Ready To Eat Food Market Report

Published Date: 31 January 2026 | Report Code: ready-to-eat-food

Ready To Eat Food Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ready To Eat Food market from 2023 to 2033, highlighting market trends, growth forecasts, and industry insights to guide stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

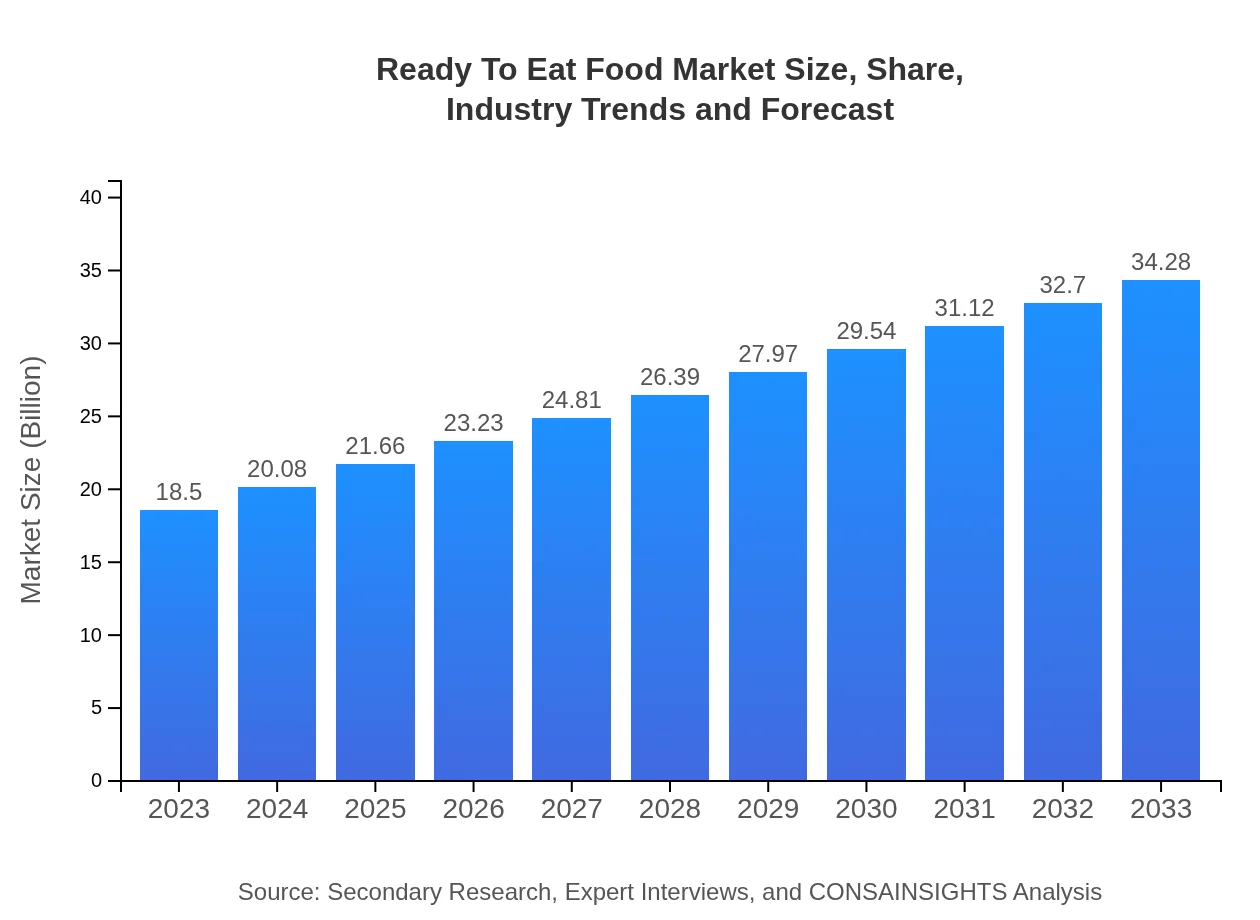

| 2023 Market Size | $18.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $34.28 Billion |

| Top Companies | Nestlé S.A., Kraft Heinz Company, Unilever, General Mills, Inc., Conagra Brands, Inc. |

| Last Modified Date | 31 January 2026 |

Ready To Eat Food Market Overview

Customize Ready To Eat Food Market Report market research report

- ✔ Get in-depth analysis of Ready To Eat Food market size, growth, and forecasts.

