Real Time Payment

Published Date: 31 January 2026 | Report Code: real-time-payment

Real Time Payment Market Size, Share, Industry Trends and Forecast to 2033

This report covers insights into the Real Time Payment market, exploring trends, growth forecasts from 2023 to 2033, and various factors shaping the industry landscape.

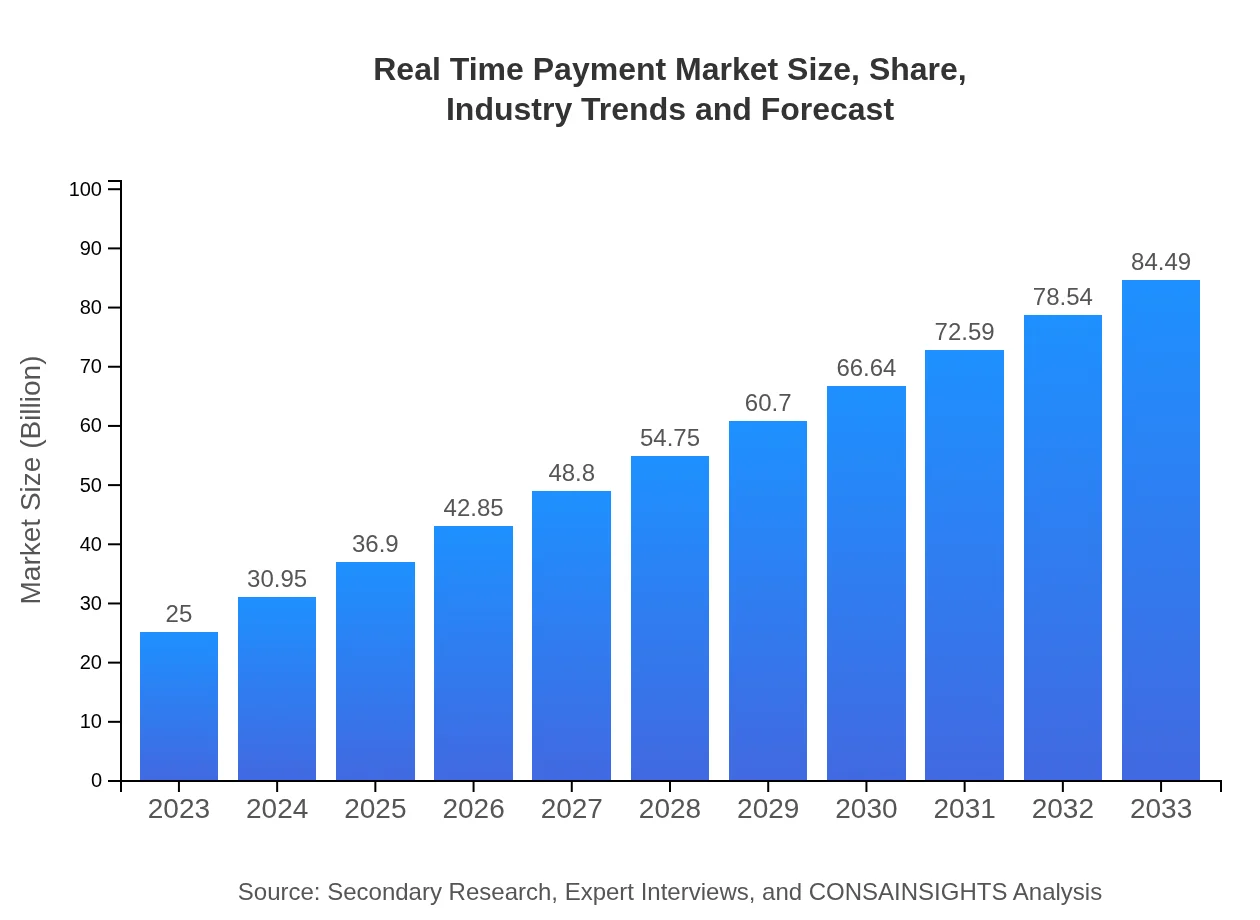

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 12.4% |

| 2033 Market Size | $84.49 Billion |

| Top Companies | PayPal Holdings, Inc., Visa Inc., Mastercard Incorporated, Square, Inc. |

| Last Modified Date | 31 January 2026 |

Real Time Payment Market Overview

Customize Real Time Payment market research report

- ✔ Get in-depth analysis of Real Time Payment market size, growth, and forecasts.

