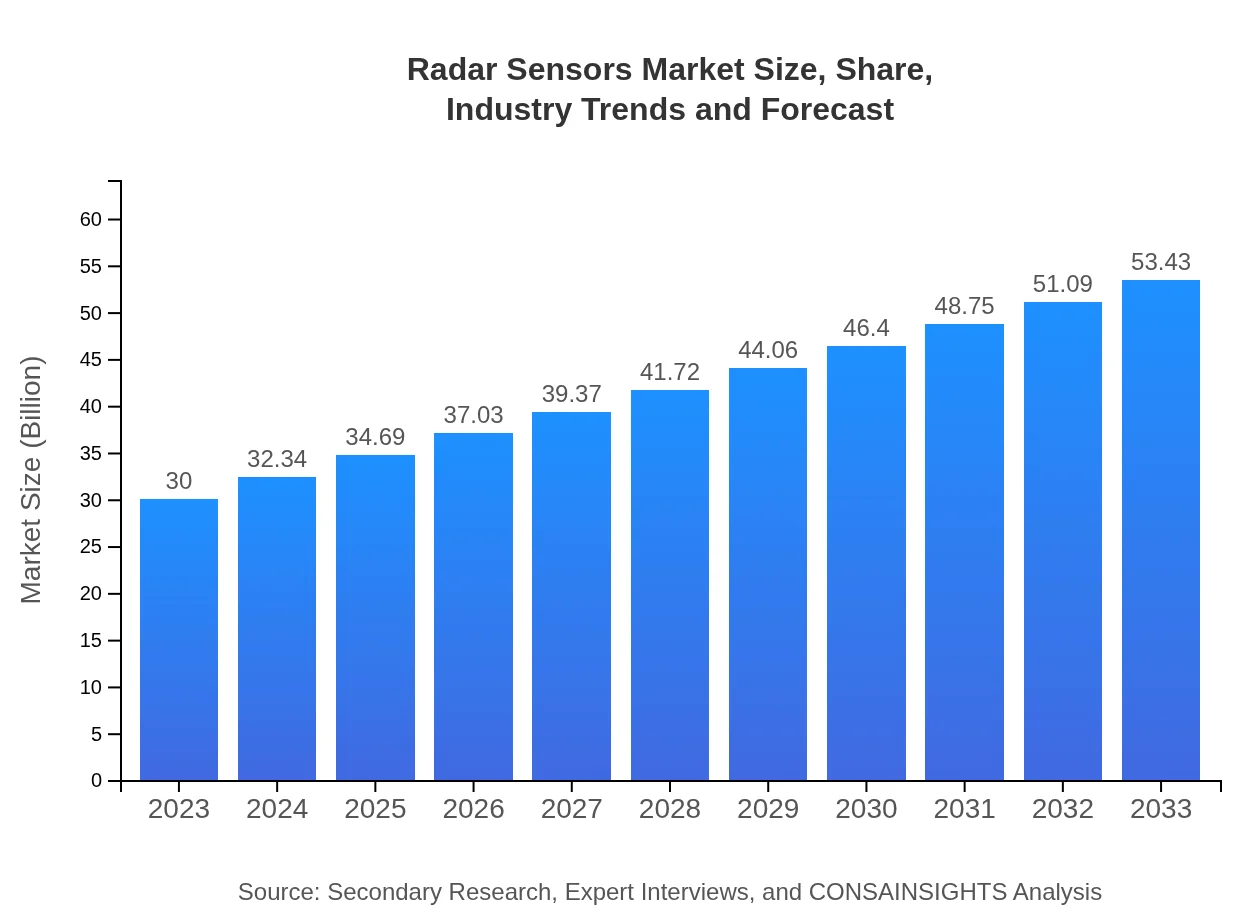

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $53.43 Billion |

| Top Companies | Bosch, Honeywell , Texas Instruments, Raytheon Technologies |

| Last Modified Date | 31 January 2026 |

Radar Sensors Market Overview

Customize Radar Sensors Market Report market research report

- ✔ Get in-depth analysis of Radar Sensors market size, growth, and forecasts.

