Radio Access Network Market Report

Published Date: 31 January 2026 | Report Code: radio-access-network

Radio Access Network Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report explores the Radio Access Network market, providing detailed insights on market dynamics, segmentation, regional analyses, key players, and future forecasts for the period of 2023 to 2033.

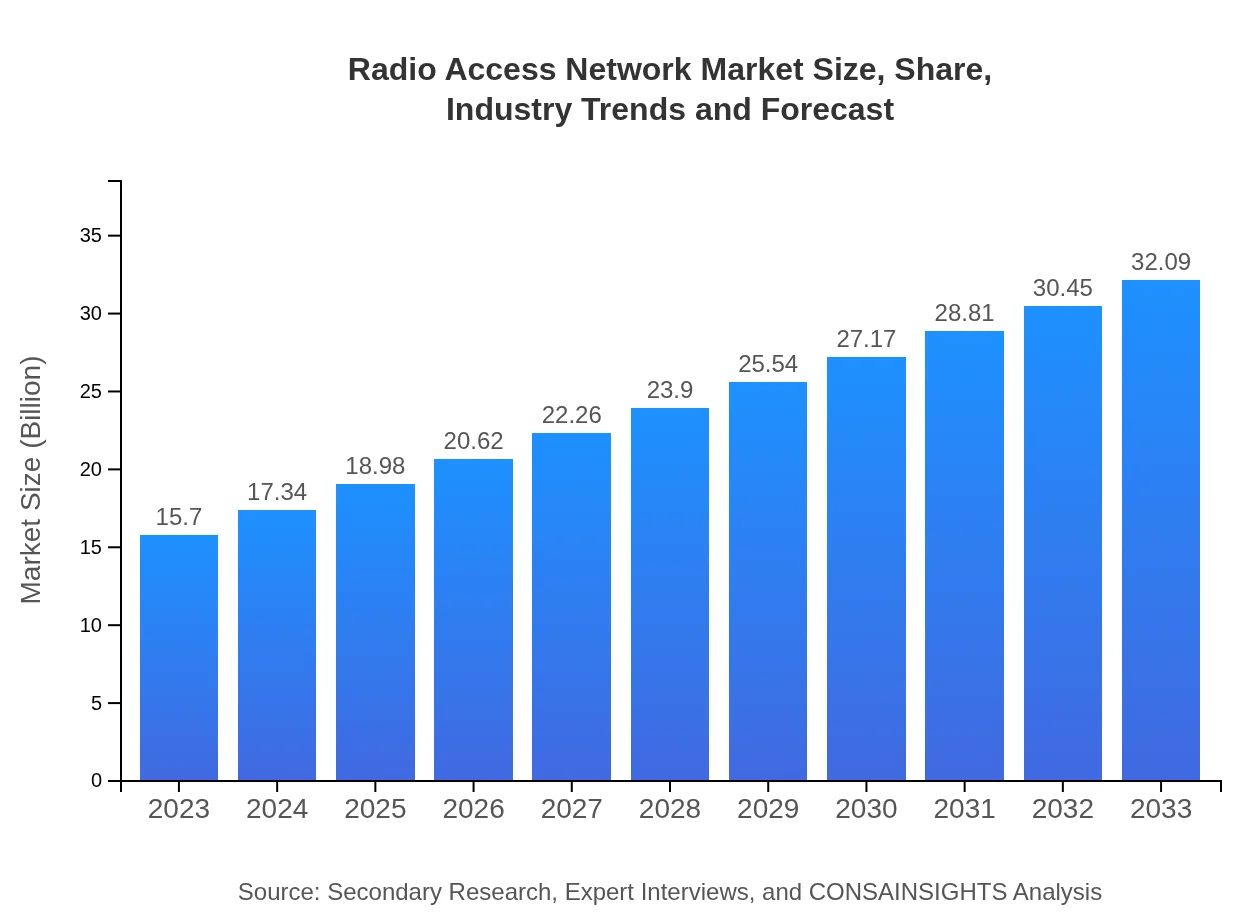

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $32.09 Billion |

| Top Companies | Ericsson , Nokia , Huawei , Samsung , ZTE Corporation |

| Last Modified Date | 31 January 2026 |

Radio Access Network Market Overview

Customize Radio Access Network Market Report market research report

- ✔ Get in-depth analysis of Radio Access Network market size, growth, and forecasts.

