Radiography Test Equipment Market Report

Published Date: 31 January 2026 | Report Code: radiography-test-equipment

Radiography Test Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Radiography Test Equipment market, covering insights into market size, trends, forecasts, and industry dynamics from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | GE Healthcare, Siemens Healthineers, Philips Healthcare, Fujifilm Holdings Corporation, Canon Medical Systems |

| Last Modified Date | 31 January 2026 |

Radiography Test Equipment Market Overview

Customize Radiography Test Equipment Market Report market research report

- ✔ Get in-depth analysis of Radiography Test Equipment market size, growth, and forecasts.

- ✔ Understand Radiography Test Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Radiography Test Equipment

What is the Market Size & CAGR of Radiography Test Equipment market in 2033?

Radiography Test Equipment Industry Analysis

Radiography Test Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

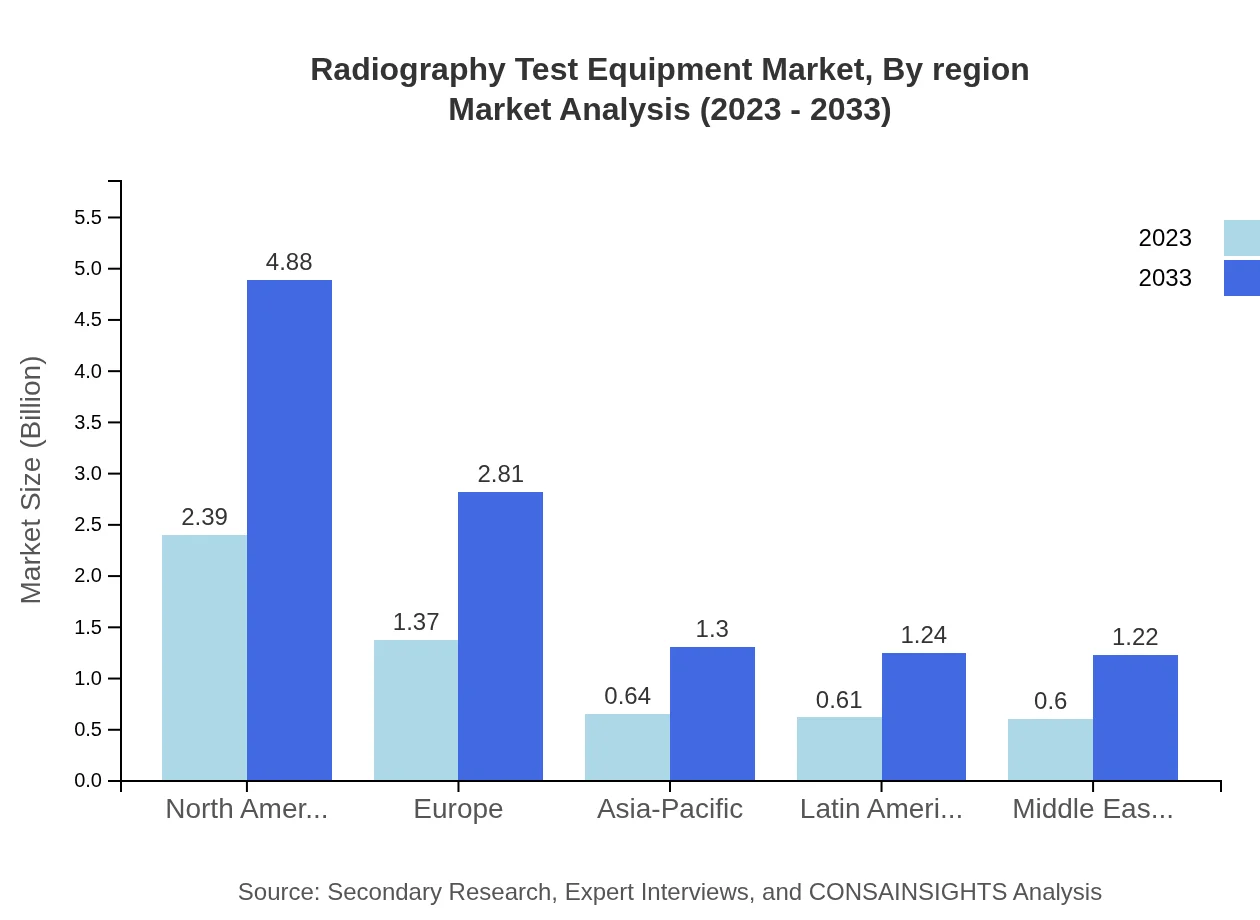

Radiography Test Equipment Market Analysis Report by Region

Europe Radiography Test Equipment Market Report:

