Rapid Application Development Market Report

Published Date: 31 January 2026 | Report Code: rapid-application-development

Rapid Application Development Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Rapid Application Development market, analyzing trends, growth potential, and challenges from 2023 to 2033. It presents detailed data on market size, CAGR, regional performance, and industry players, offering a roadmap for stakeholders.

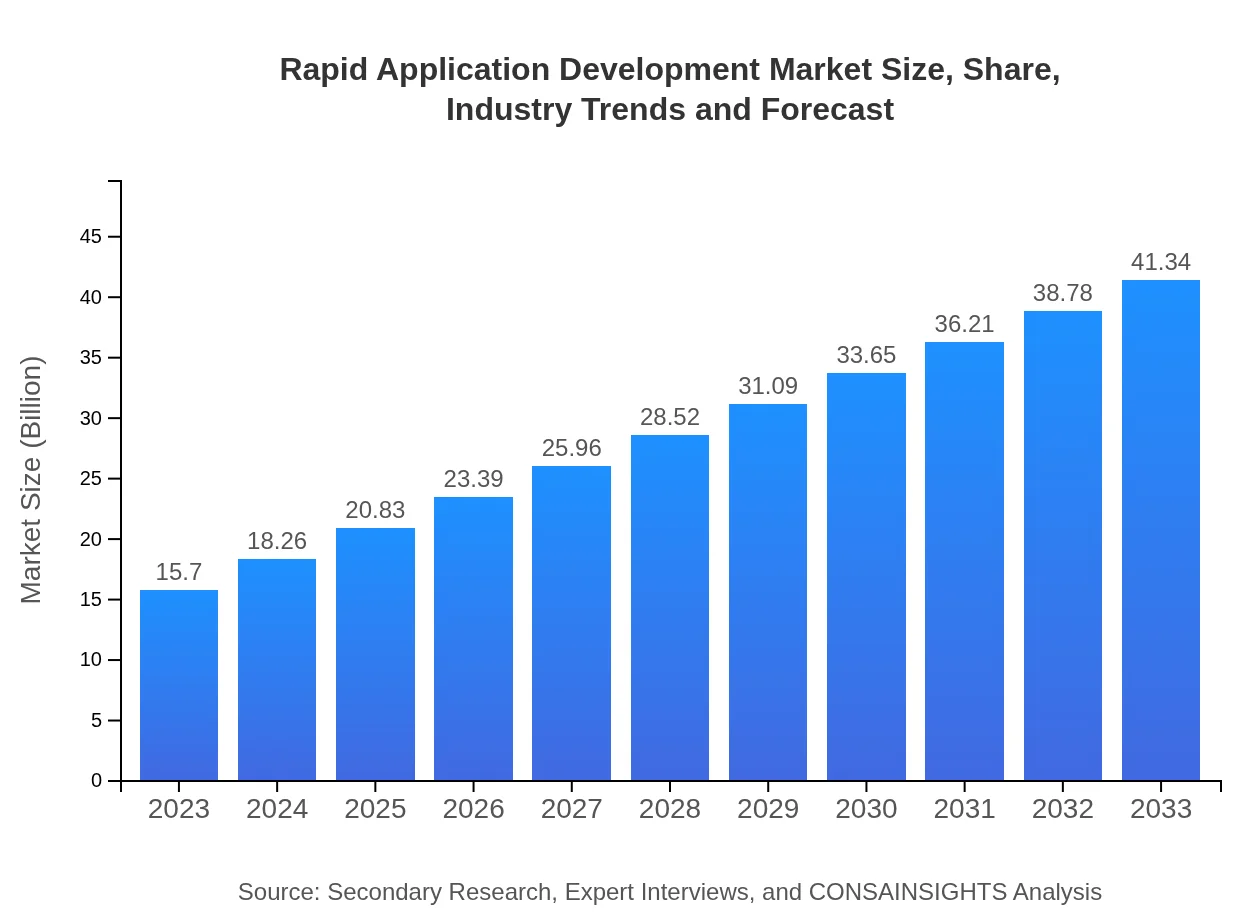

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $41.34 Billion |

| Top Companies | OutSystems, Appian, Microsoft Power Apps, Mendix |

| Last Modified Date | 31 January 2026 |

Rapid Application Development Market Overview

Customize Rapid Application Development Market Report market research report

- ✔ Get in-depth analysis of Rapid Application Development market size, growth, and forecasts.

