Real Time Payments Market Report

Published Date: 31 January 2026 | Report Code: real-time-payments

Real Time Payments Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Real Time Payments market, offering insights into current trends, market size projections, and future growth from 2023 to 2033. The report includes detailed regional and technological analyses, segmentation, and key players shaping the market landscape.

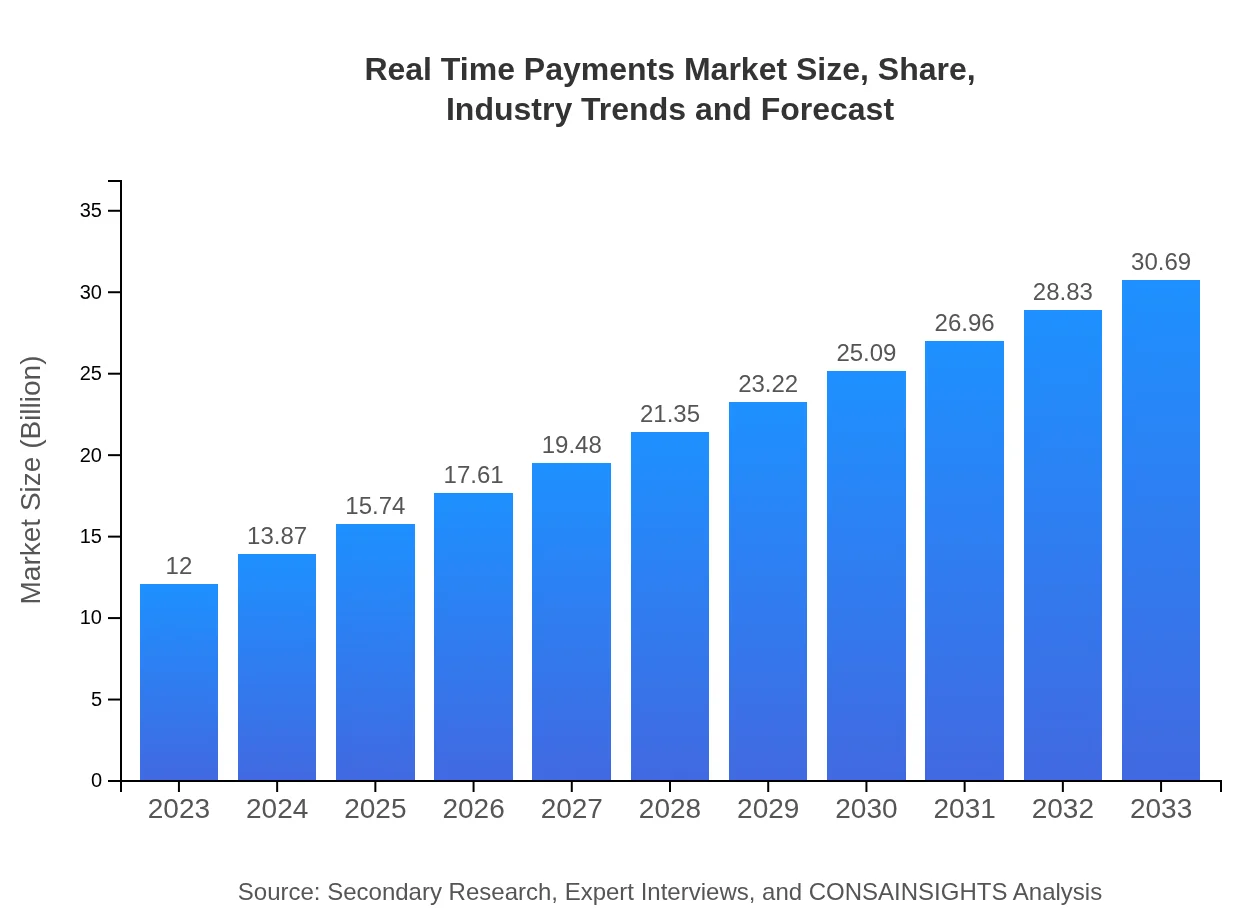

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Visa Inc., Mastercard, PayPal Holdings Inc., Square, Inc., Nium |

| Last Modified Date | 31 January 2026 |

Real Time Payments Market Overview

Customize Real Time Payments Market Report market research report

- ✔ Get in-depth analysis of Real Time Payments market size, growth, and forecasts.