The European market is expected to grow from USD 2.09 billion in 2023 to USD 4.27 billion by 2033. The region benefits from strict regulations regarding health and safety, which drive demand for non-destructive testing applications, particularly in industrial contexts.Asia Pacific Radiography Test Equipment Market Report:

In 2023, the Radiography Test Equipment market in Asia-Pacific is valued at USD 0.93 billion, with a projected increase to USD 1.90 billion by 2033. This growth is primarily driven by increasing healthcare investments, technological adoption, and a rising population requiring medical services.North America Radiography Test Equipment Market Report:

In 2023, North America leads the market with a size of USD 1.82 billion, projected to rise to USD 3.72 billion by 2033. This region's demand is boosted by high healthcare spending, advanced technological integration in medical imaging, and a robust regulatory framework that promotes the use of innovative diagnostic equipment.South America Radiography Test Equipment Market Report:

The South American market for Radiography Test Equipment is expected to grow from USD 0.11 billion in 2023 to USD 0.22 billion by 2033. Growth factors include expanding healthcare facilities and an increase in awareness regarding advanced diagnostic methods.Middle East & Africa Radiography Test Equipment Market Report:

In the Middle East and Africa, the market for Radiography Test Equipment is anticipated to grow from USD 0.65 billion in 2023 to USD 1.33 billion by 2033. Increased healthcare initiatives and investments aimed at improving patient care standards are the key drivers behind this growth.Tell us your focus area and get a customized research report.

