Radio Frequency Identification Rfid Market Report

Published Date: 31 January 2026 | Report Code: radio-frequency-identification-rfid

Radio Frequency Identification Rfid Market Size, Share, Industry Trends and Forecast to 2033

This report offers comprehensive insights into the Radio Frequency Identification (RFID) market, covering market dynamics from 2023 to 2033. It highlights market size, growth rates, industry trends, regional analysis, and forecasts, providing stakeholders with pertinent data for informed decision-making.

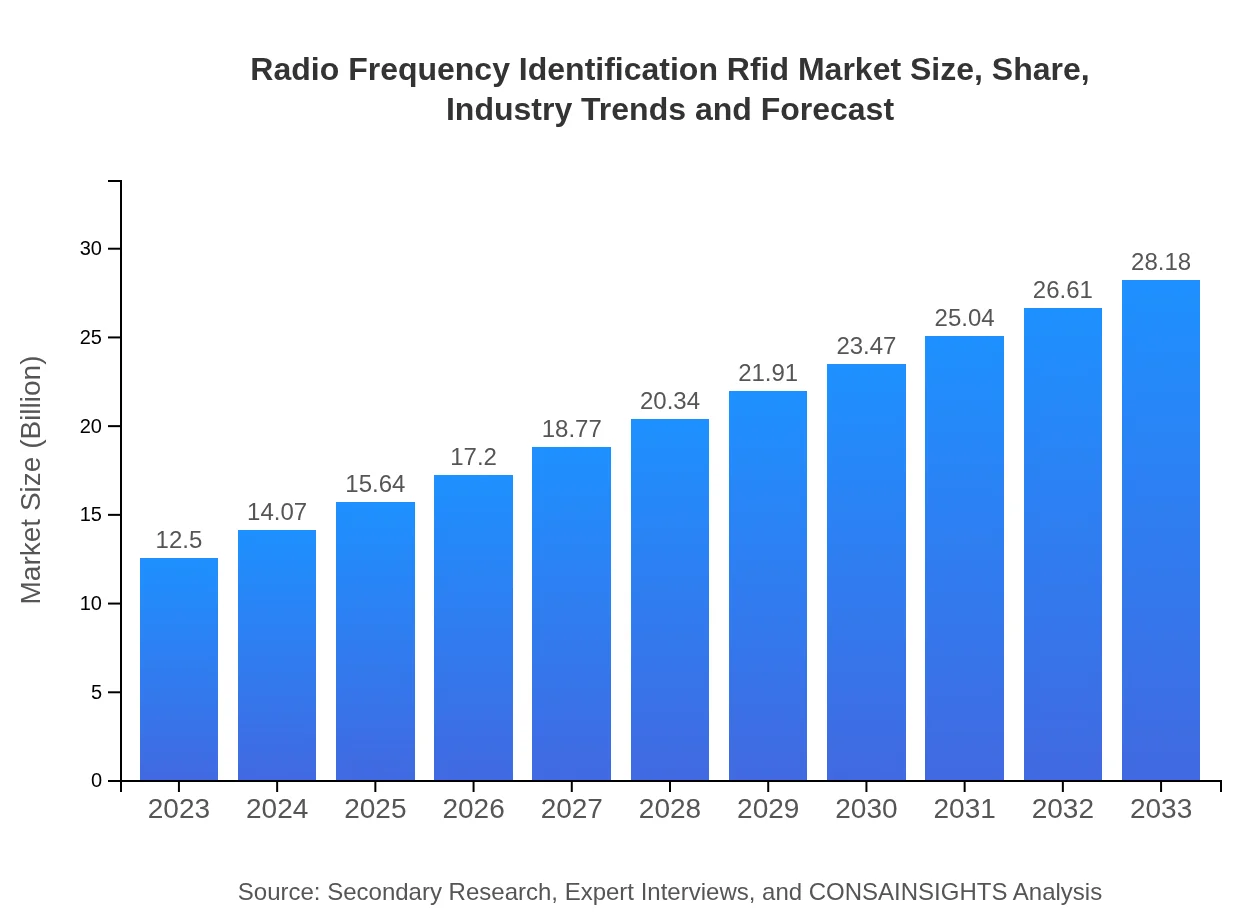

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $28.18 Billion |

| Top Companies | Zebra Technologies, Impinj, Inc., Alien Technology, SML Group, Avery Dennison |

| Last Modified Date | 31 January 2026 |

Radio Frequency Identification RFID Market Overview

Customize Radio Frequency Identification Rfid Market Report market research report

- ✔ Get in-depth analysis of Radio Frequency Identification Rfid market size, growth, and forecasts.