- ✔ Understand Real Time Payments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Real Time Payments

What is the Market Size & CAGR of Real Time Payments market in 2023?

Real Time Payments Industry Analysis

Real Time Payments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Real Time Payments Market Analysis Report by Region

Europe Real Time Payments Market Report:

Europe presents a prominent RTP market, where it is projected to grow from $3.70 billion in 2023 to approximately $9.45 billion by 2033. The European Union's initiatives to enhance transaction speed and security have encouraged widespread RTP adoption, with countries like Sweden and Germany leading the way in embedded payment solutions.Asia Pacific Real Time Payments Market Report:

In 2023, the Real Time Payments market in Asia Pacific is valued at $2.25 billion, projected to grow to $5.75 billion by 2033. Countries like China and India are at the forefront, with rapid digital payments adoption due to their large unbanked populations and increasing smartphone penetration. Local governments are actively promoting digital payment infrastructures, contributing to market growth.North America Real Time Payments Market Report:

North America, holding a significant share in the RTP market valued at $4.27 billion in 2023, is expected to reach $10.92 billion by 2033. The region is characterized by advanced banking technologies, well-established regulatory frameworks, and a high adoption rate of payment innovations, particularly driven by consumer demand for immediate payment solutions.South America Real Time Payments Market Report:

In South America, the RTP market is relatively nascent but is expected to see significant progress, rising from $0.14 billion in 2023 to $0.37 billion by 2033. Brazil and Argentina are leading the charge, supported by national financial technology reforms and the integration of digital payment systems, enhancing transactional speed and accessibility.Middle East & Africa Real Time Payments Market Report:

The Middle East and Africa region is anticipated to experience substantial growth in the RTP market, increasing from $1.65 billion in 2023 to $4.21 billion by 2033. Expanding digital infrastructures and mobile payment solutions, especially in the Gulf Cooperation Council (GCC) countries, are driving market growth, alongside governmental initiatives to reduce reliance on cash.Tell us your focus area and get a customized research report.

