Radiology Information Systems Market Report

Published Date: 31 January 2026 | Report Code: radiology-information-systems

Radiology Information Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Radiology Information Systems market, covering insights on market size, growth forecasts, regional analysis, and key players from 2023 to 2033, focusing on trends and innovations shaping the industry.

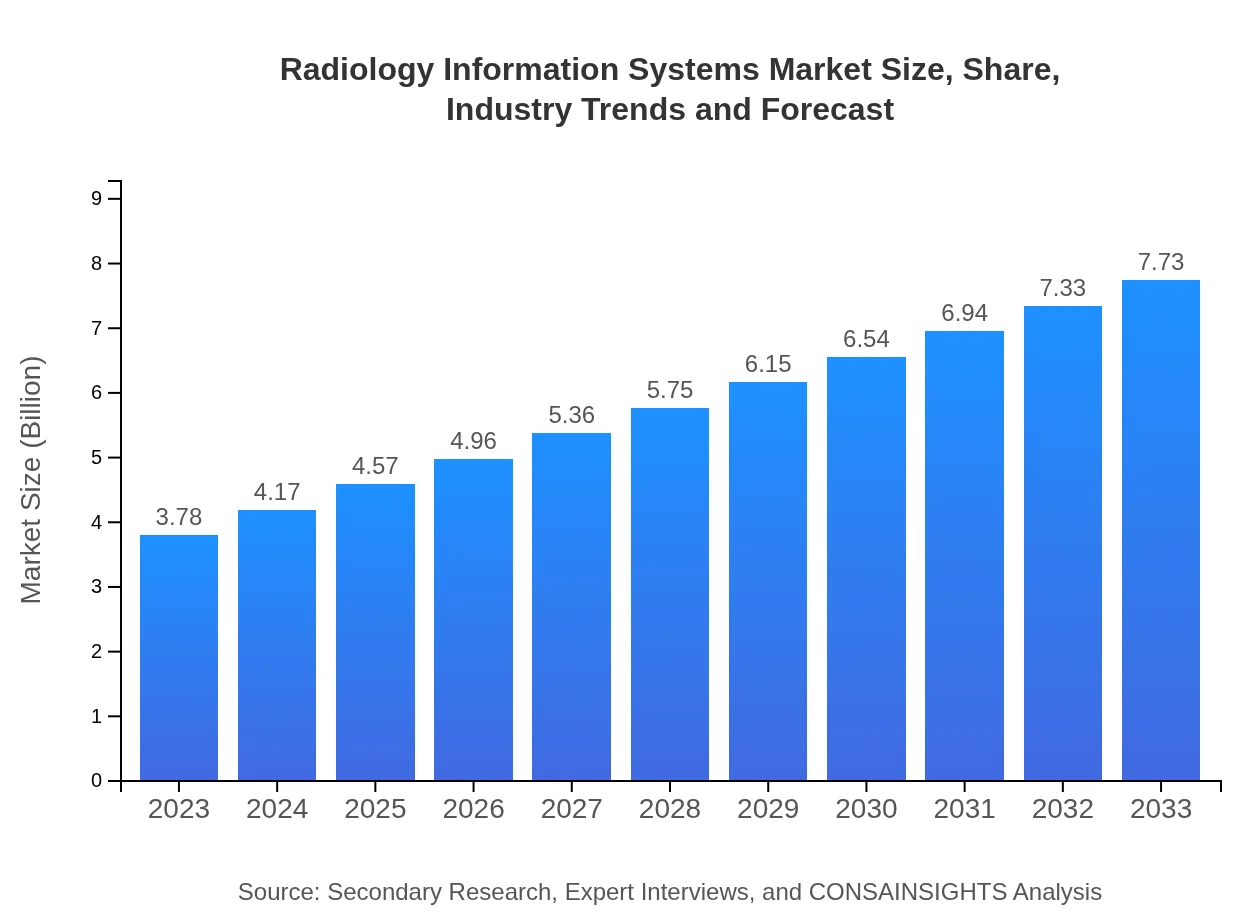

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.78 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.73 Billion |

| Top Companies | GE Healthcare, Siemens Healthineers, Philips Healthcare, Cerner Corporation, McKesson Corporation |

| Last Modified Date | 31 January 2026 |

Radiology Information Systems Market Overview

Customize Radiology Information Systems Market Report market research report

- ✔ Get in-depth analysis of Radiology Information Systems market size, growth, and forecasts.

