Rapid Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: rapid-diagnostics

Rapid Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Rapid Diagnostics market from 2023 to 2033. It covers market size, growth rates, industry insights, segmentations, regional performances, and forecasts, presenting valuable data for stakeholders to make informed decisions.

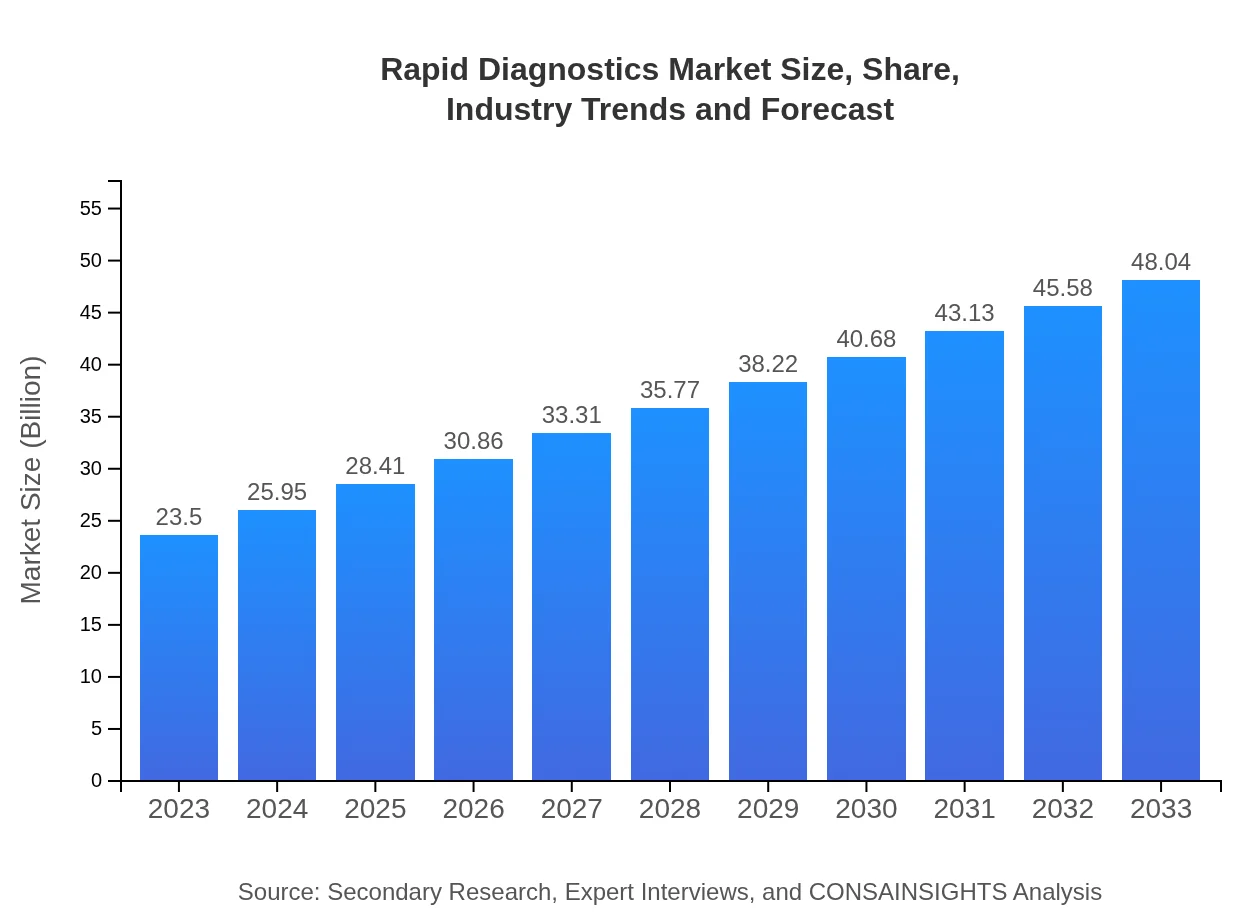

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $48.04 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Thermo Fisher Scientific, Becton, Dickinson and Company |

| Last Modified Date | 31 January 2026 |

Rapid Diagnostics Market Overview

Customize Rapid Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Rapid Diagnostics market size, growth, and forecasts.