- ✔ Understand Ready To Eat Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ready To Eat Food

What is the Market Size & CAGR of Ready To Eat Food market in 2023?

Ready To Eat Food Industry Analysis

Ready To Eat Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ready To Eat Food Market Analysis Report by Region

Europe Ready To Eat Food Market Report:

Europe's market is projected to evolve from $5.17 billion in 2023 to $9.58 billion by 2033, fueled by a rising trend toward healthy eating and convenience foods, alongside advancements in packaging technology that extend shelf life.Asia Pacific Ready To Eat Food Market Report:

In the Asia Pacific region, the Ready To Eat Food market is poised for substantial growth, from a size of $3.81 billion in 2023 to an estimated $7.05 billion by 2033. The rise in disposable income, coupled with a growing urban population, is driving demand for convenience food options.North America Ready To Eat Food Market Report:

North America, holding a significant share in the Ready To Eat Food market, is projected to expand from $6.18 billion in 2023 to $11.45 billion by 2033. The robust demand for meal kits and frozen foods in the region reflects a shift towards quick meal solutions among busy consumers.South America Ready To Eat Food Market Report:

South America shows a modest yet positive growth trajectory in the Ready To Eat Food market with a size of $1.07 billion in 2023 expected to reach approximately $1.99 billion by 2033. This growth is primarily fueled by increasing urbanization and lifestyle changes.Middle East & Africa Ready To Eat Food Market Report:

The Middle East and Africa region is forecasted to grow from $2.27 billion in 2023 to $4.21 billion by 2033. Increased working populations and changes in eating habits are significant factors driving market growth in this region.Tell us your focus area and get a customized research report.

