Rapid Prototyping Materials Market Report

Published Date: 22 January 2026 | Report Code: rapid-prototyping-materials

Rapid Prototyping Materials Market Size, Share, Industry Trends and Forecast to 2033

This report covers the Rapid Prototyping Materials market, providing insights into the current state, trends, and forecasts from 2023 to 2033. It includes detailed analysis of market size, growth rates, regional insights, and key players shaping the industry.

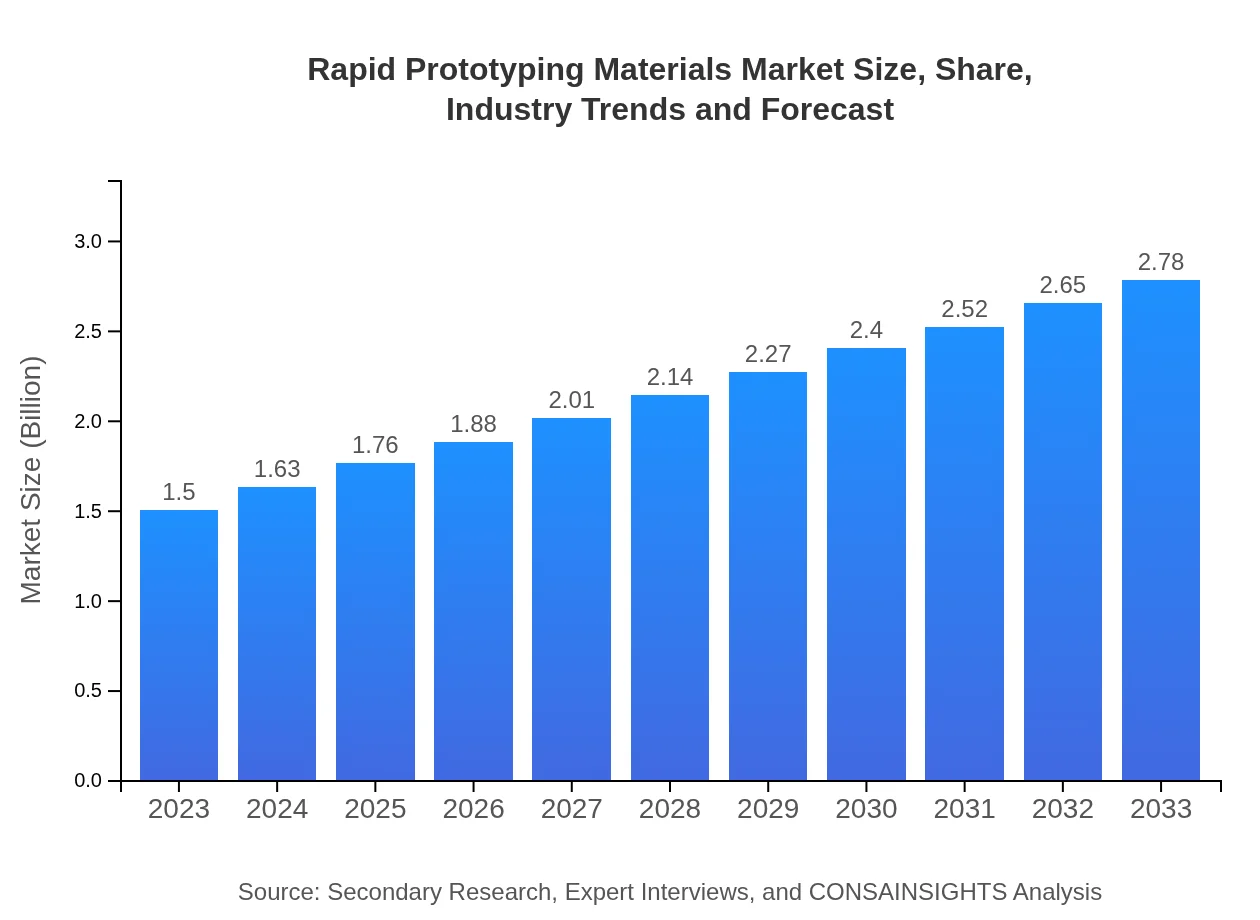

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Stratasys Ltd., 3D Systems Corporation, Materialise, Ultimaker |

| Last Modified Date | 22 January 2026 |

Rapid Prototyping Materials Market Overview

Customize Rapid Prototyping Materials Market Report market research report

- ✔ Get in-depth analysis of Rapid Prototyping Materials market size, growth, and forecasts.