- ✔ Understand Rapid Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rapid Diagnostics

What is the Market Size & CAGR of Rapid Diagnostics market in 2023?

Rapid Diagnostics Industry Analysis

Rapid Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rapid Diagnostics Market Analysis Report by Region

Europe Rapid Diagnostics Market Report:

The European Rapid Diagnostics market is projected to rise from $6.11 billion in 2023 to $12.48 billion by 2033. The adoption of advanced testing technologies and supportive regulatory frameworks facilitate this growth, alongside increasing public and private partnerships.Asia Pacific Rapid Diagnostics Market Report:

In the Asia Pacific region, the market for Rapid Diagnostics is projected to grow from $4.76 billion in 2023 to $9.72 billion by 2033, driven by increasing healthcare investments and the prevalence of chronic diseases. The rise in governmental initiatives to support healthcare expansions also significantly contributes to this growth.North America Rapid Diagnostics Market Report:

North America is the largest market for Rapid Diagnostics, with a forecasted growth from $8.99 billion in 2023 to $18.37 billion by 2033. The region's robust healthcare system, combined with a strong emphasis on research and product innovations, illustrates the expansive growth potential.South America Rapid Diagnostics Market Report:

South America is expected to see growth from $1.92 billion in 2023 to $3.93 billion by 2033. Factors such as improvements in healthcare infrastructure and the growing awareness of rapid diagnostics are vital for market development in this region.Middle East & Africa Rapid Diagnostics Market Report:

Middle East and Africa's market for Rapid Diagnostics is anticipated to increase from $1.73 billion in 2023 to $3.53 billion by 2033. Growth in healthcare accessibility and investments in diagnostic technologies pave the way for a brighter market outlook in the region.Tell us your focus area and get a customized research report.