- ✔ Understand Radio Access Network's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Radio Access Network

What is the Market Size & CAGR of the Radio Access Network market in 2033?

Radio Access Network Industry Analysis

Radio Access Network Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Radio Access Network Market Analysis Report by Region

Europe Radio Access Network Market Report:

The European market for Radio Access Networks is estimated to grow from $4.26 billion in 2023 to $8.71 billion by 2033. The region is witnessing a rapid shift towards 5G technology, with several countries, including Germany and the UK, leading investments in next-generation RAN systems. Regulatory initiatives by the European Union to promote digitalization further bolster growth.Asia Pacific Radio Access Network Market Report:

The Asia Pacific region is a significant market for Radio Access Networks, primarily driven by the rapid deployment of 5G networks. The market size is projected to grow from $3.07 billion in 2023 to $6.28 billion by 2033, fueled by a high smartphone penetration rate and continuous investments in telecommunications infrastructure. Countries like China, India, and Japan are leading the charge with technological advancements and a growing consumer base.North America Radio Access Network Market Report:

North America holds a substantial share of the Radio Access Network market, with a projected growth from $5.29 billion in 2023 to $10.82 billion by 2033. The adoption of 5G technology in this region is leading the market, supported by strong telecom infrastructure and the presence of major service providers. The U.S. is at the forefront of RAN technology deployment, focusing on enhancing network capacity and reducing latency.South America Radio Access Network Market Report:

In South America, the Radio Access Network market is expected to increase from $0.95 billion in 2023 to $1.95 billion by 2033. The growth is driven by the increasing adoption of mobile broadband services and government initiatives aimed at enhancing digital communication capabilities. However, challenges such as economic fluctuations and regulatory issues may moderate growth rates.Middle East & Africa Radio Access Network Market Report:

In the Middle East and Africa, the market is anticipated to expand from $2.12 billion in 2023 to $4.33 billion by 2033. The growth is propelled by increasing mobile subscriber penetration and investments in mobile broadband infrastructure, particularly in urban areas. However, challenges related to political instability and economic diversity in the region may impact growth rates.Tell us your focus area and get a customized research report.