- ✔ Understand Radar Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Radar Sensors

What is the Market Size & CAGR of Radar Sensors market in 2023?

Radar Sensors Industry Analysis

Radar Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Radar Sensors Market Analysis Report by Region

Europe Radar Sensors Market Report:

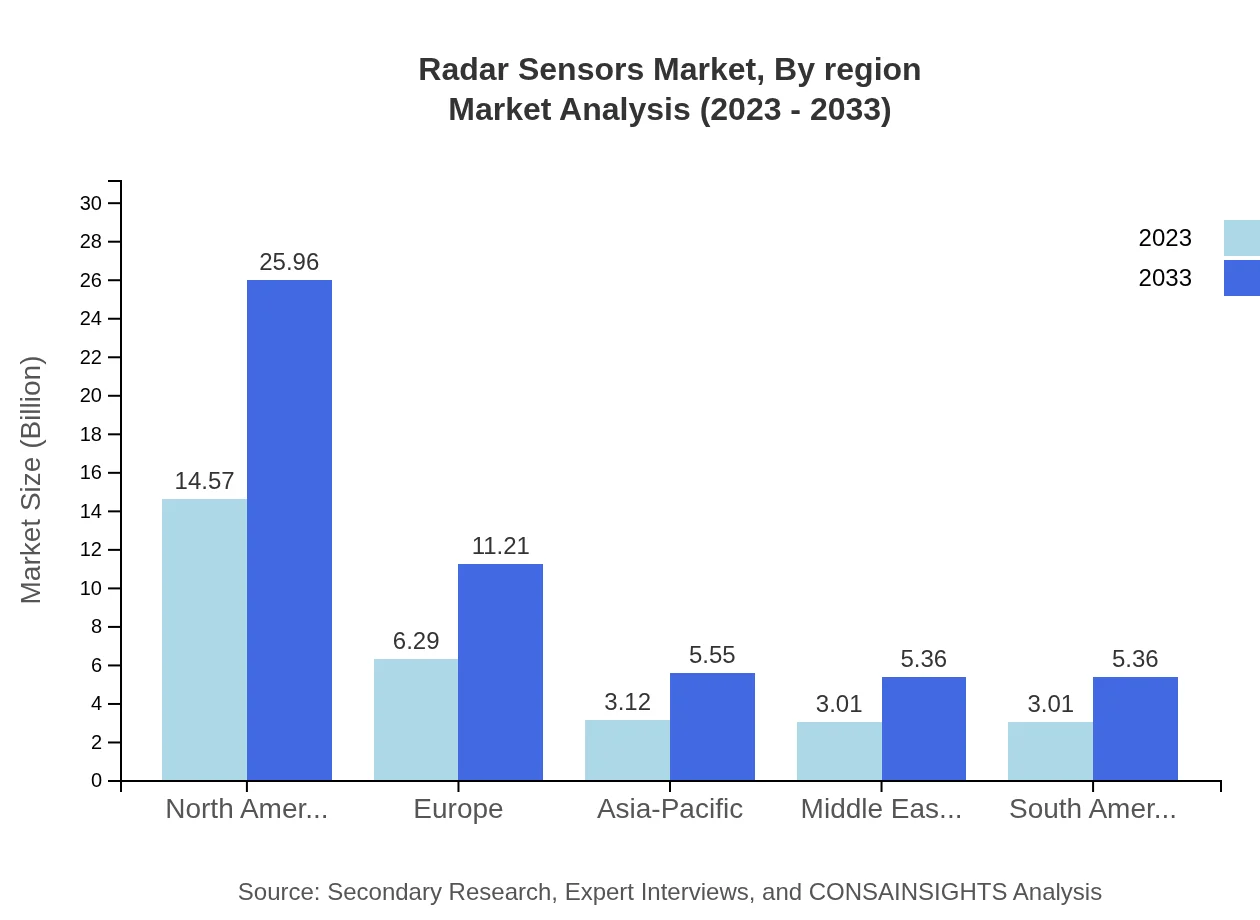

The European Radar Sensors market is also expanding, expected to reach $16.62 billion by 2033, up from $9.33 billion in 2023. The region benefits from stringent safety regulations and a strong automotive sector focusing on innovation and safety features.Asia Pacific Radar Sensors Market Report:

The Asia Pacific region is witnessing significant growth in the Radar Sensors market, with a market size expected to reach approximately $11.39 billion by 2033, growing from $6.39 billion in 2023. The increased adoption of radar technology in automotive and defense sectors is driving this growth.North America Radar Sensors Market Report:

North America remains a leading region for the Radar Sensors market, with a projected size of $17.17 billion by 2033, increasing from $9.64 billion in 2023. Key factors include high demand in the automotive sector, technological innovations in radar systems, and the presence of major market players.South America Radar Sensors Market Report:

In South America, the Radar Sensors market is gaining traction, primarily driven by advancements in infrastructure and safety regulations. The market size is projected to grow from $0.87 billion in 2023 to $1.55 billion by 2033, reflecting a strong CAGR as more industries adopt radar solutions.Middle East & Africa Radar Sensors Market Report:

The Middle East and African markets for Radar Sensors are anticipated to grow from $3.77 billion in 2023 to $6.71 billion by 2033. This growth is fueled by increased defense spending and advancements in aviation technologies, particularly in the military and logistics sectors.Tell us your focus area and get a customized research report.

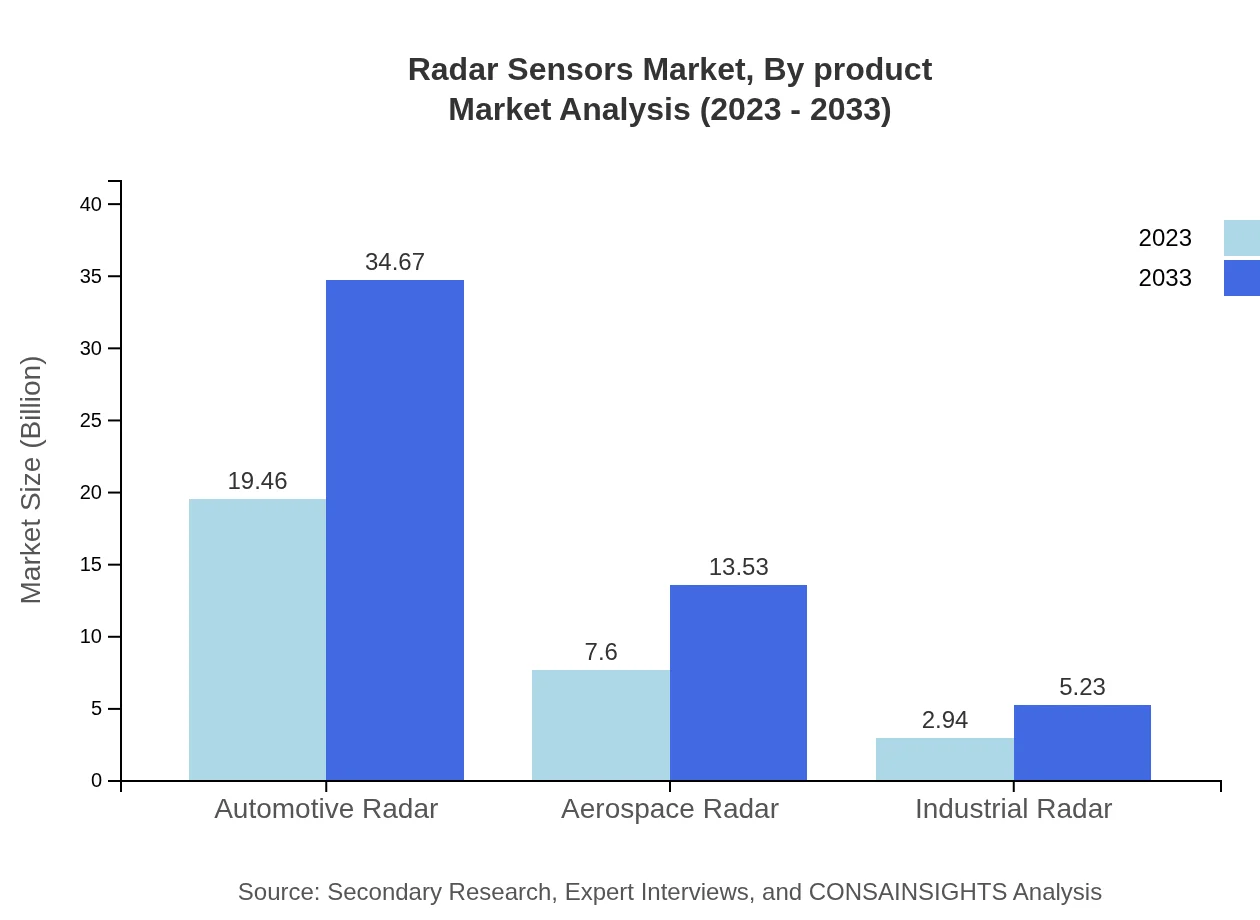

Radar Sensors Market Analysis By Product

Within the Radar Sensors market, product types include Automotive Radar, Aerospace Radar, Industrial Radar, and Military Radar. Automotive Radar remains the largest segment, with a market size of $19.46 billion in 2023 and projected to reach $34.67 billion by 2033, driven by the demand for advanced driver-assistance systems (ADAS).