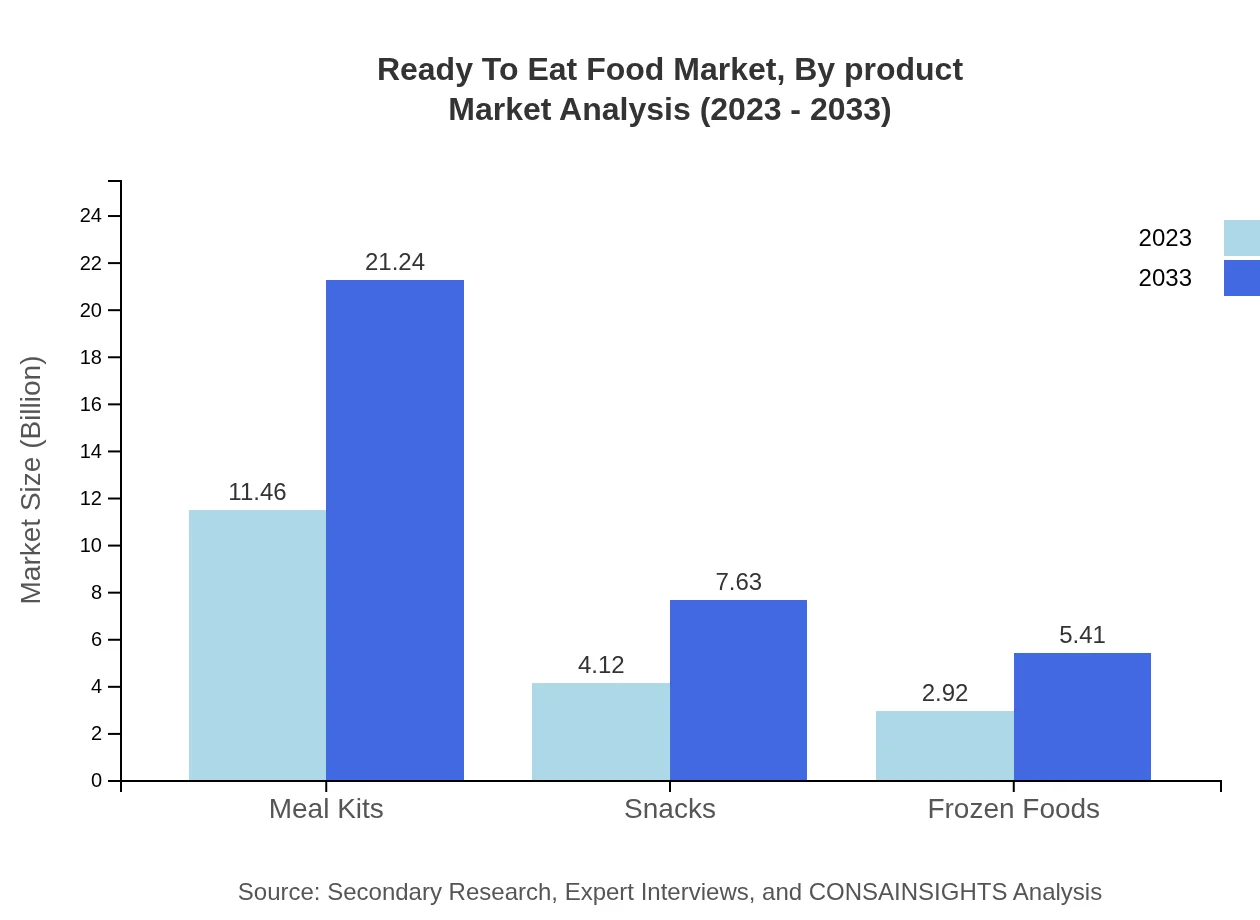

Ready To Eat Food Market Analysis By Product

The market for meal kits is anticipated to grow from $11.46 billion in 2023 to $21.24 billion in 2033, maintaining a strong market share of 61.96%. Snacks, on the other hand, represent a substantial portion of the market, growing from $4.12 billion to $7.63 billion, capturing about 22.26% of the market in 2033. Frozen foods also hold a significant share, increasing from $2.92 billion to $5.41 billion and accounting for around 15.78%. These product types highlight the shift in consumer preferences toward variety and convenience.

