Real Time Location Systems Market Report

Published Date: 31 January 2026 | Report Code: real-time-location-systems

Real Time Location Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Real Time Location Systems (RTLS) market, detailing its trends, forecasts, and regional insights from 2023 to 2033, along with market sizes and key player profiles.

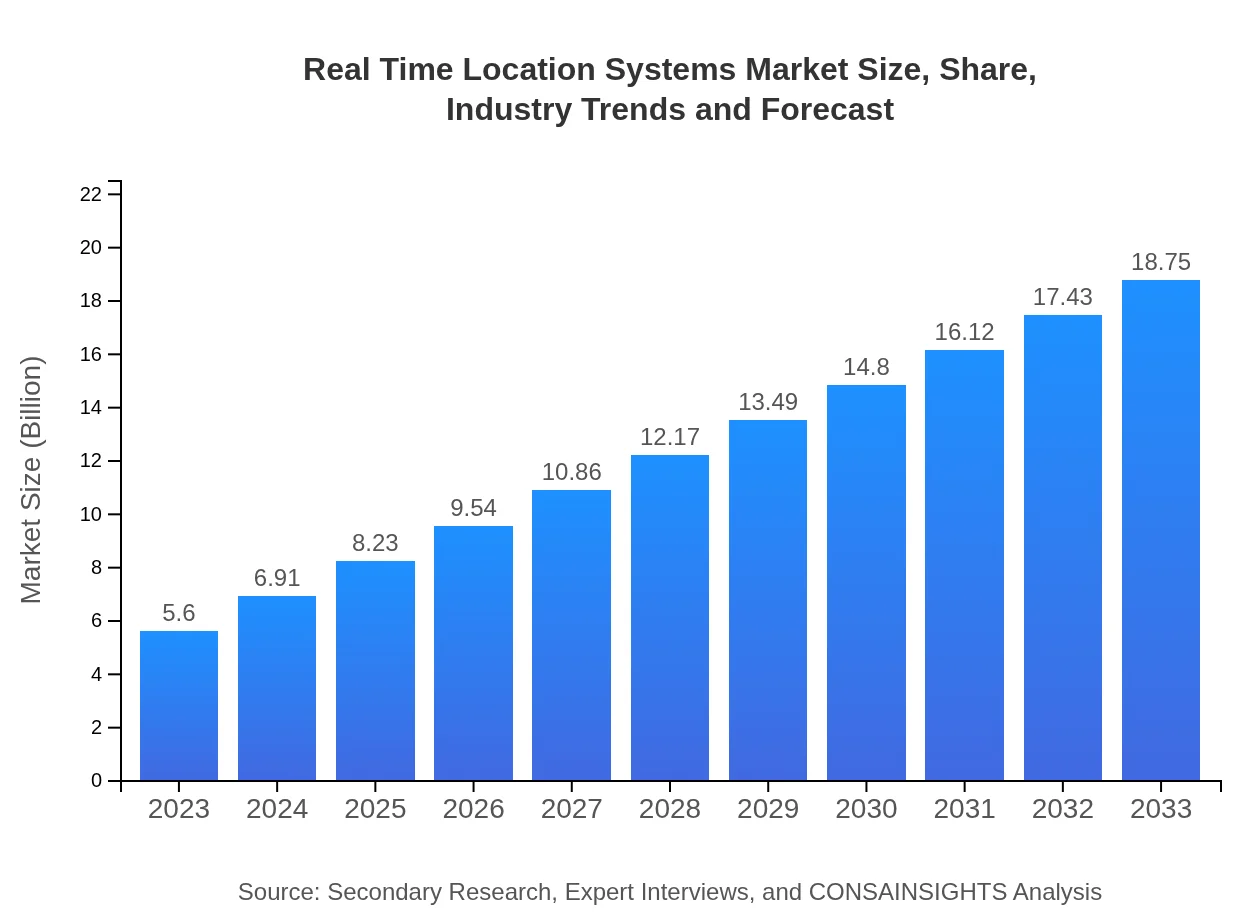

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $18.75 Billion |

| Top Companies | Zebra Technologies, Cisco Systems, Siemens , Intelleflex, Impinj |

| Last Modified Date | 31 January 2026 |

Real Time Location Systems Market Overview

Customize Real Time Location Systems Market Report market research report

- ✔ Get in-depth analysis of Real Time Location Systems market size, growth, and forecasts.