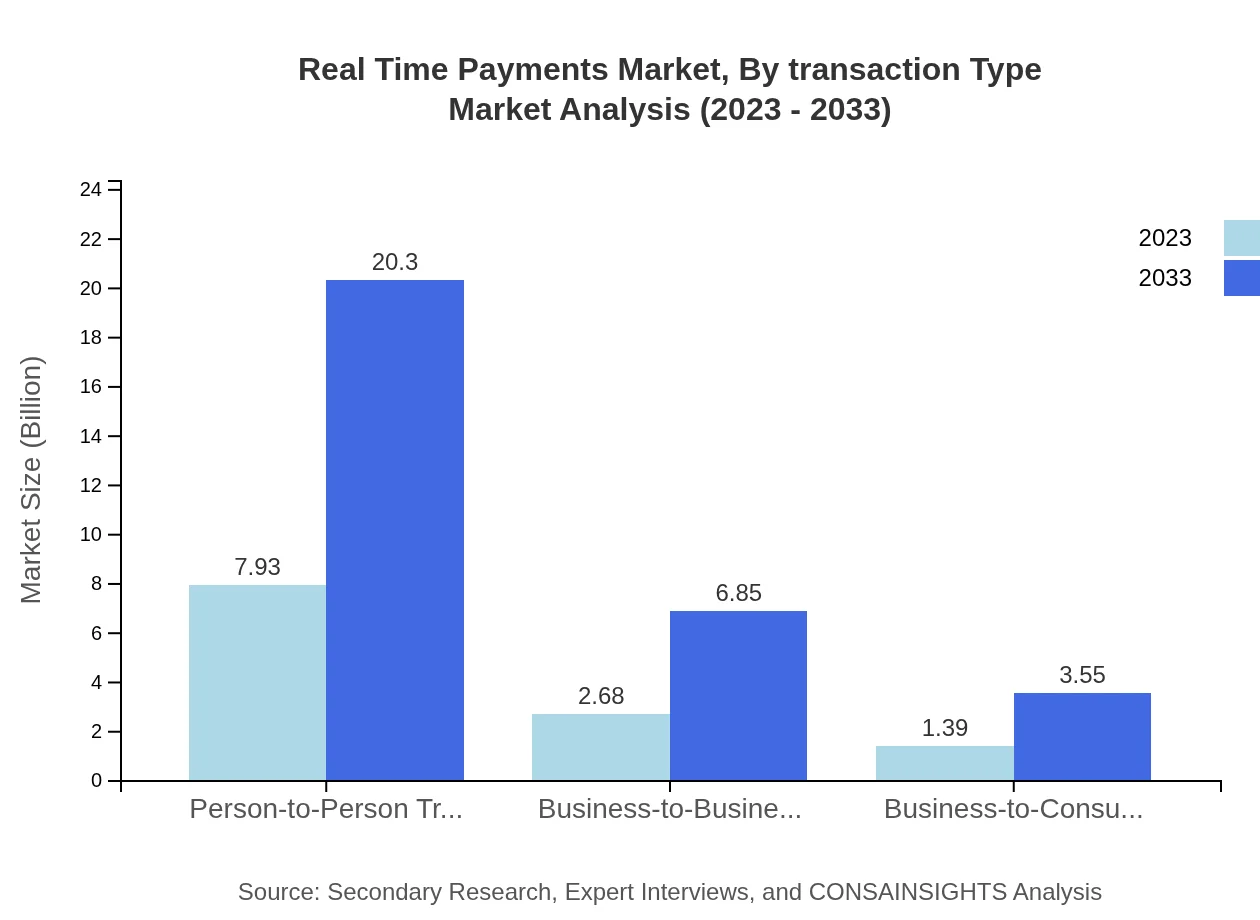

Real Time Payments Market Analysis By Transaction Type

Person-to-Person (P2P) transactions dominate the Real Time Payments market with a projected size of $7.93 billion in 2023, reaching $20.30 billion by 2033. Conversely, Business-to-Business (B2B) payments are expected to grow from $2.68 billion to $6.85 billion in the same period, indicating a thriving interest from enterprises in optimizing payment efficiency and enhancing cash flow management.

