Railway Air Conditioning System Market Report

Published Date: 22 January 2026 | Report Code: railway-air-conditioning-system

Railway Air Conditioning System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Railway Air Conditioning System market from 2023 to 2033, covering market size, growth rates, trends, segmentation, and regional insights to help key stakeholders make informed decisions.

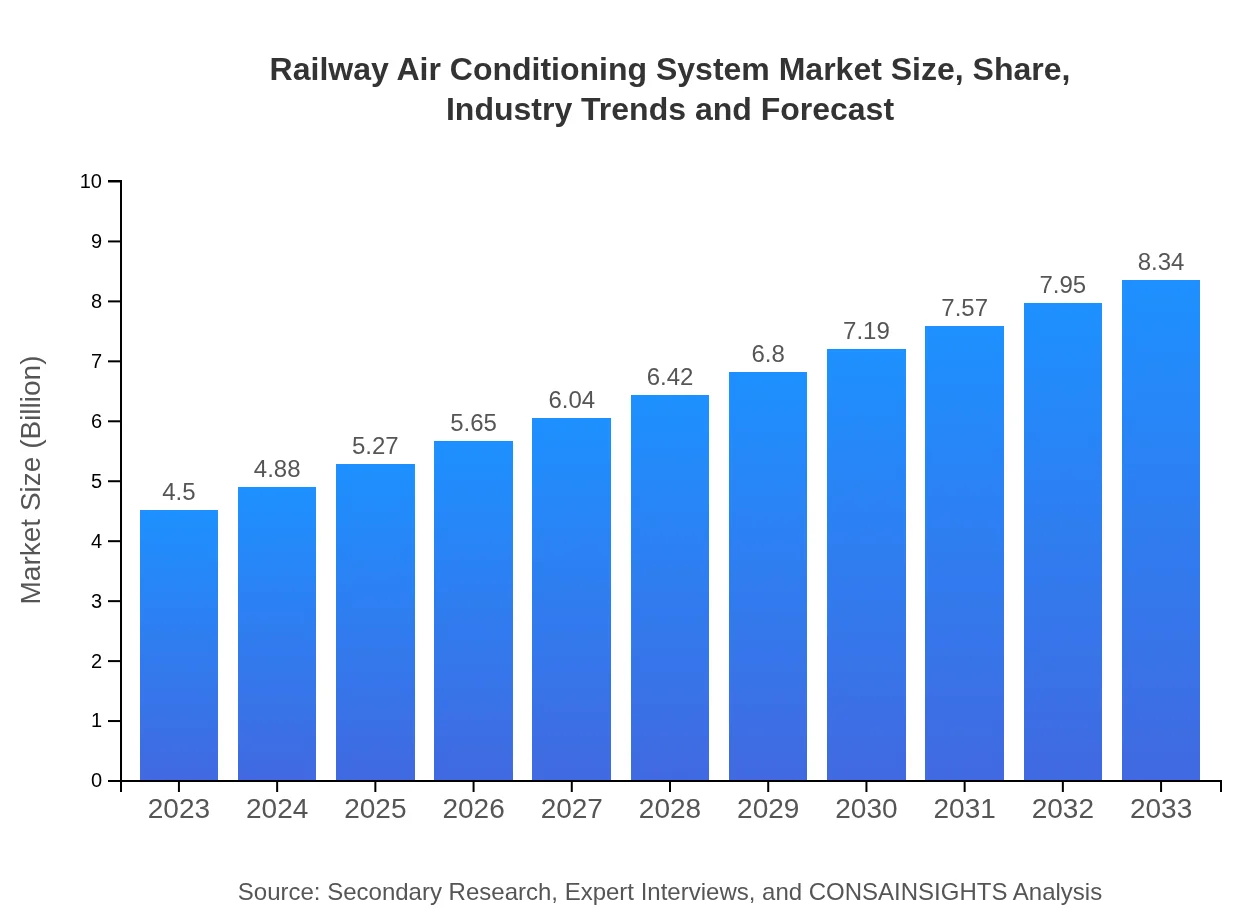

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $8.34 Billion |

| Top Companies | Carrier Global Corporation, Knorr-Bremse AG, Faurecia, Hitatchi Rail, Thermo King Corporation |

| Last Modified Date | 22 January 2026 |

Railway Air Conditioning System Market Overview

Customize Railway Air Conditioning System Market Report market research report

- ✔ Get in-depth analysis of Railway Air Conditioning System market size, growth, and forecasts.