- ✔ Understand Radiology Information Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Radiology Information Systems

What is the Market Size & CAGR of Radiology Information Systems market in 2023?

Radiology Information Systems Industry Analysis

Radiology Information Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Radiology Information Systems Market Analysis Report by Region

Europe Radiology Information Systems Market Report:

The European Radiology Information Systems market is anticipated to rise from USD 0.99 billion in 2023 to USD 2.02 billion by 2033. The region’s growth is driven by increasing investments in healthcare IT solutions, along with the aging population that demands enhanced healthcare services, particularly in diagnostics.Asia Pacific Radiology Information Systems Market Report:

In the Asia-Pacific region, the Radiology Information Systems market is expected to grow from USD 0.72 billion in 2023 to USD 1.48 billion by 2033. This growth is fueled by increasing healthcare expenditures and the growing adoption of advanced imaging technologies. Rising awareness about early disease diagnosis and improving healthcare infrastructure in developing countries also play a crucial role in market development.North America Radiology Information Systems Market Report:

North America holds the largest share of the Radiology Information Systems market, estimated at USD 1.29 billion in 2023, growing to USD 2.64 billion by 2033. The region's growth is attributed to advanced healthcare technologies, high adoption rates of digital imaging practices, and strict regulations that necessitate the use of efficient patient management systems.South America Radiology Information Systems Market Report:

The South American market is projected to increase from USD 0.31 billion in 2023 to USD 0.64 billion in 2033. Factors contributing to this growth include the increasing prevalence of chronic diseases and the subsequent demand for diagnostic imaging services. Moreover, investments in healthcare infrastructure and IT solutions are expected to bolster market growth.Middle East & Africa Radiology Information Systems Market Report:

The Middle East and African markets for Radiology Information Systems are projected to grow from USD 0.46 billion in 2023 to USD 0.94 billion by 2033. The growth is largely supported by improving healthcare systems and technology infrastructure, along with rising health awareness among populations. Expansion of private hospitals and diagnostic centers in the region further contributes to the market surge.Tell us your focus area and get a customized research report.