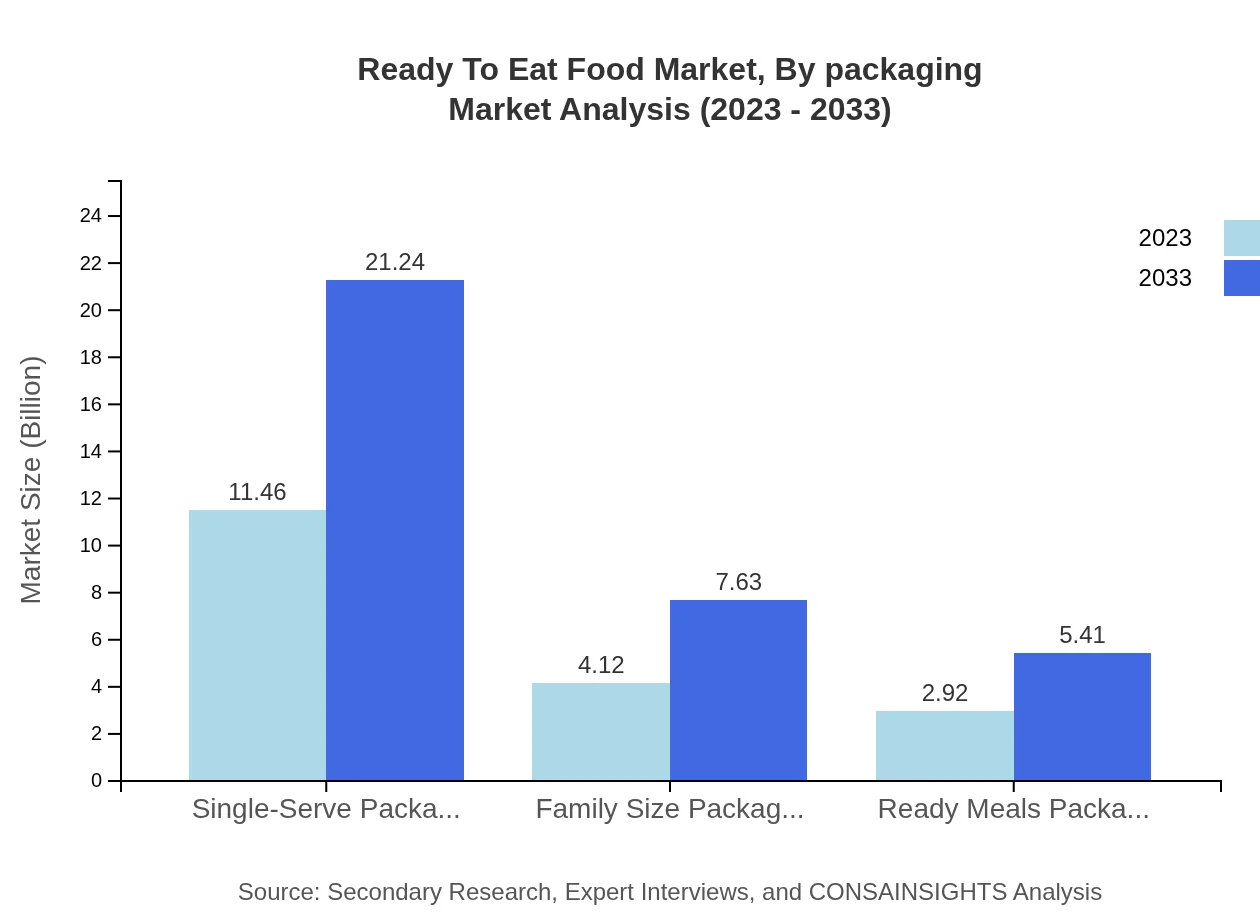

Ready To Eat Food Market Analysis By Packaging

The trend in packaging types indicates a preference for single-serve options, which will see growth from $11.46 billion in 2023 to $21.24 billion by 2033. Family size packaging also shows promising growth, from $4.12 billion to $7.63 billion, while ready meals packaging will increment from $2.92 billion to $5.41 billion. These figures imply strong consumer acceptance of convenient and larger pack sizes, reflecting varied consumption habits.

