Rapid Test Market Report

Published Date: 31 January 2026 | Report Code: rapid-test

Rapid Test Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Rapid Test market, focusing on market size, growth potential, industry dynamics, and key trends from 2023 to 2033. Comprehensive insights are presented across various segments and regions, offering valuable data for stakeholders.

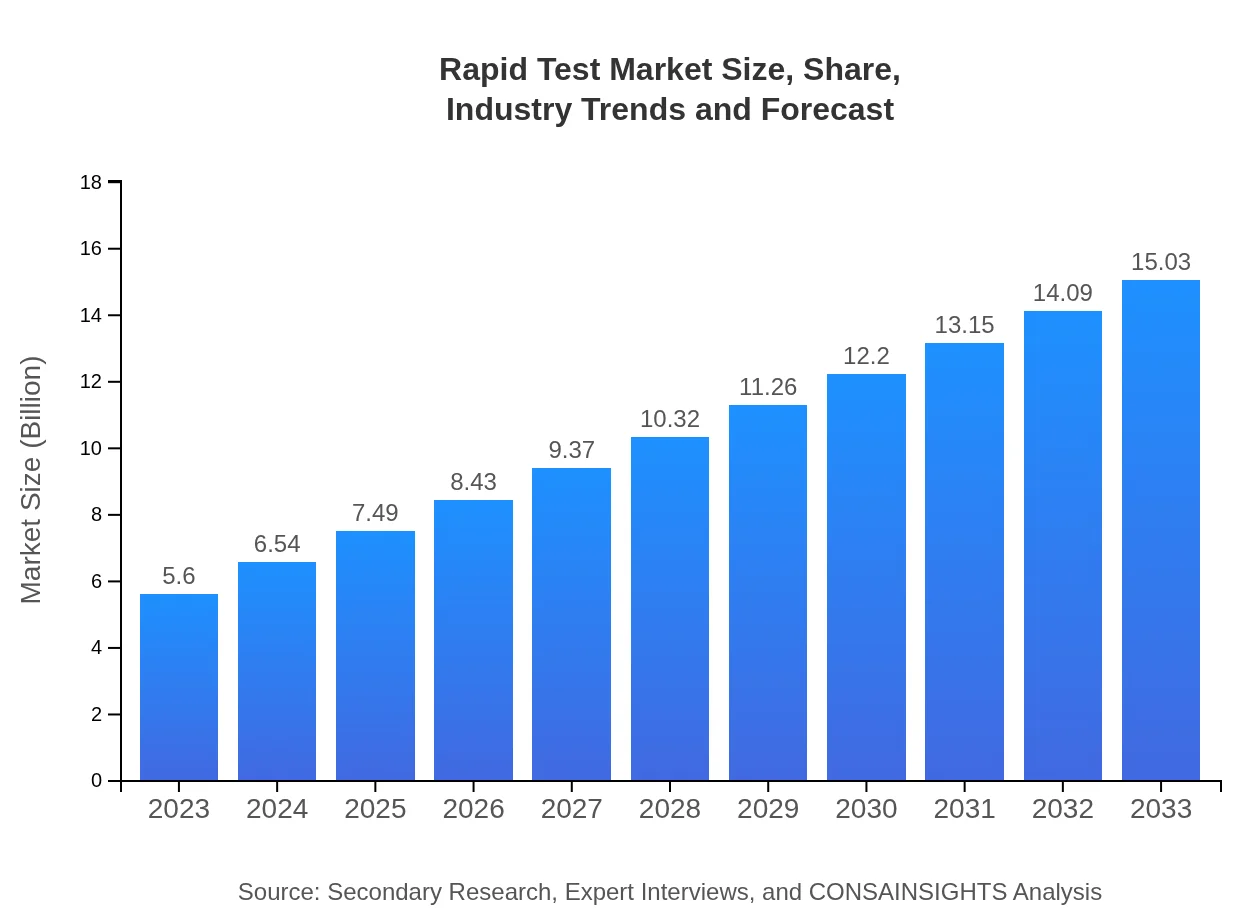

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $15.03 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Rapid Test Market Overview

Customize Rapid Test Market Report market research report

- ✔ Get in-depth analysis of Rapid Test market size, growth, and forecasts.