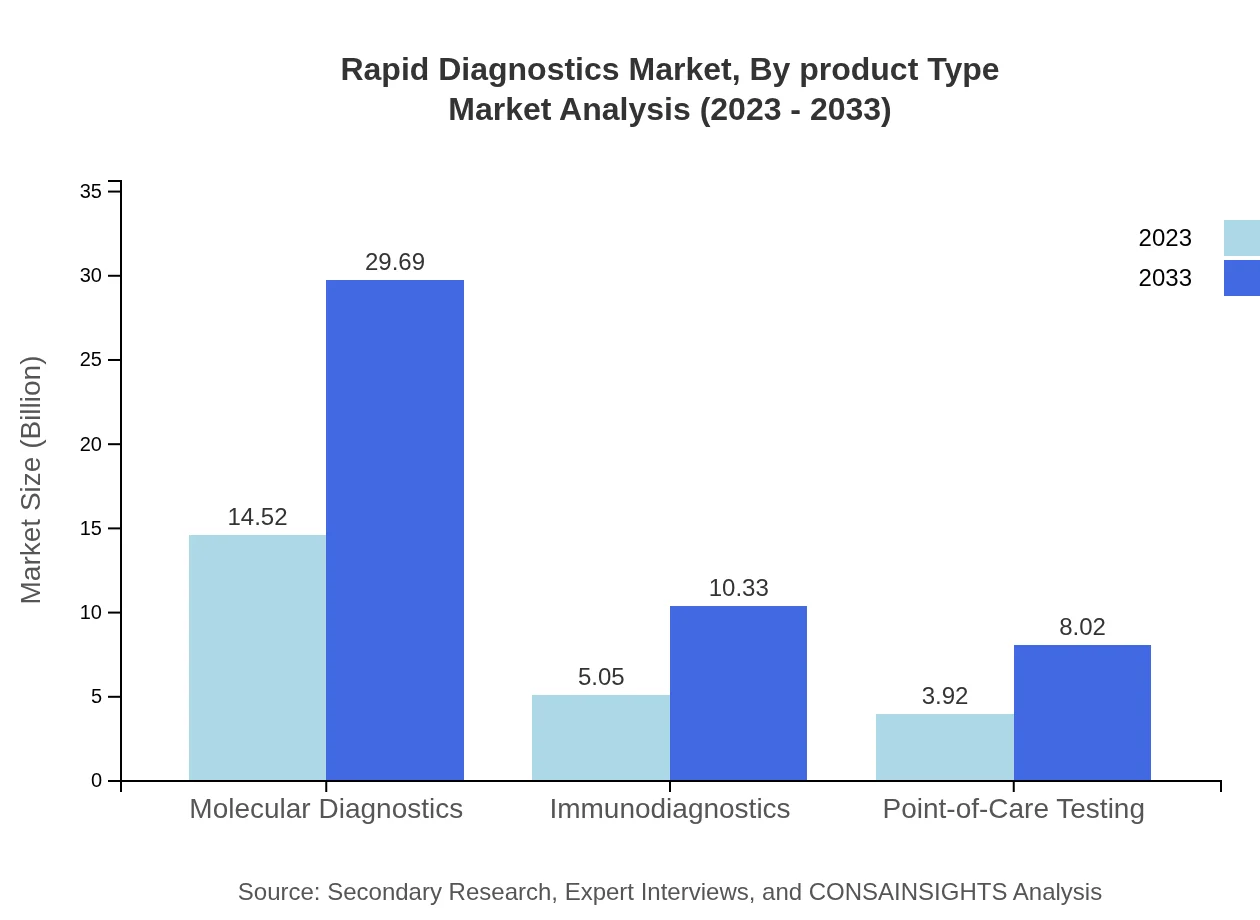

Rapid Diagnostics Market Analysis By Product Type

The Rapid Diagnostics market is dominated by various product segments. Molecular diagnostics, leading the market, accounted for $14.52 billion in 2023 and is expected to reach $29.69 billion by 2033, representing a 61.8% market share. Immunodiagnostics and Point-of-Care Testing follow, with significant shares of 21.51% and 16.69% respectively, indicating the diversified applications across numerous diseases.