- ✔ Understand Railway Air Conditioning System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Railway Air Conditioning System

What is the Market Size & CAGR of Railway Air Conditioning System market in 2023 and 2033?

Railway Air Conditioning System Industry Analysis

Railway Air Conditioning System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Railway Air Conditioning System Market Analysis Report by Region

Europe Railway Air Conditioning System Market Report:

Europe is expected to see its market grow from $1.43 billion in 2023 to $2.65 billion in 2033. This growth is supported by stringent environmental regulations and increasing investments in railway networks, with countries like Germany and France leading in sustainable rail enhancements.Asia Pacific Railway Air Conditioning System Market Report:

The Railway Air Conditioning System market in the Asia Pacific region is projected to grow from $0.78 billion in 2023 to $1.44 billion in 2033. The expansion is attributed to robust railway development projects and an increasing focus on passenger comfort across countries like China and India, which are investing heavily in modernizing their rail systems.North America Railway Air Conditioning System Market Report:

The North American market size is projected to increase from $1.70 billion in 2023 to $3.15 billion in 2033, reflecting a significant growth opportunity. This surge is primarily fueled by new rail projects and the ongoing modernization of existing fleets to improve operational efficiency and passenger experience.South America Railway Air Conditioning System Market Report:

In South America, the market is expected to rise from $0.15 billion in 2023 to $0.27 billion in 2033. The growth is driven by rising urbanization and governmental initiatives to enhance the rail transport infrastructure, coupled with the increasing demand for efficient air conditioning solutions.Middle East & Africa Railway Air Conditioning System Market Report:

In the Middle East and Africa region, the market is projected to grow from $0.45 billion in 2023 to $0.83 billion in 2033, as governments in the region invest in expanding their railway systems and improving passenger amenities amid growing urbanization.Tell us your focus area and get a customized research report.