- ✔ Understand Real Time Payment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Real Time Payment

What is the Market Size & CAGR of Real Time Payment market in 2023?

Real Time Payment Industry Analysis

Real Time Payment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Real Time Payment Market Analysis Report by Region

Europe Real Time Payment:

Europe is anticipated to increase from $7.81 billion in 2023 to $26.40 billion in 2033, powered by technological advancements and strict regulations aimed at optimizing cross-border transaction processes. The European Union's regulatory framework promotes integration and innovation in payment solutions.Asia Pacific Real Time Payment:

In the Asia Pacific region, the Real Time Payment market is projected to grow from $4.92 billion in 2023 to $16.64 billion by 2033. This growth is backed by rapid digital adoption and an expanding middle-class population. Countries like China and India are leading in the adoption of RTP systems due to government initiatives promoting cashless transactions.North America Real Time Payment:

The North American Real Time Payment market is estimated at $8.33 billion in 2023, with a rise to approximately $28.14 billion by 2033. This robust growth is attributed to mature financial services, high consumer trust in digital transactions, and widespread adoption of mobile banking applications.South America Real Time Payment:

The South American market, starting at $1.98 billion in 2023 and expected to grow to $6.69 billion by 2033, reflects how fast-tracking digital payment infrastructure can enhance economic efficiencies. Brazil and Argentina are at the forefront, driven by their expansive fintech ecosystems.Middle East & Africa Real Time Payment:

In the Middle East and Africa, the market is estimated at $1.96 billion in 2023, expected to grow to $6.62 billion by 2033. The expansion is largely driven by the adoption of mobile payment solutions and increasing investment in payment technologies, particularly in urbanized and developing areas.Tell us your focus area and get a customized research report.