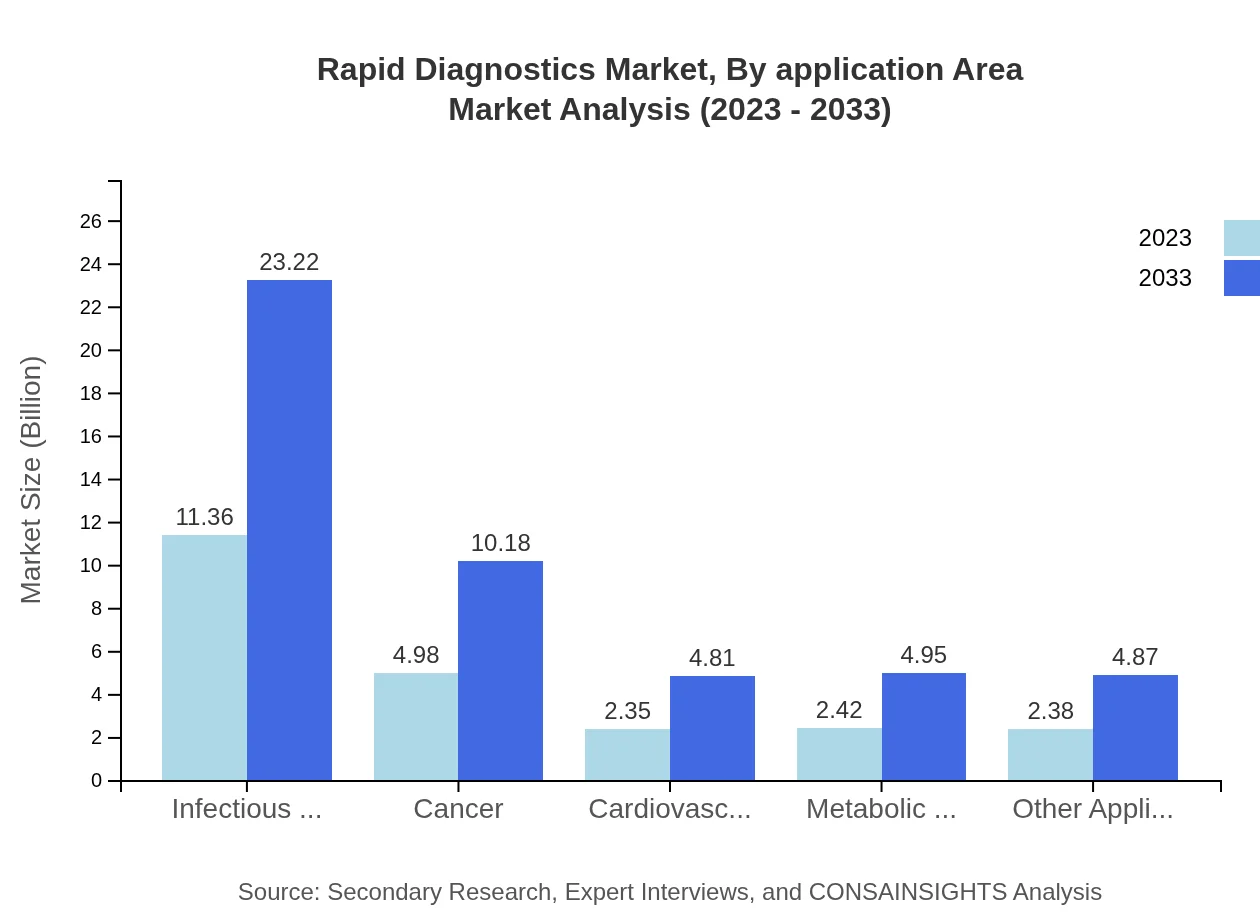

Rapid Diagnostics Market Analysis By Application Area

In the application area, Infectious Diseases holds the largest share, contributing $11.36 billion in 2023 and expected to reach $23.22 billion by 2033, maintaining a 48.34% market share. Other key areas include Cancer, Cardiovascular Diseases, and Metabolic Disorders, reflecting an evolving market addressing prevalent health issues.