- ✔ Understand Rapid Test's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rapid Test

What is the Market Size & CAGR of Rapid Test market in 2023?

Rapid Test Industry Analysis

Rapid Test Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rapid Test Market Analysis Report by Region

Europe Rapid Test Market Report:

Europe's Rapid Test market is anticipated to grow from USD 1.39 billion in 2023 to USD 3.73 billion by 2033. An increasing emphasis on preventive healthcare and early diagnosis drives growth in this region, coupled with supportive regulations.Asia Pacific Rapid Test Market Report:

The Asia Pacific region is projected to witness robust growth, with the market size increasing from USD 1.20 billion in 2023 to USD 3.21 billion by 2033. Factors driving this growth include increasing investments in healthcare infrastructure and a rising burden of infectious diseases.North America Rapid Test Market Report:

North America dominates the Rapid Test market, with a market size of USD 2.13 billion in 2023 expected to reach USD 5.71 billion by 2033. The significant adoption of advanced diagnostic technologies and a strong presence of key market leaders contribute to this growth.South America Rapid Test Market Report:

In South America, the Rapid Test market is expected to grow from USD 0.43 billion in 2023 to USD 1.15 billion by 2033. Growing healthcare initiatives and government support for rapid testing solutions fuel market dynamics in this region.Middle East & Africa Rapid Test Market Report:

The Middle East and Africa region is expected to grow from USD 0.46 billion in 2023 to USD 1.23 billion by 2033. Ongoing investments in healthcare systems and increasing disease prevalence contribute significantly to market growth.Tell us your focus area and get a customized research report.