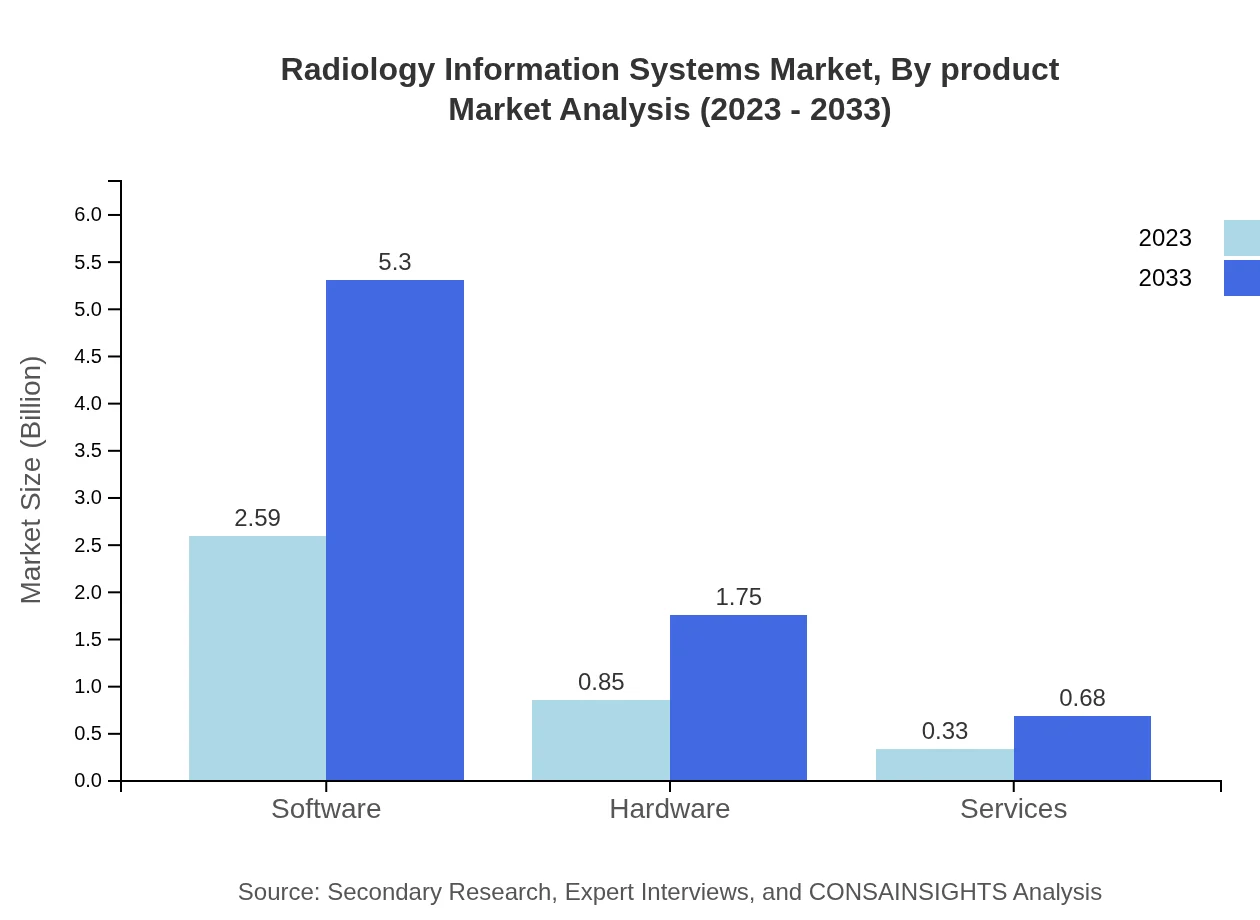

Radiology Information Systems Market Analysis By Product

The Radiology Information Systems market, categorized by products, includes software, hardware, and services. The software segment is expected to dominate, projected to grow from USD 2.59 billion in 2023 to USD 5.30 billion in 2033, representing a share of 68.62%. The hardware segment will potentially rise from USD 0.85 billion to USD 1.75 billion during the same period, establishing a 22.59% market share. Services are also gaining traction, expected to grow from USD 0.33 billion to USD 0.68 billion, accounting for 8.79% of the total market.