- ✔ Understand Rapid Prototyping Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rapid Prototyping Materials

What is the Market Size & CAGR of Rapid Prototyping Materials market in 2023?

Rapid Prototyping Materials Industry Analysis

Rapid Prototyping Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rapid Prototyping Materials Market Analysis Report by Region

Europe Rapid Prototyping Materials Market Report:

The European market is also set for substantial growth, jumping from $0.50 billion in 2023 to $0.93 billion in 2033. This growth is driven by stringent regulations around product quality and compliance, pushing industries to adopt advanced prototyping materials.Asia Pacific Rapid Prototyping Materials Market Report:

The Asia Pacific region is anticipated to grow significantly, with the market expected to reach $0.51 billion by 2033 from $0.27 billion in 2023. The surge is attributed to rapid industrialization and increasing investment in advanced technologies, particularly in countries like China and Japan where manufacturing is a dominant sector.North America Rapid Prototyping Materials Market Report:

North America maintains a significant market presence, increasing from $0.52 billion in 2023 to $0.96 billion by 2033. The growth is supported by strong demand from the aerospace and automotive sectors, where rapid prototyping is crucial for innovation.South America Rapid Prototyping Materials Market Report:

In South America, the market is notably smaller but is projected to grow from $0.04 billion in 2023 to $0.07 billion in 2033 as local industries begin adopting modern manufacturing practices, bolstered by regional economic developments expanding the manufacturing base.Middle East & Africa Rapid Prototyping Materials Market Report:

The market in the Middle East and Africa is expected to grow from $0.17 billion in 2023 to $0.32 billion in 2033, aided by rising manufacturing capabilities and the region's focus on diversifying its economy beyond oil dependency, which includes embracing modern manufacturing technologies.Tell us your focus area and get a customized research report.