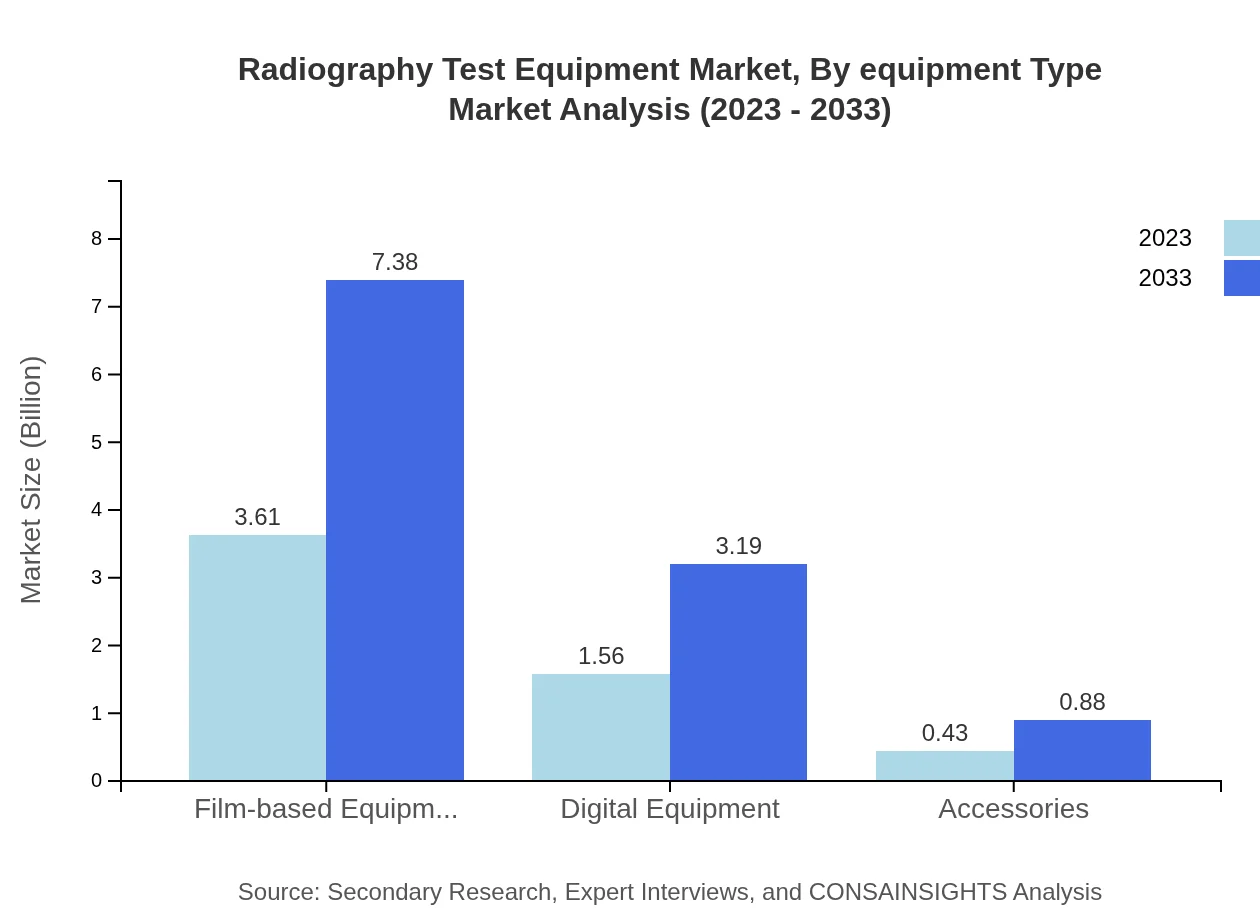

Radiography Test Equipment Market Analysis By Equipment Type

The Radiography Test Equipment market is significantly impacted by the adoption of both film-based and digital technologies. In 2023, film-based equipment dominates the market with a share of 64.47% while representing a size of USD 3.61 billion, projected to reach USD 7.38 billion by 2033. Digital equipment, on the other hand, is growing rapidly, envisaged to increase from USD 1.56 billion in 2023 to USD 3.19 billion in 2033.