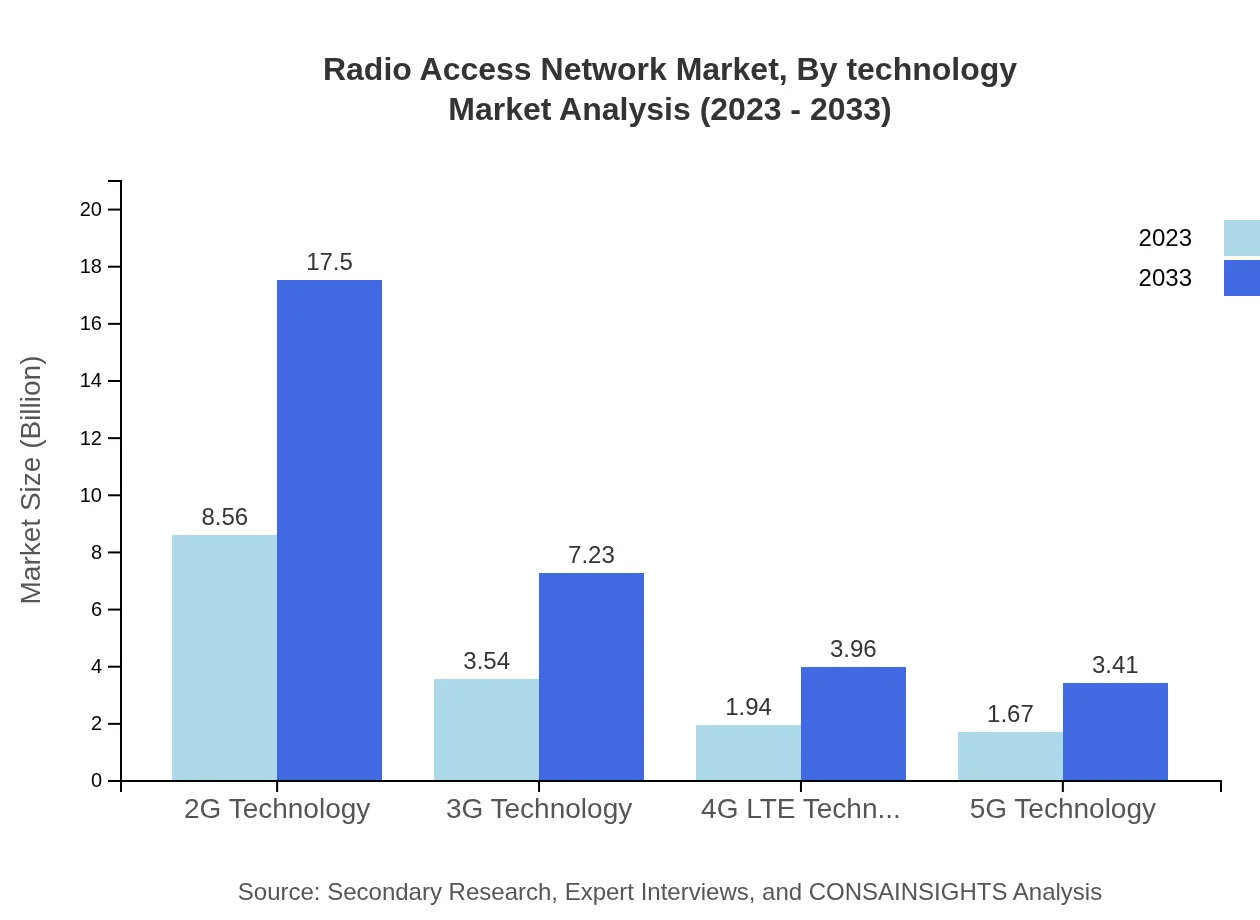

Radio Access Network Market Analysis By Technology

The RAN market by technology includes several segments: 2G, 3G, 4G LTE, and 5G. The 2G segment remains substantial, valued at $8.56 billion in 2023, while 5G technology is gaining momentum with a forecasted growth from $1.67 billion to $3.41 billion by 2033, reflecting the transition to next-gen technologies. Each technology segment offers unique capabilities and cater to various user needs.