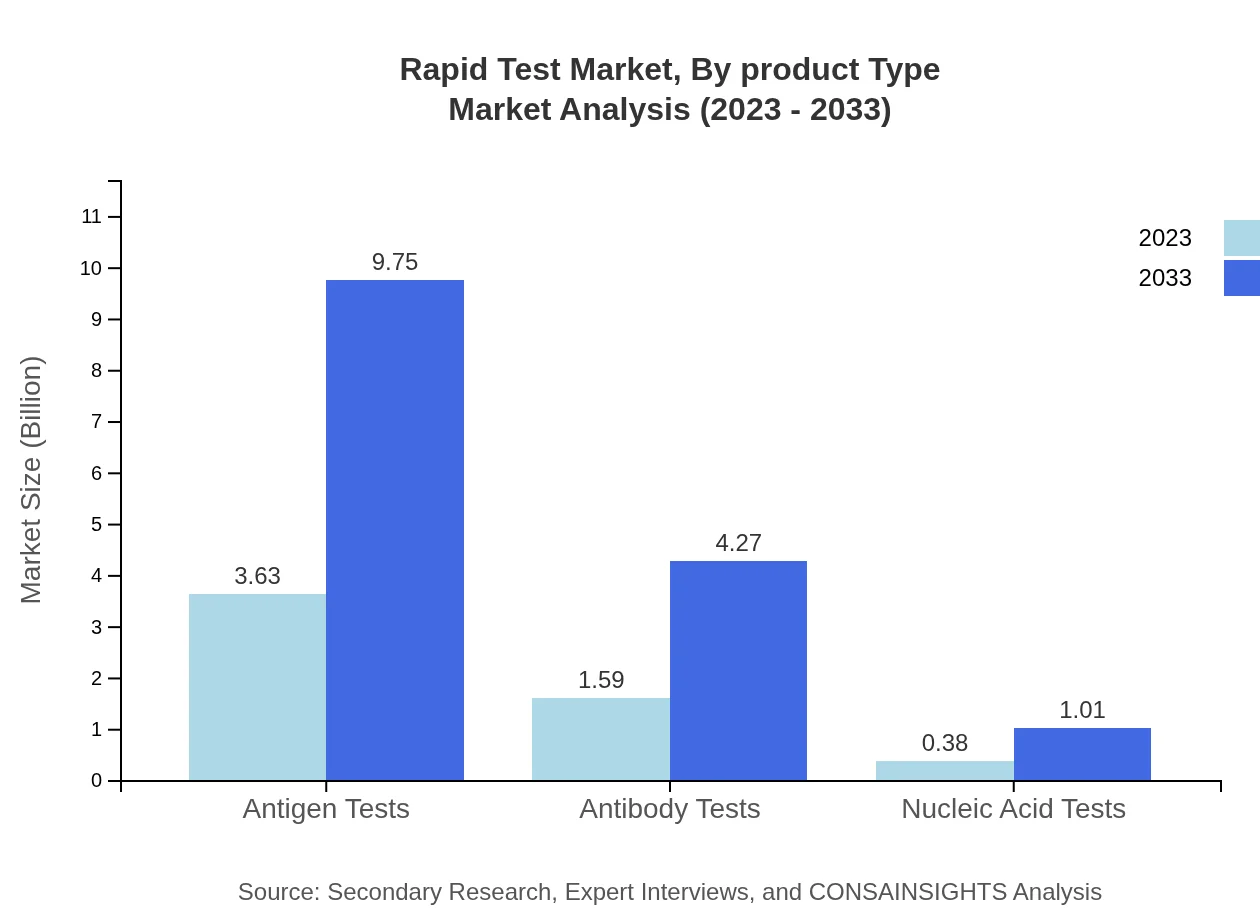

Rapid Test Market Analysis By Product Type

The product type segment is crucial in the Rapid Test market, with antigen tests dominating the market size at USD 3.63 billion in 2023, projected to reach USD 9.75 billion by 2033. Antibody tests and nucleic acid tests follow, contributing significantly to the overall growth.