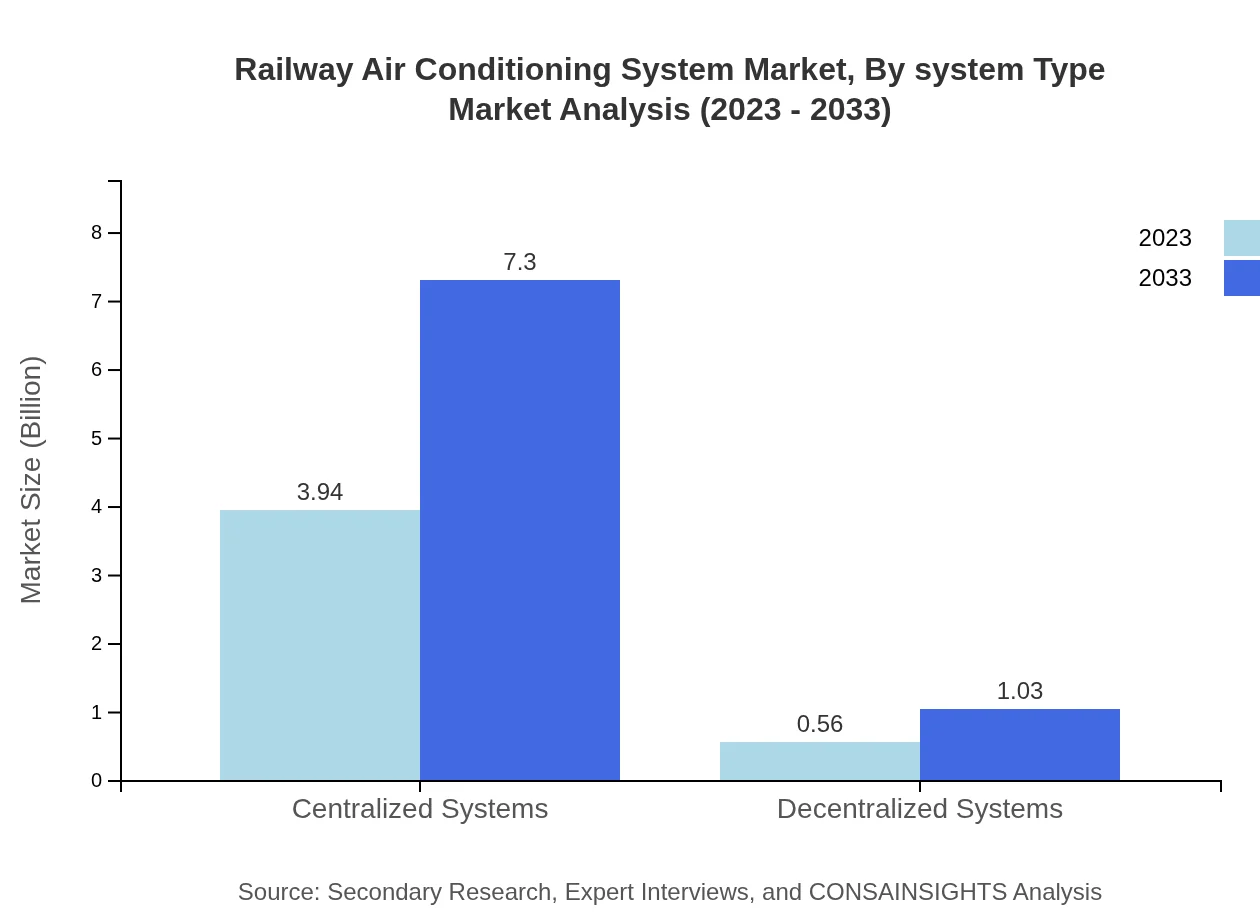

Railway Air Conditioning System Market Analysis By System Type

The system type segment of the Railway Air Conditioning System market is pivotal, with Centralized Systems dominating, projected to maintain around an 87.61% share by 2033. Decentralized Systems, while currently representing a smaller portion of the market, are anticipated to increase their share gradually due to specific applications in freight and small passenger trains.