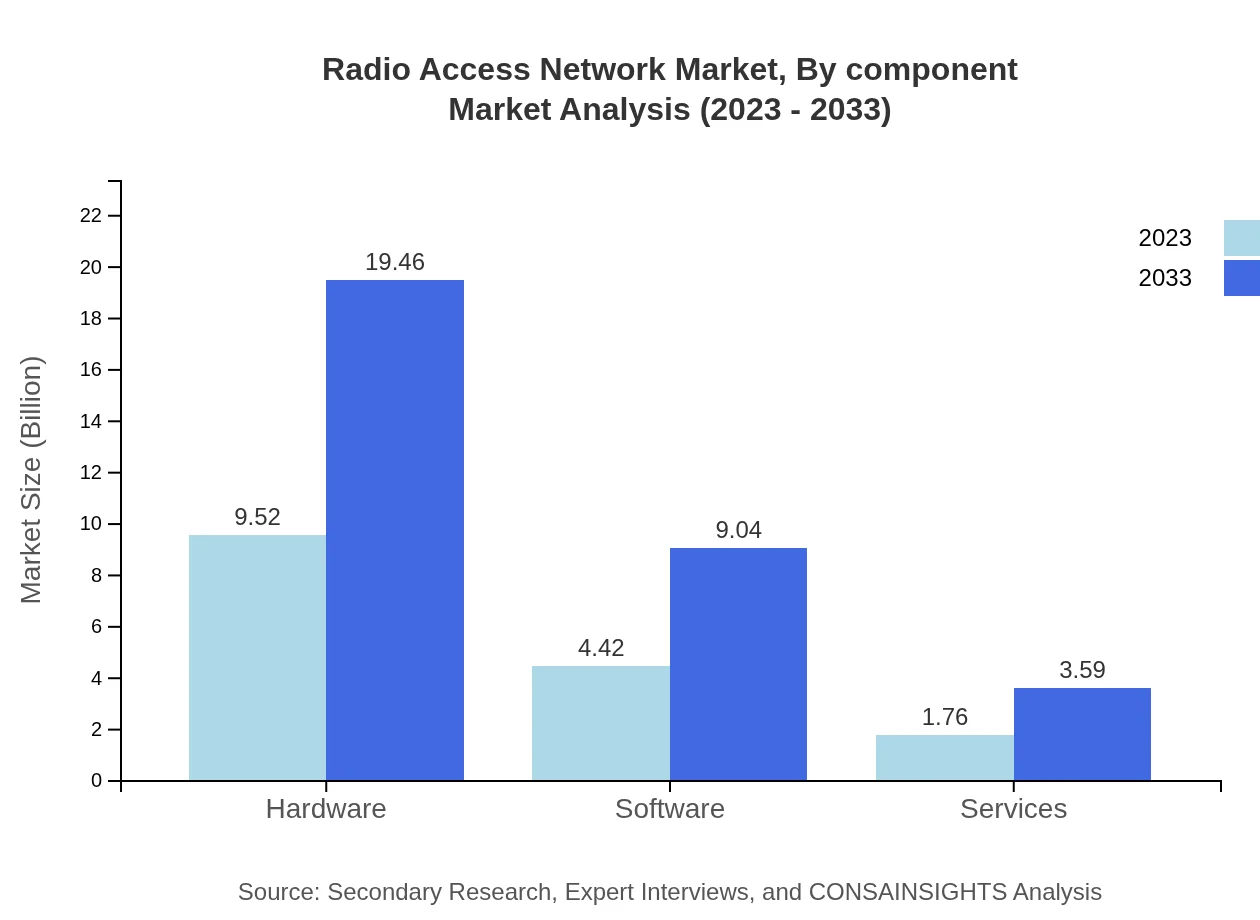

Radio Access Network Market Analysis By Component

The market is segmented into hardware, software, and services. Hardware constitutes the largest segment with a market size of $9.52 billion in 2023, expected to reach $19.46 billion by 2033. Software and services, while smaller, are significant contributors, focusing on network management and optimization, leading to overall market enhancement.