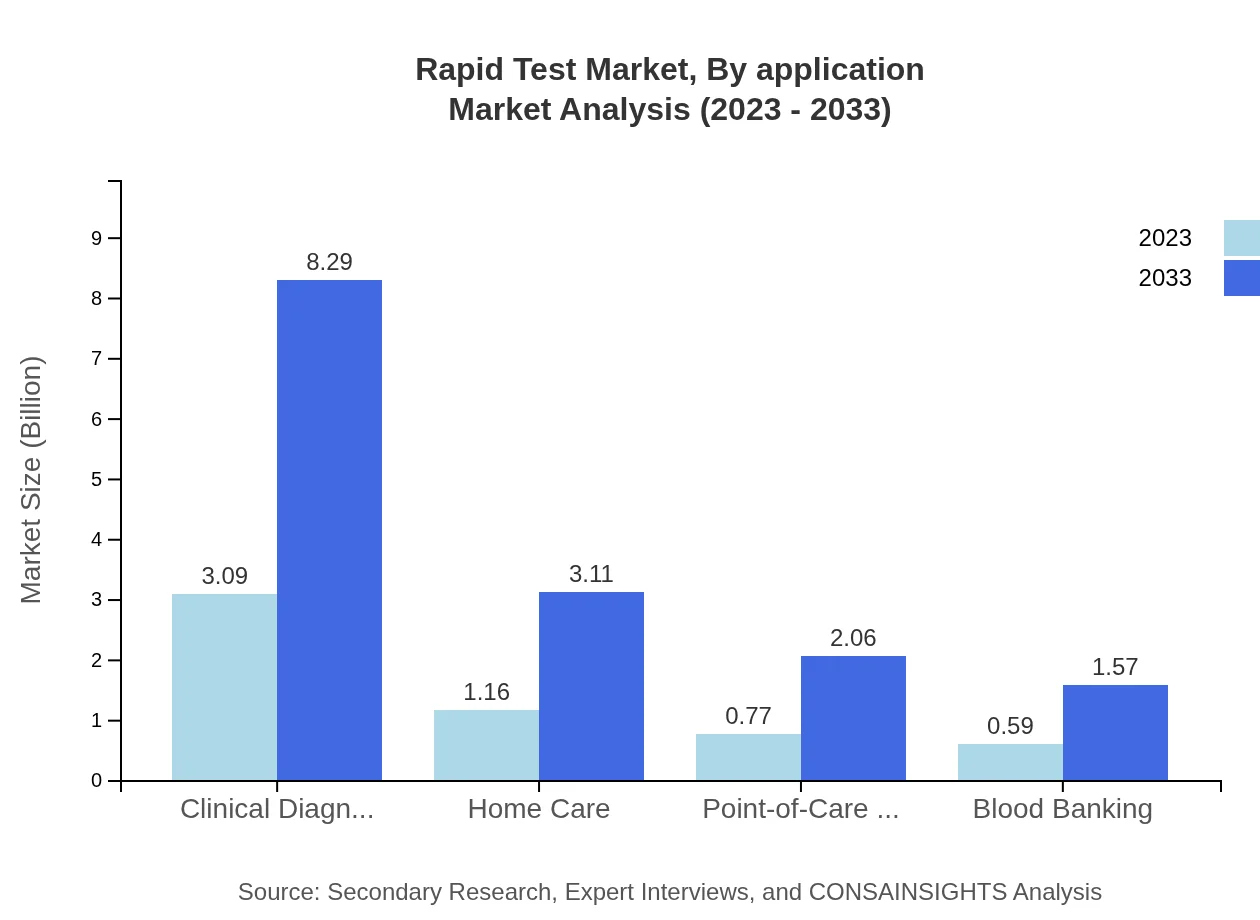

Rapid Test Market Analysis By Application

Applications in clinical diagnostics hold the largest market share in the Rapid Test sector, with a size of USD 3.09 billion in 2023, expected to grow to USD 8.29 billion by 2033. Home care providers and point-of-care testing are also growing, reflecting shifts in patient management.