- ✔ Understand Real Time Location Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Real Time Location Systems

What is the Market Size & CAGR of Real Time Location Systems market in 2023?

Real Time Location Systems Industry Analysis

Real Time Location Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Real Time Location Systems Market Analysis Report by Region

Europe Real Time Location Systems Market Report:

Europe's RTLS market is poised for incremental growth, moving from $1.47 billion in 2023 to approximately $4.93 billion by 2033. Key drivers include stringent regulations requiring improved asset management and growing awareness about operational efficiencies. Countries such as Germany and the UK are at the forefront of implementing RTLS technologies.Asia Pacific Real Time Location Systems Market Report:

The Asia-Pacific region represents significant growth potential for the RTLS market. In 2023, the market size is estimated at $1.08 billion, projected to expand to $3.62 billion by 2033, reflecting a growing adoption of RTLS in sectors like healthcare, manufacturing, and logistics. Countries such as China and India are investing heavily in smart technologies and infrastructure, further spurring demand.North America Real Time Location Systems Market Report:

North America, particularly the United States, dominates the RTLS market, with a valuation of $1.96 billion in 2023, projected to grow to $6.57 billion by 2033. The region benefits from advanced technology adoption, robust infrastructure, and high demand in healthcare and retail, contributing significantly to overall market growth.South America Real Time Location Systems Market Report:

In South America, the RTLS market is currently valued at $0.40 billion in 2023, with expectations of increasing to $1.33 billion by 2033. The region's growth is primarily driven by sectors like logistics and education, as organizations seek effective means to enhance tracking and management capabilities amidst urbanization and infrastructural development.Middle East & Africa Real Time Location Systems Market Report:

In the Middle East and Africa, the RTLS market is valued at $0.69 billion in 2023 and is expected to reach $2.30 billion by 2033. The region's growth is supported by increasing investments in healthcare and tourism, pushing industries to adopt RTLS to improve services and operational efficiencies.Tell us your focus area and get a customized research report.