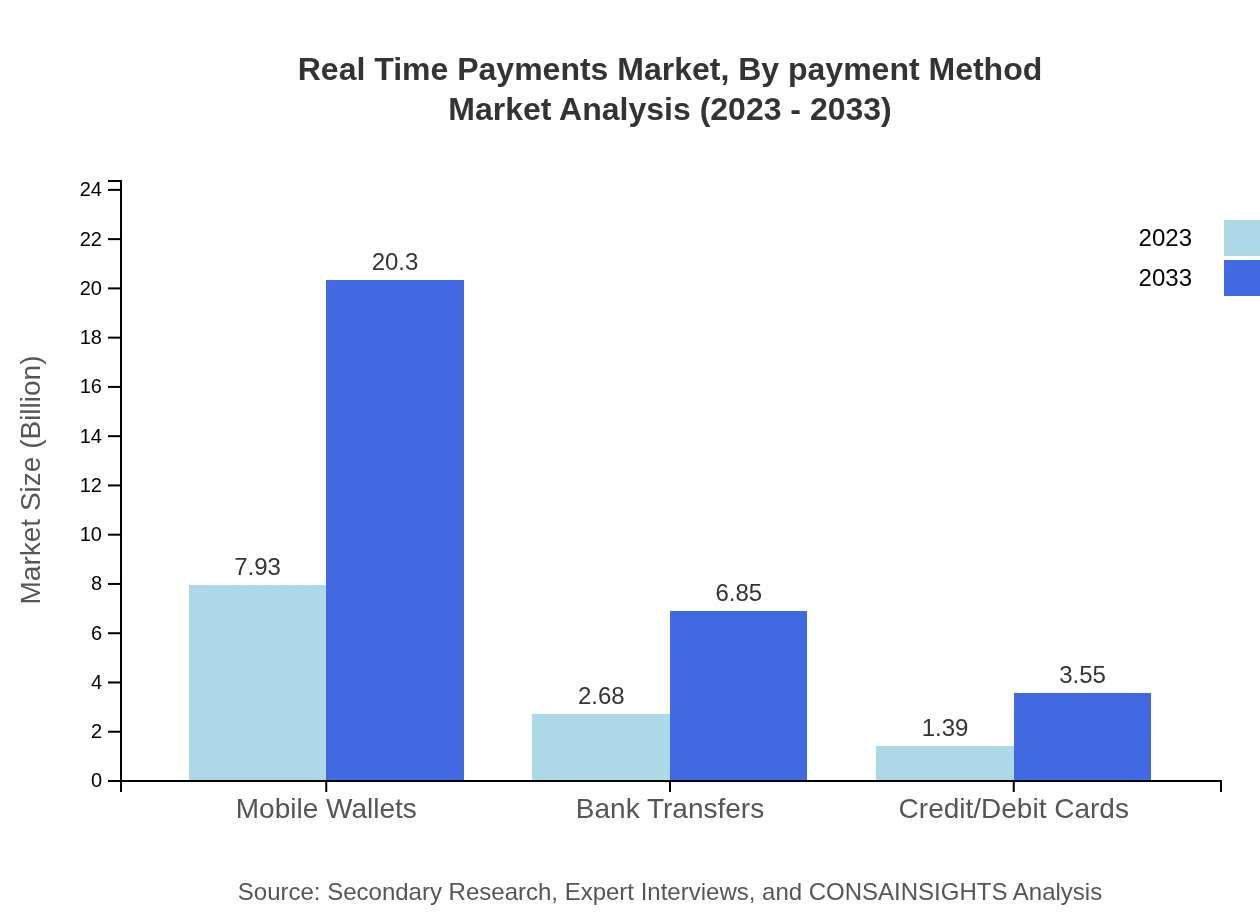

Real Time Payments Market Analysis By Payment Method

Mobile Wallets are the leading payment method in 2023 at $7.93 billion, slated to grow to $20.30 billion by 2033, emphasizing consumer preferences for convenient mobile solutions. Bank Transfers and Credit/Debit Cards add significant value, with respective market sizes expected to increase from $2.68 billion to $6.85 billion and $1.39 billion to $3.55 billion, showcasing traditional methods still retaining relevance.