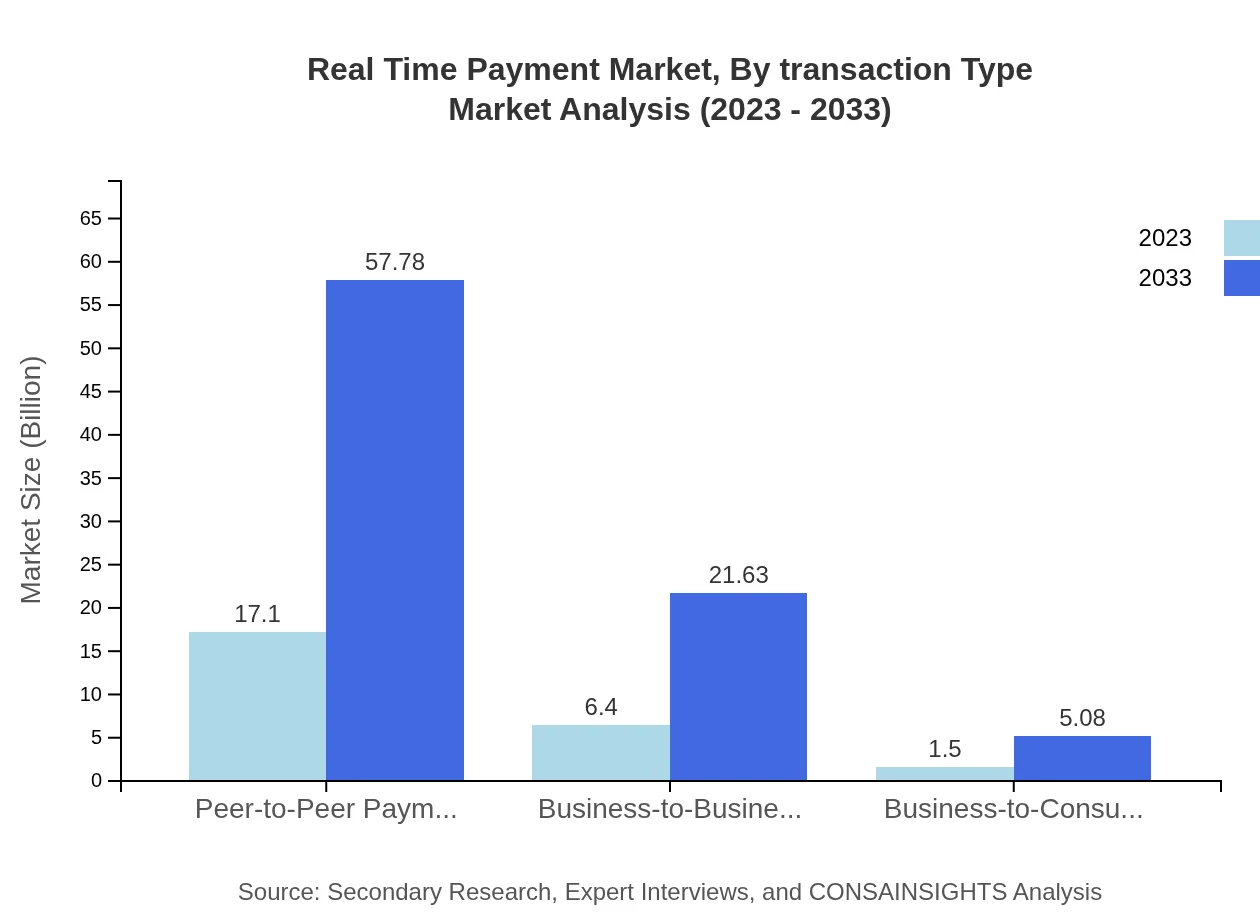

Real Time Payment Market Analysis By Transaction Type

The Real-Time Payment Market is predominantly driven by person-to-person (P2P) payments, contributing a significant portion to the growth trajectory. In 2023, P2P payments accounted for substantial market share, with expectations of continued dominance as social distancing measures have amplified the demand for contactless payment options.