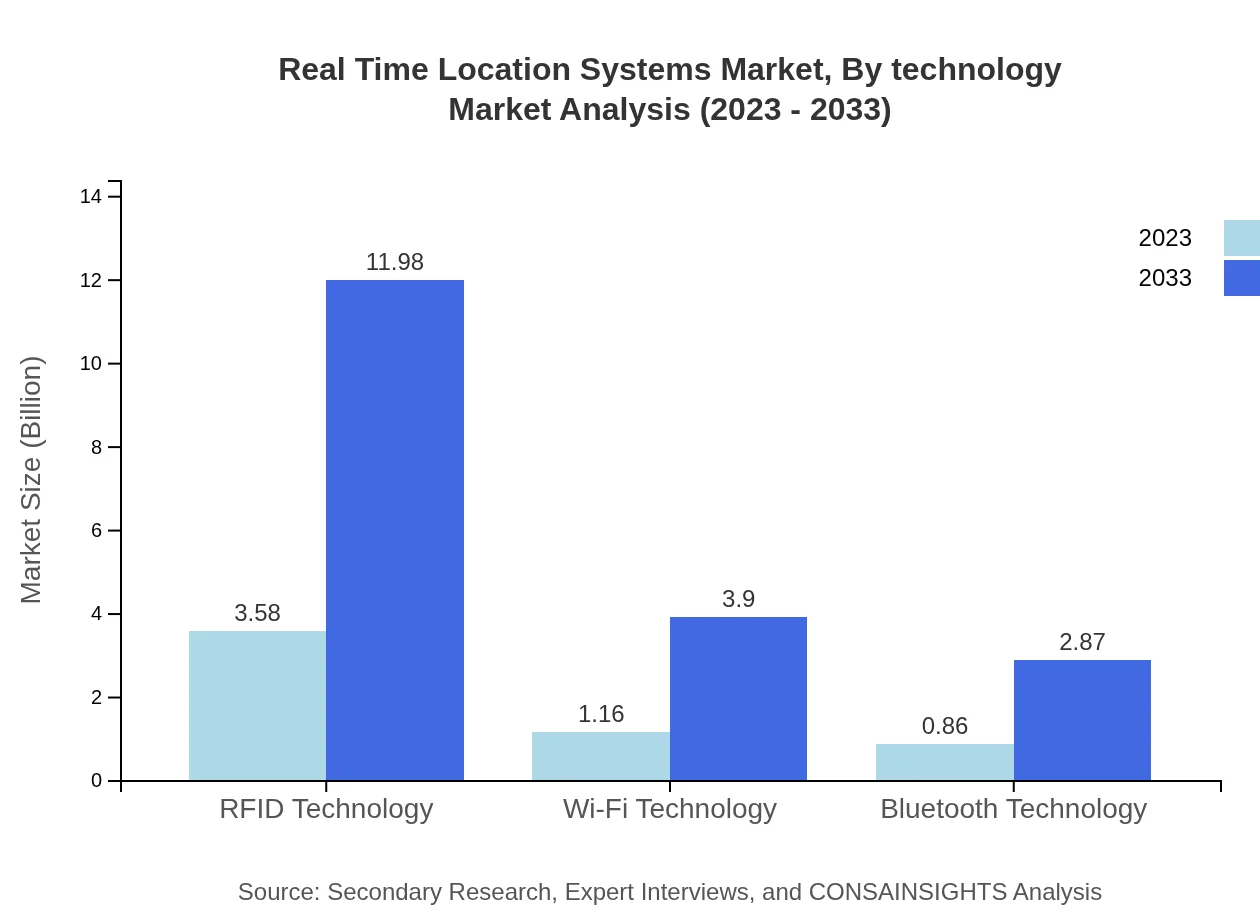

Real Time Location Systems Market Analysis By Technology

The technology segment of the RTLS market highlights a clear preference for RFID technology, which accounted for $3.58 billion in 2023 and is projected to grow to $11.98 billion by 2033. Other technologies like Wi-Fi and Bluetooth are also relevant, with Wi-Fi technology generating $1.16 billion in 2023 and expected to reach $3.90 billion by 2033. The steady growth of RFID is attributed to its efficacy in asset tracking, while Wi-Fi and Bluetooth provide complementary solutions in various applications.