- ✔ Understand Rapid Application Development's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rapid Application Development

What is the Market Size & CAGR of Rapid Application Development market in 2023?

Rapid Application Development Industry Analysis

Rapid Application Development Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rapid Application Development Market Analysis Report by Region

Europe Rapid Application Development Market Report:

Europe’s RAD market is set to grow from 4.52 billion USD in 2023 to 11.91 billion USD by 2033. The market is characterized by an increasing focus on digital strategies across various sectors, including healthcare and finance. Additionally, the ESC’s regulatory push towards digital solutions is promoting rapid development practices to meet these standards. The united approach towards fostering a digital economy among European countries also strengthens market prospects in this region.Asia Pacific Rapid Application Development Market Report:

In the Asia Pacific region, the RAD market is expected to grow from 3.15 billion USD in 2023 to approximately 8.29 billion USD by 2033. The rapid digitalization in countries like China and India, along with increasing investments in IT infrastructure, are major drivers. Additionally, the region's favorable government initiatives aimed at promoting startups and technological innovation will contribute to this growth. Integration of advanced technologies like AI and IoT in software development is also expected to enhance market prospects.North America Rapid Application Development Market Report:

North America is anticipated to dominate the RAD market, growing from 5.42 billion USD in 2023 to 14.28 billion USD by 2033. The presence of leading technology firms and continuous investment in research and development activities are major contributors. Furthermore, the increasing demand for low-code and no-code platforms, driven by a skilled workforce and high technology adoption rates, is expected to further enhance market growth.South America Rapid Application Development Market Report:

The South American RAD market is projected to expand from 1.22 billion USD in 2023 to 3.20 billion USD by 2033. The rising adoption of cloud-based solutions and the growing emphasis on digital transformation among local enterprises are key drivers. Additionally, increasing internet penetration and mobile connectivity in rural areas are helping businesses adopt RAD tools to improve operational efficiency and customer engagement.Middle East & Africa Rapid Application Development Market Report:

The Middle East and Africa are projected to experience growth from 1.39 billion USD in 2023 to 3.67 billion USD by 2033. The increasing necessity for rapid digital transformation in enterprises across various sectors, driven by increasing smartphone penetration and internet connectivity, is essential in boosting the RAD market. Additionally, governmental initiatives aimed at promoting technology adoption in the region present significant opportunities for market players.Tell us your focus area and get a customized research report.