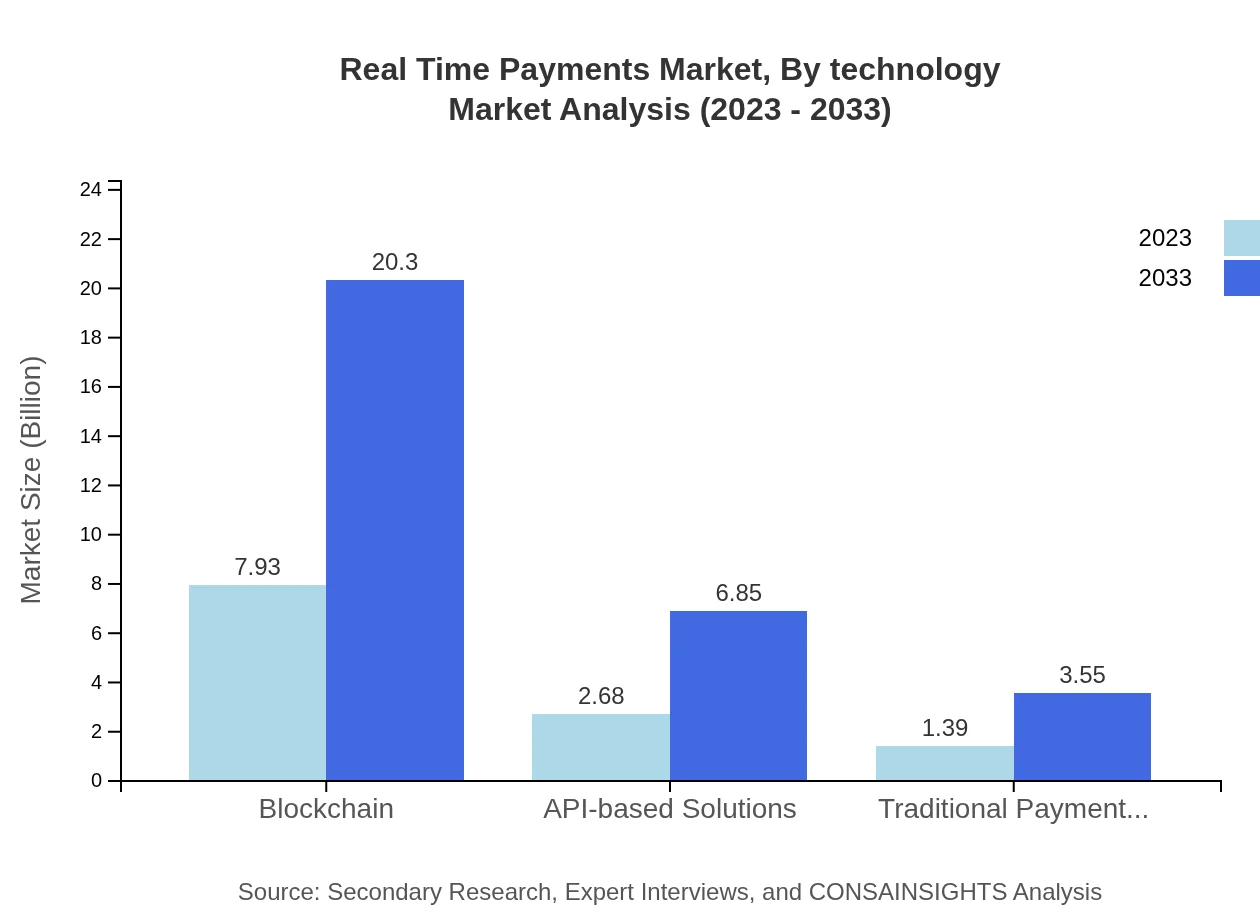

Real Time Payments Market Analysis By Technology

Technologically, Blockchain is emerging as a powerhouse in the RTP market, projected to grow from $7.93 billion in 2023 to $20.30 billion by 2033. API-based solutions facilitate interoperability and efficiency with expected growth from $2.68 billion to $6.85 billion. Traditional payment networks, while significant, are showing slower growth, highlighting a shift towards innovative technological frameworks.