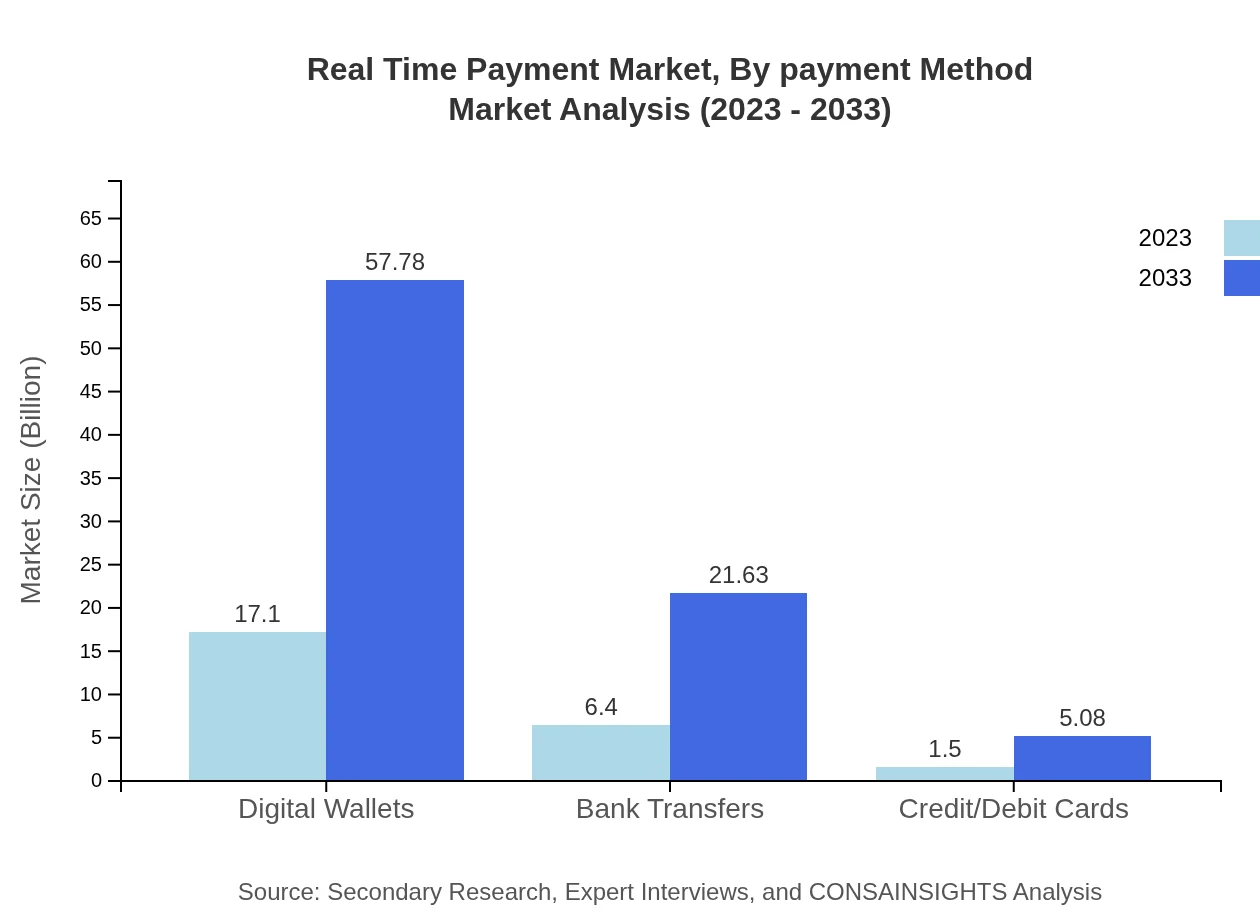

Real Time Payment Market Analysis By Payment Method

Digital wallets are the leading payment method, boasting 68.39% market share in 2023, expected to maintain the same percentage by 2033. Other methods such as bank transfers and peer-to-peer payments are also experiencing growth, driven by enhanced security and convenience.