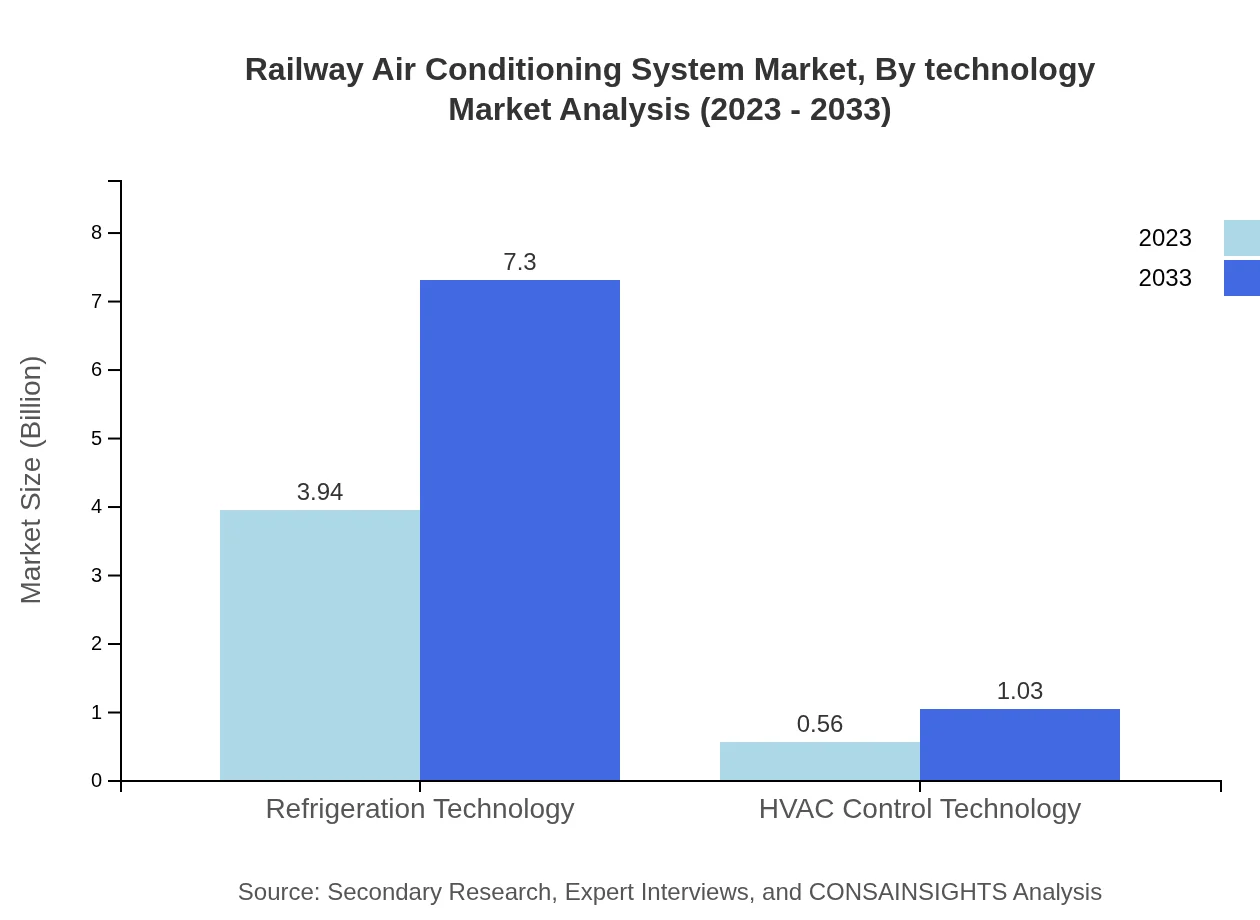

Railway Air Conditioning System Market Analysis By Technology

Within the technology segment, Refrigeration Technology leads with an 87.61% market share in 2023 and is expected to grow by 2033. HVAC Control Technology is also gaining traction, projected to maintain its 12.39% share, reflecting the integration of smart technologies in rail operations.