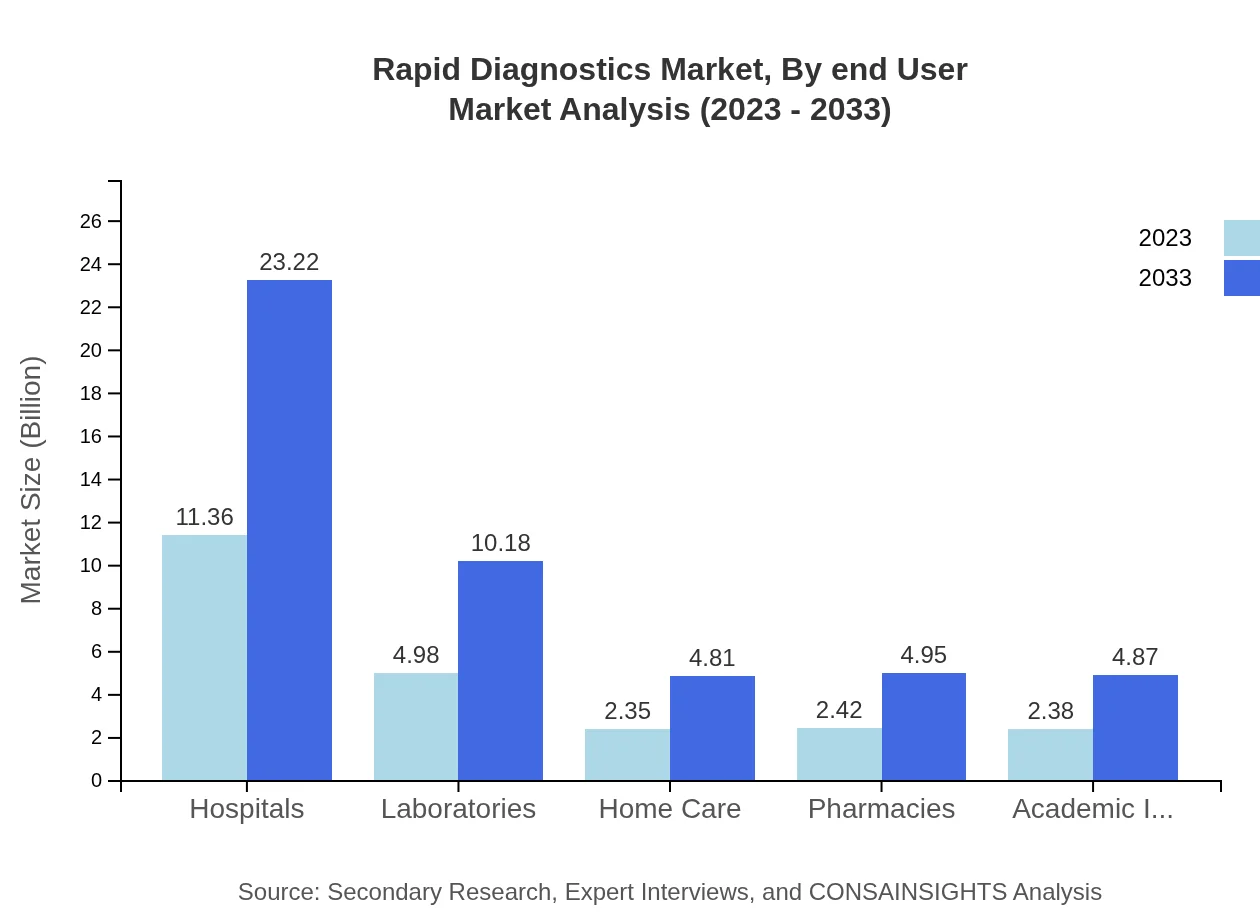

Rapid Diagnostics Market Analysis By End User

The end-user segment highlights Hospitals as the primary consumers at $11.36 billion in 2023, growing to $23.22 billion by 2033, representing 48.34% of the market. Laboratories and Home Care settings follow, each playing critical roles in improving diagnosis rates and treatment efficiency.