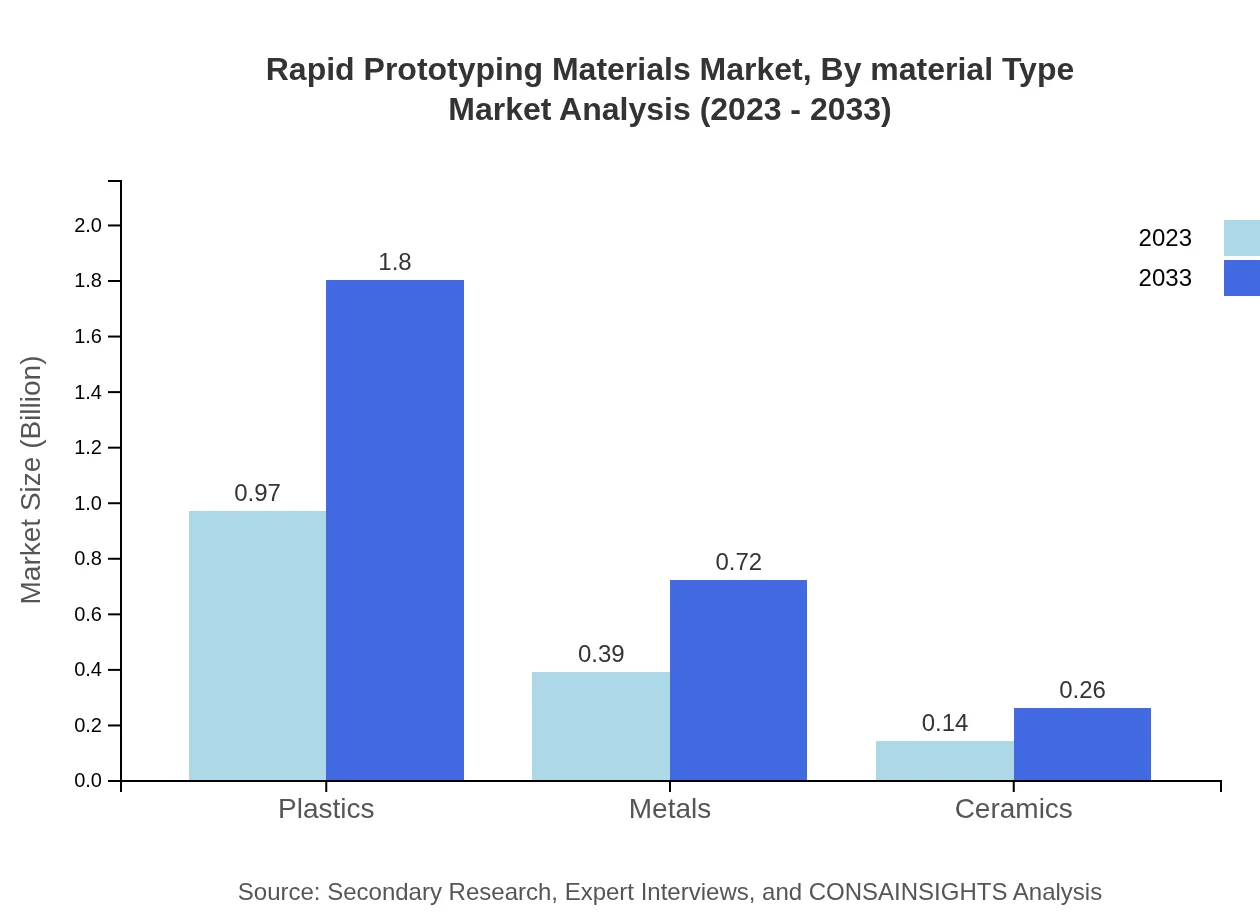

Rapid Prototyping Materials Market Analysis By Material Type

In this segment, plastics represent the largest share of the market at 64.7% in 2023, expected to maintain growth to $1.80 billion by 2033. Metals account for 25.93%, while ceramics hold a smaller share at 9.37%. Innovations in various composites and the increasing availability of bio-based materials are also noticeable trends within this category.