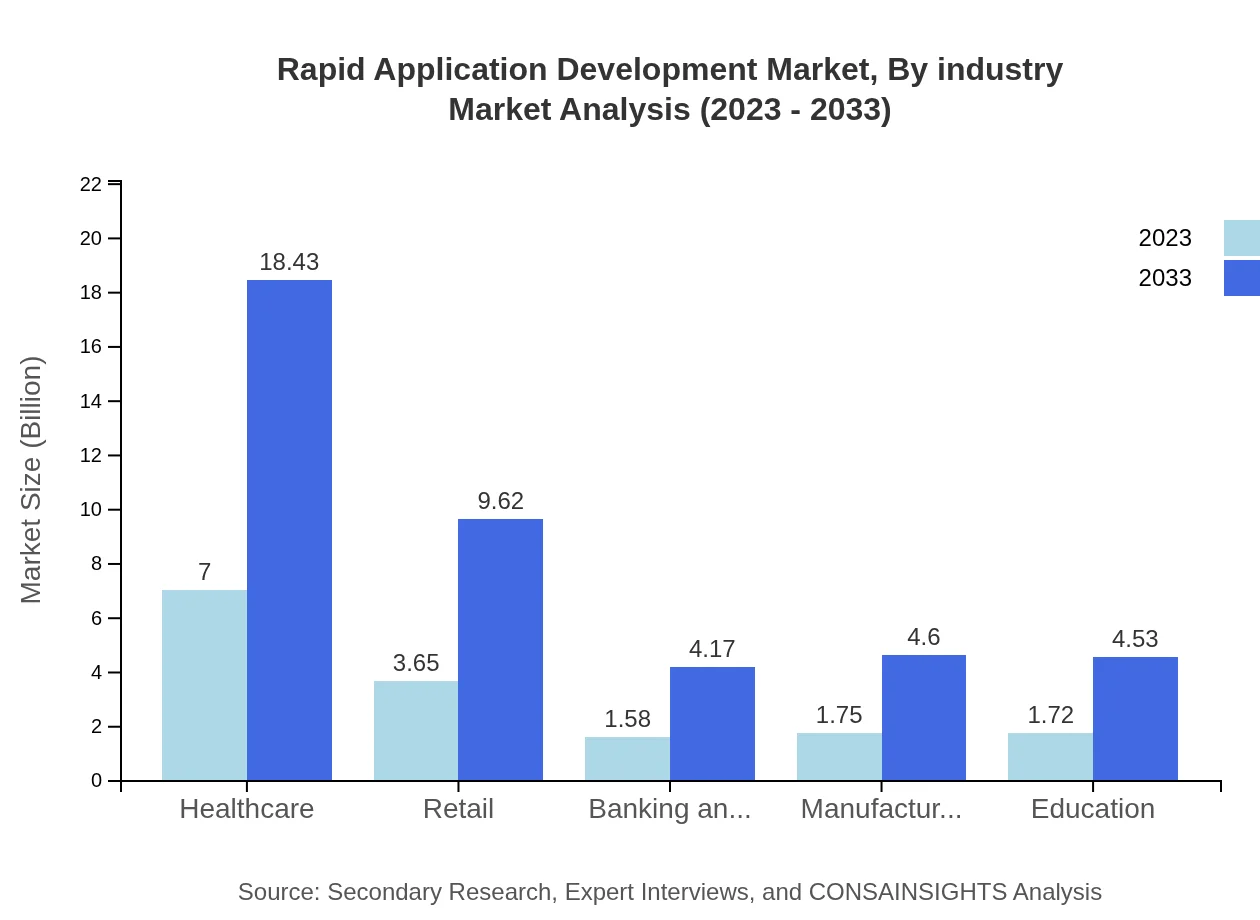

Rapid Application Development Market Analysis By Industry

In the healthcare sector, the RAD market is expected to grow from 7.00 billion USD in 2023 to 18.43 billion USD by 2033, driven by the need for quick deployments in health tech innovations. In retail, growth from 3.65 billion USD to 9.62 billion USD reflects increasing demand for rapid e-commerce solutions. The banking and financial services sector is also witnessing growth from 1.58 billion USD to 4.17 billion USD, driven by the need for quicker transaction processing and customer management systems.