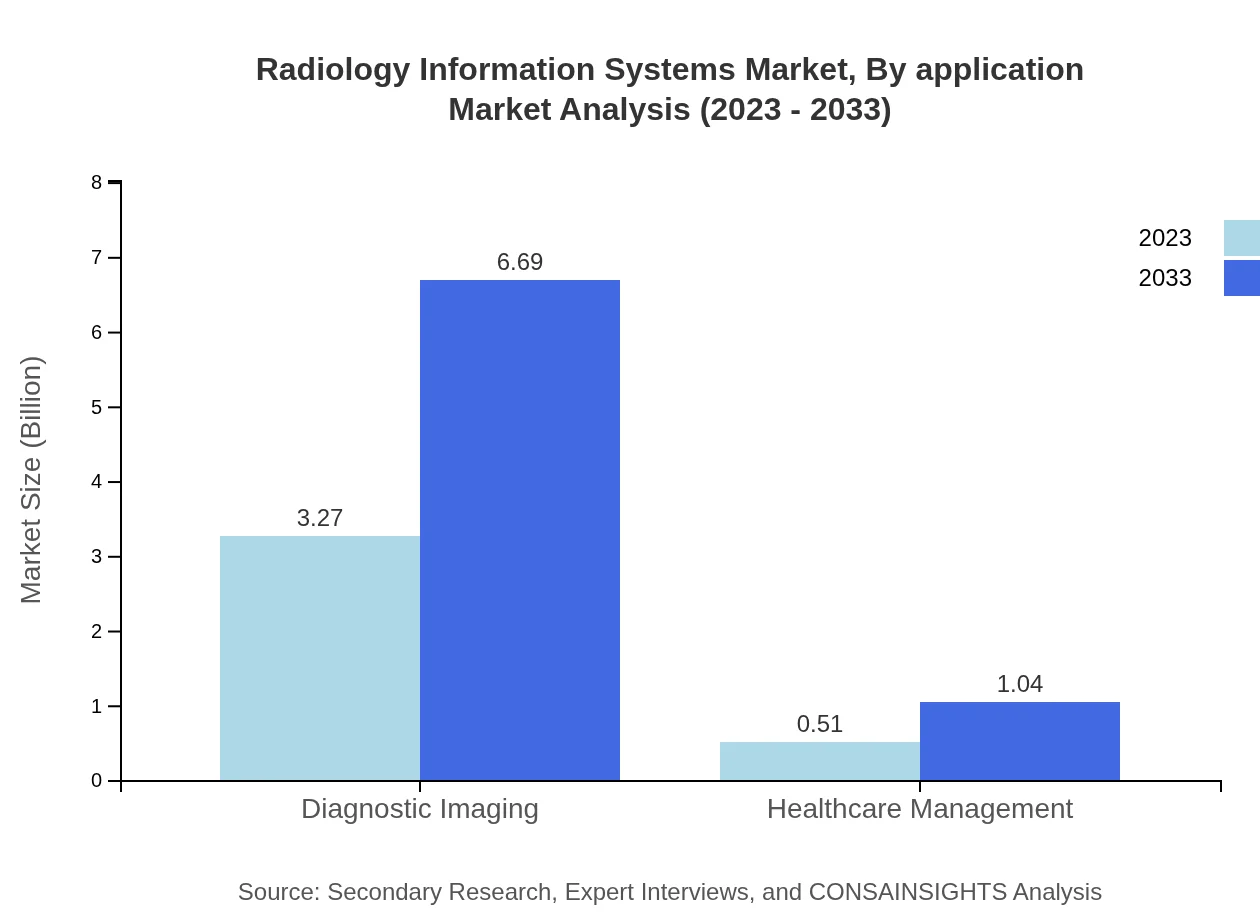

Radiology Information Systems Market Analysis By Application

The primary application sectors of the Radiology Information Systems market encompass hospitals, diagnostic centers, and research institutions. Hospitals lead the application spectrum, representing a significant share and increasing from USD 2.59 billion in 2023 to USD 5.30 billion by 2033. Diagnostic centers will reflect a gradual increase from USD 0.85 billion to USD 1.75 billion, while research institutions are anticipated to grow from USD 0.33 billion to USD 0.68 billion, indicating heightened utilization of radiology solutions in research and development.