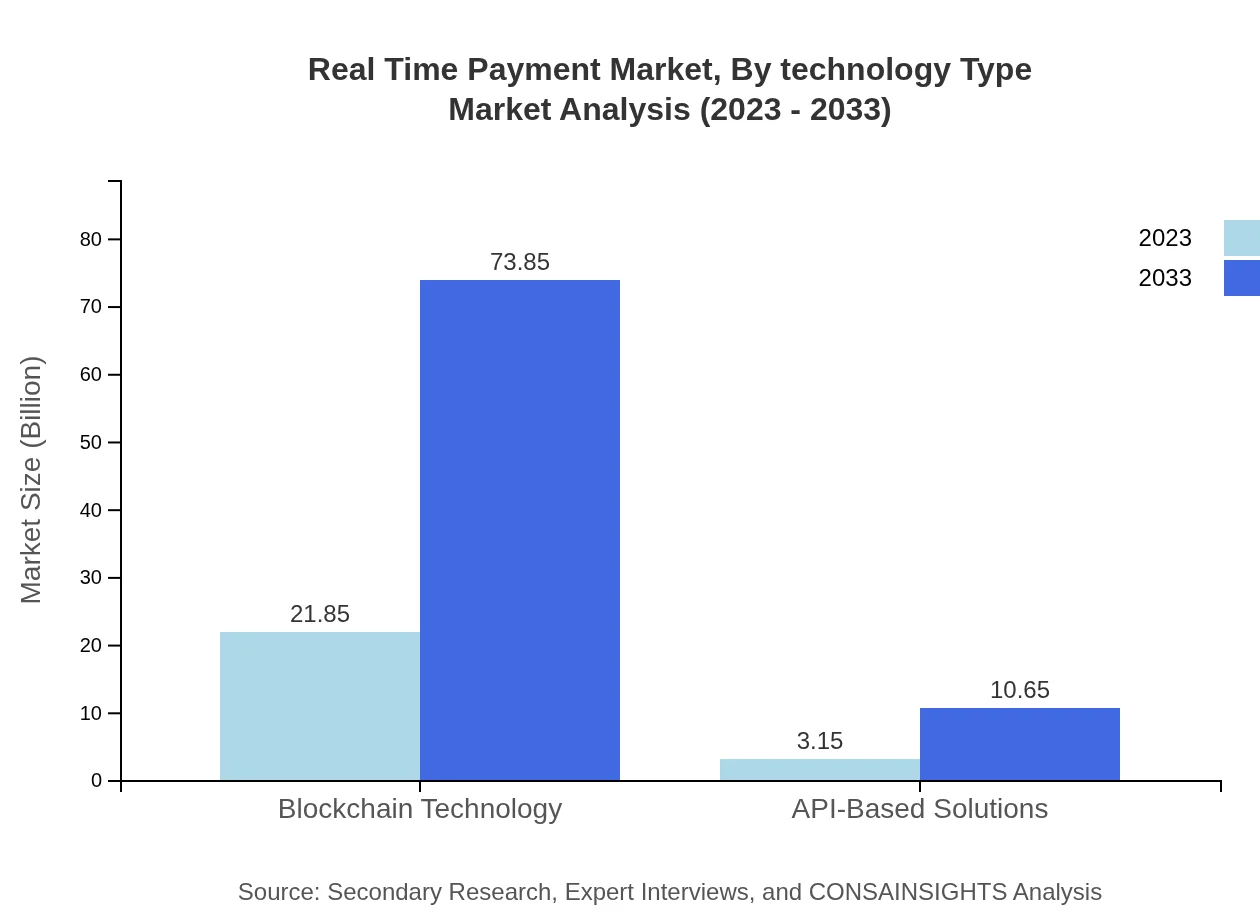

Real Time Payment Market Analysis By Technology Type

Technologies such as blockchain and API-based solutions are pivotal in shaping the Real-Time Payment market. Blockchain technology alone accounted for $21.85 billion in 2023, with projections indicating strong demand driven by its security and transparency.