- ✔ Understand Radio Frequency Identification Rfid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Radio Frequency Identification Rfid

What is the Market Size & CAGR of Radio Frequency Identification RFID market in 2023?

Radio Frequency Identification RFID Industry Analysis

Radio Frequency Identification RFID Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Radio Frequency Identification RFID Market Analysis Report by Region

Europe Radio Frequency Identification Rfid Market Report:

The European RFID market size is projected to grow from USD 4.59 billion in 2023 to USD 10.36 billion by 2033. The growth is driven by strict regulations regarding supply chain transparency and the rising demand for advanced tracking solutions among manufacturing and retail companies.Asia Pacific Radio Frequency Identification Rfid Market Report:

The Asia Pacific region is expected to witness significant growth, with the market size projected at USD 4.55 billion by 2033, up from USD 2.02 billion in 2023. This growth is driven by increasing adoption of RFID technology in retail and supply chain sectors, supported by government initiatives to enhance technological infrastructure.North America Radio Frequency Identification Rfid Market Report:

North America remains a dominant player in the RFID market, with growth expected from USD 4.10 billion in 2023 to USD 9.23 billion by 2033. The region's advanced technology landscape, coupled with early adoption across various sectors, solidifies its leadership position.South America Radio Frequency Identification Rfid Market Report:

In South America, the RFID market is anticipated to grow from USD 0.68 billion in 2023 to USD 1.53 billion by 2033. The rise is attributed to the increased focus on improving operational efficiencies in logistics and inventory management, within a rapidly evolving retail landscape.Middle East & Africa Radio Frequency Identification Rfid Market Report:

In the Middle East and Africa, the RFID market is forecasted to increase from USD 1.11 billion in 2023 to USD 2.50 billion by 2033. Rising urbanization, coupled with technological advancements, is prompting more organizations to adopt RFID for asset tracking and management.Tell us your focus area and get a customized research report.