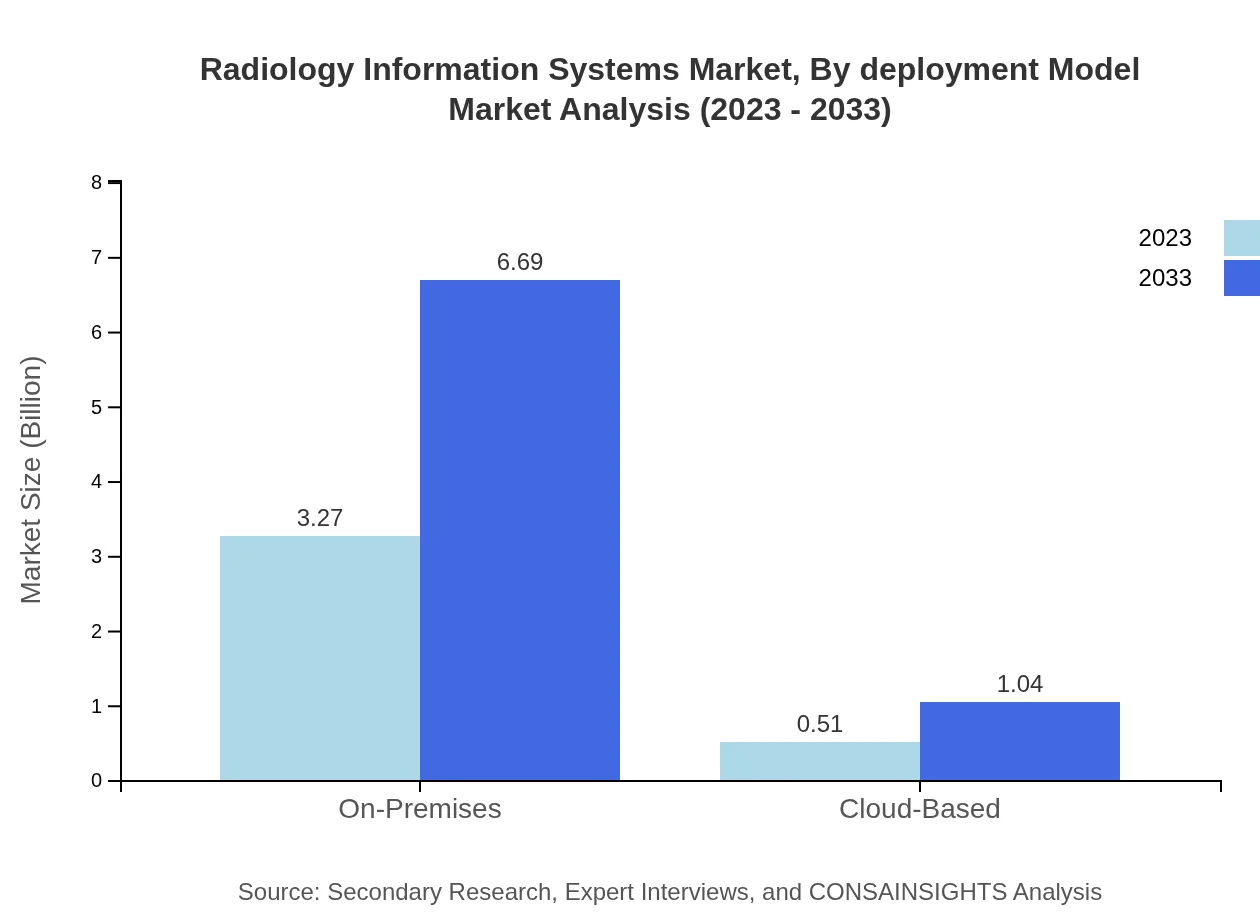

Radiology Information Systems Market Analysis By Deployment Model

The market is further categorized by deployment models into On-Premises and Cloud-Based solutions. The On-Premises segment will primarily dominate, forecasted to grow from USD 3.27 billion in 2023 to USD 6.69 billion by 2033, maintaining a strong 86.56% share. The Cloud-Based model, while smaller, is expected to grow from USD 0.51 billion to USD 1.04 billion, reflecting a growing trend towards cloud solutions for enhanced flexibility and accessibility.