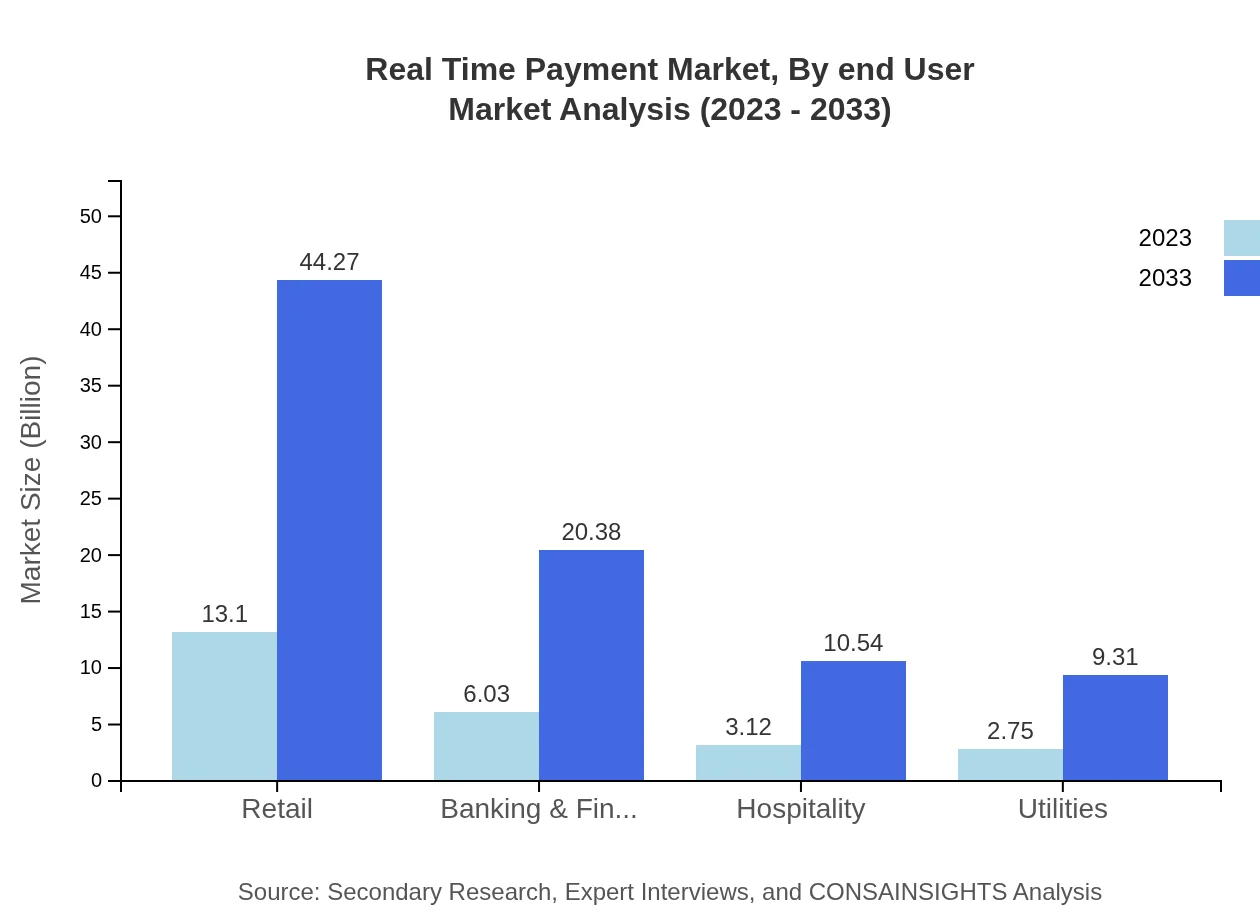

Real Time Payment Market Analysis By End User

Retail remains the leading end-user industry for Real-Time Payments, constituting a significant percentage of total market share. Banking and financial services are also major contributors, as these sectors continue to adopt real-time solutions to improve transaction speeds and customer satisfaction.