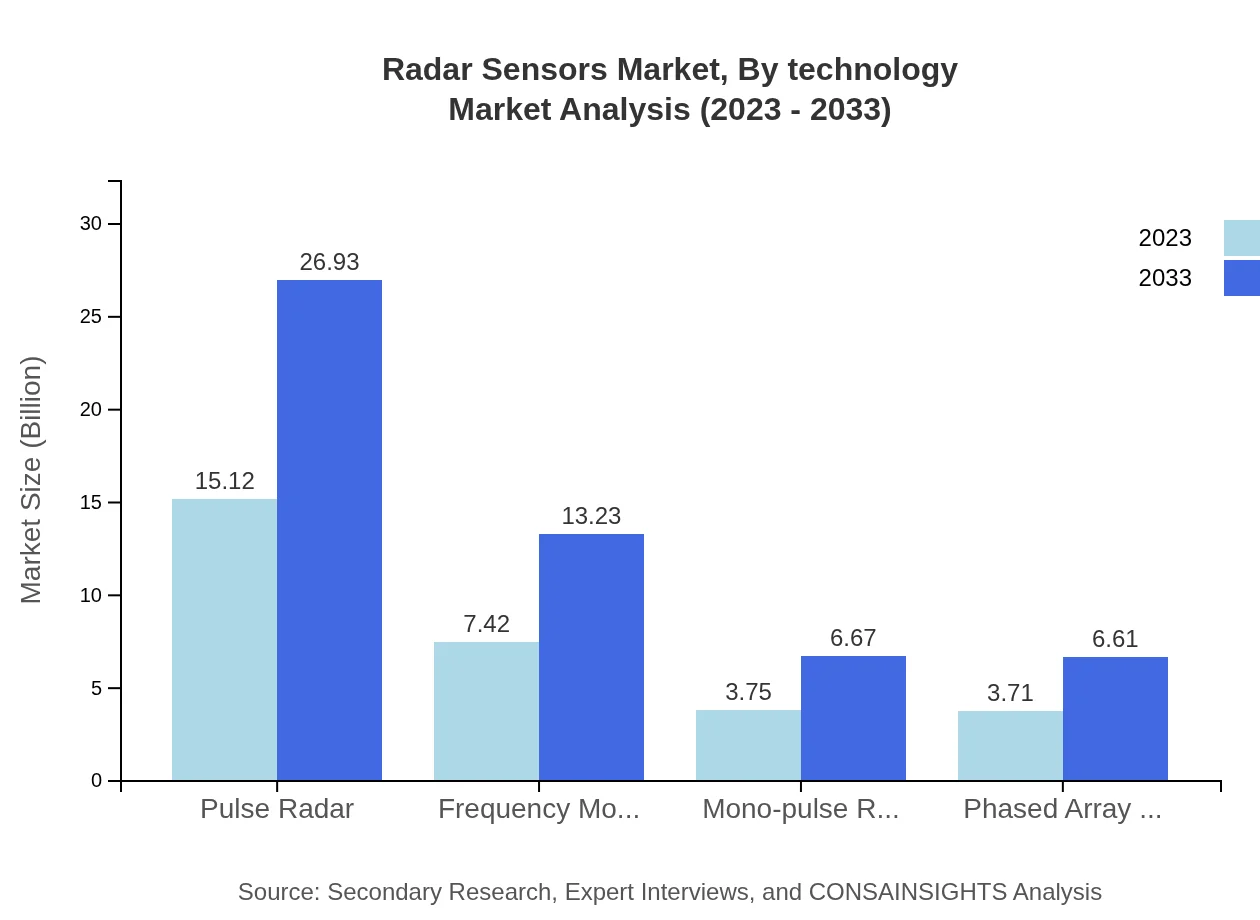

Radar Sensors Market Analysis By Technology

Key technologies in radar sensors include Pulse Radar, Frequency Modulated Continuous Wave (FMCW), Mono-pulse Radar, and Phased Array Radar. Pulse Radar is leading with a significant market size of $15.12 billion in 2023, expected to increase to $26.93 billion by 2033, playing a crucial role in automotive applications.