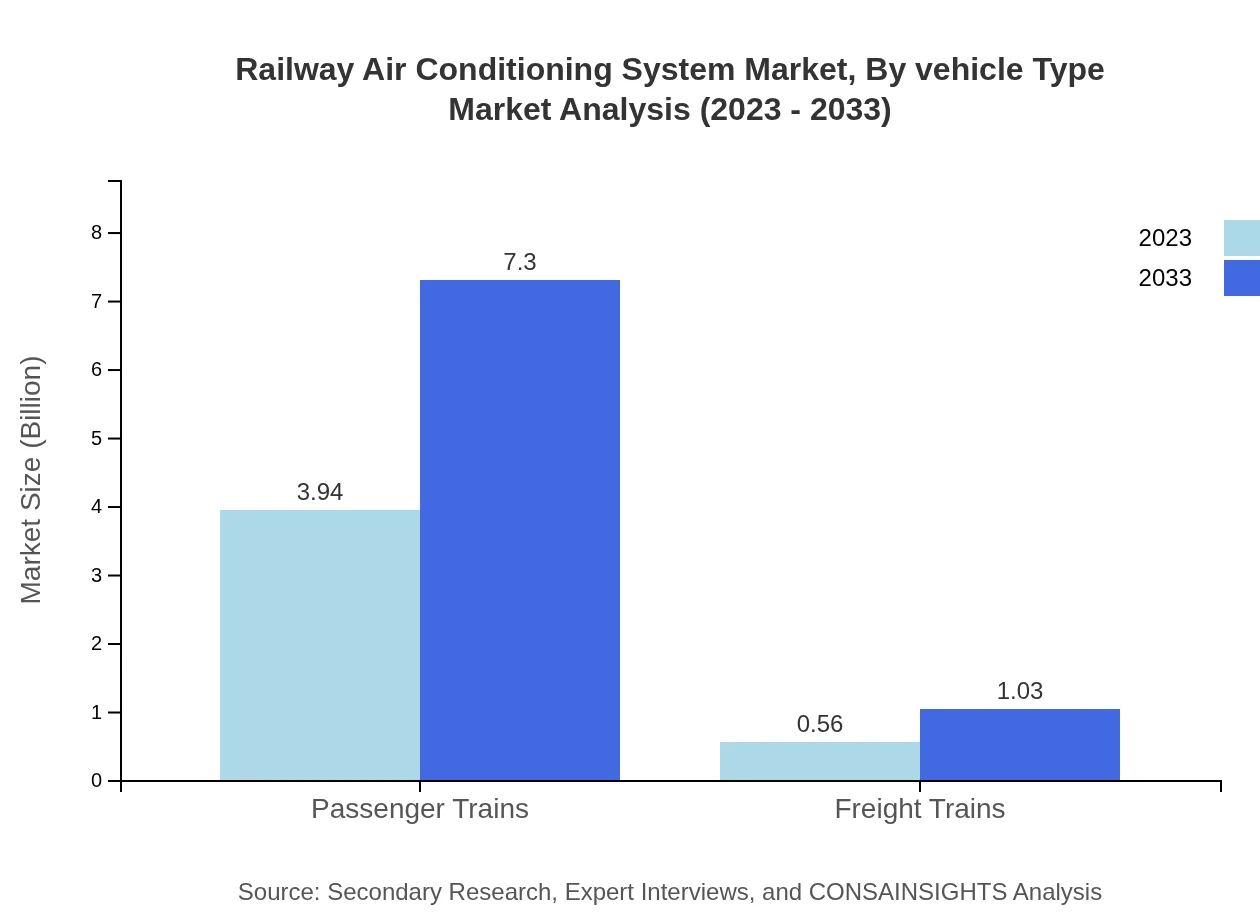

Railway Air Conditioning System Market Analysis By Vehicle Type

Passenger trains are the key segment in the vehicle type category, holding an 87.61% market share in 2023. Freight trains represent a smaller segment but are showing potential growth due to increased operational efficiency initiatives in logistics.