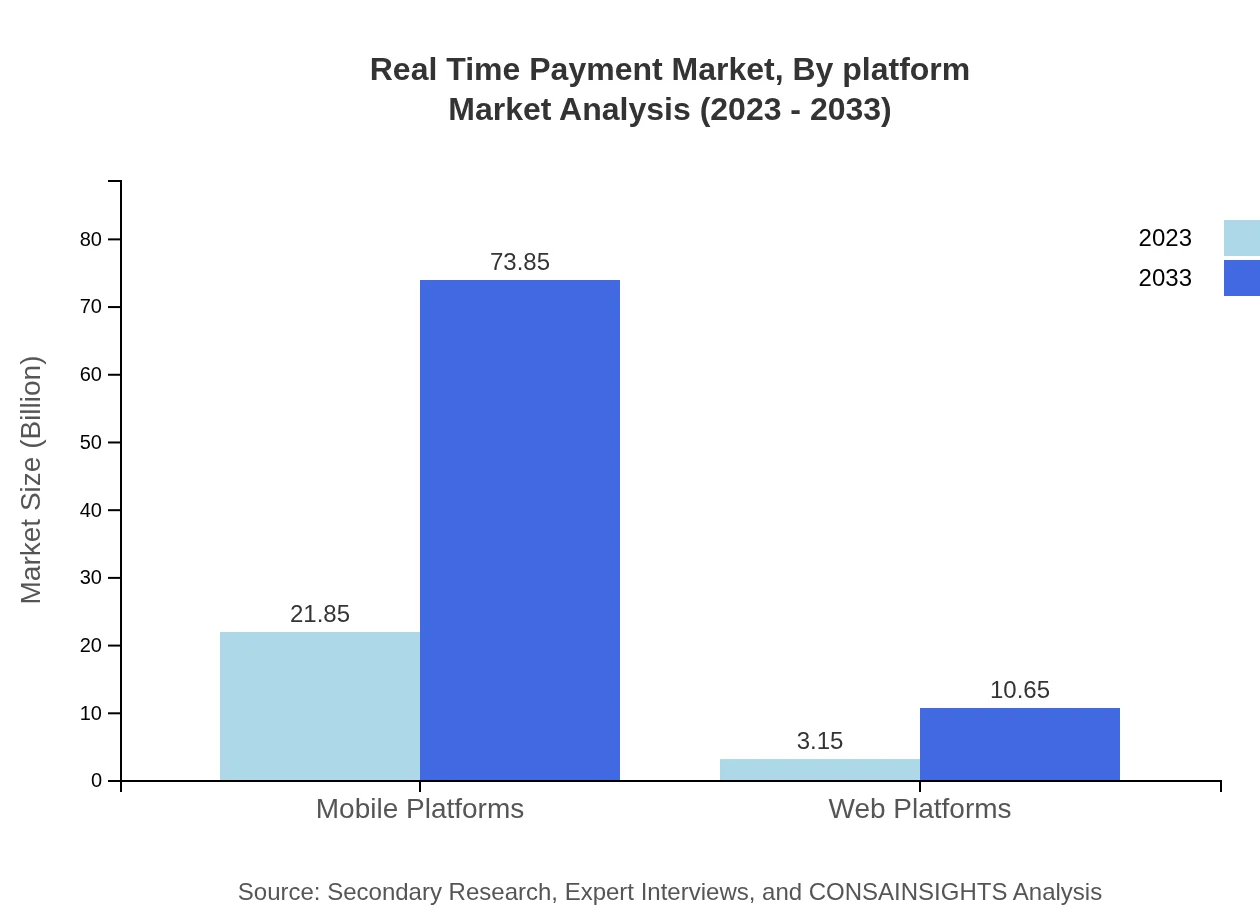

Real Time Payment Market Analysis By Platform

Mobile platforms dominate the RTP market, with a staggering share of 87.4% in 2023. As consumers increasingly prefer mobile solutions for transactions, this trend is likely to continue, prompting financial institutions to optimize mobile platforms for enhanced user experiences.

Real Time Payment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Real Time Payment Industry

PayPal Holdings, Inc.:

A global leader in digital payments, PayPal offers various payment solutions, including real-time payment processing for online retailers and consumers, facilitating seamless transactions across borders.Visa Inc.:

Known for its extensive payment network, Visa has integrated real-time payment functionalities into its card services, providing businesses with instant settlement mechanisms.Mastercard Incorporated:

Mastercard enables real-time payments through its global network, supporting both consumers and businesses with instant payment solutions crucial for a rapidly evolving financial landscape.Square, Inc.:

Square offers innovative payment solutions, including real-time payment capabilities for small businesses via its point-of-sale technology and Cash App.We're grateful to work with incredible clients.

FAQs

What is the market size of real Time Payment?

The real-time payment market is currently valued at $25 billion with a remarkable Compound Annual Growth Rate (CAGR) of 12.4%. This growth is driven by increased demand for instantaneous transactions across various sectors.

What are the key market players or companies in the real Time Payment industry?

Key players in the real-time payment industry include established banks, fintech companies, and digital wallet providers. Major companies include PayPal, Square, and various payment processing platforms that are innovating to enhance consumer experiences.

What are the primary factors driving the growth in the real Time payment industry?

Growth in the real-time payment industry is driven by increasing smartphone penetration, growing e-commerce transactions, and consumer demand for immediate payment solutions. Additionally, advancements in regulatory frameworks are facilitating this growth.

Which region is the fastest Growing in the real Time payment market?

North America currently leads in the real-time payment market growth, projected to increase from $8.33 billion in 2023 to $28.14 billion by 2033, showcasing significant regional investment and consumer adoption.

Does ConsaInsights provide customized market report data for the real Time payment industry?

Yes, ConsaInsights offers tailored market reports for the real-time payment industry, enabling clients to receive specific data aligned with their strategic objectives and market interests, ensuring a comprehensive analysis.

What deliverables can I expect from this real Time payment market research project?

From this project, clients can expect detailed market analysis, segmented data by region and type, forecasts, trends, and competitive landscape insights to inform strategic decisions and investments in the real-time payment sector.

What are the market trends of real Time payment?

Current trends in the real-time payment market include the rise of digital wallets, mobile payments, and blockchain technology integration. There is also an emphasis on API-based solutions and peer-to-peer payments, reflecting shifting consumer behaviors.