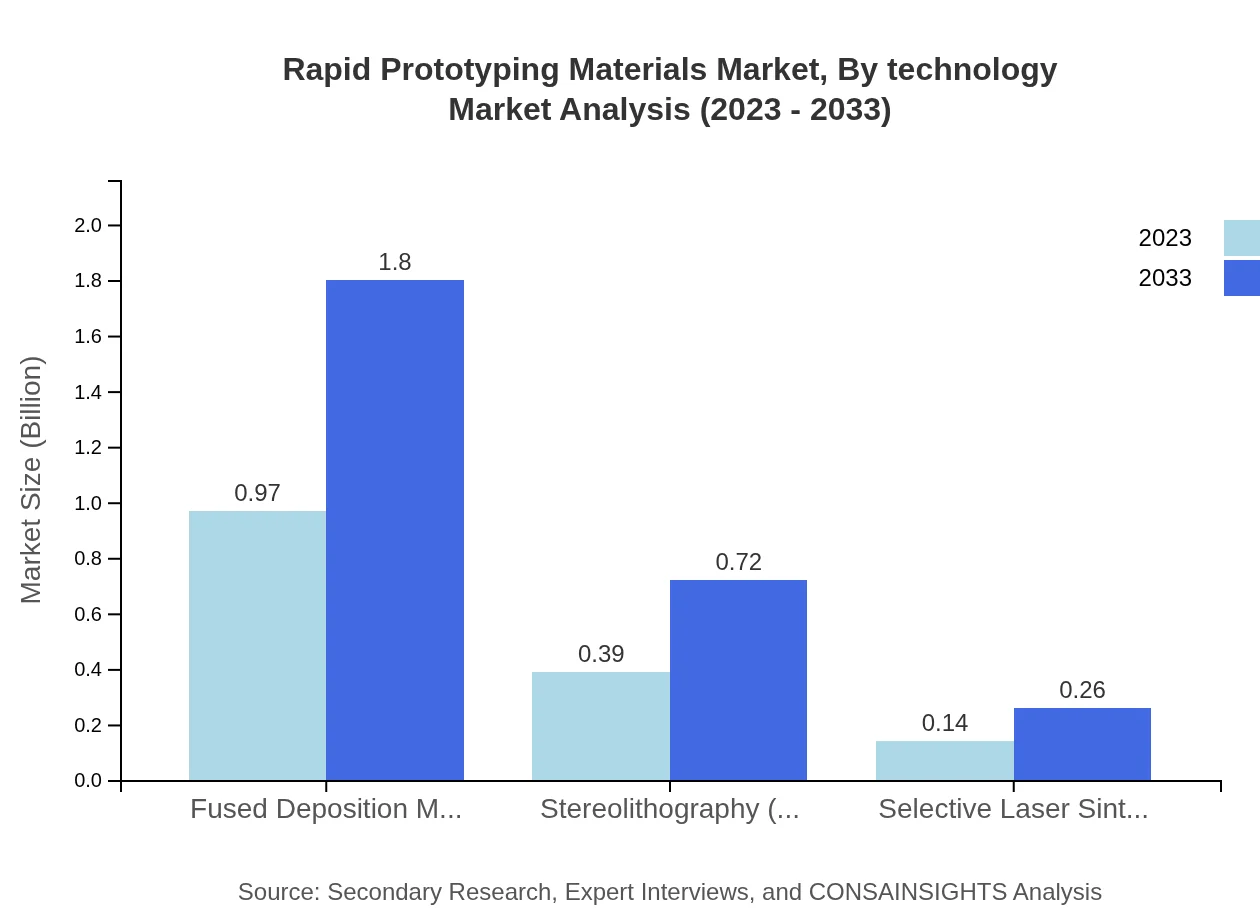

Rapid Prototyping Materials Market Analysis By Technology

Fused Deposition Modeling (FDM) is a leading technology, covering 64.7% of the market in 2023, followed by Stereolithography (25.93%) and Selective Laser Sintering (9.37%). The development of multi-material capabilities is enhancing the versatility of these technologies, promoting further adoption across various industries.