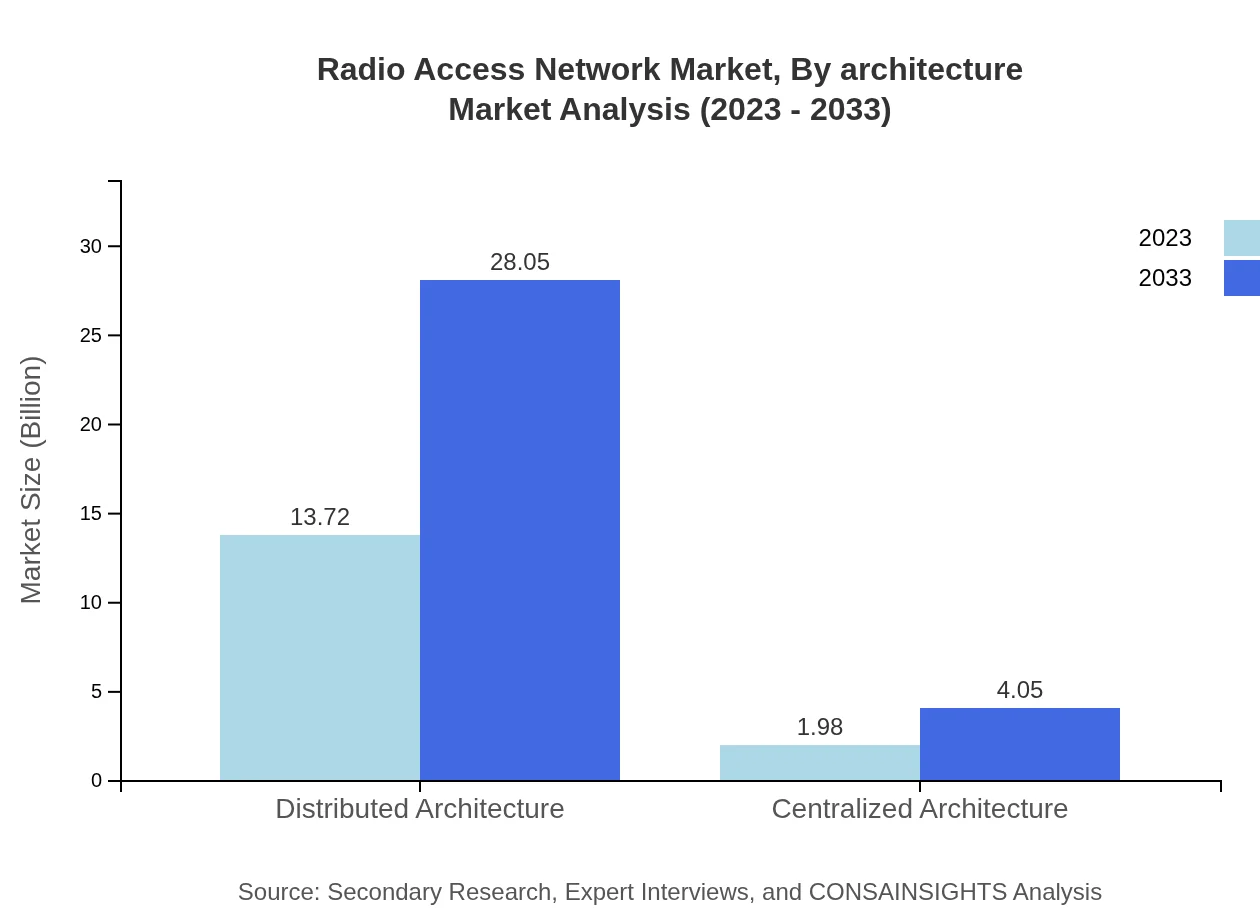

Radio Access Network Market Analysis By Architecture

The market is also divided between centralized and distributed architectures. Distributed architecture dominates the landscape, valued at $13.72 billion in 2023, and is expected to grow to $28.05 billion by 2033. This architecture provides greater flexibility and is essential for 5G deployment, accommodating diverse user requirements effectively.