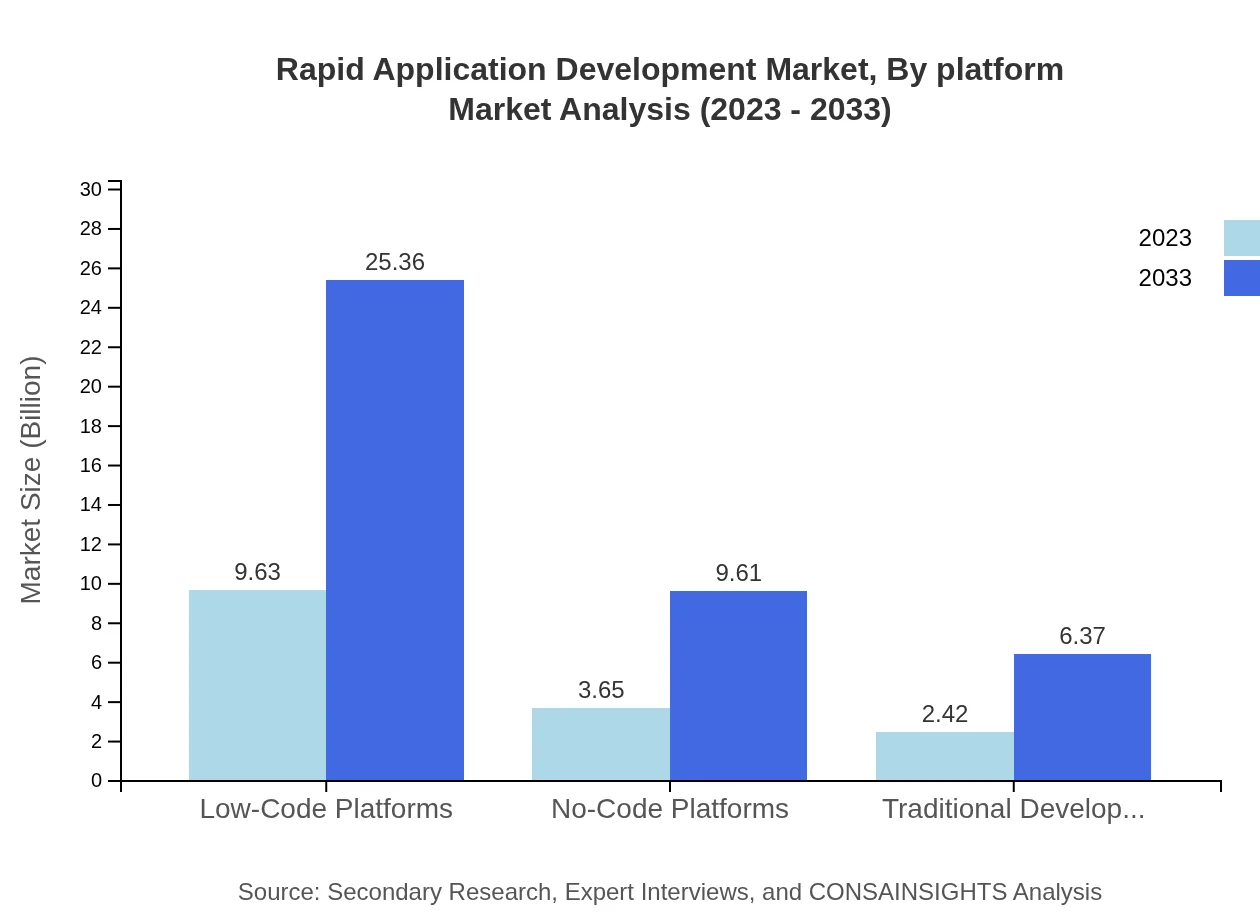

Rapid Application Development Market Analysis By Platform

The low-code platforms segment dominates the RAD market, with a growth forecast from 9.63 billion USD in 2023 to 25.36 billion USD by 2033. On the other hand, no-code platforms are gaining traction, expected to grow from 3.65 billion USD to 9.61 billion USD. Traditional development tools are projected to see modest growth from 2.42 billion USD to 6.37 billion USD as businesses transition to more agile methodologies.