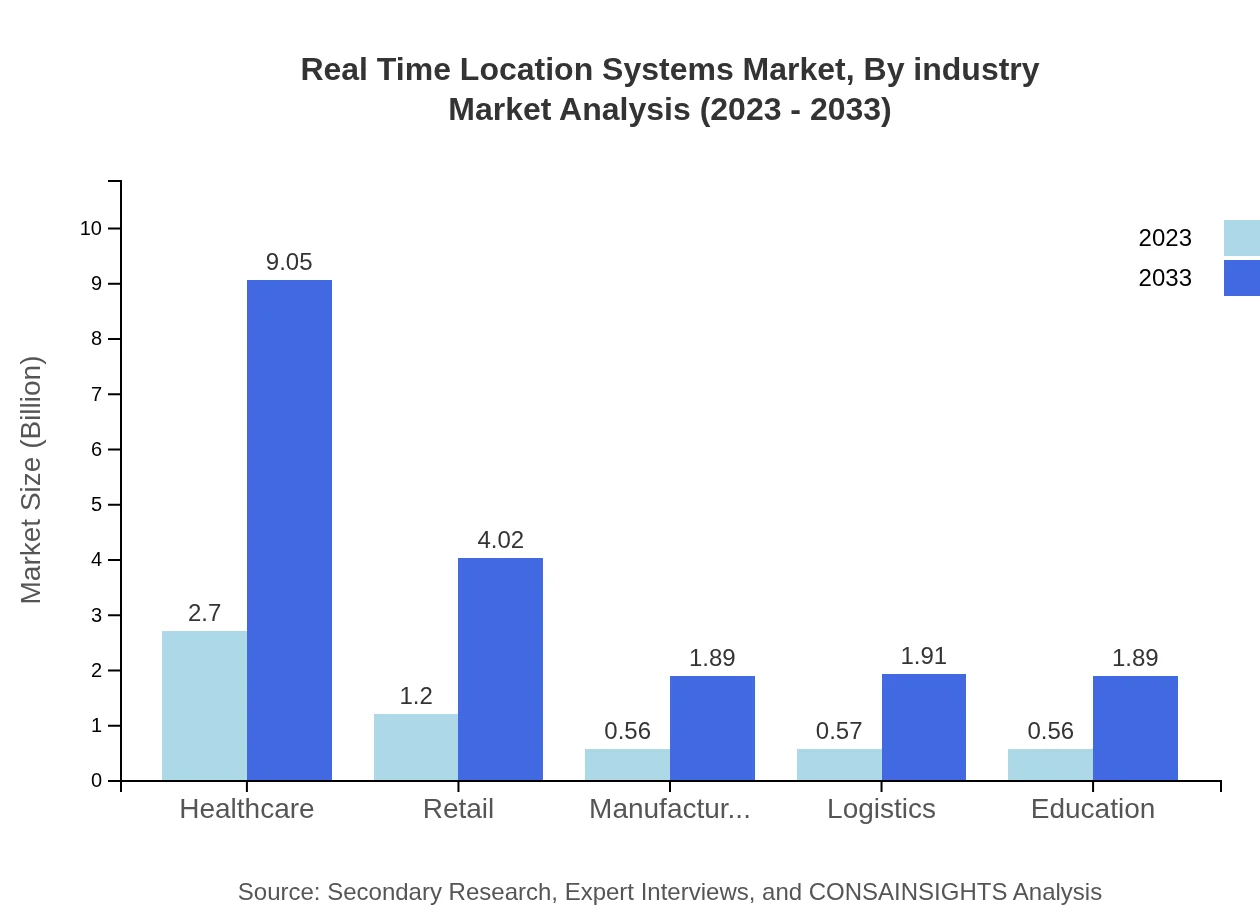

Real Time Location Systems Market Analysis By Industry

The RTLS market by industry reveals significant involvement from the commercial sector, expected to see market size grow from $2.70 billion in 2023 to $9.05 billion by 2033. Following closely are healthcare, logistics, and manufacturing, each demonstrating strong growth metrics. The healthcare segment, valued at $2.70 billion in 2023, underscores the importance of RTLS for patient and asset management, with projections of reaching $9.05 billion by 2033.