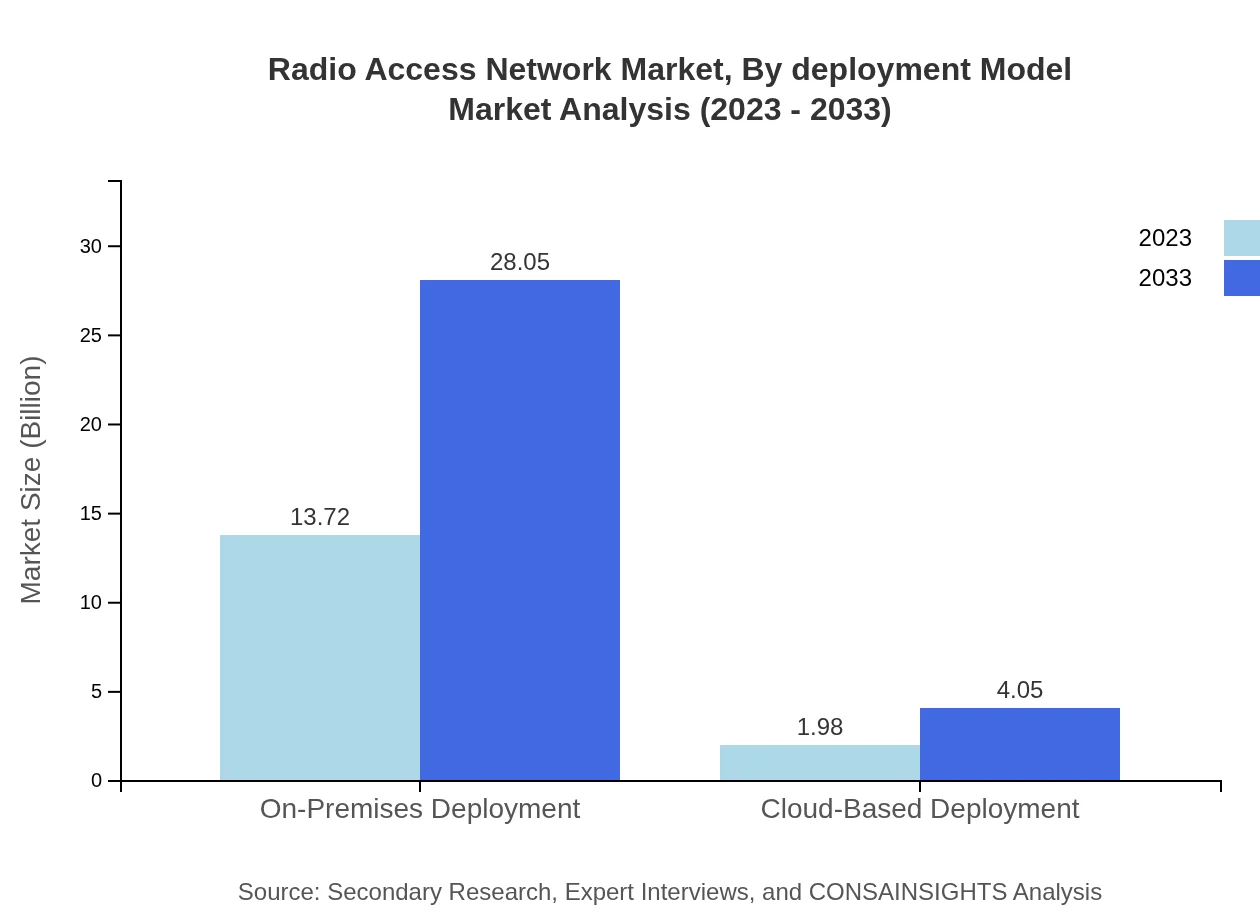

Radio Access Network Market Analysis By Deployment Model

The deployment model segments include on-premises and cloud-based solutions. On-premises deployment holds the majority market share, valued at $13.72 billion in 2023, as many enterprises prefer this for control and security. However, cloud-based models are steadily gaining traction due to their cost-effectiveness and scalability, projected to grow from $1.98 billion to $4.05 billion by 2033.