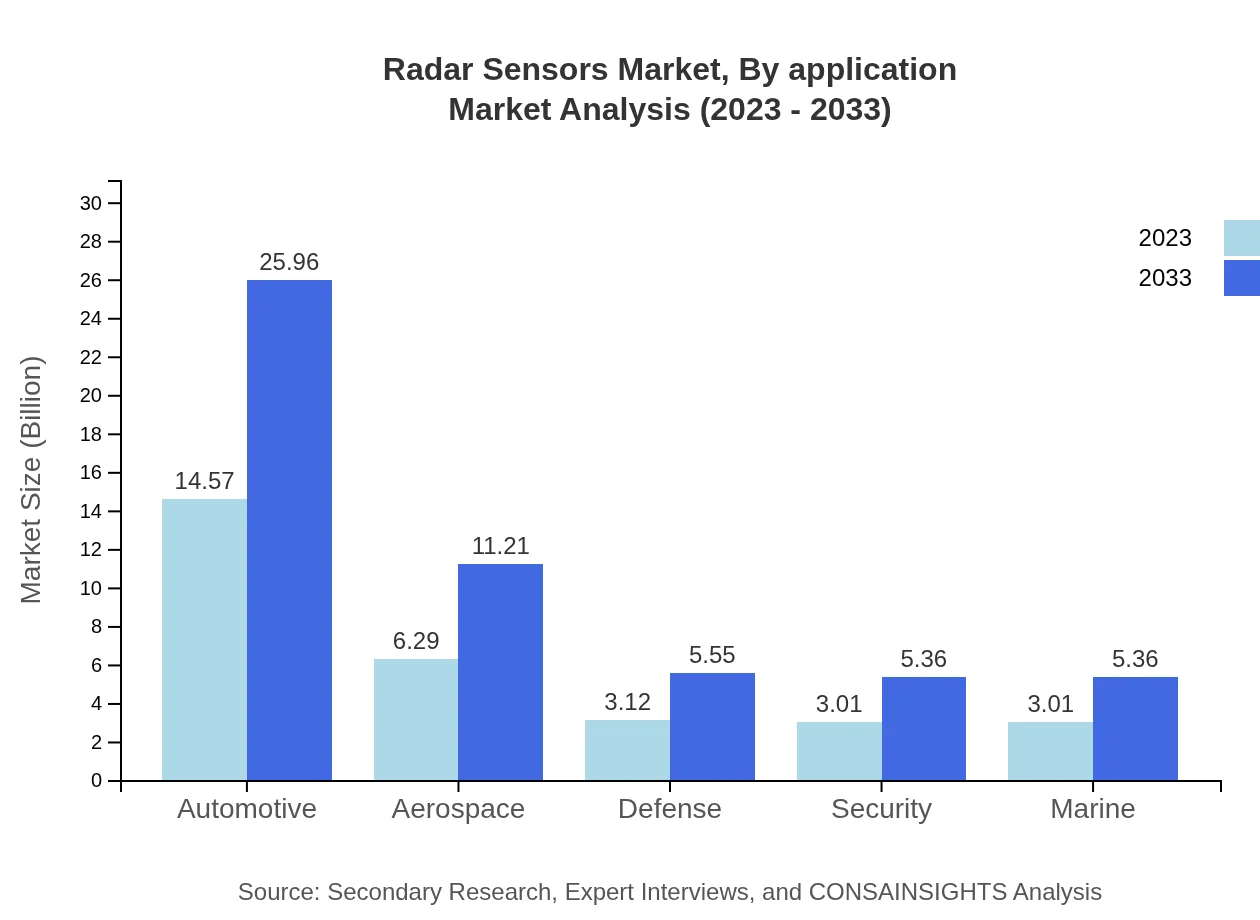

Radar Sensors Market Analysis By Application

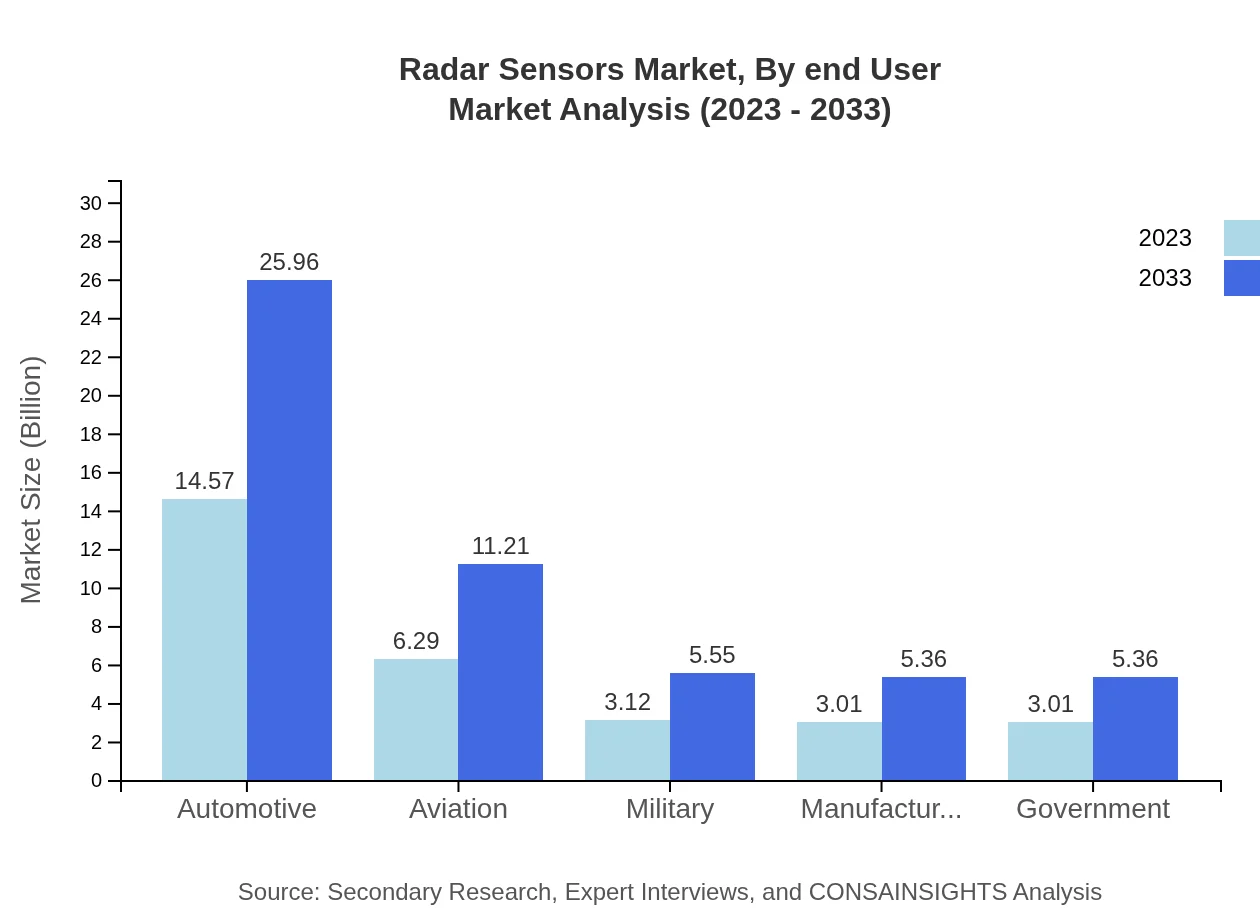

The applications of radar sensors span across various sectors, including Automotive, Aviation, Military, and Security. The Automotive application segment is projected to maintain its dominance, growing steadily from $14.57 billion in 2023 to $25.96 billion by 2033, largely due to ongoing developments in self-driving and smart vehicle technologies.

Radar Sensors Market Analysis By End User

The end-users of radar sensors include automotive manufacturers, aerospace companies, military defense contractors, and industrial sectors. The automotive industry is the primary driver, significantly contributing to market size due to increasing focus on vehicle safety and automation technologies. Market demand from the military and aerospace is expected to increase as global tensions rise.

Radar Sensors Market Analysis By Region

Regionally, the North American market is the largest due to strong automotive and defense sectors, while Asia Pacific is expected to grow at the fastest rate due to increased investments in technology and infrastructure. Europe remains a critical market due to regulatory frameworks promoting safety features.

Radar Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Radar Sensors Industry

Bosch:

Bosch is a leading global supplier of technology and services, prominently known for its advanced radar solutions in automotive applications, driving innovation in safety and automation.Honeywell :