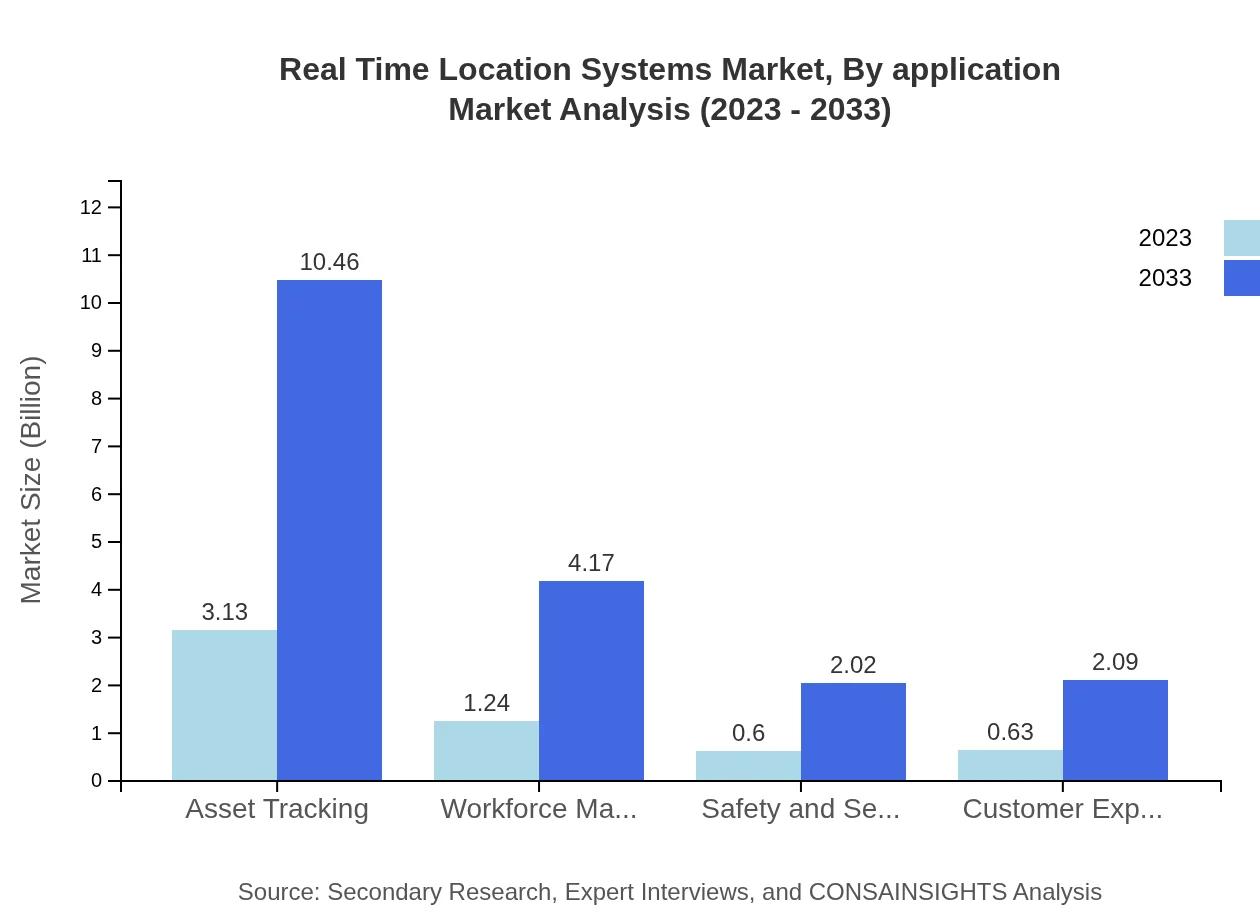

Real Time Location Systems Market Analysis By Application

When categorized by application, asset tracking takes a lead with a market share of $3.13 billion in 2023, projected to expand to $10.46 billion by 2033. Safety and security applications are also significant, with an increase from $0.60 billion in 2023 to $2.02 billion by 2033, driven by heightened security needs in various sectors.