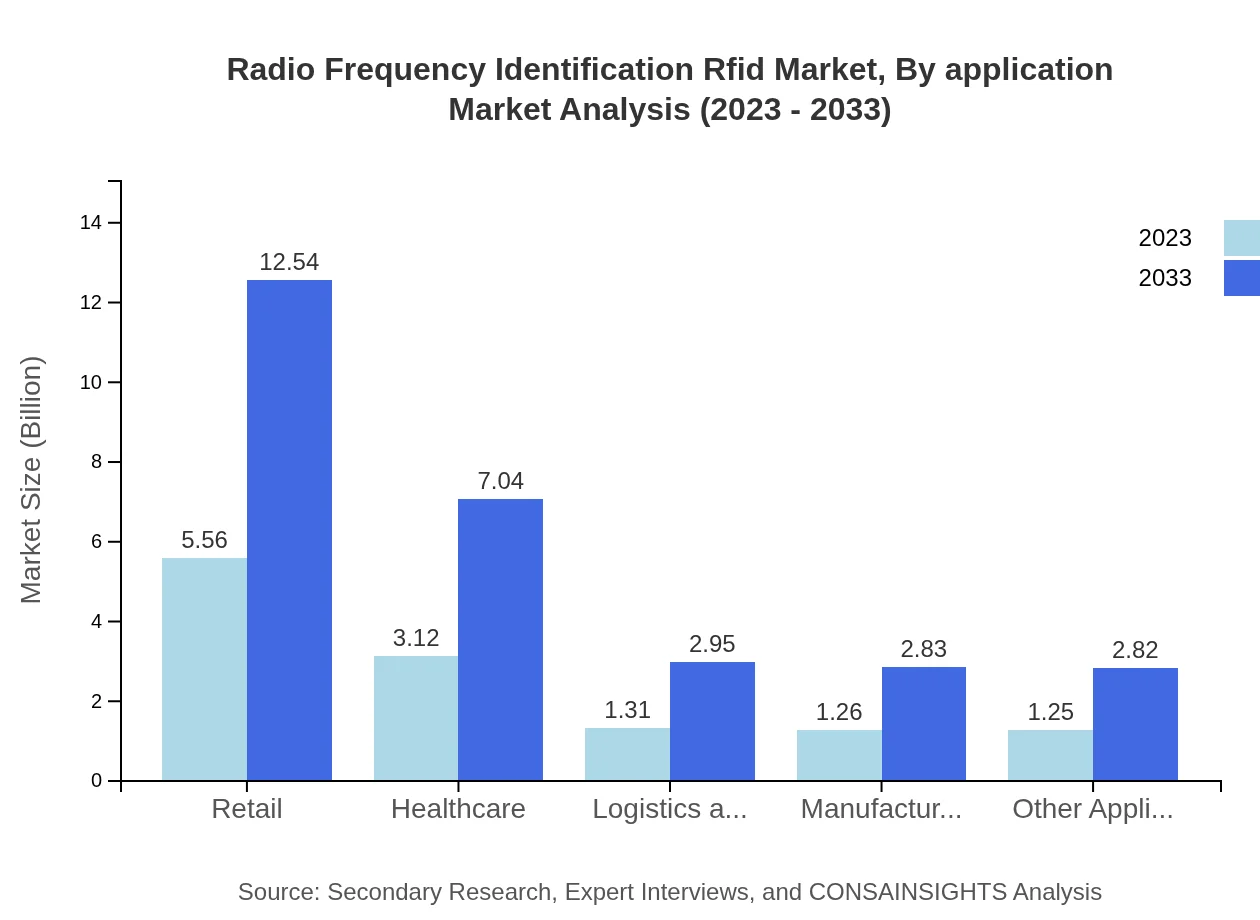

Radio Frequency Identification Rfid Market Analysis By Application

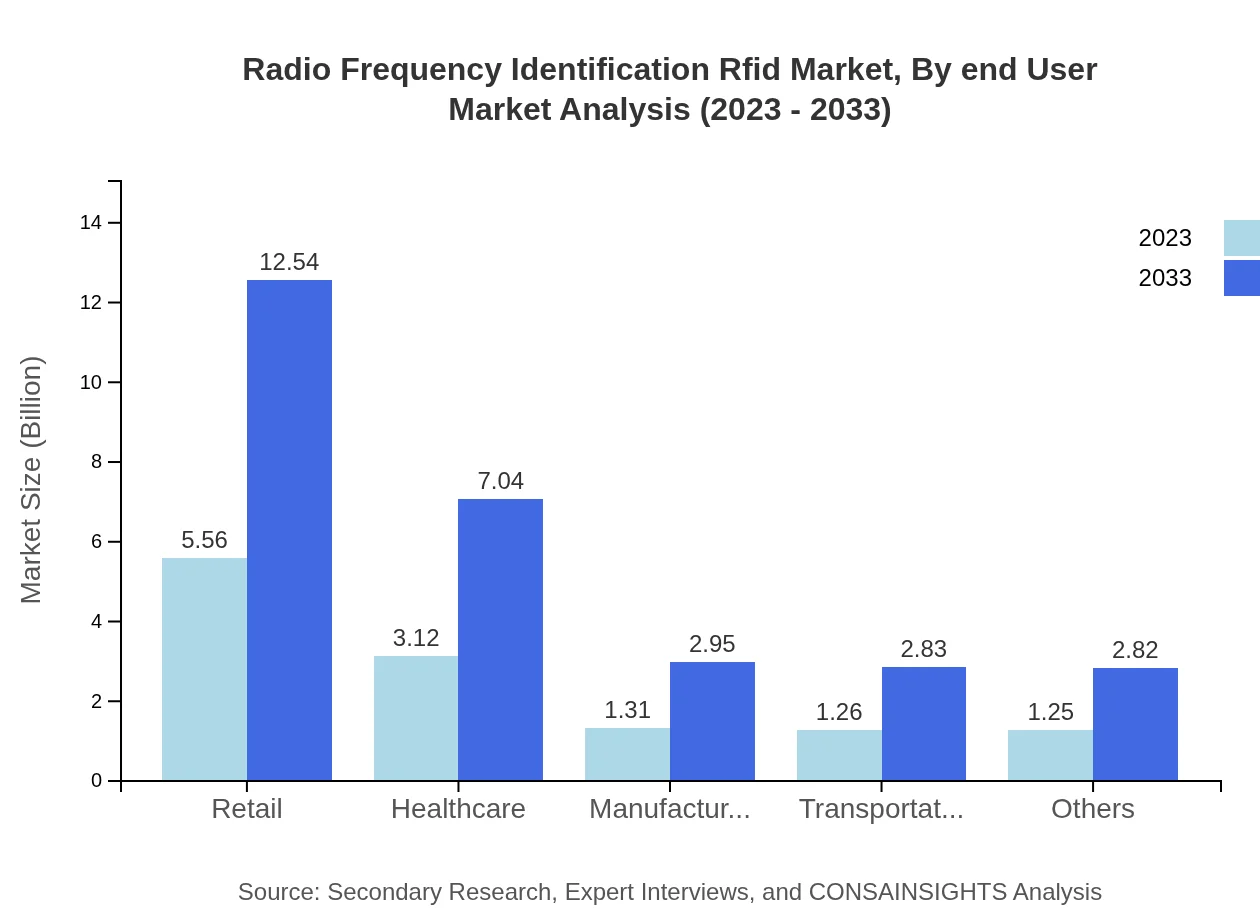

The application segment reveals that retail leads the market with a size of USD 5.56 billion in 2023 and expected growth to USD 12.54 billion by 2033, capturing approximately 44.49% market share. Healthcare follows closely, growing from USD 3.12 billion to USD 7.04 billion over the same period, making up 24.98% of the market share. Manufacturing, transportation, and others are also critical segments with respective market sizes that indicate the growing impact of RFID.