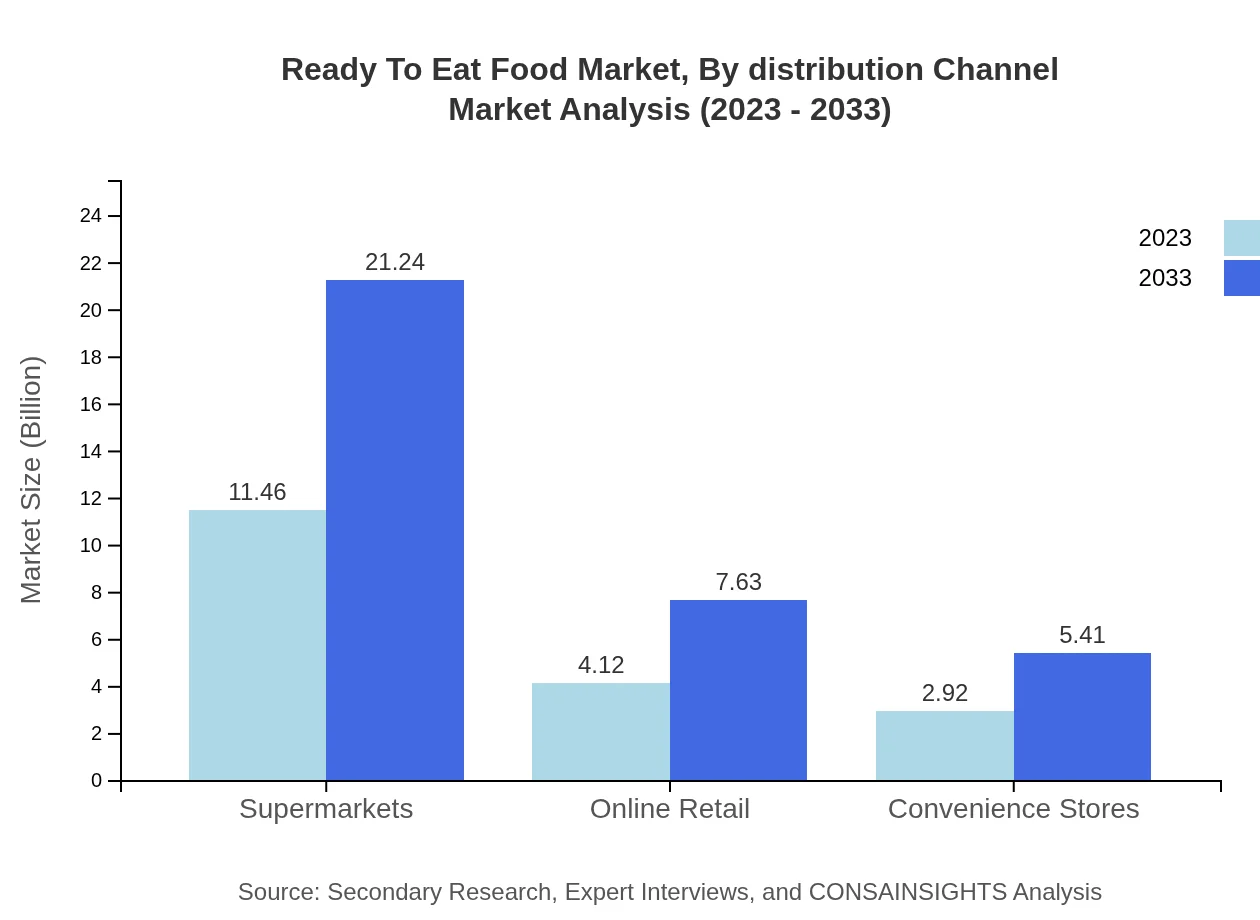

Ready To Eat Food Market Analysis By Distribution Channel

The distribution channel analysis reveals that supermarkets are pivotal, capturing a size of $11.46 billion in 2023 with forecasted growth to $21.24 billion by 2033. Online retail channels, with increased digital adoption, will grow from $4.12 billion to $7.63 billion, and convenience stores from $2.92 billion to $5.41 billion. These channels indicate a strong consumer reliance on both traditional and digital retailing for accessing ready-to-eat food products.