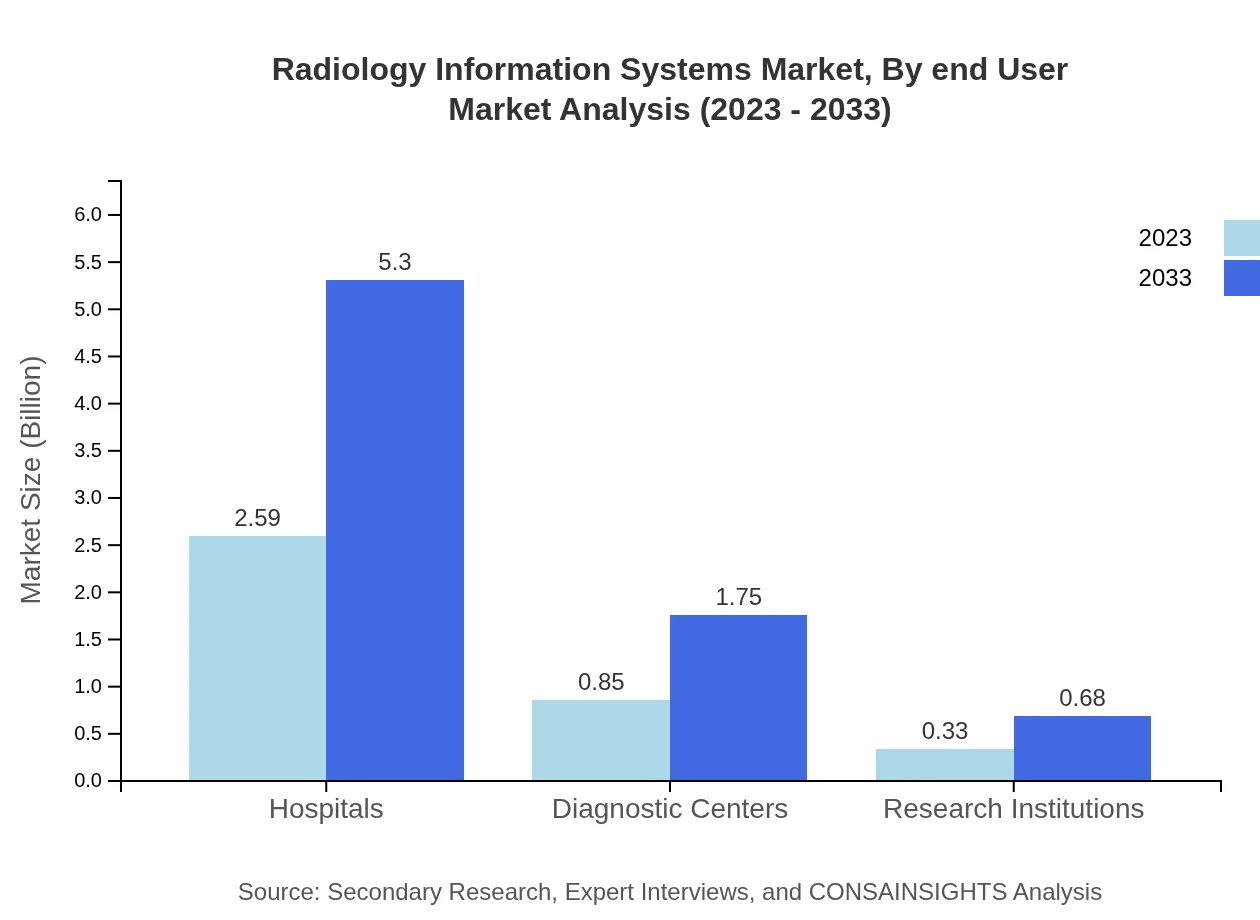

Radiology Information Systems Market Analysis By End User

In terms of end-users, hospitals are the primary consumers of Radiology Information Systems, projected to maintain their dominance with a projected growth from USD 2.59 billion in 2023 to USD 5.30 billion by 2033. Diagnostic centers will show steady growth from USD 0.85 billion to USD 1.75 billion, whereas research institutions are expected to grow modestly from USD 0.33 billion to USD 0.68 billion, indicating a diversified user base looking for advanced radiology solutions.

Radiology Information Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Radiology Information Systems Industry

GE Healthcare:

A leading global company specializing in medical imaging and information technologies, GE Healthcare offers comprehensive RIS software solutions and plays a key role in enhancing health management systems for healthcare institutions.Siemens Healthineers:

Siemens Healthineers provides cutting-edge imaging solutions and a robust RIS platform that integrates seamlessly with their imaging equipment. Their innovations aim to optimize workflows in healthcare settings.Philips Healthcare:

Philips Healthcare is renowned for integrating advanced technology into diagnostic imaging. They offer comprehensive RIS that enhance clinical efficiency and improve patient outcomes.Cerner Corporation:

Cerner Corporation leads in health information technology solutions with its fully integrated RIS system that helps hospitals and healthcare providers manage their radiology departments efficiently.McKesson Corporation:

McKesson Corporation provides advanced analytics and technology solutions, including RIS, that empower healthcare organizations to improve operational efficiencies and enhance patient care delivery.We're grateful to work with incredible clients.

FAQs

What is the market size of radiology Information Systems?

The radiology information systems market is valued at approximately $3.78 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2%, indicating significant growth potential over the next decade.

What are the key market players or companies in this radiology Information Systems industry?

Key players in the radiology information systems industry include major firms such as GE Healthcare, Siemens Healthineers, Philips Healthcare, and Agfa HealthCare, which dominate various market segments through innovative solutions.

What are the primary factors driving the growth in the radiology Information Systems industry?

Key drivers of growth include an increase in the prevalence of chronic diseases, advancements in imaging technologies, and the rising demand for integrated healthcare solutions that improve operational efficiency.

Which region is the fastest Growing in the radiology Information Systems?

The Asia Pacific region is expected to witness the fastest growth in the radiology information systems market, with an increase from $0.72 billion in 2023 to $1.48 billion by 2033, reflecting a surge in healthcare investments.

Does ConsaInsights provide customized market report data for the radiology Information Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the radiology information systems industry, accommodating specific client needs for detailed insights and analysis.

What deliverables can I expect from this radiology Information Systems market research project?

Deliverables from this market research project include comprehensive reports, market trends analysis, competitive landscape assessments, and segment-specific data analytics to guide business strategies.

What are the market trends of radiology Information Systems?

Current trends in the radiology information systems market include a shift towards cloud-based solutions, increased automation in diagnostics, and the integration of AI technologies improving diagnostic accuracy.