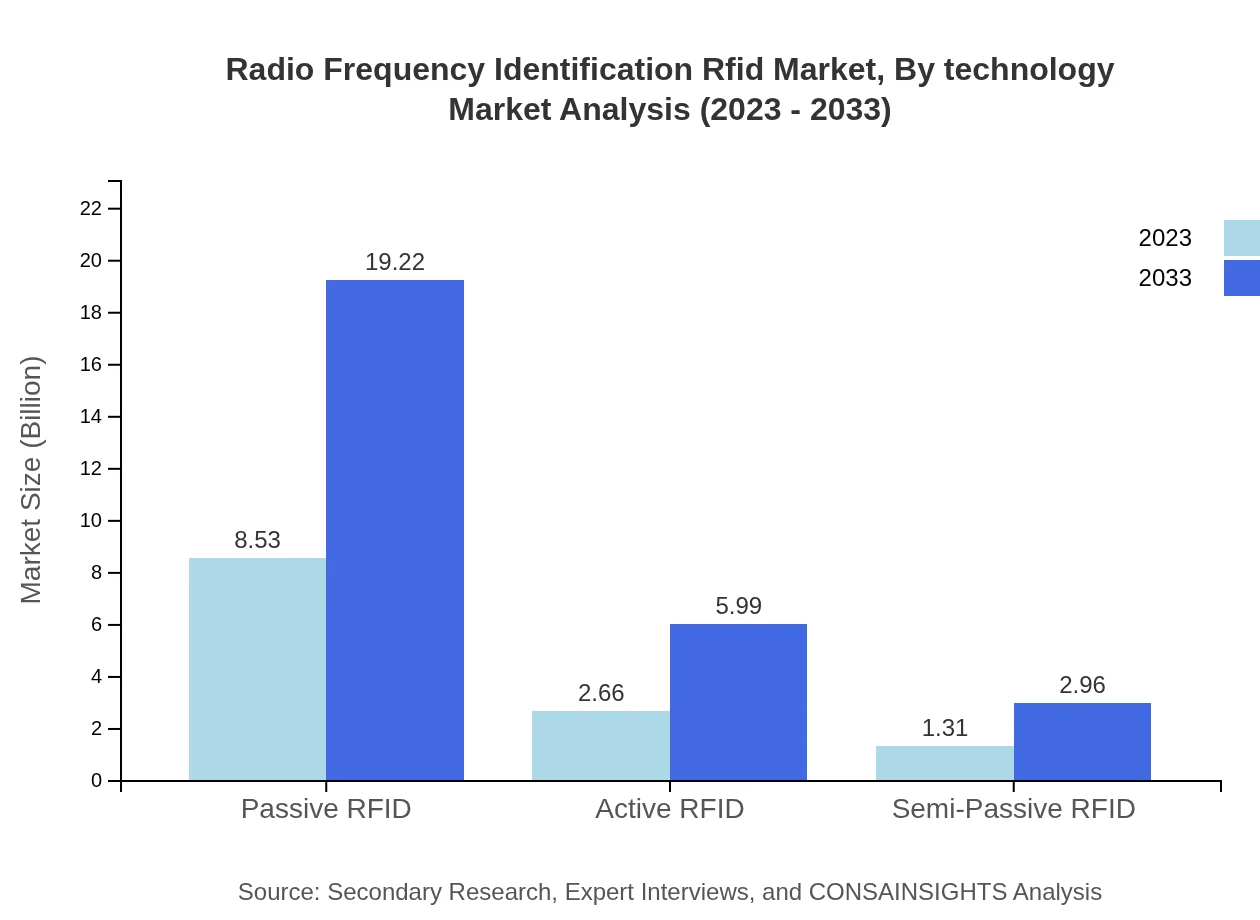

Radio Frequency Identification Rfid Market Analysis By Technology

The technology segment for RFID is dominated by passive RFID systems, achieving a market size of USD 8.53 billion in 2023 and projected to expand to USD 19.22 billion by 2033, representing a 68.21% share. Active RFID is also significant, predicted to grow from USD 2.66 billion to USD 5.99 billion, capturing 21.27% share. Semi-passive RFID technology is gradually rising, showing robust growth in various applications.