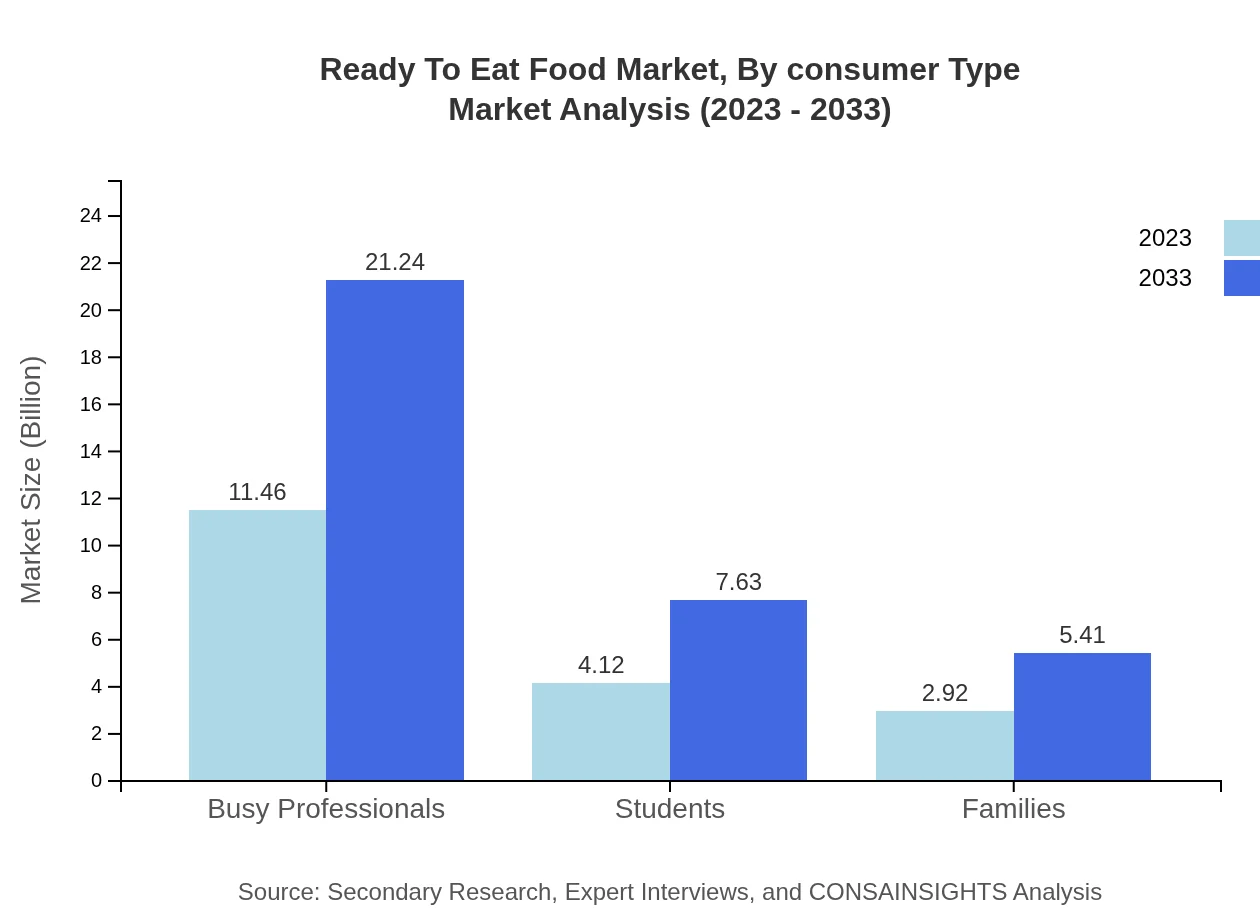

Ready To Eat Food Market Analysis By Consumer Type

Consumer segmentation shows that busy professionals will drive growth, projected to increase from $11.46 billion in 2023 to $21.24 billion by 2033. Students represent a relevant segment as well, increasing from $4.12 billion to $7.63 billion. Families also exhibit a robust segment, with growth forecasted from $2.92 billion to $5.41 billion. This segmentation emphasizes the diverse needs and preferences across demographic groups.

Ready To Eat Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ready To Eat Food Industry

Nestlé S.A.:

A leader in the food and beverage industry, Nestlé offers a wide range of ready-to-eat food products including meals and snacks, focusing on nutrition and quality.Kraft Heinz Company:

Known for its iconic brands, Kraft Heinz excels in the ready-to-eat meals segment with a commitment to innovation and consumer satisfaction.Unilever:

Unilever's diversified portfolio includes a variety of ready-to-eat meal solutions and snacks tailored to meet different consumer tastes and preferences.General Mills, Inc.:

General Mills produces several well-known brands in the ready-to-eat food market, focusing on quick-prepare meals and frozen foods.Conagra Brands, Inc.:

Conagra specializes in meal solutions including frozen and shelf-stable ready-to-eat foods, catering to various consumer needs and lifestyles.We're grateful to work with incredible clients.

FAQs

What is the market size of ready To Eat food?

The global ready-to-eat food market is valued at approximately $18.5 billion in 2023 and is expected to grow at a CAGR of 6.2% through 2033, reflecting increasing consumer demand for convenience in meals.

What are the key market players or companies in this ready To Eat food industry?

The ready-to-eat food industry features major players such as Nestlé, PepsiCo, ConAgra Foods, General Mills, and Kraft Heinz. These companies lead through innovation and product diversity, catering to changing consumer habits.

What are the primary factors driving the growth in the ready To Eat food industry?

Key factors include busy lifestyles, increasing disposable income, demand for convenience, and evolving dietary preferences. As consumers seek quicker meal solutions, ready-to-eat products are becoming a staple.

Which region is the fastest Growing in the ready To Eat food?

The Asia Pacific region is the fastest-growing market for ready-to-eat food, projected to expand from $3.81 billion in 2023 to $7.05 billion by 2033, driven by urbanization and changing consumption patterns.

Does ConsaInsights provide customized market report data for the ready To Eat food industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and requirements, ensuring that clients receive relevant and actionable insights into the ready-to-eat food market.

What deliverables can I expect from this ready To Eat food market research project?

Expect comprehensive deliverables including market size data, growth forecasts, competitive analysis, consumer trends, and segmentation insights, customized to your strategic needs in the ready-to-eat food sector.

What are the market trends of ready To Eat food?

Trends include a rise in meal kits, health-conscious snacks, and single-serve packaging. The market is increasingly influenced by the shift towards online retail and demand for family-sized packaging options.