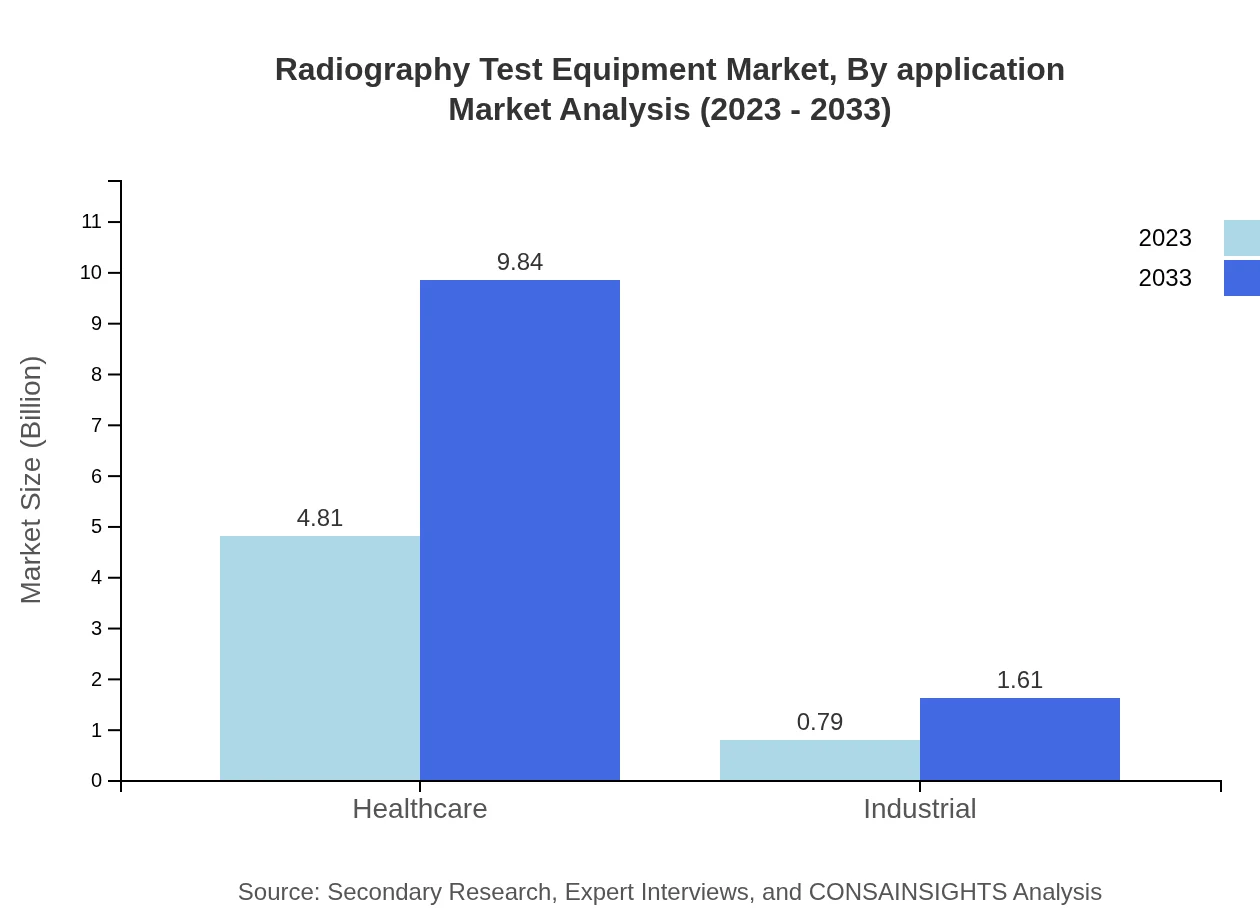

Radiography Test Equipment Market Analysis By Application

Applications in the healthcare sector, particularly diagnostics, account for the largest share, contributing to a market size of USD 4.81 billion in 2023. This segment facilitates enhanced patient monitoring and disease management, underscoring its significance in the overall market landscape. Additionally, industrial applications leveraging radiography for quality assurance are expanding, particularly in manufacturing.