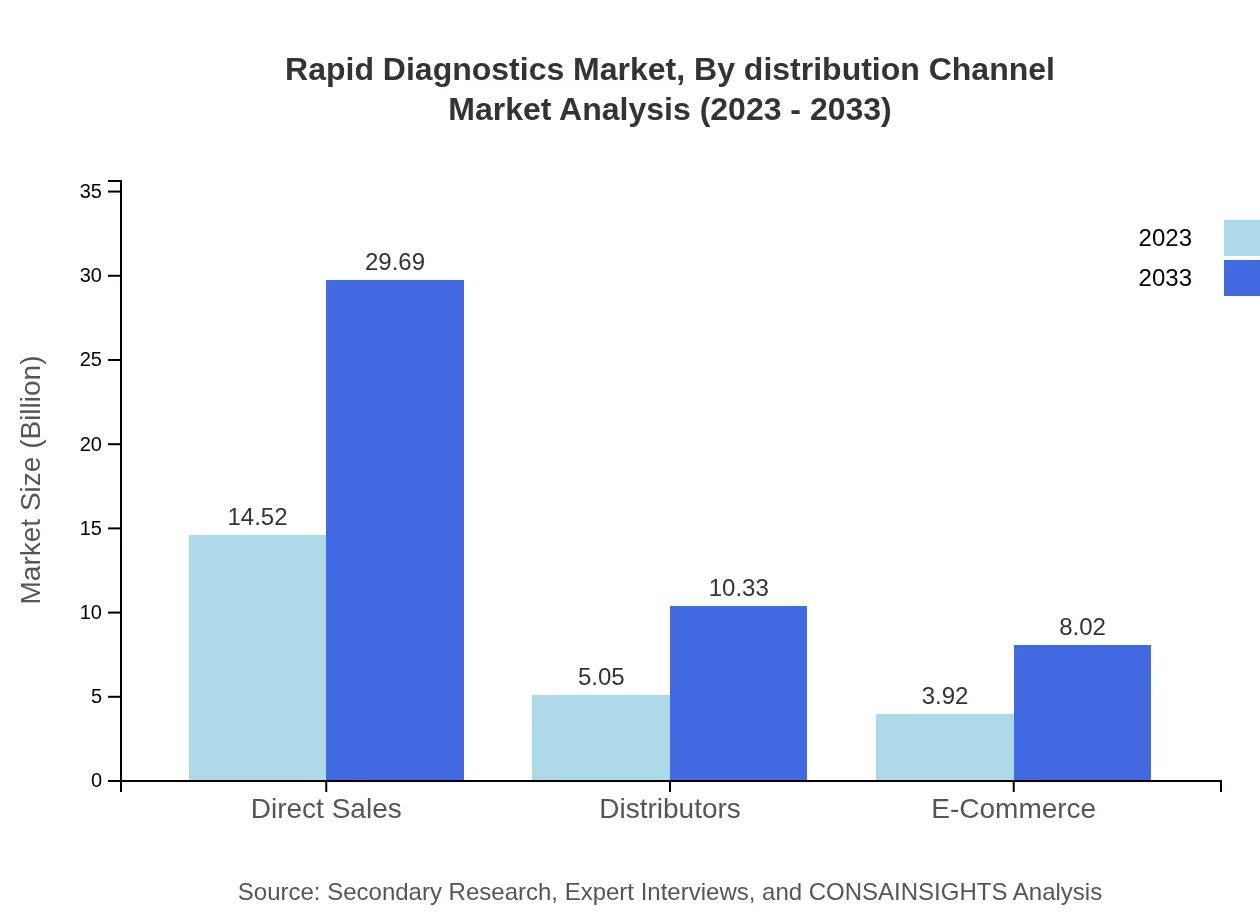

Rapid Diagnostics Market Analysis By Distribution Channel

Distribution channels reveal Direct Sales as the dominant model, constituting 61.8% of the market share. Distributors and E-commerce are also significant, reflecting the trend towards digitalization in healthcare product sales.

Rapid Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rapid Diagnostics Industry

Abbott Laboratories:

Abbott is a global leader in healthcare, specializing in diagnostics, device manufacturing, nutrition, and pharmaceuticals. Their innovative diagnostic solutions, including rapid tests for infectious diseases, are widely recognized.Roche Diagnostics:

Roche is renowned for its excellence in diagnostics and focuses on innovation in the medical field. The company offers a comprehensive range of rapid diagnostic tests.Thermo Fisher Scientific:

Thermo Fisher provides essential scientific solutions, including rapid diagnostics tools designed for various healthcare settings, focusing on quality and efficiency.Becton, Dickinson and Company:

BD is a leading global medical technology company, providing a diverse range of rapid diagnostics solutions, significantly contributing to public health and safety.We're grateful to work with incredible clients.

FAQs

What is the market size of rapid Diagnostics?

The global rapid diagnostics market is valued at approximately $23.5 billion in 2023 and is projected to grow at a CAGR of 7.2%, indicating substantial growth potential and investment opportunities through 2033.

What are the key market players or companies in this rapid Diagnostics industry?

Prominent players in the rapid diagnostics market include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific. These companies are known for their innovative diagnostic solutions and significant market contributions.

What are the primary factors driving the growth in the rapid diagnostics industry?

Driving factors for the rapid diagnostics industry include increasing prevalence of infectious diseases, technological advancements in testing methodologies, a growing focus on personalized medicine, and rising investments in healthcare infrastructure.

Which region is the fastest Growing in the rapid diagnostics market?

The fastest-growing region in the rapid diagnostics market is Asia Pacific, projected to grow from $4.76 billion in 2023 to $9.72 billion by 2033, driven by increased healthcare access and rising disease incidences.

Does ConsaInsights provide customized market report data for the rapid diagnostics industry?

Yes, ConsaInsights offers tailored market report data for the rapid diagnostics industry, enabling clients to address specific business needs and enhance strategic decision-making based on customized research insights.

What deliverables can I expect from this rapid Diagnostics market research project?

Key deliverables from the rapid diagnostics market research include a comprehensive market report with actionable insights, growth forecasts, competitive analysis, regional and segment data, and a detailed overview of market trends.

What are the market trends of rapid diagnostics?

Current market trends in rapid diagnostics include increased adoption of point-of-care testing, rising focus on molecular diagnostics, growing demand for home testing options, and integration of digital technologies in diagnostic devices.