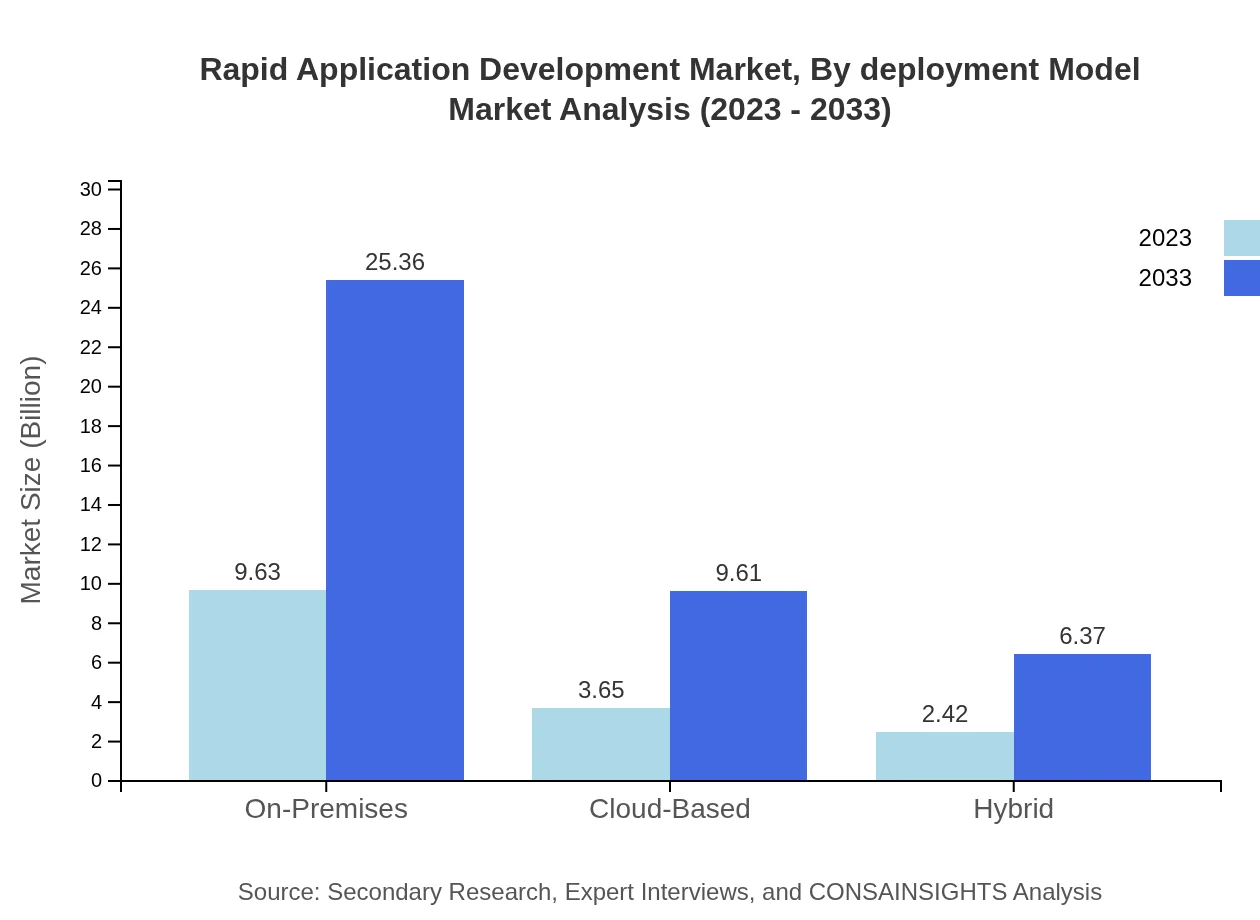

Rapid Application Development Market Analysis By Deployment Model

On-premises deployments constitute a significant portion of the RAD market, growing from 9.63 billion USD to 25.36 billion USD. Cloud-based solutions are expected to follow closely, with growth from 3.65 billion USD to 9.61 billion USD, driven by their flexibility and cost-effectiveness. Hybrid models are also emerging as organizations strive for a balance between on-premises and cloud solutions, anticipated to grow from 2.42 billion USD to 6.37 billion USD.