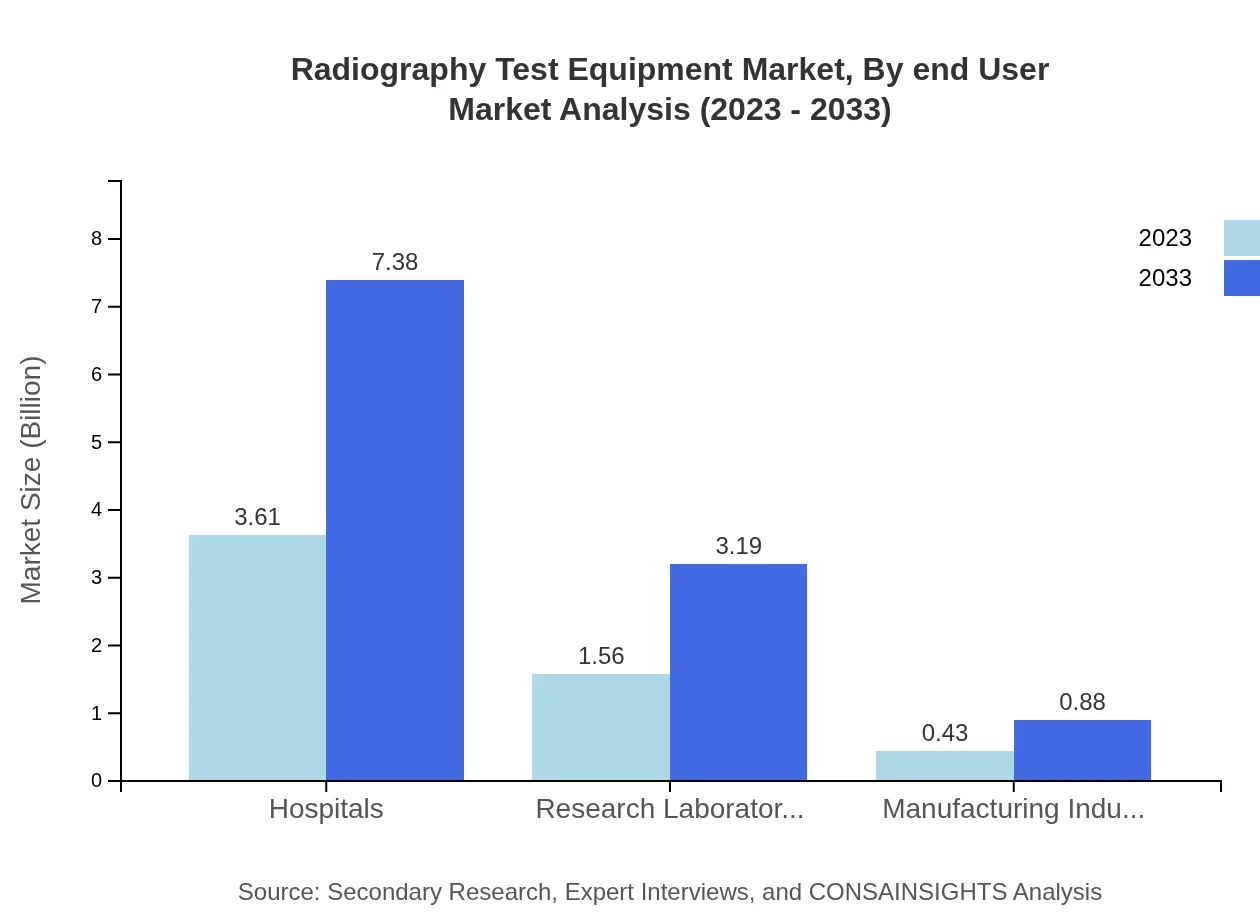

Radiography Test Equipment Market Analysis By End User

Hospitals represent the largest end-user with a size of USD 3.61 billion in 2023, maintaining a steady 64.47% market share. Research laboratories are also pivotal, with a growing market contribution expected to rise from USD 1.56 billion in 2023 to USD 3.19 billion by 2033 as they invest in advanced imaging technologies for experimental studies.