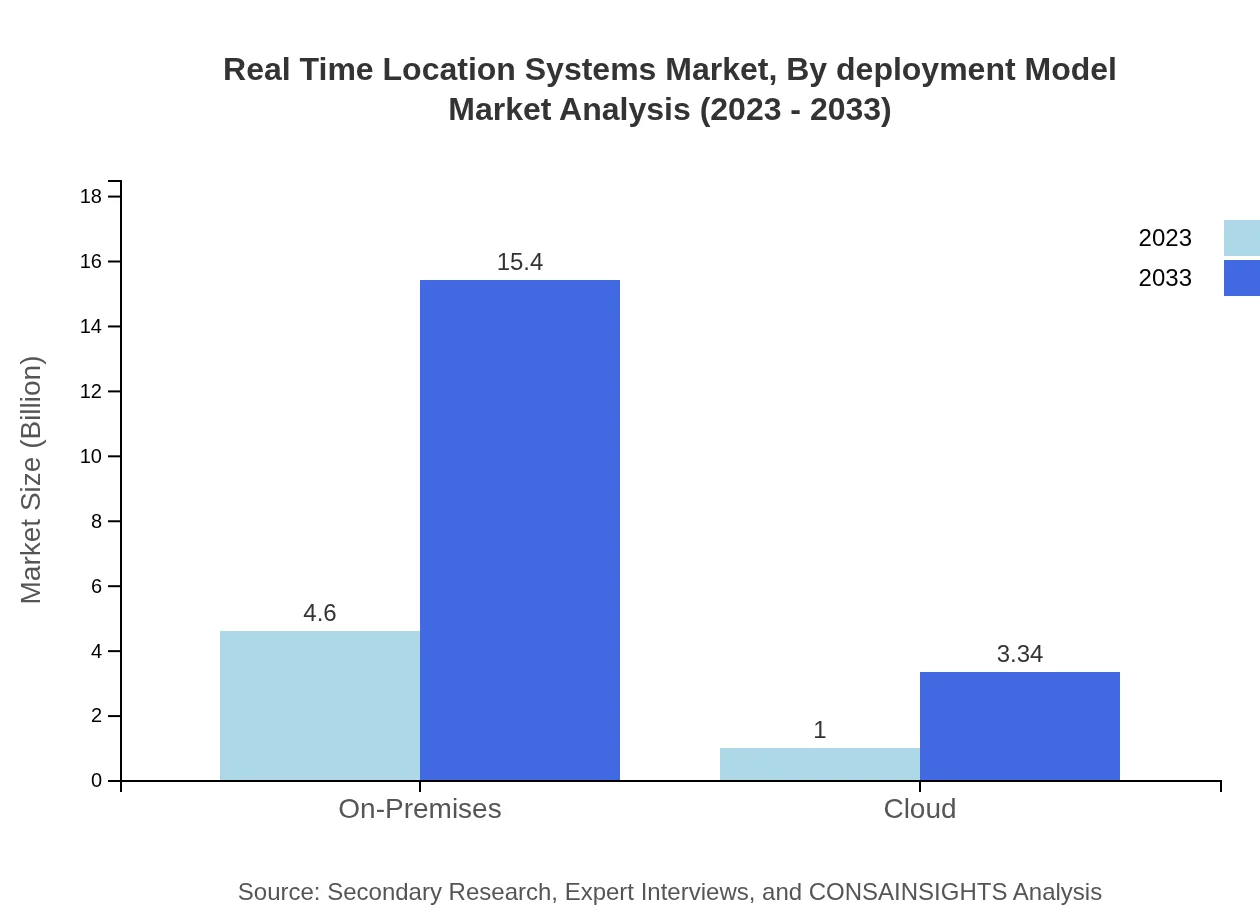

Real Time Location Systems Market Analysis By Deployment Model

The on-premises deployment model captures a large share of the RTLS market, valued at $4.60 billion in 2023 and set to grow to $15.40 billion by 2033. This model is preferred for industries requiring complete control over their systems. Cloud deployments, however, are gaining traction, with market figures increasing from $1.00 billion to $3.34 billion within the same timeframe.