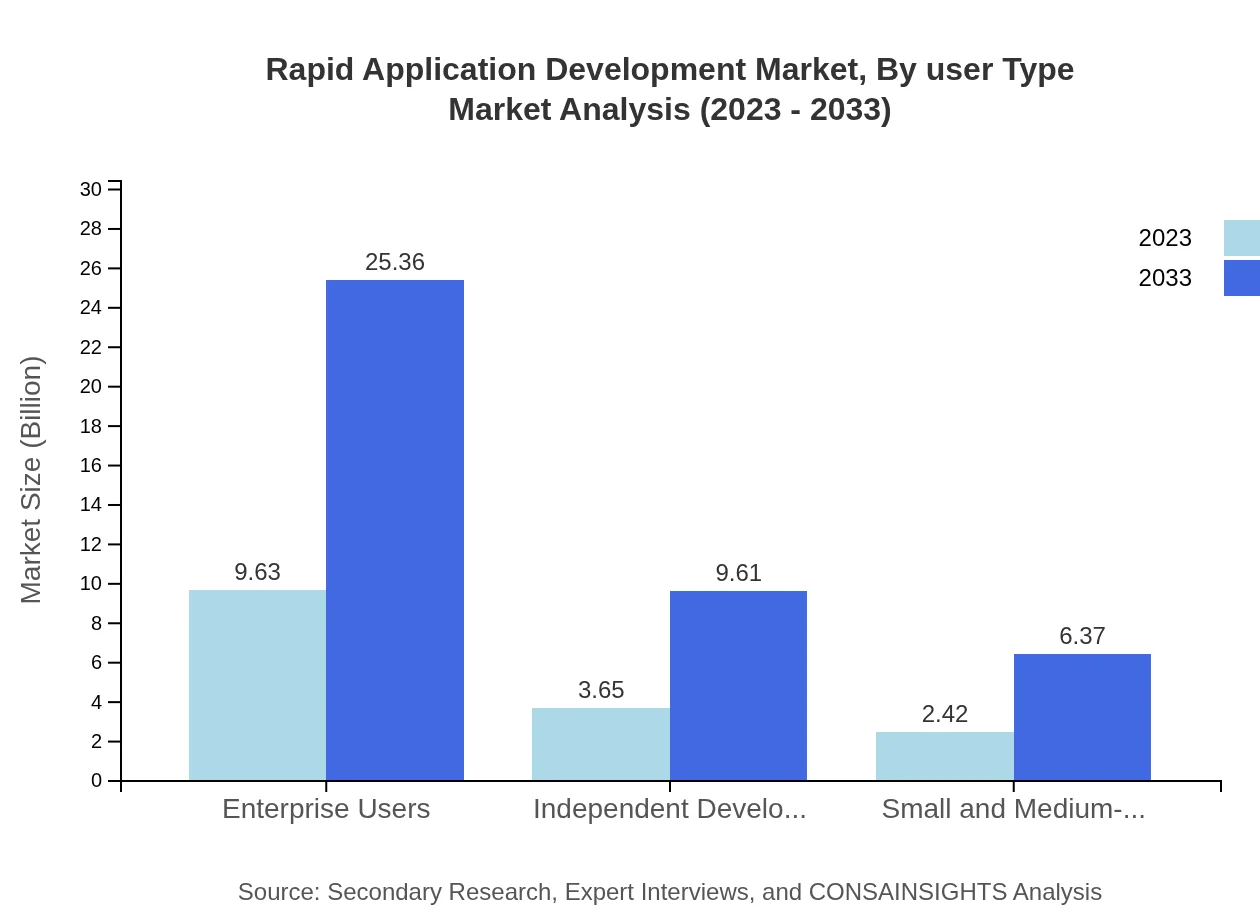

Rapid Application Development Market Analysis By User Type

Enterprise users lead the RAD market, with growth expected from 9.63 billion USD in 2023 to 25.36 billion USD by 2033. This segment's expansion highlights the increasing reliance on RAD tools in large organizations for rapid digital innovations. Independent developers are also on the rise, projected to increase from 3.65 billion USD to 9.61 billion USD, reflecting the democratization of technology.