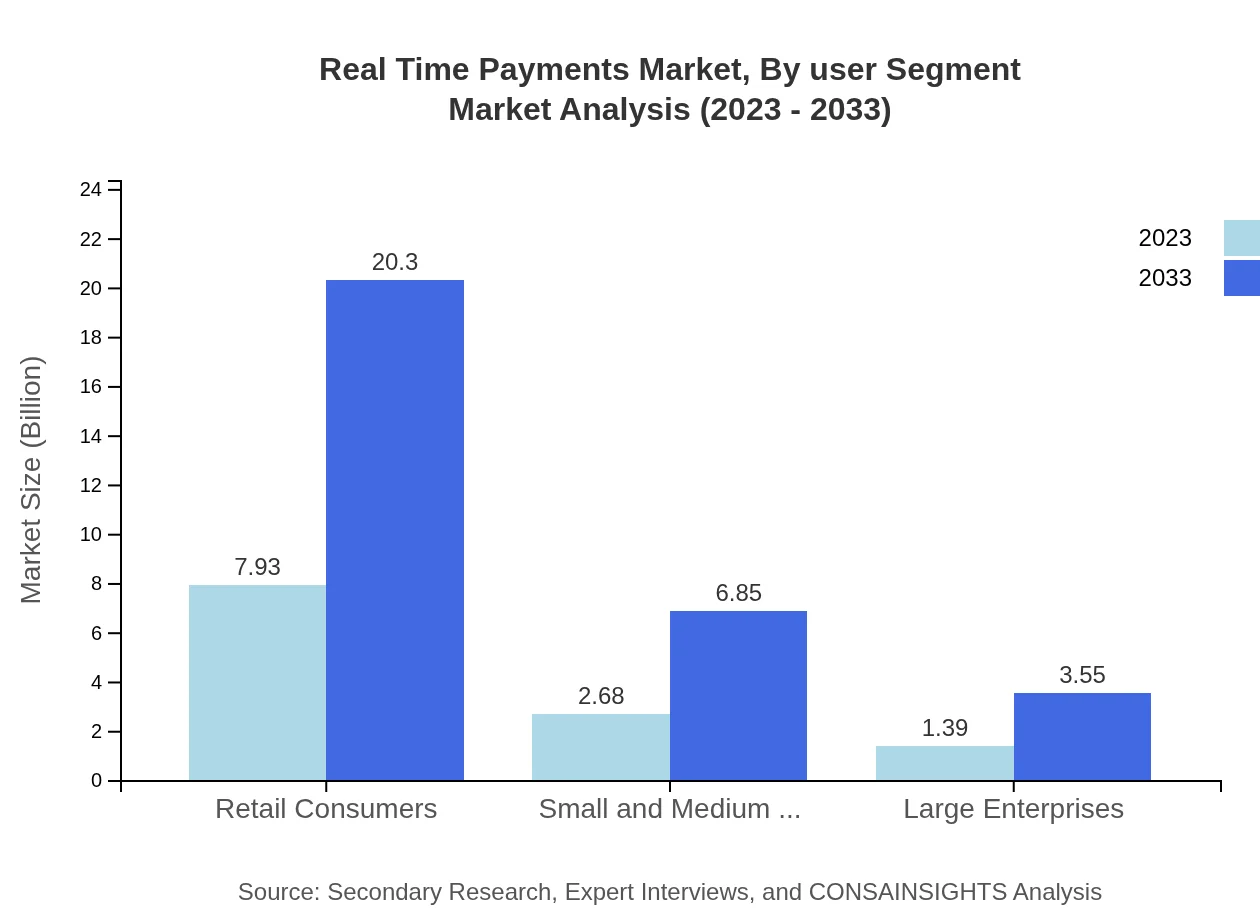

Real Time Payments Market Analysis By User Segment

The segment of Retail Consumers dominates the Real Time Payments market, with a size of $7.93 billion in 2023 expanding to $20.30 billion by 2033, reflecting high engagement in digital payment platforms. Small and Medium Businesses (SMBs) and Large Enterprises are also fast adopters, with respective sizes growing from $2.68 billion to $6.85 billion and $1.39 billion to $3.55 billion, indicating the industry's broad applicability.