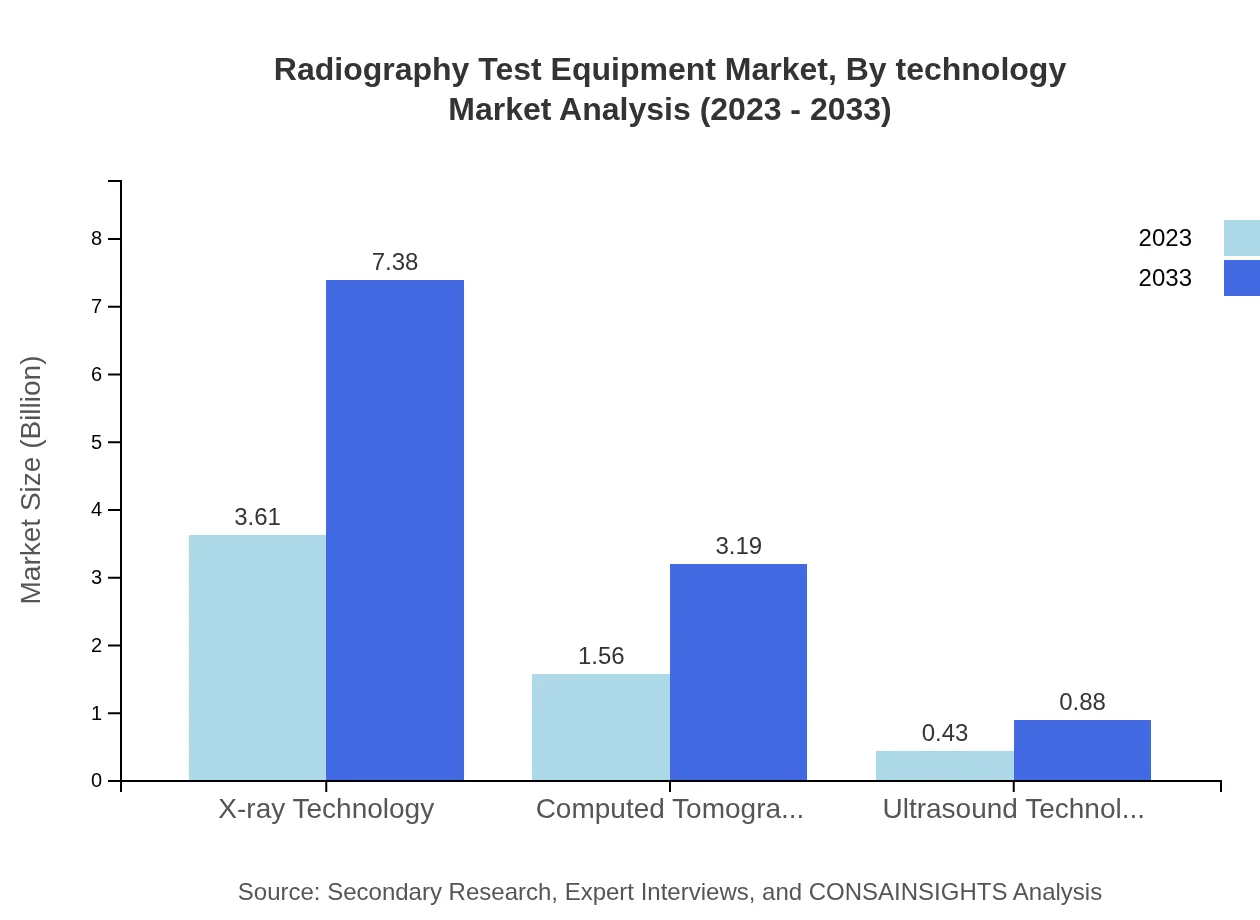

Radiography Test Equipment Market Analysis By Technology

X-ray technology currently leads with a market size of USD 3.61 billion in 2023, expected to grow steadily, driven by increased demand in the healthcare sector. Computed tomography also contributes significantly, expected to rise from USD 1.56 billion in 2023 to USD 3.19 billion by 2033, underlining the shift towards more sophisticated diagnostic procedures.

Radiography Test Equipment Market Analysis By Region

The regional analysis reveals that North America holds a significant market share of 42.59%, followed by Europe at 24.53% and Asia-Pacific at 11.36% in 2023. The growth trajectory within each region varies, influenced by factors such as healthcare policies, technological investments, and market demands, indicating the diverse landscape of radiography test equipment utilization worldwide.

Radiography Test Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Radiography Test Equipment Industry

GE Healthcare:

A subsidiary of General Electric, GE Healthcare designs innovative imaging equipment and offers advanced technologies such as digital radiography and ultrasound imaging.Siemens Healthineers:

Siemens Healthineers provides cutting-edge medical imaging solutions, leading in digital imaging and diagnostics integration across healthcare systems.Philips Healthcare:

Philips focuses on enhancing patient outcomes through diagnostic imaging solutions, with significant investments in AI-driven technologies.Fujifilm Holdings Corporation:

Fujifilm is known for its digital X-ray imaging solutions, emphasizing sustainability and patient-centric practices in the healthcare sector.Canon Medical Systems:

Canon Medical Systems delivers a range of radiology solutions aimed at improving clinical efficiency and patient care with advanced imaging technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of radiography test equipment?

The global radiography test equipment market is valued at approximately $5.6 billion in 2023, with an expected CAGR of 7.2%, projecting significant growth and expansion over the next decade.

What are the key market players or companies in this radiography test equipment industry?

Key players in the radiography test equipment industry include global entities specializing in medical imaging technologies, providing innovative solutions and competing for market share through advanced product development and technological advancements.

What are the primary factors driving the growth in the radiography test equipment industry?

Factors such as rising healthcare expenditure, advancements in imaging technology, increasing prevalence of chronic diseases, and enhanced diagnostic capabilities are pivotal in propelling the growth of the radiography test equipment market.

Which region is the fastest Growing in the radiography test equipment?

Europe emerges as the fastest-growing region in the radiography test equipment market, with a projected increase from $2.09 billion in 2023 to $4.27 billion by 2033, showing robust demand for advanced diagnostic equipment.

Does ConsaInsights provide customized market report data for the radiography test equipment industry?

Yes, ConsaInsights offers customized market report data for the radiography test equipment industry, tailoring insights to fit specific client needs and providing detailed analysis for informed decision-making.

What deliverables can I expect from this radiography test equipment market research project?

Clients can expect comprehensive deliverables such as detailed market size analysis, forecast reports, segmentation data, competitive landscape assessments, and actionable insights tailored to their specific requirements.

What are the market trends of radiography test equipment?

Current market trends in radiography test equipment include the transition from film-based to digital technology, increasing adoption of portable imaging devices, and a focus on enhancing patient safety and diagnostic accuracy.