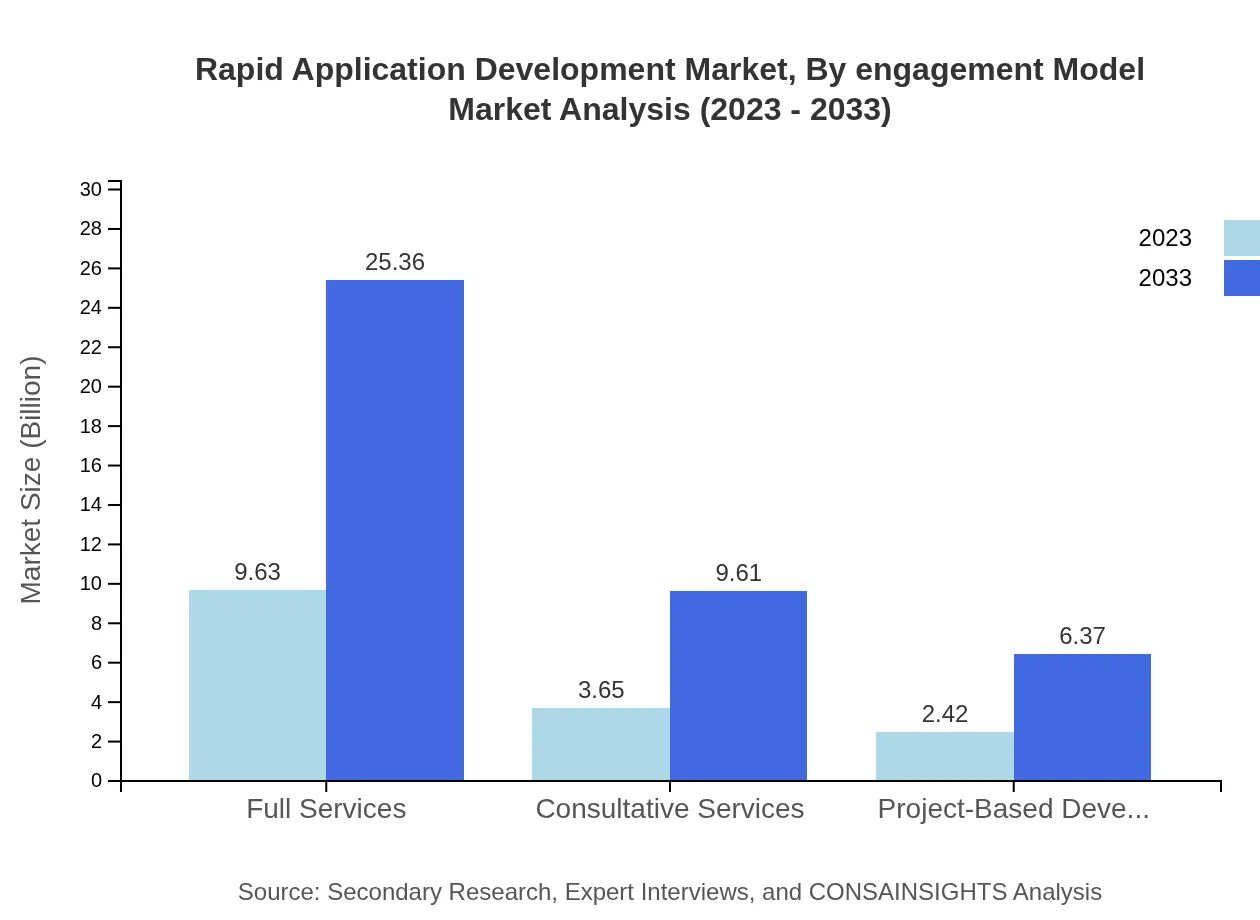

Rapid Application Development Market Analysis By Engagement Model

Full services engagement models dominate the RAD landscape, expected to grow from 9.63 billion USD to 25.36 billion USD. Consultative services are also growing, from 3.65 billion USD to 9.61 billion USD, as businesses seek expert guidance for implementing RAD processes. Project-based development solutions also hold promise, anticipated to grow from 2.42 billion USD to 6.37 billion USD.

Rapid Application Development Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rapid Application Development Industry

OutSystems:

OutSystems provides a leading low-code platform that allows enterprises to rapidly develop applications and improve their digital transformation. They cater to a wide range of industries, focusing on enhancing productivity and reducing development costs.Appian:

Appian offers a robust low-code automation platform that helps organizations build applications rapidly while integrating artificial intelligence and process automation features, thereby improving overall operational efficiency.Microsoft Power Apps:

Microsoft Power Apps enables users to create custom applications with minimal coding experience, enhancing business productivity and agility. The platform integrates seamlessly with other Microsoft services, expanding its capabilities in enterprise settings.Mendix:

Mendix focuses on a comprehensive low-code platform that accelerates the application development process through collaborative tools and agile methodologies, helping businesses stay ahead in today’s fast-paced market.We're grateful to work with incredible clients.

FAQs

What is the market size of Rapid Application Development?

The Rapid Application Development market is projected to reach approximately $15.7 billion by 2033, growing at a CAGR of 9.8%. This growth reflects increasing demand for faster and more efficient application development methods across various industries.

What are the key market players or companies in the Rapid Application Development industry?

Key players in the Rapid Application Development industry include companies like OutSystems, Appian, Mendix, Salesforce, and Microsoft. These companies are driving innovation in development speed and offering robust platforms that cater to various business needs.

What are the primary factors driving the growth in the Rapid Application Development industry?

Factors driving growth in the Rapid Application Development space include the rising demand for quick deployment solutions, increasing adoption of low-code/no-code platforms, and the need for businesses to respond swiftly to changing market dynamics and customer needs.

Which region is the fastest Growing in the Rapid Application Development?

The North American region currently stands as the fastest-growing area for Rapid Application Development, with a market size projected to grow from $5.42 billion in 2023 to an estimated $14.28 billion by 2033, fueled by technological advancements and enterprise adoption.

Does ConsaInsights provide customized market report data for the Rapid Application Development industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the Rapid Application Development industry. Clients can request specific insights and data that align with their business strategies and market requirements.

What deliverables can I expect from this Rapid Application Development market research project?

Expect detailed reports including market analysis, competitive landscape, regional breakdowns, growth forecasts, and segmented insights. Deliverables may also include executive summaries and strategic recommendations based on data-driven insights.

What are the market trends of Rapid Application Development?

Key trends in the Rapid Application Development sector include the shift towards low-code/no-code solutions, increasing emphasis on agility, growth in cloud-based applications, and a focus on integrating AI and machine learning to enhance development processes.