Honeywell specializes in a wide range of technology solutions, and its radar systems are pivotal in defense and aerospace, providing enhanced surveillance and situational awareness.Texas Instruments:

Texas Instruments is a key player in semiconductor technologies, with significant contributions to radar sensor technologies for automotive and industrial applications, enhancing detection and accuracy.Raytheon Technologies:

Raytheon Technologies focuses on aerospace and defense solutions, with innovative radar technologies that improve tracking, surveillance, and missile systems.We're grateful to work with incredible clients.

FAQs

What is the market size of radar Sensors?

The global radar sensors market is projected to reach approximately $30 billion by 2033, growing at a CAGR of 5.8% from its current value. This growth trajectory underscores the increasing demand across various industries such as automotive, aerospace, and defense.

What are the key market players or companies in the radar Sensors industry?

Key players in the radar sensors market include industry leaders such as Bosch, Honeywell, and Texas Instruments. These companies are recognized for their innovative products and substantial market influence, driving technological advancements and fostering industry competition.

What are the primary factors driving the growth in the radar sensors industry?

The growth in the radar sensors industry is primarily driven by advancements in automotive safety technologies, increasing demand for automation in various sectors, and expanding applications in defense and surveillance. The emphasis on enhancing vehicle safety features significantly boosts market growth.

Which region is the fastest Growing in the radar sensors market?

North America is currently the fastest-growing region for radar sensors, projected to expand from $9.64 billion in 2023 to $17.17 billion by 2033. This growth can be attributed to robust automotive and aerospace industries, spearheading demand for radar technology.

Does ConsaInsights provide customized market report data for the radar sensors industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the radar sensors industry. Clients can obtain insights that align with their objectives, including niche markets, competitive analyses, and regulatory environments.

What deliverables can I expect from this radar sensors market research project?

The radar sensors market research project delivers comprehensive reports, including market size forecasts, trend analyses, competitive landscapes, and detailed regional breakdowns. Clients receive actionable insights to make informed business decisions and strategic planning.

What are the market trends of radar sensors?

Current market trends in radar sensors include the increasing integration of advanced technologies like AI and machine learning, rising demand for automotive radar systems for advanced driver-assistance systems (ADAS), and the growing use of radar in unmanned aerial vehicles (UAVs).