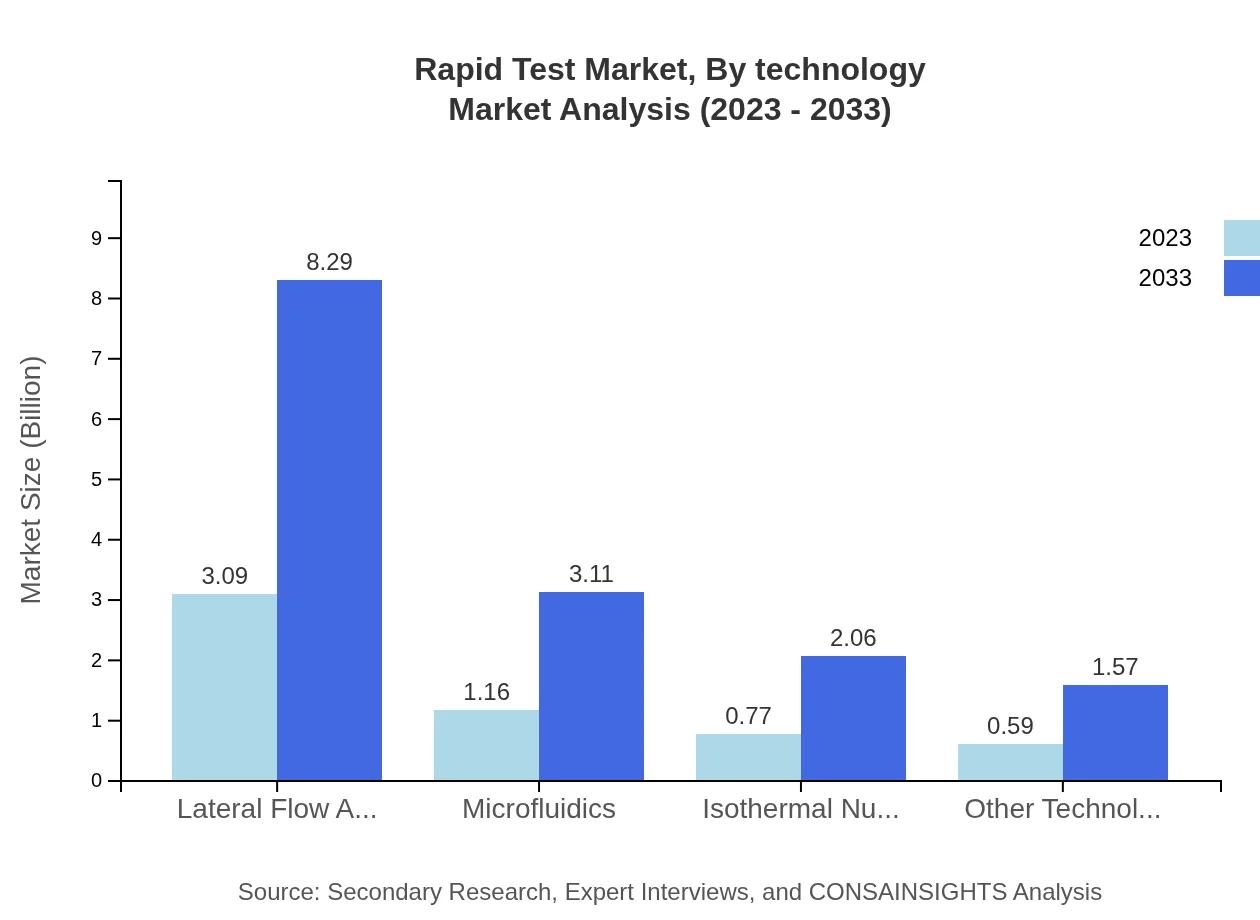

Rapid Test Market Analysis By Technology

With advancements in science, lateral flow assays are prevalent with a market size of USD 3.09 billion in 2023, projected to reach USD 8.29 billion by 2033. Emerging technologies like microfluidics show promising growth, driven by their efficiency and accuracy in testing.