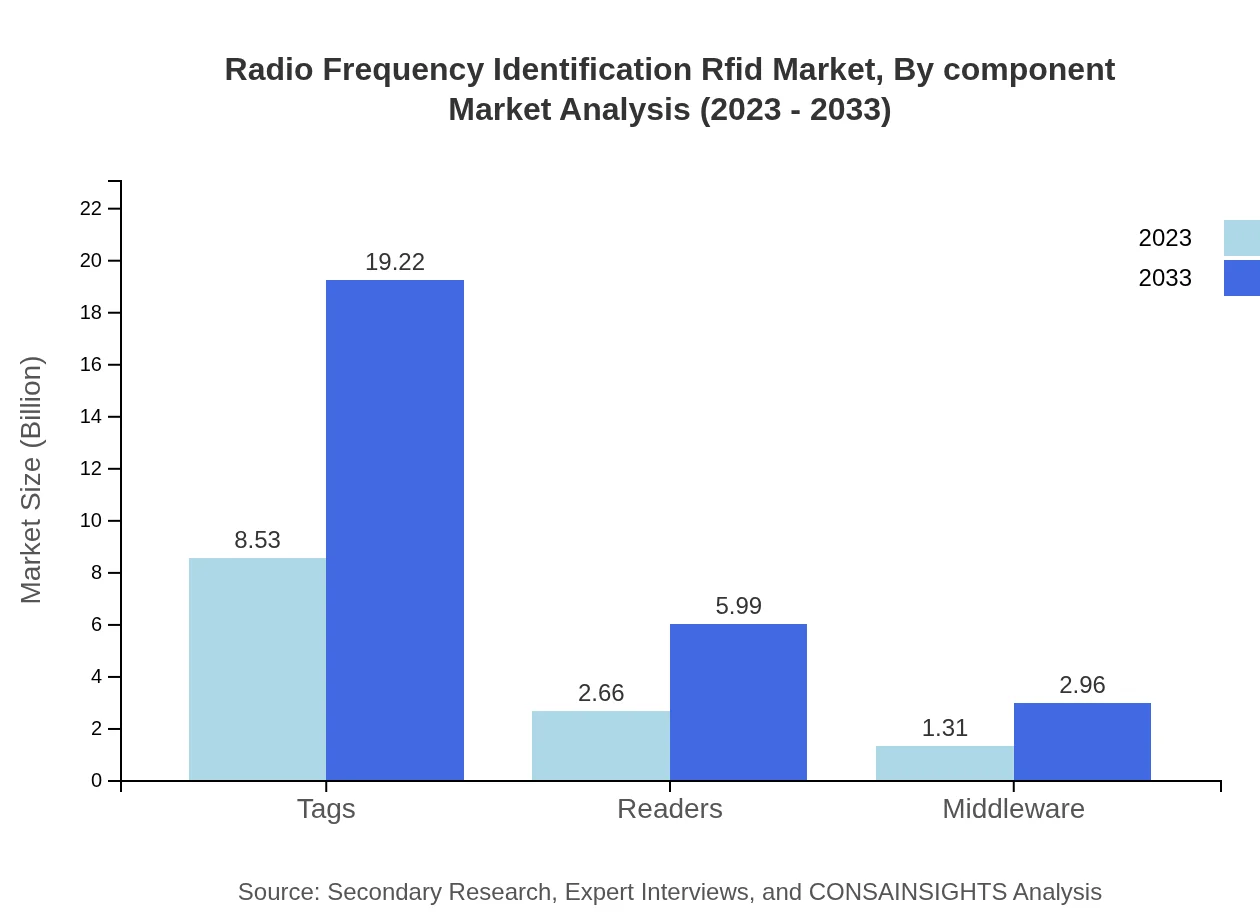

Radio Frequency Identification Rfid Market Analysis By Component

The components of RFID systems include tags, readers, and middleware. Tags lead the component market with substantial growth, showing a market size of USD 8.53 billion in 2023 and a projection of USD 19.22 billion by 2033. Readers and middleware also hold critical roles in RFID system application, enhancing the overall efficiency of tracking and data management.

Radio Frequency Identification Rfid Market Analysis By End User

By end-user, retail is the largest segment, holding a market size of USD 5.56 billion in 2023 and expected to reach USD 12.54 billion by 2033, representing a steady share. Other sectors like healthcare, manufacturing, and logistics are rapidly adopting RFID technology to improve their operational efficiencies and data management capabilities.

Radio Frequency Identification RFID Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Radio Frequency Identification RFID Industry

Zebra Technologies:

Zebra Technologies is a leading provider of RFID solutions, recognized for its innovative hardware and software. The company specializes in inventory and asset tracking solutions that enhance operational efficiency across various sectors.Impinj, Inc.:

Impinj, Inc. offers a robust IoT platform that leverages RFID technology, focusing on smart tracking applications. Their solutions enable real-time visibility of inventory and assets for enhanced decision-making.Alien Technology:

Alien Technology is known for developing high-quality, cost-effective RFID tags and readers. The company serves a diverse range of markets and is committed to enabling the use of RFID for asset management and inventory control.SML Group:

SML Group specializes in RFID solutions for the retail industry, providing tags, readers, and software solutions that empower businesses to optimize their inventory management and operational processes.Avery Dennison:

Avery Dennison is a global leader in labeling and packaging materials, including RFID technology. The company focuses on sustainable innovations to enhance supply chain operations and efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of radio Frequency Identification Rfid?

The global Radio Frequency Identification (RFID) market is projected to reach approximately $12.5 billion by 2033, growing at a CAGR of 8.2%. This growth is driven by increasing deployment across sectors such as retail, healthcare, and manufacturing.

What are the key market players or companies in this radio Frequency Identification Rfid industry?

Key players in the RFID industry include companies like Zebra Technologies, Impinj, and NXP Semiconductors. These companies lead in innovation and market share, contributing to the industry’s growth through advanced RFID solutions.

What are the primary factors driving the growth in the radio Frequency Identification Rfid industry?

Key growth drivers for the RFID market include rising demand for inventory management, increasing automation in logistics, and improvements in supply chain transparency. Technological advancements and the growing trend of IoT also significantly influence market expansion.

Which region is the fastest Growing in the radio Frequency Identification Rfid?

The Asia Pacific region is experiencing rapid growth in the RFID market, projected to reach $4.55 billion by 2033. This is significantly fueled by large-scale adoption in retail and logistics to enhance operational efficiency.

Does ConsaInsights provide customized market report data for the radio Frequency Identification Rfid industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the RFID industry. Our reports provide detailed insights, segmentation data, and forecasts to help businesses make informed decisions.

What deliverables can I expect from this radio Frequency Identification Rfid market research project?

Deliverables from our RFID market research include comprehensive reports with detailed market size analysis, trends, segment data, and regional insights, alongside strategic recommendations based on the latest market dynamics.

What are the market trends of radio Frequency Identification Rfid?

Market trends for RFID include a growing shift towards passive RFID solutions, increased investment in supply chain digitization, and the integration of RFID with AI and IoT technologies to enhance tracking capabilities.