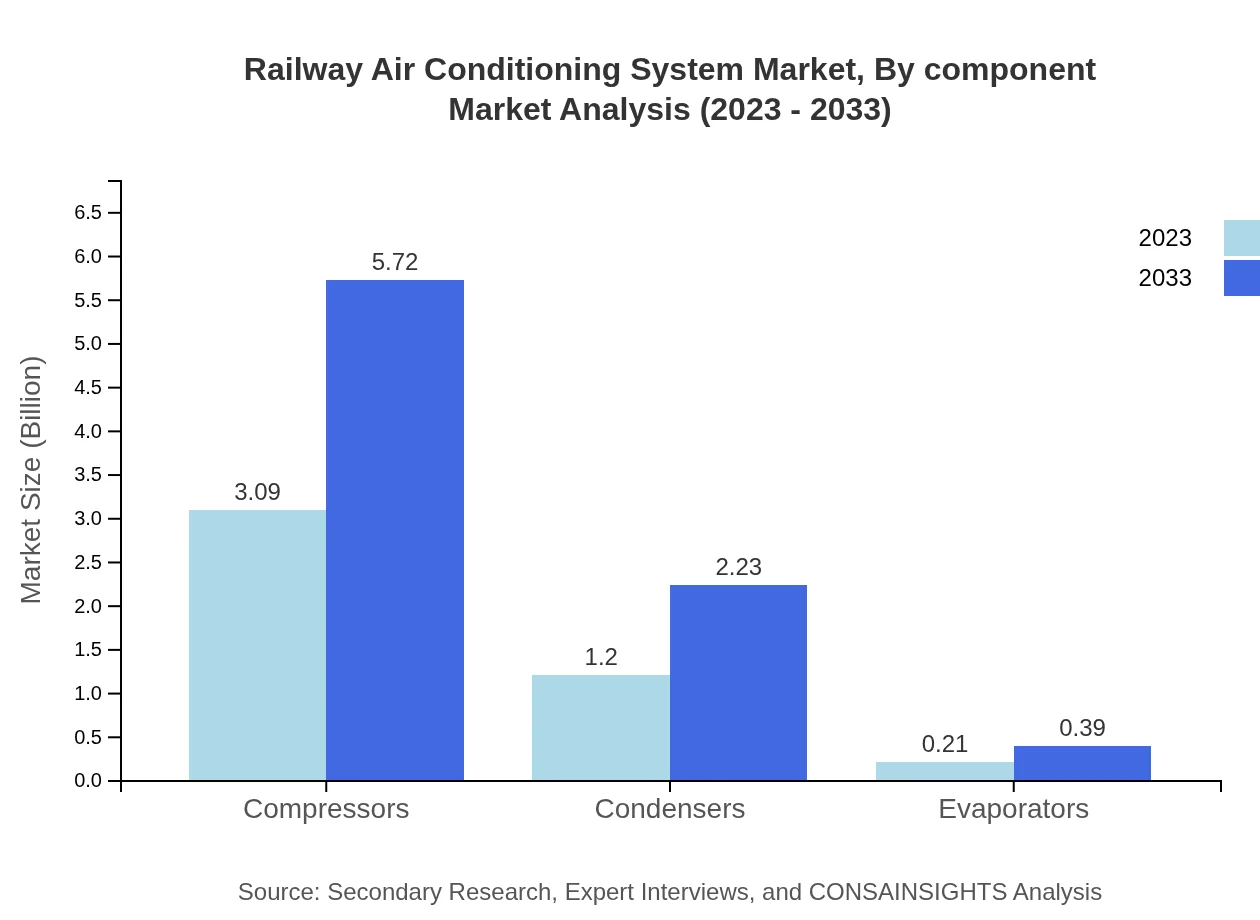

Railway Air Conditioning System Market Analysis By Component

Among components, Compressors dominate the market, with significant growth anticipated from $3.09 billion in 2023 to $5.72 billion in 2033. Condensers and Evaporators, while smaller in market share, are essential for system functionality, with their respective market sizes projected at $2.23 billion and $0.39 billion in 2033.

Railway Air Conditioning System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Railway Air Conditioning System Industry

Carrier Global Corporation:

A leading global provider of heating, ventilation, air conditioning, and refrigeration systems, Carrier is renowned for its innovative technologies and solutions tailored for railway applications.Knorr-Bremse AG:

A premier manufacturer of braking systems and other critical components, Knorr-Bremse also specializes in railcar climate control systems, contributing significantly to air conditioning technologies.Faurecia:

Global leader in automotive technology, Faurecia is recognized for its advanced air conditioning and climate control systems, including applications in rail transport.Hitatchi Rail:

Hitachi Rail is involved in the design and manufacture of comprehensive train systems, including air conditioning systems, focusing on energy efficiency and sustainable practices.Thermo King Corporation:

A part of the Ingersoll Rand Company, Thermo King is known for its transport temperature control solutions, including rail applications, innovating continuously in climate control technology.We're grateful to work with incredible clients.

FAQs

What is the market size of railway Air Conditioning System?

The global railway air conditioning system market is valued at $4.5 billion in 2023 and is projected to grow at a CAGR of 6.2%, reaching significant growth by 2033. This growth indicates a rising demand for efficient climate control in rail transport.

What are the key market players or companies in this railway Air Conditioning System industry?

Key market players in the railway air conditioning system industry include major manufacturers specializing in HVAC solutions for rail systems, focusing on innovation and sustainability to capture growing market shares.

What are the primary factors driving the growth in the railway Air Conditioning System industry?

The primary factors driving growth in the railway air conditioning system industry include increasing passenger comfort expectations, advancements in HVAC technology, and the rise of environmentally friendly transport solutions.

Which region is the fastest Growing in the railway Air Conditioning System?

The fastest-growing region for railway air conditioning systems is North America, with a market size expected to expand from $1.70 billion in 2023 to $3.15 billion by 2033, showcasing substantial investments in rail infrastructure.

Does ConsaInsights provide customized market report data for the railway Air Conditioning System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the railway air conditioning system industry, providing clients with in-depth analysis and insights.

What deliverables can I expect from this railway Air Conditioning System market research project?

Deliverables from the railway air conditioning system market research project include comprehensive reports, market analytics, trend forecasts, and segment-specific data to aid in strategic decision-making.

What are the market trends of railway Air Conditioning System?

Current trends in the railway air conditioning system market include a shift towards energy-efficient technologies, integration of IoT for enhanced control, and growing focus on passenger experience enhancement through advanced climate control solutions.