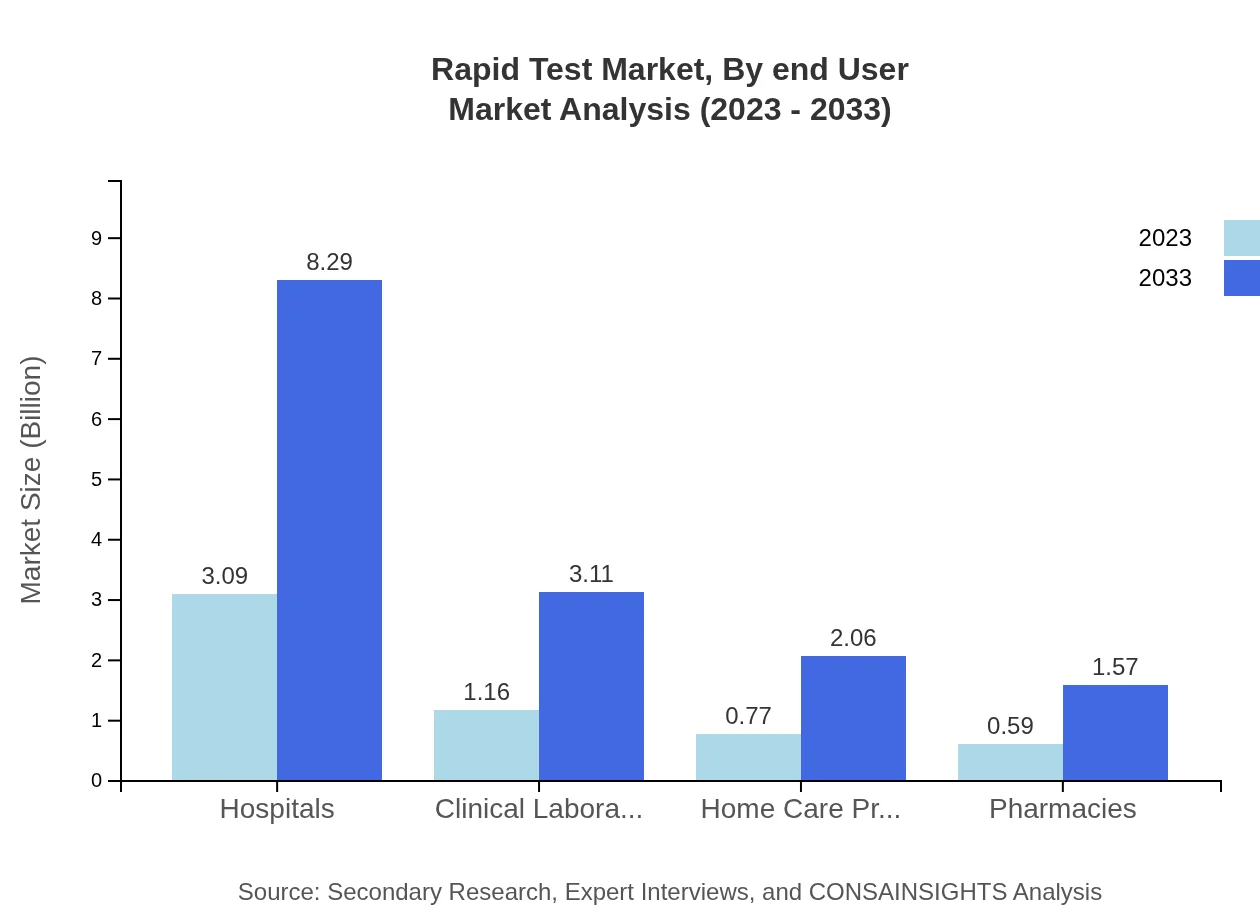

Rapid Test Market Analysis By End User

Hospitals are the primary end-users in the Rapid Test market, accounting for USD 3.09 billion in 2023, expected to reach USD 8.29 billion by 2033, demonstrating the critical role of rapid testing in healthcare settings.