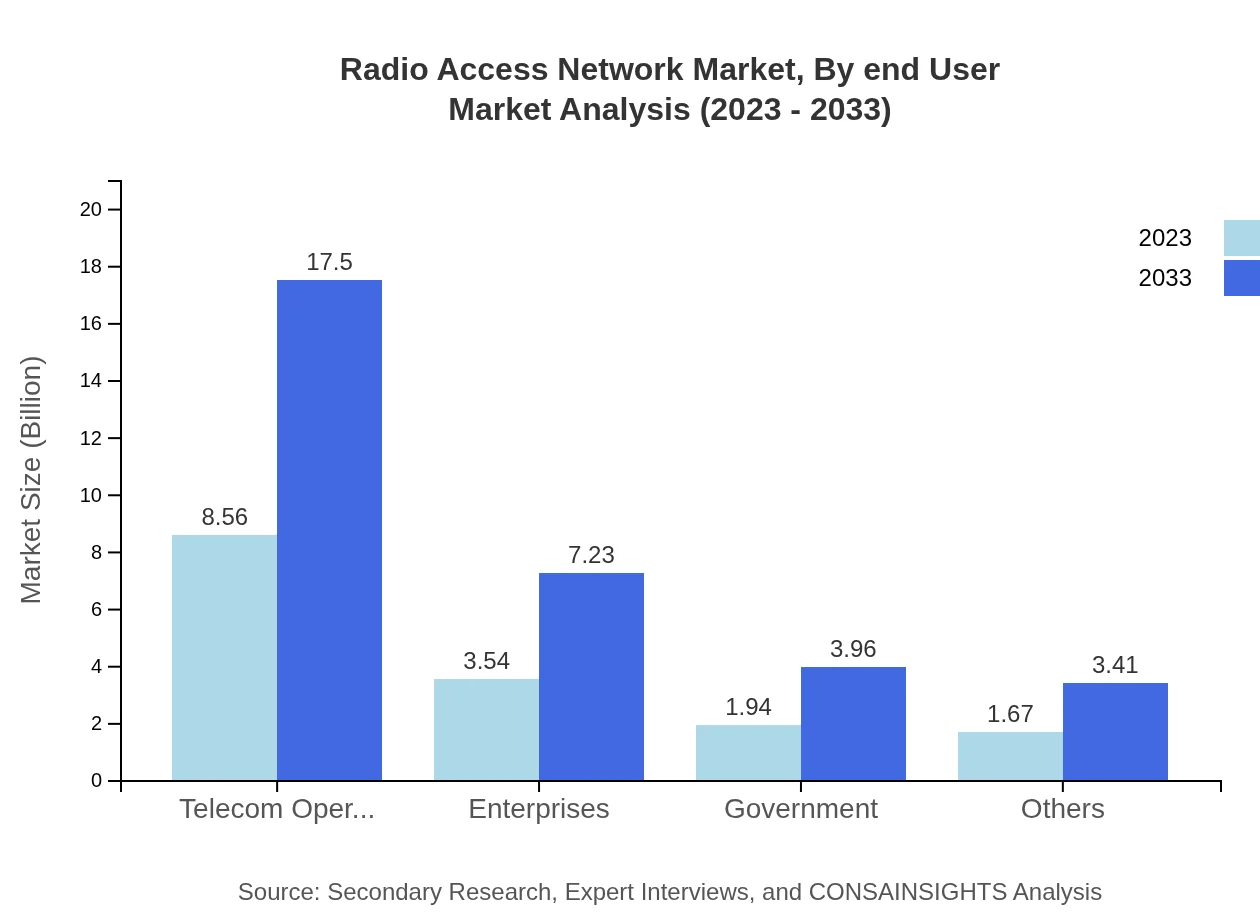

Radio Access Network Market Analysis By End User

The end-user segmentation includes telecom operators, enterprises, and government entities. Telecom operators are the primary consumers, with a market size of $8.56 billion in 2023. The enterprise sector is witnessing growth from $3.54 billion to $7.23 billion by 2033 as companies transition to more connected operations. Government entities also represent a growing market, focusing on improving communication infrastructure.

Radio Access Network Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Radio Access Network Industry

Ericsson :

A leading provider of communication technology and services, Ericsson specializes in telecommunications equipment and has been pivotal in the deployment of 5G networks globally.Nokia :

Nokia is renowned for its innovations in network infrastructure, offering a range of solutions for both 5G and legacy networks, driving digital transformation for carriers.Huawei :

Huawei is a major player in the telecommunications industry, providing advanced RAN solutions and actively participating in the deployment of next-generation mobile networks.Samsung :

Samsung focuses on state-of-the-art RAN technologies, particularly for 5G, enabling faster and more efficient network experiences for users.ZTE Corporation:

As a key global provider of telecommunications equipment, ZTE specializes in innovative RAN solutions, catering to various operators worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of Radio Access Network?

The global Radio Access Network market is poised to reach $15.7 billion by 2033, growing at a CAGR of 7.2%. This indicates significant demand and investment opportunities in the coming years.

What are the key market players or companies in this Radio Access Network industry?

Key players in the Radio Access Network market include leading telecom companies and hardware manufacturers, specifically focusing on innovations in wireless technologies and network infrastructure.

What are the primary factors driving the growth in the Radio Access Network industry?

Growth is primarily driven by the increasing demand for mobile data services, advancements in technology such as 5G, and the rising need for enhanced connectivity in various sectors globally.

Which region is the fastest Growing in the Radio Access Network?

Asia Pacific is expected to be the fastest-growing region for the Radio Access Network market, expanding from $3.07 billion in 2023 to $6.28 billion by 2033, due to rapid urbanization and technology adoption.

Does ConsaInsights provide customized market report data for the Radio Access Network industry?

Yes, ConsaInsights offers tailored market research reports for the Radio Access Network industry, allowing clients to access specific data and insights that align with their unique business needs.

What deliverables can I expect from this Radio Access Network market research project?

Deliverables typically include comprehensive market analysis reports, trend assessments, competitive landscape insights, and forecasts, along with segment-wise data to aid strategic decision-making.

What are the market trends of Radio Access Network?

Key trends include the transition to 5G networks, increasing investments in network infrastructure, a shift towards distributed architectures, and growing integration of cloud solutions for enhanced scalability.