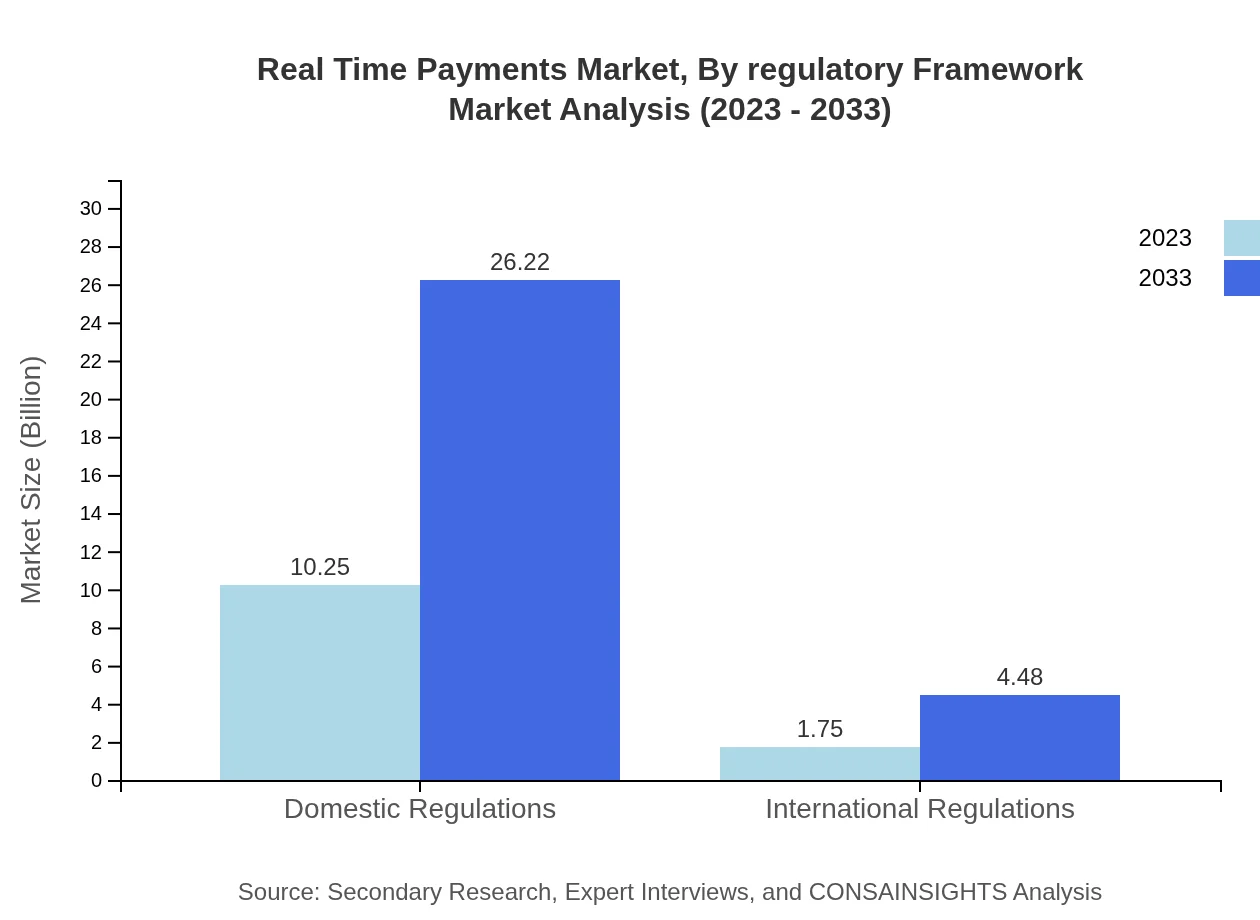

Real Time Payments Market Analysis By Regulatory Framework

The Real Time Payments market is heavily influenced by regulatory frameworks across different jurisdictions. Domestic Regulations are projected to remain dominant, increasing from $10.25 billion in 2023 to $26.22 billion by 2033, while International Regulations show steady growth from $1.75 billion to $4.48 billion. This indicates that compliance and regulatory development will significantly shape RTP growth trajectories.

Real Time Payments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Real Time Payments Industry

Visa Inc.:

Visa is a global leader in digital payments, providing fast and secure RTP solutions, enhancing customer experiences across various platforms.Mastercard:

Mastercard offers cutting-edge real-time payment services, focusing on technological innovations and enabling seamless transactions across borders.PayPal Holdings Inc.:

PayPal revolutionizes digital payments, providing real-time Money Transfer solutions supported by a diverse ecosystem of e-commerce services.Square, Inc.:

Square integrates RTP capabilities into its user-friendly platforms for businesses, allowing instant transactions and high customer satisfaction.Nium:

Nium specializes in providing innovative real-time payment solutions for businesses globally, offering seamless cross-border transactions and customization.We're grateful to work with incredible clients.

FAQs

What is the market size of real Time Payments?

The real-time payments market is projected to reach $12 billion by 2033, growing at a CAGR of 9.5% from its current valuation. This growth indicates a robust demand for immediate and efficient payment solutions globally.

What are the key market players or companies in the real Time Payments industry?

Key players in the real-time payments industry include major financial institutions, payment processors, and technology vendors. Companies like Visa, Mastercard, PayPal, and various fintech startups are pivotal in driving innovation and competitiveness.

What are the primary factors driving the growth in the real Time Payments industry?

Key drivers of growth include increased consumer demand for instant payment solutions, advancements in payment technology, and regulatory support. The convenience and speed of transactions are reshaping payment landscapes, compelling adoption rates.

Which region is the fastest Growing in the real Time Payments?

North America is currently the fastest-growing region in the real-time payments market, expected to grow from $4.27 billion in 2023 to $10.92 billion by 2033. Europe and Asia Pacific also show significant growth potential.

Does ConsaInsights provide customized market report data for the real Time Payments industry?

Yes, ConsaInsights offers tailored market report data for the real-time payments industry. Custom reports can cater to specific business insights, analysis needs, and market segments, providing actionable data for stakeholders.

What deliverables can I expect from this real Time Payments market research project?

Deliverables typically include comprehensive reports detailing market size, growth projections, competitive analysis, and sector-specific trends. Insights will cover regional data and consumer behavior aspects for informed decision-making.

What are the market trends of real Time Payments?

Current trends in real-time payments involve the rise of blockchain technology, API-based solutions, and increased integration of mobile wallets. Additionally, regulatory changes are facilitating smoother cross-border transactions and expanding usage scenarios.