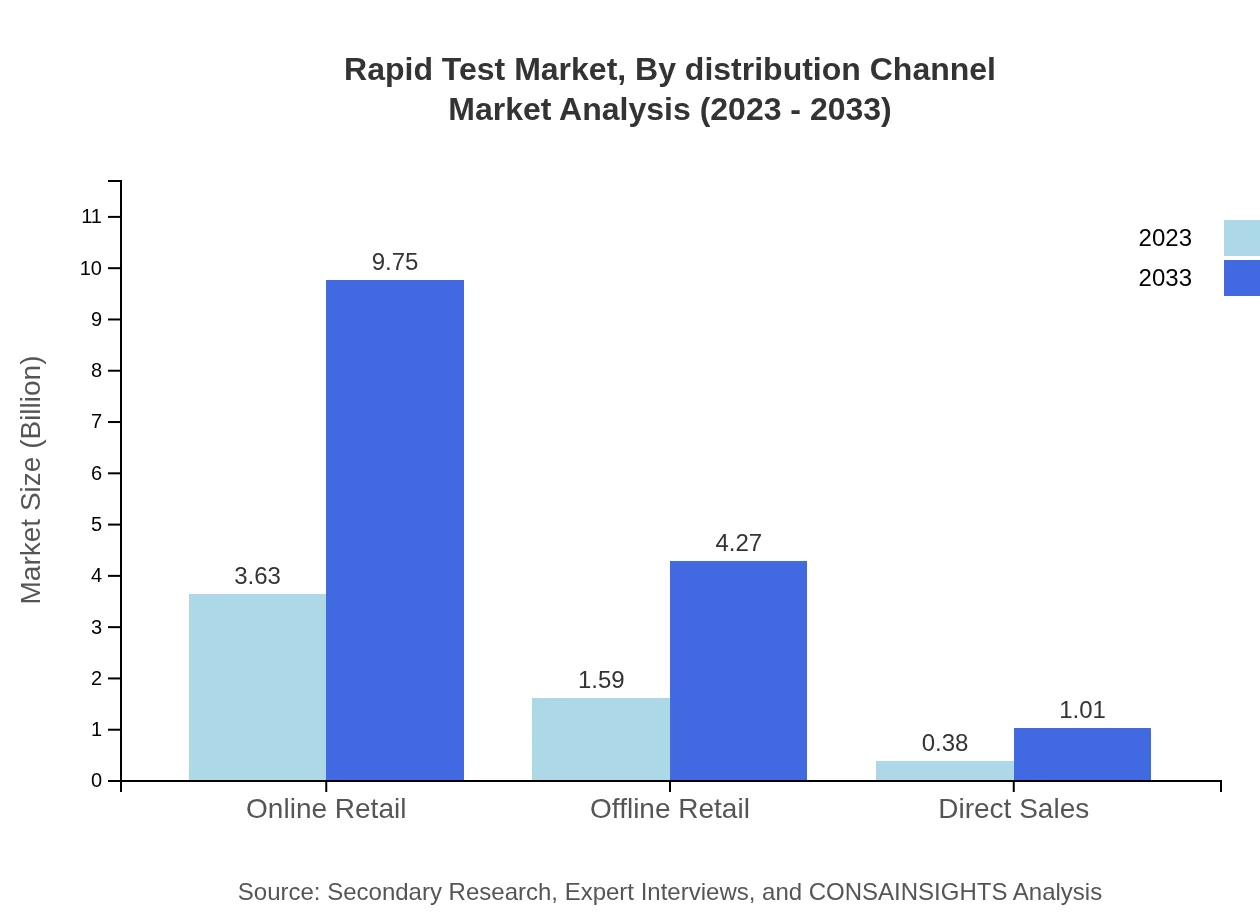

Rapid Test Market Analysis By Distribution Channel

The online retail sector represents a growing distribution channel, with its market size of USD 3.63 billion in 2023 projected to grow to USD 9.75 billion by 2033. Offline retail continues to be significant, evidencing diverse consumer purchasing preferences.

Rapid Test Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rapid Test Industry

Roche Diagnostics:

Roche is a global leader in rapid diagnostic testing, providing innovative solutions for infectious diseases, encompassing a range of testing modalities including point-of-care rapid tests.Abbott Laboratories:

Abbott Laboratories excels in rapid test development, particularly in infectious disease testing, delivering advanced testing kits that prioritize accuracy and speed in diagnosis.Siemens Healthineers:

Siemens Healthineers offers a variety of rapid testing solutions and is recognized for its cutting-edge technology in enhancing the efficacy of diagnostic testing.We're grateful to work with incredible clients.

FAQs

What is the market size of the rapid Test?

The global market size for the rapid test industry is projected to reach approximately $5.6 billion by 2033, growing at a robust CAGR of 10% from its current valuation.

What are the key market players or companies in this rapid Test industry?

Key players in the rapid test market include major healthcare corporations and diagnostic manufacturers that prioritize technology innovation and competitive pricing strategies.

What are the primary factors driving the growth in the rapid Test industry?

The growth in the rapid-test market is driven by increasing demand for point-of-care testing, technological advancements, and the rising prevalence of infectious diseases and chronic conditions.

Which region is the fastest Growing in the rapid Test?

The fastest-growing region in the rapid-test market is North America, expected to expand from $2.13 billion in 2023 to $5.71 billion by 2033, indicating a significant demand surge.

Does ConsaInsights provide customized market report data for the rapid Test industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and unique insights within the rapid-test industry.

What deliverables can I expect from this rapid Test market research project?

Deliverables for the rapid-test market research project include comprehensive market analysis, regional breakdowns, competitive landscapes, and future growth forecasts.

What are the market trends of rapid Test?

Current trends in the rapid-test market include a shift towards home testing solutions, increased use of digital health technologies, and a focus on rapid antigen detection methods.