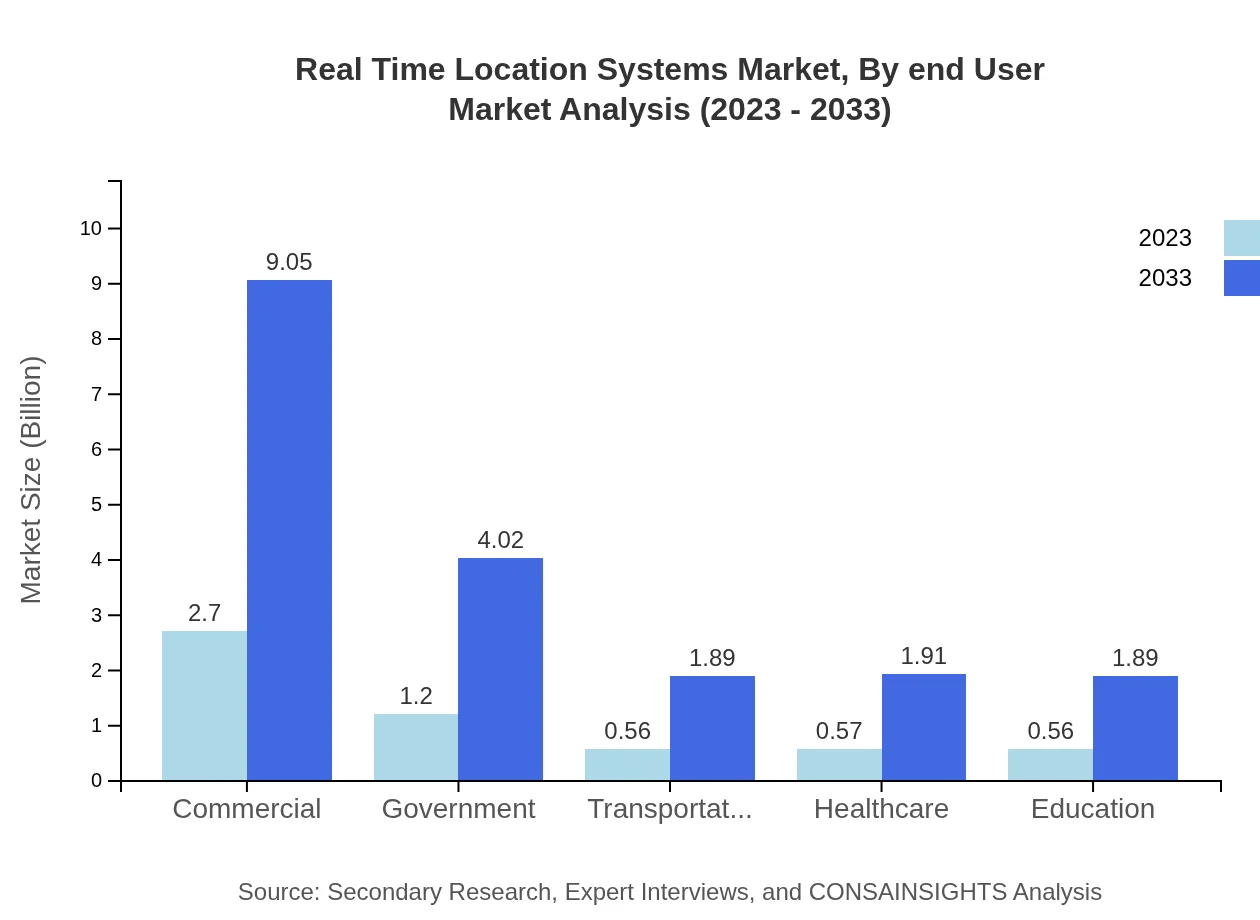

Real Time Location Systems Market Analysis By End User

The market serves diverse end-users, with retail showing significant growth from $1.20 billion in 2023 to $4.02 billion by 2033. The government sector is also prominent, shifting from $1.20 billion to $4.02 billion, reflecting the increasing adoption of technology for public services and asset management.

Real Time Location Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Real Time Location Systems Industry

Zebra Technologies:

A leader in asset tracking solutions and operational visibility, Zebra Technologies offers advanced RTLS solutions tailored for healthcare, retail, and logistics sectors.Cisco Systems:

Cisco is at the forefront of RTLS technology with a portfolio that integrates RFID and Wi-Fi solutions, enabling organizations to enhance visibility and management of assets.Siemens :

Siemens provides comprehensive RTLS solutions utilizing IoT technology, particularly focused on manufacturing efficiency and healthcare management.Intelleflex:

Specializes in active RFID technologies for real-time tracking and monitoring solutions primarily in the healthcare and logistics sectors.Impinj:

Impinj focuses on RFID technology solutions that enhance inventory management and streamline supply chains for various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of real Time Location Systems?

The global real-time location systems market was valued at $5.6 billion in 2023 and is projected to grow with a CAGR of 12.3% to reach significantly higher figures by 2033. This indicates a robust rise in demand for RTLS solutions.

What are the key market players or companies in the real Time Location Systems industry?

Key players in the real-time location systems industry include major technology firms and innovators specializing in asset tracking, workforce management, and safety solutions. These companies drive growth through advancements in RFID, Wi-Fi, and Bluetooth technologies.

What are the primary factors driving the growth in the real Time Location Systems industry?

The growth of the real-time location systems industry is primarily driven by increasing demand for asset tracking, the need for optimizing operational efficiency, advancements in cloud computing, and an upsurge in IoT devices enhancing location accuracy across various sectors.

Which region is the fastest Growing in the real Time Location Systems?

As projected, North America emerges as the fastest-growing region in the real-time location systems market, with a market size of $6.57 billion by 2033, up from $1.96 billion in 2023, indicating strong growth potential and technological adoption in this region.

Does ConsaInsights provide customized market report data for the real Time Location Systems industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the real-time location systems industry. This includes detailed analysis, market trends, and segmentation, catering to client-specific information and insights.

What deliverables can I expect from this real Time Location Systems market research project?

Deliverables from the real-time location systems market research project include comprehensive reports, market size estimates, growth forecasts, competitive landscape analysis, and customized insights that assist decision-making processes.

What are the market trends of real Time Location Systems?

Current market trends in real-time location systems point towards increased adoption of RFID and cloud solutions, significant investments in IoT, and a focus on enhancing user experiences through advanced asset tracking and workforce management capabilities.