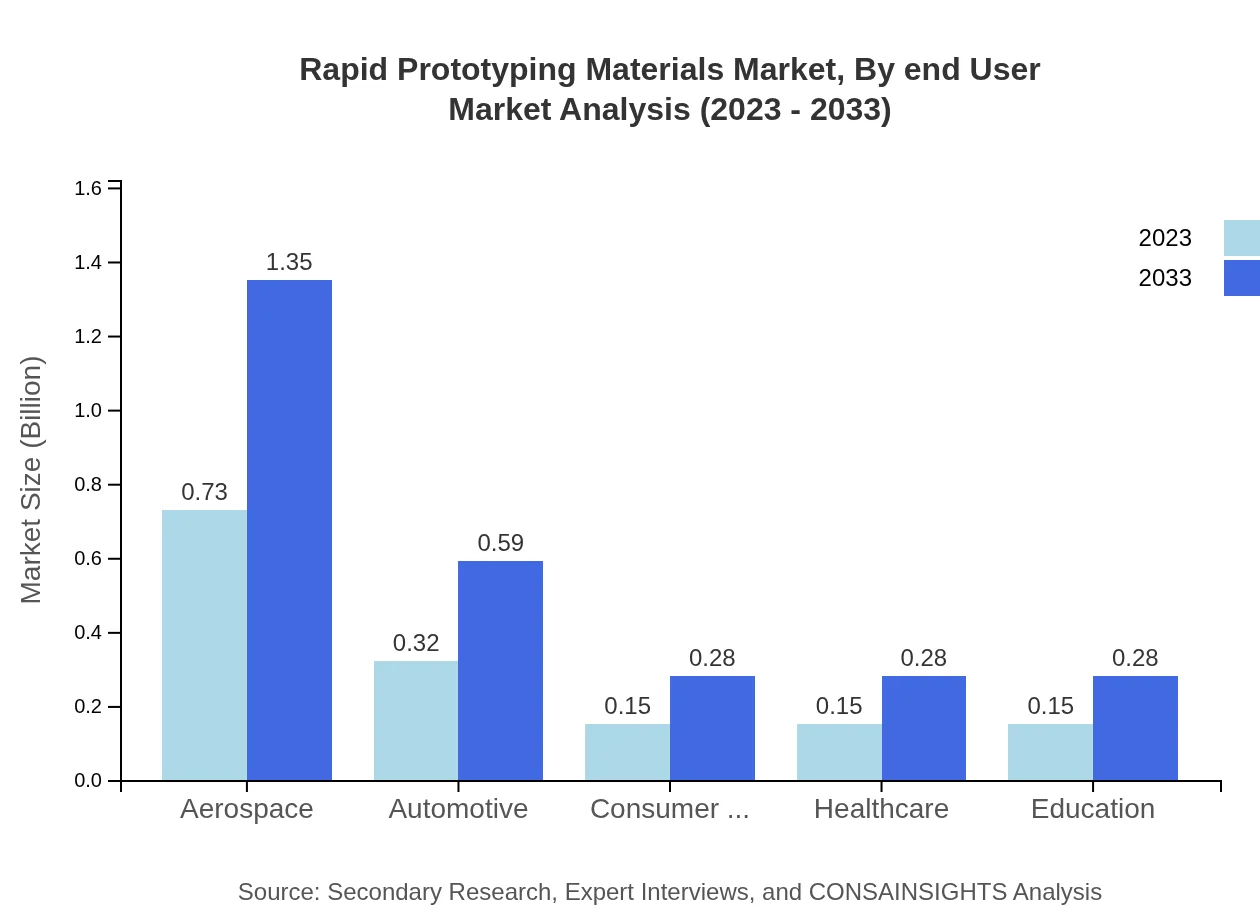

Rapid Prototyping Materials Market Analysis By End User

The aerospace industry dominates the end-user segment, projected to grow from $0.73 billion in 2023 to $1.35 billion by 2033, representing a market share of 48.57%. Other significant segments include automotive, healthcare, and consumer products, all of which are increasingly leveraging rapid prototyping for effective design and manufacturing processes.

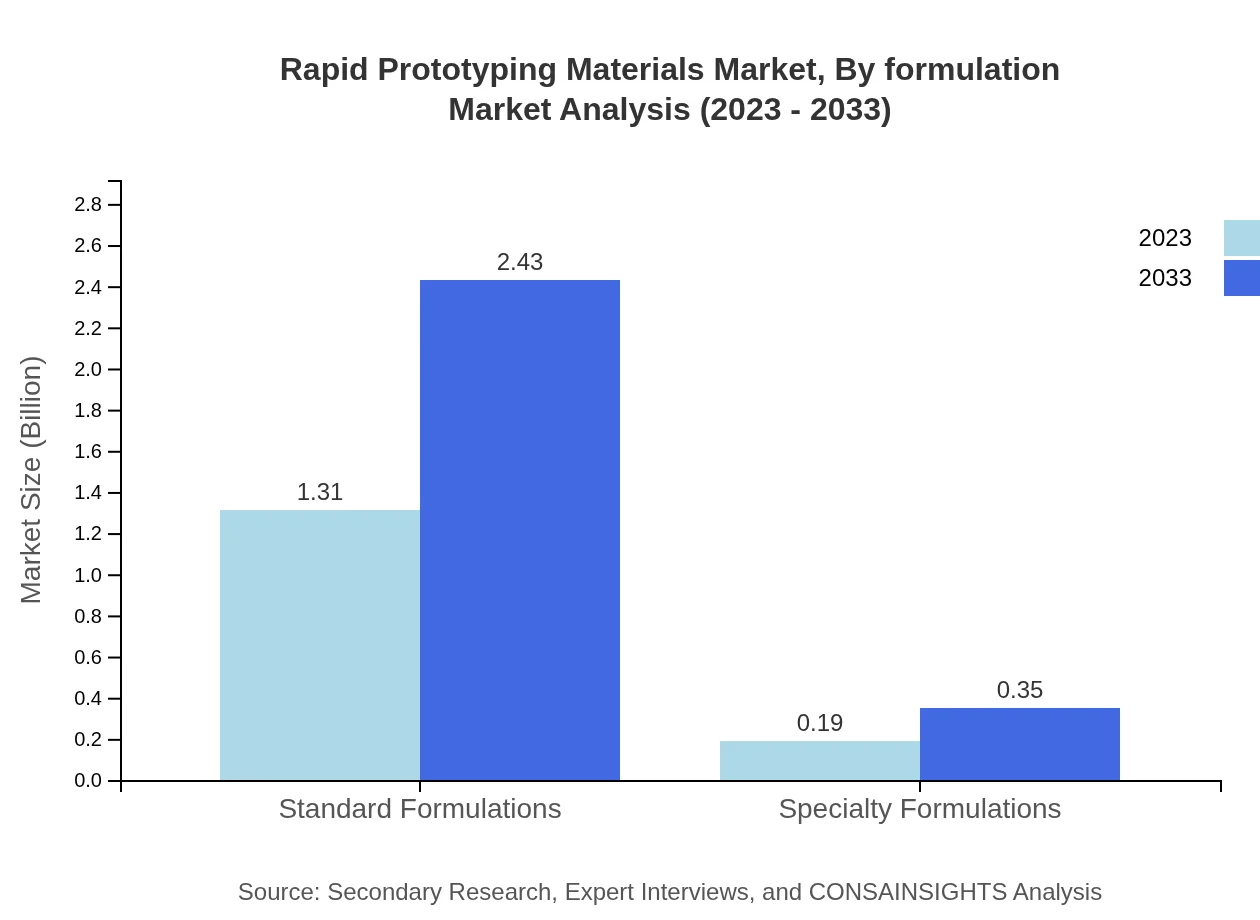

Rapid Prototyping Materials Market Analysis By Formulation

The market is further segmented into standard formulations, which constitute 87.36% of applications, projected to grow from $1.31 billion in 2023 to $2.43 billion by 2033. Specialty formulations, while smaller at 12.64%, are gaining traction due to unique performance requirements across different applications.

Rapid Prototyping Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rapid Prototyping Materials Industry

Stratasys Ltd.:

A leader in 3D printing and additive manufacturing, Stratasys offers a range of prototyping materials and solutions helping industries innovate faster.3D Systems Corporation:

Known for its advanced 3D printing technologies, 3D Systems provides innovative materials and services for rapid prototyping across multiple sectors.Materialise:

Materialise specializes in software solutions and services for 3D printing, with a strong focus on developing customized materials for rapid prototyping.Ultimaker:

A prominent 3D printer manufacturer that focuses on high-performance FDM printers and materials, Ultimaker supports a wide array of industries.We're grateful to work with incredible clients.

FAQs

What is the market size of rapid Prototyping Materials?

The global rapid prototyping materials market is currently valued at approximately $1.5 billion, with an expected compound annual growth rate (CAGR) of 6.2% over the next decade. This growth reflects increasing demand across various industries for rapid prototyping solutions.

What are the key market players or companies in this rapid Prototyping Materials industry?

Key players in the rapid prototyping materials industry include companies such as 3D Systems Corporation, Stratasys Ltd., Materialise NV, and Autodesk Inc. These companies are recognized for their innovation, product range, and global market presence.

What are the primary factors driving the growth in the rapid Prototyping Materials industry?

The rapid prototyping materials market is driven by factors such as technological advancements in 3D printing, increased demand for customized manufacturing, and the growing aerospace and automotive sectors, which leverage rapid prototyping for product development.

Which region is the fastest Growing in the rapid Prototyping Materials?

North America is the fastest-growing region in the rapid prototyping materials market, with growth from $0.52 billion in 2023 to an estimated $0.96 billion by 2033, driven by innovation in technology and robust industrial sectors.

Does ConsaInsights provide customized market report data for the rapid Prototyping Materials industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the rapid prototyping materials industry, ensuring businesses receive insights relevant to their market segment and strategic goals.

What deliverables can I expect from this rapid Prototyping Materials market research project?

Deliverables for the rapid prototyping materials market research project include detailed market analysis reports, competitive analysis, growth forecasts, and actionable insights on trends and consumer behavior.

What are the market trends of rapid Prototyping Materials?

Market trends in rapid prototyping materials highlight a growing reliance on specialty formulations, with a significant focus on sustainability and eco-friendly materials, fueled by increasing regulatory pressure and consumer demand.